- Home

- »

- Advanced Interior Materials

- »

-

Mining Safety Equipment Market Size, Industry Report, 2033GVR Report cover

![Mining Safety Equipment Market Size, Share & Trends Report]()

Mining Safety Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Personal Protective Equipment, Fire Detection & Suppression Systems, Gas Detection Systems, Communication Systems), By Operation Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-826-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mining Safety Equipment Market Summary

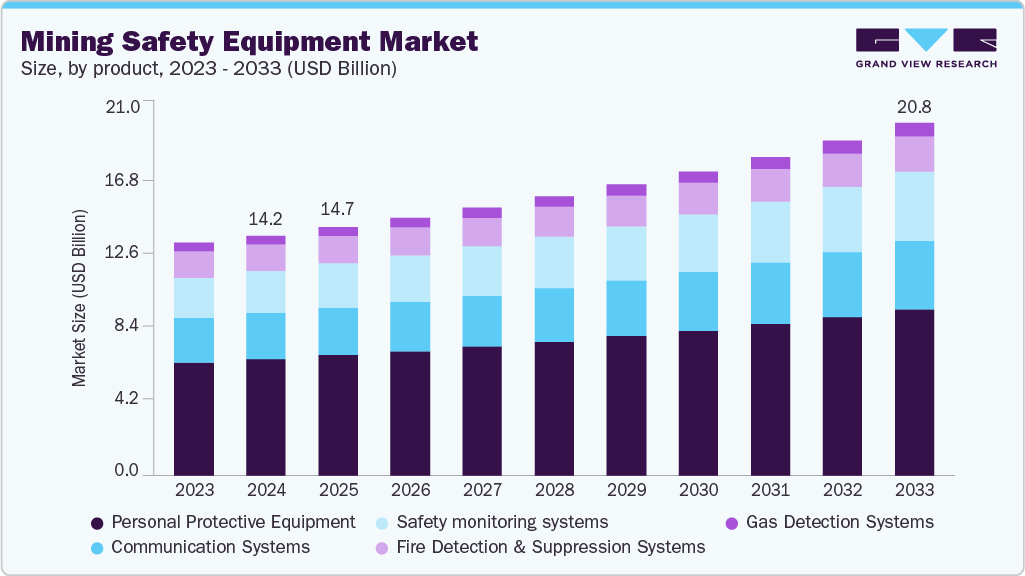

The global mining safety equipment market size was valued at USD 14,185.6 million in 2024 and is projected to reach USD 20,824.5 million by 2033, growing at a CAGR of 4.5% from 2025 to 2033. The market is poised for significant growth as mining operators worldwide intensify focus on worker protection amid deeper, more hazardous mining operations.

Key Market Trends & Insights

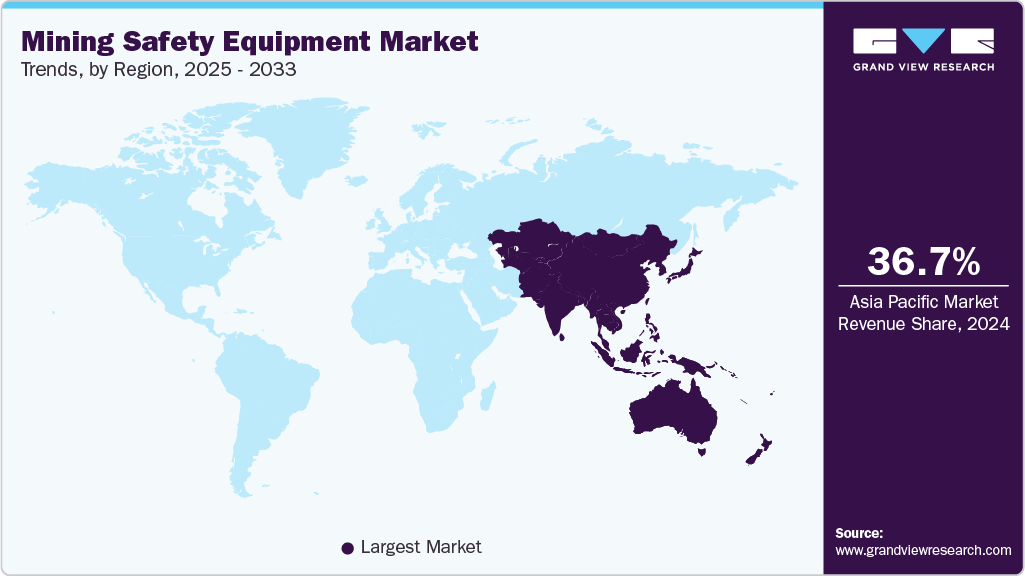

- Asia Pacific dominated the mining safety equipment market with the largest revenue share of 36.7% in 2024.

- By product, the safety monitoring systems segment is expected to grow at a considerable CAGR of 5.7% from 2025 to 2033 in terms of revenue.

- By operation type, the surface mining segment is expected to grow at a considerable CAGR of 3.9% from 2025 to 2033 in terms of revenue.

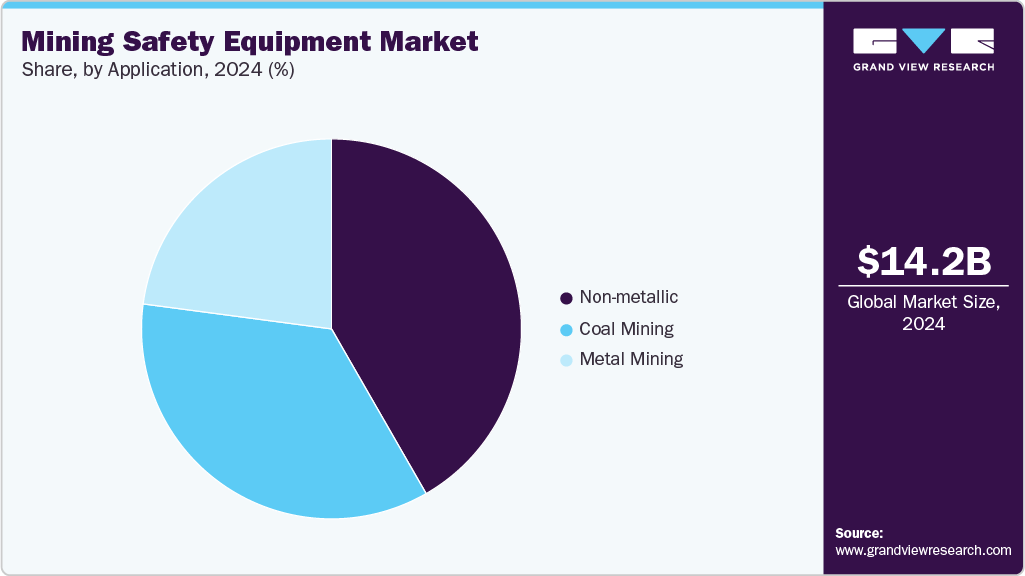

- By application, the metal mining segment is expected to grow at a considerable CAGR of 6.0% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 14,185.6 Million

- 2033 Projected Market Size: USD 20,824.5 Million

- CAGR (2025-2033): 4.5%

- Asia Pacific: Largest market in 2024

As mines expand in depth and complexity, risks such as toxic gas exposure, cave-ins, and dust-related respiratory hazards increase, prompting firms to invest more in protective gear, gas detectors, breathing apparatus, and monitoring systems. Stricter global safety regulations and rising corporate responsibility standards drive the adoption of certified safety equipment, even in developing regions.

Technological advances, including IoT-enabled sensors, smart helmets, wearable safety devices, and real-time environmental monitoring, are enhancing safety while offering operational efficiency. Growing demand for minerals and metals, especially from infrastructure, renewable energy, and tech sectors, further fuels new mining projects, which in turn expand demand for safety solutions.

Industry Concentration & Characteristics

The industry is moderately fragmented, and it includes a mix of large global manufacturers and numerous regional or specialized suppliers. No single company dominates all product categories, as needs vary widely across mines, geographies, and safety standards. Some firms focus on personal protective equipment, while others specialize in gas detection, communication systems, or monitoring technologies.

Innovation in the industry is accelerating as companies integrate digital technologies into traditional protective gear. Smart helmets, wearable sensors, real-time gas detection, and automated communication systems improve hazard monitoring and response times. Advances in materials science are enhancing durability, comfort, and protection levels. Data analytics and IoT platforms now enable predictive safety management, helping operators identify risks before incidents occur. These innovations are steadily transforming safety practices across modern mining operations.

Mergers and acquisitions in the market are driven by the need to expand product portfolios and gain access to advanced technologies. Larger companies often acquire niche innovators specializing in sensors, communication systems, or automation tools to enhance integrated safety solutions. This consolidation helps accelerate R&D, broaden global distribution, and strengthens competitive positioning. Despite this, many regional suppliers remain active, keeping the market moderately fragmented while still benefiting from technology-driven partnerships and selective acquisitions.

Regulations play a central role in shaping the mining safety equipment market by enforcing strict standards for worker protection and operational safety. Governments mandate the use of certified personal protective equipment, gas monitoring devices, and communication systems to reduce accident risks. Regular inspections and compliance requirements push mining companies to upgrade outdated equipment and adopt advanced solutions. As safety rules tighten globally, demand rises for reliable, high-performance equipment, making regulatory frameworks a persistent driver of market growth.

Drivers, Opportunities & Restraints

Increasing emphasis on worker protection as mining operations become deeper, more mechanized, and more hazardous is driving the market. Rising awareness of occupational risks, coupled with stricter enforcement of safety standards, pushes companies to invest in advanced protective gear and monitoring technologies. Frequent accident reports and higher corporate accountability also motivate operators to prioritize safety, fueling sustained demand for reliable, high-performance safety equipment across global mining sites.

Growing adoption of digital and smart safety technologies is significantly creating opportunities in the market. IoT-enabled sensors, wearable devices, autonomous monitoring systems, and real-time communication tools can significantly improve visibility into underground conditions. Mines transitioning toward automation and data-driven operations need integrated safety solutions, creating room for innovation. Emerging markets with expanding mining activities also offer strong potential, especially for cost-effective, rugged, and easy-to-deploy equipment tailored to varied geological and regulatory environments.

A significant challenge is the high cost and complexity of advanced safety equipment, which can limit adoption in smaller or budget-constrained mining operations. Integration of digital systems often requires skilled personnel, reliable connectivity, and ongoing maintenance conditions not always available in remote mining regions. Additionally, variations in global safety regulations complicate product standardization and certification. These factors can slow modernization efforts and create barriers for manufacturers trying to scale technologically advanced safety solutions.

Product Insights

The personal protective equipment segment holds the dominant share in the market and accounted for a share of 48.6% in 2024, as mining operations prioritize worker safety amid increasingly complex and hazardous environments. Rising awareness of respiratory risks, noise exposure, chemical hazards, and physical injuries drives higher adoption of advanced PPE such as reinforced helmets, high-filtration respirators, cut-resistant gloves, and improved footwear. Innovations in lightweight, durable, and comfortable materials make PPE more effective and easier to use.

The safety monitoring systems segment will see strong growth as mines adopt digital technologies for real-time detection of hazards such as gas leaks, seismic activity, equipment failures, and worker location risks. IoT-enabled sensors, automated alarms, wearable tracking devices, and integrated communication platforms are becoming essential for predictive safety management. As mining operations expand into deeper and more remote areas, reliable monitoring systems help minimize accidents and downtime. Regulatory pressure for continuous environmental and personnel monitoring further accelerates investment in these advanced systems.

Operation Type Insights

The underground mining segment continues to dominate the market and accounted for a share of 65.1% in 2024 due to the inherently higher risks associated with confined spaces, poor ventilation, and potential gas or structural hazards. Demand for advanced safety equipment, including gas detectors, ventilation monitoring systems, smart helmets, and reinforced personal protective gear, is rising. Technological adoption, such as real-time tracking and IoT-enabled hazard detection, enhances worker safety.

The surface mining segment is projected to grow as large-scale open-pit and strip mining operations expand worldwide to meet rising demand for minerals and metals. Safety concerns, including heavy machinery accidents, dust inhalation, and exposure to extreme weather, boost the adoption of protective gear, monitoring systems, and emergency response equipment. Integration of digital solutions, like remote monitoring and automated alert systems, improves operational safety and efficiency.

Application Insights

The non-metallic segment dominated the market and accounted for a share of 41.7% in 2024, due to increasing extraction of minerals like limestone, phosphate, gypsum, and potash, which are essential for construction, fertilizers, and industrial processes. As production expands, the need for advanced PPE, dust-control systems, respiratory protection, and monitoring equipment rises. Stricter safety regulations and growing awareness of worker health risks further accelerate the adoption of modern safety solutions in this segment.

The metal mining segment is projected to experience strong growth in the mining safety equipment market due to rising global demand for metals such as copper, iron ore, nickel, and lithium used in construction, electronics, and renewable energy technologies. Higher production intensity increases exposure to hazards like rockfalls, machinery accidents, and toxic gases, driving demand for advanced safety systems. Investments in smart sensors, ventilation, and automated monitoring further support growth in this segment.

Regional Insights

North America mining safety equipment industry is growing due to strong regulatory enforcement, advanced mining operations, and high adoption of modern technologies. Increasing investments in smart safety solutions such as gas detection sensors, automation, and wearable monitoring devices support market expansion. The region’s focus on worker safety, coupled with rising metal and mineral demand for manufacturing and energy storage, continues to drive significant equipment upgrades and compliance-based spending.

U.S. Mining Safety Equipment Market Trends

The mining safety equipment market in the U.S. is expanding as mining operations expand to support the renewable energy, construction, and electronics industries. Strict Mine Safety and Health Administration (MSHA) standards push companies to invest in reliable PPE, ventilation systems, and advanced monitoring technologies. Growing interest in automation, IoT-based safety devices, and predictive maintenance tools further strengthens the market, ensuring continual improvements in workplace safety and operational efficiency.

Mexico mining safety equipment market is expanding due to increased production of silver, copper, and gold, along with rising foreign investments in mining projects. Growing awareness of workplace hazards and the adoption of modern safety practices are prompting companies to upgrade protective gear, gas detection systems, and ventilation technologies. Government efforts to improve compliance and reduce accidents support ongoing demand, making safety modernization a key focus for domestic and international mining operators.

Europe Mining Safety Equipment Market Trends

The mining safety equipment market in Europe is driven by strict safety regulations, modernization of mining operations, and demand for raw materials essential to renewable energy technologies. The region’s emphasis on worker protection and environmental sustainability encourages the adoption of advanced safety systems, including automation, dust control, and real-time monitoring devices. Government support for safer mining practices further accelerates investment in high-quality equipment across major European mining regions.

Germany’s mining safety equipment market is growing due to strong industrial demand for minerals and continued modernization of mining operations. Strict occupational safety regulations encourage the use of advanced PPE, gas detection devices, and automated monitoring systems. The shift toward digitalization, including smart sensors and real-time tracking, strengthens adoption. Increased focus on reducing workplace accidents and improving operational sustainability further fuels investment in reliable, high-efficiency safety solutions.

UK’s mining safety equipment market is growing moderately, as the country focuses on improving worker protection in mineral extraction and quarrying operations. Strict regulatory frameworks and health standards accelerate the adoption of advanced PPE, monitoring systems, and ventilation technologies. Investments in digital safety tools and hazard detection systems support modernization. Growing demand for construction materials and critical minerals continues to drive safety-related equipment upgrades across the sector.

Asia Pacific Mining Safety Equipment Market Trends

The mining safety equipment market in Asia Pacific accounted for a 36.7% share in 2024, due to extensive mining activities, rising mineral consumption, and increasing investments in mining infrastructure. Countries in the region are adopting advanced PPE, gas monitoring, and automation technologies to reduce accident rates. Expanding metal and coal production, along with stricter government regulations on worker safety, support strong demand. The region’s industrialization and reliance on raw materials further accelerate equipment modernization.

China’s mining safety equipment market is growing significantly as the country focuses on modernizing its large-scale mining industry. Rising production of coal, rare earth elements, and metals fuels demand for advanced safety systems, including automation, ventilation, and real-time sensing devices. Stricter enforcement of safety regulations and government initiatives to reduce fatalities push companies toward better protective equipment. Technological adoption is accelerating, making China one of the fastest-growing markets in mining safety.

The mining safety equipment market in India is driven by expanding coal, iron ore, and bauxite production. Growing emphasis on worker safety and stricter government norms is encouraging the adoption of high-quality PPE, dust control systems, and monitoring technologies. Investments in mine mechanization and digital safety tools are increasing. Rising demand for raw materials in construction, power generation, and manufacturing continues to fuel modernization and safety equipment upgrades.

Middle East & Africa Mining Safety Equipment Market Trends

The mining safety equipment market in the Middle East and Africa region is experiencing growth due to the increasing extraction of gold, copper, phosphate, and other minerals. Rising foreign investments and large-scale mining projects encourage the adoption of modern PPE and safety monitoring technologies. Government initiatives to improve worker safety and reduce accident rates support market expansion. The region’s focus on operational efficiency and resource development further drives spending on reliable safety solutions.

Saudi Arabia mining safety equipment market is growing as part of the country’s Vision 2030 initiative, which prioritizes mining as a key economic sector. Rising extraction of gold, phosphates, and industrial minerals increases the need for advanced PPE, ventilation, and hazard detection technologies. Strong regulatory oversight and investment in modern mining infrastructure drive the adoption of innovative safety solutions. Expanding industrial activity and foreign partnerships further support continued market growth.

Latin America Mining Safety Equipment Market Trends

The mining safety equipment market in Latin America is driven by the expanding production of copper, lithium, silver, and gold. Countries across the region are increasingly adopting stricter safety standards and investing in modern monitoring equipment and personal protective gear. Foreign mining investments and large-scale projects enhance demand for reliable safety solutions. The push toward operational efficiency and accident reduction continues to accelerate market adoption.

Brazil’s mining safety equipment market is growing rapidly due to the increasing extraction of iron ore, gold, and bauxite. Recent safety incidents have led to stricter regulations and higher compliance requirements, prompting mines to upgrade PPE, monitoring systems, and emergency response equipment. Investments in modern, technology-driven mining operations further support demand. Brazil’s strong mineral export industry ensures a continuous need for reliable and advanced safety equipment across its mining sector.

Key Mining Safety Equipment Companies Insights

Key players operating in the mining safety equipment market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include Dräger Safety AG & Co. KGaA, Siemens AG, Protective Industrial Products, Inc.

-

Dräger Safety AG & Co. KGaA, a German company known for developing medical and safety technology used in industrial, emergency-response, and healthcare settings. Its products include respiratory-protection gear, portable and fixed gas-detection systems, diving apparatus, and alcohol or drug-screening devices. Dräger supplies equipment for hazardous-environment work such as firefighting, mining, and chemical operations, focusing on dependable protection and monitoring solutions.

-

Siemens AG, a major German technology company with activities across automation, energy systems, mobility, smart infrastructure, and medical technology. It designs and supplies equipment and digital solutions for factories, transportation networks, energy distribution, and healthcare operations. Siemens integrates engineering with software to support efficient industrial processes, reliable transit systems, sustainable infrastructure, and advanced medical diagnostics across global markets.

Key Mining Safety Equipment Companies:

The following are the leading companies in the mining safety equipment market. These companies collectively hold the largest Market share and dictate industry trends.

- Dräger Safety AG & Co. KGaA

- MSA Safety

- Protective Industrial Products, Inc.

- 3M

- MineARC

- CSE Corporation

- DEZEGA

- Industrial Scientific Corporation

- RKI Instruments, Inc.

- GfG Instrumentation, Inc.

- ABB Ltd

- Emerson Electric SE

- Siemens AG

- Falltech

- ISS Mine Safety

Recent Developments

-

In September 2025, MSA Safety launched the V-Gard H2 Full Brim Safety Helmet, expanding its head-protection portfolio with a design focused on comfort, durability, and all-day wear. V-Gard H2 Full Brim Safety Helmet is designed to meet the tough demands of mining environments, where head protection is critical. Its full-brim design shields miners from falling debris, low-clearance impacts and harsh outdoor conditions.

-

In May 2025, Honeywell finalized the sale of its Personal Protective Equipment business to Protective Industrial Products (PIP) for USD 1.325 billion. PIP, backed by Odyssey Investment Partners, supplies and manufactures a broad range of protective gear. The transaction allows Honeywell to streamline its portfolio while expanding PIP’s global footprint and product range in the safety-equipment market.

Mining Safety Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14,682.1 million

Revenue forecast in 2033

USD 20,824.5 million

Growth rate

CAGR of 4.5% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, operation type, application, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Dräger Safety AG & Co. KGaA; MSA Safety; Protective Industrial Products, Inc.; 3M ; MineARC; CSE Corporation; DEZEGA; Industrial Scientific Corporation ; RKI Instruments, Inc.; GfG Instrumentation, Inc.; ABB Ltd; Emerson Electric SE; Siemens AG; Falltech; ISS Mine Safety

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mining Safety Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global mining safety equipment market report based on product, operation type, application and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Personal Protective Equipment

-

Fire Detection & Suppression Systems

-

Gas Detection Systems

-

Communication Systems

-

Safety monitoring systems

-

-

Operation Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Surface Mining

-

Underground Mining

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Coal mining

-

Non-metallic

-

Metal mining

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mining safety equipment market size was estimated at USD 14,185.6 million in 2024 and is expected to be USD 14,682.1 million in 2025.

b. The global mining safety equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2033 to reach USD 20,824.5 million by 2033.

b. Personal protective equipment segment hold the dominant share in the market and accounted for a share of 48.6% in 2024, as mining operations prioritize worker safety amid increasingly complex and hazardous environments.

b. Some of the key players operating in the global mining safety equipment market include Dräger Safety AG & Co. KGaA, MSA Safety, Protective Industrial Products, Inc., 3M , MineARC, CSE Corporation , DEZEGA, Industrial Scientific Corporation , RKI Instruments, Inc., GfG Instrumentation, Inc., ABB Ltd, Emerson Electric SE, Siemens AG, Falltech, ISS Mine Safety

b. Key factors include stricter safety regulations, rising mining activity, higher accident risk awareness, adoption of advanced monitoring and detection technologies, investments in worker protection, automation of hazardous tasks, and demand for durable PPE to improve operational safety and reduce downtime in mines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.