- Home

- »

- Petrochemicals

- »

-

Monoethylene Glycol Market Size And Share Report, 2030GVR Report cover

![Monoethylene Glycol Market Size, Share & Trends Report]()

Monoethylene Glycol Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (PET, Polyester Fibers), By End-use (Packaging, Automotive), By Region (Asia Pacific, North America), And Segment Forecasts

- Report ID: GVR-4-68040-090-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Monoethylene Glycol Market Size & Trends

The global monoethylene glycol market size was valued at USD 24.16 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.2% from 2023 to 2030. The development of new areas of application for MEG, such as in the production of batteries and green solvents, is expected to drive market growth in the coming years. The market is dominated by key players, such as India Glycols Ltd., Sinopec Royal Dutch Shell PLC, Lotte Chemical Corp., The Dow Chemical Company, LyondellBasell Industries N.V., BASF SE, Reliance Industries Ltd., and SABIC. These companies have a significant share of the market and are constantly investing in R&D to improve their products and processes.

This has led to a situation where the market is very competitive and new entrants face a significant challenge in gaining a foothold. Monoethylene Glycol (MEG) is an organic compound with the formula (CH2OH)2. It is a colorless, odorless, and viscous liquid. It is miscible with water and many other organic solvents. It is a versatile chemical with a wide range of applications. It is used in the production of polyester fibers, antifreeze, brake fluids, and a variety of other products. MEG is produced by the catalytic hydration of ethylene.

The reaction is carried out in the presence of a catalyst, such as silver or copper, at elevated temperature and pressure. The reaction produces a mixture of MEG and water, which is then separated by distillation. MEG is a safe and environmentally friendly chemical. It is not flammable and does not release harmful emissions. The product is also biodegradable and can be recycled. It is a valuable chemical with a wide range of applications. It is a safe and environmentally friendly chemical that is used in a variety of products.

Application Insights

The Polyethylene Terephthalate (PET) segment dominated the market with a revenue share of more than 80% in 2022. This is attributed to the advantageous properties of MEG over other products in the production of PET. These include its thermal stability, reactivity, compatibility, clarity & transparency, and barrier properties. MEG is a key raw material in the production of polyester fiber. It is used to react with terephthalic acid to form Dimethyl Terephthalate (DMT), which is then polymerized to form polyester resin.

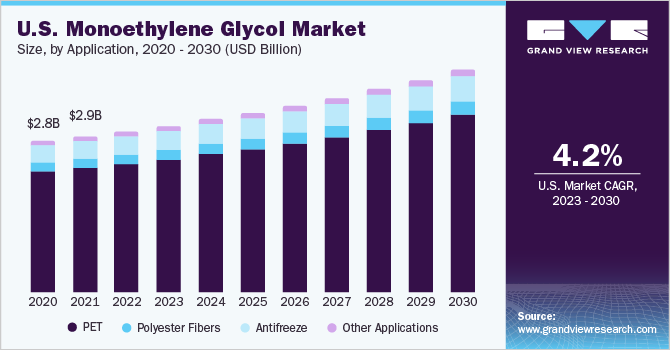

The polyester resin is then spun into fibers using a variety of methods, including melt spinning and wet spinning. There are several advantages to using MEG in polyester fiber production. MEG is a relatively inexpensive raw material and is also a safe and environmentally friendly chemical. Apart from these, monoethylene glycol is also utilized in antifreeze. MEG lowers the freezing point of water. This is because MEG molecules form hydrogen bonds with water molecules, which prevents the water molecules from freezing. As a result, antifreeze with MEG can prevent engine coolant from freezing even in very cold weather.

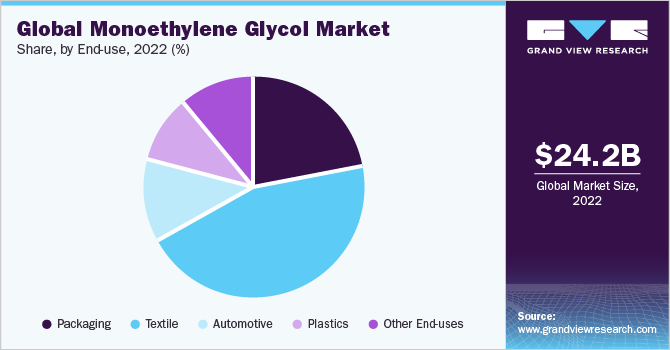

End-use Insights

The textile segment dominated the market with a revenue share of 45% in 2022. This is attributed to the diverse applicability of monoethylene glycol in the textile industry in processes, such as dyeing, polyester fiber production, textile printing, finishing, and textile processing. In the plastic industry, MEG is a key raw material in the production of polyester resins. Furthermore, it is used in a variety of plastic processing applications, such as injection molding, blow molding, and extrusion. Moreover, MEG is used in a variety of plastic processing applications, like colorants, UV stabilizers, and flame retardants. To sum up, as the global demand for plastic products with improved quality and properties increases, the demand for monoethylene glycol from the plastic industry is anticipated to bolster over the forecasted period.

Monoethylene glycol is used in the packaging industry to produce polyester resins, which are used to make a variety of packaging materials, such as bottles, food packaging, and films. It is also used as a solvent in the production of adhesives and coatings used in packaging. It is used as a solvent in the production of adhesives. It helps dissolve the adhesive ingredients and improve the flow and bonding properties of the adhesive. MEG-based adhesives are used in a variety of packaging applications, such as carton sealing, label application, and food packaging.

Regional Insights

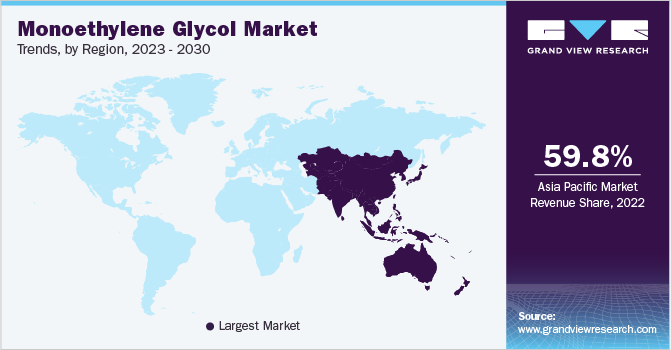

Asia Pacific region dominated the global market with a revenue share of 59.79 in 2022. This is attributed to the increasing demand from the textile, packaging, and electronics industries in the region. Furthermore, the textile industry is one of the major end-users in Asia Pacific. The product is used in the manufacturing of polyester fibers, which are used in a variety of textile products, such as clothing, carpets, and furniture. The increasing demand for polyester fibers from the textile industry is anticipated to drive regional market growth. Growing investments by leading manufacturing companies in North America are one of the major drivers of the regional market.

For example, in 2021, DowDuPont announced plans to invest $1 billion to expand its MEG production capacity at its Freeport, Texas, plant. The expansion is expected to increase the plant’s production capacity by 250,000 metric tons per year and is scheduled to be completed in 2024. Similarly, in 2022, INEOS announced plans to invest $1.2 billion to build a new MEG plant in Mont Belvieu, Texas. The plant is expected to have a production capacity of 750,000 metric tons per year and is scheduled to be completed in 2025. The electronics industry is a major end-user in Europe. MEG is used in the production of electronic components, such as capacitors and batteries. The increasing demand for electronic components from the consumer electronics, automotive, and industrial sectors is expected to drive the market in Europe.

Key Companies & Market Share Insights

The global market is highly competitive. Key players in various regions are involved in increasing their product portfolios and global presence. These players are more inclined toward expansion in terms of distribution network as well as geographical footprint. Moreover, companies are investing in R&D activities to develop and increase their production plant capacity to meet the rising product demand. For instance, in 2023, Indian Oil Corp. Ltd. listed major projects wherein the company undertook ethylene glycol project in Paradip Refinery, with a total project cost of around INR 5,654 Cr. Industry participants are also engaged in strategic initiatives, such as mergers and acquisitions, to strengthen their hold in the global market. Some of the key players in the global monoethylene glycol market include:

-

MEGlobal

-

Ishtar Company, LLC

-

Raha Group

-

India Glycols Ltd.

-

Kimia Pars Co.

-

LyondellBasell N.V.

-

Arham Petrochem Pvt. Ltd.

-

Indian Oil Corporation Ltd.

-

Pon Pure Chemicals Group

-

Acuro Organics Ltd.

-

SABIC

-

Euro Industrial Chemicals

-

Shell

-

UPM Biochemicals

Monoethylene Glycol Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 24.77 billion

Revenue forecast in 2030

USD 30.98 billion

Growth rate

CAGR of 3.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Belgium; China; India; Japan; South Korea; Singapore; Malaysia; Brazil; Argentina; Saudi Arabia; South Africa; Kuwait; Iran

Key companies profiled

MEGlobal; Ishtar Company, LLC; Raha Group; India Glycols Ltd.; Kimia Pars Co.; LyondellBasell N.V.; Arham Petrochem Pvt. Ltd.; Indian Oil Corp. Ltd.; Pon Pure Chemicals Group; Acuro Organics Ltd.; SABIC; Euro Industrial Chemicals; Shell; UPM Biochemicals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Monoethylene Glycol Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global monoethylene glycol market report based on application, end-use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

PET

-

Polyester Fibers

-

Antifreeze

-

Other Applications

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Textile

-

Automotive

-

Plastics

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Kuwait

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global monoethylene glycol market size was estimated at USD 24.16 billion in 2022 and is expected to reach USD 24.77 billion in 2023.

b. The global monoethylene glycol market is expected to grow at a compound annual growth rate of 3.2% from 2023 to 2030 to reach USD 30.98 billion by 2030.

b. Asia Pacific dominated the monoethylene glycol market with a share of 31.39% in 2022. This is attributable to

b. Some key players operating in the monoethylene glycol market include the increasing demand for MEG from the textile, packaging, and electronics industries in the region. Furthermore, the textile industry is one of the major end-users of MEG in Asia Pacific.

b. Key factors that are driving the market growth include development of new areas of application for MEG such as in the production of batteries and green solvents, and surging usage in the production of polyester fibers, antifreeze, brake fluids, and a variety of other products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.