- Home

- »

- Plastics, Polymers & Resins

- »

-

MS Polymer Hybrid Adhesives & Sealants Market Trends Report, 2025GVR Report cover

![MS Polymer Hybrid Adhesives & Sealants Market Size, Share & Trends Report]()

MS Polymer Hybrid Adhesives & Sealants Market Size, Share & Trends Analysis Report By Application (Transportation, Building & Construction), By Region (APAC, Europe), By Product (Sealants, Adhesives), And Segment Forecasts, 2020 - 2025

- Report ID: GVR-3-68038-113-9

- Number of Report Pages: 116

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2018

- Forecast Period: 2020 - 2025

- Industry: Bulk Chemicals

Report Overview

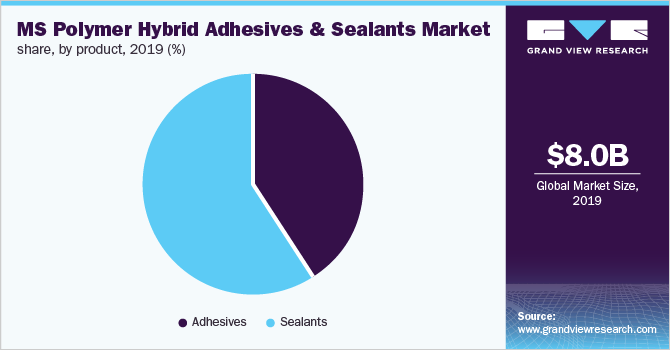

The global MS polymer hybrid adhesives and sealants market size was valued at USD 8.02 billion in 2019 and is estimated to witness a compound annual growth rate (CAGR) of 8.1% from 2020 to 2025. The market is majorly driven by the increasing popularity of hybrid adhesives & sealants in the construction and automotive industries. Modified-silane (MS) polymers are large, chained molecules terminating with a silyl group. The polymers are formed from high molecular weight polypropylene oxide. Due to their adhesion towards a wide range of substrates along with good resistance to extreme temperature and ultraviolet rays, they are used in various applications.

MS polymer hybrid sealants are increasingly being utilized for wall coverings, waterproofing, window & door frames, flooring, and insulation in the construction industry. Therefore, the expansion of the construction industry is a key contributor to the consumption of these products. Bonding ability with different substrates, compatibility with paints & coatings, and low VOC content further boosts their demand.

The increasing production of automotive vehicles coupled with the growing demand for lightweight and Electric Vehicles (EVs) is expected to augment the demand for MS polymer hybrid adhesives. These products find application in floor, component, body, chassis, external, and internal sealing. Moreover, the products are also used for general assembly, windscreen, side window, sunroof, windscreen, side panel, and trailer bonding.

However, volatility in raw material prices may hinder market growth. Polyurethane and silicone are key raw materials, which have been witnessing inflation over the last few years. For example, according to the Federal Reserve Bank of the U.S., the producer price index of plastic materials and resin manufacturing increased by 62.1% from 2008 to 2018.

MS Polymer Hybrid Adhesives& Sealants Market Trends

The demand for MS polymer hybrid adhesives and sealants is highly influenced by the growth of the building & construction industry, owing to the infrastructural developments worldwide. MS polymer hybrid adhesives and sealants are increasingly used for window & door frames, flooring, wall coverings, waterproofing, and insulation in the construction industry. The industry is anticipated to be a USD 17 trillion market by 2030 and developing economies in Asia is boosting its growth.

For instance, Indonesia launched an ambitious plan in 2016 to upgrade 24 of its aging ports, including a sizeable investment in infrastructure and real estate at several key ports. Also, supportive policies by the Indian government to bolster the urban infrastructure market is another growth driver. As per the 2018-19 India Union Budget, the government allocated USD 92.2 billion for the infrastructure sector. The growth in the construction activities in Asia is a positive indicator for the MS polymer hybrid adhesives & sealants demand.

Furthermore, a significant rise in the production of electric vehicles is expected to provide lucrative growth opportunities for the MS polymer hybrid adhesives & sealants market. These adhesives can be applied to battery packs across the emerging range of electrified powertrain designs for electric vehicles. They can be used to enhance the integrity and crashworthiness of the battery pack. The adhesives can also be used to inhibit vibration and enable the strong bonding of multiple substrates at cold temperatures.

MS polymer hybrid adhesives & sealants assist in vehicle weight reduction, thereby increasing fuel efficiency and reducing harmful emissions. Moreover, the demand and production of electric vehicles are ascending across the globe owing to the presence of stringent emission standards, pressure from governments, environmental concerns, and the consequent growing need for fuel-efficient vehicles.

According to IEA, there were 10 million electric cars on the world’s roads by the end of 2020. The registrations of electric cars increased by 43% in 2020 from 2019, despite the pandemic-related worldwide downfall in automotive sales. Over 3 million electric cars were sold globally in 2020. Moreover, there was a rise in the registration of electric buses and trucks in the major markets. These statistics indicate a positive outlook for the demand for adhesives to flourish in the EV industry.However, market growth is restricted by volatility in raw material prices. The primary raw materials required for the production of MS polymer hybrid adhesives & sealants include resins such as polyurethane and silicone. The prices of these raw materials have witnessed consistent fluctuations. For instance, in May 2018, Sun Chemicals increased the prices of its entire silicone-based product portfolio by 30%. The prices are further impacted by factors such as trade wars, import-export duties, and demand-supply gap.

Application Insights

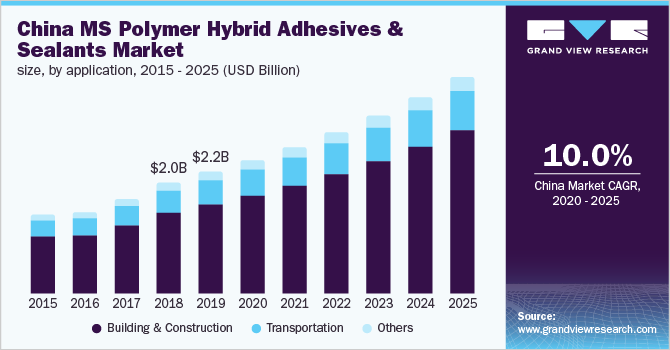

Building & construction segment accounted for the largest revenue share in 2018. The segment is driven by growing demand for the products in sealing and waterproofing applications. These products are also used for renovation purposes, which further aids in their demand. Transportation is another significant application as adhesives and sealants are used in railways, marine, automotive, and aviation industries.

With the growing production of EVs, the demand for advanced adhesives is increasing. The products are also used in boat, yacht, and shipbuilding applications as they offer elasticity, strength, durability, and UV resistance and are capable of bonding various materials, such as aluminum, glass fiber reinforced polyester, stainless steel, and woods that are used in the construction of boats, ships, and yachts.

The market growth is also driven by other applications, such as industry assembly and heavy equipment. The products offer an instant cure in presence of moisture that enhances productivity. Their properties make adhesion strong minimizing the need for mechanical fasteners.

Product Insights

The demand for adhesives is prominent in the automotive industry and industrial assembly. These products help in enhancing product efficiency along with reducing the cost of production. The requirement of adhesives is significant in automotive production; for instance, around 15 kilograms of adhesives are required in assembling, bonding, and laminating the interior parts of a vehicle. Also, the growing demand for lightweight vehicles further augments their demand as they eliminate the need for mechanical fasteners and provide enhanced strength and durability.

Sealants segment is anticipated to register the fastest CAGR over the forecast years. These products are utilized in the construction industry in both the exterior and interior of buildings, such as furniture, doors, windows, facades and cracks in the wall. The growing emphasis on using eco-friendly products is anticipated to compel builders to use MS polymer hybrid sealants. The product segment is further segregated into colored and transparent.

Consumer preference for transparent sealants has gained momentum over the past years. One of the major challenges associated with colored sealants is the availability of the exact shade, which can match the paint color applied to the structure. Transparent sealants help resolve this issue as they can be painted with the same color as the building structure.

Regional Insights

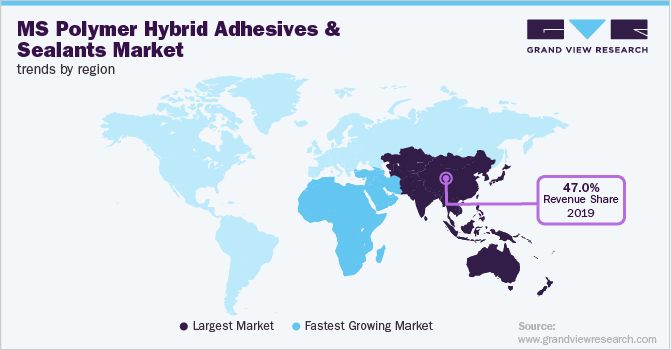

The Asia Pacific held the largest revenue share in 2019, accounting for the global market. The rising demand for MS polymer hybrid adhesives & sealants is attributed to the growth of the construction industry and manufacturing sector, along with increasing FDIs in the region. The growing infrastructural developments along with increasing vehicle production in the region are anticipated to augment the market growth. According to the OICA, Asia Pacific was the largest producer of motor vehicles as of 2018.

China is expected to be one of the promising markets for various end-use industries. China's sustained demand for industrial, health & hygiene, and infrastructural expansion has generated the requirement for new construction projects, which, in turn, is likely to boost the country’s construction sector. The increasing adhesive demand in the country is encouraging its production expansion. For instance, in August 2018, Evonik Industries and Wynca announced plans to form a joint venture for producing fumed silica in China to meet the demand for silicones, adhesives & sealants, and paints & coatings.

Europe held the second-largest revenue share in 2018. Growing construction activities on account of rising consumer spending in both residential and non-residential sectors is propelling the product demand. The shift in the trend toward the deployment of environmental-friendly adhesives & sealants in the construction industry is a key reason for the adaption of MS polymer hybrid adhesives & sealants.

The UK is a significant market in Europe. Rising construction activities in the region are propelling product demand. In 2017, the overall construction output in the UK was worth USD 250.8 billion. Continued supportive government policies have resulted in the growth of the housing sector. Moreover, multiple construction projects such as London’s USD 20 billion Crossrail development (considered to be the biggest project in Europe) and the extension of the Heathrow Airport are expected to boost the UK’s construction sector, and positively impact the demand for MS polymer hybrid adhesives and sealants.

Key Companies & Market Share Insights

The global MS polymer hybrid adhesives and sealants market is highly competitive and fragmented. The market has the presence of both large- and small-scale companies. Some of the key manufacturers in the market are The 3M Company, Bostik, H.B. Fuller Company, Henkel Corp., Sika AG, and Wacker Chemie AG. New product development and mergers & acquisitions are the key strategies implemented by these companies. For example, in June 2018, Arsenal Capital Partners, a private equity firm, acquired Epoxy Technology, Inc. In April 2018, Tremco Illbruck commissioned a new production facility for adhesives and sealants in Traunreut, Germany, worth USD 5.6 million.

MS Polymer Hybrid Adhesives & Sealants Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 8.63 billion

Revenue forecast in 2025

USD 12.87 billion

Growth rate

CAGR of 8.1% from 2020 to 2025

Base year for estimation

2019

Historical data

2014 - 2018

Forecast period

2020 - 2025

Quantitative units

Volume in kilo tons, revenue in USD million/billion and CAGR from 2020 to 2025

Report coverage

Volume and revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.;China; India; Brazil

Key companies profiled

3M; Bostik; DL Chemicals; H.B. Fuller Company; Tremco Illbruck; Henkel AG & Co. Kgaa; MAPEI S.p.A; Novachem Corporation Ltd.; The Sherwin-Williams Company (Geocel); Sika AG; Wacker Chemie AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global MS Polymer Hybrid Adhesives & Sealants Market SegmentationThis report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global MS polymer hybrid adhesives and sealants market report based on the product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Adhesives

-

Sealants

-

Transparent

-

Colored

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Building & Construction

-

Transportation

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."