- Home

- »

- Biotechnology

- »

-

North America Microbiome Sample Preparation Technology Market 2030GVR Report cover

![North America Microbiome Sample Preparation Technology Market Size, Share & Trends Report]()

North America Microbiome Sample Preparation Technology Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Workflow, By Application, By Disease, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-580-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

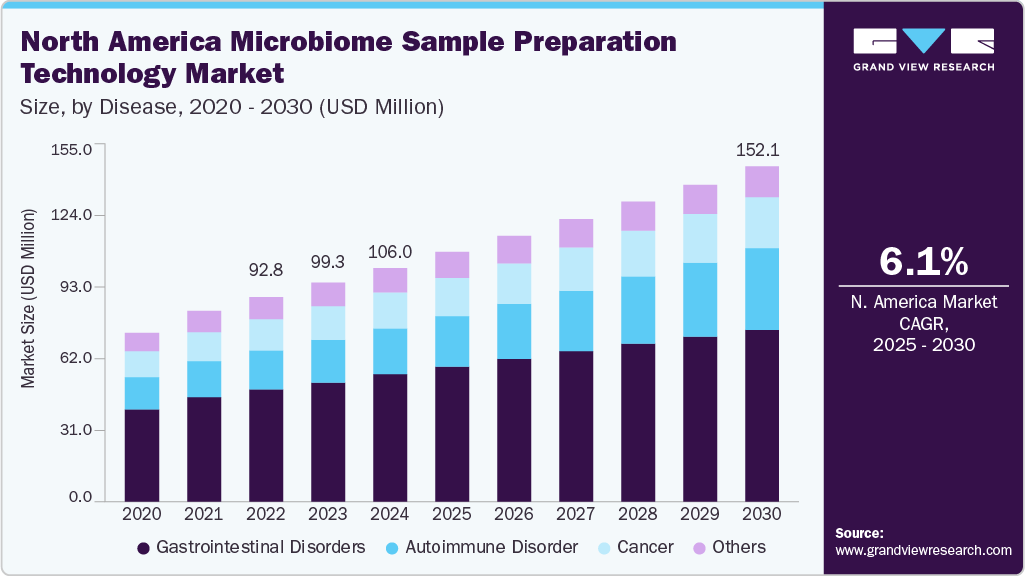

The North America microbiome sample preparation technology market size was estimated at USD 106.0 million in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2030. Rising demand for precision medicine and microbiome diagnostics is driving innovation in sample preparation technologies. Clinicians increasingly use microbiome data to improve diagnosis and outcomes, requiring accurate, reproducible tools. As awareness grows, adoption of specialized workflows and high-throughput systems is expanding in clinical and research settings.

Revolutionizing Microbiome Sample Preparation with Artificial Intelligence

Integrating Artificial Intelligence (AI) into microbiome sample preparation technology revolutionizes how researchers process and analyze complex biological samples. Traditional microbiome workflows often suffer from inconsistencies due to manual handling, variable protocols, and limitations in processing speed. AI addresses these challenges by enabling automation, precision, and adaptive optimization throughout the sample preparation pipeline. This includes intelligent scheduling, resource allocation, and predictive maintenance of lab equipment, minimizing downtime and maximizing lab efficiency.

AI also plays a crucial role in enhancing quality control. Advanced algorithms can detect anomalies in sample quality, such as contamination or degradation, early in the workflow. This prevents faulty data from progressing into sequencing or analysis stages, ultimately improving the reliability of results. AI models trained on vast datasets can classify microbiome types, suggest the best extraction methods for specific sample matrices, and optimize reagent volumes or centrifugation times dynamically. Such precision is particularly valuable in clinical settings, where consistency and traceability are essential for diagnostics.

Table 1 Comparison: Microbiome sample preparation with vs without AI

Feature

Traditional Technology

AI-Enabled Technology

Automation

Limited

Fully automated with feedback

Reproducibility

Moderate (operator-dependent)

High (algorithm-driven)

Time Efficiency

Manual, slower

Fast, optimized protocols

Scalability

Limited by manpower

Scalable to high-throughput labs

Error Reduction

Subject to human error

Self-correcting systems

Data Integration

Manual, post-process

Real-time, integrated analysis

Cost Over Time

High (labor-intensive)

Reduced (long-term automation)

Feature

Traditional Technology

AI-Enabled Technology

Furthermore, AI is facilitating a shift toward personalized medicine through microbiome analysis. By rapidly preparing and analyzing patient-specific microbiome samples, AI systems support the development of targeted therapies and individualized treatment plans. In pharmaceutical research, AI-guided microbiome sample preparation enables faster identification of microbial biomarkers and drug-microbiome interactions, accelerating drug development. As microbiome science expands into new domains like oncology, neurology, and immunotherapy, AI ensures that sample preparation keeps pace with the growing demand for accuracy, scalability, and speed.

Rising Demand for Precision Medicine and Its Impact on Microbiome Sample Preparation

The growing emphasis on precision medicine transforms how diseases are diagnosed and treated, with microbiome data emerging as a vital component in this shift. Researchers and clinicians increasingly recognize the microbiome's role in influencing individual responses to drugs, immune function, and disease progression. As a result, there's a heightened demand for microbiome-based diagnostics and therapeutics that can guide personalized treatment strategies. This evolution calls for highly accurate, consistent, and reproducible sample preparation processes that can preserve microbial diversity and integrity across varying biological samples such as stool, saliva, or skin swabs.

Accurate sample preparation is critical because even minor inconsistencies can distort microbial profiles and lead to misleading results. In precision medicine, where treatment decisions are based on fine-scale biological data, unreliable microbiome samples can compromise clinical outcomes. This has led to a growing preference for automated, high-throughput technologies that ensure standardized sample handling across labs and clinical settings. These advanced systems reduce variability, minimize contamination, and support generating high-quality microbiome data. As the precision medicine movement expands globally, the demand for innovative sample preparation tools tailored to microbiome applications is expected to accelerate significantly.

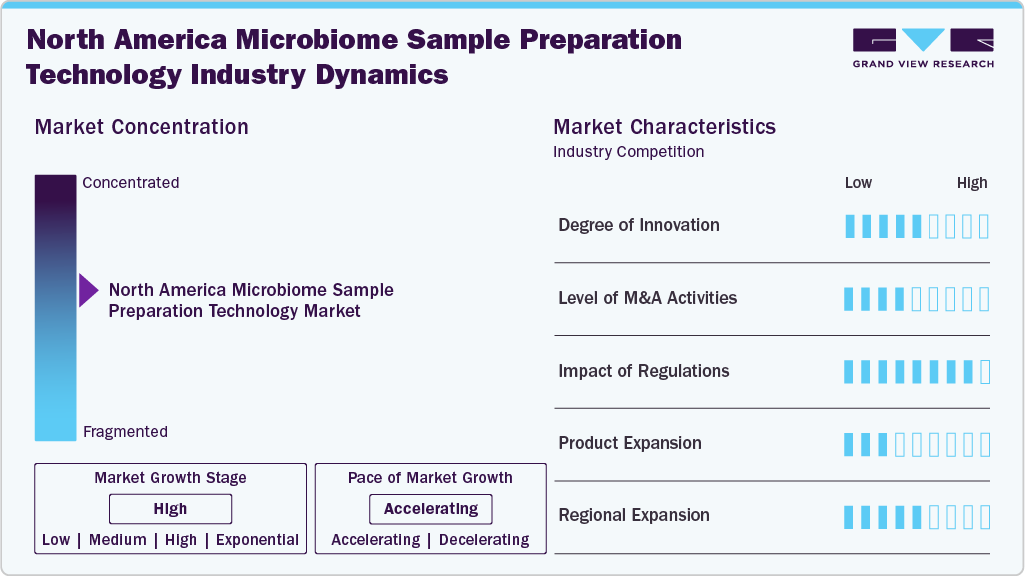

Market Concentration & Characteristics

The North American microbiome sample preparation technology industry is highly innovative, driven by advances in genomics, biotechnology, and analytical methods. Companies are continuously exploring new ways to enhance sample processing efficiency and accuracy, incorporating cutting-edge technologies like CRISPR and next-generation sequencing (NGS). Innovations are primarily focused on improving the sensitivity, scalability, and automation of sample preparation, which are crucial for high-throughput applications. The rapid pace of development fosters collaboration between academic research, healthcare institutions, and biotech firms. Additionally, startups and established companies are vying for leadership in breakthrough tools and platforms.

The North American microbiome sample preparation technology industry has witnessed moderate merger and acquisition (M&A) activities, as companies seek to diversify their portfolios and enhance their technological capabilities. Acquisitions typically focus on integrating complementary technologies, expanding product offerings, or gaining access to established distribution channels. Strategic mergers are also seen as a way to strengthen R&D capabilities and accelerate the development of innovative solutions. Larger firms with robust financial resources often acquire smaller players with niche expertise in microbiome research. This consolidation allows for more efficient commercialization of advanced technologies across North America.

Regulatory factors play a significant role in shaping the microbiome sample preparation technology industry in North America, with strict guidelines established by bodies like the FDA and EPA. The oversight of clinical and laboratory practices influences the design and commercialization of new products, ensuring they meet safety and efficacy standards. Additionally, the regulatory environment ensures that ethical concerns related to microbiome manipulation and data privacy are addressed. Companies must comply with these regulations when launching new technologies, leading to increased investments in quality control and regulatory affairs departments. As regulations evolve, companies must adapt to maintain compliance and gain market access.

Product expansion within North America's microbiome sample preparation technology industry is driven by the demand for more specialized tools that can handle diverse sample types and analysis methods. Companies are introducing new products with enhanced features, such as automated workflows, better sample preservation, and improved throughput capabilities. Additionally, there is a growing trend towards the development of integrated platforms that combine sample preparation with sequencing and analysis tools. This trend reflects the market’s need for more comprehensive solutions that reduce labor, improve reproducibility, and minimize the risk of contamination. Expansion into new areas of microbiome research, such as the gut-brain axis and personalized medicine, also fuels the development of new products.

Company expansion in the North American microbiome sample preparation technology industry is marked by increasing efforts to penetrate both established and emerging markets. Firms are expanding their operations into key regions like the U.S. and Canada, focusing on high-demand areas such as biotechnology hubs in California and Massachusetts. Many companies are forming strategic partnerships with local research institutions and healthcare providers to strengthen their market presence. Expansion into Latin America is also becoming a priority, driven by the growing interest in microbiome research and diagnostics. This regional diversification allows companies to leverage new growth opportunities, expand customer bases, and adapt to local market needs and regulatory requirements.

Product Insights

The consumables segment dominated the North America microbiome sample preparation technology industry with the largest revenue share of 86.04% in 2024, driven by the high frequency of sample processing and the recurring demand for reagents and kits. For instance, companies like Zymo Research have expanded their microbiome sample prep kit offerings to support large-scale clinical trials. Increased adoption of microbiome research protocols in academic and clinical laboratories has contributed to this trend. Frequent replenishment of DNA extraction and quality control consumables ensures consistent revenue generation. The growing volume of microbiome-based diagnostics and personalized treatment approaches has further accelerated the need for reliable consumable products. In addition, Thermo Fisher Scientific reported heightened demand for its sample prep consumables across US laboratories focusing on gut-brain axis studies.

The instruments segment is projected to grow at a significant CAGR over the forecast period, fueled by the increasing installation of advanced automated systems across laboratories. For instance, in November 2024, QIAGEN collaborated with McGill University to advance microbiome research, highlighting the adoption of their QIAcube Connect platform in microbiome-focused genomics labs. Rising interest in high-throughput sequencing platforms has created a need for robust and scalable sample preparation instruments. The expansion of North American biotech companies and research centers contributes to higher capital investments in laboratory equipment. Enhanced accuracy and reproducibility offered by new-generation instruments are attracting researchers seeking efficient workflows. Integrating AI-driven tools in microbiome sample preparation systems will further support segment growth.

Workflow Insights

The sample extraction/isolation segment dominated the market with the largest revenue share of 21.75% in 2024, which can be attributed to the critical role of nucleic acid purity and yield in downstream applications. For instance, the Broad Institute relies on high-efficiency isolation protocols using magnetic bead-based extraction methods for its gut microbiome projects. As microbiome studies become more comprehensive, reliable extraction methods have become essential to ensure data accuracy. Laboratories across North America are increasingly investing in automated extraction platforms to streamline sample preparation and reduce manual error. The demand for standardized and reproducible workflows has elevated the importance of this step. Furthermore, increased microbiome research in oncology and metabolic disorders has reinforced reliance on effective sample isolation techniques.

The library quantification segment is projected to grow at a significant CAGR over the forecast period, due to rising demand for precise sample normalization before sequencing. For instance, Agilent Technologies introduced updated library quantification kits for low-biomass microbiome samples, which are now widely used in clinical research labs. Accurate quantification is essential for consistent sequencing results, particularly in clinical and diagnostic settings. As research institutions adopt more complex metagenomic and transcriptomic studies, demand for sensitive and reliable quantification tools has intensified. Adoption of advanced fluorescence- and qPCR-based quantification methods is growing across North America. Furthermore, expanding next-generation sequencing platforms requires complementary improvements in library preparation accuracy.

Application Insights

The DNA sequencing segment dominated the market with the largest revenue share of 25.98% in 2024, which can be attributed to its wide use in microbiome profiling across clinical and research settings. Sequencing technologies are central to identifying microbial diversity and understanding host-microbiome interactions. North America hosts many genomics laboratories and research institutes utilizing DNA sequencing for disease-specific microbiome studies. The ability of DNA sequencing to support discovery in personalized medicine and drug development has strengthened its adoption. Moreover, declining sequencing costs have made this technology more accessible to many end users.

The metagenomics segment is projected to grow at the fastest CAGR over the forecast period, due to its capacity to analyze complex microbial communities without the need for culturing. As interest in the role of microbiota in health and disease grows, metagenomics offers a powerful approach for comprehensive microbial characterization. North American research bodies are increasing investments in large-scale metagenomic studies targeting conditions such as IBD, obesity, and neurological disorders. Advancements in computational tools and bioinformatics pipelines further enhance the utility of metagenomics. The segment benefits from increasing partnerships between academic institutions and private firms focusing on microbiome therapeutics.

Disease Insights

The gastrointestinal disorders segment dominated the market with the largest revenue share of 54.3% in 2024, driven by the strong association between gut microbiota imbalance and digestive health conditions. The Cleveland Clinic has expanded its microbiome analysis program to support early Crohn’s disease and ulcerative colitis detection. The high prevalence of such disorders in North America has led to a rising demand for microbiome-based diagnostics. Research institutions and clinical labs are prioritizing gut microbiome profiling to understand disease progression and response to therapy. Numerous clinical trials are underway across the region to assess microbiome-targeted treatments for GI disorders. This focus is reinforcing the demand for reliable sample preparation technologies.

The autoimmune disorder segment is projected to grow at the fastest CAGR over the forecast period, fueled by increasing research linking microbiome alterations to immune system dysfunction. For instance, a study published in the Annals of Rheumatic Diseases 2024 identified microbial biomarkers linked to lupus flare-ups, prompting greater adoption of microbiome sequencing. Studies in North America have highlighted microbial signatures associated with rheumatoid arthritis and lupus. The shift toward personalized treatment strategies drive the adoption of microbiome analysis in autoimmune disease management. Expanding collaborations between academic researchers and biotech firms are enhancing exploration of microbial-based immunotherapies. This growth is supported by rising diagnostic interest in the early detection of immune-related imbalances.

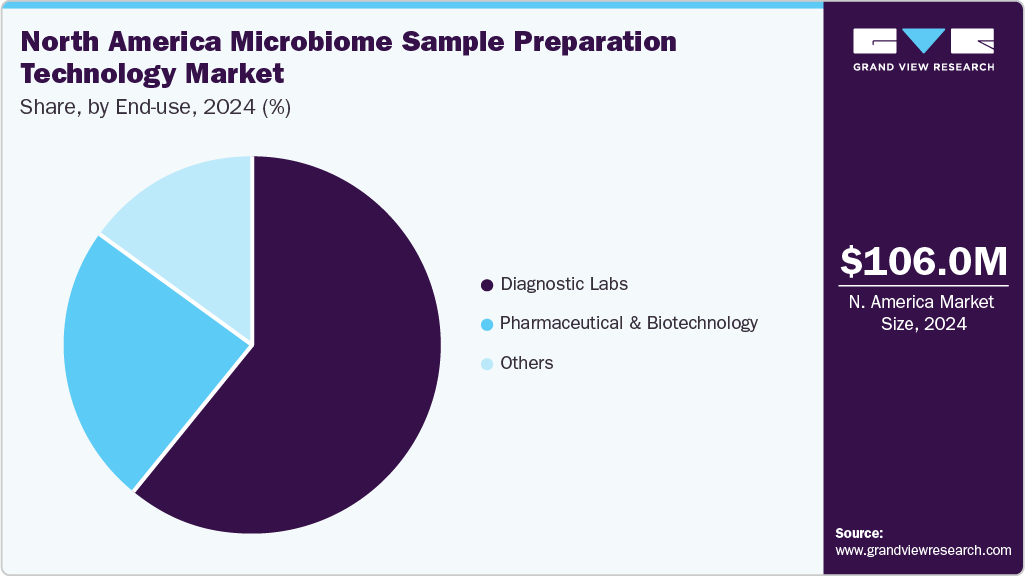

End Use Insights

The diagnostic labs segment dominated the market with the largest revenue share of 61.4% in 2024, driven by growing utilization of microbiome analysis for disease screening and early diagnosis. Clinical laboratories across North America are increasingly offering microbiome panels as part of precision medicine programs. Higher patient awareness of gut health and microbial imbalances has elevated demand for diagnostic testing. Integrating microbiome services into routine lab offerings has improved access to personalized health insights. Additionally, partnerships with healthcare providers are expanding the presence of microbiome diagnostics in outpatient settings.

The pharmaceutical and biotechnology segment is projected to grow at a significant CAGR over the forecast period, fueled by ongoing drug discovery and development focused on microbiome interventions. In 2024, Seres Therapeutics advanced late-stage trials for its microbiome drug SER-155, boosting demand for high-quality microbiome sample preparation. Biotech firms across North America actively invest in microbiome-based therapeutics targeting metabolic, neurological, and inflammatory diseases. Collaborations with academic institutions are accelerating the validation of microbial targets for drug development. The need for high-quality microbiome samples in preclinical and clinical research drives the adoption of advanced prep technologies. This momentum supports the rapid expansion of the pharmaceutical and biotech user base.

Country Insights

U.S. Microbiome Sample Preparation Technology Market Trends

The U.S. microbiome sample preparation technology industry dominated North America, with the largest revenue share of 83.1% in 2024, driven by the strong presence of advanced research infrastructure and a high concentration of microbiome-focused biotech companies. Increased funding for microbiome research by private institutions and growing partnerships with academic centers fuel demand for precise sample preparation technologies. The rising adoption of next-generation sequencing and personalized medicine is pushing laboratories to invest in optimized sample preparation tools. Furthermore, the country's robust clinical trial ecosystem supports continuous innovation and large-scale microbiome analysis.

Canada Microbiome Sample Preparation Technology Market Trends

Canada microbiome sample preparation technology market is expected to register a significant CAGR over the forecast period, attributed to expanding microbiome research programs within universities and increasing collaborations between healthcare providers and biotechnology firms. Rising awareness among clinicians about the clinical relevance of microbiome analysis encourages the adoption of standardized sample preparation solutions. The market is also benefiting from the country's growing investment in precision medicine and its emphasis on early disease detection. In addition, emerging biotech startups focusing on microbiome therapies are fostering demand for high-quality sample preparation products.

Mexico Microbiome Sample Preparation Technology Market Trends

Mexico microbiome sample preparation technology industry is driving due to the expansion of clinical laboratories and diagnostic centers. The country's rising interest in infectious disease surveillance and chronic condition monitoring supports microbiome research applications. Growth in medical tourism and investments in private healthcare infrastructure are also increasing the need for advanced diagnostic technologies. Local research initiatives exploring gut and skin microbiomes are gradually boosting demand for efficient sample preparation techniques. Moreover, the increased availability of cost-effective laboratory tools makes microbiome analysis more accessible to healthcare professionals.

Key North America Microbiome Sample Preparation Technology Company Insights

The North America microbiome sample preparation technology market is shaped by a competitive landscape of established biotechnology firms and innovation-driven emerging players. These companies are responding to the growing demand for accurate, scalable, and automated microbiome analysis tools across clinical and research settings. Investments in AI integration, automation, and high-throughput capabilities are central to gaining market advantage.

Danaher Corporation leads the market with strong performance across product breadth, innovation, and global reach. Its comprehensive portfolio and aggressive expansion strategies position it as a dominant force. QIAGEN also ranks high, driven by significant R&D investment and a robust pipeline. Illumina, Inc. maintains a strong core offering but appears less aggressive in external growth strategies. Bio-Rad Laboratories, Inc. shows medium-to-high performance, especially in its strategic initiatives and technology development.

Emerging players like DNA Genotek and firms developing AI-powered or point-of-care solutions are disrupting traditional workflows. These innovators are gaining traction in personalized healthcare, at-home diagnostics, and cost-effective microbiome analysis. Their focus on flexibility, affordability, and user-centric designs is gradually reshaping the market, offering alternatives to large-scale systems and expanding accessibility to microbiome technologies.

Overall, the market reflects a blend of established expertise and emerging innovation, with legacy players leveraging scale and resources, while startups bring agility and novel approaches. Intensifying competition is driven by increased mergers and acquisitions, strategic partnerships, and continuous product advancements. Companies that successfully integrate technological innovation with clinical reliability, user-friendly design, and ethical practices will be best positioned to secure long-term value in the evolving North American microbiome sample preparation technology landscape.

Key players adopt the most strategies, including partnerships, collaborations, and product launches. Companies such as QIAGEN partnered with Penn State University to boost microbiome research through a One Health Microbiome Center joint facility to expand their market reach globally.

Key North America Microbiome Sample Preparation Technology Companies:

- QIAGEN

- BGI

- Perkin Elmer, Inc.

- Agilent Technologies Inc.

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd..

Recent Developments

-

In October 2024, Zymo Research and BluMaiden Biosciences partnered to enhance clinical trial analytics. The collaboration integrated BluMaiden’s AI-driven precision health platform with Zymo’s trial services. It aimed to improve microbiome and epigenetics data analysis for personalized therapeutic development.

-

In January 2024, QIAGEN partnered with Penn State University to boost microbiome research through a One Health Microbiome Center joint facility. The collaboration included QIAGEN’s support with instruments, student internships in Germany, and backing for the Wolbachia Project. This multi-year alliance aimed to bridge academic research with industry innovation in microbiome sciences.

-

In July 2023, MGI Tech launched its Human Microbiome Metagenomics Sequencing Package, aiming to deepen the understanding of the human microbiome. The package integrates high-resolution sequencing technologies and data analysis tools for microbiome research, focusing on personalized medicine. It offers a cost-effective solution for researchers exploring the link between microbiomes and human health.

North America Microbiome Sample Preparation Technology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 113.1 million

Revenue forecast in 2030

USD 152.1 million

Growth rate

CAGR of 6.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, workflow, application, disease, end use, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

QIAGEN; BGI; Bio-Rad Laboratories, Inc.; Perkin Elmer, Inc.; Agilent Technologies Inc.; Illumina, Inc.; F. Hoffmann-La Roche Ltd.; Danaher Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Microbiome Sample Preparation Technology Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America microbiome sample preparation technology market report based on product, workflow, application, disease, end use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Purification/Extraction Kits

-

Library prep kits

-

DNA Library Preparation Kits

-

RNA Library Preparation Kits

-

Library Quantitation & Amplification kits

-

Clean-up and Selection Kits

-

Microbiome DNA Enrichment

-

Others

-

-

-

Instruments

-

Workstation

-

Extraction System

-

Liquid Handling Instrument

-

Other Sample Preparation Instruments

-

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Sample Extraction/Isolation

-

Library Preparation

-

Sample Quantification

-

Fragmentation

-

Target Enrichment

-

Quality Control

-

Pooling

-

Library Quantification

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA Sequencing

-

RNA Sequencing

-

Methylation Sequencing

-

Single Cell Sequencing

-

Whole-Genome Sequencing

-

Metagenomics

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Gastrointestinal Disorders

-

Autoimmune Disorder

-

Cancer

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Labs

-

Pharmaceutical & Biotechnology

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America microbiome sample preparation technology market size was estimated at USD 106.0 million in 2024 and is expected to reach USD 113.1 million in 2025.

b. The North America microbiome sample preparation technology market is expected to grow at a compound annual growth rate of 6.11% from 2025 to 2030 to reach USD 152.1 million by 2030.

b. The sample extraction/isolation segment dominated the North America microbiome sample preparation technology market with a share of 21.75% in 2024. This is attributable to the growing demand for quality microbial DNA/RNA and the increasing adoption of automated extraction systems.

b. Some key players operating in the North America microbiome sample preparation technology market include QIAGEN; BGI; Bio-Rad Laboratories, Inc.; Perkin Elmer, Inc.; Agilent Technologies Inc.; Illumina, Inc.; F. Hoffmann-La Roche Ltd.; and Danaher Corporation

b. Key factors that are driving the North America microbiome sample preparation technology market growth include rising research in human microbiome therapeutics, increasing prevalence of chronic diseases, and advancements in sequencing technologies. Additionally, growing investments in microbiome-focused startups and government funding are supporting market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.