- Home

- »

- Alcohol & Tobacco

- »

-

Middle East Spirits Market Size, Share, Industry Report, 2033GVR Report cover

![Middle East Spirits Market Size, Share & Trends Report]()

Middle East Spirits Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Vodka, Gin, Rum, Gin), By Price Point (Economy, Mid-Premium), By Distribution Channel (On-trade, Off-trade), By Product - Price Point - Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-827-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Spirits Market Summary

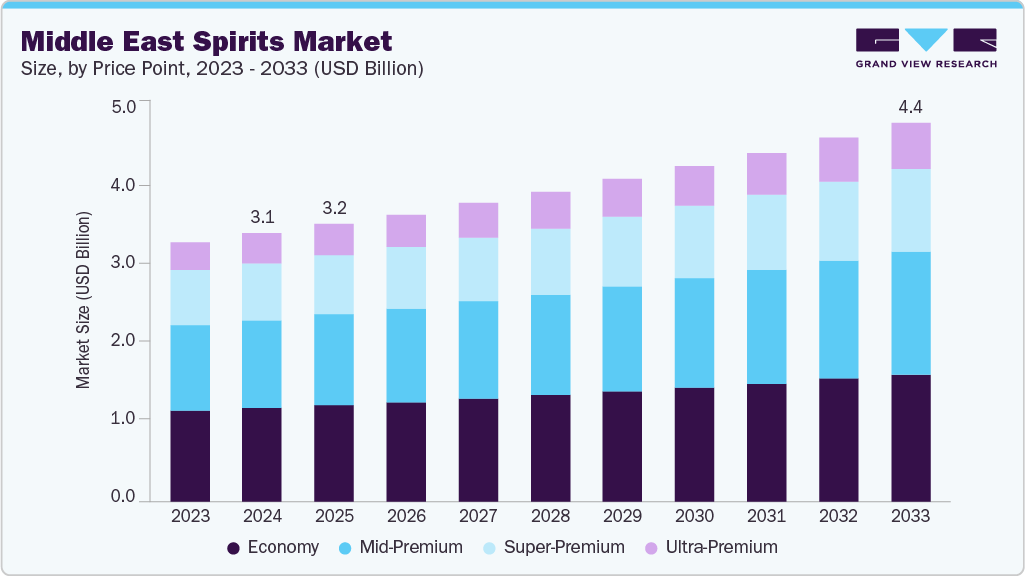

The Middle East spirits market size was estimated at USD 3.12 billion in 2024 and is projected to reach USD 4.41 billion by 2033, growing at a CAGR of 4.0% from 2025 to 2033. The rising influx of expatriates, ongoing tourism expansion, and the development of high-end hospitality infrastructure across the UAE, Bahrain, and Qatar primarily shape market growth in the region.

Key Market Trends & Insights

- By country, the UAE led the market with a share of 53.67% in 2024.

- By product, the whiskey led the Middle East spirits market and accounted for a share of 37.48% in 2024.

- By price point, the economic spirits segment led the Middle East spirits market and accounted for a share of 35.06% in 2024.

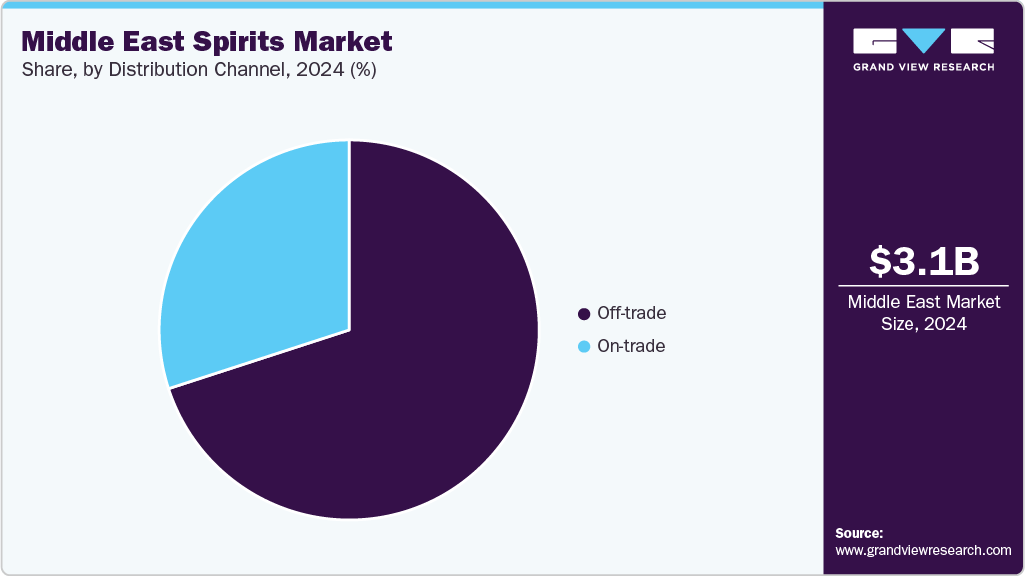

- By distribution channel, the sales of spirits through the off-trade channel led the market and accounted for a share of 59.83% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.12 Billion

- 2033 Projected Market Size: USD 4.41 Billion

- CAGR (2025-2033): 4.0%

These countries host vibrant nightlife scenes, luxury hotels, and premium dining venues that drive steady demand for imported spirits. Although alcohol consumption remains regulated, tourism-centric zones, duty-free retail, and licensed establishments have created accessible channels for both residents and visitors, increasing overall consumption levels. In addition, international events and global travelers continue to support premium and super-premium spirit sales, especially in cities like Dubai and Doha.A key trend in the region is the growing preference for premiumization as consumers increasingly gravitate toward high-quality, aged, and internationally recognized spirit brands. This shift is strongly influenced by affluent consumers, expatriate professionals, and tourists seeking refined drinking experiences. Premium whiskey, cognac, and tequila are among the highest-performing categories, benefiting from strong brand visibility, exclusive launches, and curated experiences in premium lounges and high-end bars. Retailers and hospitality operators are also expanding their offerings of limited-edition and craft spirits to cater to a discerning audience. Meanwhile, innovations in mixology are reshaping beverage menus across upscale restaurants, where cocktail culture is gradually gaining traction, further boosting demand for versatile and high-quality spirits.

E-commerce and digital platforms, though still emerging in the region due to regulatory constraints, are beginning to play a greater role, especially in markets like the UAE, where licensed online alcohol delivery services are expanding. In addition, the rise of expatriate-focused retail chains, duty-free stores, and specialty liquor outlets is improving access to a diverse range of global spirit brands. As hospitality investments intensify and the region continues to attract international tourists, the market is expected to maintain its growth momentum. Increasing product diversification, greater acceptance of premium offerings, and a gradual transformation in consumer lifestyles will collectively support steady market expansion through 2033.

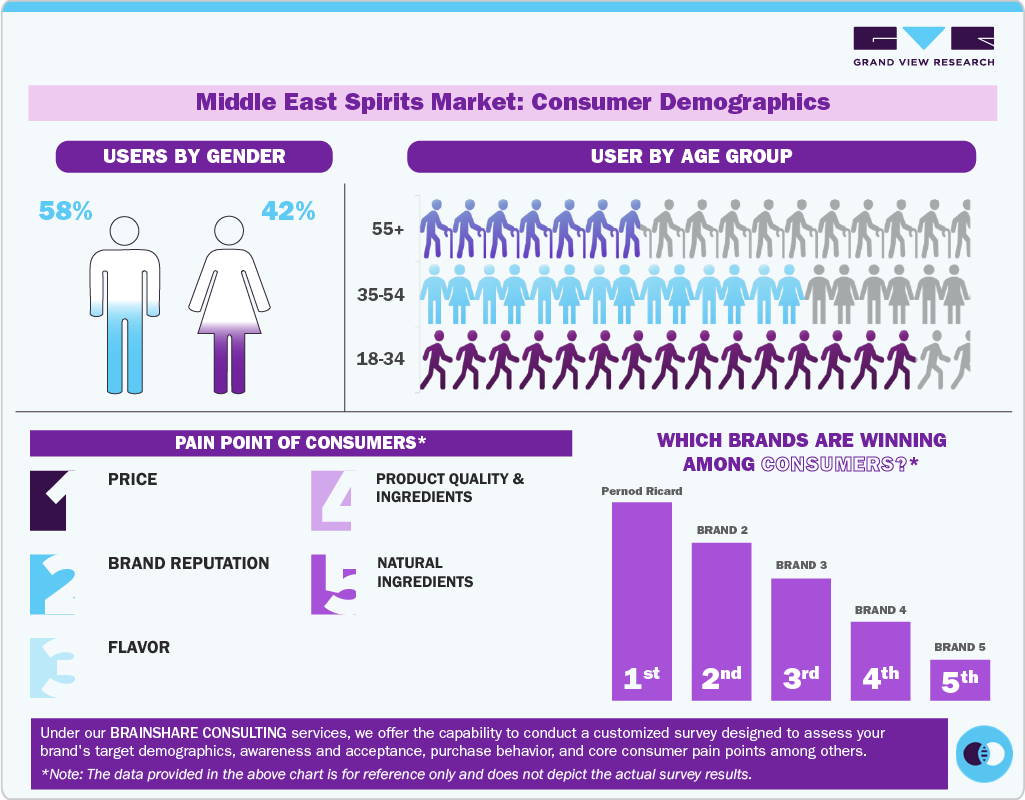

Consumer Insights

The Middle East spirits industry presents a complex tapestry of consumer insights, largely shaped by diverse regulatory environments and a significant expatriate and tourist population. Consumers in permissible markets, such as the UAE, Bahrain, and Lebanon, often exhibit a strong preference for premium and ultra-premium international brands, viewing spirits as a status symbol or a luxury indulgence for social occasions. A key demographic driving this demand includes affluent locals, a large expatriate community, and international tourists, all of whom seek quality, authenticity, and renowned labels, leading to a vibrant market for whiskies (Scotch, Irish, American), vodkas, and gins, with emerging interest in tequila and craft spirits.

Further insights reveal that consumption patterns are heavily influenced by the social context, with a prevalence of spirits enjoyed in licensed hotel venues, restaurants, and private gatherings. While traditional channels such as duty-free and dedicated retail stores remain crucial, there's a growing inclination towards curated experiences, including sophisticated cocktail offerings and unique brand activations, particularly among younger, more experimental consumers. Convenience, where legally permitted, also plays a role, with demand for in-home delivery services reflecting a shift towards more private consumption. Understanding these nuanced preferences, from brand prestige to occasion-based choices and evolving retail channels, is paramount for brands aiming to succeed in this dynamic and culturally sensitive region.

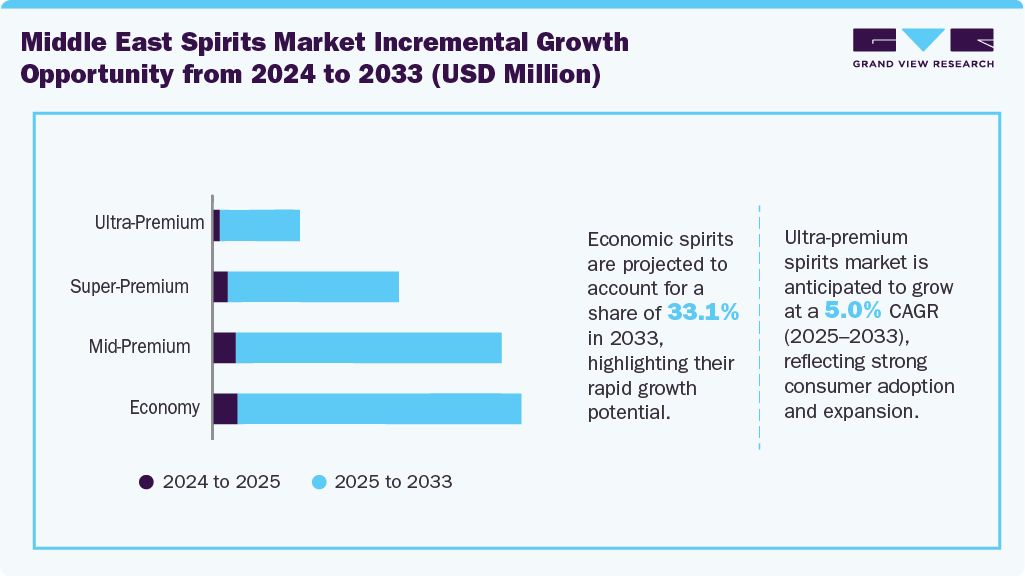

Price Point Insights

Economic spirits held the largest segment, accounting for a share of 35.06% in 2024 due to their strong affordability, wide availability, and appeal to price-sensitive consumers across the Middle East. These products remain popular among expatriate workers and value-driven buyers who seek accessible options for casual or occasional consumption without the premium price tag. The segment is further supported by the presence of budget-friendly brands in duty-free stores, licensed retail outlets, and select hospitality venues, ensuring convenient access. In addition, economic spirits often serve as entry-level choices for consumers who prefer straightforward, familiar profiles, contributing to their sustained dominance in the regional market.

Ultra-premium spirits are anticipated to witness a CAGR of 5.0% from 2025 to 2033 as demand continues to rise among affluent consumers, expatriates, and high-net-worth travelers seeking exclusive, high-quality drinking experiences. Growth is further supported by the region’s expanding luxury hospitality sector, including five-star hotels, premium lounges, and fine-dining establishments that prominently feature rare and aged spirits. Duty-free retail hubs in cities like Dubai and Doha also play a key role by offering limited-edition collections and premium gifting options. In addition, global brands are increasingly launching exclusive Middle East editions and hosting luxury tasting events, reinforcing the appeal of ultra-premium spirits among discerning drinkers.

Product Insights

Based on product, whiskey is the largest segment, accounting for a share of 37.48% in 2024, fueled by a growing appreciation for its diverse flavor profiles and the aspirational status it often carries. Consumers are increasingly exploring single malts from Scotland, premium bourbons from the United States, and even emerging Japanese whiskies, moving beyond traditional blended options. The increasing presence of international brands, along with a significant expatriate community and a more open cultural landscape, is collectively shaping a market ripe for growth and innovation across various product categories. The burgeoning luxury hospitality sector, with its emphasis on fine dining and sophisticated bars, further amplifies whiskey's appeal, providing consumers with accessible avenues to discover and enjoy this popular spirit, thus solidifying its position as a key category in the region's evolving beverage landscape.

Tequila & mezcal are anticipated to witness a CAGR of 5.4% from 2025 to 2033, driven by rising consumer interest in authentic, craft-distilled agave spirits and the growing influence of Western cocktail culture across the Middle East. Premium hospitality venues, luxury hotels, and upscale bars are increasingly incorporating tequila- and mezcal-based cocktails into their menus, appealing to expatriates and tourists seeking familiar, high-quality drinking experiences. In addition, the global popularity of premium and ultra-premium tequila is strengthening demand in key markets like the UAE and Qatar, where affluent consumers are drawn to artisanal production methods, distinctive flavor profiles, and exclusive brand offerings. Expanding travel retail and wider product availability further support category growth.

Distribution Channel Insights

Off-trade channels accounted for a share of around 59.83% in 2024, primarily due to the strong presence of duty-free outlets, licensed specialty liquor stores, and expatriate-focused retail chains that offer wide product availability and competitive pricing. Off-trade channels provide consumers with greater convenience, privacy, and flexibility in purchasing, which is particularly important in a region with regulated alcohol access. In addition, bulk buying for personal consumption, gifting, and social gatherings is more common through off-trade formats. The expansion of licensed online delivery platforms in markets like the UAE has further strengthened off-trade dominance by making premium and economic spirits more accessible to a broader consumer base.

The sales of spirits through on-trade channels are expected to grow at a CAGR of 3.6% from 2025 to 2033, due to the continued expansion of luxury hospitality venues, premium bars, and fine-dining restaurants across the Middle East. The region’s strong tourism growth-driven by international events, business travel, and holiday tourism-is boosting consumption in hotels, lounges, and nightlife establishments. Rising interest in premium cocktails, mixology experiences, and curated tasting events is further enhancing on-premise demand. In addition, affluent consumers and expatriates increasingly prefer social drinking occasions in upscale settings, while global spirit brands are partnering with top-tier hotels and bars to introduce signature cocktails and exclusive launches, supporting steady on-trade growth.

Country Insights

The spirits market in the UAE accounted for 53.67% of the Middle East revenue in 2024. The market is shaped by rising premiumization, expanding tourism, and a rapidly evolving hospitality sector. Consumers increasingly favor high-quality, aged, and globally recognized spirits, driven by strong purchasing power and a vibrant luxury lifestyle culture. Premium whisky, tequila, and cognac are among the fastest-growing categories, supported by exclusive launches and curated tasting experiences in five-star hotels and upscale bars. Cocktail culture continues to gain momentum, with mixology-led bars and themed lounges introducing innovative, globally inspired drink menus. Duty-free retail at Dubai and Abu Dhabi airports also plays a significant role by offering a wide range of premium and limited-edition spirits to tourists and business travelers. In addition, the UAE’s liberalized alcohol rules and expanding licensed e-commerce platforms have improved accessibility, contributing to a more diverse, premium-driven market.

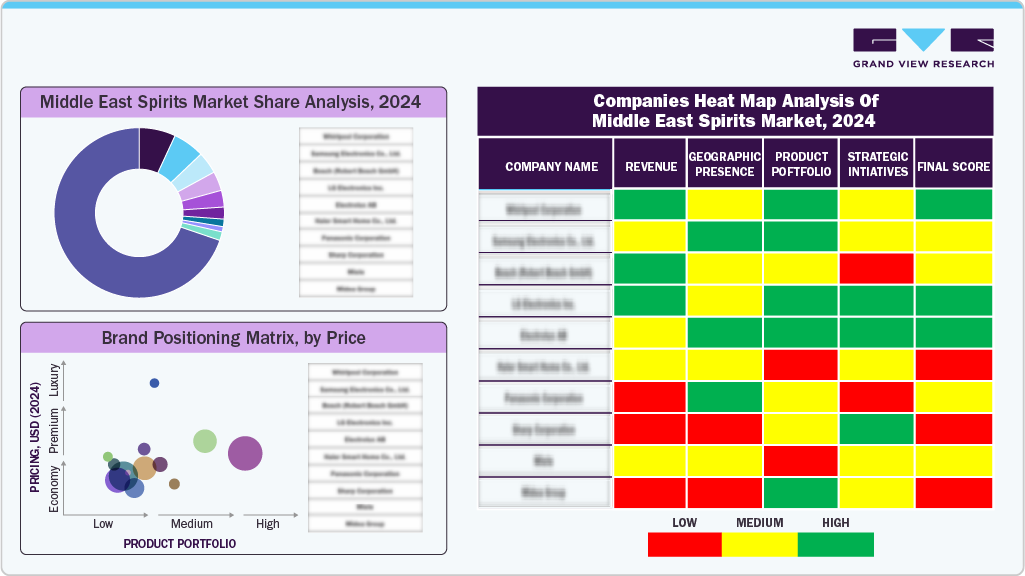

Key Middle East Spirits Company Insights

Leading players in the Middle East market include Hennessy, Pernod Ricard S.A., and Campari Group. The market remains highly competitive in the region, with leading manufacturers strategically expanding their distribution networks across online and offline platforms to improve product accessibility and visibility. Companies strongly emphasize innovation, advanced distillation processes, and diversified flavor profiles to attract younger consumers and broaden their international presence. Market growth is further fueled by the rising demand for premium and super-premium segments, the increasing influence of Western drinking culture, and global mixology trends.

Key Middle East Spirits Companies:

- Asahi Group Holdings, Ltd.

- Diageo plc

- Pernod Ricard S.A.

- Campari Group

- Constellation Brands, Inc.

- Tilaknagar Industries Ltd.

- Bacardi Limited

- Suntory Holdings Limited

- Louis Royer

- Cognac Hardy

Recent Developments

-

In March 2025, Bushmills 46-Year-Old “Secrets of the River Bush” Irish Single Malt was launched as a regional exclusive at Dubai Duty Free. Only 300 bottles were released, celebrating the River Bush heritage.

-

In September 2024, Gulf Beverages partnered with Dubai Duty Free to introduce Teremana premium tequila (Blanco, Reposado & Añejo) in the Middle East, targeting the region’s growing cocktail and travel-retail demand.

-

In June 2024, Indian celebrity-backed blended Scotch Whisky The Glenwalk made its Middle East debut in Dubai at the Travel Retail Consumer Forum ’24, marking its first entry into Gulf travel-retail.

Middle East Spirits Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.23 billion

Revenue forecast in 2033

USD 4.41 billion

Growth rate

CAGR of 4.0% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in million 9-liter cases and CAGR in % from 2025 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price point, distribution channel, product - price point - distribution channel

Regional scope

Middle East

Country scope

UAE; Qatar; Oman

Key companies profiled

Asahi Group Holdings, Ltd.; Diageo plc; Pernod Ricard S.A.; Campari Group; Constellation Brands, Inc.; Tilaknagar Industries Ltd.; Bacardi Limited; Suntory Holdings Limited; Louis Royer; Cognac Hardy

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Spirits Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the Middle East spirits market based on product, price point, distribution channel, product - price point - distribution channel, and country.

-

Product Outlook (Volume: Million 9-Liter Cases, Revenue, USD Million, 2021 - 2033)

-

Vodka

-

Whiskey

-

Rum

-

Brandy and Cognac

-

Gin

-

Cordials & Liqueurs

-

Tequila & Mezcal

-

Baijiu

-

Others

-

-

Price Point Outlook (Volume: Million 9-Liter Cases, Revenue, USD Million, 2021 - 2033)

-

Economy

-

Mid-Premium

-

Super-Premium

-

Ultra-Premium

-

-

Distribution Channel Outlook (Volume: Million 9-Liter Cases, Revenue, USD Million, 2021 - 2033)

-

On-trade

-

Off-trade

-

-

Product - Price Point - Distribution Channel Outlook (Volume: Million 9-Liter Cases, Revenue, USD Million, 2021 - 2033)

-

Vodka

-

Unflavored/Regular

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Flavored

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

-

Whiskey

-

Scotch Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Irish Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Global/American Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Japanese Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Canadian Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Other Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

-

Rum

-

Dark & Golden Run

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

White Rum

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Flavored & Spiced Rum

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Others

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

-

Gin

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Brandy & Cognac

-

Unflavored/Regular

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Flavored

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Tequila Mezcal

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Baijiu

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Other Spirits

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

-

-

Country Outlook (Volume: Million 9-Liter Cases, Revenue, USD Million, 2021 - 2033)

-

Middle East

-

UAE

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East spirits market was estimated at USD 3.12 billion in 2024 and is expected to reach USD 3.23 billion in 2025.

b. The Middle East spirits market is expected to grow at a compound annual growth rate of 4.0% from 2025 to 2033 to reach USD 4.41 billion by 2033.

b. Based on product type, Baijiu is the largest segment, accounting for a share of 37.14% in 2024 in the Middle East spirits market.

b. Key players in the Middle East spirits market are Asahi Group Holdings, Ltd.; Diageo plc; Pernod Ricard S.A.; Campari Group; Constellation Brands, Inc.; Tilaknagar Industries Ltd.; Bacardi Limited; Suntory Holdings Limited; Louis Royer; Cognac Hardy among others.

b. Key factors driving Middle East spirits market growth include rising tourism, premiumization trends, expanding on-trade channels, growing expatriate population, innovative flavored products, and relaxed alcohol regulations in select markets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.