- Home

- »

- Nutraceuticals & Functional Foods

- »

-

North America Vitamin D Market Size Report, 2020-2027GVR Report cover

![North America Vitamin D Market Size, Share & Trends Report]()

North America Vitamin D Market Size, Share & Trends Analysis Report By Source (Milk, Egg, Fruits & Vegetables, Seaweeds), By Form, By Analog, By IU Strength, By Application, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-263-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

Report Overview

The North America vitamin D market size was valued at USD 426.0 million in 2019. It is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2020 to 2027. Vitamins play a vital role in boosting the nutritional value of food and beverage products. Growing awareness among the consumers regarding the intake of a healthy diet has resulted in a significant increase in the demand for vitamin D. The regular intake of the product helps reduce the risk of diabetes, flu, and cancer. Additionally, its consumption aids in losing weight and in proper absorption of minerals. The increasing number of diabetic and obese population in the region is projected to boost the demand for nutrition-dense products, which, in turn, is anticipated to augment the demand for vitamin D over the upcoming years.

The U.S. accounted for the largest share of the North America vitamin D market in 2019 on account of the growing demand for the product from pharmaceutical, food and beverage, and pet food industries. As of 2019, over 50% of the country's population was suffering from vitamin D deficiency due to unhealthy eating habits and less exposure to direct sunlight.

The advancements in vitamin D rich food products coupled with the presence of prominent multinational players in the regional market are expected to impact the industry positively. The food and beverage manufacturers increasingly emphasize offering vitamin-fortified food products due to rising awareness among the consumers regarding the benefits of consuming nutritionally rich foods.

Furthermore, the product is being widely used in pet food and animal feed products to enhance these products' nutritional value. Growing awareness regarding pet health has resulted in a shift towards the purchase of nutritious food products by pet owners, which is expected to positively impact pet food over the forecast period, thereby propelling the demand for pet food fortified with vitamin D.

However, increasing awareness among consumers about the adverse impact of inorganic food on human health has resulted in a shift in the trend toward the market growth of organic foods. Organic food and beverages are naturally-derived products and do not contain synthetic chemicals and additives. The gradual shift toward consuming organic food over supplements or fortified food is projected to limit the demand for vitamin D and thus, affect the market growth.

Form Insights

The dry form segment led the market and accounted for 60.5% share of the total revenue in 2019. The dry form of the product is majorly used in the food & beverage and pharmaceutical industries. The dry product segment is anticipated to ascend at a significant rate owing to the rising demand for vitamin D in capsule and powdered forms for their high solubility.

The dry product is easy to handle and store, highly stable, and convenient to be utilized in an array of products. As a result, it is a popular choice among the food and beverage, feed and pet food, and pharmaceutical manufacturers. Moreover, the production of vitamin D consumables in tablets and capsules form is anticipated to increase its penetration in medication prescribed by doctors. Major dry vitamin D applications include food fortification, dietary supplements, functional food & beverage, and medical food.

The liquid vitamin D segment is anticipated to accelerate at a moderate rate owing to its limited usage in pharmaceutical and food and beverage applications. The liquid product is prominently used in food supplements to boost immunity, maintain cardiovascular health, and support bone and dental health. The liquid formula generally offers 100 to 1,000 IU per drop and is preferably used in food items and drinks.

Superior absorbability of liquid product and prominent ways to treat vitamin D deficiency by directly administering it into the body is expected to increase its popularity. The growing demand for liquid dietary supplements in the sports nutrition section is expected to boost the segment growth over the forecast period.

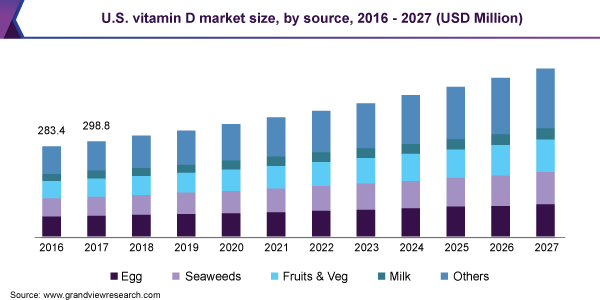

Source Insights

Eggs are a prominent vitamin D source, as 100 gm of eggs contain nearly 87 IU of vitamin D. In addition to this, eggs are rich in fats, cholesterol, sodium, potassium, carbohydrates, and proteins. The egg yolk is the prime source of vitamins, fats, and minerals and is consumed in the case of vitamin D deficiency. One egg yolk gives 37 IU of vitamin D or 5% of the daily value.

The fruits and vegetable segment is expected to expand at a considerable CAGR during the forecast period due to the increasing vegetarian diet consumption. Mushrooms are the primary choice for vitamin D in the fruits and vegetable category. The rising number of vegans is expected to boost product demand from vegetarian sources in the region.

The others segment, which includes cod liver oil; sunlight; and fish, led the market and accounted for more than 31.5% share of the total revenue in 2019. The fish species such as salmon, herring, and sardines can provide up to 170 to 1,300 IU of vitamin D per serving of 100 gm. In addition to this, cod liver oil and canned tuna are significant vitamin D sources in the market.

In other sources segment, the prominent source of vitamin D is sunlight. The human body's exposure to direct sunlight for 10-20 minutes daily can reduce the risk of vitamin D deficiency. However, weak sunlight in cold regions for most of the year has resulted in vitamin D deficiency in the population. To overcome this situation, consumers are adopting alternatives such as animal and plant-based product sources.

Analog Insights

The Vitamin D3 segment led the market and accounted for more than 66.0% share of the total revenue in 2019. Vitamin D3, also known as cholecalciferol, is commonly found in animal products such as liver oil, egg yolk, fish and fish oil, dietary supplements, and butter. Human skin tends to produce vitamin D3 when exposed to direct sunlight. Direct radiation helps the formation of vitamin D3 from the already existing 7-dehydrocholesterol in human skin.

Vitamin D2 or ergocalciferol is commonly found in a vegetarian diet, which is popular among people consuming vegetarian food. The primary sources of vitamin D2 are fortified food, mushrooms grown in UV light, and dietary supplements. The low production cost of vitamin D2 has increased its application in the fortification of food.

Vitamin D2 and D3 are used to raise the blood levels in the human body by using 25-hydroxyvitamin D2 and 25-hydroxyvitamin D3, collectively known as calcifediol. The amount of calcifediol present in the blood reflects the nutrient content in the body. Thus, healthcare specialists measure calcifediol levels in the blood to estimate vitamin D levels.

The high content of vitamin D2 and D3 is used to heal the deficiency in the body and for the robust health of bone and teeth. Increasing consumption of vitamin D3 in pharmaceutical and food and beverage products due to its effectiveness in raising the blood level in the body is expected to propel the market growth at a substantial rate during the review period.

IU Strength Insights

600 IU segment led the market and accounted for more than 75% share of the total revenue in 2019. Vitamin D with 600 IU dosage is highly recommended for the age group of 4 to 70 owing to the requirement of a sufficient amount of vitamin content for the human body. Growing concerns regarding public health and deficiencies are expected to increase the consumption of vitamin D supplements with 600 IU dosage.

800 IU is the high dosage of the product that is recommended for people over 60 years. Vitamin D deficiency in the body can cause bone problems and low metabolism; thus, 800 IU are gaining the share. Moreover, the growing elderly population in the North American region is expected to drive the demand for 800 IU products.

Health experts' recommendation for vitamin D intake varies according to the body type and deficiency of vitamins; thus, the varied dosage of vitamins is consumed. Several scientific studies have shown that the intake of 1000 to 4000 IU or 25 mcg to 100 mcg is ideal for the human body to maintain vitamin levels. However, the dosage of vitamins to be consumed should be prescribed by a doctor.

A high dosage of more than 4000 IU is expected to gain market share with an increasing number of patients with vitamin D deficiency. Moreover, less exposure to sunlight and inadequate intake through food and beverage can increase the demand for vitamin supplements with a high dosage of 1000 IU and above.

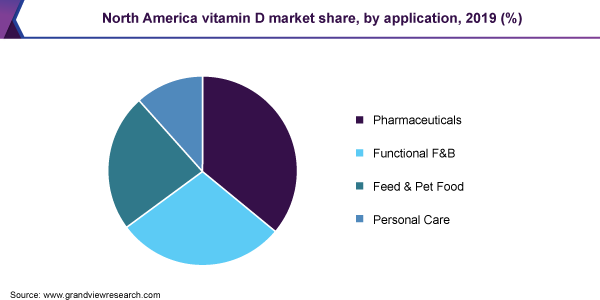

Application Insights

The pharmaceuticals segment led the market and accounted for more than 36.0% share of the total revenue in 2019. The pharma-grade products are highly effective and are composed of high-quality sources; therefore, they are used in low quantities in medicines' composition. Both plant-based and animal-based products are used as sources of vitamin D for the composition of medicines.

The rising number of patients with vitamin D deficiency in the region is expected to increase the demand for pharmaceutical products comprising vitamin D. The pharma-grade vitamin D products are expensive as compared to their counterparts, thus are acquiring the highest revenue share in the market.

The product is used in manufacturing various functional food and beverage such as snacks and cereals, food supplements, fruit juices and drinks, dairy products, and others. The growing demand for functional food and beverages for nutritional benefits and maintaining a healthy lifestyle are fueling the product demand. Dairy alternatives, dietary supplements, and sports drinks are among the significant foods containing functional ingredients.

Vitamin D is widely being used to enhance the nutrition levels of pet and animal feed, thereby improving the diet of animals such as dogs, horses, and swine; aquaculture; and hens. Moreover, the players operating in the personal care products market in the U.S., Canada, and Mexico are engaged in offering specialized vegan products and focusing on the procurement of plant-based sources.

Regional Insights

The U.S. dominated the market and accounted for over 78.1% share of total revenue in 2019. Increased consumption of functional food and beverages in the country, owing to the rising awareness about the associated health benefits such as weight loss and improved nutrient absorption in the body, is expected to drive vitamin D based functional foods.

Also, the presence of an established pharmaceutical industry in the U.S. has played a vital role in promoting the growth of the vitamin D market. Weight management is a crucial issue in the U.S. owing to the exponentially rising obesity levels. This has resulted in increased consumption of dietary supplements to combat the rising obesity levels and maintain critical weight, thus propelling the vitamin D market growth in the U.S.

Increasing marketing initiatives taken by the Vitamins Minerals Herbs and Supplements (VMHS) manufacturers in Canada to create awareness about preventive healthcare is expected to influence the market growth in the country positively. The rising elderly population and the growing occurrence of lifestyle-related diseases such as diabetes and obesity are directly contributing to the consumption of nutrition-rich food and, thus, vitamin D.

The vitamin D market in Mexico is anticipated to ascend at the highest CAGR over the forecast period owing to the rising demand for vitamin supplements from the pharmaceutical and food & beverage industries. The growing consumer preference for a healthy diet coupled with vitamins' health benefits is expected to augment the product demand over the forecast period.

Key Companies & Market Share Insights

The players operating in the market are focusing on expanding their developmental capacity to meet the demand for high-quality multivitamins and look for outsourcing to get solutions to various manufacturing and logistics facets. GlaxoSmithKline Plc. emerged as the prominent player in 2019.

The leading players in the vitamin D market are also focusing on mergers and acquisitions, joint ventures, and third party manufacturing to remain competitive in the market. Moreover, unique marketing strategies and marketing through a commercial medium are adopted by the players to promote vitamin D products.

In 2020, GlaxoSmithKline Plc announced its collaboration with a top vaccine company to make a combined effort in developing a COVID-19 vaccine, which is anticipated for a clinical trial in 2020 second half. This strategic decision highlights the company’s intent to serve the customers with its skill and collaborative technologies. From a competitive standpoint, such initiatives are aimed at enhancing stakeholder relationships, geographical dispersion, and evolving innovative ideas due to increased learning possibilities. Some prominent players in the North America vitamin D market include:

-

Koninklijke DSM N.V.

-

BASF SE

-

Dishman Group

-

Glanbia plc

-

PHW Group

-

GlaxoSmithKline Plc

-

Bio-Tech Pharmacal

-

Nestle S.A.

-

Pfizer Inc.

-

Abbott Laboratories

-

The Kraft Heinz Company

-

Cipla Inc.

North America Vitamin D Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 450.2 million

Revenue forecast in 2027

USD 666.4 million

Growth Rate

CAGR of 5.8% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, source, analog, IU strength, application, region

Regional scope

North America

Country scope

U.S., Canada, Mexico

Key companies profiled

Koninklijke DSM N.V.; BASF SE; Dishman Group; Glanbia plc; PHW Group; GlaxoSmithKline Plc; Bio-Tech Pharmacal; Nestle S.A.; Pfizer Inc.; Abbott Laboratories; The Kraft Heinz Company; Cipla Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For this study, Grand View Research has segmented the North America vitamin D market report based on form, source, analog, IU strength, application, and region:

-

Form Outlook (Revenue, USD Million, 2016 - 2027)

-

Liquid

-

Dry

-

-

Source Outlook (Revenue, USD Million, 2016 - 2027)

-

Milk

-

Egg

-

Fruits & Vegetables

-

Seaweeds

-

Others

-

-

Analog Outlook (Revenue, USD Million, 2016 - 2027)

-

Vitamin D2

-

Vitamin D3

-

-

IU Strength Outlook (Revenue, USD Million, 2016 - 2027)

-

400 IU

-

600 IU

-

800 IU

-

Others

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Functional Food & Beverages

-

Food Supplements

-

Fruit Juice & Drinks

-

Dairy Products

-

Snacks & Cereals

-

Others

-

-

Personal Care

-

Feed & Pet Food

-

Pharmaceuticals

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America vitamin D market size was estimated at USD 426.0 million in 2019 and is expected to reach USD 450.2 million in 2020.

b. The North America vitamin D market is expected to grow at a compound annual growth rate of 5.8% from 2020 to 2027 to reach USD 666.4 million by 2027.

b. On the basis of application, the pharmaceuticals segment dominated the North America vitamin D market with a share of 36.0% in 2019. Vitamin D is widely utilized for the composition of medicines and is consumed in tablet, capsule, and liquid forms. The presence of the established pharmaceutical industry in the region is driving market growth.

b. Some of the key players operating in the North America vitamin D market include Koninklijke DSM N.V., BASF SE, Dishman Group, Glanbia plc, PHW Group, GlaxoSmithKline Plc, Bio-Tech Pharmacal, Nestle S.A., Pfizer Inc., Abbott Laboratories, The Kraft Heinz Company, and Cipla Inc.

b. The key factors that are driving the North America vitamin D market include increased consumption of vitamin D fortified food products with rising health concerns and growing vitamin deficiency among the consumers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."