- Home

- »

- Electronic Devices

- »

-

Non-destructive Testing Market Size, Industry Report, 2033GVR Report cover

![Non-destructive Testing Market Size, Share & Trends Report]()

Non-destructive Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Offering (Services, Equipment), By Test Methods, By Vertical (Manufacturing, Construction, Automotive, Power Generation), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-602-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Non-destructive Testing Market Summary

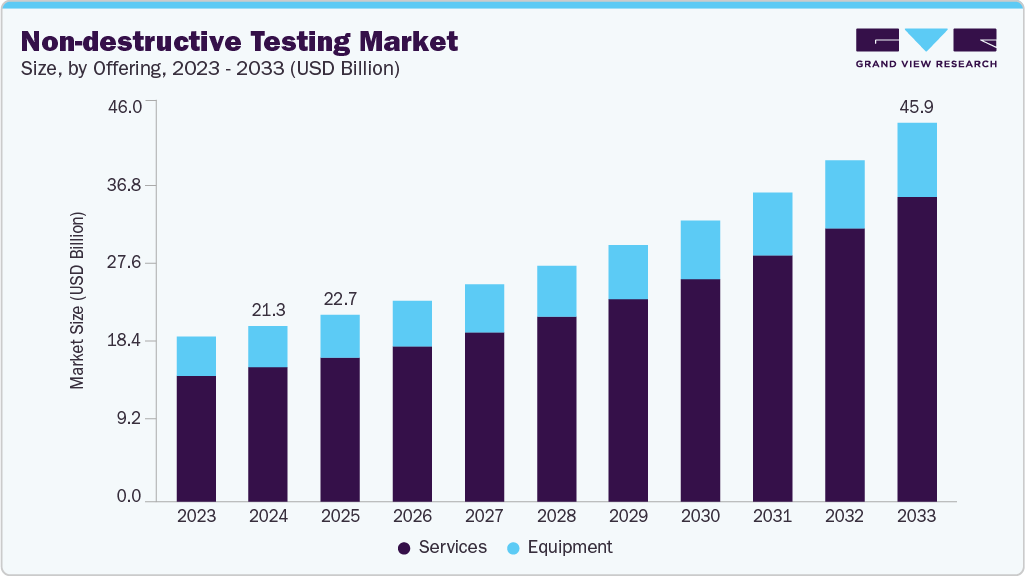

The global non-destructive testing market size was estimated at USD 21.28 billion in 2024, and is projected to reach USD 45.97 billion by 2033, growing at a CAGR of 9.2% from 2025 to 2033. The growing manufacturing activities across the developing and the developed nations are estimated to drive the market over the forecast period.

Key Market Trends & Insights

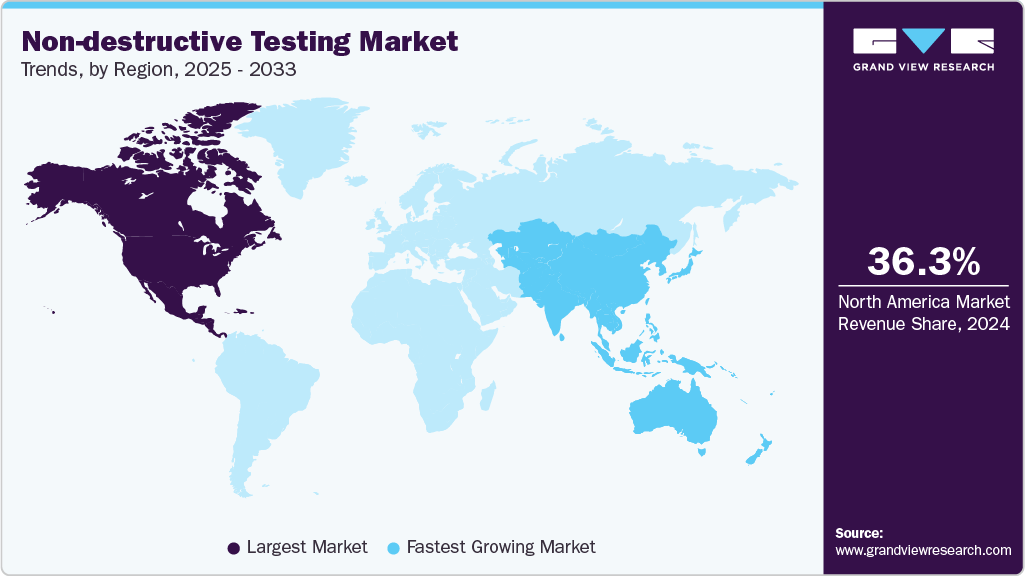

- The North America non-destructive testing market accounted for a 36.3% share of the overall market in 2024.

- The non-destructive testing industry in the U.S. held a dominant position in 2024.

- By offering, the services segment accounted for the largest share of 76.5% in 2024.

- By test methods, the traditional NDT method segment held the largest market share in 2024.

- By vertical, the manufacturing segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.28 Billion

- 2033 Projected Market Size: USD 45.97 Billion

- CAGR (2025-2033): 9.2%

The increasing technological innovations have enabled the development of advanced non-destructive testing processes with improved & precise safety & fault detection. Furthermore, increasing awareness amongst the manufacturers regarding the use of Non-destructive Testing (NDT) is expected to improve the penetration of NDT techniques in the coming years.The utilization of NDT techniques in projects allows for quicker completion due to the detection of faults in complex areas and irregular surfaces. This reduction in the possibility of failures is expected to drive the demand for non-destructive testing in the coming years. Additionally, the ease of operating and efficiency in fault detection provided by ultrasonic equipment, compared to other NDT equipment, is a significant factor contributing to the increasing adoption of the ultrasonic test method. Moreover, advancements in ultrasonic technology anticipated within the next eight years are likely to further boost the adoption of this testing procedure due to its simplicity.

The market is projected to experience significant growth during the forecast period. This growth can be attributed to the increasing urbanization in developing countries like India and China, which involves extensive construction and manufacturing projects. The fast pace of such projects necessitates the implementation of testing processes to ensure the quality of work. This trend is expected to have a positive impact on the growth of non-destructive testing (NDT) in these countries, consequently enhancing its global market penetration.

Increasing oil and gas projects in the Middle East and North America are expected to deploy NDT techniques in order to complete the projects in prescribed timelines and with finesse, thus fueling the demand for NDT equipment in the regions. Besides, the advancements in non-destructive testing technology have led to the development of radiographic testing equipment such as industrial CT scanners, which precisely detect faults in machinery and components. However, the cost of the NDT equipment and the expertise required to perform the tests increases the complexity and difficulty of deploying the radiographic testing method.

The global COVID-19 pandemic has had detrimental and unexpected consequences for various industries worldwide, such as automotive, construction, airlines, and manufacturing, among others. To mitigate the spread of the novel coronavirus and its negative impacts, governments around the world implemented lockdowns as a precautionary measure. This led to disruptions in the global supply chain and a decline in industrial productivity, placing a strain on the global economy. Furthermore, the sudden outbreak of the virus also caused disruptions in companies' production and manufacturing capabilities.

Moreover, the influence of the pandemic on the non-destructive testing (NDT) market arises from the combined response of interconnected industries that utilize NDT for their operations. One such example is the defense industry, which has experienced a relatively mild impact compared to other sectors. This can be attributed to government budget allocations that safeguard the supply and demand ecosystem. While certain defense companies have been significantly affected by the financial shock, the impact is comparatively less than that observed in the aerospace sector.

Offering Insights

The services segment dominated the market, accounting for the largest revenue share of 76.5% in 2024 and is expected to remain dominant over the forecast period. The primary factor that drives end-users to outsource their NDT operations is the significant upfront cost associated with non-destructive equipment, combined with the technical complexities involved in their deployment and installation. Additionally, the shortage of a skilled workforce proficient in non-destructive testing acts as another constraint, limiting the widespread adoption of NDT equipment worldwide. Furthermore, stringent government regulations pertaining to workplace safety further encourage end-users to outsource their NDT operations to third-party service providers.

The equipment segment is expected to experience steady growth throughout the forecast period. This growth can be attributed to technological advancements, which have resulted in the availability of state-of-the-art equipment variants. The availability of these advanced variants has broadened the range of applications for non-destructive testing (NDT) equipment, thereby generating additional demand. Moreover, the resurgence of the industrial sector, particularly in emerging economies such as India and China, is expected to stimulate the installation of new NDT equipment in the coming years.

Test Methods Insights

The non-destructive testing methods include traditional NDT methods and digital/advanced NDT methods. The traditional test method segment dominated the market, accounting for the largest revenue share of 79.9% in 2024. The notable market growth is attributed to the increasing utilization of traditional non-destructive testing methods, including visual testing, magnetic particle testing, liquid penetrant testing, eddy current testing, ultrasonic testing, and radiographic testing. Among these methods, ultrasonic testing stands out as it dominates the market due to its portability, ease of use, and ability to provide precise results compared to other traditional NDT techniques. Consequently, the adoption of ultrasonic testing is experiencing significant growth and is expected to continue improving in the forthcoming years.

The digital/advanced NDT method segment is projected to grow at the fastest CAGR over the forecast period. Within the digital/advanced NDT method segment, the phased array ultrasonic testing (PAUT) segment accounted for a significant share of 20.5% in 2024. This growth can be attributed to the increasing preference for PAUT over other digital NDT methods. The detailed visualization feature offered by the PAUT method enables the identification of defect size, depth, shape, and orientation. PAUT is considered an advanced version of ultrasonic testing as it employs multiple transducers and sets of ultrasonic testing (UT) probes comprised of numerous smaller elements.

Vertical Insights

The manufacturing vertical segment dominated the NDT market and accounted for the largest revenue share of more than 22.9% in 2024 and is projected to grow at the fastest CAGR over the forecast period. The growth is attributed to the ever-increasing volume of manufacturing across the globe. The manufacturing vertical is expected to deploy numerous NDT processes, thereby leading to an increase in demand for non-destructive testing services globally. Moreover, non-destructive testing has been traditionally used extensively in oil and gas applications. Test methods such as ultrasonic and eddy current have been used to detect cracks in the pipes, both underground and elevated. However, with increasing awareness, non-destructive testing techniques are being deployed in several other applications such as aerospace, defense, and automotive.

The oil & gas vertical is further sub-segmented into Upstream, Midstream, & Downstream. The downstream activities in the oil & gas industry include refining petroleum products to produce end products, such as gasoline and kerosene. Refineries and petrochemical plants work with large volumes of oil flowing through tubing, pressure vessels, storage tanks, and pipes. Hence, downstream oil & gas companies particularly need to ensure the safety of the environment, workers, and the facility by ensuring the integrity of equipment and spot welding.

The power generation segment comprises numerous industries such as power grids and hydroelectric power plants. The segment is expected to witness healthy growth over the forecast period with a CAGR of 9.8%. Continuous increase in the power demand in developing nations is the major reason for the considerable adoption rate of NDT techniques in power generation, as the use of NDT techniques guarantees faster production rates.

Regional Insights

The North America non-destructive testing market accounted for the largest share of the 36.3% of the overall market in 2024. North America is quietly shifting from traditional, event-based inspections to a “digital forensics” model where every inspection is treated like a data asset. Large aerospace and energy operators are building centralized inspection intelligence hubs that combine phased-array UT scans, drone visuals, and decades of archived inspection files. This is creating a new kind of demand: companies don’t just want instruments; they want systems that help them interpret the flood of inspection data. As a result, software, AI-assisted crack characterization, and digital traceability are growing faster than hardware sales.

U.S. Non-destructive Testing Market Trends

In the U.S., the single strongest trend is the merging of infrastructure renewal programs and strict regulatory oversight. With so many pipelines, bridges, and transmission assets past mid-life, operators are upgrading from manual checks to long-range ultrasonic, guided-wave, and permanent monitoring systems. Real-world contracts increasingly specify not just "inspect the asset" but “provide digital evidence that can stand up in an audit.” This is turning NDT service providers into compliance partners, and companies that can supply certified technicians plus digital documentation workflows are expanding rapidly.

Europe Non-destructive Testing Market Trends

Europe holds a substantial share of the non-destructive testing market. Europe is pushing NDT further into the realm of structural health monitoring (SHM) than any other region. Governments and private operators are embedding sensors directly into infrastructure, from bridges to aging industrial plants, and treating inspection as a continuous process rather than a scheduled event. Several European pilot projects involving rail lines and elevated structures are demonstrating that permanent sensors can reduce emergency maintenance dramatically. This shift is pulling NDT vendors toward longer-term contracts and more integrated engineering roles rather than just equipment supply.

The Germany non-destructive testing market is industrializing advanced NDT at the production-line level. Automotive and mechanical engineering plants are turning phased-array ultrasonic and automated eddy-current testing into routine, in-line stations, much like torque testing or dimensional checks. The motivation isn’t just defect detection; it’s production consistency. German manufacturers increasingly view advanced NDT as a productivity tool, not a cost. Vendors who can supply turnkey robotic cells, plug-and-play scanners, or Industry 4.0-ready systems are finding strong traction.

The UK non-destructive testing market is evolving into a leader in automated rail inspection. With rail availability targets tightening, rail operators are adopting train-mounted ultrasonic, vision, and thermal systems that inspect tracks at normal operating speeds. Instead of dispatching teams to walk tracks, software now flags anomalies from miles of continuous data. This has created a surprising trend: inspection is no longer about the sensor alone, but about algorithms that minimize false alarms. Vendors who excel in defect-triage analytics are emerging as preferred partners for rail and infrastructure clients.

Asia Pacific Non-destructive Testing Market Trends

The Asia Pacific region is growing at the fastest CAGR during the forecast period. APAC is the region where leapfrogging is most visible. Many large infrastructure and energy projects across Southeast Asia, Australia, and East Asia bypass older manual-only methods and adopt drone-based inspection, cloud reporting, and advanced UT systems from day one. Because many assets here are new, operators integrate digital inspection workflows early, without legacy resistance. The combination of new infrastructure and willingness to adopt automation makes APAC the fastest-growing region for advanced NDT platforms and long-term managed inspection services.

The China non-destructive testing market is experiencing the fastest commercial adoption curve in the global NDT market. Local manufacturers have become highly capable in developing digital ultrasonic systems, portable PAUT units, and magnetic particle equipment, putting competitive pressure on foreign brands. Large shipyards, rail manufacturers, and petrochemical plants are rapidly standardizing automated UT and radiography. With strong government emphasis on industrial quality and export standards, the demand for high-throughput, automated inspection lines is expanding at a pace unmatched elsewhere.

The Japan non-destructive testing market continues to lead in compact, robotics-driven inspection technologies. Japanese industries, especially shipbuilding, nuclear, and precision manufacturing, are pushing for robots that can navigate extremely confined or hazardous environments. This has driven the development of miniature ultrasonic crawlers, micro-robots for boiler tube inspection, and AI-assisted defect recognition tools. The cultural emphasis on precision and repeatability means that Japan is shifting from “find the defect” to “quantify the defect with extreme accuracy,” which is influencing global expectations for high-resolution imaging.

The India non-destructive testing market is being reshaped by rapid infrastructure growth and massive outsourcing. Pipeline networks, refineries, metro rail projects, and power plants are generating steady inspection work, but the supply of certified technicians hasn’t kept pace. As a result, operators rely heavily on third-party inspection companies, many of which are introducing LRUT, PAUT, and drone inspections to meet demand. One emerging trend is the strong preference for rugged, affordable instruments paired with remote mentoring or digital training modules, a model that fits India’s scale and diverse project conditions.

Key Non-destructive Testing Company Insights

Some of the major players in the Non-destructive Testing (NDT) market include Previan Technologies, Inc., Bureau Veritas, Fischer Technology Inc. (Helmut Fischer), MISTRAS Group, Comet Group (YXLON International), MME Group, TWI Ltd., Nikon Corporation, Olympus Corporation, Sonatest, Acuren, Intertek Group plc, Creaform, Vidisco Ltd., SGS S.A., and General Electric, among others, owing to their extensive inspection capabilities, advanced technology portfolios, and strong presence across safety-critical industries such as aerospace, energy, automotive, heavy manufacturing, and infrastructure. These companies consistently invest in next-generation NDT technologies, including phased-array ultrasonics, digital radiography, industrial CT, eddy current arrays, 3D metrology, AI-driven defect analytics, and robotics-assisted inspection, which enable high-precision evaluation of complex materials and components. Their ability to support a wide range of applications, such as weld integrity assessment, composite inspection, pipeline monitoring, structural health evaluation, and electronics testing, makes them central to the global NDT value chain. Furthermore, leading service providers like Bureau Veritas, Intertek, SGS, MISTRAS Group, and Acuren continue to strengthen their relevance through certified global technician networks, asset integrity management expertise, and compliance-focused inspection programs, while technology innovators like Creaform, Vidisco, Nikon, Olympus, and Helmut Fischer drive advancements in portable imaging, digital workflows, and high-resolution measurement systems. Combined with their strategic global footprints, continuous R&D investments, and deep partnerships with industrial OEMs and regulatory bodies, these firms remain highly competitive and indispensable in a market increasingly shaped by automation, predictive maintenance, and digital reporting standards.

-

General Electric has a diverse set of business units, including GE Power, GE Healthcare, GE Aviation, GE Digital, GE Transportation, GE Renewable Energy, GE Addictive, GE Lighting, GE Capital, GE Global Research, and Baker Hughes, a GE Company (BHGE). BHGE was formed by merging GE Oil & Gas with Baker Hughes Company in July 2017. In 2020, Baker Hughes Digital Solutions' Inspection Technologies division was rebranded as Waygate Technologies.

-

MISTRAS Group is a provider of asset protection solutions for evaluating the structural reliability and integrity of critical industrial, public, and energy infrastructure. The company specializes in integrating products and technologies to deliver customized solutions ranging from complex to routine inspections. It offers destructive testing, non-destructive testing, predictive maintenance, and mechanical integrity services.

Key Non-destructive Testing Companies:

The following are the leading companies in the non-destructive testing market. These companies collectively hold the largest market share and dictate industry trends.

- Previan Technologies, Inc.

- Bureau Veritas

- Fischer Technology Inc. (Helmut Fischer)

- MISTRAS Group

- Comet Group (YXLON International)

- MME Group

- TWI Ltd.

- Nikon Corporation

- Olympus Corporation

- Sonatest

- Acuren

- Intertek Group plc

- CREAFORM

- Vidisco Ltd.

- SGS S.A.

- General Electric

Recent Developments

-

In June 2025, Previan Technologies, Inc. announced a strategic realignment that will spin its two industrial technology businesses, Eddyfi Technologies and NDT Global, into independent, autonomous entities to sharpen focus on advanced NDT instrumentation and integrity-management services, the move is aimed at unlocking tailored growth for both the high-end inspection hardware (Eddyfi) and large-scale pipeline inspection and analytics (NDT Global)

-

In November 2024, Comet Yxlon (Comet Group) launched the CA20 3D X-ray/CT system tailored for high-throughput semiconductor and advanced-packaging inspection, a move that strengthens its industrial CT portfolio for precision NDT in electronics and aerospace component inspection.

Non-destructive Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.74 billion

Revenue forecast in 2033

USD 45.97 billion

Growth rate

CAGR of 9.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, test methods, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Previan Technologies, Inc.; Bureau Veritas; Fischer Technology Inc. (Helmut Fischer); MISTRAS Group; Comet Group (YXLON International); MME Group; TWI Ltd.; Nikon Corporation; Olympus Corporation; Sonatest; Acuren; Intertek Group plc; CREAFORM; Vidisco Ltd.; SGS S.A.; General Electric

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-destructive Testing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global non-destructive testing market report based on offering, test methods, vertical, and region:

-

Offering Outlook (Revenue, USD Million, 2021 - 2033)

-

Services

-

Equipment

-

-

Test Methods Outlook (Revenue, USD Million, 2021 - 2033)

-

Traditional NDT Method

-

Visual Testing

-

Magnetic Particle Testing

-

Liquid Penetrant Testing

-

Eddy Current Testing

-

Ultrasonic Testing

-

Radiographic Testing

-

-

Digital/Advanced NDT Method

-

Digital Radiography (DR)

-

Phased Array Ultrasonic Testing (PAUT)

-

Pulsed Eddy Current (PEC)

-

Time-Of-Flight Diffraction (TOFD)

-

Alternating Current Field Measurement (ACFM)

-

Automated Ultrasonic Testing (AUT)

-

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil & Gas

-

Upstream

-

Midstream

-

Downstream

-

-

Manufacturing

-

Aerospace & Defense

-

Construction

-

Automotive

-

Power Generation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global non-destructive testing market size was estimated at USD 21.28 billion in 2024 and is expected to reach USD 22.74 billion in 2025.

b. The global non-destructive testing market is expected to grow at a compound annual growth rate of 9.2% from 2025 to 2033 to reach USD 45.97 billion by 2033.

b. The services segment dominated the NDT market and accounted for the largest revenue share of 76.5% in 2024, and is expected to remain dominant over the forecast period.

b. The ultrasonic testing segment led the NDT market and accounted for the largest revenue share of 25.6% in 2024. The segment is expected to emerge as the fastest-growing test method segment at a CAGR of over 9.9% over the forecast period.

b. The manufacturing vertical segment dominated the non-destructive testing market and accounted for the largest revenue share of 22.9% in 2024. The segment is expected to witness a CAGR of more than 10.5% over the forecast period, primarily due to the ever-increasing volume of manufacturing across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.