- Home

- »

- Food Additives & Nutricosmetics

- »

-

Middle East Oat Beta Glucan Market, Industry Report, 2033GVR Report cover

![Middle East Oat Beta Glucan Market Size, Share & Trends Report]()

Middle East Oat Beta Glucan Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Powder, Liquid), By Product (Soluble, Insoluble), By End Use (Personal Care & Cosmetics, Food & Beverage, Pharmaceuticals), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-754-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Oat Beta Glucan Market Summary

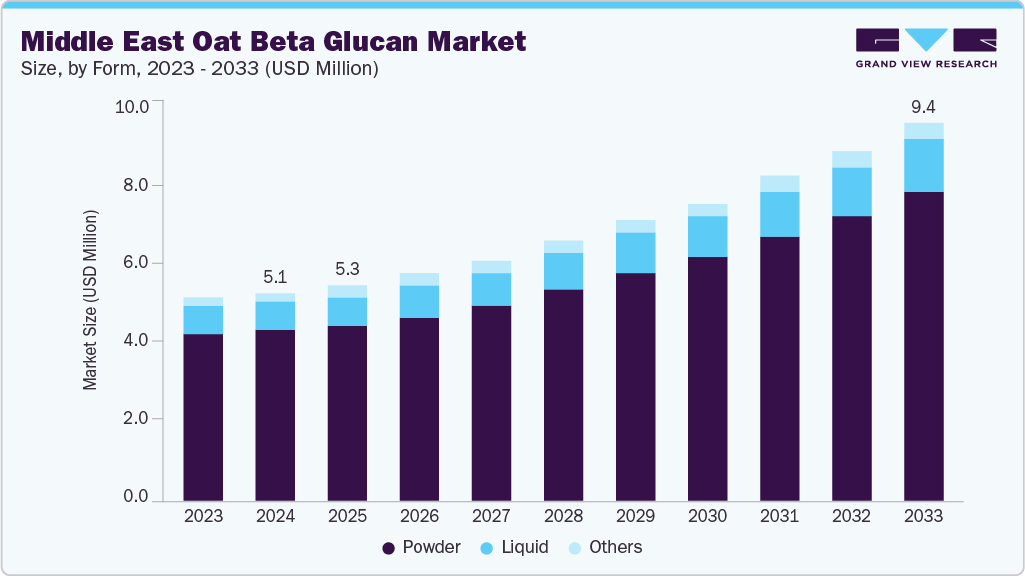

The Middle East oat beta glucan market size was estimated at USD 5.1 million in 2024 and is projected to reach USD 9.4 million by 2033, growing at a CAGR of 7.5% from 2025 to 2033. Growing health awareness, government initiatives on nutrition, and rising lifestyle-related disorders are driving demand for oat beta-glucan in the Middle East.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East oat beta glucan market with the largest revenue share of 48.5% in 2024.

- By form, the powder segment dominated the market with the largest revenue share of 81.5% in 2024.

- By end use, the personal care & cosmetics segment is expected to grow at the fastest CAGR of 7.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 5.1 Million

- 2033 Projected Market Size: USD 9.4 Million

- CAGR (2025-2033): 7.5%

- Saudi Arabia: Largest Market in 2024

Consumers are turning to functional foods and nutraceuticals as preventive health solutions, while manufacturers are incorporating oat beta-glucan to meet evolving preferences for natural and evidence-backed wellness products. The region’s largest markets, Saudi Arabia and the UAE, show rapid adoption due to their scale, purchasing power, and shifting dietary habits. Functional foods fortified with oat beta-glucan benefit from urban populations with higher exposure to global health trends. Distribution networks centered in the UAE support wider availability, while rising obesity and diabetes rates in Saudi Arabia encourage health-conscious product development. Growing retail diversification and e-commerce expansion strengthen market penetration, giving consumers better access to such specialty ingredients.

Challenges persist, including limited consumer education in smaller Gulf markets, pricing sensitivity, and competition from alternative fibers and imported supplements. Despite this, opportunities remain significant. Premium positioning in skincare and personal care products is expanding alongside food applications, offering a dual growth path. Rising investment in local food processing, coupled with favorable regulatory recognition of oat beta-glucan’s cholesterol-lowering benefits, creates strong potential for sustained market expansion between 2025 and 2033.

Form Insights

The powder segment dominated the Middle East oat beta glucan industry with the largest revenue share of 81.5% in 2024. This dominance is supported by its versatility in applications such as dietary supplements, bakery, cereals, and instant beverages. Powdered oat beta-glucan offers better stability, longer shelf life, and ease of transportation, which makes it more attractive for manufacturers and distributors. Rising consumer demand for convenient functional ingredients further strengthens powder’s stronghold across the food and nutraceutical industries.

The liquid segment is expected to grow at the fastest CAGR of 7.9% from 2025 to 2033. Growth in this format comes from expanding applications in ready-to-drink beverages, dairy alternatives, and skincare formulations. Liquids allow easy incorporation into modern product categories targeting busy, urban populations. Their higher bioavailability, smooth texture integration, and rising consumer preference for on-the-go nutrition support strong adoption. This trend positions liquid oat beta-glucan as a dynamic growth driver within the market.

Product Insights

The soluble segment dominated the Middle East oat beta glucan market with the largest revenue share of 86.4% in 2024. Its leading position is linked to scientifically proven health benefits, particularly cholesterol reduction and improved blood sugar control. Soluble oat beta-glucan dissolves in water to form a viscous solution, making it ideal for beverages, dietary supplements, and functional foods. Rising consumer demand for heart-health products and regulatory recognition by global food authorities continue to accelerate the adoption of soluble formats across the region.

The insoluble segment, though smaller, holds important opportunities within the market. Accounting for the remaining share, it provides digestive health benefits through improved bowel function and satiety enhancement. Demand is supported by growing awareness of gut health and dietary fiber intake. Manufacturers are exploring ways to integrate insoluble oat beta-glucan into bakery products, cereals, and snacks, gradually expanding its relevance despite slower uptake compared to soluble forms.

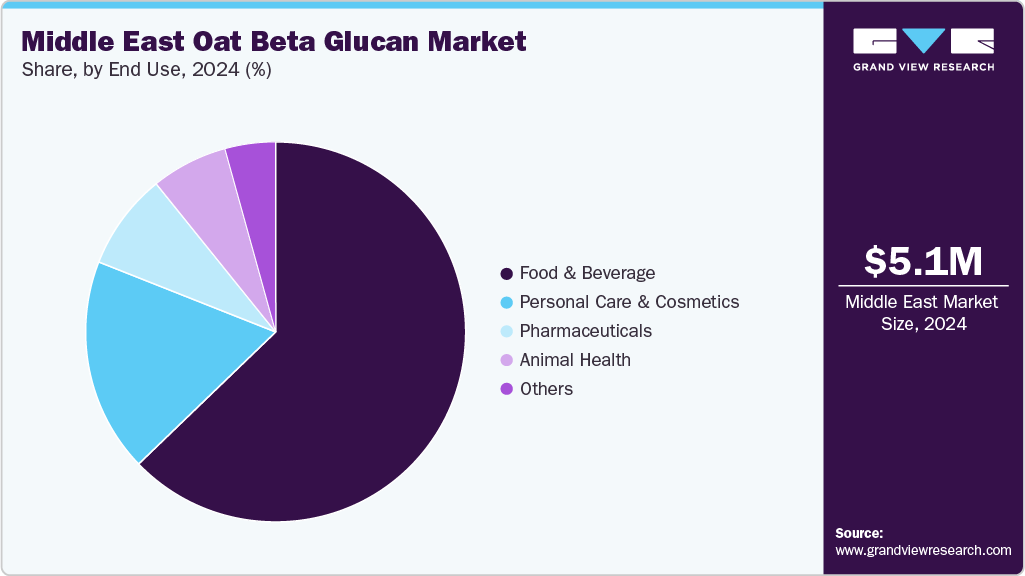

End Use Insights

The food and beverage segment dominated the Middle East oat beta glucan industry with the largest revenue share of 62.8% in 2024. This leadership stems from the widespread use of oat beta-glucan in functional foods, cereals, dairy alternatives, and nutritional drinks. Its cholesterol-lowering properties and ability to improve satiety make it highly attractive for health-conscious consumers. Growing awareness of lifestyle-related diseases such as obesity and diabetes further encourages manufacturers to fortify products with oat beta-glucan, ensuring strong and consistent demand.

The personal care and cosmetics segment is expected to grow at the fastest CAGR of 7.9% from 2025 to 2033. Expansion in this category is driven by oat beta-glucan’s moisturizing, soothing, and skin-barrier-enhancing properties. Increasing consumer preference for natural and plant-based ingredients in skincare supports its adoption in lotions, serums, and anti-aging products. Rising investment in premium beauty products across the Middle East, alongside heightened awareness of sensitive-skin solutions, positions this segment as a major opportunity for future growth.

Country Insights

UAE Oat Beta Glucan Market Trends

The UAE oat beta glucan is expected to grow at the fastest CAGR of 7.7% from 2025 to 2033. The country’s high purchasing power, cosmopolitan consumer base, and openness to global wellness trends drive adoption across functional foods, dietary supplements, and cosmetics. The UAE also acts as a regional trade and distribution hub, amplifying access to oat beta-glucan products beyond its borders. Rising investment in health-oriented innovations and premium beauty products supports the continued acceleration of market growth in the forecast period.

Saudi Arabia Oat Beta Glucan Market Trends

Saudi Arabia dominated the Middle East oat beta glucan market with the largest revenue share of 48.5% in 2024. Its leadership reflects both population size and rising health challenges, including high obesity and diabetes prevalence. Growing government efforts under Vision 2030 to promote healthier lifestyles encourage functional food adoption. Expanding retail networks and strong domestic demand for fortified foods further reinforce Saudi Arabia’s position as the largest consumer of oat beta-glucan in the region.

Key Middle East Oat Beta Glucan Company Insights

Key players operating in the market are Lantmännen Biorefineries and Tate & Lyle:

-

Lantmännen Biorefineries is a Swedish company specializing in oat-derived functional ingredients. Their PromOat Beta Glucan is widely used in functional foods and beverages for cholesterol management. Strong distribution networks in the Middle East ensure consistent supply and growing adoption in health-conscious consumer segments.

-

Tate & Lyle, a UK-based global ingredient supplier, offers PromOat Beta Glucan, a soluble oat fiber with heart-health benefits. The company leverages its regional presence to serve food, beverage, and supplement manufacturers, meeting the increasing Middle East demand for natural, functional ingredients targeting wellness and preventive health.

Key Middle East Oat Beta Glucan Companies:

- Cargill, Incorporated

- Kerry Group plc

- Tate & Lyle

- Lantmännen Biorefineries

- Swedish Oat Fiber AB

- COSCIENS BIOPHARMA

- Oy Karl Fazer Ab

- Guangzhou Sinocon Food Co., Ltd.

Recent Developments

-

In February 2025, Layn Natural Ingredients launched a new beta-glucan ingredient produced through precision fermentation, highlighting sustainable innovation. The launch strengthens its bioactive portfolio with applications in immune health, skin support, and metabolic wellness, backed by expanded biotechnology capabilities.

Middle East Oat Beta Glucan Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.3 million

Revenue forecast in 2033

USD 9.4 million

Growth rate

CAGR of 7.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, product, end use, country

Country scope

Saudi Arabia; Qatar; UAE; Oman; Israel; Kuwait; Bahrain

Key companies profiled

Cargill, Incorporated; Kerry Group plc; Tate & Lyle; Lantmännen Biorefineries; Swedish Oat Fiber AB; COSCIENS BIOPHARMA; Oy Karl Fazer Ab; Guangzhou Sinocon Food Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to the country and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Oat Beta Glucan Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2033. For this study, Grand View Research has segmented the Middle East oat beta glucan market report based on form, product, end use, and country:

-

Form Outlook (Revenue, USD Million, 2018 - 2033)

-

Powder

-

Liquid

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2033)

-

Soluble

-

Insoluble

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2033)

-

Personal Care & Cosmetics

-

Food and Beverage

-

Pharmaceuticals

-

Animal Health

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2033)

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

Israel

-

Kuwait

-

Bahrain

-

Frequently Asked Questions About This Report

b. The Middle East oat beta glucan market size was estimated at USD 5.1 million in 2024 and is expected to reach USD 5.3 million in 2025.

b. The Middle East oat beta glucan is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2033, reaching USD 9.4 million by 2033.

b. The powder form segment held the largest revenue share in 2024 due to its versatile applications, ease of incorporation in food, beverages, supplements, and rising demand for functional, health-focused dietary products.

b. Some of the key players operating in the Middle East oat beta glucan market include Cargill, Incorporated, Kerry Group plc, Tate & Lyle, Lantmännen Biorefineries, Swedish Oat Fiber AB, COSCIENS BIOPHARMA, Oy Karl Fazer Ab, Guangzhou Sinocon Food Co., Ltd.

b. The Middle East oat beta glucan market is driven by increasing health awareness, rising demand for functional foods, growing prevalence of lifestyle-related diseases, expansion of the nutraceutical sector, and consumer preference for natural, plant-based, cholesterol-lowering, and immunity-boosting ingredients.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.