- Home

- »

- Medical Devices

- »

-

Nephrology And Urology Devices Market Size Report, 2030GVR Report cover

![Nephrology And Urology Devices Market Size, Share & Trends Report]()

Nephrology And Urology Devices Market Size, Share & Trends Analysis Report By Product (Ureteral Catheters, PCN Catheters, Urology Guidewires), By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-090-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

The global nephrology and urology devices market size was valued at USD 5.57 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. Nephrological and urological diseases can be addressed with non-invasive techniques such as laser therapy, ultrasound imaging, and alternative drugs. These alternatives provide patients with practical options, reducing the demand for devices such as dialysis machines, endoscopes, and urinary catheters to treat these diseases, hence driving the market for nephrology and urology devices.

The high incidence of chronic kidney diseases (CKDs), coupled with the rising elderly population globally, is a high-impact rendering driver for the market. According to estimates from the National Kidney Foundation, 10.0% of the worldwide population is affected by chronic kidney diseases. Thus, the rapidly increasing patient population pool has driven the need for treatment of this disorder, thereby boosting the overall demand for nephrology and urology devices.

The COVID-19 pandemic is expected to have a short-term and moderate impact on industry growth. The outbreak's impact on the market varies by country, depending on the local state of health systems and the actions taken to combat the pandemic. Urological surgeries were considered non-urgent during this period. Due to this, the performance of all outpatient and elective interventional procedures were minimized or interrupted to reduce the risk of infection.

Specialty centers for dialysis and related services were also shut down during this period, further negatively impacting the industry's growth. Moreover, industry participants witnessed a significant decline in their generated sales during 2020. For instance, Olympus Corporation witnessed sales of USD 6,652.4 million, which was a decrease of 3.3% over its 2019 numbers. This drop in number was due to the decreased sales of ureteral access sheaths, cystoscopes, ancillary products, and ureteroscopes.

During the projection period, supply chains of the majority of healthcare businesses are expected to operate smoothly and efficiently, as lockdown restrictions are gradually lifted in many countries. As a result, the global market is anticipated to experience substantial growth in the coming years.

For instance, since the constraints imposed by various national governments due to the pandemic were lifted, most elective procedures were restarted between the fourth quarter of 2020 and the first quarter of 2021. This led to an increase in the patient volume in hospitals and dialysis centers, which has partially regularized the sales of nephrology and urology devices worldwide. For instance, Boston Scientific Corporation's 2021 revenue was USD 11,888 million, which was an increase of 19.9% over its 2020 revenue figures.

The resumption of urological procedures and treatments worldwide has been the main factor driving sales in recent years. Moreover, the COVID-19 outbreak has created opportunities for local manufacturers, as these firms adopt various plans and policies to gain a greater market share. Players are acquiring companies to drive revenues and reinforce their foothold in the market.

For instance, in December 2022, Alleima acquired ENDOSMART, a German company specializing in manufacturing medical devices and components using nitinol, a shape memory alloy. ENDOSMART primarily provides its products and services to medical device companies in urology, oncology, cardiology, orthopedics, and vascular applications. With the acquisition of ENDOSMART, Alleima aims to enhance its medical business offerings.

The rising incidence of diabetes and high blood pressure (hypertension) globally also contributes to the growth of this industry, as these two diseases are the primary reasons for kidney failure. According to data from the American Kidney Fund, around 807,000 Americans are suffering from kidney failure and 37 million live with kidney disease, where 45% of new kidney failure cases are caused by diabetes and 28% of kidney failures result from high blood pressure.

This high correlation between kidney failure and the disorders mentioned above is expected to accentuate the growth of the overall market. According to the National Library of Medicine, urolithiasis is a common illness that affects about 1 in 11 persons in the U.S. An estimated 1 million people attend emergency departments (ED) annually, costing the healthcare system USD 5 billion. It increasingly affects people of working age and is becoming more prevalent. Men comprise 10.6% of the affected population, compared to 7.1% in women.

In addition, the market is expected to be driven by a large geriatric population, which is highly susceptible to various diseases, including kidney and urinary disorders. As per the WHO, the global population of 65 years and above is expected to rise from 7% in 2000 to 16% in 2050. Old age is considered one of the greatest risk factors for developing various medical conditions. Aging weakens the immune system, making people more vulnerable to illnesses such as prostate cancer, diabetes, kidney problems, and urinary retention.

According to the American Society of Nephrology, urological diseases are the third most common cause of concern among the geriatric population, accounting for approximately 47% of physician visits. Thus, the increasing geriatric population is expected to be one of the significant drivers for the growth of the nephrology and urology devices market over the forecast period.

Moreover, the market is anticipated to witness an increase in the sales of nephrology and urology devices, driven by the rising demand for minimally invasive procedures due to recent technological advances. Devices such as ureteral stents, catheters, guidewires, and renal dilators are developed using advanced materials such as nitinol, polyurethanes/polycarbonates, and silicone.

In September 2021, Boston Scientific acquired the global surgical business of Lumenis LTD., which develops and commercializes energy-based medical products. The Lumenis surgical division encompasses laser systems, fibers, and accessories for urology and otolaryngology procedures. The company was projected to generate approximately USD 200 million in revenue for 2021.

Carbothane is a material resistant to several chemicals, such as iodine, hydrogen peroxide, or alcohol, which increases its life. The Medtronic-developed MAHURKAR Chronic Carbothane catheter uses carbothane, which offers superior kink resistance, makes insertion easy, and allows for high flow rates with minimal artery and vein pressure. The use of modern materials in manufacturing will have several benefits, such as increased strength and resistance, which will boost demand for these devices and propel industry growth.

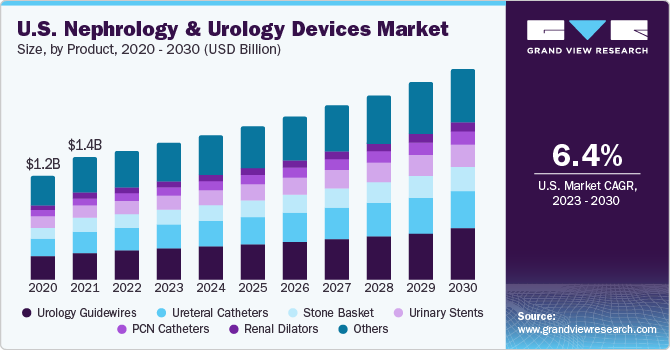

Countries such as the U.S. and Canada have witnessed a high prevalence rate of chronic kidney and urinary disorders due to sedentary lifestyles. Additionally, the expansion of the sector in these nations is being fueled by an increase in the number of patients undergoing surgery and a rise in consumer awareness regarding minimally invasive procedures. As per the Population Reference Bureau fact sheet, the number of people in the U.S. aged 65 and above is projected to increase from 52 million in 2018 to 95 million by 2060, which is a rise in population share from 16% to 23%.

Consequently, the substantial growth of the geriatric population is expected to expand the patient pool for the manufacturers of nephrology and urology devices. Similarly, the Canadian Institute for Health Information (CIHI)-managed Canadian Organ Replacement Register (CORR), 2019, states that the number of people receiving dialysis in Manitoba, a Canadian province, increased by 57% from 2009 to 2019.

During the COVID-19 outbreak, hospitals and other healthcare facilities became overburdened with a significant influx of people. As a result, many nations indefinitely delayed elective operations and other medical treatments. On the other hand, the demand for renal disease treatment products in home settings increased greatly, as chronic kidney disease patients sought home treatment options or outpatient clinics.

Similarly, the demand for home healthcare among the aging population is increasing as this demographic is at a higher risk of acquiring infections and faces difficulties in visiting medical facilities. Moreover, home health service providers offer multiple home care services, including delivery of medicines and purchase, or rent of dialysis-related equipment. This is likely to increase the industry’s growth during the forecast period.

The presence of a large number of hospitals in the U.S., coupled with a well-developed healthcare infrastructure, is another factor contributing to industry growth. For instance, according to the American Hospital Association, there were a total of 6,090 hospitals in the U.S. in 2021, of which 208 were federal government hospitals and 625 were nonfederal psychiatric hospitals.

A significant increase in the number of hospitals and hospital admissions for acute kidney injuries (AKIs) is boosting the demand for dialysis and transplant procedures, thereby propelling industry growth. Moreover, the number of dialysis clinics and treatment centers is growing with the rising prevalence of CKD across the globe. For instance, as of 2020, there were around 7,500 dialysis clinics in the U.S. This factor is expected to impact industry growth positively.

Product Insights

The others segment held a major market share of around 27.94% in 2022. The others segment includes mesh, inserts, endoscope, and sling. These devices are essential for the detection, tracking, and management of disorders related to the kidneys and urinary system. One major factor driving the expanding need for nephrology and urology devices is the rising incidence of urological illnesses, such as kidney stones, pelvic organ prolapses, and urine incontinence. For instance, the National Library of Medicine reported in 2022 that there are around 423 million UI sufferers globally who are 20 years of age and older. Additionally, around 13 million Americans, mostly senior males between the ages of 30 and 60, have UI, according to the National Library of Medicine reports published in 2023. It is believed that 2% to 11% of this population experience UI daily. Elderly people are more likely to have UI, which has a negative impact on their quality of life, mortality, and costs. This leads to the increasing demand for mesh, inserts, endoscope, and other nephrology and urology devices which drives the segment growth.

The rising prevalence of cystitis, kidney stone disease, benign prostatic hyperplasia, and other urinary tract disorders drives segment growth. As per the Journal of Taibah University Medical Sciences in 2021, kidney stones are among the most excruciating urological conditions. The disease has become very common, with a prevalence rate of 7-13% in North America, 5-9% in Europe, and 1-5% in Asia. Kidney stones increase the risk of CKDs by 60% and end-stage renal disease by 40%, which is predicted to drive market expansion.

The PCN catheters segment is expected to expand at the fastest CAGR of 7.8% through 2030, as it is used in a variety of urological issues such as non-dilated obstructive therapy, decompression of the perinephric or nephric fluid collection, and complications after renal transplants. Thus, the increasing prevalence of urological diseases such as cervical cancer, and the benefits offered by PCN catheters are expected to drive the market. As per HPV Information Centre data from 2018, in Saudi Arabia, around 316 women were diagnosed with cervical cancer and 158 women died due to this disease. Such factors are expected to boost segment growth during the forecast period.

Application Insights

The urological cancer & BPH segment held a significant revenue share in the market in 2022. Urological cancers, such as prostate cancer and bladder cancer, are among the most common cancers worldwide. As per a report by the American Cancer Society in January 2023, bladder cancer ranks fourth in terms of cancer incidence in men. BPH is also a very common condition, affecting over half of the male population over the age of 50. There have been significant technological advancements in the field of urology in recent years, leading to the development of more effective and minimally invasive devices for the diagnosis and treatment of urological cancer and BPH.

The kidney diseases segment is anticipated to expand at a significant CAGR over the forecast period due to their increasing prevalence and associated medical problems.The aging population is another important driver for the segment’s expansion, since chronic illnesses, including diabetes and high blood pressure, are the main causes of kidney disorders (CKD and ESRD) and are increasingly becoming common in the elderly. According to a study published by the National Institutes of Health in February 2023, end-stage renal disease (ESRD) affects over 500,000 people in the U.S.

End-use Insights

The hospitals segment accounted for a substantial revenue share in 2022 owing to their advanced infrastructure and availability of equipment for the diagnosis and treatment of kidney diseases and urological disorders.Hospitals offer a wide range of services, including dialysis, surgery, and other specialized treatments. In addition, the rising demand for minimally invasive procedures is further propelling segment growth.

On the other hand, the ambulatory surgical centers (ASCs) segment is anticipated to register a significant CAGR over the forecast period due to their ability to cater to a variety of surgical procedures, including urological procedures. They are becoming increasingly popular, as they offer several advantages over hospitals, such as lower costs, shorter wait times, and more convenient locations. Also, they are a convenient option for older adults, as they offer a more personalized environment than hospitals.

Regional Insights

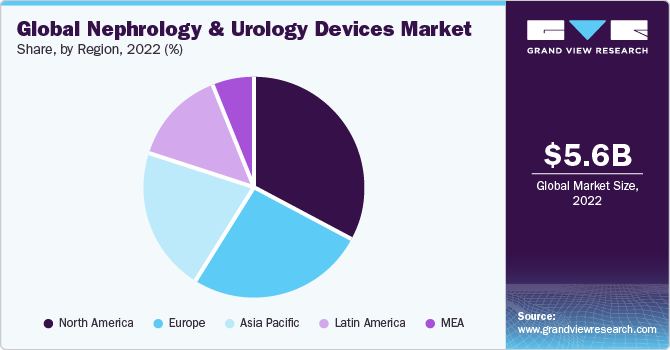

North America held the largest revenue share of 32.9% in 2022, due to the increased prevalence of kidney-associated disorders, rising government initiatives regarding efficient treatment procedures, the presence of highly-skilled physicians, and well-established healthcare facilities in the region. Furthermore, increasing research funding for developing advanced devices is positively influencing the industry growth in this region.

Additionally, the rising prevalence of conditions such as diabetes and hypertension increases the risk of developing urology and nephrology diseases, which is anticipated to drive strong demand for nephrology and urology devices in this region. For instance, according to the U.S. Department of Health and Human Services, in 2021, about 37 million people, or over 1 in 7 U.S. adults, potentially had chronic kidney disease (CKD), which is expected to drive market expansion in North America.

Asia Pacific is expected to witness significant growth from 2023 to 2030 due to various factors such as rising awareness of kidney and urinary disorders, increasing healthcare expenditure, and improving healthcare facilities in the region. The increasing prevalence of spinal cord injury, urinary tract infection, and benign prostatic hyperplasia (BPH) is driving the regional market. UTI is a highly prevalent infectious disease in this region. Additionally, the urgent need to develop new systems and replace and upgrade existing medical infrastructure are factors contributing to the growing demand for these devices.

The Middle East & Africa region is estimated to follow Asia Pacific in terms of CAGR. The African-Middle Eastern ethnicity has been observed to be the most prone to CKD among global demographics. The incidence rate of CKD among African-Middle Eastern countries stands at 18-23% of the total population, which is significantly higher than the global average. Socioeconomic factors such as higher income and access to modern facilities have led to extensive changes in the lifestyle of people, thus leading to diseases such as obesity, cancer, and heart disorders.

For instance, as per the International Diabetes Federation, 73 million adults were living with diabetes in the Middle East and North Africa (MENA) region in 2021, with this number estimated to increase to 136 million by 2045. Moreover, 796,000 deaths were caused by diabetes in the year 2021. Such factors are anticipated to drive regional market growth over the projection period.

Key Companies & Market Share Insights

Companies constantly introduce new products and broaden their geographic reach in order to generate higher revenues. For instance, in May 2022, Medtronic plc and DaVita Inc. announced their plans to form an independent kidney care company that is focused on enhancing patient treatment experience and improving overall outcomes.

Numerous companies in the nephrology and urology devices industry are acquiring companies in other countries to expand their presence. For instance, in September 2022, Advanced MedTech Holdings, a subsidiary of Temasek, acquired a majority stake in Shenzhen Wikkon Precision Instruments, a Chinese urology and shock wave therapy device company. This acquisition will significantly strengthen AMTH’s presence in China.

Key Nephrology And Urology Devices Companies:

- Hollister Incorporated

- Medtronic

- Coloplast

- Boston Scientific Corporation

- Convatec Group plc

- B. Braun SE

- Teleflex Incorporated

- Baxter

- Fresenius Medical Care AG & Co.

- Asahi Kasei Corporation

- Cook Group

- C. R. Bard Inc.

- Terumo Corporation

- NxStage Medical Inc.

- Nipro Medical Corporation

Nephrology And Urology Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.92 billion

Revenue forecast in 2030

USD 9.44 billion

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Medtronic; Coloplast; Boston Scientific Corporation; Convatec Group plc; B. Braun SE; Hollister Incorporated; Teleflex Incorporated; Baxter; Fresenius Medical Care AG & Co.; Asahi Kasei Corporation; Cook Group; C. R. Bard Inc.; Terumo Corporation; NxStage Medical Inc.; Nipro Medical Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nephrology And Urology Devices Market Report Segmentation

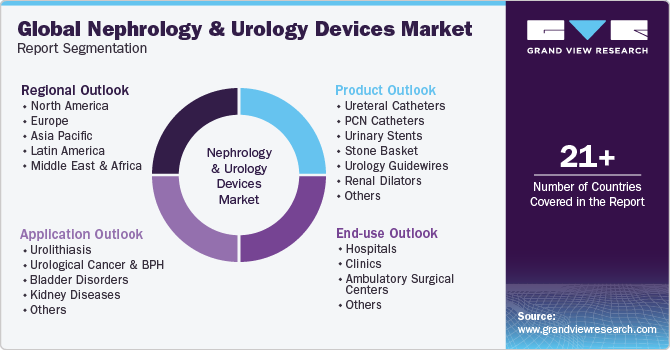

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nephrology and urology devices market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ureteral Catheters

-

PCN Catheters

-

Urinary Stents

-

Stone Basket

-

Urology Guidewires

-

Renal Dilators

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Urolithiasis

-

Urological Cancer & BPH

-

Bladder Disorders

-

Kidney Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nephrology and urology devices market size was estimated at USD 5.57 billion in 2022 and is expected to reach USD 5.92 billion in 2023.

b. The global nephrology and urology devices market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 9.44 billion by 2030.

b. North America dominated the nephrology & urology devices market with a share of 32.92% in 2022. This is attributable to the presence of prominent players, advanced healthcare infrastructure, and high disposable income.

b. Some of the key players operating in the nephrology & urology devices market include Medtronic, Coloplast, Boston Scientific Corporation, ConvaTec Group PLC, B. Braun Melsungen AG, Hollister Incorporated, Teleflex Incorporated, and J and M Urinary Catheters LLC.

b. Key factors that are driving the nephrology and urology devices market growth include increasing incidence of nephrology and urology disorders, the growing use of the technologically advanced materials in the device’s development and an increasing number of minimally invasive procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."