- Home

- »

- Medical Devices

- »

-

Ophthalmic Diagnostic Devices Market, Industry Report 2033GVR Report cover

![Ophthalmic Diagnostic Devices Market Size, Share & Trends Report]()

Ophthalmic Diagnostic Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Optical Coherence Tomography Scanners, Fundus Cameras), By Function, By Procurement/Ownership, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-768-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ophthalmic Diagnostic Devices Market Summary

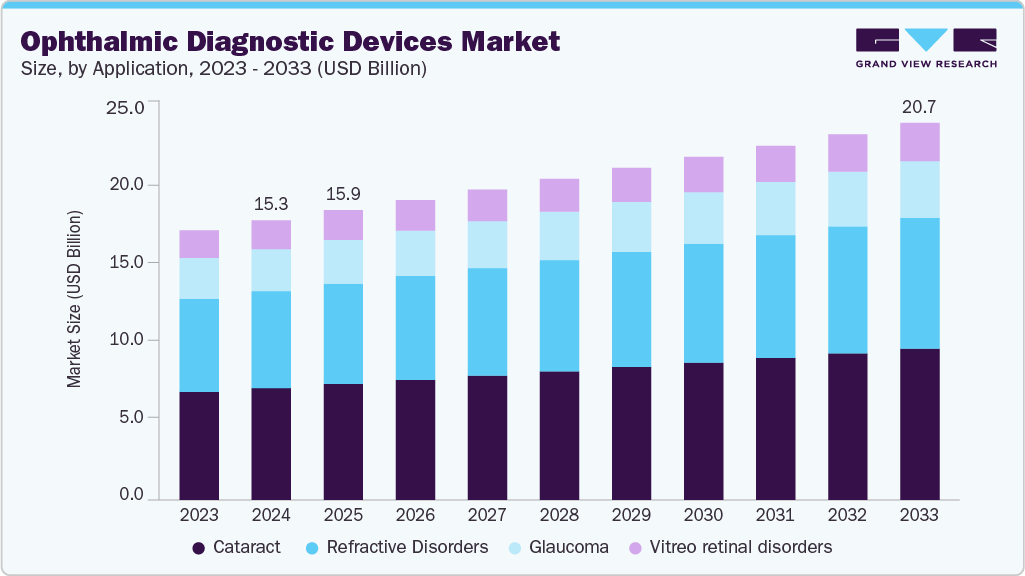

The global ophthalmic diagnostic devices market size was valued at USD 15.34 billion in 2024 and is projected to reach USD 20.69 billion by 2033, growing at a CAGR of 3.35% from 2025 to 2033. This growth is attributed to the growing geriatric population, prevalence of chronic diseases, and increasing awareness and screening programs.

Key Market Trends & Insights

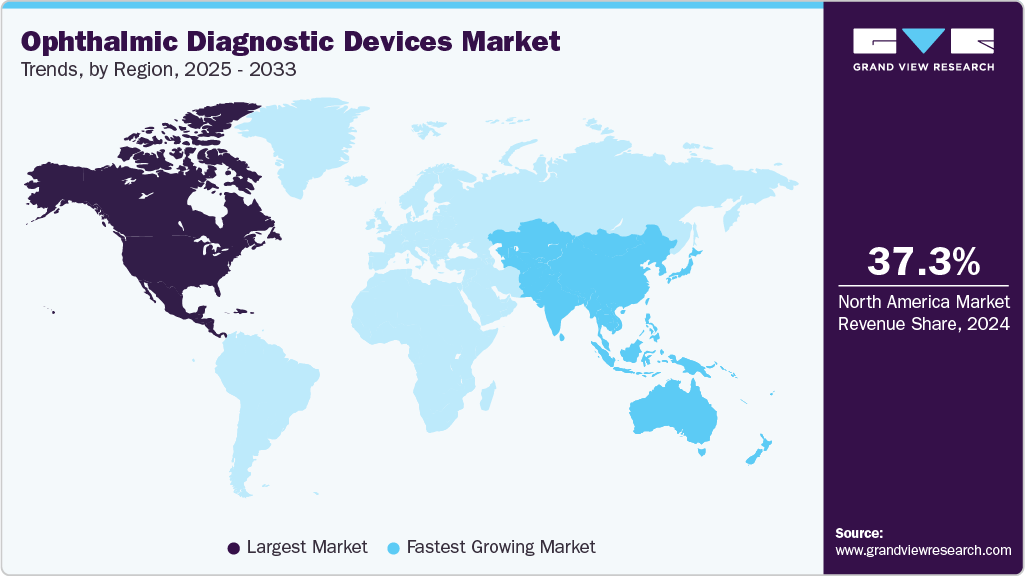

- North America's ophthalmic diagnostic devices market held the largest share of 37.32% of the global market in 2024.

- The U.S. ophthalmic diagnostic devices industry is expected to grow significantly over the forecast period.

- By product, the optical coherence tomography scanners segment held the highest market share of 22.93% in 2024.

- By function, the imaging-based diagnostic devices segment held a leading market share in 2024.

- By procurement/ownership, the purchase-based/capital acquisition segment held a leading market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.34 Billion

- 2033 Projected Market Size: USD 20.69 Billion

- CAGR (2025-2033): 3.35%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Another primary factor for market growth is technological advancement, which has resulted in many diagnostic solutions that are more accurate, less invasive, and automated. Technology that has been created and refined, such as optical coherence tomography (OCT), artificial intelligence (AI) assisted retinal imaging, adaptive optics, visual evoked potential (VEP), and corneal topography, has facilitated the early detection of eye disease and monitoring of its progression. Devices that are portable and smart, such as handheld fundus cameras and dark adaptometers, offer more convenience for patients and accessibility. For instance, an article published by the PMC Ophthalmology explains that these technologies, such as allowing for high-resolution imaging of the eye and real-time analysis for clinical diagnostics, are being used by hospitals such as the Thind Eye Hospital that have shown examples of the practical application of integrating AI and precision eye tracking in devices such as the AdaptDx Pro system and NOVA Vision Testing System.The aging population and the growing incidence of chronic diseases are other factors affecting market growth that influence ophthalmic diagnosis. Aging affects vision by gradually impairing the structure and function of the eye, leading to conditions such as cataracts and age-related macular degeneration (AMD). These issues reduce transparency in the lens and damage the macula area of the retina, ultimately leading to distorted and blurry vision. Regular eye examinations employing advanced ophthalmic diagnostic equipment, such as optical coherence tomography (OCT) and fundus imaging, can facilitate the timely detection and monitoring of age-related disorders.

Additional risk factors like oxidative stress, inflammation, and genetic predisposition can result in more rapid vision loss among older adults. For instance, in 2024, a review published in Progress in Retinal and Eye Research highlighted that age-related changes in the lens and retina, such as cataract formation and macular degeneration, increase the need for precise ophthalmic diagnostic imaging. Advanced devices like Optical Coherence Tomography (OCT) and fundus cameras enable early detection and monitoring, helping healthcare providers manage ocular health more effectively in older adults.

Adding to this, chronic health conditions like diabetes and hypertension affect age-related vision health tremendously. In diabetes, sustained high blood sugar can result in diabetic retinopathy, while uncontrolled blood pressure may lead to hypertensive retinopathy. Both conditions damage the blood vessels found in the retina and can cause diseases such as macular edema, glaucoma, or even permanent vision loss if not managed properly.

Number of People with Diabetic Retinopathy, 2010 Vs. 2050

Year

Number of People with Diabetic Retinopathy

2010

7.7 million

2050

14.6 million

Source: NIH, National Eye Institute

Furthermore, the World Health Organization (WHO) estimates that at least 2.2 billion people worldwide experience some aspect of vision impairment, with chronic eye diseases such as diabetic retinopathy, cataracts, and glaucoma being significant contributors. This increasing prevalence of vision impairment reflects the urgent need for prompt diagnoses and tracking through advanced ophthalmic diagnostic devices.

Ophthalmic diagnostic devices are also seeing market growth with the expansion of eye care facilities on a global scale. An increased numbers of hospitals, clinics, and specialty eye centers ensure advanced diagnostic and treatment services are available to urban and rural populations. For instance, the National Library of Medicine states that an increase in the eye care infrastructure and eye care professionals is needed in underserved areas. This increase aids in accommodating the demand for early detection and management of eye diseases such as cataracts, glaucoma, and diabetic retinopathy.

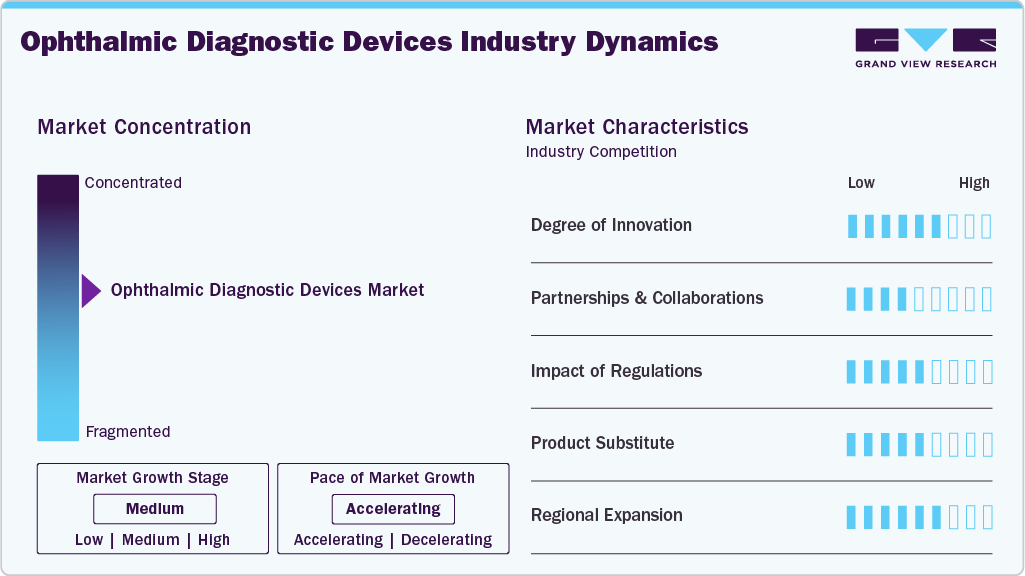

Market Concentration & Characteristics

The industry is seeing robust growth propelled by technological innovations, an increase in the prevalence of eye disorders, and a growing awareness of maintaining eye health. Healthcare Asia Magazine states that the market's growth is consistent and gradual, due to new developments in diagnostic technologies and increasing medical tourism (especially for cataract surgery). The FDA states that regulatory science and research programs are fast-tracking the development of safe and effective ophthalmic devices, further instilling confidence and growing the market. Companies such as Johnson & Johnson Vision Care, Alcon Vision LLC, and Carl Zeiss Meditec AG are positioning themselves as major players by launching new and improved diagnostic systems and expanding their international presence using regulatory expertise.

Improvements in eye care are occurring across the field, as new ophthalmic clinical diagnostic devices, including artificial intelligence (AI) imaging, robotic-assisted devices, and virtual/augmented reality (VR, AR), are enabling greater precision, earlier detection, and enhanced treatment planning in eye care. Sense Medical has highlighted innovations utilizing AI for improved imaging, emphasizing diagnostic accuracy. At the same time, ZEISS has incorporated AI into greater patient communication and advanced surgical tools for improved clinical efficiency. The Cureus collection highlights the importance of robotics, machine learning, and immersive technologies in improved diagnostics and surgery. These devices and technologies are moving the field forward through more accurate, earlier ocular disease detection, ultimately improving patient care. Along with that, ophthalmic diagnostic devices have gone through significant innovation, shifting from basic visual tests to advanced technologies like optical coherence tomography (OCT), fundus autofluorescence, and ultra-widefield imaging, which allow highly detailed, noninvasive visualization of retinal layers and ocular structures.

Partnerships and collaborations increasingly influence the ophthalmic diagnostic devices sector by creating access to innovative technologies and enhancing diagnostic capabilities. For example, Remidio's exclusive distribution agreement as the exclusive distribution partner for Occuity’s ophthalmic devices in India expands access to non-invasive diagnostic solutions, thereby enhancing glaucoma detection and access to overall eye care. Another example is ZEISS’s collaboration with Boehringer Ingelheim to utilize AI-assisted cloud-connected devices to facilitate early detection of retinal diseases by integrating diagnostic capabilities with predictive analytics for personalized treatment. Strategic partnerships allow companies in the ophthalmic diagnostics sector to leverage advanced technologies, expand market access, and promote innovation. In addition to partnerships, ZEISS has strengthened its market position through acquisitions, including purchasing the Dutch Ophthalmic Research Center and a €985 million offer to acquire another ophthalmic device maker. These strategic moves allow ZEISS to expand its ophthalmic offerings, integrate digital solutions, and provide comprehensive diagnostic and treatment technologies across retinal disorders, cataracts, glaucoma, and refractive errors.

Ophthalmic diagnostic devices are strictly regulated to ensure safety, efficacy, and quality. In the U.S., 21 CFR Part 886 classifies devices by risk and sets requirements for diagnostic tools like ophthalmic cameras, adaptometers, and ocular esthesiometers, ensuring thorough evaluation before market entry. In India, the CDSCO, under the Medical Devices Rules, 2017, mandates registration, compliance documentation, and licensing for Class C and D devices, guiding manufacturers through a clear regulatory pathway. These regulations minimize patient risk, build trust in ophthalmic technologies, and uphold ethical standards in the global medical device market.

New technologies are replacing traditional ophthalmic diagnostic devices. Non-invasive instruments for Dry Eye Disease, like TearLab, Keratograph 5M, LipiView II, and LacryDiag, allow precise tear film and ocular surface evaluation without invasive methods. Likewise, biosensing contact lens sensors provide real-time monitoring of intraocular pressure (IOP), tear biomarkers, and other ocular parameters so that continuous and personalized disease monitoring can occur for patients. In addition to traditional diagnostics, these devices assist with early detection and patient convenience, thus producing hopeful alternatives in ophthalmology.

Growth in the market is bolstered by regional expansion, facilitating the availability of advanced access to eye care. North America and Europe are leading regions due to high healthcare spending and supportive infrastructure, while the Asia-Pacific is rapidly growing with an aging population and increasing prevalence of eye diseases. Continued growth is supported through strategic investments and partnerships such as EssilorLuxottica's acquisition of Optegra clinics across Europe, government support, and telemedicine accessibility.

Product Insights

The optical coherence tomography (OCT) scanners segment accounted for the largest market share of 22.93% in 2024. This is attributed to factors such as providing high-resolution, cross-sectional, and three-dimensional imaging of ocular tissues, essential in diagnosing and monitoring such conditions as glaucoma, diabetic retinopathy, and age-related macular degeneration (AMD). Recent technological advancements have enabled the integration of OCT with robotic systems, significantly enhancing the accuracy and consistency of imaging for precise evaluation of delicate and complex ocular structures. In addition, imaging speed and resolution improvements are expanding OCT’s clinical applications, allowing ophthalmologists to perform intricate diagnostic procedures more efficiently. These innovations contribute to OCT’s position as one of the fastest-growing ophthalmic diagnostic device market segments.

The ophthalmoscopes segment is expected to witness a CAGR of 3.70%. Modern ophthalmoscopes allow excellent visualization of the retina and optic nerve, which enhances detection and monitoring of glaucoma, diabetic retinopathy, age-related macular degeneration (AMD), and more. The market has shifted from traditional handheld manual ophthalmoscopes to digital, smart, scan-dependent devices incorporating enhanced imaging, illumination, and connectivity to improve diagnostic accuracy. For example, in January 2025, the Lynx Ophthalmoscope received FDA clearance and CE marking to use an advanced, portable device to simplify retinal imaging and clinical workflows to provide better eye care efficiently and accurately.

Function Insights

The imaging-based diagnostic devices segment accounted for the largest market share of 55.31% in 2024, driven by the growing acceptance of advanced retinal imaging technologies. These technologies, including optical coherence tomography (OCT), fundus photography, and fluorescein angiography, help better visualize retinal structures in detail and in real time, providing early diagnosis and accurate reporting of diseases resulting from conditions like age-related macular degeneration (AMD). The advent of integrating multiple imaging methods has further facilitated ophthalmologists in examining and reporting the progression of the disease and accurately examining treatment. The increased reliance on imaging-based diagnostic tools for early diagnosis and follow-up of disease progression signifies the importance of imaging technology in contemporary ophthalmic care.

The functional/vision assessment devices segment is expected to witness a CAGR of 3.41% during the forecast period, due to the widespread adoption of digital refractors, autorefractors, phoropters, and retinal cameras in clinics. These devices provide accurate and efficient measurements of refractive errors and corneal curvature, and they retain health, surpassing traditional manual assessments. Their routine use enhances patient evaluations, offering near real-time results and improving clinical efficiency, reliability, and diagnostic accuracy. This trend reflects increasing trust and utilization of device-based visual/ function assessments, driving the segment’s rapid growth in the ophthalmic diagnostic devices market.

Procurement/Ownership Insights

The purchase-based/capital acquisition segment accounted for the largest market share of 66.13% in 2024, fueled by a surge in investments for companies creating and supplying essential ophthalmic devices. Recent transactions highlight the considerable inward capital to bolster the expansion of and innovation in diagnostic and surgical devices, like Warburg Pincus’ acquisition of a controlling interest in Appasamy Associates. Appasamy is a leading manufacturer of ophthalmic devices and intraocular lenses (IOLs) in India with a diverse end customer base of clinics and hospitals, which indicates a solid market for ophthalmic diagnostic and surgical devices. Investing in companies like Appasamy enables scaling operations, research, and distribution capabilities.

The subscription-based model segment is expected to grow significantly, at a CAGR of 3.69% during the forecast period. The increasing acceptance of patient membership plans in optometry and ophthalmology practices is helping to drive the adoption of subscription models. With membership plans, patients pay a monthly or annual fee for a full range of vision care services, including routine exams, eyewear discounts, and personalized care. The membership model improves patient engagement, produces predictable revenue in the clinic, and reduces reliance on traditional insurance reimbursement. Programs like BoomCloud allow practices to manage and scale membership plans, providing greater administrative ease and efficiency.

Application Insights

The cataract segment accounted for the largest market share of 40.06% in 2024, fueled by growing global demand for enhanced vision care and the opportunity to benefit from surgical intervention. Reasons such as advancements in surgical techniques, legitimatization of unique intraocular lenses (IOLs), and changes in the use of artificial intelligence to increase accuracy and precision serve as accelerators for this trend. The geriatric population and the growing prevalence of cataract-related vision impairment are notable contributors.

The refractive disorders segment is expected to grow significantly at a CAGR of 3.48% during the forecast period due to the increasing prevalence of refractive disorders, particularly myopia. Advanced surgical technologies and techniques enhance the safety and effectiveness of procedures like laser-assisted in situ keratomileusis (LASIK) and Photorefractive Keratectomy (PRK), leading to higher patient satisfaction and broader adoption. This trend underscores the growing demand for corrective vision solutions and the expanding role of refractive surgery in modern ophthalmology.

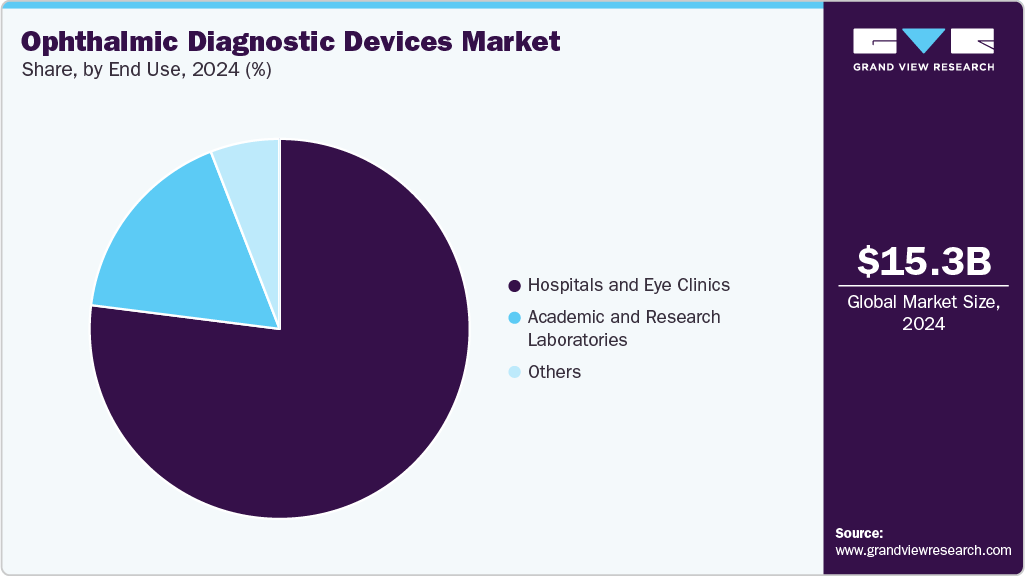

End Use Insights

The hospitals & eye clinics segment accounted for the largest market share of 76.97% in 2024, due to the growing uptake of new advanced diagnostic and surgical technologies in the clinical area. Eye-Q's installation of an Advanced Customized LASIK machine in Rewari increases access to high-precision vision correction for patients in the local area. Furthermore, the insourcing plans mentioned by Elective UK for hospitals and clinics to bring in a specialized ophthalmic team improve the efficiency of diagnostic assessments, reduce patient waiting times, and expand the overall service capacity. These components position hospitals and eye clinics to become the fastest-growing end-use segment.

The academic & research laboratories segment is expected to grow significantly at a CAGR of 3.10% during the forecast period. Academic and research laboratories have been receiving financing to conduct ophthalmic treatment. For example, the Shenzhen Eye Hospital, located in China, has acquired much funding for its research projects in intelligent ophthalmology. The publication "Development and Research Status of Intelligent Ophthalmology in China" discusses some progress in intelligent ophthalmology, primarily emphasizing the roles of academic and research laboratories in areas such as the detection of diabetic retinopathy, fundus image analysis, and the design of medical artificial intelligence products.

Regional Insights

North America ophthalmic diagnostic devices market is witnessing significant growth, driven by a fast-growing aging population and an increased prevalence of chronic eye disease, such as diabetic retinopathy, associated with increasingly poor lifestyles and stressful living. Strict regulatory systems and dynamic reimbursement models further drive demand. New devices must meet high safety, efficacy, and compliance standards yearly. The introduction of advanced imaging devices (e.g., optical coherence tomography, retinal cameras), AI-assisted diagnostics, and mobile non-invasive diagnostic devices, all to satisfy clinical and patient demands, is also seeing increased growth and adoption. With all these factors converging at once-demographic issues, the growing burden of chronic disease, regulations, and medical technology-the market is expanding steadily regarding the range of novel products and clinical use.

U.S. Ophthalmic Diagnostic Devices Market Trends

Theophthalmic diagnostic devices market in the U.S. has increased due to the significant burden of eye disorders, increasing the need for advanced and accurate ophthalmic diagnostic devices. According to the CDC, over 7 million Americans are experiencing vision loss or blindness. Furthermore, nearly 90 million adults aged 40 and older live with some kind of vision or eye problem. An estimated 20.5 million of these aged 40s have cataracts alone, which remain the leading cause of impairment. Several other eye conditions, including diabetic eye disease, glaucoma, and macular degeneration, are also among the leading causes of impairment. Many of them progress mimicking the eye's wear and tear, leading to the importance of early detection. The need for innovative and accurate diagnostic technology is growing to monitor eye health, inform treatment plans efficiently, and ultimately improve long-term patient outcomes nationwide.

Europe Ophthalmic Diagnostic Devices Market Trends

The market for ophthalmic diagnostic devices in Europeis witnessing significant growth, and the drive toward integrated, person-centered eye and vision care is boosting the demand for advanced ophthalmic diagnostic devices. The World Health Organization (WHO) emphasizes that eye care services should be accessible, available, affordable, and high-quality for diverse populations. This goal relies on accurate and efficient diagnostic testing. Increasing awareness of the prevalence and impact of vision disorders and government initiatives to strengthen research, monitoring, and evidence-based eye care further support the adoption of innovative diagnostic technologies. By integrating eye care into national health systems and promoting universal coverage, European countries are fostering an enabling environment for ophthalmic diagnostic devices, facilitating early detection, timely treatment, and improved patient outcomes.

The UK ophthalmic diagnostic device market is steadily growing. Eye disorders, such as diabetic retinopathy and age-related macular degeneration (AMD), represent significant health concerns within the UK, contributing to a growing demand for advanced ophthalmic diagnostic devices. Diabetic retinopathy, a complication of diabetes, can develop unnoticed and lead to vision loss if not detected; therefore, regular screening is beneficial. AMD is characterized by a decline of the central retina, primarily affecting those over 50. Dry AMD is a slow progression; however, wet AMD can lead to rapid vision loss. Early detection and timely diagnosis during routine eye examinations are critical in preserving vision.

Expected Growth Trends in Vision-Impairing Conditions

Eye Condition

Predicted Increase (%)

Notes

Late Age-related Macular Degeneration (AMD)

24.40%

Significant rise in older populations

Primary Open-Angle Glaucoma

15.90%

Requires long-term monitoring

Vision-Impeding Cataracts

16.70%

Expected growth with an aging population

Source: UK Eye Care Data Hub

The ophthalmic diagnostic devices market in France is witnessing substantial growth, due to the convergence of technology, public-private partnerships, and government support that continues to drive demand for these devices. For instance, ZEISS recently released its AI-enabled devices, including CIRRUS PathFinder, to improve diagnostic accuracy and workflow efficiency for retina care. Furthermore, the French government's reimbursement of HOYA's MiYOSMART myopia control lenses for children aged 5-16 is a bold public health initiative to improve myopia treatment. These advances represent meaningful collaboration to advance eye care services in France and to further facilitate the uptake of new diagnostic technology.

Germany ophthalmic diagnostic devices market is witnessing significant growth, driven by the rising incidence of eye diseases, such as cataracts, glaucoma, and age-related macular degeneration. The advanced healthcare setting and well-established healthcare institutions facilitate the adoption of devices capable of accurate, early detection of retinal disease using diagnostic technologies such as optical coherence tomography (OCT). Public health reports have presented alarming trends related to visual impairment, which has increased the need for robust screening and monitoring practices. These variables are driving the adoption of innovative ophthalmic diagnostic devices across the country.

Asia Pacific Ophthalmic Diagnostic Devices Market Trends

The ophthalmic diagnostic devices market in Asia Pacific is experiencing a growing burden of visual impairment due to increasing prevalence rates, particularly among adults of working age. Increases in visual impairment have been associated with refractive errors, cataracts, and age-related eye diseases. Public health studies and advanced epidemiological modeling have identified regional variation, with East and South Asia projected to have the highest burden by 2040. The increasing prevalence indicates an urgent need for early detection, screening programs, and effective intervention. These factors contribute to the region's capacity requirements for comprehensive eye care services and new ophthalmic diagnostic solutions.

Japan’s ophthalmic diagnostic devices market is witnessing a rise due to its aging population, which is projected to exceed 10% of those aged 80 and above as of 2023. Japan is seeing an increasing demand for ophthalmic diagnostic devices, due to increasing eye health concerns (i.e., myopia), which emphasizes the need for advanced eye health diagnostic devices to allow for precision in diagnostics. Japan's advanced medical device technology sector, government support, and healthcare advancements all facilitate the wider adoption of these next-generation tools and technologies throughout Japan.

The ophthalmic diagnostic devices market in China is rapidly growing. This growth is due to several key factors, such as the increasing prevalence of eye diseases among the population, especially in elderly individuals in suburban Shanghai, which is ultimately driving the need for better eye care. Secondly, technological advancements support this growth, with new devices like the SMART Phaco-Vitrectomy Machine that combine cataract and retinal surgery, improving diagnostic and surgical efficiency. Additionally, regulatory approvals, such as Eyebright Medical receiving a Class III certificate from the National Medical Products Administration for its phakic intraocular lens, facilitate the adoption of advanced ophthalmic devices. Together, these drivers are boosting the growth of ophthalmic diagnostic devices across China.

India's ophthalmic diagnostic devices market is driven by two primary factors. The first factor is the increased incidence of eye diseases, such as cataracts, glaucoma, refractive errors, and diabetic retinopathy, for which the need for improved diagnostic equipment is increasing. The second factor is expanding healthcare infrastructure, notably through building Vision Centers in rural and underserved settings, which provides access to device availability for early detection and treatment. These developments combine to drive the utilization and proliferation of ophthalmic diagnostic devices in India.

Latin America Ophthalmic Diagnostic Devices Market Trends

The ophthalmic diagnostic devices market in Latin America is expanding due to the rising prevalence of eye disorders, including cataracts and vision impairment, particularly in at-risk populations, like older adults. The growing burden of eye disorders requires early detection and optimal management. Advancements in healthcare infrastructure and the availability of eye care services are supporting the demand for ophthalmic diagnostic devices. These factors continue contributing to the growth of ophthalmic diagnostic devices across the region.

Brazil ophthalmic diagnostic devices market is experiencing significant growth, addressing the country’s substantial burden of vision disorders. The Brazilian Council of Ophthalmology (Conselho Brasileiro de Oftalmologia, CBO) has highlighted the rising prevalence of diabetes and an aging population as key drivers of demand for early detection tools. Hospitals and private clinics across major cities such as São Paulo, Rio de Janeiro, and Belo Horizonte are adopting technologies like optical coherence tomography (OCT), fundus cameras, and visual field analyzers to improve early diagnosis of glaucoma and retinal diseases.

Middle East & Africa Ophthalmic Diagnostic Devices Market Trends

The ophthalmic diagnostic devices market in the Middle East & Africa is witnessing steady expansion, driven by several converging factors. The prevalence of vision loss is rising in both urban and rural populations, particularly among older adults, due to cataracts, glaucoma, uncorrected refractive errors, and diabetic retinopathy. The demographic shift toward aging also contributes significantly to demand. For instance, blindness increases sharply after age 60 in many countries in Sub-Saharan Africa and the Arabian Peninsula.

The ophthalmic devices market in Saudi Arabia is expected to grow over the forecast period. Improved technologies such as optical coherence tomography (OCT) and non-mydriatic fundus cameras drive the market's overall growth. Research indicates that OCT allows for accurate early detection of glaucoma, and fundus cameras enable general practitioners to identify diabetic retinopathy screening in rural settings. With the increasing rates of eye disease, these technologies continue to drive demand for more advanced diagnostic devices, thus increasing access and accuracy and the market's overall size.

Kuwait ophthalmic diagnostic devices market is expected to grow steadily with increased healthcare investments, rising awareness of eye health, and a growing number of new healthcare facilities. In addition, increasing government action to improve access to eye care and the rising instances of eye-related illness will drive additional growth in demand for modern ophthalmic diagnostic equipment. As hospitals and clinics continue to modernize their ophthalmic departments, there should be greater uptake of diagnostic technologies, such as Optical Coherence Tomography (OCT) and fundus cameras, which will aid in continued growth.

Key Ophthalmic Diagnostic Devices Company Insights

Key players operating in the ophthalmic diagnostic devices market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Ophthalmic Diagnostic Devices Companies:

The following are the leading companies in the ophthalmic diagnostic devices market. These companies collectively hold the largest market share and dictate industry trends.

- Carl Zeiss Meditec AG

- Nidek Co. Ltd

- TOPCON Corporation

- Haag-Streit Group

- Canon, Inc.

- Heidelberg Engineering GmbH

- Visionix USA Inc.

- Reichert Technologies (AMETEK, Inc.)

- Hoya Corporation

- Ophtecs Corporation

Recent Developments

-

In September 2025, Advancing Eyecare (AEC) announced the acquisition of Eyefficient, an Ohio-based supplier of ophthalmic instruments. This acquisition strengthens AEC’s leadership in the eyecare instrumentation ecosystem, enabling expanded support, installation, and repair services for ophthalmic diagnostic devices while providing third-party distributors and independent sales representatives with a more comprehensive selection of technology.

-

In September 2025, OpZira Inc. was established as a spin-off from LumiThera after Alcon's acquisition. OpZira now offers two ophthalmic diagnostic products: the AdaptDx Pro, a portable dark adaptometer utilizing AI and precision eye-tracking to assess retinal adaptation, and the NOVA Vision Testing System, which employs Visual Evoked Potential (VEP) and Electroretinography (ERG) to evaluate the visual and neuro-visual pathways. Both devices are currently available in the United States, with the ERG module pending U.S. availability.

-

In February 2024, ARPA-H awarded funding to a project led by Washington University in St. Louis to develop a compact and affordable optical coherence tomography (OCT) device. This shoebox-sized platform aims to make eye disease diagnostics more accessible and cost-effective by miniaturizing optical components and enabling faster, high-quality retinal imaging.

Ophthalmic Diagnostic Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.89 billion

Revenue forecast in 2033

USD 20.69 billion

Growth rate

CAGR of 3.35% from 2025 to 2033

Actual period

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, function, procurement/ownership, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Carl Zeiss Meditec AG; Nidek Co. Ltd; TOPCON Corporation; Haag-Streit Group; Canon, Inc.; Heidelberg Engineering GmbH; Visionix USA Inc.; Reichert Technologies (AMETEK, Inc.); Hoya Corporation; Ophtecs Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Diagnostic Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ophthalmic diagnostic devices market report on the basis of product, function, procurement/ownership, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Optical Coherence Tomography Scanners

-

Fundus Cameras

-

Perimeters/Visual Field Analysers

-

Autorefractors and Keratometers

-

Ophthalmic Ultrasound Imaging Systems

-

Ophthalmic A-Scan Ultrasound

-

Ophthalmic B-Scan Ultrasound

-

Ophthalmic Ultrasound Biomicroscopes

-

Ophthalmic Pachymeters

-

-

Tonometers

-

Slit Lamps

-

Phoropters

-

Wavefront Aberrometers

-

Optical Biometry Systems

-

Ophthalmoscopes

-

Lensmeters

-

Corneal Topography Systems

-

Specular Microscopes

-

Retinoscopes

-

-

Function Outlook (Revenue, USD Million, 2021 - 2033)

-

Imaging-Based Diagnostic Devices

-

Functional/Vision Assessment Devices

-

Basic Clinical Examination Devices

-

-

Procurement/Ownership Outlook (Revenue, USD Million, 2021 - 2033)

-

Purchase-based/Capital Acquisition

-

Rental/Leasing Model

-

Subscription-based Model

-

Hybrid Models

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cataract

-

Vitreo-retinal Disorders

-

Glaucoma

-

Refractive Disorders

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Eye Clinics

-

Academic & Research Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ophthalmic diagnostic devices market size was valued at USD 15.34 billion in 2024 and is expected to reach a value of USD 15.89 billion in 2025.

b. The global ophthalmic diagnostic devices market is expected to grow at a compound annual growth rate of 3.35% from 2025 to 2033 to reach USD 20.69 billion by 2033.

b. The optical coherence tomography (OCT) scanners segment accounted for the largest revenue share in 2024, due to the high-resolution, cross-sectional, and three-dimensional imaging of ocular tissues, essential in diagnosing and monitoring such conditions as glaucoma, diabetic retinopathy, age-related macular degeneration (AMD), and technological advancements.

b. Some key players operating in the global ophthalmic diagnostic devices market include Carl Zeiss Meditec AG, Nidek Co. Ltd, TOPCON Corporation, Haag-Streit Group, Canon, Inc., Heidelberg Engineering GmbH, Visionix USA Inc., Reichert Technologies (AMETEK, Inc.), Hoya Corporation, and Ophtecs Corporation

b. Key drivers of the ophthalmic diagnostic devices market include the growing geriatric population, prevalence of chronic diseases, increasing awareness and screening programs, and technological advancements, leading to accurate, less-invasive, and automated diagnostic solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.