- Home

- »

- Next Generation Technologies

- »

-

On-Device AI Market Size & Share, Industry Report, 2033GVR Report cover

![On-Device AI Market Size, Share & Trends Report]()

On-Device AI Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Deployment (Cloud, On-premises), By Technology, By Device, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-612-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

On-Device AI Market Summary

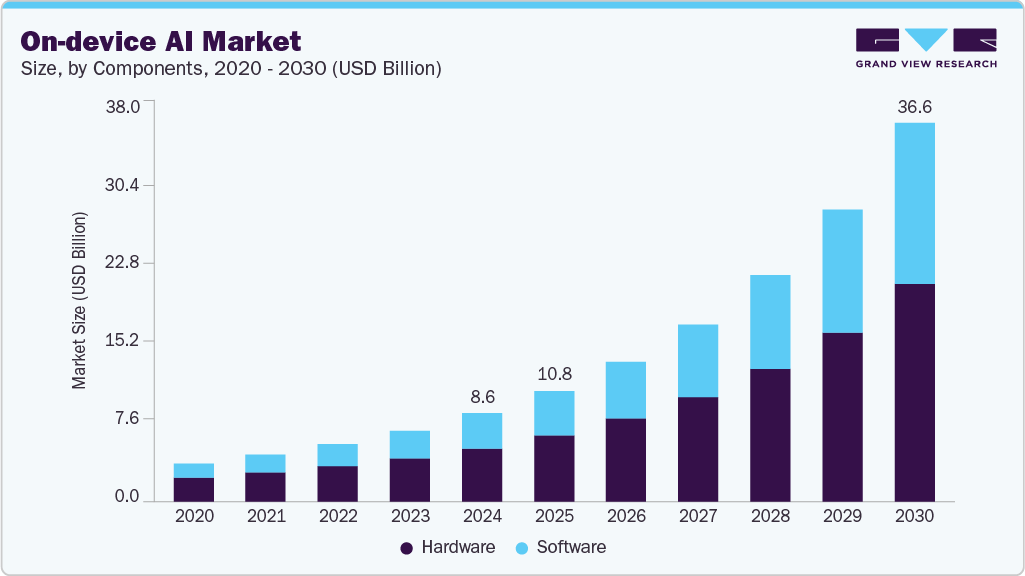

The global on-device AI market size was estimated at USD 10,764.5 million in 2025 and is projected to reach USD 75,505.9 million by 2033, growing at a CAGR of 27.8% from 2026 to 2033. The market is primarily driven by rising demand for real-time data processing, as verticals in smartphones, wearables, vehicles, and IoT systems depend on instant decision-making without relying on cloud latency.

Key Market Trends & Insights

- North America On-Device AI dominated the global market with the largest revenue share of 34.5% in 2025.

- The On-Device AI industry in the U.S. led the North America market and held the largest revenue share in 2025.

- By component, hardware led the market and held the largest revenue share of 56.6% in 2025.

- By deployment, the cloud segment held the dominant position in the market and accounted for the largest revenue share of 53.4% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 10,764.5 Million

- 2033 Projected Market Size: USD 75,505.9 Million

- CAGR (2026-2033): 27.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest market in 2025

Growing privacy and security expectations are pushing organizations to keep user data local, strengthening adoption across sensitive use cases. The market represents a significant evolution in artificial intelligence deployment, shifting computational tasks from centralized cloud servers to local devices such as smartphones, wearables, and IoT systems. This approach enables faster data processing, reduced latency, and enhanced user privacy, as information is analyzed directly where it is generated. The growing adoption of connected devices and the demand for intelligent, autonomous functionality have accelerated interest in on-device AI solutions. As organizations seek to deliver seamless and secure AI experiences, the market continues to expand across various sectors, including consumer electronics, healthcare, automotive, and industrial automation.

A major trend driving this evolution is the convergence of advanced hardware and efficient software optimization. The development of specialized AI chips, neural processing units, and lightweight models has made it possible to deploy complex AI algorithms within devices that operate under strict power and memory constraints. Simultaneously, techniques such as model compression, quantization, and federated learning are being adopted to improve inference speed and data privacy. These innovations are redefining performance benchmarks, allowing devices to perform refined tasks from image recognition to natural language processing without relying on remote servers.

Component Insights

The hardware segment accounted for the largest revenue share of 56.6% in 2025. The market is driven by the demand for high-performance processing units capable of running AI algorithms directly on devices. This growth is largely driven by the widespread adoption of IoT devices, smartphones, and advanced AI hardware such as neural processing units (NPUs), application-specific integrated circuits (ASICs), and graphics processing units (GPUs). These components play a important role in executing complex AI functions like image recognition, natural language processing, and real-time decision-making. For instance, the survey "Empowering Edge Intelligence" conducted in March 2025 underscores the pivotal impact of advanced hardware in driving on-device AI. Utilizing specialized processors and hardware accelerators, edge devices can now execute advanced AI models locally, allowing for real-time data processing with enhanced privacy and improved efficiency. This advancement is setting the stage for more intelligent, responsive, and secure edge technologies across various sectors.

The software segment is expected to grow at a CAGR of 29.3% from 2026 to 2033. The segment is driven due to its essential role in powering AI functionality through algorithms, On-Device AI models, operating systems, and platforms. Software advancements enable efficient AI processing on resource-constrained devices, making adoption feasible across industries. The growing demand for real-time tasks such as image recognition, speech processing, and analytics is fueling this growth. In addition, new tools for developing and deploying lightweight AI models on devices have increased innovation. As software continues to evolve, it supports different applications in industries such as automotive, healthcare, and manufacturing.

Deployment Insights

The cloud segment dominated the market revenue share in 2025. The market is driven as more enterprises adopt cloud-based solutions for their scalability, flexibility, and ease of managing AI models. Hybrid approaches, which blend cloud and edge processing, offer the advantages of both enabling real-time inference on devices while using the cloud’s powerful infrastructure for training and updates. This demands overall performance by supporting complex analytics and real-time processing. Improvements in cloud security and privacy are also making it a more trustworthy option for sensitive applications, further contributing to its rising adoption in the on-device AI ecosystem.

The on-premises segment is projected to hold the fastest CAGR over the forecast period. The market is driven by the need for strong data security, privacy, and compliance with regulations like HIPAA and GDPR. It gives organizations full control over their infrastructure, allowing for customized AI operations without depending on third-party cloud services. This model also reduces latency, making it ideal for real-time applications in sectors like healthcare and automotive. It offers predictability and avoids ongoing cloud fees. In addition, it ensures compliance with data sovereignty laws, making it a trusted option for security-focused enterprises.

Technology Insights

Machine Learning accounted for the largest market revenue share in 2025. The machine learning segment is being propelled by the surge in demand for real-time processing as devices increasingly operate offline and latency becomes an essential factor, effectively enabling immediate, context-aware decision making. Moreover, heightened concerns around data privacy and security issues such as keeping data on the device rather than sending it to the cloud is becoming a major differentiator and driver of adoption. For instance, in October 2025, Arm Limited, semiconductor and software design company, expanded its Flexible Access licensing Programme to include its Arm v9 edge AI platform in collaboration with startups and device makers, thereby lowering development barriers and catalyzing on-device AI design activity.

The computer vision segment is projected to grow significantly over the forecast period. Numerous factors such as, a convergence of real-time processing demands, stringent data privacy requirements, and the proliferation of lightweight hardware accelerators are driving the growth of the segment. Devices that can run vision algorithms locally without cloud dependency reduce latency and network overhead, making verticals in mobile, wearable, automotive and industrial IoT more compelling. Moreover, advances in model compression and edge AI hardware enable high accuracy computer vision even in resource-constrained devices. For instance, in November 2024, Fujitsu Limited collaborated with Advanced Micro Devices, Inc. to jointly develop next-generation, sustainable computing platforms targeting AI/HPC and edge inference.

Device Insights

Smartphones and tablets accounted for the largest market revenue share in 2025. Various factors including the surge in real-time processing demands and growing privacy concerns that favor local AI on device rather than in the cloud are driving the growth of the segment. Moreover, the hardware advances such as, NPUs embedded in mobile chipsets, alongside consumer expectations for instantaneous AI-enabled features, such as camera enhancements, voice assistants, AR-capabilities, are accelerating this growth of the segment. Leading technology companies are actively pursuing strategic initiatives that reflect the growing integration of on-device AI capabilities within smartphones and tablets to enhance device intelligence and user experience.

The automotive segment is projected to grow significantly over the forecast period. The growth of the automotive segment is being propelled by increasing demand for high-performance, low-latency compute within vehicles, as vehicles evolve toward software-defined architectures and autonomous features. Advances in edge hardware such as, NPUs, SoCs make it feasible to push AI workloads onto the vehicle rather than the cloud, enabling real-time perception, decision-making and improved safety without constant connectivity. Regulatory push for driver-assistance and autonomous features, coupled with rising consumer expectations for seamless, intelligent vehicle experiences, further drive adoption.

Vertical Insights

Consumer electronics accounted for the largest market revenue share in 2025. The market is driven by the demand for consumer electronics such as smartphones, wearables, smart home devices for real-time processing, and low-latency performance without relying on the cloud, enabling real-time responses and smooth user interactions. Smartphones, with regular connectivity and high-performance processors, are increasing the adoption of on-device AI in the consumer electronics market. Moreover, the desire for personalized and seamless user interactions, especially on smartphones, is accelerating this trend.

The retail segment is projected to grow significantly over the forecast period. The vertical is driven by the need of retailers to deliver ultra-fast, seamless customer experiences and optimize brick-and-mortar operations. Due to increasing smart-device usage and in-store sensors, retailers are leveraging on-device inference to deliver real-time insights such as smart shelves, personalized recommendations without relying on cloud latency or connectivity. Edge-based intelligence enables instant decision-making for dynamic pricing, inventory optimization, and personalized promotions without requiring constant cloud connectivity. The increasing deployment of smart cameras, IoT sensors, and AI-enabled POS systems is fueling the shift toward on-device processing to minimize latency and ensure smooth customer experiences.

Regional Insights

North America on-device AI industry dominated the global market and accounted for a 34.5% share in 2025. The market is growing as the digital landscape undergoes quick transformation, with on-device AI playing a central role. By leveraging the computing power of devices such as smartphones, tablets, and IoT gadgets, it processes data locally, minimizing dependence on cloud services. Growing demand in the region is increased by the need for enhanced privacy, real-time data processing, and progress in technologies.

U.S. On-Device AI Market Trends

The U.S. on-device AI industry is rising due to the demand for AI enabled smart devices. In the U.S., on-device AI is enabling more efficient and intelligent business operations. Localized data processing reduces reliance on cloud infrastructure, cutting latency and operational costs. Enterprises can deploy AI to optimize workflows, enhance decision-making, and improve productivity. Consumer-facing verticals benefit from faster, more personalized experiences, which strengthen engagement and brand value. The integration of AI with advanced connectivity, such as 5G, supports scalable, high-performance solutions across sectors.

Europe On-Device AI Market Trends

The on-device AI industry in Europe is driven by strong government support and privacy-focused regulations. For instance, in June 2024, the EU introduced the world’s first comprehensive AI regulation which is the Artificial Intelligence Act. While the full law takes effect 24 months after adoption, some provisions begin earlier: bans on high-risk AI systems started on February 2, 2025; codes of practice take effect nine months post-adoption; and transparency rules for general-purpose AI apply after 12 months. Advances in IoT, sensors, and 5G are making devices smarter and more affordable. In addition, a regional AI talent gap is boosting demand for specialized software services, further rising growth.

Asia Pacific On-Device AI Market Trends

The on-device AI industry in the Asia-Pacific region is experiencing rapid growth due to factors such as processing data locally on devices which fuel the demand for privacy, speed, and efficiency, crucial for the region's dynamic and diverse markets. APAC also benefits from strong software development expertise, a growing pool of skilled tech talent, and an active start-up environment centered around AI innovation. Moreover, the increasing demand of smartphones and the demand for advanced AI features such as voice recognition, smart imaging, and real-time translation are further driving the adoption of on-device AI in the region.

Key On-Device AI Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

Intel Corporation is a leading technology company focused on semiconductor advancements and computing solutions. Its mission is to develop transformative technologies that enhance the lives of people around the world. The company’s iconic "Intel Inside" campaign, introduced in 1991, exemplified ingredient branding by promoting the inclusion of Intel processors in personal computers, turning the brand into a household name. By consistently innovating in both hardware and software, Intel supports the needs of creators, businesses, and consumers globally.

-

Microsoft Corporation is a leading American multinational technology company known for its software products, including Windows and Microsoft Office, as well as its Azure cloud platform. Over the years, Microsoft has expanded into fields such as artificial intelligence, gaming with its Xbox brand, and enterprise solutions, solidifying its position as a global tech powerhouse. The company is committed to advancing innovation in cloud services, AI, and sustainability, aiming to empower individuals and organizations around the world.

Key On-Device AI Companies:

The following are the leading companies in the on-device AI market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Baidu, Inc.

- Amazon.com, Inc.

- Google LLC

- Microsoft

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Huawei Technologies Co., Ltd.

- Arm Limited

Recent Developments

-

In March 2025, Arm and Stability AI collaborated to enhance on-device text-to-audio generation by optimizing Stability AI's "Stable Audio Open" model for Arm CPUs. Utilizing Arm's KleidiAI technology, they achieved a 30-fold increase in processing speed, reducing audio generation time from 240 seconds to under 8 seconds for an 11-second clip on Armv9 CPUs. This advancement enables smartphones to produce high-quality, custom audio clips entirely offline, without the need for internet connectivity. By running the model efficiently on-device, this breakthrough makes advanced audio AI accessible to billions of users worldwide, transforming mobile AI capabilities and empowering creators, businesses, and consumers alike.

-

In June 2024, at WWDC, Apple launched Apple Intelligence, a personal AI system built into iOS 18, iPadOS 18, and macOS Sequoia. This system blends on-device processing with server-based generative models to help users with tasks such as text editing, summarizing notifications, generating images, and interacting with apps—all with a strong emphasis on privacy. Powered by Apple silicon, Apple Intelligence enables the understanding and generation of language and visuals, performs actions across apps, and uses personal context to streamline and enhance daily activities.

On-Device AI Market Report Scope

Report Attribute

Details

Market size in 2026

USD 13,558.3 million

Revenue forecast in 2033

USD 75,505.9 million

Growth rate

CAGR of 27.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, technology, device, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Apple Inc.; Baidu, Inc.; Amazon.com, Inc.; Google LLC; Microsoft; Intel Corporation; NVIDIA Corporation; Qualcomm Technologies, Inc.; Huawei Technologies Co., Ltd.; Arm Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global On-Device AI Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global on-device AI market report based on component, deployment, technology, device, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-premises

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Machine Learning

-

Natural Language Processing

-

Computer Vision

-

Speech Recognition

-

-

Device Outlook (Revenue, USD Million, 2021 - 2033)

-

Smartphones & Tablets

-

Wearables

-

Smart Home Devices

-

Automotive

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer Electronics

-

Automotive

-

Healthcare

-

Retail

-

Manufacturing

-

Security & Surveillance

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global on-device AI market size was estimated at USD 10,764.5 million in 2025 and is expected to reach USD 13,558.3 million in 2026.

b. The global on-device AI market is expected to grow at a compound annual growth rate of 27.8% from 2026 to 2033 to reach USD 75,505.9 million by 2033.

b. North America dominated the on-device AI market with a share of 34.5% in 2025. The market is growing as the digital landscape undergoes quick transformation, with On-Device AI playing a central role. By leveraging the computing power of devices such as smartphones, tablets, and IoT gadgets, it processes data locally, minimizing dependence on cloud services.

b. Some key players operating in the on-device AI market include Apple Inc.; Baidu, Inc.; Amazon.com, Inc.; Google LLC; Microsoft; Intel Corporation; NVIDIA Corporation; Qualcomm Technologies, Inc.; Huawei Technologies Co., Ltd.; Arm Limited

b. Key factors that are driving the market growth include the progress in AI technologies, growing demand for real-time data processing, and heightened concerns around privacy and security. By allowing devices to handle data locally, on-device AI reduces the dependence on cloud infrastructure

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.