- Home

- »

- Communication Services

- »

-

Mobile Virtual Network Operator Market Share Report, 2030GVR Report cover

![Mobile Virtual Network Operator Market Size, Share & Trends Report]()

Mobile Virtual Network Operator Market Size, Share & Trends Analysis Report By Service Type (4G MVNO, 5G MVNO), By Operational Model, By Contract Type, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-360-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

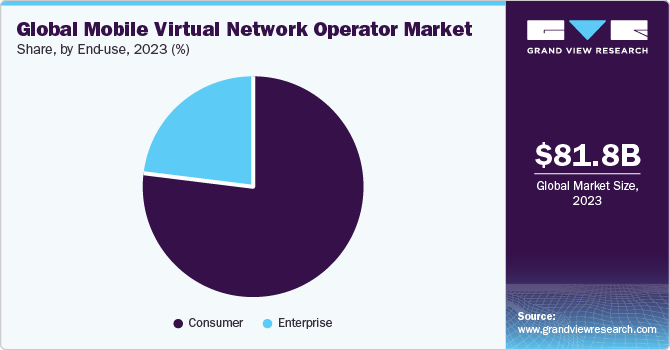

The global mobile virtual network operator market size was valued at USD 81.81 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.7% from 2023 to 2030. The increasing adoption of mobile virtual network operators (MVNO) can be attributed to affordable plans, flexible options, no credit checks, wide device compatibility, and specialized plans. Moreover, the companies in the mobile virtual network operator market have been involved in various strategic initiatives such as mergers, acquisitions, partnerships, and collaborations, among others. For instance, in July 2023, Spitfire Network Services Limited (U.K.-based provider of fixed line voice, internet, and WAN services to business) declared a full MVNO deal with BT Wholesale (U.K.-based telecom service provider). According to the partnership, Spitfire's latest generation core network will be interconnected with BT Group's EE 4G and 5G Radio Access Network offering better security, first-class connectivity, and flexible and innovative billing plans.

The advancement in 5G technology is expected to further drive the growth of the market, owing to the benefits including network slicing, fixed wireless access, and eSIMs, among others. The companies in the mobile virtual network operator (MVNO) market have been proactive in coming up with initiatives to tap into the 5G mobile virtual network operator market. For instance, in February 2023, Celcom Berhad (Malaysian MVNO provider) announced the rollout of 5G. According to the company, Customers with a 5G-supported Android device and a subscription to a 5G pass are eligible to experience free trials from 15th February onwards. To access the free 5G trial services, customers must subscribe to any high-speed data plan ranging from 10 GB to 200 GB. The 5G roaming services will also be available in more than ten countries. Such initiatives will attract consumers to the market owing to the benefits of 5G, thereby driving the growth of the mobile virtual network operator market from 2023 to 2030. To access the free 5G trial services, customers must subscribe to a high-speed data plan ranging from 10GB to 200 GB. Currently, 5G roaming service is available in more than ten countries.

Integrating advanced technologies such as AI and ML into the MVNO is expected to accelerate the mobile virtual network operator market growth from 2023 to 2030. MVNOs use AI technology to improve customer experience, increase efficiency, and streamline operations. Although previously mentioned, some of the common AI usage varies between MVNOs and depends upon size, resources, and investment into technology. Moreover, various companies in the mobile virtual network operator industry have been involved in various initiatives aimed at the integration of AI into MVNO technologies. For instance, in July 2023, Mobile X Global, Inc. (U.S.-based MVNO) pledged its allegiance to AI and the cloud. The company launched its commercial wireless services in the U.S. using AI technology and developed a cloud-native platform for its offerings. Such initiatives taken by the company operating in the mobile virtual network operator market would attract customers into MVNO who utilize AI, thereby driving the growth of the MVNO industry from 2023 to 2030.

The integration of blockchain technology is another major technological factor driving the growth of the market for MVNO; the integration of blockchain technology would offer various benefits to MVNOs, which include maintaining a tamper-proof record of all transactions, which reduces/eliminating the chances of billing discrepancies, and fraud. Blockchain technology can significantly improve the operational efficiency of MVNOs, as MVNOs rely on complex web intermediaries for services, including roaming, which increases costs and inefficiencies. However, blockchain technology can automate all these processes that can be simplified and automated, thereby helping to reduce operational costs and enhance customer service. Blockchain technology also helps in the mobile virtual network operator market by increasing transparency and providing the transaction records of all transactions, which helps users understand the areas being charged for. All these attributes contribute to the rapid adoption of blockchain technology in the mobile virtual network operator (MVNO) industry, thereby fueling the growth of the mobile virtual network operator market from 2023 to 2030.

The evolution of hybrid MVNO is another major trend in the market, gaining traction in recent years. The proliferation of tablets and smartphones and seamless connectivity have become a crucial part of wireless operators' service offerings and a requirement to stay ahead in the competitive landscape. With the 5G technology advancement and shared spectrum, MSOs (Multiple System Operators) actively evaluate offload prospects for improving MVNO economics. They are planning to deploy their mobile radio infrastructure in certain geographic areas. These MSOs are required to deal with three disparate sets of wireless infrastructures: MSO's own 4G/5G network, MNO's 4G/5G network, and MSO's community Wi-Fi network, which is creating a new set of MVNO models named hybrid-MVNO, which enables MVNO to offload the traffic of MNO network subscribers to Wi-Fi networks and MVNO-owned mobile networks when inside the coverage of wireless networks.

Market Concentration & Characteristics

The mobile virtual network operator market is witnessing a significant growth rate over the forecast period, which can be attributed to factors such as agility and adaptability, which are crucial for MVNOs as they enable MVNOs to maintain a competitive edge in the changing technological landscape of the telecommunication industry. Moreover, MVNOs offer better operational excellence to new markets. Furthermore, this attribute, combined with the government initiatives supporting MVNO operations, is further fueling the market growth. The adoption of 5G and the latest wireless technologies will drive the new generation of MVNOs. The rising digitization and advancement in 5G and other wireless technologies have also played a crucial part in the growth of the mobile virtual network operator market.

The mobile virtual network operator market is dominated by major players such as TracFone Wireless, Inc., Lyca Mobile, Verizon, and T‑Mobile USA, Inc., among others. These companies have been involved in various strategic initiatives, including partnerships, mergers, and acquisitions, among others. Some of the companies operating in the mobile virtual network operator market space have been expanding their operations to different regions, which has enabled the company to capture a significant share of the new market, which has fueled both the company’s growth as well as the growth of the mobile virtual network operator market.

MVNOs leverage their existing customer base and brand for the creation of a unique brand positioning and value proposition for attracting the target segment and utilize mobile networks as transportation for the selling of the existing services. MVNOs also leverage existing distribution channels, such as online platforms and retail stores, to simplify the customer acquisition process. MVNOs also make use of their existing customer service infrastructure to provide a seamless customer experience aimed at reducing costs and improving customer satisfaction. MVNOs also analyze the customer data or their existing customers for identification and targeting specific customer segments with tailor-made mobile service plans and marketing campaigns, which helps the MVNOs enhance customer satisfaction and loyalty, all while increasing their sales.

Key companies in the mobile virtual network operator market have been involved in various strategic initiatives that have been helping those companies gain traction in the market. For instance, in July 2023, Lyca Mobile announced its partnerships with BT Wholesale aimed at giving customers access to EE’s. The new initiative comes as an element of Lyca Mobile’s strategy to deliver low-cost and reliable international calling to target a more comprehensive value-seeking market by meeting consumer demand for low-cost mobile connectivity, which are built around three main priorities, which are service, value, and reliability. With this new partnership, customers of Lyca Mobile in the UK can access EE’s 4G and 5G radio access networks.

Type Insights

The discount segment accounted for the largest share of around 24% of the overall revenue in 2022. The mobile virtual network operator market is expected to witness significant growth in the M2M segment owing to the rising adoption of cellular connectivity in machines, from vehicles to vending machines. Advancements in technology in the 3G M2M segment, initiatives by MNOs to expand their service portfolio, and the extension of mobile network coverage are the main factors supporting the growth of MVNOs in the M2M market. There has been significant growth in the number of MNOs collaborating with M2M application service providers, which is anticipated to fuel the demand for mobile network element deployment in M2M applications over the forecast period.

The M2M segment is projected to grow with the highest CAGR from 2023 to 2030. MNOs offer various service plans and products for different markets with fewer users, leading to expensive and inefficient operational and business support systems. The cost of retaining and acquiring new customers is relatively high, mainly for fixed-term contracts. The MVNOs can help overcome cost issues, optimize resource allocation, and improve the Quality of Service (quality of service), contributing to the market's growth. Moreover, low-cost access to voice and data services is expected to be the key interest for customers.

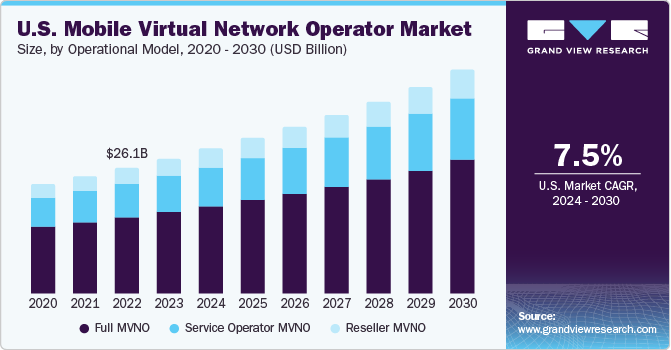

Operational Model Insights

The full MVNO segment accounted for the largest share of nearly 60% of the overall revenue in 2022. The full MVNO segment led the market in terms of revenue in 2023. Implementing a full MVNO network infrastructure involves minimal capital investment and provides complete call control, allowing customers to call internationally at highly discounted rates. The emergence of MVNOs results from regulatory interventions to lower the barriers to entry and eventually increase competition and strategic decisions undertaken by MNOs.

The reseller MVNO segment is projected to grow with the highest CAGR from 2023 to 2030. MNOs have mobile licenses, infrastructure, and customer relationships with their end users and can handle network routing. They generally have roaming deals with foreign counterparts. However, to expand their existing customer base and operations, MNOs collaborate with MVNOs and target niche segments. To avoid direct competition with MNOs, MVNOs focus on offering differentiated services. They aim to capitalize on roaming opportunities by providing special services to tourists and youth. MVNOs aid in increasing revenue for MNOs by providing wholesale deals, increasing network utilization, and creating their MVNOs by launching sub-brands.

Service Type Insights

The 4G MVNO segment is projected to occupy the largest share of the market in 2022, occupying around 70% in 2022. The growth of the 4G MVNO segment can be attributed to the increasing demand for high-speed mobile data and improved connectivity. Since 4G technology enables seamless video streaming, improved browsing experiences, and app downloads, consumers are 0opting towards 4G technology which has been a major contributor to the growth of the 4G MVNO segment over the forecast period. Moreover, the 4G MVNO had capitalized on the increasing demand for smartphones and data-savvy devices to cater to a wide range of users, businesses, and IoT devices. The combination of affordable data plans and flexible pricing options has paved the way for the 4G MVNO segment growth in the mobile virtual network operator market by service type from 2023 to 2030.

The 5G MVNO segment is projected to witness the highest growth rate of over 10% from 2023 to 2030. With the rollout of 5G technology globally, 5G MVNO has been leveraging the capabilities of 5G technology, including high data speed, low latency, and increased network capacity, enabling improved user experience. The increasing demand for data-intensive applications has resulted in the growth of 5G MVNOs, and the growth of this segment is expected to continue stronger over the period 2023 to 2030.

Contract Type Insights

The prepaid MVNO segment is projected to occupy the largest market share of over 70% in 2022. The growth of the prepaid MVNO can be attributed to benefits offered to the customer, which include flexible and cost-effective alternatives compared to traditional postpaid plans. Moreover, the companies in the mobile virtual network operator market have been coming up with various initiatives such as new product launches, mergers, and acquisitions, among others which have helped drive the growth of the prepaid MVNO. In September 2022, Xiaomi (a Chinese smartphone maker) announced two new prepaid wireless plans as its debut in the MVNO industry to compete against the Chinese national carriers. The entry of new players in the mobile virtual network operator (MVNO) market, which has a wide customer base and popularity, would drive the adoption of the prepaid MVNO, thereby driving market growth.

The postpaid MVNO segment is projected to witness a significant growth rate of around 7% from 2023 to 2030. The postpaid MVNO majorly caters to a section of the customers who opt for monthly billing and are going for long-term contracts for which, in return, additional benefits are offered to customers. The postpaid MVNOs offer competitive pricing, unlimited data, and truly international calling, among others which have impacted the growth of the postpaid MVNO segment of the mobile virtual network operator market from 2023 to 2030.

End-use Insights

The consumer segment accounted for the largest share of nearly 77% of the overall revenue in 2022. Increasing network speed and using advanced devices enable the growth of data applications such as internet browsing and video streaming. Increasing investments are made to improve network coverage and growth in Mobile Broadband (MBB) connections. The MVNO model offers benefits such as time efficiency and cost-effectiveness, which are expected to lure more consumers, accelerating the growth of the consumer segment.

The enterprise segment is projected to grow with the highest CAGR from 2023 to 2030. Managing connected living, personal data, and rising e-commerce activities are also anticipated to provide significant growth opportunities for key players operating in the market, along with increasing consumer benefits. Intelligent networks connecting a wide range of devices enable increased productivity of enterprises. The partnership between MNOs and MVNOs depends on brand reputation, distribution network, promotional strategies, and access to segments. The MVNO model is turning from voice to a more data-centric experience. MVNOs worldwide are opting for data-capable smartphones to expand their business.

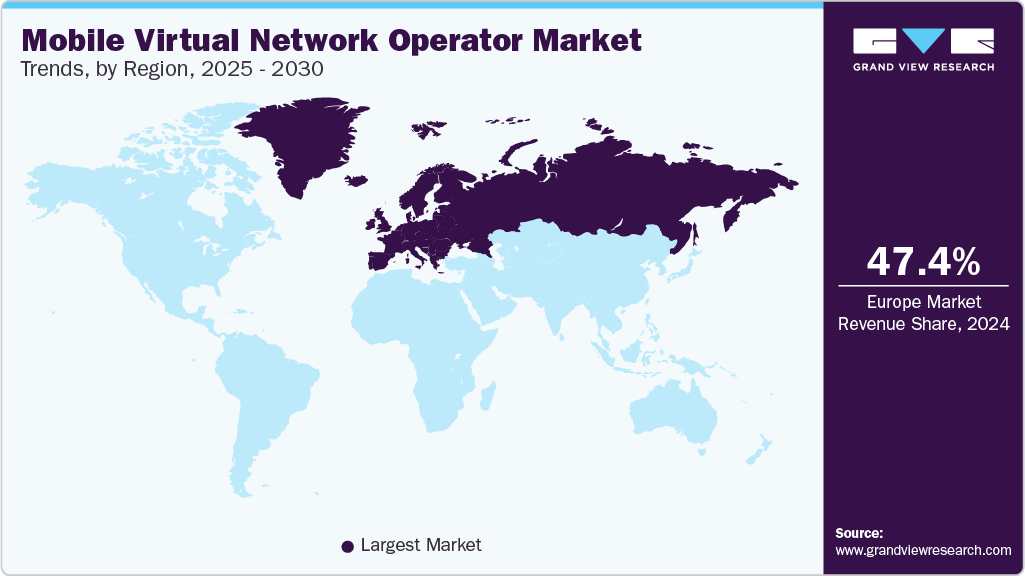

Regional Insights

North America MNVO Market

The North America MVNO market was estimated to be USD 30.21 billion in 2022. The growth of the MVNO market in North America can be attributed to the strategic initiatives happening in the region aimed at improving the MVNO offerings. For instance, in May 2023, Mobi announced the signing of an exclusive multiyear MVNO arrangement with T-Mobile, allowing Mobi customers to access the strength of the countrywide T-Mobile network from their homes on the islands and throughout the continental United States. By fusing the industry-leading 5G speeds, consistency, and coverage that T-Mobile has established through their extraordinary investments and expertise in 5G, with Mobi's warm Hawaii stores and amiable customer service team, Mobi will be able to provide an even better experience for their customers.

Europe MVNO Market

The Europe region dominated the market in 2022, accounting for a market share above 47% in 2022. The growth can be attributed to the favorable regulatory framework, which is expected to play a crucial role in developing the MVNO. Countries such as the U.K., Germany, and the Netherlands are projected to impact regional growth positively from 2023 to 2030. Data services are expected to be the key services for regional growth from 2023 to 2030.

U.K. MVNO Market

The U.K. MVNO market was estimated to hold nearly 21% of the market share in 2022 in the European MVNO market. The growth of the MVNO market in the U.K. can be attributed to various company strategic initiatives that are aimed at improving their network. For instance, in June 2023, Vodafone and Three announced a merger aimed at creating a huge network. The firms confirmed that Vodafone would own a controlling position in the new group, but only to the extent that it would own 51% of the new business, with the option to purchase the remaining 31% later to build one of Europe's most advanced standalone 5G networks, the two claim that the resulting company will invest USD 12.14 billion in the United Kingdom over the next ten years.

Germany MVNO Market

The MVNO market in Germany was estimated to hold nearly 23% of the market share in 2022 in the European MVNO market. The rapid deployment of cloud-based solutions, the growing use of segment-targeted pricing and creative distribution tactics, government actions to encourage MVNO operators, and other factors are responsible for the expansion of the mobile virtual network operator industry in Germany.

France MVNO Market

The MVNO market in France was estimated to be valued at USD 7.09 billion in 2022. The growth of the mobile virtual network operator market in France can be attributed to factors that include rapid deployment of cloud-based solutions, enhanced BYOD capabilities, easy accessibility to MVNOs, growing adoption of 5G technology, and increased demand for affordable mobile wireless services among others.

Asia Pacific MVNO Market

Asia Pacific is projected to experience significant growth from 2023 to 2030. The growth in this region can be attributed to the phenomenal expansion of the telecom services industry. Emerging economies in the region, such as India, Vietnam, and Myanmar are making efforts to expand and modernize their telecommunication services. Southeast Asian countries such as Singapore, Thailand, and the Philippines are also estimated to contribute substantially to the regional market expansion over the from 2023 to 2030.

Countries with advanced cellular networks, such as Malaysia, Japan, and Australia, are expected to expand the Asia Pacific regional market majorly. For instance, in Japan, MVNOs provide services such as online gaming, remote management of vending machines, M2M, and surveillance. In the healthcare sector, they also offer voice-controlled services for patient monitoring and security applications.

China MVNO Market

The MVNO market in China was estimated to register a growth rate of 6.7% from 2023-2030. The growth of the MVNO market in China can be attributed to an increasing partnership among various participants in the MVNO market in China aimed at offering advanced solutions. For instance, in November 2023, IPLOOK Networks and China Mobile partnered to initiate the co-development of 5GC UPF via satellite. This development holds great importance for the advancement and utilization of 5G NTN technology. In collaboration with China Mobile, IPLOOK actively supports the implementation of 5GC UPF on satellite by utilizing the successes and cutting-edge discoveries in the mobile network sector to create an orbiting, lightweight core network that complements the terrestrial cellular network. Comprehensive validation testing is still in progress.

India MVNO Market

The India MVNO market was expected to register a growth rate of 9.2% from 2023 to 2030. The growth of the MVNO market in India can be attributed to the initiatives by the government aimed at improving the country’s telecommunication infrastructure. For instance, in March 2023, the Government of India has released India's 6G Vision document and announced that 6G-related initiatives will be launched within six months of the 5G launch. According to the vision document published by the Ministry of Telecommunications, 5G technology has a maximum speed of 40-1100 Mbps and can reach 10,000 Mbps. However, 6G technology offers very low latency, up to 1 terabit second (Tbps), which is a thousand times faster than the maximum speed offered by 5G.

Japan MVNO Market

Japan MVNO market held a market share of 14.3% in 2022 in the Asia Pacific MVNO market. The growth of the MVNO market in Japan can be attributed to factors such as technological advancements, higher adoption of 5G technology, increased demand for affordable mobile wireless services, and increasing internet and telecommunication companies, among others.

Middle East & Africa MVNO Market

The Middle East & Africa MVNO market is expected to register a growth rate of 7.8% from 2023 to 2030. The growth of the MVNO market in the Middle East & Africa can be attributed to expansion activities by companies in the market. For instance, in January 2023, Telkom, South Africa’s largest mobile operator, announced plans to partner with mobile virtual network operators (MVNOs) on its network. Telkom will leverage its extensive network presence in South Africa to allow MVNOs to provide quality services on Telkom’s network, boosting competition in the telecommunications sector. MVNO partnerships are in line with spectrum licensing requirements imposed by ICASA (Regulator of Independent Electrotechnical Commission of South Africa) to benefit historically underprivileged communities. Telkom, Cell C, and MTN are among the companies that have partnered with MVNOs.

Saudi Arabia MVNO Market

The Saudi Arabia MVNO market is estimated to be USD 6.2 million in 2022. The growth of the MVNO market in Saudi Arabia can be attributed to improving digital infrastructure and advancement in digital transformation. For instance, in August 2023, Salam chose Oracle to spearhead 5G innovation in the Middle East. The modern technology architecture provided by Oracle will support and expand Salam’s digital capabilities and help accelerate the roll-out of large-scale services. By implementing Oracle’s solutions for Scale Monetization, Oracle Unified Operations, and Oracle CRM Sales, Salam will replace legacy systems with a state-of-the-art, all-in-one stack. With these solutions, Salam will be able to offer differentiated promotion bundles across different customer segments.

Key Companies & Market Share Insights

Some of the key players operating in the mobile virtual network operator market include TracFone Wireless, Inc., Boost Mobile, Virgin Plus, Lyca Mobile among others.

-

TracFone Wireless, Inc. offers a variety of plans, which include calls, text, and data. The company also offers a variety of phones from popular manufacturers such as Apple, Motorola, Samsung, and Alcatel. TracFone Wireless leases network access from the three largest wireless network operators in the United States: T-Mobile US, AT&T Mobility, and Verizon.

-

Boost Mobile offers a variety of prepaid plans, which range from one month to a year. The company also offers access to T-Mobile and AT&T’s 4G/LTE and 5G networks. Boost Mobile offers phone plans that range from 1GB to 30 GB of high-speed internet data per month, with its unlimited data plan offering. Boost Mobile also offers a variety of features that are not available on traditional wireless carriers, which include the ability to be your own phone and the ability to switch plans without penalty.

Red Pocket Mobile, FreedomPop, UVNV, Inc. are some of the emerging market participants in the mobile virtual network operator market.

-

Red Pocket Mobile offers a variety of prepaid wireless plans that range from 3GB of high-speed data to 100 GB. Most of the plans offered by the company include unlimited talk, text, and data. Red Pocket Mobile also utilizes the network infrastructure of companies such as T-Mobile, AT&T, and Sprint for providing coverage. One of the major attributes of the solutions offered by the company is its offering of affordable options to customers. Moreover, the company also offers a range of plans that are tailored to different usage patterns to ensure customers are able to find a suitable option in line with their budget and requirements.

-

FreedomPop is an emerging player in the mobile virtual network operator market that offers wireless internet and cellular service providers that offer affordable text, talk, and data plans for its customers. The company offers GSM SIM cards and iPhones that work with GSM-unlocked iOS or Android devices. The company has its major strength in offering data-centric plans that have enabled the company to make significant roads in the mobile virtual network operator market. This approach of the company has attracted consumers who are heavily dependent on data for communication, streaming, and other online activities. Furthermore, the company has introduced a freemium approach wherein the users can access basic services for free and choose to pay for additional features or data.

Key Mobile Virtual Network Operator Companies:

- Boost Mobile

- Consumer Cellular

- Cricket Wireless LLC.

- DISH Wireless L.L.C.

- FreedomPop

- Locus Telecommunications, LLC.

- Lyca Mobile

- Mint Mobile, LLC.

- Red Pocket Mobile

- Tello

- Tesco Mobile Ltd

- TracFone Wireless, Inc.

- T‑Mobile USA, Inc.

- UVNV, Inc

- Virgin Plus

Recent Developments

-

In December 2023, Tello revealed a new array of cell phone plans, which include more options for high-speed data and lower prices. Each of the high-speed data options can be paired with 0, 100, 300, 500, or unlimited minutes. The new plan options include 10GB or 15 GB of high-speed data per month. Moreover, the company has also reduced the price of the older option. For instance, 25 GB of high-speed data per month, which was previously available for USD 29, is now reduced to 35 GB of data for USD 25.

-

In November 2023, Tesco Mobile Ireland announced a new referral program, which rewards referrers and new customers for their advocacy. The company launched in Ireland in 2013 and has more than 1 million customers with a network coverage of over 99%. With the new referral program, the company aims to capture more customers and gain better traction in the Irish mobile virtual network operator market.

-

In October 2023, Fliggs Mobile announced its partnership with T-Mobile for launching its Web3 MVNO. In the mobile app of Fliggs Mobile, the company has integrated a non-custodial wallet, which offers customers a secure and convenient gateway to Web3. Fliggs mobile also enables universal access to Web3 and FinTech services, which enables customers to have better control over their data and improve privacy in digital transactions. Moreover, the wallet also facilitates cryptocurrency payments, charitable donations, and cashback loyalty programs.

-

In March 2023, T-Mobile U.S. announced its entering into a definitive agreement for acquiring Ka’ena Corporation and its subsidiaries and brands, which include Ultra Mobile, Mint Mobile, and wholesaler Plum. T-Mobile is acquiring the brand’s sales, digital, marketing, and service options; The company also intends to use its supplier relationships and distribution to assist the brand growth and offer competitive prices to U.S. customers who are looking for value offerings. Both the Mint and Ultra brands are complementary to T-Mobile’s current prepaid service offering.

Mobile Virtual Network Operator Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 81.81 billion

Revenue forecast in 2030

USD 137.31 billion

Growth rate

CAGR of 7.7% from 2023 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, operational model, service type, contract type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, Mexico, Saudi Arabia, UAE, South Africa

Key companies profiled

Boost Mobile, Consumer Cellular, Cricket Wireless LLC., DISH Wireless L.L.C., FreedomPop, Locus Telecommunications, LLC., Lyca Mobile, Mint Mobile, LLC., Red Pocket Mobile, Tello, Tesco Mobile Ltd, TracFone Wireless, Inc., T‑Mobile USA, Inc., UVNV, Inc, Virgin Plus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile Virtual Network Operator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mobile virtual network operator market report based on type, operational model, service type, contract type, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Business

-

Discount

-

M2M

-

Media

-

Migrant

-

Retail

-

Roaming

-

Telecom

-

-

Operational Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Full MVNO

-

Reseller MVNO

-

Service Operator MVNO

-

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

4G MVNO

-

5G MVNO

-

Others

-

-

Contract Type Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prepaid MVNO

-

Postpaid MVNO

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer

-

Enterprise

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mobile virtual network operator market size was estimated at USD 76.02 billion in 2022 and is expected to reach USD 81.81 billion in 2023.

b. The global mobile virtual network operator market is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 137.31 billion by 2030.

b. Europe dominated the mobile virtual network operator market with a share of 47.39% in 2022. This is attributable to the favorable regulatory framework, which is expected to play a crucial role in developing the mobile virtual network operators.

b. Prominent players in the mobile virtual network operator market for mobile virtual network operators are Lebara Group; Lyca Mobile; TalkTalk Group; Giffgaff; Poste Mobile SpA; Virgin Mobile; and TracFone Wireless Inc.

b. The growing use of data and value-added services such as live streaming and M-commerce based services are expected to drive the mobile virtual network operator market for mobile virtual network operators over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."