- Home

- »

- Pharmaceuticals

- »

-

Naltrexone And Buprenorphine Market, Industry Report, 2033GVR Report cover

![Naltrexone And Buprenorphine Market Size, Share & Trends Report]()

Naltrexone And Buprenorphine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Naltrexone, Buprenorphine), By Route Of Administration, By Application, By Distribution Channel (Hospitals Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-342-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Naltrexone And Buprenorphine Market Summary

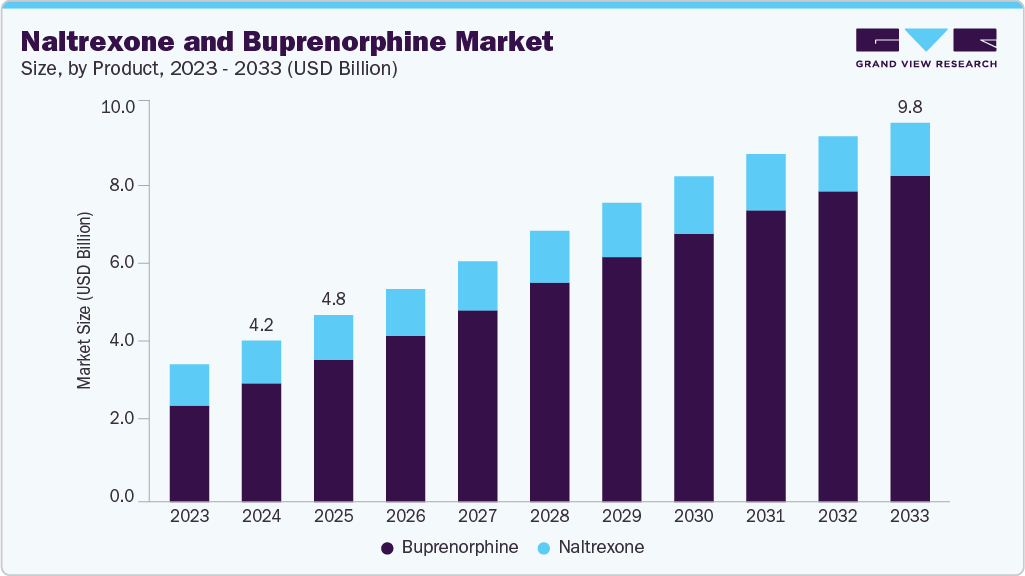

The global naltrexone and buprenorphine market size was estimated at USD 4.17 billion in 2024 and is projected to reach USD 9.80 billion by 2033, growing at a CAGR of 9.25% from 2025 to 2033. The market is expected to grow due to the increasing prevalence of substance use disorders and greater awareness of opioid use disorder treatments. Government initiatives are further increasing access to advanced addiction care solutions.

Key Market Trends & Insights

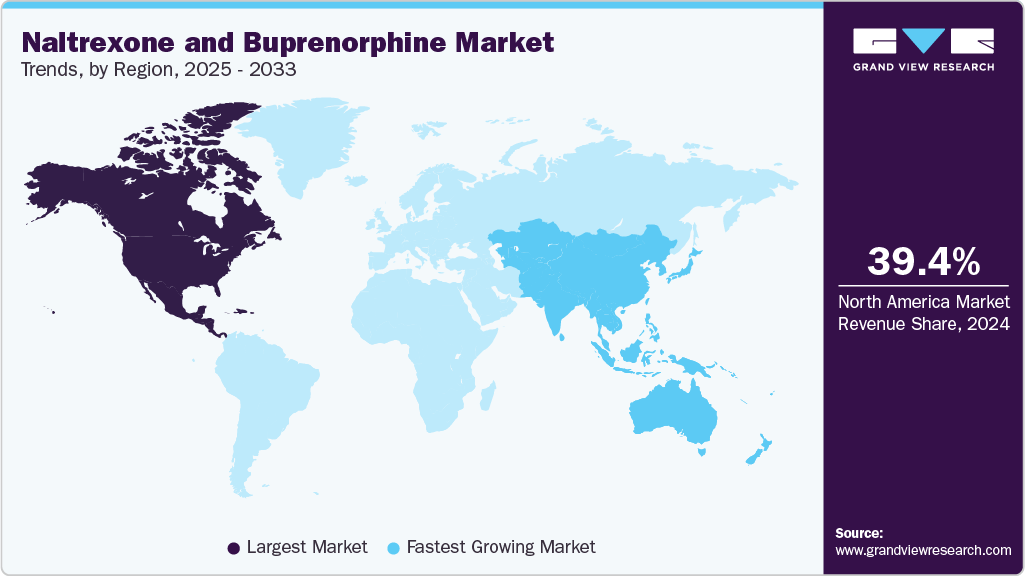

- North America naltrexone and buprenorphine market held the largest share of 39.4% of the global market in 2024.

- The naltrexone and buprenorphine industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the buprenorphine segment held the highest market share of 73.5% in 2024.

- By route of administration, buprenorphine, the injectable segment accounted for the largest share of 68.1% of the market in 2024.

- By distribution channel, the hospital pharmacies segment dominated the market with a revenue share of 47.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.17 Billion

- 2033 Projected Market Size: USD 9.80 Billion

- CAGR (2025-2033): 9.25%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

WHO Updates Opioid Treatment Guidelines

In February 2025, The World Health Organization (WHO) updated its guidelines on opioid dependence treatment and overdose prevention to expand access to effective interventions. The revised guidelines emphasized the importance of using opioid agonist maintenance treatment (OAMT) with methadone or buprenorphine as the most effective therapy for opioid dependence. WHO also recommended making naloxone more widely available to prevent overdose-related deaths, especially in community settings. The new guidance called for reducing regulatory barriers and increasing investment in harm-reduction services. Additionally, the update urged healthcare providers to deliver evidence-based, person-centered, and non-discriminatory care. These recommendations were aimed at supporting countries in addressing rising opioid-related health challenges and enhancing public health outcomes globally.

Telemedicine Expansion Approved for Buprenorphine Treatment

In January 2025, the Federal Register published a rule titled “Expansion of Buprenorphine Treatment via Telemedicine Encounter,” which allowed authorized practitioners to initiate buprenorphine treatment for opioid use disorder (OUD) through telemedicine without requiring an in-person evaluation. The rule was issued to enhance access to care, particularly in underserved and rural areas, by leveraging telehealth platforms. It outlined that practitioners must be registered with the Drug Enforcement Administration (DEA) and comply with all applicable federal and state regulations. The rule also specified that adequate patient assessment, documentation, and follow-up care were necessary to ensure safe and effective treatment. This policy change aimed to support continuity of care, reduce treatment delays, and address the growing opioid crisis. The expansion marked a significant shift in how medication-assisted treatment could be delivered across the U.S.

Strategic Phase 3 Advancements in Long-Acting Therapies for Opioid Use Disorder

The current Phase 3 pipeline for opioid use disorder (OUD) demonstrates strong strategic investment by Braeburn Pharmaceuticals, Alkermes, Inc., and Indivior Inc., with a clear focus on long-acting buprenorphine and extended-release naltrexone therapies. These trials address key clinical challenges such as improving treatment adherence, enhancing safety during transitions, and reducing relapse risk. Alkermes is exploring the combined use of buprenorphine and naltrexone to support patients switching to Vivitrol. Indivior is advancing depot buprenorphine formulations focusing on safety and long-term use. Braeburn’s trial on CAM2038 reflects the broader push for outpatient-appropriate, sustained-release options. Collectively, these late-stage programs indicate a shift toward long-acting pharmacologic solutions that align with payer demands and public health goals for more effective, low-diversion-risk treatments in OUD care.

Clinical Trials Targeting Opioid Use Disorder (OUD)

NCT Number

Study Title

Conditions

Sponsor

Phases

NCT02672111

Long-Term Safety Study of Buprenorphine (CAM2038) in Adult Outpatients With Opioid Use Disorder

Opioid Use Disorder

Braeburn Pharmaceuticals

PHASE3

NCT02696434

Evaluating Naltrexone for Use in Conjunction With Buprenorphine in Adults With Opioid Use Disorder Transitioning From Buprenorphine Maintenance Prior to First Dose of VIVITROL

Opioid Use Disorder

Alkermes, Inc.

PHASE3

NCT02896296

Open-Label Treatment Extension Study

Opioid Use Disorder|Opioid-related Disorders

Indivior Inc.

PHASE3

NCT02510014

Safety and Tolerability Study of Depot Buprenorphine in Treatment Seeking Subjects With Opioid Use Disorder

Opioid Use Disorder|Opioid-related Disorders

Indivior Inc.

PHASE3

NCT02537574

Naltrexone for Use in Conjunction With Buprenorphine in Adults With Opioid Use Disorder Prior to First Dose of VIVITROL® (Naltrexone for Extended-Release Injectable Suspension)

Opioid Use Disorder

Alkermes, Inc.

PHASE3

Source: ClinicalTrials.gov, Grand View Research

Prevalence and Clinical Burden of Opioid Use Disorder in the U.S

In January 2024, the National Center for Biotechnology Information (NCBI) reported that approximately 2.1 million individuals in the United States had an opioid use disorder (OUD), reflecting a significant burden on the healthcare system. The analysis highlighted that OUD accounted for about 21 to 29% of patients receiving chronic opioid therapy, with misuse rates estimated at 8 to 12%. Furthermore, among patients prescribed opioids for chronic pain, the incidence of developing an opioid use disorder was between 3 and 19%. The report emphasized that individuals with OUD were at increased risk of overdose, infectious diseases, and death, especially when using heroin or synthetic opioids. It also noted that less than half of those affected received medication-assisted treatment despite its demonstrated effectiveness.

The increasing incidence of substance use disorders is a key factor driving the demand for medications such as naltrexone and buprenorphine. As these conditions impact more individuals, the need for effective therapeutic interventions rises, encouraging growth and innovation in the addiction treatment landscape. The 2022 National Survey on Drug Use and Health (NSDUH), published by the Substance Abuse and Mental Health Services Administration (SAMHSA), outlines critical trends related to substance use and mental health across the U.S. According to the report, 59.8% of individuals aged 12 and older had used tobacco, alcohol, or illicit substances, while 70.3 million used illegal drugs in the past year marijuana being the most widely used. Additionally, 48.7 million people experienced substance use disorders, including both alcohol and drug-related conditions. The data also revealed that 23.1% of adults lived with a mental illness, and 19.5% of adolescents went through a major depressive episode, emphasizing the scope of these public health challenges and their implications for healthcare planning and response.

Additionally, collaborative efforts between national, state, and local agencies aim to implement evidence-based solutions to address the multifaceted challenges of opioid addiction. In July 2023, the U.S. Department of Health and Human Services (HHS), through SAMHSA, distributed USD 47.8 million across five grant programs targeting substance misuse and overdose prevention. These initiatives support a wide range of efforts, including expanded access to medications for opioid use disorder (MOUD), emergency department alternatives to opioids, prevention of underage drinking, reentry support for formerly incarcerated individuals with SUDs, and services for pregnant and postpartum women facing substance use challenges.

Market Concentration & Characteristics

Innovation in the naltrexone and buprenorphine market is driven by notable progress, including accelerated initiation protocols for extended-release naltrexone as demonstrated in the March 2023 SWIFT study, regulatory backing from the FDA for medication-assisted treatment (MAT), and ongoing research into combination therapies and tailored treatment approaches. These advancements are designed to improve the effectiveness and efficiency of opioid use disorder management, signaling a significant evolution in the field of addiction care.

The market presents moderate to high entry barriers due to strict regulatory requirements, high development costs, and the need for extensive clinical validation. Entrants must demonstrate strong safety and efficacy data to secure approvals for addiction therapies. Manufacturing complexities for long-acting injectables and implantables add to operational challenges. Established players also maintain brand loyalty and strong distribution networks, making it harder for new entrants to gain traction. Intellectual property protections further restrict immediate access to innovative delivery platforms.

Regulatory frameworks play a crucial role in shaping the growth and advancement of naltrexone and buprenorphine for treating opioid use disorder. These measures uphold safety, efficacy, and quality standards, reinforcing trust among healthcare professionals and patients. At the same time, stringent regulations can limit accessibility and drive up treatment costs, potentially impacting overall market dynamics. Nevertheless, regulatory guidelines often encourage the development of improved formulations and combination therapies aimed at better treatment results and minimizing the risk of misuse. Achieving the right balance between oversight and accessibility remains essential to maximize the therapeutic benefits of these medications.

Alternatives such as methadone and behavioral therapies present a competitive challenge to the use of naltrexone and buprenorphine in opioid addiction treatment. These substitutes utilize distinct mechanisms and therapeutic models, affecting market dynamics and influencing pricing decisions. Methadone, acting as a full opioid agonist, along with non-pharmacological interventions, offers other options for managing opioid dependence that may limit the uptake of naltrexone and buprenorphine. This moderate level of substitution pressure underscores the importance for manufacturers and clinicians to articulate these medications' specific advantages clearly. Emphasizing factors such as safety profiles, treatment adherence, and long-term outcomes can help position them more effectively within the competitive landscape of opioid use disorder therapies.

The naltrexone and buprenorphine market is expected to experience notable regional growth as efforts intensify worldwide to address the increasing burden of opioid use disorder (OUD), emphasizing the need for tailored regional approaches in delivering effective treatment solutions. In October 2023, Indivior PLC acquired exclusive global rights to develop, manufacture, and commercialize a portfolio of long-acting injectable therapies from Alar Pharmaceuticals Inc. This agreement includes multiple extended-release formulations of a buprenorphine prodrug, with ALA-1000 being a key long-acting injectable candidate. Through this partnership, Indivior aims to strengthen its position in the global OUD treatment landscape, expanding both its therapeutic offerings and international footprint.

Product Insights

The buprenorphine segment dominated the market with the largest revenue share of 73.5% in 2024, attributed to its critical function in managing opioid dependence and growing acceptance among both medical professionals and patients. As a partial opioid agonist, buprenorphine is primarily prescribed to treat opioid addiction by minimizing withdrawal symptoms and reducing cravings. It presents a safer option compared to full opioid agonists, making it a preferred choice in clinical settings. Buprenorphine’s effectiveness in controlling dependency, decreasing relapse risks, and improving patient outcomes reinforces its value in addiction care. Its ability to stabilize brain function and support recovery underscores its central role in comprehensive treatment plans for opioid use disorder.

The naltrexone segment is projected to grow at a significant CAGR of 2.20% over the forecast period. As an FDA-approved opioid antagonist, naltrexone is used in the treatment of both opioid and alcohol use disorders by blocking opioid receptors, thereby reducing cravings and preventing the euphoric effects of opioids. This segment's expansion is supported by regulatory approvals, positive clinical trial outcomes, and strategic initiatives by key market players to improve access and treatment initiation. A study published in JAMA Network Open in May 2024 found that starting extended-release injectable naltrexone (XR-naltrexone) within 5 to 7 days of seeking treatment significantly improved initiation rates compared to the standard 10 to 15 days. Although the accelerated protocol requires close medical monitoring due to safety concerns, the findings indicate its potential to boost XR-naltrexone uptake. Continued research is needed to assess this rapid induction approach's long-term viability and cost-effectiveness.

Route of Administration Insights

The buprenorphine segment is further divided based on the route of administration into oral, injectable, and implantable forms. The injectable segment accounted for the largest share of 68.1% of the market in 2024. Injectable buprenorphine plays a key role in the treatment of opioid use disorder (OUD) and pain management, offering a reliable and controlled method of drug delivery. This route of administration has gained traction due to its long-acting properties and improved adherence potential. In recent years, injectable formulations have been adopted as healthcare providers seek more effective and convenient treatment options. The growing preference reflects the segment's importance in addressing challenges associated with opioid dependence.

The naltrexone segment is categorized into oral, injectable, and implantable administration forms. The oral segment accounted for the largest share of 55.1% in 2024. Oral naltrexone remains the most frequently prescribed option, typically administered as a 50 mg daily dose with or without food. It has proven effective in reducing the number of heavy drinking days and enhancing abstinence rates among individuals with alcohol use disorder (AUD). Higher off-label doses of up to 150 mg per day are also used in certain cases. Vivitrol, an extended-release injectable form of naltrexone, is administered as a 380 mg intramuscular injection every four weeks. Approved by the FDA in 2006 for alcohol dependence and in 2010 to prevent opioid relapse, Vivitrol has demonstrated improved treatment outcomes over placebo in clinical studies addressing both alcohol and opioid dependence.

Application Insights

The naltrexone segment is divided into two key applications such as opioid use disorder (OUD) and alcohol use disorder (AUD). The OUD application generated the highest revenue share of 69.5% in 2024. The demand for naltrexone in treating both OUD and AUD is anticipated to grow as patients and healthcare professionals increasingly turn to effective medication-assisted treatment options. A notable development occurred in 2021 when the FDA approved Vivitrol, a long-acting injectable form of naltrexone that requires only monthly administration. This advancement has enhanced patient convenience and improved treatment adherence. Such innovations continue to support the growing adoption of naltrexone in managing substance use disorders.

The Opioid Use Disorder (OUD) application in the buprenorphine segment accounted for the largest share of global market in 2024. OUD application utilizes buprenorphine, a partial opioid agonist approved by the FDA for managing opioid dependence alongside acute and chronic pain. This application benefits from a variety of buprenorphine formulations, including sublingual tablets, transdermal patches, buccal films, and injectable versions. It often relies on buprenorphine as a safer alternative to methadone, given its lower risk of overdose and respiratory complications. The Opioid Use Disorder (OUD) application frequently involves the combination of buprenorphine with naloxone, an opioid receptor antagonist, to deter misuse. The Opioid Use Disorder (OUD) application includes the use of this combination, marketed as Suboxone, for maintenance therapy as part of a broader treatment approach involving counseling and psychosocial support.

Distribution Channel Insights

Hospital pharmacies dominated the market with a revenue share of 47.9% in 2024, largely due to their central role in delivering parenteral treatments for opioid use disorder (OUD), such as buprenorphine, under physician supervision. These settings provide direct access to essential medications and ensure that qualified healthcare professionals administer care. Hospitals are key hubs for treatment initiation and management, promoting adherence through monitored drug administration. This approach has significantly contributed to the increased utilization of OUD therapies within hospital pharmacies. According to Vermont’s 2024 syndromic surveillance data, emergency department visits for opioid overdoses have declined compared to the three-year average, although males aged 30-39 continue to show the highest rates. Caledonia County reports elevated visit rates, underscoring the need for targeted intervention factors that may further drive growth in this distribution channel amid rising awareness and treatment demand.

The retail pharmacies segment is expected to experience significant growth over the forecast period. These pharmacies play a vital role in opioid use disorder (OUD) treatment by improving access to medications such as buprenorphine and naltrexone. Their convenient locations allow patients to fill prescriptions and receive counseling that supports treatment adherence easily. Retail pharmacies also contribute to public health efforts aimed at addressing the opioid crisis. Their strong community presence and accessibility make them essential in expanding treatment reach and improving outcomes for individuals with OUD.Regional Insights

North America naltrexone and buprenorphine market held the largest revenue share of 39.4% in 2024. The market is expected to witness steady growth over the forecast period, primarily fueled by the rising incidence of substance use disorders, particularly Opioid Use Disorder (OUD). Contributing factors include improved awareness of treatment options, broader insurance coverage, and enhanced patient affordability. Increased rates of opioid prescriptions, persistent pain conditions, excessive alcohol intake, and limited access to appropriate care are key contributors to the OUD burden. These elements are collectively driving demand for effective pharmacological therapies. As treatment adoption expands, the market is likely to grow consistently.

U.S. Naltrexone And Buprenorphine Market Trends

The U.S. naltrexone and buprenorphine market holds the largest share of the North American market, supported by growing awareness among healthcare professionals and an increasing number of opioid use disorder (OUD) cases. Enhanced understanding of available treatment options has contributed to the broader adoption of these medications. Data from the CDC indicates that over 131 million opioid-related prescriptions were filled in the U.S. in 2022. Additionally, approximately 145,000 individuals received a new diagnosis of OUD during the same year. These trends underscore the urgent need for effective treatment solutions and continue to drive market expansion.

Europe Naltrexone And Buprenorphine Market Trends

Europe naltrexone and buprenorphine market demonstrated steady growth in 2024, supported by the rising burden of substance use disorders and expanding clinical treatment infrastructure. Hospitals and addiction care networks across the region use medication-assisted therapies to manage OUD and AUD. Availability of cost-effective generic formulations has enhanced access in both the public and private sectors. The growing emphasis on relapse prevention and long-term recovery is influencing treatment choices. Partnerships between healthcare systems and academic institutions are encouraging evidence-based therapeutic approaches. These trends collectively strengthen the regional market outlook.

The UK naltrexone and buprenorphine market is experiencing notable growth, driven by the rising incidence of substance use disorders and the expansion of structured treatment programs. In 2023, more than half of the individuals with Opioid Use Disorder (OUD) in England, the UK’s largest constituent nation, were actively receiving treatment. Most patients were administered Medications for Opioid Use Disorder (MOUD), including buprenorphine, methadone, or naltrexone. This indicates strong clinical adoption and prioritization of pharmacological therapy in managing addiction. By comparison, treatment rates in the U.S. remain lower, with under 30% of individuals with OUD receiving care. This disparity highlights the UK’s more integrated approach to addressing opioid dependency.

Naltrexone and buprenorphine market in Germany advanced steadily in 2024 due to consistent clinical use of these therapies in addiction care settings. Structured treatment models and high therapeutic adherence support market growth. Buprenorphine is frequently prescribed for opioid withdrawal and maintenance due to its efficacy and safety. Naltrexone usage is increasing, especially for managing alcohol dependence in outpatient programs. Healthcare providers prioritize evidence-based treatment, which has helped integrate these medications into standard protocols. This contributes to Germany’s continued growth within the European market.

France naltrexone and buprenorphine market maintained stable growth in 2024, supported by expanding treatment access and rising alcohol-related health concerns. Clinicians routinely prescribe buprenorphine for opioid addiction management across both inpatient and outpatient settings. The adoption of naltrexone is increasing among adults with alcohol use disorder. New formulations and flexible dosing options have improved treatment personalization. Medical professionals are focusing on patient-centered approaches to minimize relapse. These developments are supporting long-term market expansion in France.

Asia Pacific Naltrexone And Buprenorphine Market Trends

The Asia Pacific naltrexone and buprenorphine market is expected to register the fastest CAGR of 9.82% over the forecast period, driven by rising treatment demand and expanding healthcare access. Urbanization and improved diagnostic capabilities are increasing the identification of OUD and AUD cases. Pharmaceutical companies are scaling up regional manufacturing and distribution to meet demand. Medication-assisted therapy is being integrated into treatment frameworks across emerging economies. Awareness campaigns have improved the understanding of pharmacological options among healthcare providers. These shifts are accelerating adoption and fueling strong regional growth.

Japan naltrexone and buprenorphine market showed a gradual improvement in 2024, influenced by shifting perspectives on substance use as a medical condition. Medical professionals are incorporating pharmacological therapy into structured recovery programs. Buprenorphine is being used in specialty addiction clinics for long-term opioid maintenance. Naltrexone use is also increasing in the management of alcohol use disorder in adult populations. Providers are promoting adherence through careful monitoring and follow-up care. These factors support moderate but steady market growth in Japan.

China naltrexone and buprenorphine market expanded rapidly in 2024, supported by a rising awareness of OUD treatment and increased alcohol-related health interventions. Hospitals and public health institutions are adopting medication-assisted therapy for both conditions. Injectable buprenorphine and oral naltrexone are being introduced across urban and semi-urban centers. Domestic manufacturers are investing in scaling up access and lowering treatment costs. Clinical training and pilot programs have increased professional familiarity with these therapies. This evolving treatment landscape supports sustained market momentum in China.

Latin America Naltrexone And Buprenorphine Market Trends

Latin America naltrexone and buprenorphine market progressed in 2024 with growing substance use concerns and the expansion of addiction care services. Healthcare systems are gradually incorporating pharmacological treatment into outpatient and residential programs. Brazil, Argentina, and Mexico remain major contributors due to rising demand and improved access. Clinicians are increasing reliance on buprenorphine for opioid dependence and on naltrexone for alcohol abuse. Efforts to reduce stigma and increase provider education are improving treatment adherence. These drivers are building a foundation for continued regional market growth.

Brazil naltrexone and buprenorphine market grew steadily in 2024 due to a greater focus on addiction treatment infrastructure and rising patient engagement. Buprenorphine is widely used in urban clinics for opioid dependence management. Naltrexone is gaining attention in primary care settings for addressing alcohol-related disorders. Availability of affordable formulations has improved patient access. Health professionals are emphasizing treatment continuity and follow-up, which boosts adherence. These elements are reinforcing market growth across Brazil.

Middle East & Africa Naltrexone And Buprenorphine Market Trends

The Middle East & Africa naltrexone and buprenorphine market experienced rising demand in 2024 due to growing treatment needs and improved clinical infrastructure. Providers in key markets are incorporating long-acting formulations into structured recovery plans. Buprenorphine’s favorable safety profile is encouraging its use across specialized clinics. Naltrexone is being prescribed in urban centers for managing alcohol dependence. Educational initiatives are helping reduce treatment resistance and increase acceptance. These changes are fostering market development across multiple MEA countries.

Saudi Arabia naltrexone and buprenorphine market expanded in 2024 with increased clinical adoption of evidence-based addiction therapies. Treatment centers are integrating buprenorphine into care protocols for opioid withdrawal and maintenance. Naltrexone is gaining use for managing alcohol-related conditions among adult populations. Clinical professionals are receiving training on medication-assisted therapy to enhance treatment precision. Local distribution partnerships are helping improve availability and consistency in supply. These trends are supporting stable growth in Saudi Arabia’s addiction treatment market.

Key Naltrexone And Buprenorphine Company Insights

Key players in the naltrexone and buprenorphine market include Alkermes plc, Indivior PLC, Orexo AB, and Camurus, which significantly advance therapeutic innovations. These companies lead the market by developing new treatment options and advanced delivery technologies. Emerging participants such as BioCorRx, Inc., Braeburn, Inc., and Delpor, Inc. are gaining traction by focusing on innovative product pipelines and expanding their presence in underserved areas. Their strategies often involve securing financial backing from healthcare institutions and launching differentiated therapies. This mix of established leaders and agile entrants shapes a dynamic and evolving competitive landscape.

Key Naltrexone And Buprenorphine Companies:

The following are the leading companies in the naltrexone and buprenorphine market. These companies collectively hold the largest market share and dictate industry trends.

- Indivior PLC

- Collegium Pharmaceutical (BioDelivery Sciences International, Inc.)

- Alkermes, Inc.

- Orexo US, Inc. (a part of Orexo AB)

- Titan Pharmaceuticals, Inc.

- Omeros Corporations

- Camurus

- Sun Pharmaceutical Industries Ltd

Recent Developments

-

In June 2025, Indivior PLC shared data showing that 300 mg SUBLOCADE improved outcomes in OUD patients with heavy fentanyl use. They also highlighted treatment barriers among American Indian/Alaska Native populations facing higher overdose death rates. The findings support tailored strategies to improve OUD care.

-

In March 2025, Collegium Pharmaceutical Inc. revealed plans to showcase four real-world data posters from its distinct pain management portfolio at PainConnect 2025, the annual American Academy of Pain Medicine meeting.

-

In February 2025, Indivior PLC received FDA approval for label updates to SUBLOCADE based on a Phase 3 study showing sustained clinical response and treatment retention over 12 months. The updated label includes revised pharmacology data on buprenorphine levels and drug interactions.

-

In May 2024, Novo Nordisk purchased Alkermes plc’s development and manufacturing site in Athlone, Ireland, for USD 91 million. Meanwhile, Alkermes will maintain operations at its manufacturing facility in Wilmington, Ohio, where it will continue producing its proprietary commercial therapies ARISTADA, VIVITROL, ARISTADA INITIO, and LYBALVI.

-

In October 2023, Indivior PLC acquired exclusive worldwide rights to develop, manufacture, and commercialize a series of long-acting injectable therapies from Alar Pharmaceuticals Inc. The agreement covers multiple formulations designed for extended buprenorphine prodrug release, including the prominent injectable candidate ALA-1000.

-

In September 2023, Camurus AB launched Brixadi, a weekly and monthly buprenorphine-based medication approved for managing mild to intense opioid use disorder (OUD). This treatment is suitable for individuals already on daily buprenorphine therapy or those initiating care with a single dose of transmucosal buprenorphine.

Naltrexone And Buprenorphine Market Report Scope

Report Attribute

Details

Market size in 2025

USD 4.83 billion

Revenue forecast in 2033

USD 9.80 billion

Growth rate

CAGR of 9.25% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, route of administration, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Indivior PLC; Collegium Pharmaceutical (BioDelivery Sciences International, Inc.); Alkermes, Inc.; Orexo US, Inc. (a part of Orexo AB); Titan Pharmaceuticals, Inc.; Omeros Corporation; Camurus; Sun Pharmaceutical Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Naltrexone And Buprenorphine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global naltrexone and buprenorphine market report based on product, route of administration, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Naltrexone

-

Buprenorphine

-

BELBUCA

-

Sublocade

-

Suboxone

-

Zubsolv

-

Others

-

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Naltrexone

-

Oral Administration

-

Injectable Administration

-

Implantable Administration

-

-

Buprenorphine

-

Oral Administration

-

Injectable Administration

-

Implantable Administration

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Naltrexone

-

Opioid use disorder (OUD)

-

Alcohol use disorder (AUD

-

-

Buprenorphine

-

Opioid use disorder (OUD)

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.