- Home

- »

- Advanced Interior Materials

- »

-

North America Extrusion Machinery Market Size, Report, 2030GVR Report cover

![North America Extrusion Machinery Market Size, Share & Trends Report]()

North America Extrusion Machinery Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Single-Screw, Twin-Screw), By Material (Plastics, Metals), By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-034-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

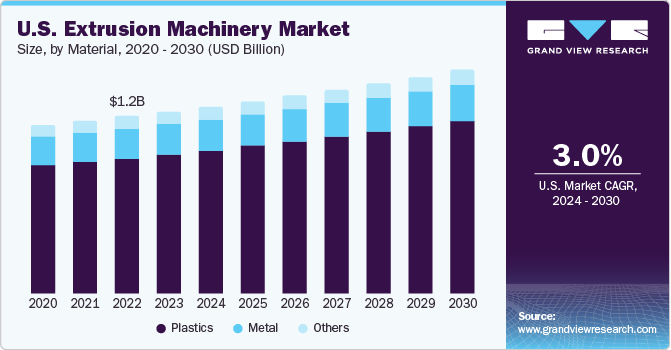

The North America extrusion machinery market size was estimated at USD 1,700.3 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.0% from 2024 to 2030. The demand for extrusion machinery in plastics is rising, owing to the ability of plastics to be formed into complex shapes and the relative ease compared to metals or ceramics. Moreover, increased usage of engineering-grade plastics for producing pipe, fencing, window frames, plastic films, wire insulation, and deck railing is anticipated to grow during the forecast period. Increasing investments in electrifying North American transportation systems will further create new opportunities for extruder manufacturers.

Increasing demand for packaging products used in the processed food & beverages and consumers goods industries is projected to fuel the adoption of extruded products, such as pouches, wraps & films, and bags in the U.S. This will drive the industry growth. The flourishing e-commerce industry owing to the rising inclination toward online shopping in the country is expected to drive the demand for extruded plastic products. This is anticipated to lead to a rise in demand for extrusion machinery in the U.S. over the forecast period. Household appliances have been the largest application segment of plastics in the past few years.

Expanding urban settlements, increasing immigration, and ongoing fast-paced modern lifestyles are expected to positively impact the demand for household appliances over the forecast period. The U.S. - China trade war created opportunities for extrusion product manufacturers, as tariffs levied on imports from China that were cheaper increased the demand for U.S.-made products. Moreover, the pandemic prompted metal and plastic part manufacturers to resort to automation and increase the use of robotics in manufacturing. The manufacturing of household appliances is likely to boost the U.S. market growth.

Increased investment in electrifying the U.S. road transportation system will create new opportunities for extruder manufacturers. For instance, in October 2022, ENTEK received a USD 200 million grant from the U.S. Department of Energy (DOE) for the construction of a new lithium separator plant in the U.S. The investment will improve ENTEK’s current production capacity to supply material for 1.4 million electric vehicles annually. The growing EV industry in the U.S. is expected to increase the demand for plastic and aluminum extruded components and in turn, is likely to increase the demand for extruders in the country.

The construction sector in Canada is anticipated to grow significantly in the forecast period as a result of the growing population, ongoing urbanization, and increasing immigration rates in the country. The surge in the number of service-providing firms in the country is expected to fuel the demand for office spaces, thereby increasing commercial construction activities in Canada. This rise in the number of commercial construction activities in the country is expected to augment the market growth of the Canada during the forecast period.

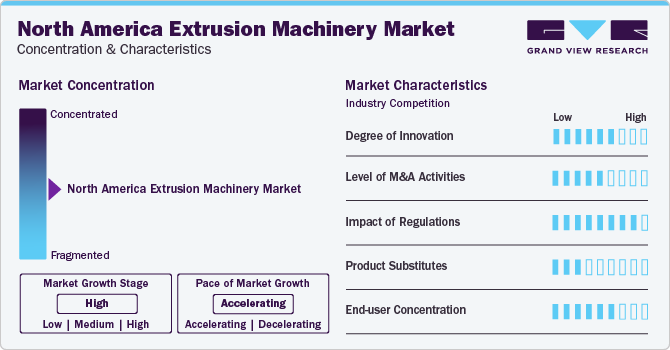

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including increasing the reach of their products in the market and enhancing the availability of their products & services in diverse geographical areas. Key market players adopting this inorganic growth strategy include KraussMaffei; Milacron, LLC; and The Japan Steel Works, LTD., Milacron, LLC, BC Extrusion Holding GmbH, and Graham Engineering.

Stringent regulations, aimed at ensuring product quality, safety, and environmental sustainability, have a profound impact on the design, manufacturing, and operation of extrusion machinery in the region. Compliance with standards set by regulatory bodies necessitates continuous innovation and adaptation within the industry, driving manufacturers to invest in research and development.

The market exhibits a notable degree of innovation, driven by factors such as technological advancements, changing consumer demands, and competitive pressures. Manufacturers in the region continuously strive to enhance the efficiency, versatility, and sustainability of extrusion machinery. Innovations in materials, process control systems, and automation have played a pivotal role in improving overall performance and output quality. The integration of smart technologies, data analytics, and Industry 4.0 principles has led to the development of more sophisticated and interconnected extrusion systems.

End-users, spanning various sectors such as packaging, construction, automotive, and consumer goods, are actively seeking extrusion machinery that not only meets standard manufacturing needs but also addresses specific challenges unique to their applications. In addition, the level of automation and integration of digital technologies within extrusion machinery is also becoming a critical consideration for end-users looking to optimize production processes and improve overall operational efficiency.

Material Insights

Based on material, the plastics segment led the market with the largest revenue share of 76.5% in 2023. Plastic materials are extensively used in the extrusion process owing to their ability to be formed into complex shapes and their relative ease compared to metals or ceramics. Factors such as lightness in weight, high tensile strength, corrosion resistance, chemical resistance, and high-temperature endurance have led to the surged usage of engineering-grade plastics for producing pipe, fencing, window frames, plastic films, wire insulation, and deck railing.

The metal extrusion is a forming process wherein metals are forced through a die of the desired cross-section. The material arising from the die is called an extrudate. Factors affecting the quality of extrusion parts include die design, billet temperature, extrusion ratio, extrusion speed, and lubrication. There are various types of metal extrusion processes including cold extrusion, hot extrusion, friction extrusion, and micro extrusion.

Type Insights

Based on type, the single-screw segment led the market with the largest revenue share of 60.7% in 2023, as they offer continuous output, compact design, low noise emission, low cost, and easy operation. Single screw extruders are mainly used in plastic forming. Thermoplastics are the largest group of plastic materials extruded through single screw extruders.

The twin screw extrusion machinery has a high level of process flexibility along with the capability to handle numerous processes including mixing, melting, cooking, cooling, and venting. This machinery is highly energy efficient as it has about 30% lower power consumption than a single screw extruder. Twin screw extrusion machinery offers numerous advantages such as excellent compounding ability, easy material feeding, excellent exhaust ability, and high productivity.

Application Insights

In terms of application, the pipe and profiles segment led the market with the largest revenue share of 42.4% in 2023. The extrusion process allows for the continuous production of pipes and profiles of various sizes and shapes made of different materials, such as metal, plastic, and rubber. These pipes and complex profiles are used in different industries, such as oil & gas, chemical, and construction.

The demand for food-grade engineered plastics is expected to grow in the forecast period, to cater to the packaging needs of the food processing industry. Compounds are effectively manufactured by using the plastic extrusion process. Demand for extrusion machinery is likely to increase over the forecast period, due to the growing demand for engineered plastics.

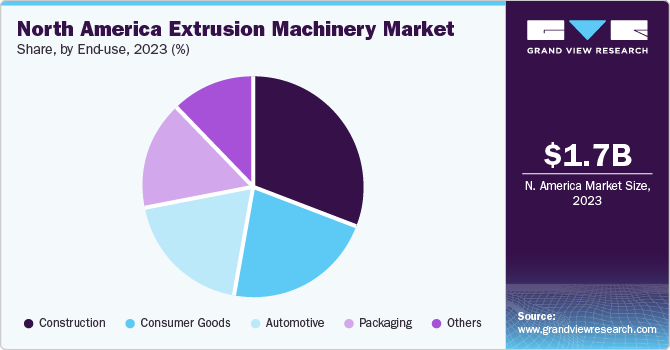

End-use Insights

Based on end-use, the construction segment led the market with the largest revenue share of 31.1% in 2023. The growth of the construction industry in the U.S. and Canada has resulted in an increased demand for extruded products, including window frames, curtain walling, door frames, roofing & exterior claddings, canopies, space frame systems, and arches, thereby driving the demand for extrusion machinery in the construction industry.

The growing population and the increasing disposable income of population in the U.S. & Canada further fuel retail spending. This contributes to the rise in demand for consumer durables that use plastic films & sheets and thermoplastic coatings, thereby surging the demand for extrusion machinery in North America. Increasing production of consumer goods is expected to boost the demand for plastic extrusion in furniture, refrigerators & freezers, toys, sporting & athletic goods, etc. over the forecast period. Hence, with the growing demand for consumer goods, the demand for plastic extrusion machines is anticipated to increase over the forecast period.

Country Insights

The U.S. dominated the North America market with the revenue share of 75.4% in 2023. Growing construction activities in the residential and non-residential sectors are projected to drive the demand for extruded products used in window frames, curtain walls, door frames, roofing & exterior claddings, canopies, space frame systems, and arches in the U.S. The increasing demand for extruded products from the construction industry is projected to have a positive impact on the market growth of the U.S. over the forecast period.

The construction industry in Canada is expected to grow the significant CAGR over the forecast period, owing to the increasing population, ongoing urbanization, and surging immigration rate in the country. The increase in the number of service-providing firms in Canada is expected to fuel the demand for office spaces, thereby driving commercial construction activities in the country. In addition, the improved domestic manufacturing activities in Canada are expected to lead to increased industrial building development projects. This, in turn, is anticipated to surge the demand for extruded products in the country over the forecast period.

Key North America Extrusion Machinery Companies:

The following are the leading companies in the north america extrusion machinery market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these north america extrusion machinery companies are analyzed to map the supply network.

- KraussMaffei

- Milacron, LLC

- The Japan Steel Works, LTD.

- NFM / Welding Engineers, Inc.

- BC Extrusion Holding GmbH

- Davis Standard

- Extrusion Technik USA, Inc

- Graham Engineering

- Wenger Manufacturing

- AMUT S.P.A.

Recent Developments

-

In December 2023, KraussMaffei Extrusion GmbH has unveiled the recently redesigned ZE 28 BluePower laboratory extruder. This extruder delivers enhanced performance by boasting swift availability, an appealing price point, and notable improvements in user-friendliness

-

In July 2022, Graham Engineering Acquires Kennedy Tool & Die. Kennedy will remain to have operations in Birdsboro and will offer key contributions to Graham Engineering’s maintenance business. The acquisition will help the company to support its consumers throughout the life of its extrusion system

North America Extrusion Machinery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,746.5 million

Revenue forecast in 2030

USD 2,089.1 million

Growth rate

CAGR of 3.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, end-use, application, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

KraussMaffei; Milacron; LLC; The Japan Steel Works, LTD.; NFM / Welding Engineers, Inc.; BC Extrusion Holding GmbH; Davis Standard; Extrusion Technik USA, Inc; Graham Engineering; Wenger Manufacturing

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Extrusion Machinery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the North America extrusion machinery market report based on material, type, end-use, application, and country:

-

Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Plastics

-

Metal

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-Screw

-

Twin Screw

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Consumer Goods

-

Automotive

-

Packaging

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pipe & Profiles

-

Compounding

-

Sheet/Roof

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. U.S. dominated the market in 2023 by accounting for a share of 75.4% of the market. The increasing demand for extruded products from the construction industry is projected to have a positive impact on the growth of the U.S. extrusion machinery market over the forecast period.

b. The North America extrusion machinery market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.0% from 2024 to 2030 to reach USD 2,089.1 million by 2030

b. North America extrusion machinery market size was estimated at USD 1,700.3 million in 2023 and is expected to be USD 1,746.5 million in 2024.

b. Some of the key players operating in the North America extrusion machinery market include KraussMaffei, Milacron, LLC, The Japan Steel Works, LTD., NFM / Welding Engineers, Inc., BC Extrusion Holding GmbH, Davis Standard, Extrusion Technik USA, Inc, Graham Engineering.

b. The demand for extrusion machinery, which is used in processes such as plastic extrusion for manufacturing pipes, profiles, and films, has been fueled by the expansion of industries such as construction, packaging, and automotive in both countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.