- Home

- »

- Next Generation Technologies

- »

-

Multimodal Biometrics Market Size, Industry Report, 2030GVR Report cover

![Multimodal Biometrics Market Size, Share & Trends Report]()

Multimodal Biometrics Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Fingerprint Recognition, Facial Recognition), By Component, By Application, By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-592-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Multimodal Biometrics Market Size & Trends

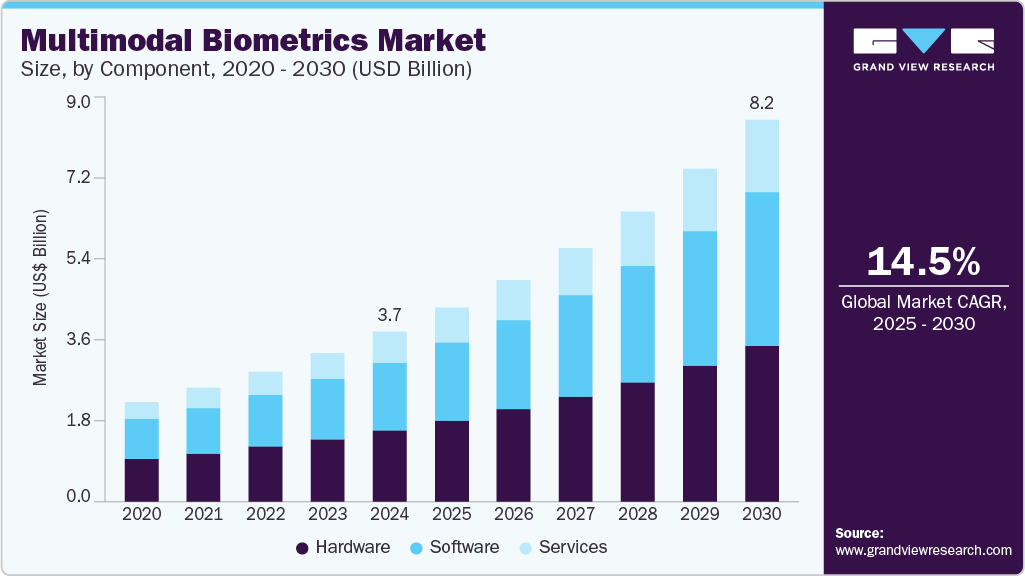

The global multimodal biometrics market size was estimated at USD 3.67 billion in 2024 and is expected to grow at a CAGR of 14.5% from 2025 to 2030. This growth is driven by increasing demand for advanced security solutions across various sectors. Growing concerns about identity theft, fraud, and unauthorized access contribute significantly to the adopting of multimodal biometric systems.

Key Highlights:

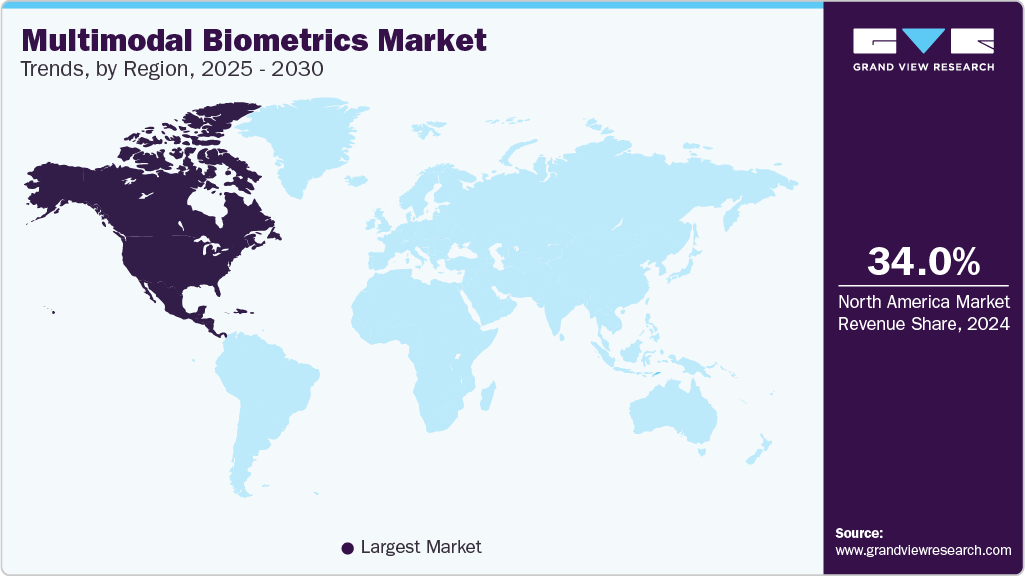

- North America multimodal biometrics industry dominated the global market with a revenue share of over 34% in 2024.

- The multimodal biometrics industry in the U.S. is expected to grow significantly in 2024.

- By technology, the fingerprint recognition segment led the market in 2024, accounting for over 40% of global revenue.

- By component, the hardware segment accounted for the largest revenue share in 2024.

- By application, the authentication & access control segment accounted for the largest market revenue share in 2024.

Combining multiple biometric modalities, such as fingerprint, facial, and iris recognition, improves accuracy and lowers false acceptance rates, making these systems suitable for high-security environments. In addition, regulatory requirements and government initiatives to implement secure identification systems support the current market expansion.

Moreover, the industry is influenced by advancements in artificial intelligence and machine learning technologies that improve biometric data processing and recognition capabilities. The rising adoption of multimodal biometrics in banking, healthcare, and law enforcement contributes to expanding use cases and applications. Furthermore, increasing investments in cloud-based biometric solutions and mobile biometric authentication improve scalability and accessibility, encouraging broader deployment across enterprises and public institutions.

Furthermore, emerging trends such as integrating multimodal biometrics with Internet of Things (IoT) devices and smart city projects contribute to future market expansion. The focus on user convenience and stringent security requirements drives innovation in biometric systems that offer seamless and contactless authentication. As organizations increasingly prioritize data privacy and secure access management, multimodal biometrics remain a key technology supporting these objectives across global markets, offering enhanced reliability and protection against evolving security threats.

Technology Insights

The fingerprint recognition segment led the market in 2024, accounting for over 40% of global revenue due to widespread deployment in consumer electronics, enterprise security, and government identification programs. Its technology benefits from mature sensor development, cost efficiency, and user familiarity, making it a reliable and accessible biometric modality. The ability to quickly capture and process fingerprint data with high accuracy supports its extensive use across diverse applications globally. Moreover, advancements in sensor miniaturization and integration with mobile devices continue to expand their reach.

The iris recognition segment is predicted to foresee the fastest growth in the forecast years as a biometric modality offering exceptional accuracy and resistance to spoofing. Advances in high-resolution imaging and AI-driven pattern analysis improve usability and speed, encouraging adoption in sectors such as border security, finance, and healthcare. Its contactless nature aligns with hygiene concerns, further supporting growth in sensitive environments. Increasing government initiatives for secure identity verification also contribute to its rising adoption.

Component Insights

The hardware segment accounted for the largest revenue share in 2024 due to the important role of biometric sensors and devices in capturing and processing unique physiological and behavioral traits. High demand for reliable and accurate biometric hardware such as fingerprint scanners, facial recognition cameras, and iris sensors drives this segment. These components form the foundation of multimodal biometric systems, ensuring precise data acquisition essential for security and authentication across finance, healthcare, and government industries. In addition, continuous technological advancements in sensor accuracy, speed, and durability support widespread adoption in diverse environments.

The services segment is expected to grow at the fastest CAGR over the forecast period. Organizations seek expert support to tailor solutions, ensure regulatory compliance, and optimize system performance. The rising adoption of cloud-based biometrics and AI integration increases demand for specialized services. In addition, ongoing support and training services are essential for maximizing system efficiency and user adoption. The complexity of integrating multimodal biometrics with IT systems also drives growth in professional services.

Application Insights

The authentication & access control segment accounted for the largest market revenue share in 2024 due to the essential need for secure entry management in enterprises, government institutions, and critical infrastructure. Multimodal biometrics enhance security by combining multiple identifiers, reducing false acceptance and rejection rates, and improving user convenience in physical and digital access scenarios. The growing trend toward zero-trust security models further emphasizes the importance of strong biometric authentication. Moreover, increasing workplace digitization and remote access requirements drive robust demand for access control solutions.

The surveillance & monitoring segment is expected to grow at the fastest CAGR over the forecast period, as governments and organizations invest in public safety and threat detection. Multimodal biometric systems improve identification accuracy in crowded or complex environments, supporting law enforcement, border control, and event security with real-time, reliable recognition capabilities. The integration of AI and video analytics improves the effectiveness of surveillance systems. In addition, rising concerns over terrorism and organized crime increase the need for advanced monitoring solutions. Adoption of smart city initiatives also contributes to the growth of this segment.

Deployment Insights

The cloud segment accounted for the prominent market revenue share in 2024. Cloud-based biometric solutions provide scalability, cost efficiency, and ease of deployment, appealing to enterprises seeking flexible and remote-access authentication systems. For instance, in February 2025, Incode Technologies Inc. and Okta announced a strategic partnership to enhance workforce identity security by integrating Incode’s biometric authentication solutions with Okta’s Workforce Identity Cloud services. This collaboration aims to provide organizations with stronger, more seamless identity verification and access management capabilities. Cloud security and encryption technology advances increase trust in cloud biometrics, enabling broader adoption across industries and geographies. The growing trend of remote work and digital transformation accelerates cloud adoption. Cloud platforms also facilitate rapid updates and integration with emerging AI capabilities. In addition, subscription-based pricing models make cloud biometrics accessible to various organizations.

The on-premises segment is anticipated to grow at a significant CAGR during the forecast period. On-premises biometric solutions offer organizations control over sensitive data and system configurations, which is critical for compliance with privacy regulations. Industries such as government, healthcare, and finance prefer on-premises deployments to ensure data sovereignty and customize security protocols according to internal policies. Operating independently of internet connectivity adds to the appeal of on-premises solutions. Furthermore, organizations with legacy infrastructure often find on-premises systems easier to integrate.

End Use Insights

The government segment accounted for the largest market revenue share in 2024 due to the extensive deployment of multimodal biometrics in national security, border control, law enforcement, and public service delivery. Increasing concerns over identity fraud, terrorism, and illegal immigration drive governments to invest heavily in biometric systems that improve identity verification accuracy and operational efficiency. Large-scale initiatives such as national ID programs, e-passports, and biometric voter registration further contribute to market share. Additionally, regulatory mandates and the need for secure citizen authentication in e-governance services sustain strong demand within the government sector.

The BFSI segment is anticipated to grow at the fastest CAGR during the forecast period. The BFSI sector is increasingly adopting multimodal biometrics to strengthen fraud prevention, secure digital transactions, and comply with stringent regulatory requirements such as KYC and AML. The rise of digital banking and mobile payment platforms necessitates reliable and seamless authentication methods to protect customer identities and assets. In addition, advancements in biometric technologies, including facial and fingerprint recognition, improve transaction security and customer experience, driving widespread adoption across banks, insurance companies, and financial institutions.

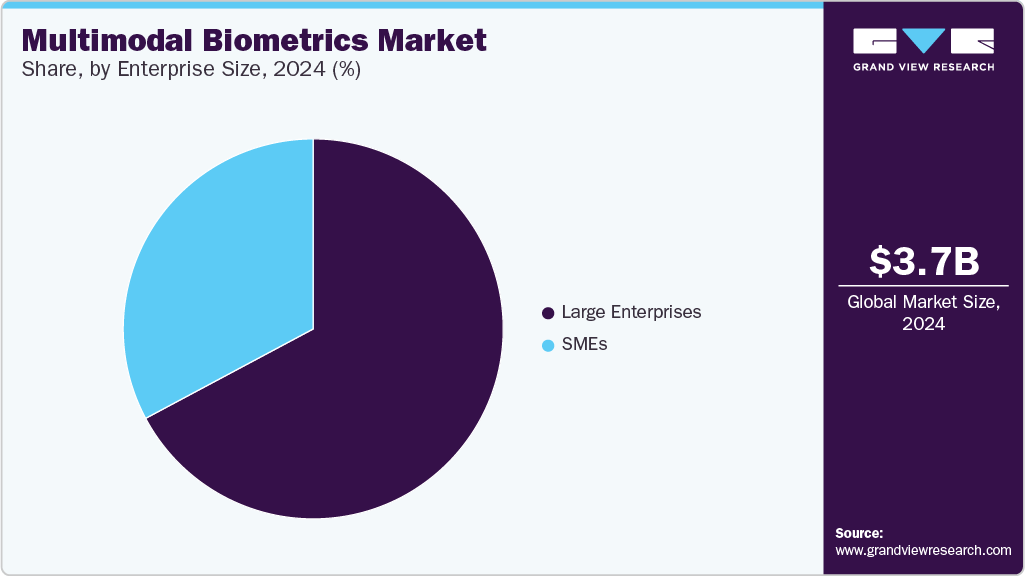

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024. Large enterprises invest heavily in multimodal biometrics to secure multiple locations, protect sensitive assets, and comply with regulatory requirements. Their capacity to deploy comprehensive, multi-layered security systems and integrate biometrics into existing IT infrastructure supports their market dominance. These organizations often require customized solutions tailored to complex operational needs. The need to protect intellectual property and customer data further drives adoption.

The SMEs segment is anticipated to grow at the highest CAGR during the forecast period, as these technologies become more affordable and scalable. SMEs face evolving security challenges, including identity theft and data breaches, prompting investment in biometric authentication to safeguard assets and comply with emerging regulations. Cloud-based and as-a-service biometric offerings lower barriers to entry, enabling SMEs to implement advanced security without heavy upfront costs. The need for seamless and user-friendly authentication methods also encourages SMEs to integrate multimodal biometrics into their operations to enhance security and customer experience.

Regional Insights

North America multimodal biometrics industry dominated the global market with a revenue share of over 34% in 2024. This can be attributed to its advanced technological infrastructure, early adoption across healthcare, BFSI, and government sectors, and strong regulatory frameworks. Significant R&D investments and heightened cybersecurity concerns accelerate the region's deployment of multimodal biometric systems. The presence of major biometric technology providers also supports market growth. Furthermore, government initiatives promoting digital identity and border security improve adoption.

U.S. Multimodal Biometrics Market Trends

The multimodal biometrics industry in the U.S. is expected to grow significantly in 2024, driven by increasing demand for secure identity verification in sectors such as defense, healthcare, and finance. Federal initiatives promoting biometric integration and rising cyber threats contribute to expanding market opportunities. Adopting multimodal biometrics in airports and public safety applications further supports growth. In addition, government and private sector collaborations facilitate innovation and deployment.

Europe Multimodal Biometrics Market Trends

The multimodal biometrics market in Europe is expected to grow significantly over the forecast period, driven by its stringent data protection laws, government programs improving border security, and investments in smart city initiatives. The region’s focus on privacy and secure digital identity solutions encourages the adoption of multimodal biometric technologies. Increasing collaboration among EU member states on security standards also boosts market development. In addition, rising demand for contactless and seamless authentication methods in the public and private sectors supports wider implementation. Integrating biometrics with emerging technologies such as AI and blockchain further enhances system security and user trust across European markets.

Asia Pacific Multimodal Biometrics Market Trends

The multimodal biometrics industry in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. Rapid digital transformation, urbanization, and government-led national ID programs drive strong demand for multimodal biometrics in Asia Pacific. Moreover, increasing smartphone penetration and technological advancements facilitate widespread biometric adoption across emerging economies. Investments in infrastructure and smart city projects further accelerate market expansion. The region benefits from a large population base and growing awareness of biometric security.

Key Multimodal Biometrics Companies Insights

Key players operating in the multimodal biometrics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Multimodal Biometrics Companies:

The following are the leading companies in the multimodal biometrics market. These companies collectively hold the largest market share and dictate industry trends.

- HID Global Corporation

- IDEMIA

- Suprema, Inc.

- Thales Group

- Fujitsu

- NEC Corporation

- EyeVerify, Inc.

- Synaptics Incorporated

- Aware, Inc.

- Qualcomm Technologies, Inc.

Recent Developments

-

In April 2025, Anonybit and Fingerprint Cards AB (FPC) announced their integration with Ping Identity’s no-code identity orchestration platform, PingOne DaVinci. This collaboration aims to deliver enterprises a robust, privacy-preserving, multi-modal biometric authentication solution designed to prevent credential theft and mitigate the risk of security breaches.

-

In March 2025, Iris ID, Inc. launched the IrisAccess iA1000, a multimodal access control reader combining iris and facial recognition technologies. The company positioned this device as a next-generation solution for secure access management, offering two configurations to accommodate different security requirements and budget considerations. This fusion technology aims to improve accuracy and reliability in identity verification for various operational environments.

-

In November 2024, NEC Corporation developed a technology enabling simultaneous authentication using facial and iris biometrics from a single camera image. This solution allows accurate iris recognition even from lower-resolution, noisy images captured by cameras primarily designed for facial recognition, thereby improving biometric verification capabilities without additional hardware.

Multimodal Biometrics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.19 billion

Revenue forecast in 2030

USD 8.25 billion

Growth rate

CAGR of 14.5% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, end use, application, enterprise size, technology, component, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

HID Global Corporation; IDEMIA; Suprema, Inc.; Thales Group; Fujitsu; NEC Corporation; EyeVerify, Inc.; Synaptics Incorporated; Aware, Inc.; Qualcomm Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Multimodal Biometrics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global multimodal biometrics market report based on technology, component, application, deployment, enterprise size, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Fingerprint Recognition

-

Facial Recognition

-

Iris Recognition

-

Voice Recognition

-

Others

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Authentication & Access Control

-

Surveillance & Monitoring

-

Identity Verification

-

Forensics

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Consumer Electronics

-

Healthcare

-

Transportation and Logistics

-

Defense & Security

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global multimodal biometrics market size was estimated at USD 3.67 billion in 2024 and is expected to reach USD 4.19 billion in 2020.

b. The global multimodal biometrics market is expected to grow at a compound annual growth rate of 14.5% from 2025 to 2030 to reach USD 8.25 billion by 2030.

b. North America dominated the multimodal biometrics market with a share of 34% in 2024. This can be attributed to its advanced technological infrastructure, early adoption across healthcare, BFSI, and government sectors, and strong regulatory frameworks.

b. Some key players operating in the multimodal biometrics market include HID Global Corporation; IDEMIA; Suprema, Inc.; Thales Group; Fujitsu; NEC Corporation; EyeVerify, Inc.; Synaptics Incorporated; Aware, Inc.; Qualcomm Technologies, Inc.

b. Key factors that are driving the market growth include increasing demand for high-security authentication and rising adoption in government and civil ID programs

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.