- Home

- »

- Plastics, Polymers & Resins

- »

-

North America & Europe Cold Chain Packaging Materials Market Report, 2030GVR Report cover

![North America And Europe Cold Chain Packaging Materials Market Size, Share & Trends Report]()

North America And Europe Cold Chain Packaging Materials Market Size, Share & Trends Analysis Report By Material (Plastics, Metal, Paper), By Product, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-596-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

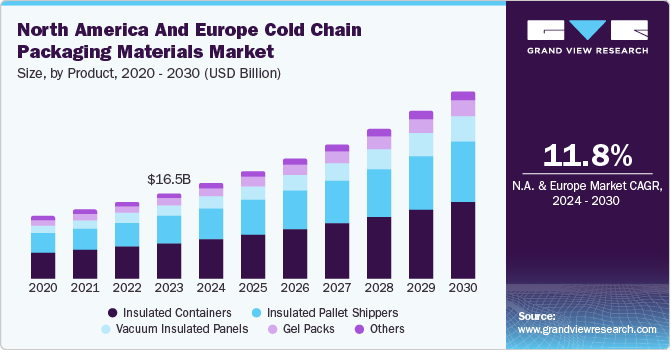

The North America and Europe cold chain packaging materials market size was valued at USD 16.48 billion in 2023 and is projected to grow at a CAGR of 11.8% from 2024 to 2030. The rise of biologics, vaccines, and other temperature-sensitive drugs necessitates reliable cold chain logistics to ensure product integrity from production to the end user. Moreover, the expansion of personalized medicine, which involves highly sensitive biological materials, further emphasizes the need for specialized cold chain packaging materials across these regions.

As consumers become more health-conscious and seek high-quality, sustainably sourced seafood, maintaining product freshness and safety from harvest to retail is essential. The expansion of the global seafood trade and the rising popularity of online seafood sales further boost the need for advanced cold chain packaging solutions to preserve these products' quality during long-distance transportation and storage. Regulatory requirements in both regions also emphasize the need for effective cold chain management to prevent spoilage and ensure food safety, leading to increased investment in innovative and sustainable packaging materials. For instance, in June 2024, IFCO launched Marina, the smart reusable IFCO Fish Crate. It is developed to increase protection, efficiency, and sustainability in the fresh seafood supply chain. The crate is part of the IFCO SmartCycle pooling system, which ensures a switch to sustainable packaging for producers, wholesalers, and retailers. It incorporates functionalities such as Bluetooth low energy tags for tracking and tracing and QR codes.

The rising demand for convenience foods, including ready-to-eat meals, frozen foods, and packaged fresh produce, drives North America and Europe's cold chain packaging materials market. Consumers' busy lifestyles, with the need for quick and easy meal solutions, have led to increased consumption of these products, requiring temperature-controlled environments. Cold chain packaging materials play a critical role in preserving the quality and safety of these convenience foods, ensuring they remain fresh from production to consumption.

Material Insights

The plastics segment dominated the market and accounted for a share of 77.7% in 2023. Plastics are dominant in cold chain packaging due to their cost-effectiveness and versatility. In these regions, the demand for economical packaging solutions produced at scale drives the use of plastics. They offer various properties essential for cold chain logistics, such as durability, lightweight, and excellent insulation capabilities. Plastics are easily molded into different shapes and sizes, allowing manufacturers to create customized packaging solutions that meet specific cold chain requirements.

The paper segment is expected to register the fastest CAGR during the forecast period. Companies increasingly prefer eco-friendly packaging options due to concerns about plastic pollution and environmental impact. Paper is biodegradable, recyclable, and sourced from renewable resources, making it a suitable alternative to plastic. Moreover, the shift in consumer preferences towards eco-friendly and sustainable paper cold chain packaging products drives the market demand in North America and Europe. Consumers are increasingly aware of the environmental impact of their purchases and are demanding products packaged in less harmful materials.

Product insights

The insulated containers segment accounted for the largest market revenue share in 2023. Vaccines, biologics, fresh produce, and seafood require precise temperature control during transportation and storage to maintain their quality and efficacy. Insulated containers offer superior thermal protection and ensure that these goods remain within the required temperature ranges, thus minimizing the risk of spoilage or degradation. The ongoing expansion of the pharmaceutical and biotechnology sectors, especially with biologics and personalized medicine growth, is fueling the demand for these specialized containers.

The vacuum insulated panels segment is expected to witness the fastest CAGR over the forecast period. With the growing consumer demand for fresh and high-quality food products, there is an increased need for reliable insulation solutions that maintain product freshness during transportation. Vacuum insulated panels provide the necessary thermal protection to extend the shelf life of perishable goods, reduce food waste, and ensure that products reach consumers in optimal condition. This demand is high in e-commerce, where delivering temperature-sensitive food items directly to consumers has become more prevalent.

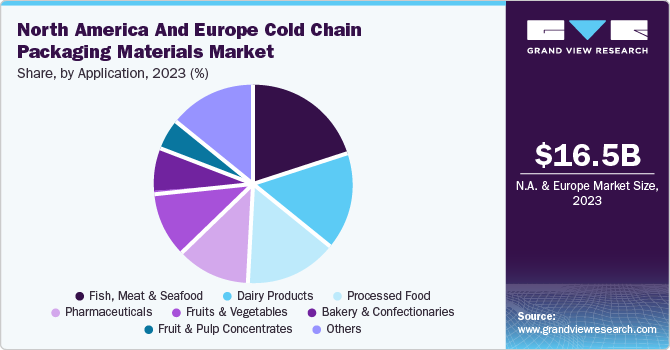

Application Insights

The fish, meat & seafood segment accounted for the largest market revenue share in 2023. North America and Europe have a growing consumer preference for fresh and high-quality fish, meat, and seafood. As more people prioritize healthy eating and pursue premium products, the demand for cold chain packaging materials that maintain the freshness and safety of these perishable goods is on the rise. Consumers prefer a premium for fresh products with a longer shelf life, driving the need for advanced packaging solutions to prevent spoilage and contamination during transportation and storage.

The pharmaceuticals segment is anticipated to register the fastest CAGR over the forecast period. Biopharmaceuticals, including vaccines and cell and gene therapies, require strict temperature control to maintain efficacy. These products are highly sensitive to temperature fluctuations and are generated ineffective if exposed to conditions outside their prescribed storage range. As the biopharmaceutical sector continues to expand, particularly with the growth of personalized medicine and advanced therapies, the demand for specialized cold chain packaging materials that ensure these products' safe transportation and storage is increasing.

Regional Insights

North America cold chain packaging material market accounted for the largest revenue share of 52.6% in 2023. As North America continue to import and export large volumes of perishable goods, there is an increased need for reliable insulated containers that protect products during long-distance transportation. The expansion of e-commerce, particularly in the food and pharmaceutical sectors, has also led to an increased demand for insulated packaging solutions that ensure the safe delivery of temperature-sensitive products directly to consumers. This trend is expected to continue, further drive the demand for cold chain packaging material in North America.

U.S. Cold Chain Packaging Materials Market Trends

The U.S. cold chain packaging material market accounted for the largest revenue share in 2023. The aging population in the U.S. is leading to increased healthcare expenditures, particularly on pharmaceutical products that require cold chain logistics. Due to the geriatric population, chronic diseases are more prevalent, driving demand for biologics, vaccines, and other temperature-sensitive medications. This demographic trend is expected to continue, fueling the need for robust cold chain packaging materials that ensure the safe delivery of critical healthcare products.

Europe Cold Chain Packaging Materials Market Trends

Europe cold chain packaging material market is expected to witness significant growth over the forecast period. The increasing consumption of processed and convenience foods in Europe has increased demand for cold chain logistics. Urbanization, changing lifestyles, and the growing preference for ready-to-eat meals have fueled the need for efficient cold chain packaging to ensure the freshness and safety of these products. This trend is strong in countries such as Germany, France, and the UK, where there is high demand for packaged and processed foods.

The UK cold chain packaging material market is expected to witness significant growth over the forecast period. The food and beverage sectors in the UK are witnessing a surge in demand for fresh, organic, and processed food products that require cold chain logistics. Consumers' increasing preference for high-quality, perishable goods has driven the need for effective temperature-controlled packaging solutions. The rise of online grocery shopping and food delivery services has further fueled this demand. Companies are increasingly investing in cold chain packaging materials that ensure the safe transportation of perishable items and reduce food waste.

Key North America And Europe Cold Chain Packaging Materials Company Insights

Key players inNorth America and Europe cold chain packaging materialsmarket include Cold Chain Technologies, Sonoco ThermoSafe, Pelican Products, Inc., Inmark Global Holdings, LLC. and others.

-

Cold Chain Technologies (CCT) is a prominent global provider specializing in reusable and sustainable thermal packaging solutions. The company's products are categorized into Parcel Shippers, Pallet Shippers, Thermal Covers, and Monitoring Solutions.

-

Pelican Products, Inc., is a global company specializing in designing and manufacturing high-performance protective cases, advanced lighting systems, and temperature-controlled packaging solutions. Through its Pelican BioThermal division, Pelican offers a range of temperature-controlled packaging solutions in the cold chain market, including reusable and single-use temperature-controlled shippers, gel packs, and phase change materials.

Key North America And Europe Cold Chain Packaging Materials Companies:

- Cold Chain Technologies

- Cryopak

- Sonoco ThermoSafe

- SOFRIGAM

- Pelican Products, Inc.

- CSafe

- TOWER Cold Chain Solutions.

- Sealed Air

- CoolPac.

- Nordic Cold Chain Solutions.

- Global Cooling, Inc.

- Inmark Global Holdings, LLC.

- Envirotainer

- Intelsius

Recent Developments

-

In August 2024, VPL Rx and Cold Chain Technologies partnered to improve the shipment of temperature-sensitive medications. The partnership aims to provide a value-added service for VPL Rx's pharmacy customers. It provides VPL Rx customers with seasonal pack-out guidance, reliable thermal packaging solutions, real-time tracking, economical shipping options, and exportable metrics, all incorporated into the VPL Rx platform.

-

In May 2024, Ranpak Holdings Corp. launched Climaliner Plus, temperature-protective paper liners developed for cold chain shipping. The liners are made from paper and can be fully recycled through curbside recycling. They provide up to 72 hours of thermal protection and are safe for secondary food contact. Food, beverage, and healthcare companies utilize these liners to transport temperature-controlled goods.

North America And Europe Cold Chain Packaging Materials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.46 billion

Revenue forecast in 2030

USD 36.05 billion

Growth Rate

CAGR of 11.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, Product, Application, and Region

Regional scope

North America; Europe

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain

Key companies profiled

Cold Chain Technologies; Cryopak; Sonoco ThermoSafe; SOFRIGAM; Pelican Products, Inc.; CSafe; TOWER Cold Chain Solutions; Sealed Air; CoolPac.; Nordic; Cold Chain Solutions.; Global Cooling, Inc.; Inmark Global Holdings, LLC.; Envirotainer; Intelsius

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America And Europe Cold Chain Packaging Materials Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America and Europe cold chain packaging materialsmarket report based on material, type, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyethylene Terephthalate (PET)

-

Expanded Polystyrene (EPS)

-

Polyurethane (PU)

-

Others

-

-

Metal

-

Paper

-

-

Product Outlook (Revenue; USD Million, 2018 - 2030)

-

Insulated Pallet Shippers

-

Insulated Containers

-

Vacuum Insulated Panels

-

Gel Packs

-

Others

-

-

Application Outlook (Revenue; USD Million, 2018 - 2030)

-

Fruits & Vegetables

-

Fruit & Pulp Concentrates

-

Dairy Products

-

Fish, Meat & Seafood

-

Processed Food

-

Pharmaceuticals

-

Bakery & Confectionaries

-

Others

-

-

Regional Outlook (Revenue; USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."