- Home

- »

- Advanced Interior Materials

- »

-

Nickel Mining Market Size & Share, Industry Report, 2033GVR Report cover

![Nickel Mining Market Size, Share & Trend Report]()

Nickel Mining Market (2025 - 2033) Size, Share & Trend Analysis Report, By End Use (Stainless Steel, Non-ferrous Alloys, Batteries), By Region (North America, Europe, Asia Pacific Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-143-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nickel Mining Market Summary

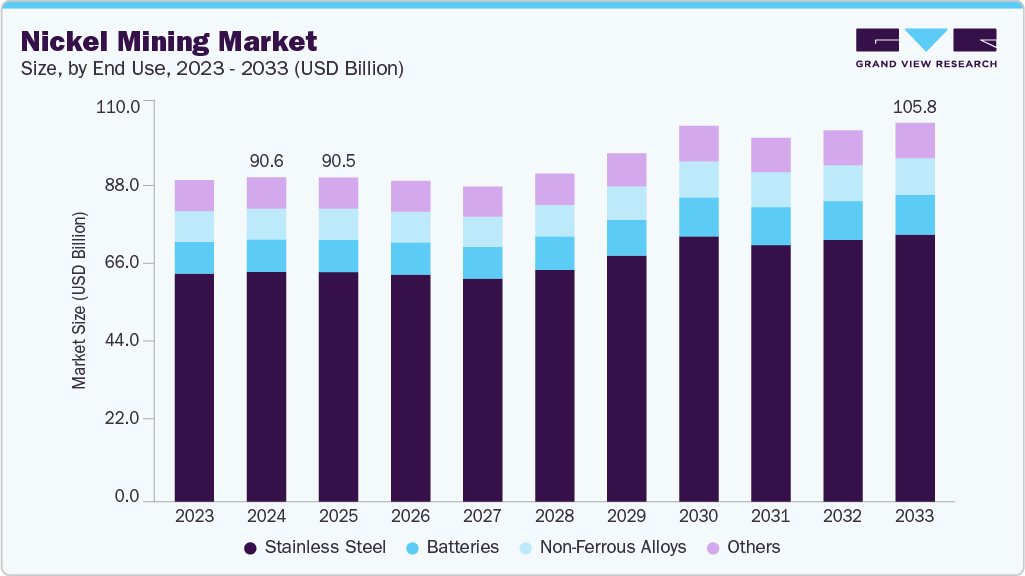

The global nickel mining market size was estimated at USD 90.57 billion in 2024 and is projected to reach USD 105.82 billion by 2033, at a CAGR of 2.0% from 2025 to 2033. The growth of the nickel mining market is primarily driven by rising demand from the stainless steel industry.

Key Market Trends & Insights

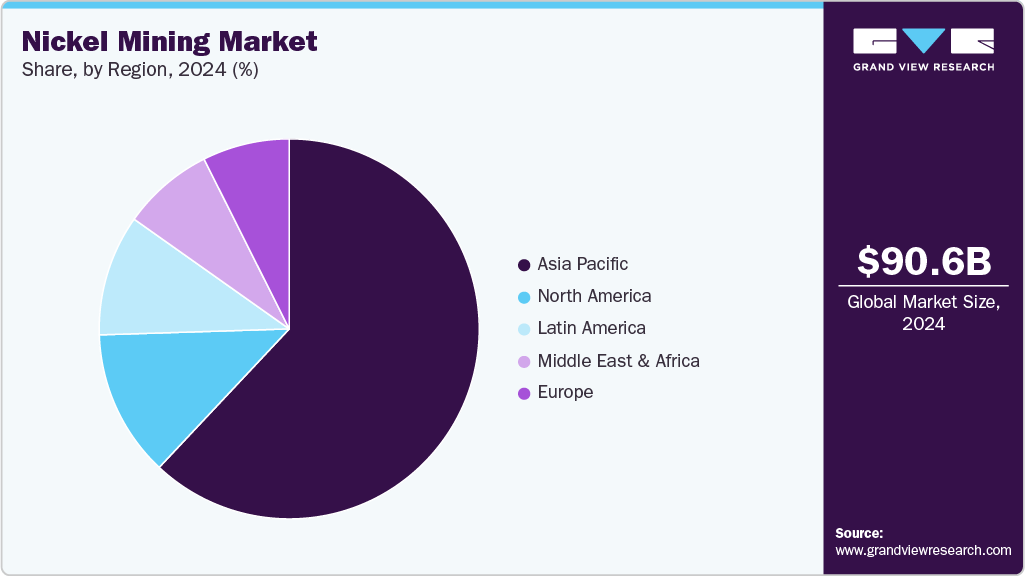

- Asia Pacific dominated the nickel mining market with the largest market revenue share of 62.0%.

- Nickel mining market in the U.S. is expected to grow at a substantial CAGR of 2.0% from 2025 to 2033.

- By end use, stainless steel accounted for the largest market revenue share of over 70.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 90.57 Billion

- 2033 Projected Market Size: USD 105.82 Billion

- CAGR (2025-2033): 2.0%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Nickel is a key alloying element that enhances strength, corrosion resistance, and heat tolerance in stainless steel. As industrialization intensifies in developing nations, particularly across the Asia Pacific and Latin America, the construction and infrastructure sectors continue to expand. This, in turn, fuels the consumption of stainless steel and sustains the need for a steady nickel supply from mining operations.Nickel is critical in producing lithium-ion batteries, especially high-nickel chemistries like NMC (Nickel Manganese Cobalt) and NCA (Nickel Cobalt Aluminum), which offer higher energy density and longer range. As EV adoption accelerates due to stricter emission regulations and shifting consumer preferences toward sustainable transportation, demand for battery-grade nickel is rising sharply. Global electric vehicle sales crossed 17 million units in 2024, reflecting a growth of over 25 percent from the previous year. EVs accounted for over 20 percent of all new passenger vehicles sold globally. This rapid market penetration intensifies the demand for high-purity nickel used in battery cathodes, prompting efforts to scale up mining and ensure a reliable supply. This trend is prompting investments in new mining projects and refining technologies.

The growing push toward energy storage solutions also supports expansion in the sector. Utility-scale and off-grid battery storage systems are gaining importance in balancing power grids and supporting renewable energy integration. These applications frequently utilize high-nickel chemistries, further increasing pressure on global supply. Governments and private players are growing interested in securing raw materials for such energy applications, boosting exploration and extraction activities worldwide.

Technological advancements in mining and ore processing are vital in making previously uneconomical reserves viable. Developments in hydrometallurgy, particularly High-Pressure Acid Leach (HPAL) methods, have enabled efficient extraction from laterite ores. These technological strides allow producers to access and monetize low-grade deposits, expanding the resource base and supporting overall market growth.

Another driver is the need to secure supply chains for key industrial inputs. As energy transition strategies accelerate, governments and corporations seek to diversify sourcing strategies and reduce overdependence on a few dominant players. This has led to a global surge in mining investments, exploration campaigns, and long-term procurement deals.

Geopolitical and supply chain factors are further influencing the direction of investment. Countries are promoting domestic initiatives to reduce foreign dependence on critical minerals. Strategic partnerships, policy incentives, and resource nationalism encourage regional activities across Indonesia, the Philippines, and several African nations. This shift is reshaping global supply dynamics and reinforcing long-term growth.

Drivers, Opportunities & Restraints

The rising demand for stainless steel and battery-grade nickel drives the mining market. Stainless steel production accounts for a large share of global nickel consumption, and expanding infrastructure and construction activities across the Asia Pacific reinforce demand. In addition, the growth of the EV industry has significantly increased the need for high-purity class 1 nickel used in lithium-ion batteries. Governments and private stakeholders are investing in nickel exploration projects and refining capacities to support this surge in demand, especially as countries push for cleaner transportation and renewable energy storage systems.

Notable opportunities are emerging in the nickel mining market. Growing interest in recycling and circular economy practices fosters the development of secondary nickel production, which could help bridge the supply gap. Advancements in hydrometallurgical processing methods make extracting nickel from low-grade ores and laterites more viable. In addition, several untapped reserves in Africa and Latin America present potential for future exploration and investment.

Despite strong demand signals, the nickel mining sector faces several restraints. Volatile nickel prices and high capital requirements for mine development affect investor confidence and long-term planning. Environmental concerns, including land degradation, tailing waste, and carbon emissions, have also brought regulatory scrutiny, slowing project approvals and increasing operational costs.

End Use Insights

Nickel is a crucial alloying element in stainless steel, enhancing its corrosion resistance, strength, and durability. A significant portion of mined nickel, especially class 2 ferronickel, is consumed in producing austenitic stainless steels. Rapid industrialization and infrastructure development across the Asia Pacific, particularly in China and India, have spurred demand for stainless steel in construction, automotive, kitchenware, and industrial machinery applications. This sustained growth in downstream demand continues to support robust nickel consumption.

The batteries segment is one of the fastest-growing end-use areas in the nickel mining market, driven by the global shift toward electrification and clean energy. Nickel, particularly high-purity class 1 nickel, is a key component in lithium-ion battery chemistries such as NMC and NCA. Due to their high energy density and long cycle life, these chemistries are widely used in electric vehicles, energy storage systems, and consumer electronics. With EV adoption accelerating worldwide and government policies encouraging low-emission transportation, demand for battery-grade nickel continues to rise sharply.

Regional Insights

Asia Pacific accounted for the largest market revenue share of 62.0% in 2024. Asia Pacific is witnessing significant growth in the nickel mining market due to expanding industrial activities, rapid urbanization, and strong demand for stainless steel and batteries. China and India, in particular, are driving infrastructure development, which fuels stainless steel consumption and, in turn, increases demand for nickel. The region’s robust construction, manufacturing, and automotive sectors are contributing to steady consumption of nickel-based alloys. In addition, government-backed initiatives to modernize public infrastructure and build smart cities create long-term demand for corrosion-resistant materials such as stainless steel.

North America Nickel Mining Market Trends

The nickel mining market in North America is gaining momentum due to increasing demand for battery materials and efforts to strengthen domestic supply chains. The U.S. and Canada are investing in critical mineral strategies to reduce reliance on imports, especially for EV batteries and clean energy technologies. This push for resource independence has led to renewed interest in developing and reopening nickel mines across the region.

U.S. Nickel Mining Market Trends

The growth of the nickel mining market in the United States is driven by an increasing focus on building a domestic critical minerals supply chain. Federal policies such as the Inflation Reduction Act offer tax credits and funding incentives for extracting and processing key minerals such as nickel, which are essential for electric vehicles and energy storage systems. Surging demand for nickel in EV batteries is also fueling growth. The U.S. is one of the fastest-growing markets for electric vehicles, and battery chemistries increasingly rely on high-purity class 1 nickel. This has drawn attention to domestic resources such as the Eureka deposit in Alaska, which holds substantial measured and indicated reserves. Alongside mining, investments in refining and processing facilities, such as the planned Westwin Elements refinery in Oklahoma, are expanding downstream capabilities. Combined with state-level support and private investment, these developments position the U.S. as a rising hub for nickel mining and processing aligned with clean energy goals.

Europe Nickel Mining Market Trends

The nickel mining market in Europe is anticipated to register the fastest CAGR over the forecast period due to strong policy support to enhance supply chain resilience and reduce dependence on external sources. The European Union's Critical Raw Materials Act has set clear targets to ensure at least 10% of nickel demand is met through domestic mining, 40% through local processing, and 25% through recycling by 2030. The EU has prioritized dozens of strategic projects across member states for fast-track permitting and financial support to achieve this. These efforts are designed to reduce exposure to geopolitical risks and secure the raw materials necessary for Europe's clean energy and industrial transition.

Latin America Nickel Mining Market Trends

The nickel mining market in Latin America is increasingly shaping the global supply landscape, supported by growing exploration and production investments. Brazil, the region's largest producer, recorded an estimated 79,970 metric tons of nickel production in 2024, an upward trend reflecting intensifying mining activity. While this output still places Brazil behind the world's largest producers, the country is gaining prominence as a strategic supplier for stainless steel and battery-grade nickel markets.

Middle East & Africa Nickel Mining Market Trends

The Middle East and Africa nickel mining market is gaining traction due to increasing regional production and growing international investment. Countries such as Saudi Arabia, Turkey, and Iraq are leading producers of unwrought nickel in the Middle East, contributing to a total regional output of approximately 179,000 tons in 2024. Though nickel matte production remains relatively low, it is growing steadily, supported by developments in Oman, Iran, and Saudi Arabia. National efforts to diversify economies and enter critical mineral value chains, particularly as part of Saudi Arabia’s Vision 2030, encourage further investment in nickel exploration and refining capabilities across the region.

Key Nickel Mining Company Insights

Some of the key players operating in the market include Anglo American, BHP, and others

-

Anglo American is a multinational mining company headquartered in London, UK, with operations across Africa, Australia, and the Americas. Founded in 1917, it is one of the world’s largest producers of platinum, diamonds, copper, and iron ore, with a strong focus on sustainability and responsible mining practices. The company is listed on the London and Johannesburg stock exchanges and operates under a diversified portfolio that supports decarbonization, electrification, and green energy transitions. Anglo American’s key asset in nickel mining is the Barro Alto mine, which is located in Brazil. This high-quality, long-life nickel laterite operation uses a ferro-nickel production process via rotary kiln electric furnaces (RKEF).

-

BHP (formerly BHP Billiton) is a global mining and resources company headquartered in Melbourne, Australia. It is one of the world’s largest commodity producers, including iron ore, copper, and metallurgical coal. BHP has a long-standing reputation for operational excellence, large-scale project execution, and an increasing emphasis on sustainability and low-emissions technologies. The company is listed on the Australian Securities Exchange and the London Stock Exchange, with operations spread across key resource-rich geographies including Australia, Chile, Canada, and the U.S. In nickel mining, BHP’s flagship asset is the Nickel West operation in Western Australia.

Key Nickel Mining Companies:

The following are the leading companies in the nickel mining market. These companies collectively hold the largest market share and dictate industry trends.

- Anglo American

- BHP

- Eramet

- Glencore

- Jinchuan Group International Resources Co. Ltd.

- MMC Norilsk Nickel

- Norilsk Nickel

- Sherritt International Corporation

- Sumitomo Metal Mining Co., Ltd.

- Vale S.A.

Recent Development

-

In June 2025, an association of Indonesian nickel miners is preparing to launch a domestic metal exchange aimed at futures contracts for nickel and other metals, targeting its debut in the first half of 2026. This initiative, led by the nickel miners group APNI and endorsed by the government, is a strategic move following Indonesia’s 2020 ban on nickel ore exports, a step taken to boost domestic investment in smelting and give the country greater influence over global nickel pricing, especially after prices hit four-year lows at the end of 2024.

Nickel Mining Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 90.49 billion

Revenue forecast in 2033

USD 105.82 billion

Growth rate

CAGR of 2.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil

Key companies profiled

Vale S.A.; Norilsk Nickel; BHP; Glencore; Jinchuan Group International Resources Co. Ltd.; Anglo American; Sumitomo Metal Mining Co., Ltd.; MMC Norilsk Nickel; Sherritt International Corporation; Eramet

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nickel Mining Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global nickel mining market report on the basis of end use and region.

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Stainless Steel

-

Non-Ferrous Alloys

-

Batteries

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global nickel mining market size was estimated at USD 90.57 billion in 2024 and is expected to reach USD 90.49 billion in 2025.

b. The global nickel mining market is expected to grow at a compound annual growth rate of 2.0% from 2025 to 2033 to reach USD 105.82 billion by 2033.

b. The stainless steel segment dominated the market with a revenue share of 70.9% in 2024.

b. Some of the key players of the global nickel mining market are Vale S.A., Norilsk Nickel, BHP, Glencore, Jinchuan Group International Resources Co. Ltd., Anglo American, Sumitomo Metal Mining Co., Ltd., MMC Norilsk Nickel, Sherritt International Corporation, Eramet, and others.

b. The key factor driving the growth of the global nickel mining market is the rising demand for nickel in battery production, particularly for electric vehicles and energy storage systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.