- Home

- »

- Plastics, Polymers & Resins

- »

-

Middle East Smart Packaging Market, Industry Report, 2033GVR Report cover

![Middle East Smart Packaging Market Size, Share & Trends Report]()

Middle East Smart Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Active Packaging, Intelligent Packaging, MAP), By Application (Food & Beverages, Pharmaceuticals, E-commerce, Electronics), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-764-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Smart Packaging Market Summary

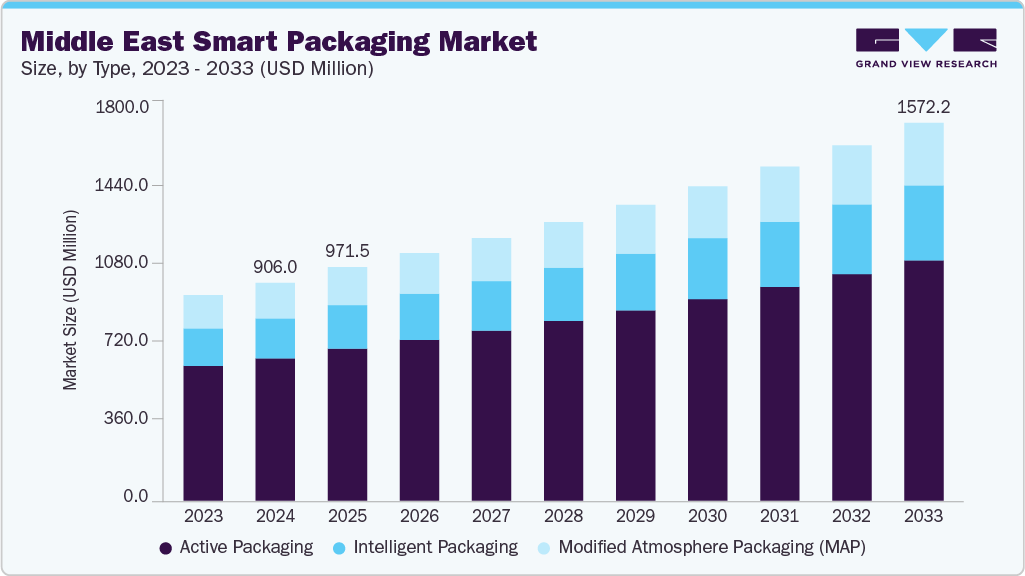

The Middle East smart packaging market size was estimated at USD 906.0 million in 2024 and is projected to reach USD 1,572.2 million by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The market is driven by growing demand for food safety, traceability, and extended shelf life across the food & beverage and pharmaceutical sectors.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East smart packaging industry with the largest revenue share of over 38.0% in 2024 and is expected to grow at a substantial CAGR of 6.5% from 2025 to 2033.

- By type, the intelligent packaging segment is expected to grow at a fastest CAGR of 7.1% from 2025 to 2033 in terms of revenue.

- By application, the pharmaceuticals segment is expected to grow at a fastest CAGR of 7.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 906.0 Million

- 2033 Projected Market Size: USD 1,572.2 Million

- CAGR (2025-2033): 6.2%

- Saudi Arabia: Largest market in 2024

Rising e-commerce penetration and government initiatives toward digitalization further boost the adoption of intelligent and connected packaging solutions. Countries such as Saudi Arabia, the UAE, and Qatar are witnessing rapid urbanization and growth in packaged food consumption, particularly through modern retail channels and online food delivery platforms. Smart packaging technologies, such as time-temperature indicators and freshness sensors, are gaining traction as they help detect spoilage and ensure quality throughout the supply chain. This aligns with regulatory requirements for stricter food safety standards, further boosting adoption.The booming e-commerce sector in the Middle East is significantly influencing smart packaging adoption. With online grocery and food delivery platforms such as Talabat, HungerStation, and Instashop gaining popularity, there is a heightened need for packaging that enhances product traceability, authenticity, and consumer engagement. Interactive smart packaging solutions, such as QR codes and NFC tags, allow brands to provide product information, authenticity checks, and promotional content directly to consumers, thereby enhancing customer trust and brand loyalty.

The pharmaceutical and healthcare sector is a major growth driver for smart packaging in the Middle East. Countries such as the UAE and Saudi Arabia are investing heavily in healthcare infrastructure, local drug manufacturing, and advanced distribution systems. Smart packaging technologies, such as RFID-enabled tracking and tamper-evident seals, help ensure supply chain security and regulatory compliance while combating counterfeiting, a persistent issue in the region. With governments promoting local pharmaceutical production, the demand for intelligent packaging solutions is set to increase.

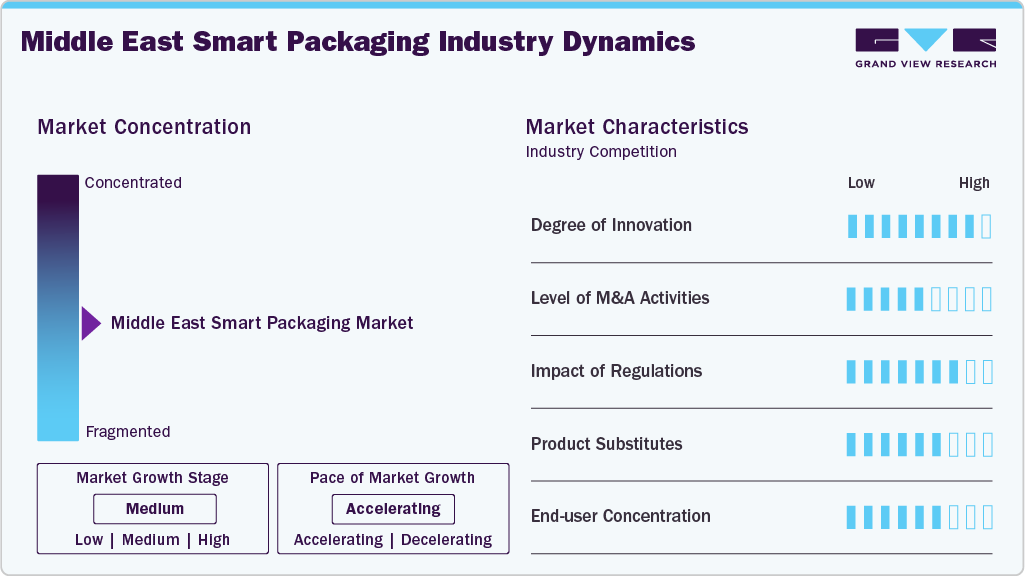

Market Concentration & Characteristics

Regulations are shaping the structure of the market. Governments in the GCC are enforcing stricter rules on food safety, pharmaceutical traceability, and sustainability. For example, Saudi Arabia’s Saudi Food and Drug Authority (SFDA) and the UAE’s Ministry of Health require advanced packaging compliance for pharmaceuticals to combat counterfeiting and ensure supply chain transparency. This regulatory pressure is accelerating the adoption of smart packaging technologies in critical sectors.

The Middle East smart packaging industry is characterized by strong innovation, with technologies such as RFID, NFC, QR codes, biosensors, and time–temperature indicators being increasingly integrated into packaging. Innovation is driven by the need for real-time product tracking, improved consumer engagement, and enhanced safety standards, especially in food & beverage and pharmaceuticals. Global players are partnering with local companies to introduce smart packaging tailored to Middle Eastern regulatory, cultural, and logistical needs.

Type Insights

The active packaging segment recorded the largest market revenue share of over 65.0% in 2024. This type of packaging extends product shelf life by incorporating components such as oxygen scavengers, moisture absorbers, antimicrobial coatings, and ethylene absorbers. For instance, in the Gulf region’s growing processed food and fresh produce industries, active packaging helps preserve quality during long storage and transport, which is critical for export markets. In addition, the pharmaceutical sector in countries like Saudi Arabia and the UAE relies on active packaging to maintain drug stability in hot climates.

The intelligent packaging segment is expected to grow at the fastest CAGR of 7.1% during the forecast period. Intelligent packaging integrates features such as QR codes, RFID tags, time-temperature indicators, and freshness sensors to monitor product condition and improve traceability. In the Middle East, this is becoming increasingly important in the food supply chain, especially for imported meat, seafood, and dairy products, where safety and compliance with international quality standards are critical. The surge in e-commerce and demand for transparency in supply chains is pushing the adoption of intelligent packaging in the region. In addition, the growth of halal-certified foods, which require strict quality monitoring, is further accelerating intelligent packaging adoption.

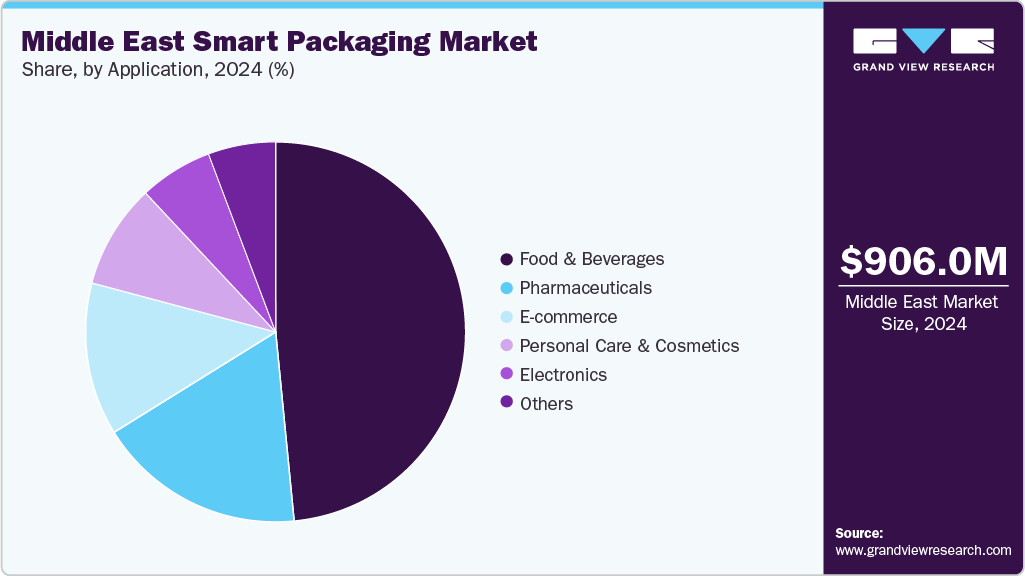

Application Insights

The food & beverages segment recorded the largest market share of over 48.0% in 2024.The food & beverages sector is the largest adopter of smart packaging in the Middle East, driven by growing consumer demand for safe, fresh, and traceable products. Smart labels, RFID, and QR-enabled packaging are increasingly being used to track the authenticity of packaged food, ensure freshness, and monitor temperature during transportation. For example, in the Gulf region, premium dairy and meat brands are leveraging time-temperature indicators to guarantee freshness in extreme climatic conditions. Beverage companies are also adopting NFC-enabled bottles to enhance customer engagement through digital experiences.

The pharmaceuticals segment is projected to grow at the fastest CAGR of 7.1% during the forecast period. Pharmaceutical companies in the Middle East are rapidly integrating smart packaging for serialization, anti-counterfeiting, and patient adherence solutions. Smart blister packs and RFID-enabled containers help track medicine usage, prevent counterfeiting, and comply with strict serialization regulations. In markets such as the UAE and Saudi Arabia, where counterfeit medicines pose significant risks, smart packaging plays a critical role in ensuring patient safety and compliance with Gulf Health Council and Ministry of Health mandates.

Country Insights

Saudi Arabia Smart Packaging Market Trends

Saudi Arabia smart packaging industry dominated the Middle East market in 2024 and accounted for the largest revenue share of over 38.0%. This outlook is due to its robust food & beverage, pharmaceutical, and petrochemical sectors. The government’s Vision 2030 diversification plan is pushing manufacturers to adopt advanced packaging technologies, including track & trace solutions, RFID-enabled logistics, and eco-friendly intelligent packaging. The growing demand for longer shelf-life packaging in dairy, processed meat, and beverage sectors is accelerating adoption. For instance, local F&B giants such as Almarai are increasingly shifting toward active packaging solutions to preserve freshness and reduce waste.

UAE Smart Packaging Market Trends

The smart packaging industry in the UAE is a regional hub for innovation in smart packaging, fueled by its role as a logistics and trade gateway. Dubai and Abu Dhabi host many multinational FMCG and pharma companies, which demand track & trace, QR codes, and intelligent labeling for exports. The country’s luxury retail and cosmetics sector also fuels demand for interactive packaging to enhance customer engagement. Sustainability regulations in the UAE are prompting companies to integrate recyclable materials with smart technologies. For example, Expo 2020 highlighted smart packaging for food and beverages to reduce waste and ensure traceability.

Turkey Smart Packaging Market Trends

Turkey smart packaging industry is emerging as a key manufacturing hub, linking Europe and the Middle East, and is a fast-growing adopter of smart packaging technologies. The country’s large food processing industry and expanding pharmaceutical production are encouraging the use of active and intelligent packaging solutions. Turkish e-commerce growth is also fostering the use of QR codes and NFC-enabled packaging for brand protection and consumer engagement.

Key Middle East Smart Packaging Company Insights

The competitive environment of the Middle East smart packaging industry is shaped by a mix of global players, regional packaging firms, and technology providers that are increasingly investing in innovation to cater to rising demand from the food & beverage, pharmaceutical, and logistics sectors.

Strategic partnerships, mergers, and investments in IoT-enabled and sustainable packaging solutions are becoming key competitive strategies, while compliance with regional regulations on food safety and sustainability further intensifies rivalry. Overall, the industry is moderately fragmented, with strong competition focused on innovation, cost efficiency, and localization of production to serve rapidly growing consumer markets.

-

In August 2024, Alesayi Beverage Corporation partnered with SIG to launch a state-of-the-art aseptic bag-in-box (BIB) system at its new 98,000 sq. m Jeddah facility. Featuring the SIG SureFill 42 line and 10L SIG bags with 2Pure Film, the packaging ensures up to one-year product quality and includes the OptiTap 2300 valve for HoReCa use. Initially targeting water, then juices and sauces, the move supports Alesayi’s goal of becoming the region’s top co-packer while advancing its sustainability roadmap.

-

In May 2024, Huhtamaki consolidated its three flexible packaging manufacturing sites in the UAE by keeping one factory in Jebel Ali and expanding its factory in Ras Al Khaimah. The consolidation aims to optimize the manufacturing footprint, improve competitiveness, and strengthen the foundation for future growth in the region.

Key Middle East Smart Packaging Companies:

- Mayr-Melnhof Karton AG

- SIG

- Sealed Air

- Amcor plc

- Huhtamaki

- Tetrapak

- Zultec Group

- Gulf Cryo

- Mondi Group

- Aypek

- SEALPAC

Middle East Smart Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 971.5 million

Revenue forecast in 2033

USD 1,572.2 million

Growth rate

CAGR of 6.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, country

Country scope

Saudi Arabia; UAE; Turkey; Qatar; Israel; Kuwait; Oman; Bahrain

Key companies profiled

Mayr-Melnhof Karton AG; SIG; Sealed Air; Amcor plc; Huhtamaki; Tetra Pak; Zultec Group; Gulf Cryo; Mondi Group; Aypek; SEALPAC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Smart Packaging Market Report Segmentation

This report forecasts revenue growth at a regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East smart packaging market report based on type, application, and country:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Active Packaging

-

Intelligent Packaging

-

Modified Atmosphere Packaging (MAP)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Pharmaceuticals

-

E-commerce

-

Personal Care & Cosmetics

-

Electronics

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Turkey

-

Qatar

-

Israel

-

Kuwait

-

Oman

-

Bahrain

-

Frequently Asked Questions About This Report

b. The Middle East smart packaging market was estimated at around USD 906.0 million in the year 2024 and is expected to reach around USD 971.5 million in 2025.

b. The Middle East smart packaging market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach around USD 1,572.2 million by 2033.

b. The food & beverages segment dominates the Middle East smart packaging market due to rising demand for extended shelf-life, freshness, and traceability in perishable products.

b. The key players in the Middle East smart packaging market include Mayr-Melnhof Karton AG; SIG; Sealed Air; Amcor plc; Huhtamaki; Tetra Pak; Zultec Group; Gulf Cryo; Mondi Group; Aypek; and SEALPAC.

b. Rising e-commerce penetration and government initiatives toward digitalization further boost adoption of intelligent and connected packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.