- Home

- »

- Plastics, Polymers & Resins

- »

-

North America 3D Printing Plastics Market, Industry Report, 2030GVR Report cover

![North America 3D Printing Plastics Market Size, Share & Trends Report]()

North America 3D Printing Plastics Market Size, Share & Trends Analysis Report By Type (Photopolymers, ABS & ASA, Polyamide/Nylon), By Form (Filament, Ink, Powder), By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-256-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

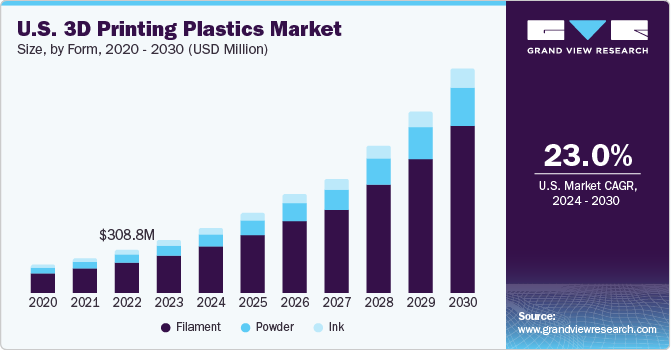

The North America 3D printing plastics market size was estimated at USD 489.4 million in 2023 and is anticipated to grow at a CAGR of 23.0% from 2024 to 2030. This growth is attributed to the expansion of industries in the U.S. and Canada that utilize end products. The existence of economies with high income is fueling the need for consumer goods of superior quality and advanced technology, such as vehicles, appliances, and electronics. These elements, along with substantial investments in the manufacturing sector, are anticipated to boost the market for 3D printing plastics in the coming years.

The region is home to well-established markets and is distinguished by a 3D printing industry that is technologically advanced, thus making a significant contribution to the worldwide market for 3D printing plastics. The North American market for 3D printing plastics is expected to see promising growth in Polylactic acid. PLA filament, which is available in a variety of colors and blends, is extensively used in numerous applications. It is user-friendly and imparts a high-quality finish to the final printed product. Moreover, the U.S. has seen a substantial increase in the use of 3D printing plastics for prototype creation in recent years. Furthermore, it is anticipated that an increasing number of manufacturers will employ additive manufacturing for mass production. The market presents attractive opportunities in aftermarket applications, as manufacturers are progressively using additive manufacturing technology to produce new components in the aftermarket industry.

The market's growth in the region can be ascribed to the expanding end-use industries in the U.S. and Canada. The existence of high-income economies is driving the need for consumer goods of superior quality and advanced technology, such as vehicles, appliances, and electronics. These elements, combined with substantial investments in the manufacturing sector, are anticipated to boost the market for 3D printing plastics in the coming years. The market is likely to be driven by a high rate of adoption of 3D printing plastics across various end-user industries. The automotive applications of 3D printing plastics are expected to experience steady growth. In addition, the presence of major manufacturers is fueling the demand for 3D printing plastics in the region.

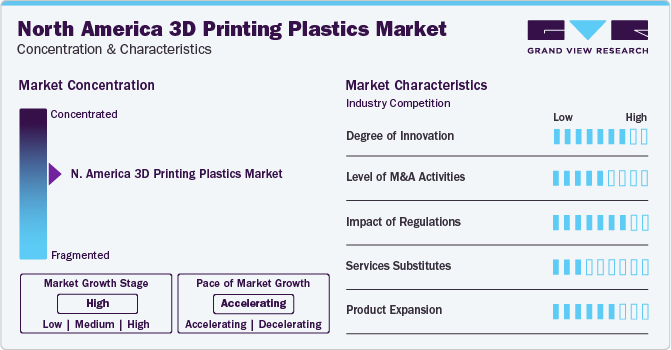

Market Concentration & Characteristics

The North America 3D Printing Plastics market is characterized by a high level of innovation. This is driven by ongoing advancements in additive manufacturing technologies, material science, and the development of new applications. Businesses are continually launching new types of 3D printing plastics with improved characteristics such as durability, flexibility, and thermal resistance to cater to the changing requirements of diverse sectors.

The market experiences a moderate level of merger and acquisition activities. While there have been cases of consolidation among major players aiming to broaden their range of products or access novel technologies, the market remains relatively scattered with a multitude of small to mid-sized firms vying for a share.

Regulatory impacts on the market are moderate. While there are overarching regulations that govern the production and usage of plastics, specific rules that directly target 3D printing plastics are still under development. Nonetheless, regulatory bodies are paying increasing attention to aspects such as the safety of materials, recycling, and environmental implications, which could shape the market's future trajectory.

The market has few substitutes, particularly for applications that demand specific material attributes and precision manufacturing. While there are alternative manufacturing techniques available, such as injection molding and CNC machining, they may not provide the same degree of design adaptability, customization, and cost efficiency as 3D printing with plastics.

The market sees a high level of product expansion. Producers are constantly launching new categories of 3D printing plastics designed for various industries and applications. These encompass engineering-grade plastics, biodegradable substances, conductive plastics, and composite filaments, among others, broadening the scope for additive manufacturing.

Form Insights

The filament segment led the market and accounted for the largest revenue share of 70.9% in 2023. This growth is attributed to 3D plastic filaments being widely used in the global 3D printing market due to their ability to become flexible when heated. The printing industry frequently uses Polylactic acid and ABS filaments. These are thermoplastic materials that are employed in fused deposition modeling in 3D printers.

The powder segment had a substantial market share in 2023. 3D printing plastics possess several characteristics such as flexibility, high rigidity, and temperature resistance. The powder is also offered in a variety of vibrant colors. Polyamide/nylon and alumide are typically used as powder for building 3D models. Selective laser sintering is a favored technology for producing 3D-printed components from polyamide powder.

End-use Insights

The medical segment accounted for the largest market share of 48.5% in 2023. This growth is attributed to the affordability, adaptability, and increasing instances of vascular and osteoarthritis diseases that contribute to the popularity of 3D printing plastics in medical applications. The market demand for these materials is predicted to surge due to advancements in technology, supportive government policies, and swift product development. These plastics are utilized in various medical applications such as prototyping, personalized orthodontic implants, prosthetics, medical tools, training models, and more. Dentistry is a major sector driving the demand for 3D printing plastics in the medical field.

The aerospace & defense sector accounted for a substantial portion of the market in 2023. Aerospace uses include the fabrication of armrests and engine parts. The use of 3D printing plastics is expected to expand in the manufacturing of aircraft winds, offering promising opportunities for market growth in the forecast period. Factors such as efficient use of raw materials, ease of customizing intricate products, supportive government policies, and shorter lead times are anticipated to boost the market demand for 3D printing plastics in the aerospace & defense industry.

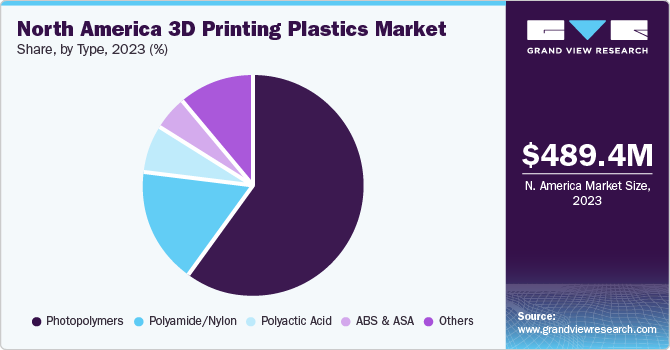

Type Insights

Photopolymers dominated the market and accounted for the largest share of 59.42% in 2023. The growth is attributed to the widespread application of Photopolymers in various industries where they serve as binders, additives, colorants, plasticizers, and chemical agents in 3D printed items. They provide numerous benefits such as clear imaging, improved ink deposition, and enhanced durability. As a result, these advantages are anticipated to propel the market demand for 3D printing plastics in the future.

Polyamide/Nylon accounted for a substantial portion of the market in 2023 due to increasing demand in both residential and commercial applications. Polyamide is extensively used in various application industries of the 3D printing plastic market due to its low sliding friction, high chemical resistance, rigidity, and dimensional stability. Polyamide is also known as Nylon (PA). Nylon 6 and Nylon 6, 6 are two distinct grades of nylon, composed of similar ratios of hydrogen, oxygen, nitrogen, and carbon. Nylon's relatively higher melting point makes it an ideal material for various applications.

Country Insights

U.S. 3D Printing Plastics Market Trends

The U.S. 3D Printing Plastics Market accounted for the largest market share of 77.7% in 2023. This growth is attributed to the rising elderly population in the country is leading to a surge in demand in the medical sector, which is the primary source of demand in the country. The need for medical equipment is increasing due to the mechanical and chemical properties they offer. Factors such as biocompatibility, optical clarity, and cost-effective production methods are anticipated to fuel the demand for these products in the healthcare sector.

Canada 3D Printing Plastics Market Trends

The 3D Printing Plastics Market in Canada registered a considerable market share in 2023. The manufacturing industries in Canada are growing their base, supported by various manufacturers' innovations. The emergence of new systems that assist in producing high-quality functional parts with reduced lead time and input costs is leading to a rise in the adoption of 3D printing plastics in Canada. Photopolymers are being increasingly used in the Canadian 3D printing plastics industry.

Mexico 3D Printing Plastics Market Trends

The Mexico 3D Printing Plastics Market experienced significant growth in 2023, due to the rapid expansion of the manufacturing industry in Mexico. This growth is driven by key factors such as beneficial trade agreements and cost-efficient, skilled labor availability. The educated younger workforce is more inclined to adopt new manufacturing methods such as additive manufacturing, thereby increasing the demand for 3D printing plastics in the country.

Key North America 3D Printing Plastics Company Insights

The North America 3D Printing Plastics Market is dispersed, marked by the existence of numerous small to mid-sized firms offering a broad array of materials and services. While there are a few larger players in the market, the industry remains decentralized, with many specialized providers serving niche applications and customer demands.

Key players in the market include 3D Systems, Inc.; Stratasys Ltd, and Arkema Inc.

-

3D Systems, Inc., along with its subsidiary companies, is a global provider of three-dimensional printing products and associated services. Their comprehensive product range includes 3D printers, materials, software, scanners & haptics, virtual surgical simulators, and 3D scan data modeling services. The company's 3D printing materials encompass metal, plastic, wax, composite, elastomer, and other bio-compatible materials.

-

Arkema Inc. conducts its operations through three principal business divisions, namely coating solutions, high-performance materials, and industrial specialties. The high-performance materials division is further broken down into Bostik and advanced materials. The company, keeping customer needs in mind, provides solutions for a variety of applications such as 3D printing, adhesives, air conditioning & refrigeration, bio-sourced materials, energy storage, paints & coatings, and plastic & additives.

The ExOneCompany and Carbon3D Inc.are some other participants in the North America 3D Printing Plastics market

-

Carbon3D Inc. is a company specializing in 3D printing technology that assists businesses in creating superior products and accelerating their time to market. The company's product offerings include MA printers, M2 printers, smart part washers, and it also pioneers the continuous liquid interface production (CLIP) technology for layer-less 3D printing, leveraging software, hardware, and molecular science.

Key North America 3D Printing Plastics Companies:

- 3D Systems, Inc.

- Arkema Inc.

- Stratasys Ltd.

- Avient Corporation

- The ExOne Company

- Huntsman Corporation

- Proto Labs Inc.

- Carbon3D Inc.

- Formlabs inc.

- HP Inc.

Recent Developments

-

In April 2023, Arkema has unveiled "EASY3D", a new online platform for on-demand additive manufacturing. This innovative platform combines material science and cloud-based software expertise to facilitate access to a worldwide network of suppliers for 3D printing on demand. Some of these integrated suppliers are even part of the HP Digital Manufacturing Network and EOS Contract Manufacturing Network, both of which are certified by HP and EOS, global leaders in industrial 3D printing solutions.

-

In March 2024,Avient Corporation, a leading provider of unique and eco-friendly material solutions and services, has launched new Gravi-Tech™ Density Modified Formulation grades that exhibit low shrinkage. These new grades present an alternative to acrylonitrile butadiene styrene (ABS) based materials for luxury packaging customers. Avient has engineered new PP-based grades that exhibit shrinkage comparable to ABS materials traditionally used, enabling customers to utilize their existing ABS molds. The Gravi-Tech Density Modified Formulations 5200 MS series provides an optimal choice for replacing ABS in the luxury packaging market, thereby facilitating the use of existing ABS molds.

North America 3D Printing Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 603.8 million

Revenue forecast in 2030

USD 2,089.8 million

Growth rate

CAGR of 23.0% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in tons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, form, end-use, country

Regional Coverage

North America

Country Coverage

U.S.; Mexico; Canada

Key companies profiled

3D Systems, Inc.; Arkema Inc.; Stratasys Ltd.; Avient Corporation; The ExOne Company;

Huntsman Corporation; Proto Labs Inc.; Carbon3D Inc.; Formlabs inc.; HP Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America 3D Printing Plastics Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America 3D Printing Plastics market report based on Type, form, end-use, and region.

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Photopolymers

-

ABS & ASA

-

Polyamide/Nylon

-

Polyactic acid

-

Others

-

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Filament

-

Ink

-

Powder

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Medical

-

Aerospace & Defense

-

Consumer Goods

-

-

Country Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America 3D printing plastics market was valued at USD 489.4 million in the year 2023 and is expected to reach USD 603.8 million in 2024.

b. The North America 3D printing plastics market is expected to grow at a compound annual growth rate of 23.0% from 2024 to 2030 to reach USD 2,089.8 million by 2030.

b. The filament segment led the market and accounted for the largest revenue share of 70.9% in 2023. This growth is attributed to 3D plastic filaments being widely used in the global 3D printing market due to their ability to become flexible when heated.

b. The key market player in the North America 3D printing plastics market includes 3D Systems, Inc.; Arkema Inc.; Stratasys Ltd.; Avient Corporation; The ExOne Company; Huntsman Corporation; Proto Labs Inc.; Carbon3D Inc.; Formlabs inc.; and HP Inc.

b. The key factors that are driving the North America 3D Printing Plastics Market includes the expansion of industries in the U.S. and Canada that utilize end products is on the rise. The existence of economies with high income is fueling the need for consumer goods of superior quality and advanced technology, such as vehicles, appliances, and electronics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."