- Home

- »

- Petrochemicals

- »

-

North America Calcium Carbonate Market Size Report, 2030GVR Report cover

![North America Calcium Carbonate Market Size, Share & Trends Report]()

North America Calcium Carbonate Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Ground Calcium Carbonate, Precipitated Calcium Carbonate), By Application (Automotive, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-425-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

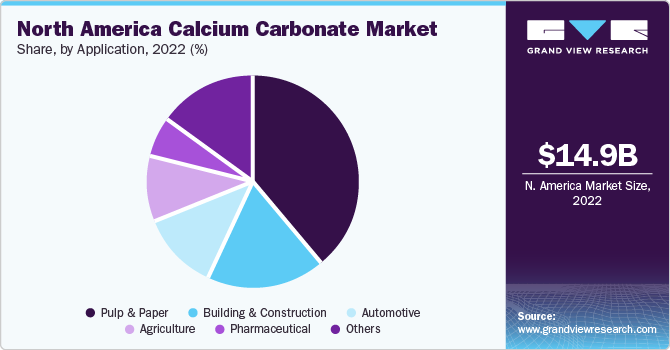

The North America calcium carbonate market size was valued at USD 14.91 billion in 2022 and is anticipated to grow at a CAGR of 5.8% over the forecast period. The market is anticipated to witness robust growth on account of its increasing use as an industrial filler in various applications. Along with increasing usage in the construction, paper, plastic industry, calcium carbonate is also used as a dietary supplement, additive for thermoplastics, and in various metalloid mineral applications. Product demand from the paper industry has grown rapidly in recent years, resulting from an overall increase in paper production.

Factors such as changing lifestyles and growing hygiene awareness have led to an increase in the consumption of paper, especially tissues, packaging paper, etc. This is expected to fuel the growth of the paper industry as well as the use of calcium carbonate over the next five years.

Moreover, rising demand for calcium carbonate in other industries such as dietary supplements, metalloid minerals, and additives in thermoplastics such as polyvinyl chloride (PVC) is projected to drive this growth further. Industrial filters are added to materials such as plastics, concrete, & composite materials to lower the cost of expensive binder materials or enhance the properties of the end product.

These factors are likely to hinder the market growth. Pulverized limestone-based rock dust is used in the coal mines to prevent underground coal dust explosions. The mine operators regularly spray rock dust on the floor, rib & roof areas of the coal mines. Large numbers of coal mines are present in North America, and the U.S. is one of the leading coal exporters, especially to Europe.

However, from the past few years, coal production in the U.S. has been decreasing as a reflection of increasing focus on renewable energy sources, and the same trend is expected to continue over the forecast period as well thus hampering rock dust demand over the forecast period.

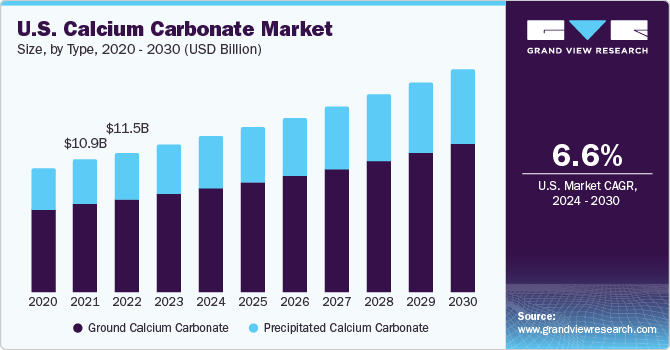

Product Insights

On the basis of product, the market is segmented into ground calcium carbonate and precipitated calcium carbonate. The ground calcium carbonate segment accounted for the largest revenue share of 35.3% in 2022. The increasing application of calcium carbonate in end-use industries, such as the automotive sector, where it serves as a filler material enhancing the strength, stiffness, and impact resistance of various automotive components, is expected to drive the growth of this segment.

The precipitated calcium carbonate (PCC) segment is expected to grow at the fastest CAGR of 6.0% during the forecast period. One of the major factors driving the demand for PCC is its extensive use in the paper industry. It is commonly used as a filler material in paper production to enhance paper properties such as brightness, opacity, smoothness, and printability.

Environmental regulations play a crucial role in driving the demand for precipitated calcium carbonate. In many industries, there is a growing need to reduce carbon emissions and minimize environmental impact. Precipitated calcium carbonate offers a sustainable alternative to other materials that have higher carbon footprints. For example, in the paper industry, using it as a filler reduces the reliance on wood pulp, which requires energy-intensive processes like logging and pulping. By substituting wood pulp with precipitated carbonate, companies can reduce their environmental footprint.

Application Insights

The pulp & paper segment accounted for the largest revenue share of 39.3% in 2022. Calcium carbonate is a widely used industrial filler in industries including paper, plastic, paints & coatings, etc., owing to its superior properties such as special white color used as a coating pigment, light scattering & high brightness, and inexpensiveness compared to wood flour or sawdust.

The automotive segment is expected to grow at the fastest CAGR of 6.7% during the forecast period. The demand for calcium carbonate is significantly influenced by the expansion of the automobile sector in North America. This region boasts a thriving automotive market and is home to significant automakers. High-quality materials that can boost the functioning and efficiency of vehicles are becoming more and more necessary as the automotive industry grows. For automotive applications, calcium carbonate is the best additive because of its high reinforcing capabilities, impact resistance, and dimensional stability, thereby propelling its market.

According to the International Organization of Motor Vehicle Manufacturers, in 2020, 14.5 million light vehicles were sold in the U.S. The U.S. ranks second in the world for both car manufacturing and sales. In 2020, the U.S. exported 1.4 million new light automobiles, 108,754 medium & heavy trucks, and automotive parts worth USD 66.7 billion to more than 200 markets worldwide. These exports totaled over USD 52 billion.

Calcium carbonate is used to produce calcium citrate (citric acid) which is used as a food additive, most commonly as a preservative, acidifier, and flavoring agent. It is also employed in some other applications such as cleaning agents, cosmetics, pharmaceuticals, and dietary supplements. Such a broad application scope of citric acid is expected to boost the North America calcium carbonate market growth further.

Regional Insights

The U.S. dominated the market and accounted for the largest revenue share of 77.4% in 2022 and is anticipated to grow at the fastest CAGR of 6.0 % during the forecast period. The resurgent growth in the building & construction, paper & plastic industry in the U.S. will boost the product use as industrial fillers. Moreover, the increased demand for the product in other industries such as dietary supplements, metalloid minerals, and additives in thermoplastics such as polyvinyl chloride (PVC) is projected to boost the market growth further.

Canada is expected to grow at a CAGR of 5.6% during the forecast period. Increased export levels of limestone from Canada, changing lifestyles, and increasing use of calcium carbonate in personal care products are projected to create opportunities for growth in this region. However, the sluggish industrial growth & slowing economy in Mexico and the strong consumption levels of the product in paper & plastic industries are expected to hinder market growth in the region.

Key Companies & Market Share Insights

PCC (Precipitated Calcium Carbonate), as the most valuable and high-quality product, faces limited availability worldwide due to its exclusive production by a select few companies operating at the regional and country levels. Consequently, the global trade of PCC is primarily conducted through the key suppliers who dominate the market.

Satellite plants cater to paper mills, the largest end-user segment. Other segments such as paints, plastics, etc. are provided through national-level manufacturers. Key market players have focused on establishing on-site production facilities, especially to supply high-quality precipitated calcium carbonate (PCC) to paper mills.

The Sahuarita manufacturing facility expands Cimbar's product line and is expected to help it serve clients from a number of locations while ensuring optimal product security, availability, and business continuity. Some of the major market participants in North America calcium carbonate market include:

-

Imerys

-

Parchem fine & specialty chemicals

-

Omya AG

- Mineral Technologies, Inc.

Recent Developments

-

In April 2023, Minerals Technologies Inc. announced that it has signed three long-term contracts for the supply of precipitated calcium carbonate (PCC), which would allow the company to increase the scope of its Specialty Additives product line in China and India. The agreements are for the construction and operation of satellite precipitated calcium carbonate (PCC) plants on-site with Andhra Paper Limited, Nine Dragons Paper, and Zhefeng New Materials Company, three significant paper businesses.

-

In October 2022, Omya AG revealed its plans to strengthen its presence in North America by acquiring Hall Technologies, a distributor of specialty chemicals.

-

In August 2022, Imerys unveiled a multi-million investment strategy aimed at enhancing capacity in its Southeast Ground-Calcium-Carbonate division at the Marble Hill (GA) plant. This strategic expansion aims to support the growing building and construction sectors, including coatings, roofing, joint compound, and flooring applications.

-

In August 2022, Cimbar Resources Inc. announced that it had completed the acquisition of Imerys Manufacturing facilities for calcium carbonate in Sahuarita, Arizona.

North America Calcium Carbonate Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.70 billion

Revenue forecast in 2030

USD 23.48 billion

Growth rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in kilo tons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Imerys; Parchem fine & specialty chemicals; Omya AG; Mineral Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Calcium Carbonate Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America calcium carbonate market based on product, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Ground Calcium Carbonate

-

Precipitated Calcium Carbonate

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Pharmaceutical

-

Agriculture

-

Pulp & Paper

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

- Mexico

-

-

Frequently Asked Questions About This Report

b. north america calcium carbonate market size was estimated at USD 14.91 billion in 2022 and is expected to reach USD 15.70 billion in 2023.

b. north america calcium carbonate market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 23.48 billion by 2030.

b. The U.S. dominated the market and accounted for the largest revenue share of 77.4% in 2022 and is anticipated to grow at the fastest CAGR of 6.0 % during the forecast period.

b. Imerys; Parchem fine & specialty chemicals; Omya AG; Mineral Technologies, Inc.

b. The market is anticipated to witness robust growth on account of its increasing use as an industrial filler in various applications

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.