- Home

- »

- Next Generation Technologies

- »

-

North America Residential Ductwork Design Software Market Report, 2030GVR Report cover

![North America Residential Ductwork Design Software Market Size, Share & Trends Report]()

North America Residential Ductwork Design Software Market Size, Share & Trends Analysis Report By Component (Software, and Services), By Deployment, By Application, By Construction Type, By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-118-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

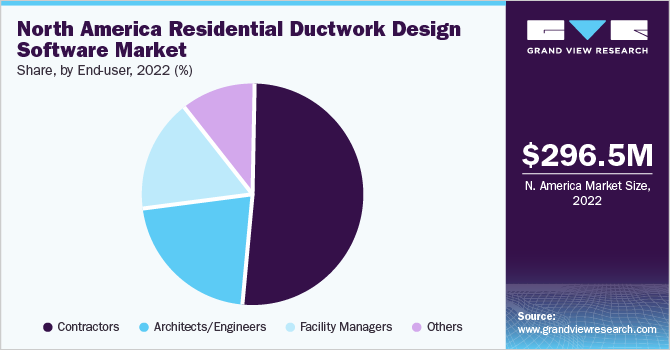

The North America residential ductwork design software market size was estimated at USD 296.5 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. This growth is attributed to the increased need for energy-efficient solutions and the expanding number of residential development projects in the region. The advent of innovative technologies and software tools that help enhance the design and installation of ducting systems is also predicted to boost the overall residential ductwork design software industry.

Homeowners are increasingly seeking methods to minimize their energy use and save money on their utility bills as they become more aware of energy-efficient devices' environmental and financial benefits. This has increased demand for ductwork design software, which may assist homeowners and contractors in designing and installing efficient HVAC systems. The increasing number of new building projects is another element contributing to the growth of the market. With the increasing demand for new houses, developers and builders seek methods to simplify operations and cut costs.

In addition to new developments, there is a high demand for home retrofitting and rehabilitation projects. Many older houses in the region are designed without contemporary HVAC systems. This enables the homeowners to upgrade their buildings. Ductwork design software can aid in the simplification of the retrofitting process of ductwork, making it easier and less expensive for homeowners and contractors to retrofit older homes with modern HVAC systems. Despite the increasing potential of the home ducting design software industry, numerous challenges must be overcome to benefit from this opportunity effectively. One of the most significant issues is the industry's need for standards. There are no globally established standards for ductwork design software, making it difficult for designers and contractors to evaluate systems and guarantee they utilize the most effective solutions.

Another challenge in the residential ductwork design software business is the continual demand for training and education. As new products and technology emerge, designers and contractors must keep current on the newest trends and best practices. Continued training and education programs are necessary for firms, which may be costly and time-consuming. Despite these obstacles, the North American home ducting design software business has a promising future due to rising building and renovation sectors and increased demand for energy-efficient HVAC systems.

On the other hand, increasing indoor air quality (IAQ) awareness is also contributing to the growing demand for effective ductwork design software within the market. The software ensures optimal ventilation and air distribution systems, which are essential for maintaining healthy and comfortable indoor environments. As people become more conscious of the potential health risks associated with poor IAQ, the importance of using advanced software solutions to design and manage ductwork systems has become evident. Indoor air quality refers to the air quality within buildings and structures as it relates to the health and comfort of occupants. Poor IAQ can lead to various health issues, including respiratory problems, allergies, and other adverse health effects. This concern has spurred regulatory agencies, building professionals, and property owners to take measures to improve indoor air quality and ensure proper ventilation in various indoor spaces.

Ductwork design software has evolved to address these concerns by providing advanced tools and simulations that help engineers, architects, and HVAC professionals design ventilation systems that meet stringent IAQ standards. These software solutions consider airflow, pressure temperature, and humidity to create an optimized duct layout that ensures efficient air distribution while minimizing energy consumption and maintaining IAQ. The factor behind the demand is the increased emphasis on energy efficiency and sustainability. As energy costs rise and environmental concerns become more prominent, there is a greater need for HVAC systems that are both energy-efficient and capable of providing healthy indoor environments. Ductwork design software aids in achieving this balance by enabling engineers to develop HVAC systems that maximize energy efficiency while adhering to IAQ guidelines.

Component Insights

The software segment captured a significant market share of around 79.0% in 2022. The growth of this segment is attributed to the rising adoption of sustainable building practices and the increased number of building construction activities in the North America region. Green building certificates, such as LEED (Leadership in Energy and Environmental Design), require specific HVAC design standards prioritizing energy efficiency and sustainability. Ductwork design software aids in meeting such standards by enabling precise calculations and simulations that ensure compliance with green building requirements. In addition, technological advancements have led to the development of more sophisticated and user-friendly ductwork design software tools. These tools incorporate features such as 3D modeling, simulation, and Building Information Modeling. Such capabilities enable the designers and engineers to visualize and optimize duct layout in a virtual environment before implementation, reducing the likelihood of errors and costly revisions. Furthermore, the expanding construction industry, particularly in the residential sector, is also contributing to the market’s growth. As more homes are being built or renovated, there’s a higher demand for efficient HVAC systems, boosting the need for ductwork design software.

The services segment is expected to witness a CAGR of over 6.0% during the forecast period. The service component encompasses a range of offerings to assist professionals in optimizing their design processes, improving efficiency, and ensuring the creation of effective HVAC systems. These services are tailored to address the unique challenges and complexities of residential ductwork design, considering energy efficiency, comfort, indoor air quality, and compliance with building codes. Software developers and vendors offer training sessions, webinars, workshops, and documentation to ensure users are well-versed in utilizing the software effectively. As ductwork design software continues to evolve, staying updated with new features and functionalities is crucial, and these training initiatives help professionals harness the full potential of these tools at their disposal.

Deployment Insights

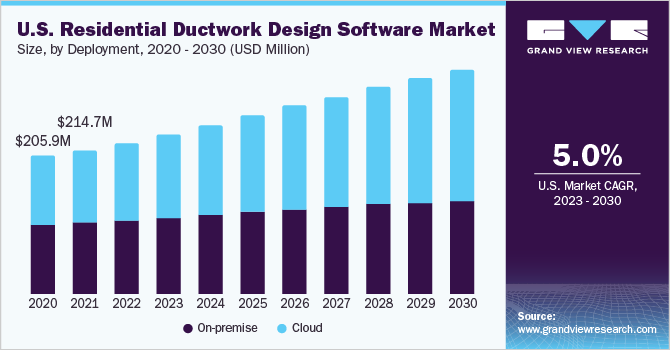

The on-premises segment captured a significant market share of over 48.0% in 2022. This significant market share can be attributed to the high demand for on-premises software due to regulatory, compliance, and security requirements. Organizations keep confidential information in-house rather than give it over to cloud providers. Moreover, storing information in-house decreases dependencies on third-party organizations and helps protect and monitor data. Thus, the demand for on-premises software is high, and this segment contributes more to the market. On-premises solutions typically provide high data security for construction projects while facilitating functionalities such as estimating, job costing, project design and scheduling, and project management.

The cloud segment is expected to witness the highest CAGR of over 7.0% through 2030. The advancements in cloud computing technology have revolutionized the creative software marketplace and enabled high-quality content creation in recent years. To offer higher bandwidth and efficiency, creative solutions and service providers are offering cloud-based solutions. Design software providers have chosen cloud-based deployment over on-premises because it can handle more substantial data content while giving a better viewer experience. The migration of on-premises software to cloud-based software is due to low upfront and infrastructure maintenance costs. Furthermore, the need to access applications across devices and remote places is increasing the demand for cloud-based software.

Application Insights

The new Construction segment captured a significant market share of around 58.0% in 2022. The segment’s growth is driven by rising population and urbanization in the North America region. As more individuals and families seek housing in urban centers and suburban areas, the need for new residential construction has intensified. This has increased demand for ductwork design services to ensure optimal ventilation and air distribution systems within these new homes. Moreover, there has been a growing emphasis on energy efficiency and sustainability in residential construction. As environmental concerns and energy costs continue rising, builders and homeowners are prioritizing energy-efficient designs. This has prompted adoption of advanced HVAC systems and ductwork layouts that enhance indoor air quality while minimizing energy consumption. Ductwork design is crucial in achieving these goals, further boosting demand.

The retrofitting segment is expected to witness a CAGR of over 4.0% through 2030. As homes age and technologies advance, there’s a growing need to update HVAC systems to meet modern standards. Retrofitting allows homeowners to integrate new ductwork designs and components into their existing structures without requiring complete system replacements. This approach minimizes costs and reduces the environmental impact associated with manufacturing new materials. The push toward energy efficiency is one of the key drivers of the retrofit application segment. Homeowners are increasingly aware of the benefits of reducing energy consumption, both for cost-saving and environmental reasons. Retrofitting ductwork systems enable the incorporation of advanced insulation materials and sealed joints, preventing air leakage and improving overall system efficiency. This is especially important in regions with extreme weather conditions, where well-designed ductwork can significantly impact heating and cooling costs. Moreover, the rise of smart home technologies has further fueled the demand for retrofit applications.

Construction Type Insights

Single-family household segment captured a significant market share of around 58.0% in 2022. The growth of this segment is driven by a rise in single-family household construction activities along with population growth, urbanization, and changing preferences of homeowners. As more individuals and families seek to own homes, the demand for residential construction has soared. Single-family homes remain popular due to their privacy, space, and sense of ownership. This has led to a substantial increase in construction activities, creating a domino effect on related industries, including HVAC. Integrating ductwork design software with billing information modeling and energy modeling programs is becoming more vital for an integrated and optimized design process as homes get smarter. Under-friendly and mobile interfaces are making ductwork software more accessible to small contractors as well.

The multi-family household segment is expected to witness a CAGR of around 6.0% through 2030. The multi-family household includes apartments, condos, and townhomes. This segment represents a major growth opportunity for the ductwork design software industry. As more multi-family projects are built to meet housing demand, HVAC systems have increased in scale and complexity. This has driven the adoption of ductwork design software to optimize system performance. The surge in construction can be attributed to several factors, such as rapid urbanization, higher population densities in urban areas, and the consequent need for more efficient use of space. Additionally, changing lifestyles and the desire for convenience have made multi-family living appealing to diverse individuals and families.

End-user Insights

The contractors segment captured a significant market share of over 51.0% in 2022. Contractors in the North America region are moving towards the use of residential ductwork design software due to the need to streamline the entire design process. This software enables the contractors to create accurate layouts, optimize airflow distribution, and ensure compliance with regulations. In addition, the segment growth can be attributed to the emphasis on energy efficiency and environmental sustainability, which has pushed contractors to adopt sophisticated software that aids in creating optimized HVAC systems.

The architects/engineer segment is expected to witness a CAGR of over 6.0% through 2030. Architects and engineers are often tasked with creating HVAC systems that provide optimal comfort and adhere to strict energy efficiency and environmental standards. As such, the demand for software tools that aid in designing, simulating, and optimizing ductwork systems has surged. The increasing demand for smart homes and IoT integration also fuels the segment’s growth. Architects and Engineers are integrating ductwork design software with broader building automation systems, allowing homeowners to control and monitor their HVAC systems remotely.

Regional Insights

U.S. dominated the residential ductwork design market in 2022 by holding a revenue share of over 76.0%. This market growth is driven by increasing building construction activities and demand for energy-efficient buildings. Ductwork design software has become an essential tool for HVAC professionals, architects, and engineers in the U.S. involved in residential construction and renovation projects. The increasing emphasis on energy efficiency and sustainable building practices is further contributing to the growth of the market in the country. As environmental concerns mount and energy costs rise, the demand for more efficient HVAC systems has surged. Rising investment into residential ductwork design software solutions is further projected to boost the growth of the market in upcoming years.

Mexico is projected to record the highest CAGR of around 7.0% through 2030 as the country presents remarkable growth opportunities in the construction sector. The market growth in Mexico is attributed to the booming construction and real estate sectors, increasing awareness of energy efficiency, and technological advancements. The country's construction and real estate sectors have been expanding rapidly, creating a strong demand for residential properties. As more homes are built for renovation, the need for efficient and effective HVAC systems has surged. Ductwork design software is crucial in this aspect, helping architects, engineers, and HVAC professionals design and optimize duct systems for better comfort and energy efficiency.

Key Companies & Market Share Insights

The major players in the market for North America residential ductwork design software include Autodesk, CAD International, Trane, Graphisoft, Elite Software Development, and others. These market players were ranked according to the key strategies they employed to maintain a competitive edge in the market, their product offerings, the applications segment they served, the sophistication of their technology, their strategy to differentiate their products, and their industry impact. The key strategies include strategic collaborations, partnerships, and agreements; new product development; capability expansion; mergers & acquisitions; and research & development initiatives. The market is highly competitive with leading players having an extended operating history, large customer base, and significant competitive strengths. They leverage these strategies to enhance their product offerings and expand their geographic footprint to untapped markets.

For instance, In May 2023, Trimble Inc. acquired Transporeon, and cloud-based transportation management platform. This acquisition aimed to fund Transporeon which in turn would make the company a part of Trimble’s Transportation Segment. Some prominent players in the North America residential ductwork design software market include:

-

Autodesk Inc.

-

Avenir Software Inc.

-

CAD International

-

CAD Pro (Delta Software International LLC)

-

Cadmatic

-

Cadsoft Corporation

-

Carrier

-

CS Odessa Corp

-

Design Master Software Inc.

-

DesignBuilder Software Ltd.

-

Edrawsoft

-

Elite Software Development Inc.

-

EnergyPlus (DOE, USA)

-

EnergySoft LLC

-

Graphisoft (Nemetschek Group)

-

H2X Pty Ltd.

-

HidraSoftware

-

Integrated Environmental Solutions Limited

-

QUICK PLUMB

-

Trane

-

Trimble Inc.

-

Wrightsoft Corporation

North America Residential Ductwork Design Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 313.5 million

Revenue forecast in 2030

USD 450.7 million

Growth rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, construction type, end-user, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Autodesk Inc.; Avenir Software Inc.; CAD International; CAD Pro (Delta Software International LLC); Cadmatic; Cadsoft Corporation; Carrier; CS Odessa Corp; Design Master Software Inc.; DesignBuilder Software Ltd.; Edrawsoft; Elite Software Development Inc.; EnergyPlus (DOE, USA); EnergySoft LLC; Graphisoft (Nemetschek Group); H2X Pty Ltd.; HidraSoftware; Integrated Environmental Solutions Limited; QUICK PLUMB; Trane; Trimble Inc.; Wrightsoft Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Residential Ductwork Design Software Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America residential ductwork design software market report based on component, deployment, application, construction type, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

HVAC

-

Load Calculation Software

-

Duct Desing Software

-

Simulation Software

-

Others

-

-

Gas Pipeline

-

Plumbing

-

Water Supply

-

Drainage System

-

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

New Construction

-

Retrofitting

-

-

Construction Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-Family Household

-

Multi-Family Household

-

-

End-User Outlook (Revenue, USD Million, 2018 - 2030)

-

Contractors

-

Architects/Engineers

-

Facility Managers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America residential ductwork design software market size was estimated at USD 296.5 million in 2022 and is expected to reach USD 313.5 million in 2023.

b. The North America residential ductwork design software market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 450.7 million by 2030.

b. Based on component, the software segment dominated the market in 2022 with a share of over 79%. The segment growth is attributed to the rising adoption of sustainable building practices and the increased number of building construction activities in the North America region.

b. The key players in this industry are Autodesk Inc., Avenir Software Inc., CAD International, CAD Pro (Delta Software International LLC), Cadmatic, Cadsoft Corporation, and others.

b. Key factors that are driving the North America residential ductwork design software market growth include the increased need for energy-efficient solutions and the expanding number of residential development projects in the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."