- Home

- »

- Clothing, Footwear & Accessories

- »

-

North America Footwear Market Size, Industry Report, 2030GVR Report cover

![North America Footwear Market Size, Share & Trends Report]()

North America Footwear Market Size, Share & Trends Analysis Report By Type (Athletic, Non-athletic), By End-use (Men, Women, Children), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-211-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

North America Footwear Market Trends

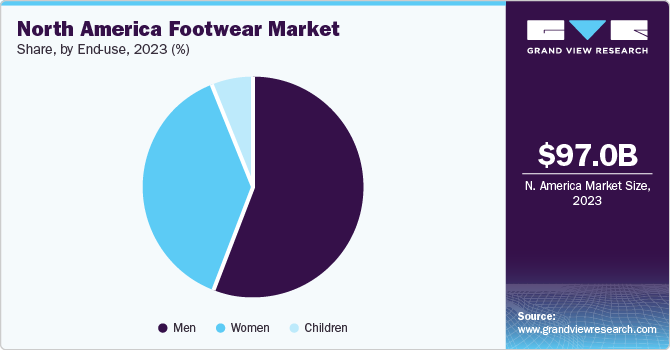

The North America footwear market size was estimated at USD 97.00 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 3.5% from 2024 to 2030.The increasing demand for stylish and comfortable footwear among consumers is fueling the market. The growing popularity of sports such as football, basketball, and various snow sports is expected to create strong opportunities for the growth of the market over the forecast period. Furthermore,the rising instances of lifestyle-related health issues, such as stress and obesity, are pushing an increasing number of people to engage in sports and fitness activities, which is fueling the demand for comfortable and stylish footwear.

The North America market accounted for a share of 24.1% of the global footwear market in 2023. A high concentration of footwear manufacturers in the U.S. and the rest of North America is a key factor driving the market. Big players such as Nike, VF Corporation, Under Armour, New Balance, and Skechers USA, Inc. are headquartered in the U.S., where product innovations and research & development are incorporated and new products are launched every year. Major manufacturers are adopting various marketing strategies, including expanding distribution channels, entering the e-commerce space, and collaborating with celebrities, to gain maximum customer penetration.

The increased demand for sustainable footwear is a trend that is gaining traction in the global market. According to the U.S. Department of the Interior, around 20 billion pairs of footwear are created annually and approximately 300 million end up in the landfills, with a majority of them containing non-biodegradable materials including synthetic rubber, EVA foam, PU, and PVC. There has been a growth in the use of sustainable materials and of sustainable footwear brands that have built sustainability into their brands from their inception. For instance, Nike with Nike Grind experimented with breaking down footwear into pellets, turning them into material for flooring instead of new footwear.

The global footwear industry is a multibillion-dollar industry, with the U.S. accounting for a large portion of annual revenues. Every year, Americans give more than half of their income to shoe manufacturers, retailers, and distributors. It is also a part of the overall clothing and apparel sector, selling athletic, luxury, and sporting shoes to customers. Sneakers make up a sizable portion of the industry as well. Popular companies such as Nike, Adidas, Puma, Skechers, and Timberland dominate this business. Their marketing initiatives are flawlessly executed and earn millions of dollars in income, allowing for market expansion.

Market Concentration & Characteristics

The North America footwear market is characterized by moderate degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings.Players in the market are focusing on enhancing the comfort and performance of players. In October 2020, Adidas developed a new technology - Strung - the first textile technology that transforms athlete data into dynamic performance material. The company says it wants this to be the most data-informed textile, based on foot anatomy and athlete movement. The first shoe made using the new technology is expected to be available by late 2021/early 2022.

The industry is also characterized by a high level of merger and acquisition (M&A) activity by the leading players.Companies are trying to maximize market penetrationteam sponsorships, and partnerships with athletes of various sports.With an aim to expand product visibility, especially in emerging markets, manufacturers are showcasing their products across online platforms, such as company-owned portals as well as third-party retailers. Omnichannel is the new strategy that all major manufacturers have been incorporating in their functions.

End-user concentration is a significant factor in the North America footwear market.The increasing number of females participating in sports is also driving the demand for footwear, mainly shoes.Consumers consider factors like comfort, durability, affordability, brand name, style, materials used, and ethical production while purchasing a footwear product. Several companies are reaching a wider consumer base using social media and listing their products in several marketplaces. The increasing penetration of the internet is helping companies boost their product visibility across regions.Moreover, the increasing number of sports sponsorships and partnerships is helping companies spread brand awareness and increase their product offerings.

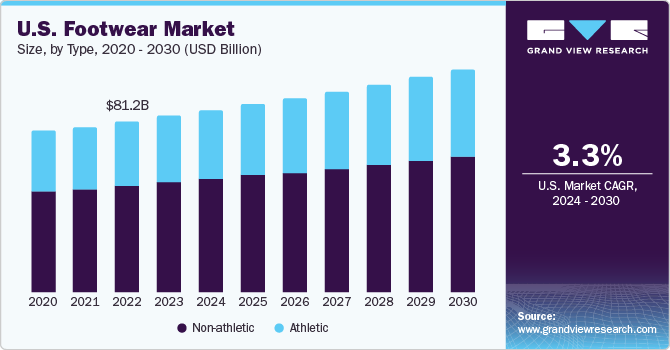

Type Insights

The non-athletic footwear market accounted for a revenue share of 62.2% in 2023.Non-athletic footwear is a broad category and comprises fashion footwear, formal footwear, and casual footwear. Niche companies and startups as well as independent designers are launching products in the sustainable category to target mass consumers and gain traction. Including a range of sneakers is one of the key priorities in the non-athletic segment. For instance, the Converse Renew collection consists of customizable sneakers that are made using recycled plastic bottles.

The athletic footwear category is projected to grow at a CAGR of 4.0% from 2024 to 2030.The increasing participation of women and kids in sports and fitness activities is likely to create a significant demand for athletic footwear over the forecast period. Major manufacturers are launching new products in the region to attract customers.

End-use Insights

The men’s footwear category accounted for a revenue share of 55.6% in 2023. Celebrity endorsements, social media campaigns, and advertising to create awareness of the variety of footwear available in the market have been fueling the growth of this segment. The growth of the men’s segment is also attributed to various product launches within the sustainable footwear space. For instance, in August 2020 New Balance—in collaboration with Casablanca— introduced a sustainable iteration of its 327 silhouette. The 327 “Undyed” arrives without any pigmentation or coloration, saving water, energy and waste in the production process.

The women’s footwear category is projected to grow at a CAGR of 4.0% from 2024 to 2030.The growing number of working women is likely to create a significant demand for long-lasting, comfortable, and stylish footwear over the forecast period. According to data from the United States Department of Labor, in 2018, women constituted approximately 45% of the workforce in the U.S., including hospitality, tourism, pharmaceuticals, and civil engineering. This is expected to increase the spending power of women on footwear products. The women’s end-user segment is projected to progress at a CAGR of 4.4% over the forecast period.

Country Insights

The growth of the North America market is attributed to the rising demand for comfortable and trendy footwear, coupled with the rising number of the working population in the region.

U.S. Footwear Market Trends

The footwear market in the U.S. is projected to grow at a CAGR of 3.3% from 2024 to 2030. In 2020, the U.S. imported 5.7 pairs of shoes for every man, woman, and child in the country, and annual sales topped USD 76.9 billion. Starting from the place where shoes are sold to the styles and trends that consumers want to buy, footwear retail has changed tremendously. Footwear firms invest tens of millions of dollars each year in their employees, stores, and platforms to ensure that they provide high-quality shoes on time—in fact, the footwear industry has one of the world's most resilient supply chains.

Canada & Mexico Footwear Market Trends

The growth of the footwear markets in Canada and Mexico, most particularly athletic footwear, can be attributed to the growing consumer awareness regarding healthier and active lifestyles. The availability of trendy and fashionable footwear in the region, coupled with rising consumer spending, is anticipated to fuel market growth. Sneakers remain dominant among men’s footwear in the region, with skate and runner styles among the most popular subcategories.

Key North America Footwear Company Insights

The North America footwear market is characterized by the presence of several well-established players such as Nike, Inc.; Adidas AG.; PUMA; Timberland; Skechers USA, Inc.; and Under Armour Inc. These players account for a considerable market share and have a strong presence in the region. Companies in the market are focusing on collaborations to introduce innovative products to address the evolving needs of customers and to gain a competitive edge over other manufacturers.

Key North America Footwear Companies:

- Nike, Inc.

- Adidas AG

- Puma

- Timberland

- Skechers U.S.A., Inc.

- Under Armour, Inc

- Under Armour, Inc

- ASICS

- VF Corp

- Wolverine World Wide, Inc.

- Crocs Retail, LLC

North America Footwear Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 100.12 billion

Revenue forecast in 2030

USD 122.87 billion

Growth rate

CAGR of 3.5% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America

Country scope

U.S., Canada, Mexico

Key companies profiled

Nike, Inc.; Adidas AG; Puma; Skechers; ASICS; Under Armour; VF Corp; Wolverine World Wide, Inc.; Crocs Retail, LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Footwear Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis on the latest trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the North America footwear market report based on type, end-use, and country:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Athletic

-

Non Athletic

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

Children

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Canada

-

U.S.

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America footwear market size was estimated at USD 97.00 billion in 2023 and is expected to reach USD 100.12 billion in 2024.

b. The North America footwear market is expected to grow at a compound annual growth rate of 3.5% from 2024 to 2030 to reach USD 122.87 billion by 2030.

b. The U.S. dominated the North America footwear market with a share of 86.2% in 2023. This is attributable to the growing demand for athletic footwear among women and children, along with the increasing population of working women in the country.

b. Some key players operating in the North America footwear market include Nike, Inc., Adidas AG, Puma, Skechers, ASICS, Under Armour, VF Corp, Wolverine World Wide, Inc., and Crocs Retail, LLC.

b. Key factors that are driving the market growth include increasing demand for fashionable and comfortable footwear and the growing participation of women and children in sports and fitness activities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."