- Home

- »

- Advanced Interior Materials

- »

-

Middle East HVAC Systems Market, Industry Report, 2033GVR Report cover

![Middle East HVAC Systems Market Size, Share & Trends Report]()

Middle East HVAC Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Equipment (Heating, Cooling, Ventilation), By Application (Residential, Commercial, Industrial), By Distribution Channel (Online, Retail Stores), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-706-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East HVAC Systems Market Summary

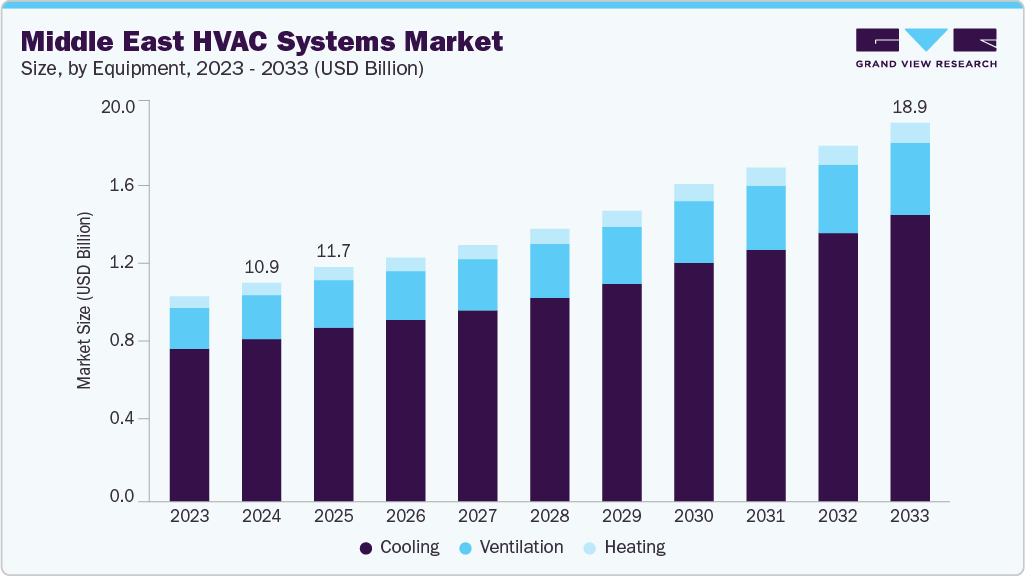

The Middle East HVAC systems market size was estimated at USD 10,954.3 million in 2024 and is expected to reach USD 18,982.5 million by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The Middle East’s extreme climatic conditions, especially soaring summer temperatures, significantly boost the demand for HVAC systems.

Key Market Trends & Insights

- The Middle East HVAC systems market in Saudi Arabia is expected to grow at a rapid CAGR of 7.4% from 2025 to 2033.

- By equipment, the cooling equipment segment is expected to grow at a considerable CAGR of 6.5% from 2025 to 2033 in terms of revenue.

- By application, the commercial segment is expected to grow at a significant CAGR of 6.7% from 2025 to 2033 in terms of revenue.

- By distribution channel, the online segment is expected to grow at a significant CAGR of 7.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 10,954.3 Million

- 2033 Projected Market Size: USD 18,982.5 Million

- CAGR (2025-2033): 6.2%

Rapid urbanization and infrastructure growth particularly in Gulf countries such as the UAE, Saudi Arabia, and Qatar further amplify the need for advanced cooling solutions. Government initiatives promoting energy efficiency and green building standards are driving the transition toward sustainable HVAC systems. The integration of smart technologies, such as IoT-enabled systems, is gaining traction, especially in premium developments. In addition, the region’s expanding hospitality and tourism sector fuels HVAC installation in hotels, malls, and entertainment complexes. These trends position the Middle East as a key growth region in the HVAC market.

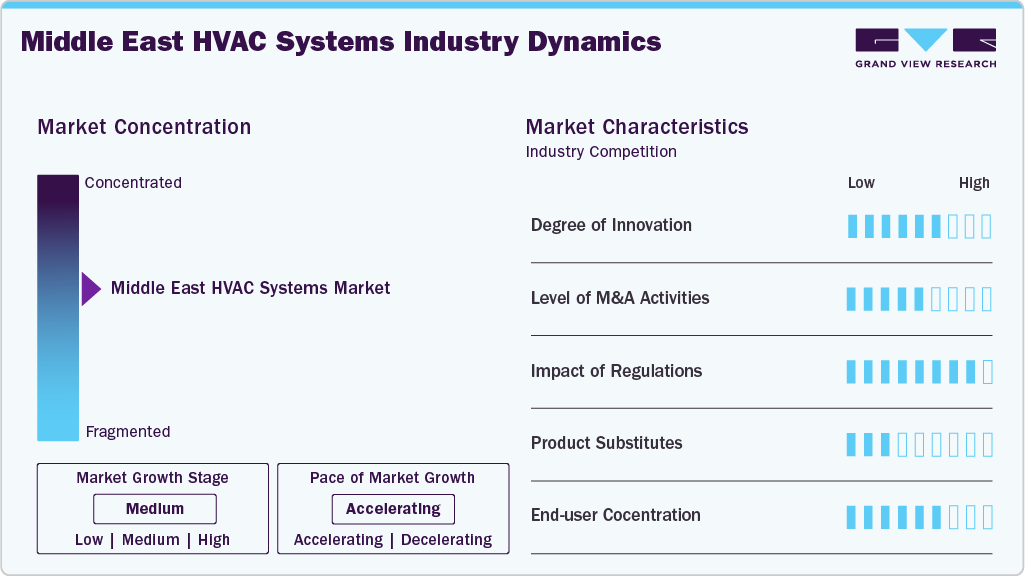

Market Concentration & Characteristics

The Middle East HVAC systems market is moderately concentrated, with a few major players dominating key segments across the region. Companies such as Daikin, Carrier, and LG hold significant market shares, particularly in urban and high-income areas. However, a growing number of regional and local manufacturers are entering the market, especially in cost-sensitive sectors. This mix of global dominance and rising local presence defines a competitive but moderately concentrated industry landscape.

The Middle East HVAC market is witnessing a steady rise in innovation, driven by the need for energy-efficient and smart climate control systems. Integration of IoT, AI-based controls, and solar-powered units are becoming more prevalent in premium residential and commercial projects. Countries such as the UAE and Saudi Arabia are encouraging sustainable tech through smart city initiatives. This push is accelerating the adoption of advanced, eco-friendly HVAC technologies across the region.

Mergers and acquisitions in the Middle East HVAC sector are gaining momentum, with global players acquiring regional firms to strengthen their footprint. These deals often focus on enhancing distribution networks and expanding product portfolios tailored to local climate needs. Strategic partnerships are also increasing to address rising demand in sectors such as hospitality and infrastructure. Overall, M&A activity reflects growing consolidation and market expansion strategies.

Government regulations across the Middle East are increasingly focused on energy efficiency and environmental standards for HVAC systems. Initiatives such as the UAE’s Estidama and Saudi Arabia’s SEEC policies are pushing manufacturers to comply with stricter performance and sustainability benchmarks. These regulations are shaping product innovation and limiting the use of high-emission refrigerants. As a result, compliance is becoming a key factor influencing market competitiveness.

Drivers, Opportunities & Restraints

The Middle East HVAC market is driven by harsh climatic conditions, with temperatures often exceeding 45°C in summer, making cooling systems essential. Rapid urbanization, rising construction activities, and government-backed infrastructure projects boost HVAC demand. Mega projects such as NEOM in Saudi Arabia and Expo-linked developments in the UAE further support growth. Increasing adoption of energy-efficient and smart HVAC systems also acts as a strong market catalyst.

Growing focus on green buildings and sustainable development creates opportunities for energy-efficient and solar-integrated HVAC solutions. The expansion of commercial spaces, airports, and entertainment venues drives demand for large-scale HVAC installations. Government policies promoting renewable energy and smart technologies open avenues for innovation. In addition, untapped markets in smaller Gulf and Levant nations offer growth potential for regional players.

High initial investment costs for advanced HVAC systems can limit adoption, especially in cost-sensitive residential segments. Regulatory compliance and certification processes can delay product launches and market entry. Dependence on imports for key components makes the industry vulnerable to global supply chain disruptions. Moreover, fluctuating oil revenues in some countries may impact public infrastructure spending, indirectly affecting HVAC demand.

Equipment Insights

The cooling equipment segment dominated the market in 2024 accounting for 74.3% of the market share in 2024 driven by the region’s consistently high temperatures and arid climate. Residential, commercial, and industrial sectors all rely heavily on air conditioning for comfort and operational efficiency. Centralized cooling systems such as chillers and VRF units are widely used in urban developments and high-rise buildings. Demand remains strong throughout the year, especially in Gulf countries such as the UAE and Saudi Arabia.

The heating segment is witnessing notable growth in colder regions and during winter months, particularly in countries such as Jordan, Lebanon, and northern Saudi Arabia. The rise of integrated HVAC systems combining heating and cooling supports this expansion. Growth in hospitality and luxury residential developments also fuels the demand for advanced heating features. In addition, improved energy efficiency regulations are encouraging adoption of modern heating solutions.

Distribution Channel Insights

Retail stores dominate the distribution of HVAC systems and accounted for 37.1% share, in the Middle East, as consumers prefer physical outlets for product inspection and after sales support. Established retailers and exclusive brand showrooms offer a wide range of products, installation services, and financing options. This channel is especially preferred for residential and small commercial purchases. Trust in in-person consultation and localized service drives strong sales through retail outlets.

The online distribution channel is growing rapidly, fueled by rising internet penetration and digital transformation across the Middle East. E-commerce platforms and brand websites now offer competitive pricing, doorstep delivery, and installation packages. The convenience of comparing models and accessing reviews is attracting tech-savvy consumers and commercial buyers. This trend is particularly strong in urban areas such as Dubai, Riyadh, and Doha.

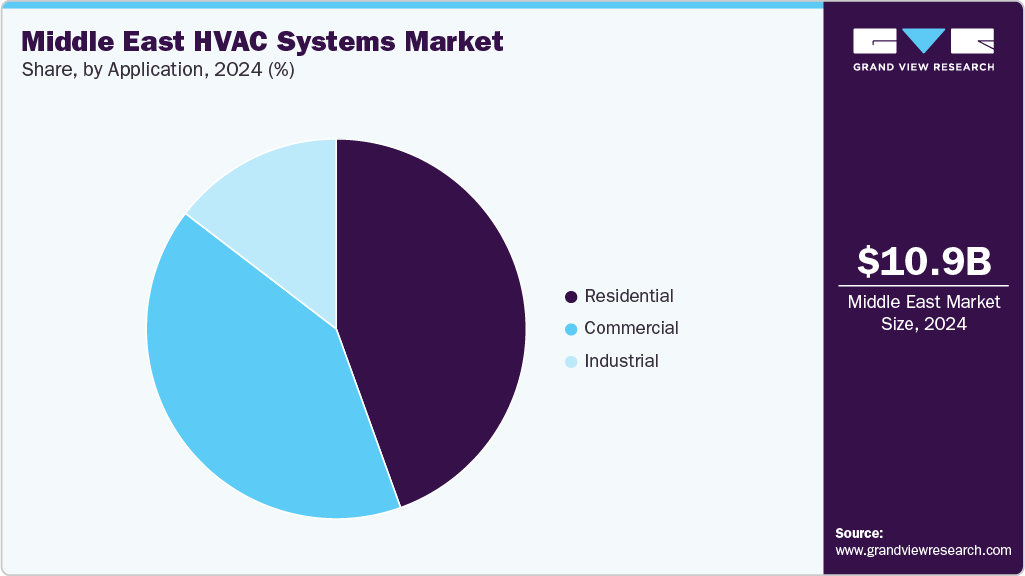

Application Insights

The residential segment dominated the market in 2024 accounting for a 44.5% market share in 2024 driven by widespread reliance on air conditioning in homes across the region’s hot climate. Rising population, urban housing developments, and increased disposable incomes drive steady demand. Government-backed housing projects in countries such as Saudi Arabia and the UAE further support market expansion. Split and window ACs remain common, especially in mid-income and low-rise housing units.

The commercial segment is experiencing the fastest growth, driven by large-scale investments in malls, airports, hotels, and office complexes. Events such as Expo 2020 and Vision 2030 initiatives have boosted commercial construction across the region. These developments require advanced, large-capacity HVAC systems to ensure energy efficiency and comfort. In addition, increasing demand for smart and centralized systems in premium commercial spaces is accelerating segment growth.

Country Insights

Saudi Arabia HVAC Systems Market Trends

Saudi Arabia leads the Middle East HVAC systems market and accounted for 44.8% share in 2024, due to its vast geographical size, extreme heat, and ambitious infrastructure projects. Vision 2030 has accelerated developments in smart cities, hospitality, and commercial real estate, all driving HVAC demand. Government-backed housing schemes further boost the residential HVAC segment. High energy consumption has also spurred interest in energy-efficient and smart cooling technologies.

Oman HVAC Systems Market Trends

Oman’s HVAC market is growing steadily, supported by rising urbanization and infrastructure development in Muscat and coastal areas. The country’s hot climate creates consistent demand for air conditioning in both homes and offices. Government initiatives to diversify the economy and invest in tourism infrastructure are also key drivers. Energy efficiency regulations are gradually influencing consumer preferences toward sustainable systems.

UAE HVAC Systems Market Trends

The UAE remains a major HVAC hub due to its luxury real estate, tourism-driven economy, and year-round high temperatures. Massive projects such as Expo 2020 legacy sites, hotels, and mixed-use developments fuel continuous demand. Strict green building codes, such as Estidama and Dubai Green Building Regulations, push adoption of advanced, energy-efficient HVAC technologies. In addition, high-income households and businesses are quick to adopt smart and connected systems.

Qatar HVAC Systems Market Trends

Qatar’s HVAC market is driven by rapid infrastructure expansion, especially post-FIFA World Cup developments. The country’s harsh desert climate and urban growth in Doha sustain strong demand for cooling solutions. Government investments in smart cities and high-end commercial spaces also support advanced HVAC installations. Energy optimization and sustainability goals are encouraging wider adoption of efficient and eco-friendly systems.

Key Middle East HVAC Systems Company Insights

Some of the key players operating in the market include Carrier Corporation and Daikin Industries, Ltd among others.

-

Carrier Corporation provides heat pumps, air conditioners, boilers, furnaces, air purifiers, humidifiers, dehumidifiers, ventilators, air scrubbers, thermostats, UV lamps, energy services, and building controls to the retail, commercial, transport, and foodservice sectors. It was acquired by United Technologies Corporation in 1979; however, it was separated into a separate business in April 2020.

-

Daikin Industries, Ltd. offers air-conditioning systems, room heating and heat pump hot water supply systems, room air conditioning systems, packaged air-conditioning systems, and air conditioning systems for plants, facilities, and office buildings.

Key Middle East HVAC Systems Companies:

- Carrier Corporation

- DAIKIN INDUSTRIES Ltd.

- Awal Gulf Manufacturing

- Zamil Air Conditioners

- Panasonic Corporation

- GREE

- Blue Star

- LG Electronics

- SAMSUNG

- Trane

Recent Developments

-

In February 2025, Carrier Ventures made a strategic investment in ZutaCore, a company specializing in liquid cooling systems for data centers. The collaboration focuses on improving cooling efficiency for high-density computing, especially as AI demands grow. ZutaCore’s technology supports energy savings and increased server performance, helping to reduce data center emissions.

-

In March 2024, Trane Technologies launched a new residential HVAC line featuring energy-efficient heat pumps and ACs with low-GWP refrigerants. The systems include smart controls and support reduced emissions. This upgrade aligns with the company’s sustainability goals.

Middle East HVAC Systems Market Report Scope

Report Attribute

Details

Market size in 2025

USD 11,750.3 million

Revenue forecast in 2033

USD 18,982.5 million

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, distribution channel, country

Country scope

Saudi Arabia; UAE; Oman; Qatar

Key companies profiled

Carrier Corporation; DAIKIN INDUSTRIES Ltd.; Awal Gulf Manufacturing; Zamil Air Conditioners; Panasonic Corporation; GREE; Blue Star; LG Electronics; SAMSUNG; Trane

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East HVAC Systems Market Report Segmentation

This report forecasts revenue growth at Middle East, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research Inc has segmented the Middle East HVAC systems market on the basis of equipment, application, distribution channel, and country:

-

Equipment Outlook (Revenue, USD Million, 2021 - 2033)

-

Heating

-

Heat Pump

-

Furnace

-

Unitary Heaters

-

Boilers

-

Electric Baseboards

-

Heating Cables

-

Others

-

-

Ventilation

-

Air Purifier

-

Dehumidifier

-

Air Handling Units

-

Ventilation Fans

-

Others

-

-

Cooling

-

Air Conditioning

-

Chillers

-

Cooling Towers

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

By Equipment

-

-

Commercial

-

By Equipment

-

-

Industrial

-

By Equipment

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Retail Stores

-

Wholesale Stores

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

UAE

-

Saudi Arabia

-

Oman

-

Qatar

-

Frequently Asked Questions About This Report

b. The Middle East HVAC systems market size was estimated at USD 10,954.3 million in 2024 and is expected to reach USD 11,750.3 million in 2025

b. The Middle East HVAC systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 18,982.5 million by 2033.

b. The cooling equipment segment dominated the market in 2024 accounting for 74.3% of the market share in 2024 driven by the region’s consistently high temperatures and arid climate. Residential, commercial, and industrial sectors all rely heavily on air conditioning for comfort and operational efficiency. Centralized cooling systems like chillers and VRF units are widely used in urban developments and high-rise buildings.

b. Some of the key players operating in the HVAC systems market are Carrier Corporation, DAIKIN INDUSTRIES Ltd., Awal Gulf Manufacturing, Zamil Air Conditioners, Panasonic Corporation, GREE, Blue Star, LG Electronics, Lennox International Inc., SAMSUNG, Trane.

b. The Middle East HVAC systems market is driven by extreme climatic conditions, rapid urbanization, and large-scale infrastructure projects. Government initiatives promoting energy efficiency and sustainable construction further support market growth. Rising demand for smart and integrated HVAC solutions also fuels expansion across residential and commercial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.