- Home

- »

- Next Generation Technologies

- »

-

Ultrasonic Testing Market Size, Share, Industry Report, 2030GVR Report cover

![Ultrasonic Testing Market Size, Share & Trends Report]()

Ultrasonic Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Phased Array Ultrasonic Testing, Time-of-Flight Diffraction), By Equipment, By Services, By Application, By End Use Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-577-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ultrasonic Testing Market Summary

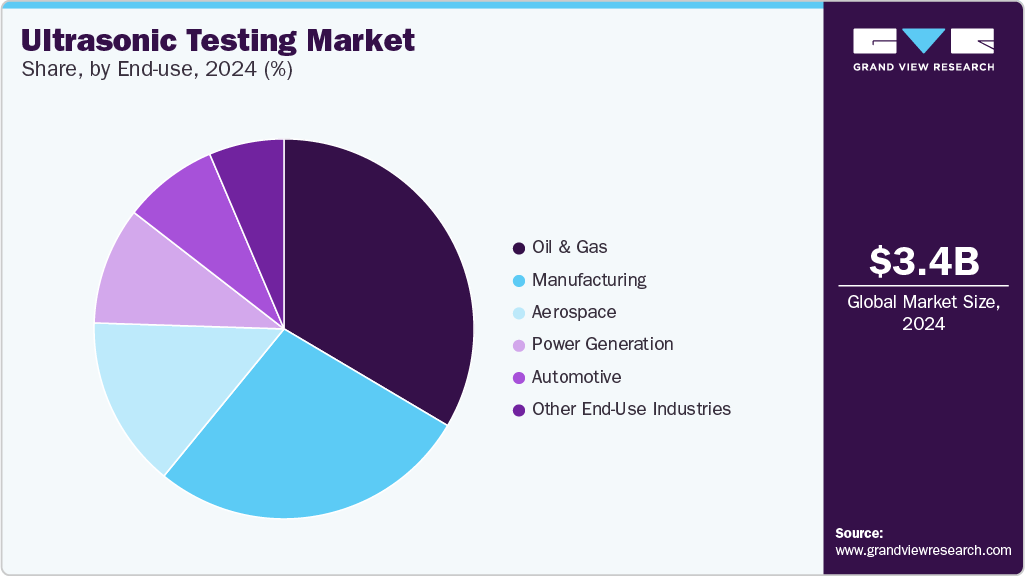

The global ultrasonic testing market size was estimated at USD 3.36 billion in 2024 and is projected to reach USD 5.12 billion by 2030, growing at a CAGR of 7.5% from 2025 to 2030. The growth can be attributed to the government regulations mandating Non-Destructive Testing (NDT), including Ultrasonic Testing (UT).

Key Market Trends & Insights

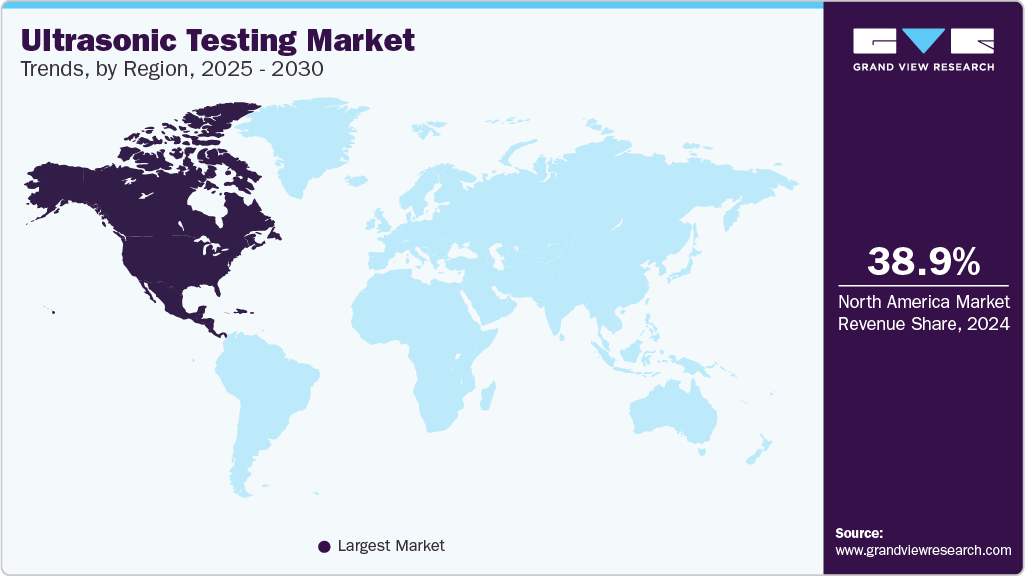

- North America ultrasonic testing market accounted for 38.9% share of the overall industry in 2024.

- The ultrasonic testing industry in the U.S. held a dominant position in 2024.

- By type, the Phased Array Ultrasonic Testing (PAUT) segment accounted for the largest share of 36.2% in 2024.

- By application, the weld inspection segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period.

- By equipment, the flaw detectors segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.36 Billion

- 2030 Projected Market Size: USD 5.12 Billion

- CAGR (2025-2030): 7.5%

- North America: Largest market in 2024

The U.S. Nuclear Regulatory Commission (NRC) enforces strict guidelines requiring regular ultrasonic testing inspections of reactor components to identify potential cracks or weaknesses that lead to catastrophic accidents. For instance, ultrasonic testing is used to inspect pressure vessels and piping systems in nuclear plants to prevent radioactive leaks.Similarly, in the oil and gas sector, regulations from agencies like the U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA) stipulate ultrasonic testing inspections during pipeline construction and maintenance to ensure integrity and prevent leaks or explosions. These regulatory requirements create a robust demand for ultrasonic testing equipment and qualified personnel, driving market expansion.

Advancements in ultrasonic testing technology, such as phased array ultrasonic testing (PAUT) and time-of-flight diffraction (TOFD), are transforming the market by offering higher precision, faster inspection times, and improved defect detection capabilities. PAUT, for instance, uses multiple ultrasonic probes to generate detailed images, enabling precise flaw characterization. The National Institute of Standards and Technology (NIST) plays a pivotal role in developing standards and methodologies for these advanced ultrasonic testing techniques, ensuring their reliability and accuracy.

The integration of automation and robotics in ultrasonic testing systems further enhances efficiency, reducing inspection times and operational costs. For example, automated ultrasonic testing systems are increasingly used in aerospace to inspect complex composite materials, minimizing human error. These technological innovations make ultrasonic testing more attractive to industries, contributing to market growth. The ongoing research and development supported by government agencies like NIST are expected to drive further advancements, sustaining this trend.

The adoption of continuous monitoring techniques using ultrasonic testing is a significant trend, particularly in industries like manufacturing, energy, and transportation. Continuous ultrasonic testing monitoring enables real-time detection of developing fractures, voids, and other flaws, preventing unexpected equipment failures and reducing downtime for repairs. This approach enhances production efficiency and cost savings, making it highly desirable.

The U.S. Department of Energy (DOE) emphasizes the importance of NDT methods, including ultrasonic testing, for ensuring the safety and reliability of energy infrastructure, such as pipelines and power generation equipment. For instance, ultrasonic testing is used to monitor pipelines for corrosion, preventing costly failures and environmental hazards. The regulatory push for regular inspections in power generation, driven by agencies like the DOE, supports the growth of continuous ultrasonic testing monitoring systems, fueling market demand.

The integration of ultrasonic testing with digital technologies, such as artificial intelligence (AI) and data analytics, is creating new opportunities for market growth. AI-driven ultrasonic testing systems can analyze inspection data more accurately and quickly, improving defect detection and reducing human error. This trend is particularly evident in industries like aerospace and defense, where precision and reliability are paramount. The Federal Aviation Administration (FAA) supports the development of advanced NDT technologies, including ultrasonic testing, to ensure the safety and performance of aircraft components. For example, AI-enhanced ultrasonic testing is used to inspect composite materials in aircraft, detecting hidden defects with greater accuracy. Similarly, the U.S. Department of Defense (DOD) leverages advanced ultrasonic testing for defense applications, such as inspecting military equipment. The growing emphasis on predictive maintenance, supported by digital technologies, is expected to drive further adoption of ultrasonic testing, contributing to market expansion.

Type Insights

The Phased Array Ultrasonic Testing (PAUT) segment accounted for the largest share of 36.2% in 2024. Phased Array Ultrasonic Testing (PAUT) is becoming widely adopted across industries due to its ability to scan large areas rapidly while delivering high-resolution images. It allows technicians to inspect complex geometries without physically moving the probe, which is especially valuable in aerospace and power generation sectors. As industrial safety regulations tighten globally, companies are shifting toward more precise and efficient testing methods like PAUT for weld integrity checks and corrosion monitoring.

The Time-of-Flight Diffraction (TOFD) segment is expected to grow at a significant CAGR during the forecast period. Time-of-Flight Diffraction (TOFD) is gaining momentum for critical weld inspection, particularly in pipelines and pressure vessels. Its ability to size defects accurately and detect cracks with minimal operator influence makes it indispensable in industries where human safety and operational continuity are top priorities. Energy companies increasingly integrate TOFD into their quality assurance protocols due to its reliability and reproducibility.

Equipment Insights

The flaw detectors segment held the largest market share in 2024. Flaw detectors are advancing with touchscreen interfaces and real-time imaging features, making them easier to use in field conditions. Modern handheld flaw detectors are compact and battery-efficient, ideal for technicians working on-site in sectors like railways, aviation, and marine. These devices now support wireless data transfer and cloud connectivity, enabling faster reporting and remote collaboration. Additionally, integration with AI algorithms allows for automated flaw recognition, improving accuracy and reducing human error.

The thickness gauges segment is expected to grow at a significant CAGR during the forecast period. Thickness Gauges are evolving to offer dual-element probes and automatic data logging, enabling inspections even through paint or coatings. These instruments are vital in industries where wall thinning due to corrosion or erosion could lead to system failures, such as in chemical processing plants and ship hull inspections. Recent advancements also include Bluetooth connectivity and integration with mobile apps, streamlining data collection and analysis on-site. As regulatory standards tighten across industries, the demand for precise, efficient thickness measurement tools continues to rise.

Services Insights

The inspection services segment dominated the market in 2024. Inspection services are growing in demand as companies seek third-party expertise for compliance and risk management. Hiring specialized service providers ensures inspections are conducted with the latest equipment and certified technicians, which is particularly crucial in regulated industries such as nuclear energy and aviation. Moreover, outsourcing inspection services reduces operational downtime and internal resource strain, allowing companies to focus on core functions. The rise of asset integrity management and predictive maintenance strategies further fuels the demand for professional inspection services.

The equipment rental services segment is projected to grow at the fastest CAGR over the forecast period. Equipment Rental Services are gaining traction among SMEs and project-based contractors who need access to advanced ultrasonic equipment without high upfront investments. Rental options are especially popular in the construction and civil engineering sectors for temporary bridge or structural inspections. This trend is supported by flexible rental models and bundled service offerings that include maintenance, calibration, and technical support. Additionally, as technology evolves rapidly, renting allows users to access the latest equipment without concerns about asset depreciation.

Application Insights

The weld inspection segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period. Weld Inspection continues to be the primary application for ultrasonic testing, especially in infrastructure projects, shipbuilding, and pipeline networks. Non-destructive weld evaluation ensures the integrity of joints without halting production lines or dismantling structures. Advancements in phased array UT and time-of-flight diffraction (TOFD) are enhancing the precision and speed of weld inspections. With stricter quality standards and safety regulations worldwide, demand for reliable weld testing solutions is expected to remain strong across sectors.

The corrosion detection segment is projected to grow at a significant CAGR over the forecast period. Corrosion detection is essential in sectors where metal degradation leads to environmental hazards or financial losses, such as in offshore oil rigs or chemical storage tanks. Ultrasonic testing helps detect early-stage corrosion, enabling proactive maintenance. Modern UT systems now offer high-resolution thickness mapping and automated scanning, improving detection accuracy in hard-to-reach areas. As infrastructure ages globally, the emphasis on corrosion monitoring is intensifying to extend asset life and ensure operational safety.

End Use Industry Insights

The oil & gas segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period. The oil & gas sector heavily relies on ultrasonic testing for pipeline inspection, tank bottom mapping, and corrosion under insulation. Strict regulations, such as PHMSA standards, drive ultrasonic testing adoption. Government investments in energy infrastructure, like pipeline upgrades, further boost demand. Additionally, the shift toward digital oilfields is accelerating the integration of advanced UT systems with real-time monitoring and data analytics. As exploration moves into harsher environments, the need for robust, accurate, and remote inspection tools continues to rise.

The manufacturing segment is projected to grow at a significant CAGR over the forecast period. Ultrasonic testing ensures quality control of manufactured goods, meeting safety and quality standards. Government support for manufacturing, such as India’s “Make in India” initiative, increases ultrasonic testing demand. ASTM standards for material testing further drive this segment. Innovations like in-line UT systems enable real-time defect detection during production, reducing waste and rework. As manufacturers adopt Industry 4.0 practices, the integration of UT with automated and smart inspection systems is becoming increasingly prevalent.

Regional Insights

North America ultrasonic testing market accounted for 38.9% share of the overall industry in 2024, driven by advanced industrial sectors, robust regulatory frameworks, and significant infrastructure investments. The region’s focus on safety and quality assurance in aerospace, oil & gas, and transportation fuels ultrasonic testing adoption. Widespread adoption of digital inspection technologies and skilled workforce availability further strengthen the region’s market position. Ongoing upgrades to aging infrastructure, such as bridges and pipelines, continue to create sustained demand for UT solutions.

U.S. Ultrasonic Testing Industry Trends

The ultrasonic testing industry in the U.S. held a dominant position in 2024, propelled by widespread adoption in aerospace, oil & gas, and railway infrastructure inspections. The integration of advanced ultrasonic testing technologies, such as phased array ultrasonic testing (PAUT), enhances inspection accuracy. The U.S. Bipartisan Infrastructure Law (2021), allocating USD 1.2 trillion for transportation and energy projects, drives ultrasonic testing use for weld and corrosion inspections in bridges and pipelines.

Europe Ultrasonic Testing Industry Trends

The ultrasonic testing industry in Europe was identified as a lucrative region in 2024, driven by strong automotive, aerospace, and manufacturing sectors. The region’s commitment to quality standards and technological advancements supports ultrasonic testing growth.

Germany ultrasonic testing market thrives due to its robust automotive and manufacturing industries, with a focus on automated ultrasonic testing (AUT) for quality control.

The ultrasonic testing market in the UK is a hub for ultrasonic testing innovation, particularly in aerospace and defense, with increasing adoption of continuous monitoring techniques.

Asia Pacific Ultrasonic Testing Industry Trends

The ultrasonic testing market in Asia-Pacific is fueled by industrialization and infrastructure development in countries like China, India, and Japan. The increasing focus on quality assurance and safety standards in industries such as oil & gas, manufacturing, and construction drives the demand for ultrasonic testing solutions. Government initiatives to promote technology adoption and ensure regulatory compliance further boost market growth.

China ultrasonic testing market is expanding due to its robust manufacturing sector and extensive infrastructure projects. The country's emphasis on safety in industries like oil & gas, construction, and transportation leads to increased adoption of ultrasonic testing solutions. Additionally, China's investments in renewable energy and high-speed rail projects necessitate regular inspection and maintenance, further driving the demand for ultrasonic testing technologies.

The ultrasonic testing market in India is growing rapidly, supported by government initiatives like “Make in India” and increased investments in infrastructure and manufacturing. The country’s emphasis on safety and quality standards across industries such as aerospace, oil & gas, and construction drives the demand for ultrasonic testing solutions. Additionally, India’s push for defense indigenization and the development of smart cities further propels the adoption of ultrasonic testing technologies to ensure safe and reliable infrastructure.

Key Ultrasonic Testing Companies Insights

Key players operating in the ultrasonic testing market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Ultrasonic Testing Companies:

The following are the leading companies in the ultrasonic testing market. These companies collectively hold the largest market share and dictate industry trends.

- Baker Hughes Company

- MISTRAS Group

- Eddyfi Technologies

- Sonatest

- Intertek Group plc

- Olympus Corporation

- TÜV Rheinland

- NDT Systems Inc

- Sonotron NDT

- Cygnus Instruments Ltd.

Recent Developments

-

In April 2025, MISTRAS Group launched MISTRAS Data Solutions, a unified platform integrating its inspection data services, digital twins, IoT-enabled sensors, and predictive analytics capabilities. This strategic move aims to provide customers across the energy, aerospace, and infrastructure sectors with centralized, real-time integrity data to improve maintenance efficiency. Furthermore, in May 2025, MISTRAS announced strong Q1 2025 earnings, attributing growth to the increased demand for ultrasonic inspection services and rising adoption of its new digital solutions suite, reinforcing its position as a data-driven leader in the ultrasonic testing market.

-

In April 2024, Baker Hughes Company’s Waygate Technologies introduced the Krautkrämer CL Go+, a next-generation ultrasonic precision thickness gauge offering ±0.001 mm accuracy and a user-friendly interface. The portable device is designed for fast, non-destructive wall-thickness measurement across industries like aerospace and energy. Additionally, in April 2025, Baker Hughes showcased its RotoArray comPAct phased-array probe and Krautkrämer USM 100 flaw detector at Control 2025 in Stuttgart, Germany. These innovations feature AI-assisted imaging and miniaturized electronics, underlining Baker Hughes’ commitment to precision, portability, and digital transformation in ultrasonic testing.

Ultrasonic Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.57 billion

Revenue forecast in 2030

USD 5.12 billion

Growth rate

CAGR of 7.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, equipment, services, application, end use industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Baker Hughes Company; MISTRAS Group; Eddyfi Technologies; Sonatest; Intertek Group plc; Olympus Corporation; TÜV Rheinland; NDT Systems Inc; Sonotron NDT; Cygnus Instruments Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ultrasonic Testing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ultrasonic testing market report based on type, equipment, services, application, end use industry, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Phased Array Ultrasonic Testing (PAUT)

-

Time-of-Flight Diffraction (TOFD)

-

Guided Wave Testing

-

Immersion Testing

-

Others

-

-

Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Flaw Detectors

-

Thickness Gauges

-

Transducers & Probes

-

Imaging Systems

-

Tube Inspection Systems

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Inspection Services

-

Equipment Rental Services

-

Calibration Services

-

Training Services

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Weld Inspection

-

Corrosion Detection

-

Thickness Measurement

-

Material Characterization

-

Others

-

-

End Use Industry Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oil & Gas

-

Manufacturing

-

Aerospace

-

Power Generation

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ultrasonic testing market size was estimated at USD 3.36 billion in 2024 and is expected to reach USD 3.57 billion in 2025.

b. The global ultrasonic testing market size is expected to grow at a significant CAGR of 7.5% to reach USD 5.12 billion in 2030

b. North America held the largest market share of 38.9% in 2024.The region’s focus on safety and quality assurance in aerospace, oil & gas, and transportation fuels ultrasonic testing adoption. Widespread adoption of digital inspection technologies and skilled workforce availability further strengthen the region’s market position.

b. Some of the key players in the ultrasonic testing market include Baker Hughes Company, MISTRAS Group, Eddyfi Technologies, Sonatest, Intertek Group plc, Olympus Corporation, TÜV Rheinland, NDT Systems Inc, Sonotron NDT, Cygnus Instruments Ltd.

b. Rising demand for non-destructive testing in aging infrastructure and advanced manufacturing is driving growth in the ultrasonic testing market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.