- Home

- »

- Plastics, Polymers & Resins

- »

-

Middle East Specialty Polymers Market, Industry Report 2033GVR Report cover

![Middle East Specialty Polymers Market Size, Share & Trends Report]()

Middle East Specialty Polymers Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Natural, Synthetic), By Form (Solid, Liquid), By Product Type (Specialty Elastomers, Specialty Thermoplastics), By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-708-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Specialty Polymers Market Summary

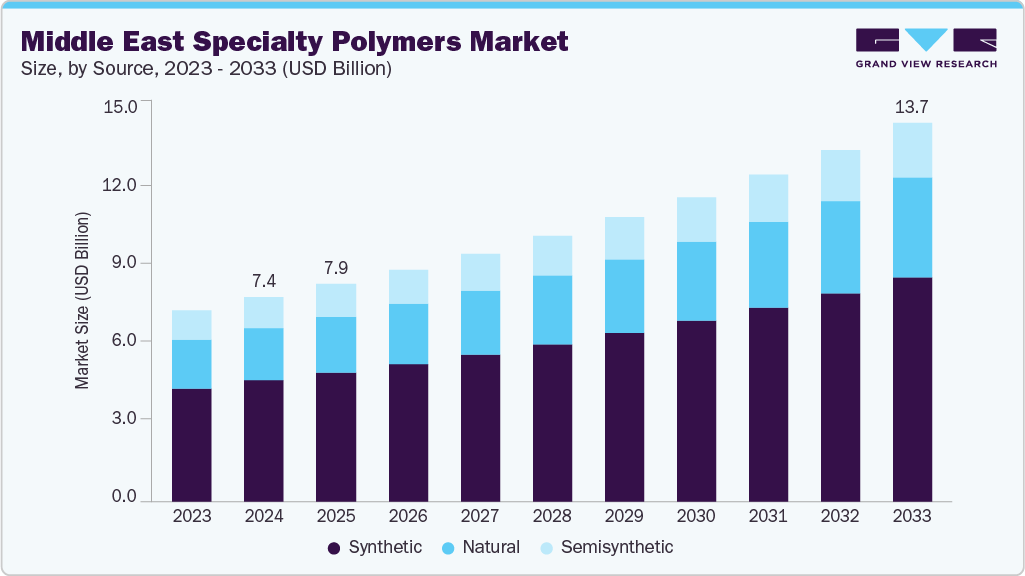

The Middle East specialty polymers market size was estimated at USD 7.42 billion in 2024 and is projected to reach USD 13.74 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. Growing demand from the region’s water management and desalination projects is boosting the need for specialty polymers, as these materials offer superior corrosion resistance and durability in harsh saline environments.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East specialty polymers market with the largest revenue share of 23.72% in 2024.

- By source, the synthetic segment dominated the Middle East specialty polymers market with the largest revenue share of 59.37% in 2024.

- By form, the solid segment dominated the Middle East specialty polymers market with a revenue share of 76.11% in 2024.

- By product type, the specialty elastomers segment led the Middle East specialty polymers industry with the largest revenue share of 28.01% in 2024.

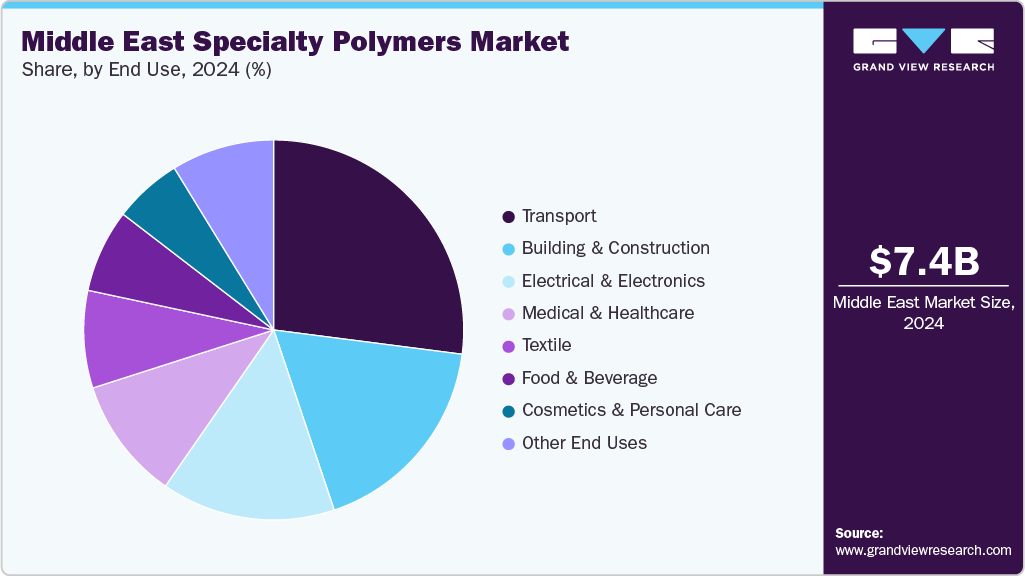

- By end use, the building & construction segment is expected to grow at a considerable CAGR of 8.3% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 7.42 Billion

- 2033 Projected Market Size: USD 13.74 Billion

- CAGR (2025-2033): 7.2%

This is encouraging greater adoption in pipelines, membranes, and filtration systems. The Middle East specialty polymers industry is witnessing a marked shift toward high-performance, application-specific materials, particularly in industries such as oil and gas, construction, automotive, and renewable energy. Manufacturers are focusing on developing polymers with enhanced chemical resistance, thermal stability, and lightweight properties to meet stringent operational requirements.

There is also a growing integration of specialty polymers into advanced manufacturing processes, including 3D printing and precision molding, which is expanding their application scope and enabling product differentiation across industrial sectors.

Drivers, Opportunities & Restraints

Rapid infrastructure development and industrial diversification initiatives in the Middle East are driving strong demand for specialty polymers. National agendas such as Saudi Arabia’s Vision 2030 and the UAE’s industrial growth programs are fueling investments in advanced materials to support sectors like aerospace, energy, water treatment, and healthcare. Specialty polymers are increasingly chosen for their ability to extend service life, reduce maintenance costs, and enhance performance in challenging climatic and operational environments, making them a strategic fit for the region’s evolving industrial base.

There is a significant opportunity for the Middle East to emerge as a global production hub for specialty polymers by leveraging its strong petrochemical feedstock availability and expanding value-added manufacturing capabilities. Localizing production of high-grade engineering plastics, fluoropolymers, and conductive polymers can reduce import dependence and position the region as an export supplier to Africa, Europe, and Asia. Additionally, the growing emphasis on sustainability and circular economy frameworks opens avenues for innovation in bio-based and recyclable specialty polymers tailored to regional and international regulatory demands.

The high production costs and complex manufacturing requirements of specialty polymers pose a challenge to broader market penetration in the Middle East. Limited regional expertise in specialty compounding and processing technologies has led to dependence on imports for advanced grades, impacting cost competitiveness.

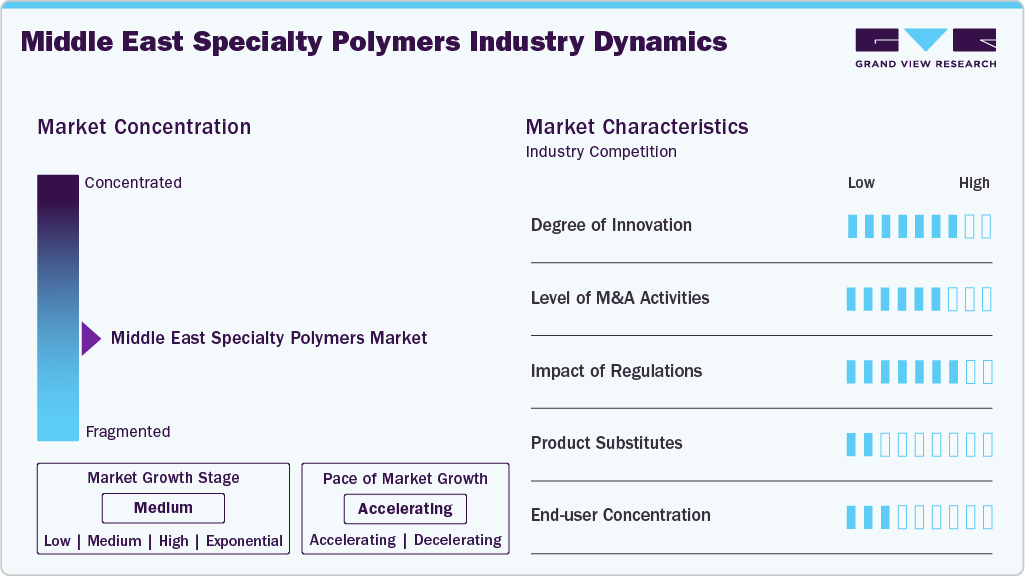

Market Concentration & Characteristics

The Middle East specialty polymers market growth stage is medium, and the pace is accelerating. The market exhibits significant fragmentation, with key players dominating the industry landscape. Major companies like SABIC, Saudi Kayan Petrochemical Company, Sipchem, Borouge, Petro Rabigh, Qatar Petrochemical Company (QAPCO), Farabi Petrochemicals Company, Nama Chemicals, BASF Middle East, Alujain Corporation, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation in the Middle East specialty polymers industry is increasingly driven by targeted R&D partnerships between national petrochemical players, technical universities, and technology startups that focus on application-specific formulations and advanced recycling technologies. Public and private research labs are working on high-performance grades, graphene and nanocomposite additives, and chemical recycling processes that can convert mixed waste back into feedstock, shortening the loop between production and reuse. These developments are supported by new domestic capacity projects and pilot plants that bridge laboratory chemistry with commercial-scale compounding, allowing a faster route to market for differentiated materials. The result is a rising pipeline of regionally engineered solutions that address local climate, corrosion, and weight reduction requirements.

Regulation is reshaping product design and supply chains across the region as governments introduce single-use plastic restrictions, tighter product safety frameworks, and specific technical rules for degradable and recyclable plastics. These policies are prompting manufacturers to redesign formulations for compliance, accelerate investment in domestic recycling, and secure local certifications for export markets, which raises qualification costs in the near term but strengthens long-term market access.

At the same time, national strategies to develop a circular plastics economy and new standards from regional bodies are creating clear commercial signals for capital investment in chemical recycling, traceability systems, and certified bio-based alternatives. Overall, regulation is moving the market from low-cost volume supply toward higher value, compliance-driven manufacturing.

Source Insights

The synthetic segment dominated the Middle East specialty polymers market with the largest revenue share of 59.37% in 2024 and is forecasted to grow at a 7.1% CAGR from 2025 to 2033. Buyers in oil and gas, automotive, and industrial manufacturing prefer engineered synthetic grades for predictable thermal and chemical resistance, which simplifies qualification cycles and reduces time to market.

Manufacturers are therefore prioritizing investments in synthetic compounding and downstream conversion to capture long-term contracts and volume business. This structural advantage keeps synthetic polymers at the core of regional procurement strategies.

The natural segment is anticipated to grow at the fastest CAGR of 7.5% through the forecast period. Rising regulatory emphasis on sustainability and growing end customer preference for biodegradable materials are accelerating the uptake of natural polymers across packaging, personal care, and specialty applications.

Suppliers are responding by reformulating products and introducing bio-based variants that meet regional sustainability mandates and export-grade specifications. This shift is creating a higher growth base for natural sources as stakeholders from brands to regulators push for lower environmental impact materials.

Form Insights

The solid segment dominated the Middle East specialty polymers market with a revenue share of 76.11% in 2024. End users in construction, infrastructure, and heavy industry favor pellets, powders, and granules for predictable dosing, long shelf life, and compatibility with existing equipment. As a result, processors and distributors build logistical networks optimized around solid shipments and inventory turns, reinforcing solids as the backbone of regional supply chains.

The liquid segment is anticipated to grow at a significant CAGR of 5.9% through the forecast period. Liquid specialty polymers are gaining strategic importance in coatings, adhesives, and membrane manufacturing, where formulation flexibility and in situ curing deliver performance benefits.

Producers can rapidly tune viscosity and reactive profiles to meet client specifications, enabling localized customization for extreme climates and infrastructure projects. The form factor also supports consolidation of multi-component systems, which reduces assembly complexity at downstream manufacturing sites and encourages formulators to favor liquid chemistries for advanced performance needs.

Product Type Insights

The specialty elastomers segment led the Middle East specialty polymers industry with the largest revenue share of 28.01% in 2024 and is anticipated to grow at an 8.1% CAGR over the forecast period. The region’s ongoing investments in heavy industry and infrastructure sustain steady demand for elastomeric grades engineered for extreme temperatures and chemical exposure. Suppliers that can offer qualified elastomer compounds with regional service and certification enjoy durable contract relationships with OEMs and EPC firms.

The specialty thermoplastics segment is anticipated to grow at a significant CAGR of 7.9% through the forecast period. Specialty thermoplastics are attracting interest where weight reduction, design complexity, and recyclability matter, such as in advanced components and lightweight assemblies. Regional manufacturers are adopting high-performance thermoplastics to replace metals and standard plastics, seeking cost savings in logistics and fuel efficiency. This creates a pull for localized extrusion and injection capabilities, enabling faster part qualification and supporting exporters who need consistent compliance with international specifications.

End Use Insights

Transport led the Middle East specialty polymers market with the largest revenue share of 27.04% in 2024 and is expected to grow at a CAGR of 8.2% through the forecast period. This can be attributed to the growing demand from automotive, aerospace, and logistics sectors that require large volumes of tailored polymer solutions for interiors, powertrain components, and lightweight body structures.

The region’s push to modernize fleets, expand airport infrastructure, and support regional supply corridors keeps polymer consumption elevated. Innovations in polymers for battery housings and electrical insulation are further entrenching the transport sector as the primary demand engine for specialty grades.

The building & construction segment is expected to expand at a substantial CAGR of 8.3% through the forecast period. Developers and contractors favor specialty polymers for insulation, membranes, sealants, and piping systems because they extend service life and lower maintenance costs in harsh climates. The combination of large project pipelines and regulatory focus on resilient infrastructure creates an accelerating adoption curve for advanced polymer solutions across the built environment.

Country Insights

Saudi Arabia led the Middle East specialty polymers market with the largest revenue share of 23.72% in 2024, driven by its extensive petrochemical infrastructure, integrated supply chains, and strong government-backed industrial diversification programs under Vision 2030. The country’s focus on expanding high-value downstream manufacturing in sectors such as automotive, aerospace, water treatment, and renewable energy is creating sustained demand for advanced polymer grades with enhanced performance characteristics. Strategic joint ventures with global chemical majors are accelerating technology transfer and enabling the production of engineered polymers tailored to both local environmental conditions and export market standards, reinforcing Saudi Arabia’s leadership in the regional market.

Turkey Specialty Polymers Market Trends

Turkey’s specialty polymers demand is accelerating due to its rapidly growing manufacturing base in automotive components, electricals, packaging, and construction materials, supported by its strategic position as a trade bridge between Europe, Asia, and the Middle East. Government incentives for industrial innovation, combined with increasing adoption of lightweight, high-durability materials in transport and infrastructure projects, are boosting the use of advanced polymers. Additionally, Turkey’s export-oriented manufacturing strategy and alignment with EU regulatory standards are encouraging local producers to adopt specialty polymer solutions that meet stringent quality and sustainability requirements, fueling its position as the fastest-growing market in the region.

Key Middle East Specialty Polymers Company Insights

The Middle East specialty polymers industry is highly competitive, with several key players dominating the landscape. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Middle East Specialty Polymers Companies:

- SABIC

- Saudi Kayan Petrochemical Company

- Sipchem

- Borouge

- Petro Rabigh

- Qatar Petrochemical Company (QAPCO)

- Farabi Petrochemicals Company

- Nama Chemicals

- BASF Middle East

- Alujain Corporation

Recent Developments

- In March 2025, Abu Dhabi National Oil Company (ADNOC) and OMV agreed to create a global polyolefins company by combining Borouge and Borealis into Borouge Group International, which will acquire Nova Chemicals for USD 13.4 billion.

Middle East Specialty Polymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.91 billion

Revenue forecast in 2033

USD 13.74 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Report segmentation

Source, form, product type, end use, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Oman; Kuwait; Qatar; Bahrain; Israel; Turkey

Key companies profiled

SABIC; Saudi Kayan Petrochemical Company; Sipchem; Borouge; Petro Rabigh; Qatar Petrochemical Company (QAPCO); Farabi Petrochemicals Company; Nama Chemicals; BASF Middle East; Alujain Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Specialty Polymers Market Report Segmentation

This report forecasts volume & revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East specialty polymers market report based on source, form, product type, end use, and country:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Natural

-

Semisynthetic

-

Synthetic

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Solid

-

Liquid

-

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Specialty Elastomers

-

Fluoroelastomers

-

Fluorosilicone Rubber

-

Liquid Silicone Rubber

-

Natural Rubber

-

Others

-

-

Specialty Thermoplastics

-

Polyolefins

-

Polyimides

-

Vinylic Polymer

-

Polyphenyles

-

Others

-

-

Specialty Thermosets

-

Epoxy

-

Polyester

-

Vinyl Ester

-

Polyimides

-

Others

-

-

Biodegradable Polymers

-

Liquid Crystal Polymers

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Building & Construction

-

Transport

-

Medical & Healthcare

-

Textile

-

Food & Beverage

-

Electrical & Electronics

-

Cosmetics & Personal Care

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Oman

-

Kuwait

-

Qatar

-

Bahrain

-

Israel

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The Middle East specialty polymers market size was estimated at USD 7.42 billion in 2024 and is expected to reach USD 7.91 billion in 2025.

b. The Middle East specialty polymers market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2033 to reach USD 13.74 billion by 2033.

b. Synthetic dominated the Middle East specialty polymers market across the polymer type segmentation in terms of revenue, accounting for a market share of 59.37% in 2024, as buyers in oil and gas, automotive and industrial manufacturing prefer engineered synthetic grades for predictable thermal and chemical resistance

b. Some key players operating in the Middle East specialty polymers market include Arkema, SABIC, Saudi Kayan Petrochemical Company, Sipchem, Borouge, Petro Rabigh, Qatar Petrochemical Company (QAPCO), Farabi Petrochemicals Company, Nama Chemicals, BASF Middle East, and Alujain Corporation

b. The factors driving the Middle East specialty polymers market are growing demand from the region’s water management and desalination projects, as these materials offer superior corrosion resistance and durability in harsh saline environments

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.