- Home

- »

- Advanced Interior Materials

- »

-

Middle East Injection Molding Machine Market Report, 2033GVR Report cover

![Middle East Injection Molding Machine Market Size, Share & Trends Report]()

Middle East Injection Molding Machine Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Plastics, Metals), By Technology (Hydraulic, Electric, Hybrid), By End-use (Automotive, Consumer Goods, Packaging, Electronics), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-737-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Injection Molding Machine Market Summary

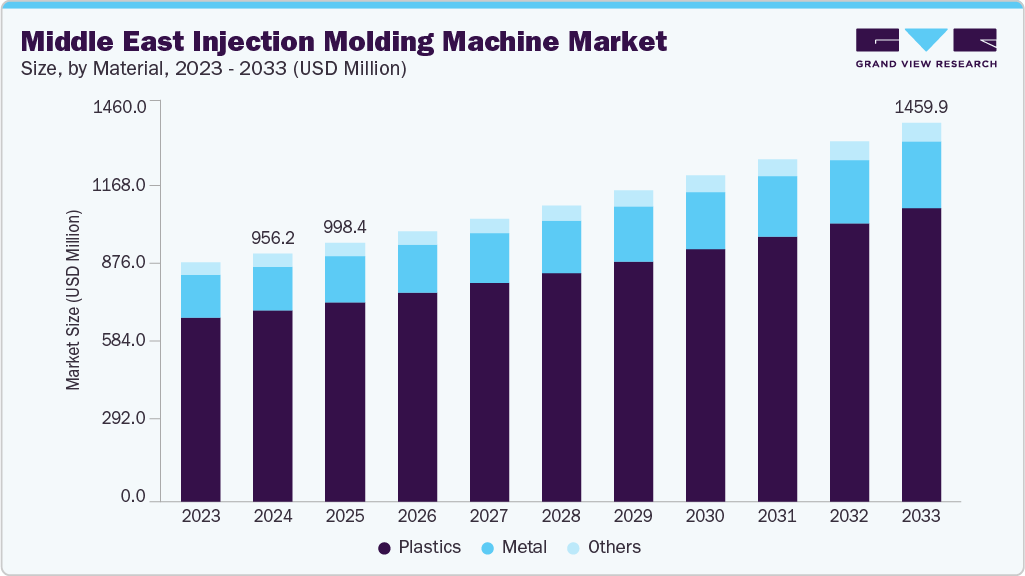

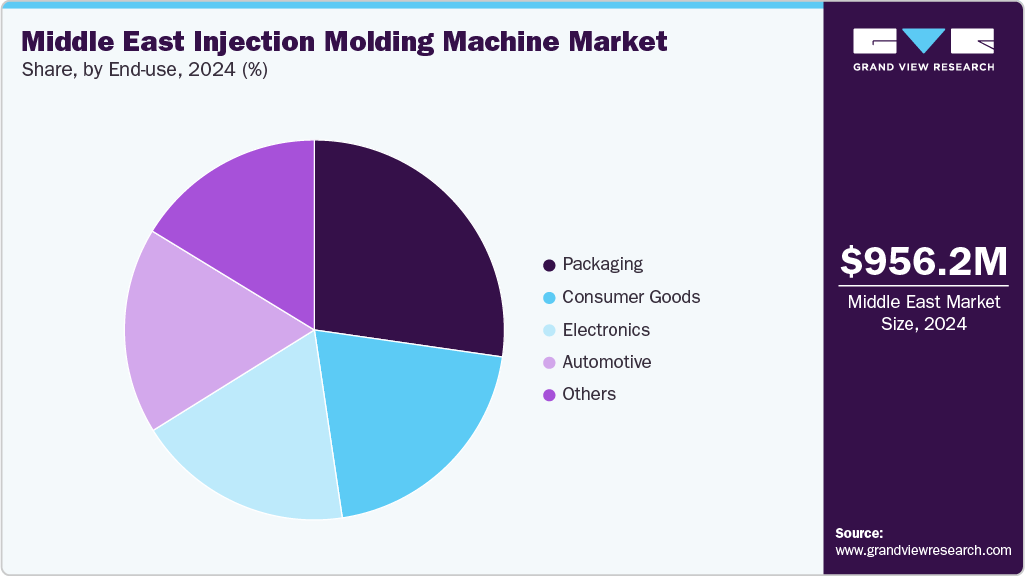

The Middle East injection molding machine market size was valued at USD 956.2 million in 2024 and is projected to reach USD 1,459.9 million by 2033, growing at a CAGR of 4.9% from 2025 to 2033. Strong growth in packaging, consumer goods, and automotive manufacturing across Saudi Arabia, the UAE is creating higher demand for injection molding machines.

Key Market Trends & Insights

- The UAE injection molding machine market is expected to grow at a CAGR of 5.5% from 2025 to 2033.

- By material, the plastics segment is expected to grow at a CAGR of 4.9% from 2025 to 2033 in terms of revenue.

- By technology, the electric segment is expected to grow at a considerable CAGR of 5.6% from 2025 to 2033 in terms of revenue.

- By end use, the electronics segment is expected to grow at a considerable CAGR of 5.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 956.2 Million

- 2033 Projected Market Size: USD 1,459.9 Million

- CAGR (2025-2033): 4.9%

Expanding FMCG consumption, coupled with rising use of plastic components in appliances and medical devices, is fueling equipment adoption. Government-led industrial strategies, such as Saudi Vision 2030 and the UAE’s manufacturing agenda, are encouraging greater investment in plastics processing technology. Incentives for local production, import substitution policies, and rising energy competitiveness are making the region attractive for machine deployment. Companies are adopting automation and digitalized molding systems to enhance efficiency. These factors collectively strengthen demand for advanced injection molding machines in the Middle East.

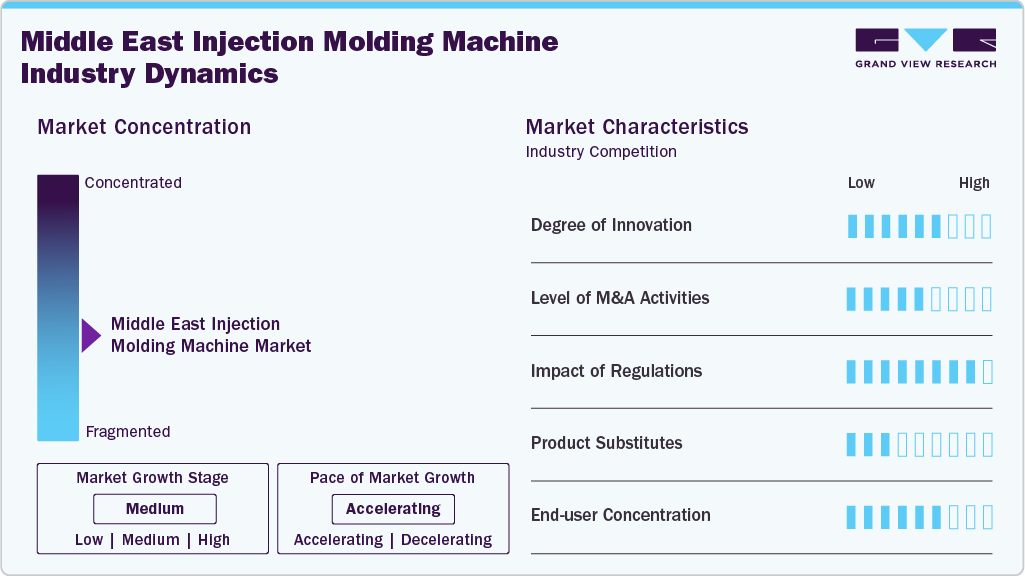

Market Concentration & Characteristics

The industry is relatively fragmented, with demand spread across packaging, automotive, consumer goods, and medical sectors rather than dominated by a few players. Local distributors and regional agents play a major role in machine supply, while international brands compete for contracts through partnerships and service networks. Countries like Saudi Arabia and the UAE attract large OEMs due to industrialization programs.

The market is gradually adopting advanced technologies such as all-electric systems, energy-efficient drives, and Industry 4.0 integration. Automation and robotics are increasingly used to improve precision and reduce labor costs in molding operations. Innovation is driven mainly by global machine manufacturers introducing new models tailored for regional industries. However, adoption levels vary, with GCC markets moving faster than smaller economies.

Mergers and acquisitions in the Middle East injection molding sector remain limited compared to mature markets. Most activity comes from international players forming distribution alliances or acquiring local agents to strengthen regional access. Joint ventures with Gulf-based companies are also common to comply with localization rules and tap into industrial clusters. While large-scale M&A is rare, consolidation is slowly emerging in packaging and automotive plastics supply chains.

Regulatory policies in the Middle East strongly influence machine demand, especially through plastic-use restrictions and recycling targets. GCC nations are tightening standards on single-use plastics, prompting molders to shift toward sustainable resins and biodegradable materials. Industrial strategies like Saudi Vision 2030 promote domestic manufacturing, creating incentives for equipment investment. Compliance with environmental and safety regulations is also pushing companies toward modern, energy-efficient molding machines.

Drivers, Opportunities & Restraints

Rising demand from the packaging, automotive, and medical industries is propelling the need for injection molding machines across the Middle East. Government-led industrialization programs in Saudi Arabia and the UAE further stimulate local manufacturing investments. Availability of competitive energy resources supports cost-effective production. Expansion of regional free zones and industrial hubs encourages machine adoption by global and local players.

The shift toward sustainable plastics and recyclable materials presents opportunities for advanced molding solutions. Increasing adoption of automation, robotics, and digital monitoring creates demand for technologically superior machines. Regional infrastructure projects and diversification strategies drive investments in plastics processing. Partnerships with international OEMs allow local firms to upgrade capabilities and expand product offerings.

High initial capital costs for advanced injection molding machines act as a barrier for small and mid-sized enterprises. Heavy reliance on imported equipment makes local buyers vulnerable to currency fluctuations and supply disruptions. Limited technical expertise in smaller Middle Eastern economies slows the adoption of high-tech solutions. Additionally, tightening regulations on plastic usage may restrain growth in certain end-use segments.

Material Insights

Plastics dominated the industry and accounted for a 77.0% share in 2024, due to strong demand in packaging, automotive interiors, and medical devices. Their versatility, lightweight properties, and cost-effectiveness make them the preferred choice for manufacturers. Rising consumption of FMCG and e-commerce packaging further strengthens this dominance. Governments’ push for local manufacturing ensures continued growth in plastic-based molding applications.

Metals segment is expected to grow at a CAGR of 4.7% from 2025 to 2033 in terms of revenue, as industries like automotive, construction, and electronics demand stronger and more durable components. Precision molding of lightweight alloys and metal composites is gaining traction to meet performance and safety standards. Regional industrialization programs are encouraging the use of advanced materials in manufacturing. This shift is creating opportunities for metal-compatible injection molding machines in the Middle East.

Technology Insights

Hydraulic injection molding machines dominated the market and accounted for a 56.4% share in 2024, due to their robustness, affordability, and ability to handle large and complex molds. They are widely used in packaging, automotive, and consumer goods industries where high tonnage is required. Their durability and cost-effectiveness make them the preferred choice for mass production. Strong regional demand from established plastics converters sustains their leading position.

The electric segment is expected to grow at a fastest CAGR of 5.6% from 2025 to 2033 in terms of revenue, supported by the shift toward energy efficiency and precision manufacturing. These machines consume less power, operate with lower noise, and deliver higher accuracy compared to hydraulic models. Adoption is rising in sectors like medical devices and electronics where precision and cleanliness are critical. Industrial modernization programs in the GCC are accelerating their market penetration.

End-use Insights

The packaging sector is the leading end-use industry for injection molding machines, which accounted for a 27.3% share in 2024. This growth is fueled by the increasing need for efficient and cost-effective packaging across industries such as food and beverages, pharmaceuticals, and consumer goods. The expansion of the industrial packaging market in the region highlights the critical role of packaging in driving demand for injection molding machines. Factors such as urbanization, changing consumer lifestyles, and the rise of e-commerce are further boosting the need for diverse and sustainable packaging solutions, making packaging a key growth driver in the market.

The electronics segment is expected to grow at the fastest CAGR of 5.6% from 2025 to 2033 in terms of revenue, as regional demand for consumer devices, appliances, and semiconductors continues to expand. Precision and miniaturization requirements are fueling the adoption of advanced injection molding machines. The surge in smart home products and renewable energy electronics in the GCC is also creating growth opportunities. Increasing investments in local electronics assembly further accelerate the uptake of molding technology in this segment.

Country Insights

Saudi Arabia led the Middle East injection molding machine market and accounted for a 33.3% share in 2024, due to its well-established industrial base and strong demand from the manufacturing and packaging sectors. Investments in industrial infrastructure and the expansion of local manufacturing activities are driving market growth. The presence of key manufacturers and suppliers further supports the adoption of advanced injection molding machines. Overall, Saudi Arabia remains the dominant market in the region.

The injection molding machine market in the UAE is the fastest-growing market in the Middle East, driven by rapid industrialization and diversification initiatives. Growth in sectors such as packaging, automotive, and consumer goods fuels demand for injection molding machines. Supportive government policies and investments in advanced manufacturing technologies accelerate market expansion. The UAE’s focus on innovation and smart manufacturing contributes to its rising market share.

Key Middle East Injection Molding Machine Companies Insights

Key players operating in the Middle East injection molding machine market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Middle East Injection Molding Machine Companies:

- Arburg GmbH + Co KG

- Haitian International Holdings Limited

- Milacron

- Yizumi Holdings Co., Ltd

- Sumitomo (SHI) Demag Plastics Machinery GmbH

- Chen Hsong Holdings Limited

- Toyo Machinery & Metal Co., Ltd

- Husky Injection Molding Systems Ltd

- UBE Machinery

- Wittmann Battenfeld

Recent Developments

-

In October 2024, YIZUMI, together with AFC INDUSTRY, showcased its TP5 Series T200P5 injection molding machine at Saudi Plastics & Petrochem 2025 in Riyadh. The model features faster injection speeds, improved plasticizing efficiency, and reduced cycle times. Designed with servo-hydraulic technology, it enhances energy savings and operational stability. Its smart control system further supports precise monitoring and efficient production.

-

In February 2024, Haitian introduced its fifth-generation injection molding machines, featuring advanced AI and sensor technologies for smarter process control. The machines include functions like HT Inject for weight control, HT Energy for efficient energy use, HT Clamp for precise mould operation, and HT Lubricate for automated maintenance. With flexible integration options, they can easily connect to peripherals and automation systems, enhancing productivity and efficiency.

Middle East Injection Molding Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 998.4 million

Revenue forecast in 2033

USD 1,459.9 million

Growth rate

CAGR of 4.9% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, technology, end-use, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Qatar; Oman; Kuwait; Israel

Key companies profiled

Arburg GmbH + Co KG; Haitian International Holdings Limited; Milacron; Yizumi Holdings Co., Ltd; Sumitomo (SHI) Demag Plastics Machinery GmbH; Chen Hsong Holdings Limited; Toyo Machinery & Metal Co., Ltd.; Husky Injection Molding Systems Ltd; UBE Machinery; Wittmann Battenfeld

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Injection Molding Machine Market Report Segmentation

This report forecasts revenue growth at the regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East injection molding machine market report based on material,technology, end-use, and country.

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastics

-

Metals

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Hydraulic

-

Electric

-

Hybrid

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Consumer Goods

-

Packaging

-

Electronics

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

Israel

-

Kuwait

-

Frequently Asked Questions About This Report

b. The Middle East injection molding machine market size was estimated at USD 956.2 million in 2024 and is expected to be USD 998.4 million in 2025.

b. The Middle East injection molding machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2033 to reach USD 1,459.9 million by 2033.

b. Plastics dominate the Middle East injection molding machine market and accounted for 77.0% share in 2024, due to strong demand in packaging, automotive interiors, and medical devices. Their versatility, lightweight properties, and cost-effectiveness make them the preferred choice for manufacturers.

b. Some of the key players operating in the Middle East injection molding machine market include Arburg GmbH + Co KG; Haitian International Holdings Limited; Milacron; Yizumi Holdings Co., Ltd; Sumitomo (SHI) Demag Plastics Machinery GmbH; Chen Hsong Holdings Limited; Toyo Machinery & Metal Co., Ltd.; Husky Injection Molding Systems Ltd; UBE Machinery; Wittmann Battenfeld.

b. Key factors driving the Middle East injection molding machine market include rising demand for lightweight and durable plastic components across automotive, packaging, and consumer goods sectors. Technological advancements, such as electric and hybrid machines, improve efficiency and reduce energy consumption. Increasing adoption of automation and sustainable manufacturing practices further fuels market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.