- Home

- »

- Advanced Interior Materials

- »

-

North America Microencapsulation Market Size Report, 2030GVR Report cover

![North America Microencapsulation Market Size, Share & Trends Report]()

North America Microencapsulation Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Pharmaceutical & Healthcare Products, Home & Personal Care, F&B, Agrochemicals, Construction, Textile), By Technology, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-078-6

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

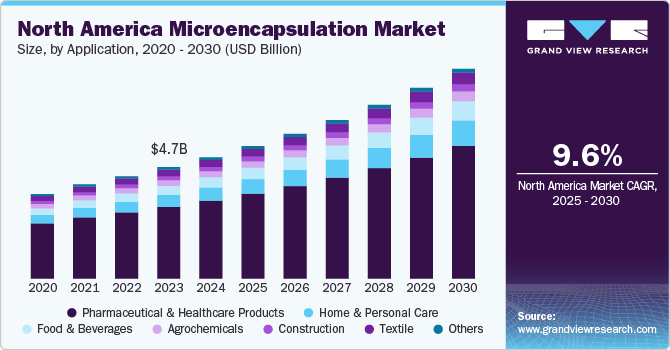

The North America microencapsulation market size was estimated at USD 5,204.1 million in 2024 and is anticipated to grow at a CAGR of 9.6% from 2025 to 2030. The increasing demand for advanced delivery systems across industries such as pharmaceuticals, food and beverages, and agriculture is a key driver of market growth. Microencapsulation enables the controlled release of active ingredients, which enhances product efficacy and stability. In the pharmaceutical sector, this technology is used to improve the bioavailability of drugs, reduce side effects, and facilitate sustained or targeted drug delivery, driving its adoption.

Microencapsulation allows for the controlled release of pesticides, fertilizers, and herbicides, reducing environmental impact and improving the efficiency of agricultural practices. By minimizing waste and enhancing the effectiveness of inputs, microencapsulation is seen as a solution to the challenges of modern farming, particularly in the face of increasing concerns about chemical overuse and environmental degradation.

Drivers, Opportunities & Restraints

The rising consumer demand for functional foods and nutraceuticals is fueling market growth. Microencapsulation helps protect sensitive nutrients such as vitamins, probiotics, and omega-3 fatty acids from degradation, extending shelf life and ensuring consistent delivery. As consumers become more health-conscious, the demand for such value-added products continues to rise, pushing manufacturers to explore new microencapsulation technologies.

A key restraint on the growth of the North America Microencapsulation Market is the high cost of production. The complex processes involved in microencapsulation, including the need for specialized materials and advanced technologies, can lead to significant manufacturing costs. These high costs can be a barrier for smaller companies, limiting their ability to compete and hindering widespread adoption of the technology across various industries.

The growing trend towards personalized nutrition and medicine provides a significant opportunity for microencapsulation technologies to expand into new applications and markets, potentially driving further growth. In addition, as more cost-effective and scalable microencapsulation methods are developed, they will likely help reduce production costs, making the technology more accessible to a wider range of companies.

Application Insights

The growth of the North America Microencapsulation Market in the home and personal care industry is driven by the increasing demand for enhanced, longer-lasting, and more effective products. Microencapsulation allows for the controlled release of active ingredients such as fragrances, moisturizers, vitamins, and sunscreen agents, which provides consumers with longer-lasting benefits

The pharmaceutical & healthcare products industry segment dominated the market in 2024 accounting for 62.3% market share fueled by the need for better drug delivery systems. Microencapsulation is particularly important for improving the bioavailability of poorly soluble drugs, enabling controlled release, and reducing side effects associated with certain medications. The demand for sustained-release formulations that deliver a drug over an extended period of time is growing, as it reduces the frequency of administration and improves patient compliance.

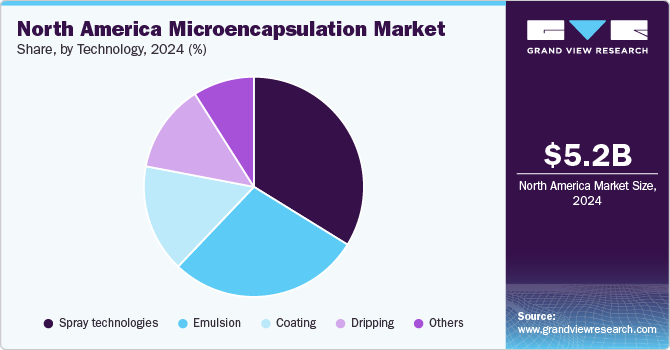

Technology Insights

Spray technologies are growing in popularity within the North America microencapsulation market due to their versatility, scalability, and ability to create fine, uniform coatings for a wide range of applications in various industries. The spray drying segment is witnessing growing demand because it offers a cost-effective way to produce large quantities of encapsulated particles while maintaining a high level of control over the size and consistency of the microcapsules.

The emulsion segment held a 28.3% market share in 2024. Emulsion-based microencapsulation has become a favored technique due to its ability to encapsulate a wide range of materials-both hydrophilic and hydrophobic-in a stable and efficient manner. This technology is widely used in the food, pharmaceuticals, and cosmetic industries. In the food and beverage sector, emulsions allow for the encapsulation of sensitive ingredients like flavors, vitamins, and essential oils, protecting them from environmental factors and providing controlled release

Country Insights

In North America, market is expanding rapidly due to a combination of technological advancements, increasing demand for functional products, and growing consumer interest in health and wellness. The region benefits from a strong research and development ecosystem, supported by both private sector innovation and government-funded initiatives

U.S. Microencapsulation Market Trends

The market in the U.S. accounted for 82.4% of the North America market in 2024. The country has a well-established pharmaceutical and healthcare industry, with a strong emphasis on improving drug delivery and therapeutic efficacy. The increasing consumer demand for personalized, health-focused food and skincare products is pushing innovation in the home and personal care sectors as well. On the industrial side, the U.S. is witnessing growing applications of microencapsulation in agriculture, where it is used to reduce the environmental impact of fertilizers, pesticides, and herbicide.

Mexico Microencapsulation Market Trends

Mexico is emerging as a significant market for microencapsulation in North America and is expected to grow at a CAGR of 10.4%. The market in the country is driven by a combination of factors, including expanding industrial sectors and increasing consumer demand for innovative products. In the pharmaceutical industry, Mexico has been investing heavily in improving healthcare infrastructure and expanding the production of pharmaceutical and biotechnological products, which boosts the need for advanced drug delivery systems such as microencapsulation

Key North America Microencapsulation Company Insights

Some of the players operating in the market include Balchem Corp.and Lycored.

-

Lycored is a global company specializing in the development and production of natural ingredients, focusing on nutrients, colors, and taste enhancements for various industries, including food, dietary supplements, and cosmetics. Lycored offers advanced microencapsulation solutions to serve the food & beverage, pharmaceutical, and other industries.

-

Balchem Corporation is a diversified company that operates through three primary business segments - Human Nutrition & Health, Animal Nutrition & Health, and Specialty Products.The company offers tailored ingredient systems that cater to specific customer requirements in sectors such as nutrition and pharmaceuticals,

Key North America Microencapsulation Companies:

- CAPSULE

- Lycored

- BASF

- Balchem Corp.

- Encapsys, LLC

- AVEKA Group

- Reed Pacific

- Microtek Laboratories, Inc

- GAT Microencapsulation GmbH

- Ronald T. Dodge Company

- Evonik Industries AG

- Inno Bio Limited

- Bayer AG

- Dow

- 3M

Recent Developments

-

In March 2023, Reed Pacific announced the general availability of its advanced microencapsulation systems, Potenza BD and Potenza Q, designed for various industries including personal care, FMCG, and agrochemicals. These technologies offer manufacturers effective options for protecting and delivering active ingredients, particularly natural and essential oils.

-

In December 2022, Surtec International GmbH has acquired Omnitechnik Mikroverkapselung GmbH, enhancing its capabilities in the chemical surface technology sector. This acquisition includes all shares of the joint venture Precote USA L.L.C.

North America Microencapsulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,679.9 million

Revenue forecast in 2030

USD 9,000.0 million

Growth rate

CAGR of 9.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Application, technology, country

Country Scope

U.S., Canada, Mexico

Key companies profiled

CAPSULE, Lycored, BASF, Balchem Corp., Encapsys, LLC, AVEKA Group, Reed Pacific, Microtek Laboratories, Inc, GAT Microencapsulation GmbH, Ronald T. Dodge Company, Evonik Industries AG, Inno Bio Limited, Bayer AG, Dow, and 3M

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Microencapsulation Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America microencapsulation market report on the basis of application, technology, and country:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Healthcare Products

-

Home & Personal Care

-

Food & Beverages

-

Agrochemicals

-

Construction

-

Textile

-

Others

-

-

Technology (Revenue, USD Million, 2018 - 2030)

-

Coating

-

Emulsion

-

Spray Technologies

-

Dripping

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America microencapsulation market size was estimated at USD 5,204.1 million in 2024 and is expected to reach USD 9,000.0 million in 2025.

b. The North America microencapsulation market, in terms of revenue, is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2030 to reach USD 9,000.0 million by 2030.

b. The pharmaceutical & healthcare products segment dominated the market in 2024 accounting for 64.3% of overall revenue share. The ability to target specific areas in the body, such as the intestines or liver, is expanding the scope of microencapsulation in drug development and therefore its demand in the industry.

b. Some of the key players operating in the North America microencapsulation market are CAPSULE, Lycored, BASF, Balchem Corp., Encapsys, LLC, AVEKA Group, Reed Pacific, Microtek Laboratories, Inc, GAT Microencapsulation GmbH, Ronald T. Dodge Company, Evonik Industries AG, Inno Bio Limited, Bayer AG, Dow, and 3M

b. Key factors driving the North America microencapsulation market include increasing demand for controlled release and targeted delivery systems in pharmaceuticals, food, and agriculture, along with ongoing technological advancements that improve the efficiency and scalability of microencapsulation processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.