- Home

- »

- Renewable Chemicals

- »

-

Mint Essential Oils Market Size, Share & Trends Report 2030GVR Report cover

![Mint Essential Oils Market Size, Share & Trends Report]()

Mint Essential Oils Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Medical, Food & Beverages, Spa & Relaxation, Cleaning & Home), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-836-7

- Number of Report Pages: 147

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mint Essential Oils Market Size & Trends

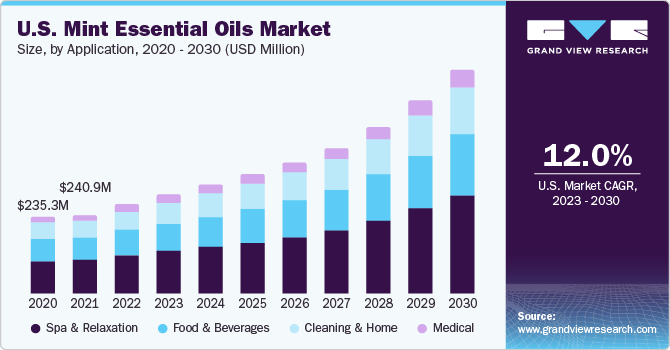

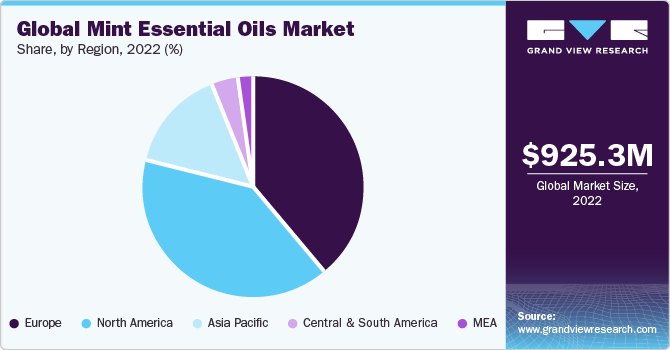

The global mint essential oils market size was valued at USD 925.3 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.8% from 2023 to 2030.The noteworthy growth of end-use industries, such as aromatherapy, personal care & cosmetics, pharmaceuticals, and food & beverage is expected to propel product demand during the forecast period. Moreover, rapid technological advancements in oil extraction methods are anticipated to fuel production of these oils and positively influence the growth.

Spa & relaxation emerged as the top application segment of the market. It includes various sub-segments, such as aromatherapy, massage oils, and personal care products, including cosmetics, toiletries, and fragrances. Food and beverage applications such as bakery, confectionery, dairy, ready-to-eat meals, beverages, meat, poultry, seafood, snacks, and nutritional bars also hold a significant consumer share in the market for mint essential oils.

Factors such as growing disposable income and inclination towards natural and organic ingredient-based personal care and cosmetic items, particularly in the developed countries of North America and Europe, including the U.S., U.K., and Germany have boosted the consumption of organically extracted oils in personal care and cosmetic industries.

Increasing urbanization, coupled with the strong influence of social media, has popularized natural plant extract-based healing treatments, such as spa and aromatherapy, among consumers. This has increased product penetration in the stress relieving spa and aromatherapy application segments. Moreover, the rising prominence of aromatherapy owing to changing lifestyles and the growing media influence among the urban population is anticipated to further fuel product demand in the near future.

Application Insights

The spa & relaxationsegment accounted for the largest revenue share of 42.7% in 2022 and is expected to further expand at the fastest CAGR of 10.1% during the forecast period. Mint essential oils are primarily used as an additive and flavoring agent in cosmetics and personal care products. Their application in personal care items, such as soaps, shampoos, perfumes, and toiletries help add value and aroma to the end product. These factors are projected to drive the demand for mint essential oils in the coming years.

General hygiene is one of the key application areas of mint essential oils. In this segment, these oils are used in baby products, shampoos, soaps, and oral health care products. Their use in personal care applications is further driven by the rising awareness regarding the benefits of natural and organic products. Besides personal care and cosmetics, they are majorly used for natural plant extract-based healing treatments in aromatherapy.

The food & beverages segment accounted for the second largest revenue share in 2022 and is estimated to witness significant CAGR over the forecast period. These essential oils are primarily used in food and beverages for their minty aroma and taste. Furthermore, the induction of therapeutic benefits of mint essential oils in food and beverage items has increased their consumption. The antioxidant and anti-microbial activities of these products are anticipated to bode well for a growth in their application in the near future.

Regional Insights

Europe accounted for a significant revenue share of 39.3% in the market in 2022. The strong presence of established industries such as personal care & cosmetics and flavors & fragrances is expected to be the primary regional growth driver over the forecast period. The presence of several well-developed economies along with higher standards of living are contributing to the development of key end-use industries in Europe. Furthermore, significant preference for natural ingredient-based products is anticipated to further drive regional demand.

Moreover, the presence of regulatory bodies in Europe such as the European Federation of Essential Oils (EFEO), which promotes and safeguards the interests of stakeholders across the value chain, has further propelled market growth. This organization is also involved in the EU Parliament and EU Commission discussions to amend or introduce legislations regarding these oils. Such regulatory trends are positively benefitting market expansion.

North America, on the other hand, is expected to expand at the fastest CAGR of 11.7% during the forecast period. The mint essential oil market in North America is driven by several factors that contribute to its strong growth and demand. These factors include an increasing awareness regarding the health benefits of mint essential oils, the rising popularity of aromatherapy and natural remedies among consumers, and the growing demand for organic and natural products in the region.

Key Companies & Market Share Insights

The global mint essential oils market is significantly fragmented, with the presence of a number of major market participants. Vertical integration for raw material sourcing, manufacturing, and distribution, coupled with the intensifying competition for technological advancements, are some of the factors fueling the market’s expansion.

The increasing number of mergers and acquisitions with players involved in mint cultivation or distribution business is moving the market towards consolidation. Requirements of advanced technology and high capital costs have heightened the entry barriers for new players. This is likely to lower the threat of new entrants. The market is also characterized by a balance between the production capacities of different players. This is expected to reduce the rivalry for profit margin among existing competitors.

Key Mint Essential Oils Companies:

- H. Reynaud & Fils

- FLAVEX Naturextrakte GmbH

- India Essential Oils

- Sydney Essential Oil Company

- Moksha

- Rocky Mountain Oils, LLC

Recent Developments

-

In February 2023, Zed Black introduced Orva Naturals, a new pure essential oil range. One of the six pure essential oil variants in this range is peppermint oil

-

In June 2023, ACTIZEET, a notable natural health & wellness brand, unveiled its new range of revolutionary Pure Essential Oils in India. This new line presents a diverse selection of alternatives to meet the varied demands and preferences of customers. The portfolio includes products such as calming lavender, invigorating eucalyptus, revitalizing peppermint, and soothing rose

-

In December 2021, Tilley Company, Inc. announced the successful completion of its merger with Phoenix Aromas & Essential Oils, LLC. The merger between Tilley and Phoenix is aimed at creating a major supplier of ingredients that is equipped with laboratories, a strong regulatory and technical support team, as well as a global sales and customer service workforce. This combination is designed to enhance the ability to cater to the needs of both new and existing customers

Mint Essential Oils Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,015.3 million

Revenue forecast in 2030

USD 1,961.9 million

Growth Rate

CAGR of 9.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Turkey; Russia; China; Japan; India; Taiwan; South Korea; Singapore; Australia; Thailand; Indonesia; Argentina; Brazil; South Africa; Saudi Arabia; Nigeria

Key companies profiled

H. Reynaud & Fils; FLAVEX Naturextrakte GmbH; India Essential Oils; Sydney Essential Oil Company; Moksha; Rocky Mountain Oils, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mint Essential Oils Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global mint essential oils market report on the basis of application and region:

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Medical

-

Pharmaceutical

-

Nutraceuticals

-

-

Food & Beverages

-

Bakery

-

Confectionery

-

Dairy

-

RTE meals

-

Beverages

-

Meat, Poultry & Seafood

-

Snacks & Nutritional Bars

-

-

Spa & Relaxation

-

Aromatherapy

-

Massage Oil

-

Personal Care

-

Cosmetics

-

Hair Care

-

Skin Care

-

Sun Care

-

-

Makeup and colour cosmetics

-

Toiletries

-

Oral care

-

Soaps

-

Shampoos

-

Baby Care

-

Men's Grooming

-

-

Fragrances

-

Perfumes

-

Body Sprays

-

Air fresheners

-

-

-

Cleaning & Home

-

Kitchen Cleaners

-

Floor Cleaners

-

Bathroom Cleaners

-

Fabric Care

-

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Taiwan

-

South Korea

-

Singapore

-

Australia

-

Thailand

-

Indonesia

-

-

CSA

-

Brazil

-

Argentina

-

-

MEA

-

Saudi Arabia

-

South Africa

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global mint essential oils market size was estimated at USD 925.3 million in 2022 and is expected to reach USD 1015.3 million in 2023

b. The global mint essential oils market is expected to grow at a compound annual growth rate of 9.8% from 2023 to 2030 to reach USD 1961.8 million by 2030.

b. Spa and relaxation dominated the mint essential oils market with a share of 42.7% in 2022. This is attributable to its wide use as an additive and flavoring agent in cosmetics and personal care products

b. Some key players operating in the mint essential oils market include Reynaud & Fils (HRF), Flavex Naturextrakte GmbH, India Essential Oils, Sydney Essential Oil Co. (SEOC), Moksha Lifestyle Products, and Rocky Mountain Essential Oils.

b. Key factors that are driving the market growth include noteworthy growth of end-use industries, such as aromatherapy, personal care and cosmetics, pharmaceuticals and food and beverage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.