- Home

- »

- Plastics, Polymers & Resins

- »

-

Middle East Reusable Packaging Market Size Report, 2033GVR Report cover

![Middle East Reusable Packaging Market Size, Share & Trends Report]()

Middle East Reusable Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Plastics, Wood, Metal, Glass), By Product (Containers, Crates, Bottles, Pallets), By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-759-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Reusable Packaging Market Summary

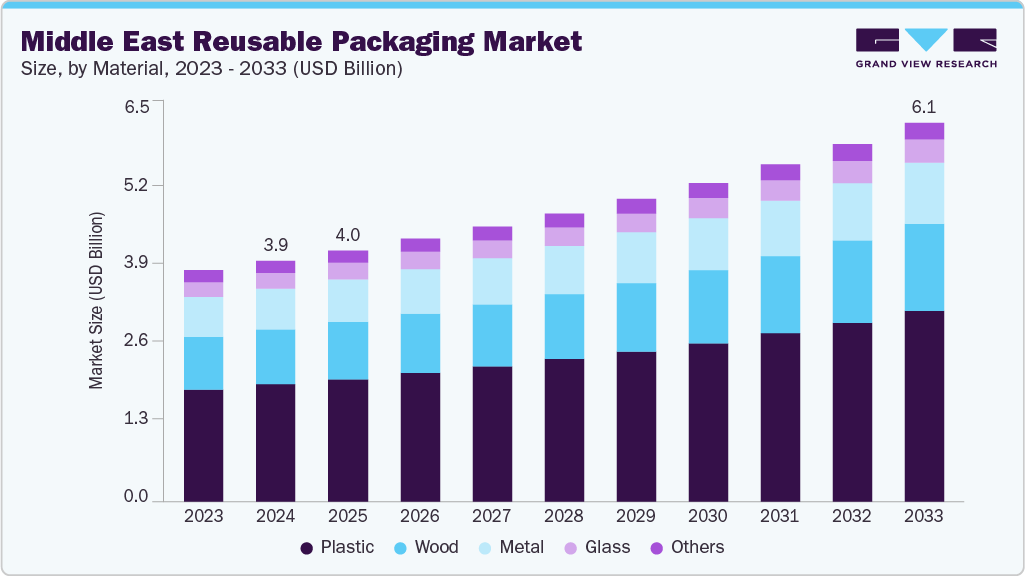

The Middle East reusable packaging market size was estimated at USD 3.89 billion in 2024 and is projected to reach USD 6.11 billion by 2033, growing at a CAGR of 5.3% from 2025 to 2033. Rising government initiatives for sustainability and circular economy practices are driving the adoption of reusable packaging in the Middle East.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East reusable packaging market, with a revenue share of over 38.85% in 2024, and is expected to grow at a substantial CAGR of 5.6% from 2025 to 2033.

- By material, the plastic segment is expected to grow at a considerable CAGR of 5.7% from 2025 to 2033 in terms of revenue.

- By product, the container segment is expected to grow at a considerable CAGR of 5.8% from 2025 to 2033 in terms of revenue.

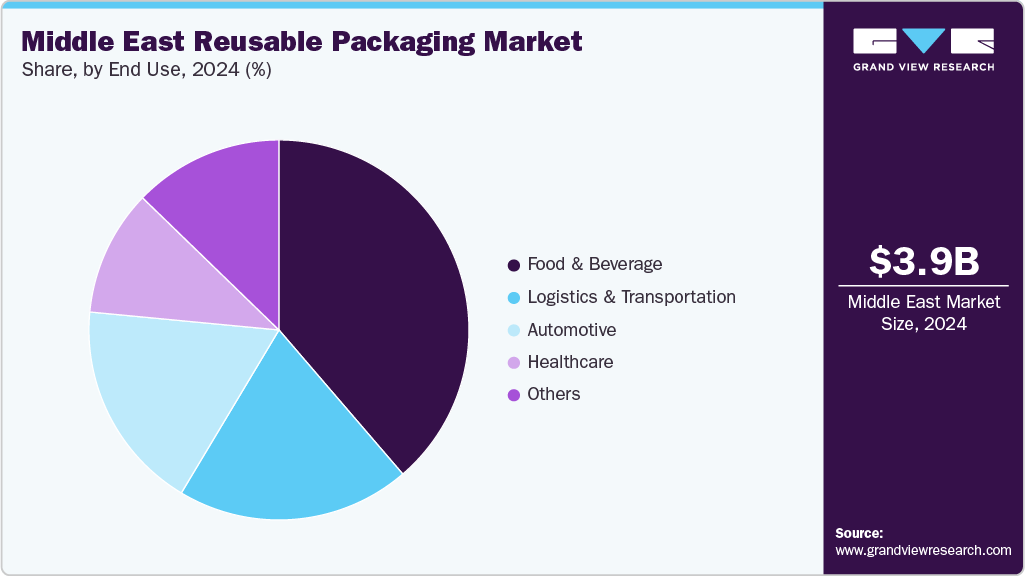

- By end use, the food & beverages segment is expected to grow at a considerable CAGR of 6.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 3.89 Billion

- 2033 Projected Market Size: USD 6.11 Billion

- CAGR (2025 - 2033): 5.3%

- Saudi Arabia: Largest market in 2024

In addition, the rapid growth of e-commerce, food delivery, and logistics sectors is boosting demand for cost-efficient and eco-friendly packaging solutions. The Middle East increasingly prioritizes sustainability as governments and industries align with global circular economy goals. Countries like the UAE and Saudi Arabia have launched national sustainability strategies, such as Saudi Vision 2030 and the UAE Circular Economy Policy 2021-2031, encouraging industries to adopt eco-friendly packaging solutions. Reusable packaging helps reduce single-use plastics, aligning with regulations and corporate ESG commitments. For example, Dubai Municipality has introduced measures to reduce plastic waste, pushing retailers and manufacturers toward reusable packaging adoption in logistics and retail sectors.The region's booming e-commerce and food delivery market is fueling demand for reusable packaging to improve supply chain efficiency and reduce costs. Online grocery delivery services like Carrefour Now and Noon Daily are adopting reusable crates and delivery bins to minimize waste and optimize logistics. Similarly, food delivery companies are testing reusable container models to appeal to environmentally conscious consumers. The growth of large-scale retail chains and QSRs across Saudi Arabia, the UAE, and Qatar is also creating opportunities for reusable plastic pallets, bins, and containers to manage high-volume packaging and reduce operational expenses.

The rapid expansion of industrial activities, particularly in oil & gas, petrochemicals, automotive, and pharmaceuticals, is driving the adoption of reusable packaging solutions. Durable packaging products like intermediate bulk containers (IBCs), drums, and reusable pallets are widely used for transporting raw materials and finished goods in these sectors. For instance, reusable plastic pallets are increasingly preferred in logistics hubs like Jebel Ali Free Zone (UAE) and King Abdullah Economic City (Saudi Arabia) due to their long lifecycle and lower cost-per-use compared to single-use alternatives. This industrial adoption ensures consistent demand for reusable packaging across the supply chain.

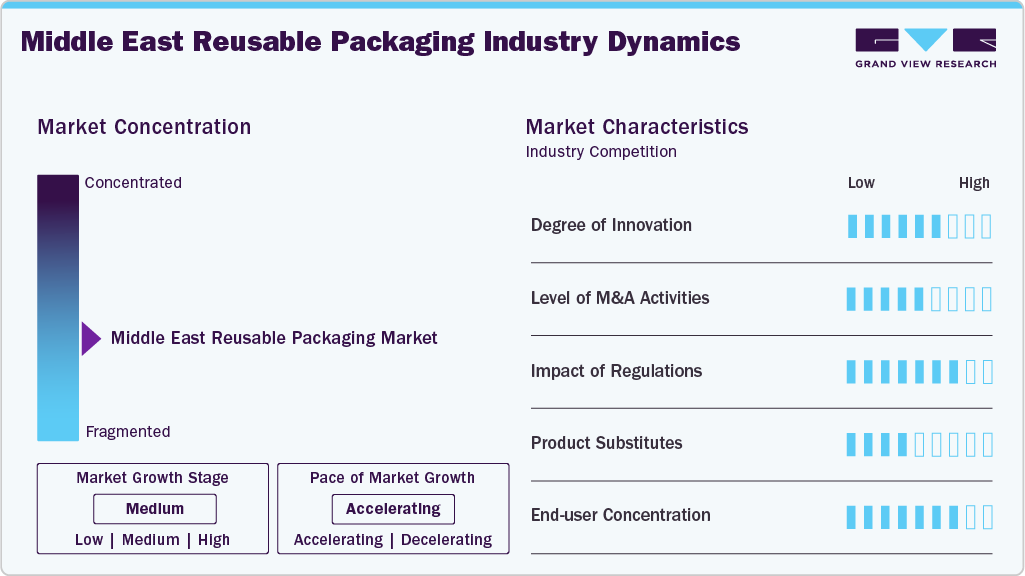

Market Concentration & Characteristics

The reusable packaging industry in the Middle East is closely tied to industrial growth, particularly in oil & gas, petrochemicals, automotive, pharmaceuticals, and FMCG. These sectors require durable and standardized packaging such as pallets, crates, IBCs, and drums to transport heavy goods and hazardous materials efficiently. Major logistics hubs like Jebel Ali Free Zone (UAE), Khalifa Industrial Zone Abu Dhabi (KIZAD), and Saudi Arabia’s King Abdullah Port drive demand for reusable packaging as companies focus on optimizing cross-border trade and reducing packaging costs.

Plastic remains the dominant material in the Middle East reusable packaging industry due to its durability, lightweight nature, and cost-effectiveness. High-density polyethylene (HDPE) and polypropylene (PP) are commonly used in manufacturing reusable pallets, crates, and containers. However, there is a growing interest in alternative materials like metal and wood for specialized applications. Moreover, innovation in biodegradable plastics and hybrid materials is emerging, as manufacturers respond to rising consumer and regulatory demand for more sustainable options.

Material Insights

The plastic segment recorded the largest market revenue share of over 48.0% in 2024 and is projected to register the fastest CAGR of 5.7% from 2025 to 2033. This dominance is due to its durability, lightweight nature, and cost-effectiveness. Reusable plastic crates, pallets, bins, and containers are widely used in food & beverage, agriculture, retail, and industrial logistics. In addition, plastic offers flexibility in design, making it suitable for industries that demand high customization, such as pharmaceuticals and FMCG. Rising sustainability initiatives also push manufacturers to adopt recyclable plastics, like HDPE and PP, instead of single-use plastics.

Wood-based reusable packaging, particularly pallets and crates, remains a strong choice for heavy-duty applications in logistics, construction, and export-oriented industries. In the Middle East, where construction and oil & gas sectors dominate, wooden pallets are extensively used for transporting machinery, building materials, and bulk goods. The availability of softwood and hardwood imports also supports the sector, though environmental concerns and ISPM-15 compliance regulations are important considerations. The resilience of wood packaging for heavy load-bearing applications, combined with its relatively lower cost than metal and glass, drives its use.

Product Insights

The container segment recorded the largest market revenue share of over 37.0% in 2024 and is expected to grow at the fastest CAGR of 5.8% during the forecast period. Reusable containers are widely used in the Middle East across industries such as food & beverages, retail, and pharmaceuticals for the safe handling and storage of products. Collapsible plastic containers are used in retail and logistics operations by companies such as Carrefour and Lulu Hypermarket for bulk transporting perishable goods. Industrial-grade containers are also used in the chemical and automotive sectors to handle liquids or components. The need for sustainable logistics and cost efficiency primarily drives the demand for reusable containers.

Reusable crates are heavily used in agriculture, food distribution, and retail for transporting fruits, vegetables, and packaged goods. Plastic and wooden crates dominate this segment, with plastic crates offering greater durability and resistance to moisture. Supermarkets and fresh produce suppliers across the region often use stackable crates for efficient storage and distribution. The growth of the fresh produce sector and expansion of modern retail formats such as hypermarkets are boosting crate demand.

End Use Insights

The food & beverages segment recorded the largest market share of over 38.0% in 2024 and is projected to grow at the fastest CAGR of 6.1% during the forecast period. The food & beverage sector in the Middle East is a major consumer of reusable packaging, particularly in beverages, fresh produce, and dairy distribution. Products such as reusable plastic crates, glass bottles, pallets, and insulated containers are widely used to ensure food safety, maintain product freshness, and reduce waste. For example, Coca-Cola and PepsiCo in the region rely on returnable glass bottles and plastic crates, while dairy companies in Saudi Arabia and the UAE use reusable plastic containers for milk and yogurt distribution. This segment benefits from the strong focus on reducing single-use plastics and the region’s growing retail and food service networks.

Logistics and transportation companies in the Middle East rely heavily on reusable packaging to support industrial supply chains. Reusable pallets, crates, intermediate bulk containers (IBCs), and totes are standard warehousing, shipping, and cross-border trade solutions. With Dubai positioning itself as a global logistics hub, companies like DP World and Aramex integrate reusable packaging systems to optimize cargo handling, reduce costs, and enhance supply chain sustainability. The surge in e-commerce and cross-border trade in the Middle East is a major growth driver, as reusable packaging ensures durability and multiple-use cycles, cutting costs for logistics providers.

Country Insights

Saudi Arabia Reusable Packaging Market Trends

In 2024, Saudi Arabia led the reusable packaging market, accounting for over 38.85% of revenue, and is projected to register the fastest CAGR of 5.6% during the forecast period. Saudi Arabia is the largest and most influential market for reusable packaging in the Middle East, driven primarily by its ambitious Vision 2030 economic diversification plan. The market is characterized by heavy investment in industrial sectors like automotive, petrochemicals, and pharmaceuticals, where reusable plastic containers (RPCs), intermediate bulk containers (IBCs), and pallets are essential for streamlining supply chains. For example, the burgeoning automotive manufacturing sector, with plants like those of Hyundai and Ceer, relies heavily on reusable packaging for the safe and efficient transport of components from suppliers to assembly lines.

UAE Reusable Packaging Market Trends

The reusable packaging market in the UAE is expected to grow significantly, particularly in Dubai and Abu Dhabi, which are mature and sophisticated hubs for reusable packaging, serving as the region's primary logistics and re-export gateway. The market is advanced due to the presence of world-class ports (Jebel Ali), airports (Dubai International, Al Maktoum), and free zones. The UAE has strong adoption in the retail and fresh food sectors. For instance, major hypermarket chains like Lulu and Carrefour have implemented pool systems of RPCs for transporting fresh produce, vegetables, and baked goods from central distribution centers to stores, significantly reducing product damage and packaging waste.

Turkey Reusable Packaging Market Trends

The reusable packaging market in Turkey is a major manufacturing powerhouse, particularly in the European supply chain. Its strong automotive, textile, and manufacturing industries are deeply integrated with Europe, where reusable packaging standards such as EUR-pallets are prevalent. Turkish automotive OEMs and their suppliers extensively use returnable transit packaging (RTP) such as custom plastic crates and pallets for just-in-sequence parts delivery. The agriculture and food export sector is another significant user, employing RPCs to transport fruits and vegetables to European supermarkets, ensuring quality and meeting the sustainability requirements of those retailers.

Key Middle East Reusable Packaging Company Insights

The competitive environment of the Middle East reusable packaging industry is moderately fragmented, with a mix of established regional players and emerging local startups competing across sectors such as food & beverage, logistics, and retail. Key international suppliers operate alongside regional companies such as Arabian Plastics Industrial Company and Onyx Plastic, offering solutions ranging from reusable crates and pallets to durable containers.

Competition is driven by product quality, sustainability credentials, and customization capabilities, with companies increasingly focusing on eco-friendly materials and smart packaging technologies to differentiate themselves. Strategic partnerships, mergers, and collaborations with logistics providers and FMCG companies are common, aiming to expand distribution networks and strengthen market presence in countries like the UAE, Saudi Arabia, and Turkey.

Key Middle East Reusable Packaging Companies:

- Sonoco Asia

- Schutz

- Takween Advanced Industries

- Onyx Plastic

- Tekin Plast

- Paxxal

- Arabian Plastics Industrial Company

- 3P Gulf Group

- Iplast Industries

- Hotpack

- Zero Point Packaging

Recent Developments

- In January 2025, Schütz GmbH, a German industrial packaging company, partnered with Saudi Arabia’s National Plastic Factory (NPF) to locally produce ECOBULK IBCs at a new Dammam facility starting in 2026. This move expands Schütz’s presence in the Middle East, supplying high-quality transport packaging for chemicals, oil, lubricants, and food, with advanced technology, faster deliveries, and enhanced service for regional customers.

Middle East Reusable Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.05 billion

Revenue forecast in 2033

USD 6.11 billion

Growth rate

CAGR of 5.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, end use, country

Country scope

UAE; Saudi Arabia; Oman; Kuwait; Qatar; Bahrain; Israel; Turkey

Key companies profiled

Sonoco Asia; Schutz; Takween Advanced Industries; Onyx Plastic; Tekin Plast; Paxxal; Arabian Plastics Industrial Company; 3P Gulf Group; Iplast Industries; Hotpack; Zero Point Packaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Reusable Packaging Market Report Segmentation

This report forecasts revenue growth at a regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East reusable packaging market report based on material, product, end use, and country:

-

Material Outlook (Revenue, USD Million 2021 - 2033)

-

Plastic

-

Wood

-

Metal

-

Glass

-

Others

-

-

Product Outlook (Revenue, USD Million 2021 - 2033)

-

Container

-

Crates

-

Bottles

-

Pellets

-

Drums & Barrels

-

Others

-

-

End Use Outlook (Revenue, USD Million 2021 - 2033)

-

Food & Beverage

-

Automotive

-

Healthcare

-

Logistics & Transportation

-

Others

-

-

Country Outlook (Revenue, USD Million 2021 - 2033)

-

UAE

-

Saudi Arabia

-

Oman

-

Kuwait

-

Qatar

-

Bahrain

-

Israel

-

Turkey

-

Frequently Asked Questions About This Report

b. The Middle East reusable packaging market was estimated at around USD 3.89 billion in the year 2024 and is expected to reach around USD 4.05 billion in 2025.

b. The Middle East reusable packaging market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2033 to reach around USD 6.11 billion by 2033.

b. The food & beverages segment dominates the Middle East reusable packaging market due to the region’s growing foodservice industry, high demand for sustainable packaging, and increasing adoption of reusable crates, containers, and pallets by manufacturers and retailers.

b. The key players in the Middle East reusable packaging market include Sonoco Asia; Schutz; Takween Advanced Industries; Onyx Plastic; Tekin Plast; Paxxal; Arabian Plastics Industrial Company; 3P Gulf Group; Iplast Industries; Hotpack; and Zero Point Packaging.

b. Rising government initiatives for sustainability and circular economy practices are driving the adoption of reusable packaging in the Middle East.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.