- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Aerospace Plastics Market, Industry Report 2030GVR Report cover

![North America Aerospace Plastics Market Size, Share & Trends Report]()

North America Aerospace Plastics Market Size, Share & Trends Analysis Report By Plastic Type (PEEK, PPSU, PC, PEI, PMMA, PA, PPS, PAI, PPE, PU), By Process, By Application, By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-249-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trend

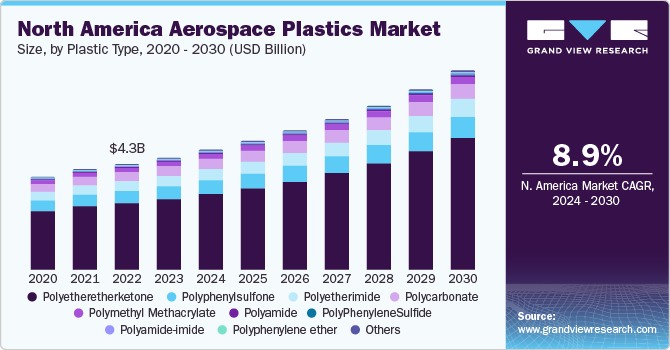

The North America aerospace plastics market was valued at USD 4.3 billion in 2023 and is projected to grow at a CAGR of 8.9% from 2024 to 2030. This growth is attributed to several key driving factors including the increasing demand for lightweight materials in the aerospace industry, advancements in plastic technologies, and the rising number of air passengers. Additionally, the growing use of plastics in the manufacturing of cabin interiors, windows, windshields, and other aerospace components also contributes to the market expansion.

The aerospace industry in North America is witnessing a significant trend toward increased utilization of plastics in cabin applications. Aircraft manufacturers are strategically focusing on reducing overall aircraft weight while maintaining or enhancing load-carrying capacity. Plastics play a crucial role in achieving these objectives, leading to improved fuel efficiency and operational performance.

Regional aircraft, in particular, are experiencing a high replacement rate. Airlines and operators are actively seeking to upgrade or replace existing inefficient aircraft with more fuel-efficient alternatives. This drive for modernization is expected to drive market growth in the aerospace plastics sector.

Market Characteristics & Concentration

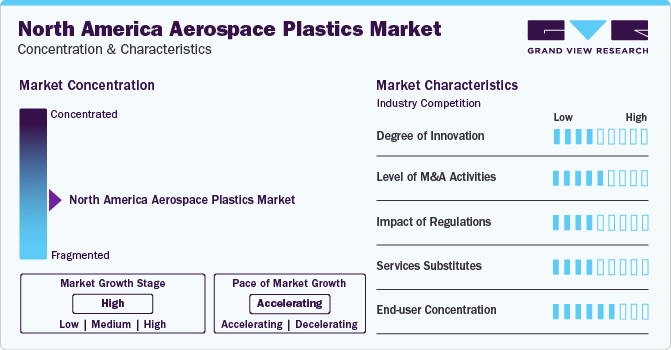

The global aerospace plastics market is driven by continuous innovation, particularly in the development of lightweight and durable materials. The ongoing advancements in aerospace plastics technology are expected to boost the demand for various types of aerospace plastics.

Recent innovations in the North America Aerospace Plastics Market are primarily driven by advancements in material science and manufacturing processes. For instance, the advent of 3D printable filament based on PEEK (polyether ether ketone) is particularly significant as 3D printing is poised to register the fastest growth in the aerospace plastics market.

Another noteworthy innovation is the development of advanced polymers imparting chemical and flame resistance. These polymers are designed to operate at variable temperatures and require a high degree of thermal stability. These innovations reflect the ongoing efforts to improve the performance and versatility of aerospace plastics, thereby driving the growth of the market.

The market is significantly influenced by regulations and specifications such as UL94, FAR 25.853, ASTM, DFAR’s, MIL-PRF-5425, MIL-PRF-8184, and MIL-PRF-25690. These strict standards result in significant R&D expenditure, limiting the participation of new players that lack the necessary technical expertise to produce aerospace-grade plastics. Moreover, the Environmental Protection Agency (EPA) imposes regulations on the production of aerospace plastics, which increase the cost of raw materials and act as a barrier to the market.

Materials such as silicone elastomer pose a significant challenge to aerospace plastics due to their high resistance to extreme conditions and lower cost. However, the unique properties of aerospace plastics, such as their lightweight and durability, make them irreplaceable in certain applications.

Plastic Type Insights

The Polyetheretherketone (PEEK) segment holds the largest market share in the North America Aerospace Plastics market, accounting for 62% of the total revenue in 2023. This dominance can be attributed to its extensive use in the aerospace industry due to its lightweight, strong, and durable properties. It is used for producing aircraft interior parts, flight control components, and many other items. The escalating production of aerospace components in North America is expected to drive the demand for PEEK resin over the coming years.

The Polymethyl Methacrylate (PMMA) segment is anticipated to witness the second-fastest growth in revenue with a CAGR of 8.6% from 2024 to 2030. PMMA’s growth is driven because of its transparency and excellent light transmission properties, which are essential for applications like aircraft canopies and windows. These not only contribute to structural integrity or aerospace components but also enhance the aesthetic and functional aspects of aircraft design.

Process Insights

Injection molding is a dominant process in the North America Aerospace Plastics Market, accounting for the largest market share of 22.8% in terms of revenue in 2023. This process is significantly used in the production of aerospace parts as it offers repeatable precision with high-volume production. However, this segment is expected to experience limited growth due to the high upfront costs of entry and the strong presence of alternative and new technologies such as 3D printing.

CNC machining stands out as the process with the second fastest projected growth with a CAGR of 8.6% from 2024 to 2030. CNC machining’s growth is propelled by its precision and versatility, which are vital for creating detailed and durable aerospace parts. The process’ adaptability to various materials and its capacity for producing both small and large components make it a good choice for the aerospace industry’s evolving needs.

Application Insights

The cabin interiors segment holds the largest revenue share in the North America Aerospace Plastics Market, accounting for 29% of the total revenue in 2023. Plastics are extensively used in several cabin interior applications such as door slides, latches, drawers, stowage bin parts, stowage bin doors, seating, and other interior decorations. The increasing demand for modern amenities in aircraft cabins and the trend of retrofitting older aircraft with these amenities have driven the demand for plastics in cabin interiors.

The structural components segment is projected to experience robust growth in terms of revenue with a CAGR of 8.7% from 2024 to 2030. The increasing demand for lightweight and durable materials in the aerospace industry is expected to drive the growth of the structural components segment in the North America Aerospace Plastics Market. The ongoing advancements in plastic technologies and the increasing demand for new aircraft are also expected to contribute to the growth of this segment.

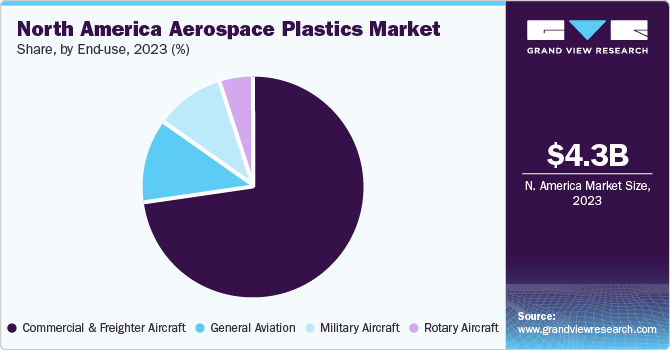

End-use Insights

The commercial and freighter aircraft industry holds the largest revenue share in the North America Aerospace Plastics Market, accounting for 72% of the total revenue in 2023. According to the International Trade Administration, and the U.S. Department of Commerce, the U.S. is considered the leading country in the global aerospace market.

General aviation is the second largest segment in terms of revenue in the U.S. market and it also has the second-fastest projected growth rate with a CAGR of 8.1% from 2024 to 2030. The increasing use of plastic in general aviation points toward a broader trend of modernizing aircraft to meet evolving standards of efficiency and sustainability.

Country Insights

U.S. Aerospace Plastics Market Trends

The U.S. holds the largest market share in the North America Aerospace Plastics Market, accounting for 72% of the total revenue in 2023. This dominance can be attributed to the presence of major aircraft manufacturers, including Boeing, Lockheed Martin Corporation, Gulfstream Aerospace Corporation, and Airbus Helicopters, Inc., in the U.S. Anticipated advancements in aerospace plastics technology, coupled with higher investments in the U.S. aerospace industry, are poised to drive demand for various types of aerospace plastics.

Mexico Aerospace Plastics Market Trends

Mexico is the fastest-growing region in the North America Aerospace Plastics Market in terms of revenue, with a projected CAGR of 9.8% from 2024 to 2030. The Mexican aerospace industry has been growing rapidly in recent years, driven by the country’s strategic location, competitive labor costs, and the presence of numerous aerospace companies. The country has been successful in attracting foreign direct investment in the aerospace sector, which has contributed to the growth of the market. However, the specific market share and growth rate of the Aerospace Plastics Market in Mexico are not readily available in the search results.

Key North America Aerospace Plastics Company Insights

The market is characterized by a high level of concentration, with a few key players dominating the sector. This concentration can be attributed to the high entry barriers, including the need for substantial capital investment and technical expertise. Some key players operating in this market include SABIC, Victrex, and Drake Plastics:

-

SABIC is a Saudi Arabian multinational chemical manufacturer that offers cutting-edge composite solutions for diverse aerospace applications. Their products are used in cabin interiors, structural components, electrical control panels, windows, windshields, and canopies.

-

Victrex is a UK-based company that has established a joint venture with Tri-Mack Plastics Manufacturing Corporation, TxV Aero Composites, to accelerate the commercial adoption of polyketone (PAEK) composite applications within the aerospace industry.

Key North America Aerospace Plastics Companies:

- SABIC

- Victrex plc

- Drake Plastics Ltd

- Solvay S.A

- BASF SE

- Evonik Industries AG

- DuPont de Nemours, Inc

- 3P - Performance Plastics Products

- Vantage Plane Plastics

- Paco Plastics, Inc

Recent Developments

-

In June 2023, Victrex and Tool Gauge initiated a collaboration to develop a new co-molding technology for the aerospace industry. This technology is anticipated to reduce manufacturing costs and timelines while enhancing the performance and sustainability of aerospace materials.

-

In November 2023, Drake Plastics embarked on a new project by breaking ground on its new 140,000 Sq Ft campus, which will function as its new headquarters. The project is expected to double its manufacturing capacity. This expansion is anticipated to enhance the supply chain for high-performance polymers.

-

In February 2024, Evonik launched a new photopolymer resin that is both flame retardant and mechanically durable when cured. These properties make it suitable for high-stress environments. Its compatibility with DLP 3D printing technology allows for the creation of intricate aerospace parts that meet the safety and performance standards.

North America Aerospace Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.6 billion

Revenue forecast in 2030

USD 7.7 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Actual data

2019 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in tons and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Plastic type, process, application, end-use, country

Country Scope

U.S., Canada, Mexico

Key companies profiled

SABIC; Victrex plc; Drake Plastics Ltd; Solvay S.A; BASF SE; Evonik Industries AG; DuPont de Nemours, Inc; 3P - Performance Plastics Products; Vantage Plane Plastics; and Paco Plastics, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Aerospace Plastics Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the North America Aerospace Plastics market report based on product, process, application, end-use, and region:

-

Plastics Type Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

-

Polyetheretherketone (PEEK)

-

Polyphenylsulfone (PPSU)

-

Polycarbonate (PC)

-

Polyetherimide (PEI)

-

Polymethyl Methacrylate (PMMA)

-

Polyamide (PA)

-

PolyPhenyleneSulfide (PPS)

-

Polyamide-imide (PAI)

-

Polyphenylene ether (PPE)

-

Polyurethane (PU)

-

Others

-

-

Process Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

-

Injection Molding

-

Thermoforming

-

CNC Machining

-

Extrusion

-

3D Printing

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

-

Cabin Interiors

-

Structural Components

-

Electrical, Electronics, and Control Panel

-

Window & Windshields, Doors, and Canopies

-

Flooring & Wall Panels

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

-

Commercial & Freighter Aircraft

-

General Aviation

-

Military Aircraft

-

Rotary Aircraft

-

-

Country Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America aerospace plastics market size was estimated at USD 4.3 billion in 2023 and is expected to be USD 4.6 billion in 2024.

b. The North America aerospace plastics market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.9% from 2024 to 2030 to reach USD 7.7 billion by 2030.

b. The cabin interiors segment dominated the North America aerospace plastics market with a revenue share of 93% in 2023, on account of extensive use of plastics in several cabin interior applications such as door slides, latches, drawers, stowage bin parts, stowage bin doors, seating, and other interior decorations.

b. Some of the key players operating in the North America aerospace plastics market include SABIC; Victrex plc; Drake Plastics Ltd; Solvay S.A; BASF SE; Evonik Industries AG; DuPont de Nemours, Inc; 3P – Performance Plastics Products; Vantage Plane Plastics; Paco Plastics, Inc.

b. Key factors that are driving the North America aerospace plastics market growth include the increasing demand for lightweight materials in the aerospace industry, advancements in plastic technologies, and the rising number of air passengers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."