- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Automotive Foams Market Report, 2028GVR Report cover

![North America Automotive Foams Market Size, Share & Trends Report]()

North America Automotive Foams Market Size, Share & Trends Analysis Report By Type (PU, Polyolefin), By Application (Seating, Bumper Systems), By End Use (Cars, LCVs), By Country (U.S., Mexico), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-376-8

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Bulk Chemicals

Report Overview

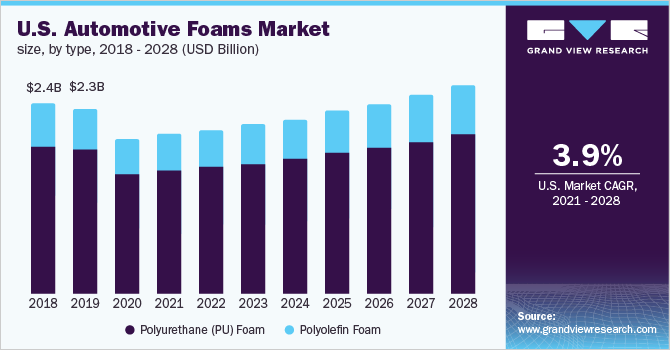

The North America automotive foams market size was valued at USD 2.45 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 3.7% from 2021 to 2028. The automotive industry in North America has witnessed rapid growth in recent years owing to the growing population coupled with rising disposable incomes and increasing purchasing power parity. The obligatory norms laid down by the regulatory authorities to control emissions and the diminishing oil & gas reserves have propelled automotive manufacturers in North America to concentrate on manufacturing lightweight and energy-efficient automobiles. According to the American Chemistry Council, presently, plastics make up 50% of a vehicle’s structure. This is due to the fact that the majority of the interior components in automobiles utilize plastic foams like Polyurethane (PU), Polypropylene (PP), Polyethylene (PE), Ethyl Vinyl Acetate (EVA), ethylene, and propylene diene monomer.

Excellent mechanical strength, high wear & weathering resistance of PU and Polyolefin (PO) foams, along with their weight reduction ability, have made them one of the most important materials used in automobile production. The U.S. accounted for a significant revenue share of the North America automotive foams market in 2020. Ongoing technological innovations in the processes used for manufacturing automobile components have led to an increased usage of automotive foams in various applications in the automotive industry. Conventional foams used for manufacturing seat paddings of vehicles are being replaced by high-performance automotive foams, such as PU, PO, EVA, PE, PP, and Ethylene Propylene Diene Monomer (EPDM).

North American automakers have witnessed a shifting of their vehicle production towards electrification due to stringent emission norms introduced by the governments of the U.S., Canada, and Mexico. The introduction of incentives and mandates by the governments also emerged as the key driving factor for the high demand for Electric Vehicles (EVs). Moreover, the demand for commercial vehicles witnessed a rise from the e-commerce and logistics industries, which surged further due to COVID-19 and is one of the major factors that has been driving the market growth in the region. The automotive foams not only provide comfort to passengers but also enable a reduction in the overall weight of the vehicles. The rising demand for consumer vehicles positively impacted the growth of automotive foams in North America.

Type Insights

The PU foam segment led the market in 2020, accounting for more than 77.0% of the overall revenue. Properties such as low density, durability, high load-bearing capacity, good compressibility, good water resistance, and excellent sound absorption properties have made them suitable for Noise, Vibration, and Harshness (NVH) solutions, as well as in various automobile components such as seats, armrests & headrests, and door panels.

The EVA, PE, PP, and ethylene propylene diene monomer foams fall under the category of polyolefins. Polyolefin foams have high demand in the automotive industry and have become an indispensable part of modern transportation systems owing to their low density, low weight, high weather resistance, and excellent mechanical properties. Companies such as ARMACELL and Borealis AG produce polyolefin foams in the form of rolls and sheets. These foams are eco-friendly, versatile, lightweight, and inherently recyclable, thereby ensuring a sustainable end-of-life performance.

End-use Insights

The cars segment accounted for the maximum revenue share of over 45% of the overall market in 2020. The increasing demand for low-emission vehicles has forced manufacturers to innovate and develop new technologies to curb the environmental impact. This has driven the EV segment. The presence of leading EV manufacturers in North America, including Tesla, BYD Company Ltd., Daimler AG, Ford Motor Company, and General Motors, has increased the demand for automotive foams for manufacturing seating, arms, headrests, headliners, door panels, and bumper systems of vehicles.

The COVID-19 pandemic led to a surge in hospitalization and e-commerce business. This propelled the demand for Heavy And Light Commercial Vehicles (HCVs/LCVs). The increased investments in setting up warehouses to cater to the proliferating e-commerce business are expected to positively impact the commercial vehicle demand and boost the market growth in North America.

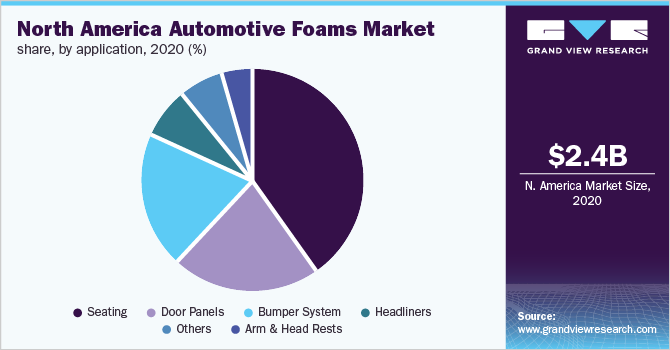

Application Insights

The seating application segment dominated the market in 2020 with a revenue share of more than 40%. The automotive industry is encouraging designers and engineers to evolve automotive seating to deliver superior comfort, safety, flexibility, durability, and ergonomics. This has propelled product consumption in seating applications. The nature of chemistry involved in the production of PU allows it to be molded into unusual shapes, making it suitable for seating applications.

Door panels accounted for the second-largest revenue share of the market in 2020. The door panel houses internal parts like the window regulator, power window motor, and wiring. Hence it requires adequate impact and dent resistance to protect the essential internal parts housed within it. Polypropylene has better impact resistance, which makes it suitable to be used in the production of door panels. Bumpers are used to absorb low-impact energy and hence require material that has high impact resistance. The earlier vehicle models used an aluminum and steel reinforcement bar along with springs for protection. Nowadays, PP foam is used widely for bumper manufacturing due to its ruggedness and resistance to chemicals, acids, and bases.

Country Insights

The U.S. dominated the market in 2020 accounting for the largest revenue share of over 80%. According to the statistics released by the OICA, the U.S. is the prominent producer of cars and commercial vehicles in the North American region. Despite the pandemic, the country witnessed a rise in demand for pickup trucks in 2020. Ford Motor’s F-Series truck retained the dominance, followed by pickups from General Motors and Fiat Chrysler.

The automotive sector plays a significant role in Canada’s economy and is one of the largest manufacturing sectors in the country. The presence of global automotive OEMs, including General Motors, Honda Motor Co., Ltd., Ford Motor Company, TOYOTA MOTOR CORPORATION, and Stellantis N.V. has positioned Canada as one of the world’s top 12 producers of light vehicles. Moreover, the phasing out of tariffs on imported passenger vehicles under the Trans-Pacific Partnership trade deal is expected to drive the market for passenger vehicles and propel the market for automotive foams.

The automotive sector in Mexico is one of the major sectors contributing to the GDP. According to the International Trade Administration, it emerged as the sixth-largest passenger vehicle manufacturer in the world and the leading global exporter of HCVs. It is a prominent manufacturing hub for many global automotive players, including MAN SE, Cummins Inc., Scania AB AG, Mercedes-Benz AG, AB Volvo, and Isuzu Motors Ltd.

Key Companies & Market Share Insights

The market is competitive due to the presence of several global as well as medium- & small-scale regional players. Established players, such as Dow Inc., are collaborating with other companies to develop innovative solutions and for the development of their products portfolios. For instance, in June 2021, Dow, Inc. collaborated with leading automotive suppliers, Autoneum and Adient plc, to produce polyurethane foam from Voranol C and Specflex C sourced from a waste product of the mobility sector and replacing virgin fossil-fuel-based feedstock. Some of the prominent players operating in the North America automotive foams market are:

-

BASF SE

-

ARMACELL

-

Woodbridge

-

Wisconsin Foam Products

-

Dow Inc.

-

Rogers Corp.

-

American Excelsior, Inc.

-

Toray Plastics (America), Inc.

-

Bridgestone Corp.

-

Custom Foam Systems

-

Grand Rapids Foam Technologies

-

Saint-Gobain

North America Automotive Foams Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 2.52 billion

Revenue forecast in 2028

USD 3.26 billion

Growth rate

CAGR of 3.7% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2021 to 2028

Report coverage

Volume forecast, revenue forecast, company profiles, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, country

Regional scope

North America

Country Scope

U.S.; Canada; Mexico

Key companies profiled

BASF SE; ARMACELL; Woodbridge; Wisconsin Foam Products; Dow Inc.; Rogers Corp.; American Excelsior, Inc.; Toray Plastics (America), Inc.; Bridgestone Corp.; Custom Foam Systems; Grand Rapids Foam Technologies; Saint-Gobain

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the North America automotive foams market report based on type, application, end use, and country:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Polyurethane (PU) Foam

-

Polyolefin Foam

-

Ethylene Vinyl Acetate

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Ethylene Propylene Diene Monomer (EPDM)

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Seating

-

Arm and Head Rests

-

Headliners

-

Door Panels

-

Bumper System

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America automotive foams market size was estimated at USD 2.45 billion in 2020 and is expected to reach USD 2.52 billion in 2021.

b. The North America automotive foams market is expected to grow at a compound annual growth rate of 3.7% from 2021 to 2028 to reach USD 3.26 billion by 2028

b. Polyurethane (PU) foams dominated the product segment in the automotive foams market with a share of 77.58% in 2020. This is attributable to the robust physical properties of polyurethane in comparison to other polyolefin members like polypropylene, ethyl vinyl acetate, and ethylene propylene diene monomer.

b. Some key players operating in the North America automotive foams market include BASF SE; ARMACELL; Woodbridge; Wisconsin Foam Products; Dow Inc.; Rogers Corporation; American Excelsior, Inc.; Toray Plastics (America), Inc.; Bridgestone Corporation; Custom Foam Systems; Grand Rapids Foam Technologies; and Saint-Gobain

b. Key factors that are driving the North America automotive foams market growth include the flourishing automotive industry across North America, increasing demand for lightweight vehicles and hospitalization rate, and increasing consumer concerns regarding comfort in vehicles.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."