- Home

- »

- Renewable Chemicals

- »

-

North America Glycerol Market Size & Trends Report, 2033GVR Report cover

![North America Glycerol Market Size, Share & Trends Report]()

North America Glycerol Market Size, Share & Trends Analysis Report By Type (Refined, Crude), By Raw Material (Biodiesel, Fatty Acids, Soap, Fatty Alcohols), By Source (Plant, Animal, Synthetic), And Segment Forecasts, 2023 - 2033

- Report ID: GVR-4-68040-136-0

- Number of Report Pages: 107

- Format: PDF, Horizon Databook

- Historical Range: 2013 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

Market Size & Trends

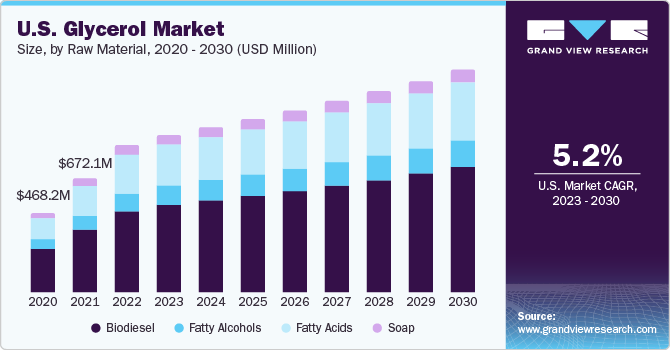

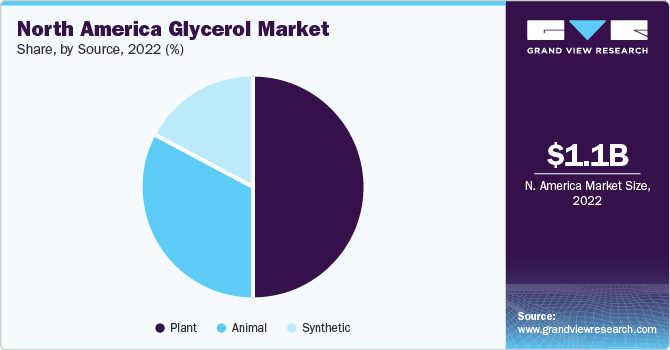

The North America glycerol market size was estimated at USD 1.13 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2033. This is attributed to its wide utilization for improving hydration and performance levels in athletes and relieving constipation. Moreover, the product demand is likely to rise in the coming years as it is easy to store and does not harm the environment. The increasing consumer awareness regarding naturally sourced products and the high demand for biodiesel have resulted in a significant rise in demand for the product across the globe. The product is extensively utilized in various cosmetic formulations and personal care products, including body wash, hair conditioners, moisturizers, shampoos, and toothpaste.

It helps in smoothening the skin by providing moisture to the surface of the skin. It is regulated as Generally Recognized as Safe (GRAS) by the U.S. FDA for use in various skincare products. Glycerol (C3H8O3) is widely used as a flavoring agent in beverages and as a softening agent in confectionaries in the food & beverages industry. It is used as an artificial sweetener owing to the presence of high-calorie content. The U.S. FDA has approved the use of the product as a caloric macronutrient. Favorable government regulations in North America, coupled with flourishing end-use industries, are expected to augment the demand for the product market in the region over the forecast period.

Glycerol can be produced by using different feedstock and processes. It can be obtained using propylene synthesis in several ways, by the hydrolysis of oil or by transesterification of fatty acids/oils. The hydrolysis process involves the interaction between triglycerides and alkaline hydroxides, such as caustic soda, resulting in the formation of glycerol and soap. In the transesterification reaction, glycerol and fatty esters (or biodiesel) are produced through the reaction of methanol with triglycerides. Crude form of the C3H8O3 is a major byproduct of biodiesel manufacturing from crops and other oils derived from biomass. Each batch of biodiesel yields approximately 10% crude glycerol.

The renewable energy sector is rapidly advancing, aiming to reduce the reliance on conventional fossil fuels like oil and natural gas. According to the IEA’s report on the COP26 Climate Change Conference, an expected surge of 50% in renewable capacity is projected between 2021 and 2026, propelled by robust governmental backing for clean energy initiatives and the transition away from non-renewable resources. According to the World Energy Outlook, renewable energy sources are predicted to grow at the fastest rate among all energy sources.

Raw Material Insights

Biodiesel as a raw material dominated the market with the highest revenue share of 55.7% in 2022. This is attributed to the increasing consumer awareness regarding naturally sourced products and the high demand for biodiesel has resulted in a significant rise in the demand for the product market across the region. Biodiesel is the most widely adopted source of the product owing to its affordability. This is also due to a significant increase in the production and usage of biodiesel as a replacement for conventional diesel owing to its biodegradable, renewable, and non-toxic nature, as well as low emissions of toxic gases.

Biodiesel is produced through the transesterification of vegetable oils or animal fats with methanol. C3H8O3 can also be derived from fatty acids by the lipolysis process, which breaks down lipids. It involves the hydrolysis of triglycerides, which are esters derived from glycerol (C3H8O3) and free fatty acids. This hydrolysis yields glycerol and free fatty acids. Triglycerides are major components of human skin oils, vegetable oils, and animal fats and hence, are abundant.

Type Insights

The refined type segment dominated the market with the highest revenue share of 65.3% in 2022. This is attributed to its emulsifying and moisturizing properties, making it an effective additive in various personal care and home care formulations. It isused in several applications as it is non-toxic to the environment and human health. It is commonly used in personal care products & cosmetics owing to its ability to retain moisture. It is also widely used as a sweetener in food owing to its sweet taste. This product form is also used in pharmaceutical products owing to its non-toxic nature. Refined product form is developed by purifying crude glycerol using laboratory-controlled processes, such as hydrolysis, transesterification, and saponification.

Various types of vegetable oils can be used to derive this substance. The degree of refinement of the product is influenced by economic factors and the presence of production facilities in a given area. Notably, major biodiesel producers, such as Aemetis, Green Plains, and Pacific Ethanol, refine their products and offer them to other industries for commercial purposes. Crude form of the product mostly contains impurities, such as methanol and free fatty acids, making it less preferable among customers in the market. Biodiesel producers use an excessive volume of methanol for fast completion of chemical transesterification; however, it leads to an excess amount of impurities in the final product. This form is used as a supplement in cattle, pig, and broiler feed.

Source Insights

The plant source segment dominated the market with the highest revenue share of 50.1% in 2022 owing to their renewable and sustainable nature.Vegetable oils, such as soybean and palm oil, are among the most common plant sources of glycerol. These oils are rich in triglycerides, which can be saponified with sodium hydroxide to produce glycerol and fatty sodium salt or soaps. In addition, glycerol can be produced in some plants and yeasts as a byproduct of their metabolism. C3H8O3 acts as an emerging renewable bio-derived feedstock that is used for producing hydrogen through steam reforming reactions. In addition, plants are important sources of bioactive phytochemicals. Glycerol and alkanediols are being studied as alternative solvents to extract these compounds.

Thus, plants are an important and renewable source of C3H8O3 production. Although glycerol can be obtained from both, plants and animals, animal-derived glycerol is also used in various industries in North America. Animal sources of glycerol include animal fats, such as tallow and lard, which are rich in triglycerides that can be saponified to produce glycerol and fatty acid salts. One of the main advantages of animal-derived glycerol is its abundance and easy availability. Animal fats are widely available as they are byproducts of meat processing and soap manufacturing industries. This leads to a steady supply of animal-derived glycerol for use in various industrial processes.

End-use Insights

The personal care & cosmetics end-use segment dominated the market with the highest revenue share of 32.1% in 2022. This is attributed to the increased utilization in enhancing the smoothness of skin care products, shaving creams, hair care products, soaps, water-based personal lubricants, etc. It also acts as a lubricant and a humectant. Glycerol is a fundamental ingredient in glycerin soaps, which are infused with essential oils for fragrance. People with sensitive or easily irritated skin use these soaps as they prevent dryness owing to their moisturizing properties. Moreover, glycerol is also used as an emollient, which implies that it softens and soothes the skin. This makes glycerol a popular ingredient in lip balms, body scrubs, and other exfoliating products.

Glycerin is used in cosmetics as a viscosity-decreasing agent, a skin protectant, a skin conditioning agent, an oral health care drug, a humectant, a hair conditioning agent, and a fragrance ingredient. It is a well-known humectant that prevents the loss of moisture from skin care products to prevent the quick drying out of the skin. Increasing awareness among the masses regarding personal hygiene & health and improving lifestyle of the earning population in North America is expected to fuel the growth of this segment in the coming years. Glycerol is used in a wide range of applications in the food & beverages industry. As a humectant, glycerol helps retain moisture of food products and prevents their drying out. This makes it a popular ingredient in baked goods, such as cakes and bread. The product is also used as a solvent to dissolve additives and flavors, which can then be easily incorporated into food products.

Key Companies & Market Share Insights

The market is fragmented with international & domestic players operating globally. A few of the prominent players in the product market are ADM, BASF SE, Cargill, Inc., Dow, Kao Corporation, Procter & Gamble Chemicals, and Wilmar International Ltd. Players have adopted various strategies, such as mergers and acquisitions, to enhance the reach of their products by utilizing the network of acquired players and increasing the availability of their products in diverse geographies. For instance, in February 2023, KLK OLEO announced its plan to enter into a definitive agreement to acquire Italy-based Temix Oleo. This acquisition will help KLK Oleo strengthen its oleochemicals division, which includes the production of glycerine. Some of the prominent players in the North America glycerol market include:

-

ADM

-

BASF SE

-

Cargill, Inc.

-

CREMER OLEO GmbH & Co. KG

-

Dow

-

Emery Oleochemicals

-

Kao Corporation

-

KLK OLEO

-

Oleon NV

-

Procter & Gamble Chemicals

-

Wilmar International Ltd.

North America Glycerol Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.21 billion

Revenue forecast in 2033

USD 1.94 billion

Growth rate

CAGR of 5.0% from 2023 to 2033

Base year for estimation

2022

Historical data

2013 - 2021

Forecast period

2023 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2023 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, type, source, end-use, region

Country scope

U.S.; Canada; Mexico

Market Players

ADM; BASF SE; Cargill, Inc.; CREMER OLEO GmbH & Co. KG; Dow; Emery Oleochemicals; Kao Corp.; KLK OLEO; Oleon NV; Procter & Gamble Chemicals; Wilmar International Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Glycerol Market Report Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2013 to 2033. For this study, Grand View Research has segmented the North America glycerol market on the basis of raw material, source, type, end-use, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2013 - 2033)

-

Biodiesel

-

Fatty Alcohols

-

Fatty Acids

-

Soap

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2013 - 2033)

-

Crude

-

Refined

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2013 - 2033)

-

Plant

-

Animal

-

Synthetic

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2013 - 2033)

-

Food & Beverage

-

Pharmaceutical

-

Nutraceutical

-

Personal Care & Cosmetics

-

Industrial

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2013 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America glycerol market size was estimated at USD 1.13 billion in 2022 and is expected to reach USD 1.21 billion in 2023

b. The North America glycerol market is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 1.94 billion by 2030.

b. Plant source dominated the market with the highest revenue share of 50.1% in 2022 owing to their renewable and sustainable nature. Vegetable oils, such as soybean oil and palm oil are among the most common plant sources of glycerol.

b. Some key players operating in the North America glycerol market include TADM, BASF SE, Cargill, Incorporated., CREMER, OLEO GmbH & Co. KG, Dow, Emery Oleochemicals,, Kao Corporation, KLK OLEO, Oleon NV, Procter & Gamble Chemicals & Wilmar International Ltd.

b. Key factors that are driving the market growth include the increasing application of glycerol in numerous industries such as personal care, pharmaceuticals, and food & beverages, thereby leading to a significant rise in its demand in North America.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."