- Home

- »

- Medical Devices

- »

-

Oligonucleotide CDMO Market Size, Industry Report, 2033GVR Report cover

![Oligonucleotide CDMO Market Size, Share & Trends Report]()

Oligonucleotide CDMO Market (2025 - 2033) Size, Share & Trends Analysis Report By Service (Contract Development, Contract Manufacturing), By Type (Antisense Oligonucleotides, Small Interfering RNA), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-832-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oligonucleotide CDMO Market Summary

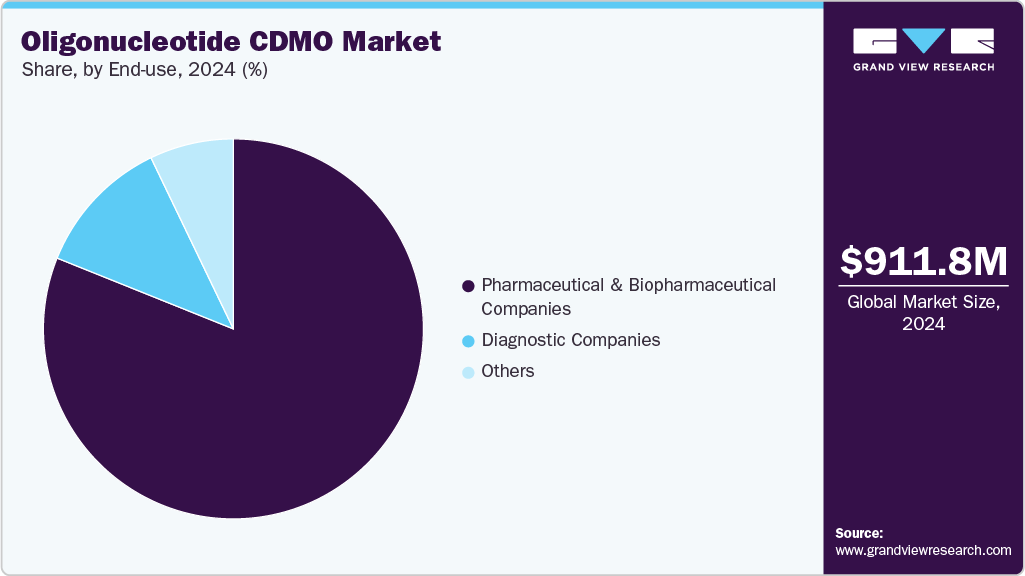

The global oligonucleotide CDMO market size was estimated at USD 911.78 million in 2024 and is projected to reach USD 3,168.97 million by 2033, growing at a CAGR of 14.98% from 2025 to 2033. The market is driven by the rising clinical pipeline of antisense and siRNA therapies, growing adoption of mRNA-based therapeutics beyond vaccines, and increasing outsourcing by biotech firms to reduce manufacturing complexity.

Key Market Trends & Insights

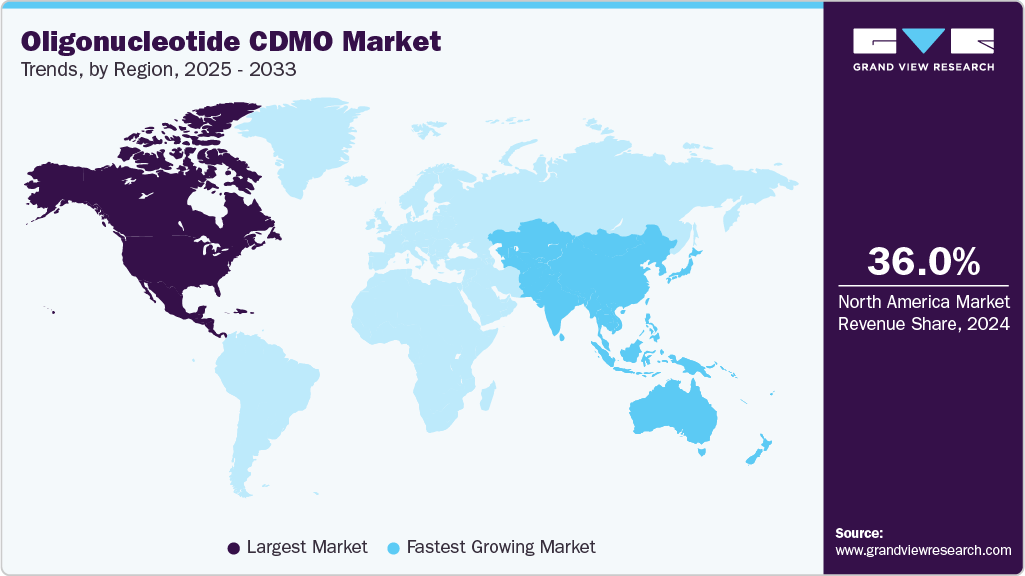

- North America oligonucleotide CDMO industry held the largest share of 36.02% of the global market in 2024.

- The oligonucleotide CDMO industry in the U.S. is expected to grow significantly over the forecast period.

- By service, the contract manufacturing segment led the market with the largest revenue share of 63.78% in 2024.

- By type, the antisense oligonucleotides segment led the market with the largest revenue share in 2024.

- By application, the therapeutic segment held the largest share in the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 911.78 Million

- 2033 Projected Market Size: USD 3,168.97 Million

- CAGR (2025-2033): 14.98%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

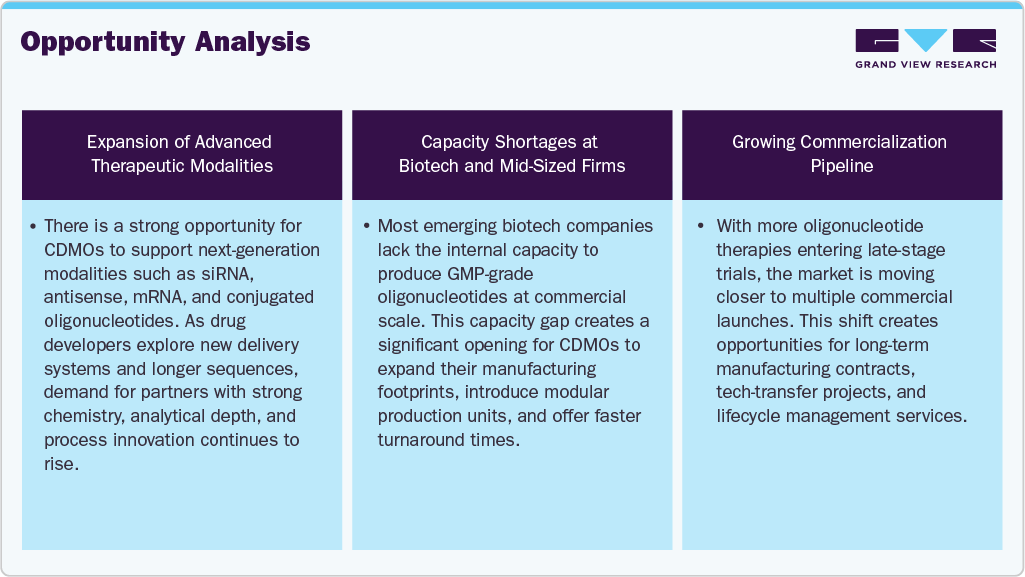

In addition, the increasing number of pipeline of RNA-based and antisense therapeutics is driving the need for specialized manufacturing partners to help them scale production. As these candidates progress into late-stage clinical trials, sponsors encounter capacity constraints and heightened purity requirements, prompting a shift toward experienced contract development and manufacturing organizations (CDMOs) for scalable and compliant production. The need for consistent GMP-grade materials across multiple development phases further strengthens outsourcing trends and supports the steady uptake of contract manufacturing services in this domain.

Furthermore, the growing complexity of oligonucleotide chemistry, which requires sophisticated synthesis platforms and analytical capabilities that many emerging biotech firms cannot develop internally is also contributing to market growth. Several advancements such as conjugated oligos, advanced delivery systems, and long-chain sequences is adding additional technical challenges which is encouraging companies to depend on CDMOs with proven expertise. Thus, technologically advanced providers that can deliver high yield, reduced impurity profiles, and flexible batch scaling are becoming crucial across the development range.

Opportunity Analysis

Service Insights

In terms of service, the market is classified into contract manufacturing and contract development. The contract manufacturing segment accounted for the largest revenue share in the oligonucleotide CDMO industry with 63.78% in 2024. The segment's growth is due to the rising number of oligonucleotide programs moving into late-stage trials, which is increasing the need for large-scale, GMP-compliant production. Moreover, several biopharma companies rely on external partners because they lack in-house capacity and specialized equipment required for high-purity synthesis. Thus, the growing focus on commercial readiness, supply reliability, and cost-efficient scaling is further strengthening the preference for outsourcing manufacturing activities.

The contract development segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is driven due to the rising demand for early-stage support services, including sequence design, process optimization, and analytical method development. Many emerging biotech companies depend on CDMOs to overcome limited internal R&D capacity and accelerate the transition from discovery to clinical readiness. The increasing interest in complex chemistries, such as conjugated and modified oligonucleotides, has further underscored the need for specialized development expertise. Thus, these factors are further contributing to market growth.

Type Insights

Based on type, the market is segregated into antisense oligonucleotides, small interfering RNA, and other oligonucleotides. The antisense oligonucleotides segment held the largest share in the market in 2024. The growth of the segment is due to the increasing number of antisense therapies advancing through clinical pipelines and representing strong therapeutic potential across genetic, neuromuscular, and rare diseases. Developers are prioritizing antisense platforms because they enable precise gene expression modulation with relatively predictable safety profiles. As more candidates progress into later phases, the need for high-quality synthesis, purification, and GMP production has expanded. This has strengthened demand for CDMOs with established expertise in antisense chemistry and scalable manufacturing capabilities.

The small interfering RNA segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is due to the increasing development and commercialization of siRNA-based therapeutics for rare genetic disorders, oncology, and metabolic diseases. Advances in delivery technologies and chemical modifications have improved the stability and efficacy of siRNA molecules, encouraging more companies to pursue this modality.

Application Insights

Based on application, the market is segregated into therapeutic, research, and diagnostic segments. The therapeutic segment held the largest share in the market in 2024. The growth of the segment is due to the increasing use of oligonucleotide-based therapies for treating rare genetic disorders, neuromuscular diseases, and cancers. Rising clinical success rates and regulatory approvals for antisense, siRNA, and other oligonucleotide therapeutics have encouraged broader adoption by pharmaceutical and biotech companies. Thus, the demand for high-quality, scalable, and GMP-compliant production is driving the outsourcing to specialized CDMOs.

The diagnostic segment is anticipated to grow at a considerable CAGR during the forecast period. The segment growth is due to the increasing use of oligonucleotides in molecular diagnostics, including PCR assays, genetic testing, and biomarker detection. Moreover, rising demand for rapid, accurate, and high-sensitivity diagnostic tools, particularly in infectious diseases and personalized medicine is also one of the factors contributing to the segment’s market growth.

End Use Insights

On the basis of the end use segment, the market is segregated into pharmaceutical and biopharmaceutical companies, diagnostic companies, and others. The pharmaceutical and biopharmaceutical companies segment accounted for the largest revenue share in 2024 due to their extensive focus on developing oligonucleotide-based therapeutics for a wide range of diseases, including chronic and lifestyle disorders. These companies increasingly rely on CDMOs to outsource both development and manufacturing processes to optimize costs, enhance efficiency, and accelerate time-to-market.

The diagnostic companies segment is anticipated to grow at a considerable CAGR during the forecast period. This growth is due to the rising demand for high-quality oligonucleotides in molecular diagnostics, genetic testing, and biomarker-based assays. Diagnostic firms increasingly rely on CDMOs for custom synthesis, stringent quality control, and scalable production to meet regulatory requirements. Advancements in personalized medicine and rapid testing technologies are further driving the need for reliable external manufacturing support.

Regional Insights

North America oligonucleotide CDMO industry accounted for the largest revenue share of 36.02% in 2024. This is attributed to the regions well-established pharmaceutical and biotechnology industries, strong R&D infrastructure, and presence of leading CDMO service providers. In addition, favorable regulatory frameworks, significant investments in advanced manufacturing technologies, and high adoption of personalized medicine and biologics contribute to the region’s dominance.

U.S. Oligonucleotide CDMO Market Trends

The oligonucleotide CDMO industry in the U.S. held the largest share in 2024. The country’s growth is due to the country’s strong biopharmaceutical ecosystem, extensive R&D investments, and presence of numerous leading pharmaceutical and biotech companies. Moreover, supportive regulatory policies from agencies like the FDA, along with advanced manufacturing infrastructure and a focus on innovation in personalized medicine, have made the U.S. a preferred hub for oligonucleotide drug development and manufacturing.

Europe Oligonucleotide CDMO Market Trends

The oligonucleotide CDMO industry in Europe is expected to grow significantly due to increasing investments in biotechnology and pharmaceutical R&D, supportive government initiatives promoting advanced therapies, and a strong focus on personalized medicine across the region.

The oligonucleotide CDMO industry in Germany held a significant share in 2024, owing to the country’s strong pharmaceutical and biotechnology industry, advanced manufacturing infrastructure, and robust investment in research and development. Germany’s supportive regulatory framework, skilled workforce, and strategic location within Europe make it an attractive hub for CDMO services.

The oligonucleotide CDMO industry in the UK held a significant share in 2024. The growth of the market is due to country’s strong biopharmaceutical sector, substantial investments in cutting-edge research, and government initiatives supporting innovation in advanced therapies. The UK’s well-established clinical trial ecosystem, skilled talent pool, and favorable regulatory environment encourage the development and outsourcing of oligonucleotide therapeutics.

Asia Pacific Oligonucleotide CDMO Market Trends

Asia Pacific oligonucleotide CDMO industry is anticipated to witness the fastest CAGR over the estimated timeline. The regional growth is due to the region’s rapidly growing pharmaceutical and biotechnology sectors, cost-effective manufacturing capabilities, and increasing investments in R&D infrastructure. In addition, rising demand for personalized medicine and biologics, supportive government policies, and the presence of emerging CDMOs with advanced technological capabilities are driving market expansion.

The oligonucleotide CDMO industry in China held the largest share in 2024. The growth is due to the country’s rapidly expanding pharmaceutical and biotechnology industries, significant government support for innovation, and increasing investments in advanced manufacturing infrastructure. China’s large patient population, cost-efficient production capabilities, and growing number of clinical trials further boost demand for outsourced oligonucleotide development and manufacturing services.

The Japan oligonucleotide CDMO industry is expected to grow over the forecast period. The country’s growth is due to the country’s strong pharmaceutical industry, advanced technological capabilities, and significant investments in biopharmaceutical R&D. Japan’s aging population and increasing prevalence of chronic diseases are driving demand for innovative oligonucleotide therapies.

The oligonucleotide CDMO industry in India is anticipated to grow at a lucrative CAGR over the forecast period. The country’s market growth is due to the lower operational costs, skilled scientific workforce, and growing R&D investments from both domestic and multinational companies.

Key Oligonucleotide CDMO Company Insights

The major players operating across the market are focused on adopting inorganic strategic initiatives such as mergers, partnerships, acquisitions, etc. Moreover, companies focus on technological innovations to augment their market position.

Key Oligonucleotide CDMO Companies:

The following are the leading companies in the oligonucleotide CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- PolyPeptide Group

- STA Pharmaceutical Co. Ltd.

- Bachem

- Creative Peptides

- Aurigene Pharmaceutical Services Ltd.

- Merck KGaA

- EUROAPI

- Curia Global, Inc.

- CordenPharm

- Sylentis, S.A.

Recent Developments

-

In July 2024, CordenPharma announced to invest USD 1061.24 million (Euro 900 Million), which aims to expand its peptide platform, both at its Colorado, U.S. site and in Europe. This expansion covers both existing facilities and new constructions.

-

In April 2024, Aurigene Pharmaceutical Services Ltd. Entered into a partnership agreement with Vipergen ApS, a small-molecule drug discovery service provider which aims to accelerate innovation in drug discovery by increasing success rates and reducing timelines through screening a more billion small-molecule compounds.

Oligonucleotide CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,037.55 million

Revenue forecast in 2033

USD 3,168.97 million

Growth rate

CAGR of 14.98% from 2025 to 2033

Actual data

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE; Oman; Qatar

Key companies profiled

PolyPeptide Group; STA Pharmaceutical Co. Ltd.; Bachem; Creative Peptides; Aurigene Pharmaceutical Services Ltd.; Merck KGaA; EUROAPI; Curia Global, Inc.; CordenPharm; Sylentis, S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oligonucleotide CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global oligonucleotide CDMO market report based on service, type, application, end use, and region:

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Contract Manufacturing

-

Contract Development

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Antisense Oligonucleotides

-

Small Interfering RNA

-

Other Oligonucleotides

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Therapeutic

-

Research

-

Diagnostic

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biopharmaceutical Companies

-

Diagnostic Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global oligonucleotide CDMO market size was estimated at USD 911.78 million in 2024 and is expected to reach USD 1,037.55 million in 2025.

b. The global oligonucleotide CDMO market is expected to grow at a compound annual growth rate of 14.98% from 2025 to 2033 to reach USD 3,168.97 million by 2033.

b. North America dominated the oligonucleotide CDMO market with a share of 36.02% in 2024. This is attributable to the regions well-established pharmaceutical and biotechnology industries, strong R&D infrastructure, and presence of leading CDMO service providers.

b. Some key players operating in the oligonucleotide CDMO market include PolyPeptide Group; STA Pharmaceutical Co. Ltd.; Bachem; Creative Peptides; Aurigene Pharmaceutical Services Ltd.; Merck KGaA; EUROAPI; Curia Global, Inc.; CordenPharm; Sylentis, S.A.

b. Key factors that are driving the market growth include the rising clinical pipeline of antisense and siRNA therapies, growing adoption of mRNA-based therapeutics beyond vaccines, and increasing outsourcing by biotech firms to reduce manufacturing complexity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.