- Home

- »

- Medical Devices

- »

-

Eye Examination Equipment Market Size Report, 2030GVR Report cover

![Eye Examination Equipment Market Size, Share & Trends Report]()

Eye Examination Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Ophthalmic Ultrasound Imaging Systems, OCT, Corneal Topography Systems), By End Use (Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-455-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Eye Examination Equipment Market Summary

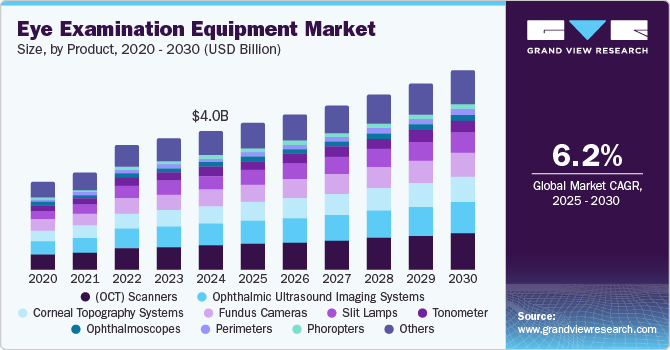

The global eye examination equipment market size was valued at USD 4.02 billion in 2024 and is projected to reach USD 5.75 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030. This growth is driven by the rising prevalence of eye diseases such as cataracts, glaucoma, and age-related macular degeneration, increasing the demand for diagnostic and treatment equipment.

Key Market Trends & Insights

- The North American eye examination equipment market held the largest share of 42.8% in 2024.

- The Asia Pacific eye examination equipment market is anticipated to grow at a CAGR of 7.0% during the forecast period.

- By product, the OCT scanners segment held the largest share of 17.5% in the global eye examination equipment market in 2024.

- By end use, the clinics segment is projected to grow at the fastest CAGR of 6.7% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.02 Billion

- 2030 Projected Market Size: USD 5.75 Billion

- CAGR (2025-2030): 6.2%

- North America: Largest market in 2024

Technological advancements in ophthalmic devices, including optical coherence tomography (OCT) and advanced retinal imaging systems, make eye examinations more accurate and efficient. The aging population is also more susceptible to eye conditions, further driving the need for eye examination equipment. The growing awareness about eye health and regular eye check-ups is encouraging more people to seek professional eye care, boosting the demand for eye examination equipment.The rise in digital device usage has led to increased digital eye strain, prompting more frequent eye examinations and the need for specialized equipment. For example, the widespread use of smartphones and computers has resulted in a surge of patients seeking eye care to address symptoms like dry eyes and headaches. This trend is driving demand for advanced diagnostic tools and treatments.

Additionally, government initiatives and funding to improve access to eye care services are crucial in market growth. For instance, the World Health Organization (WHO) launched a guide to integrate eye care into health systems, supporting member states in planning and implementing eye care services. In India, the National Programme for Control of Blindness and Visual Impairment (NPCBVI) has been instrumental in reducing blindness through comprehensive care, including prevention, early detection, and treatment. These efforts are making eye care more accessible, especially in underserved areas, and addressing unmet healthcare needs.

Product Insights

The OCT scanners segment held the largest share of 17.5% in the global eye examination equipment market in 2024. This dominance can be attributed to the widespread adoption of OCT scanners in ophthalmology for their non-invasive, high-resolution imaging capabilities. The increasing prevalence of these eye disorders, coupled with advancements in OCT technology such as the development of spatially encoded frequency domain OCT is also driving the demand. This advanced imaging technique offers improved scanning capabilities and reduced motion artifacts, making it a preferred choice in clinical settings.

On the other hand, the ophthalmic ultrasound imaging systems segment is projected to grow at a CAGR of 6.8% during the forecast period. This growth can be attributed to the versatility and essential role of ultrasound imaging in various ophthalmic applications, including A-scan and B-scan ultrasound techniques. The ability of ultrasound imaging to provide real-time data and its non-invasive nature makes it a crucial tool in both emergency and routine eye examinations. The portability of these devices makes them particularly valuable in remote and underserved areas where access to advanced eye care is limited.

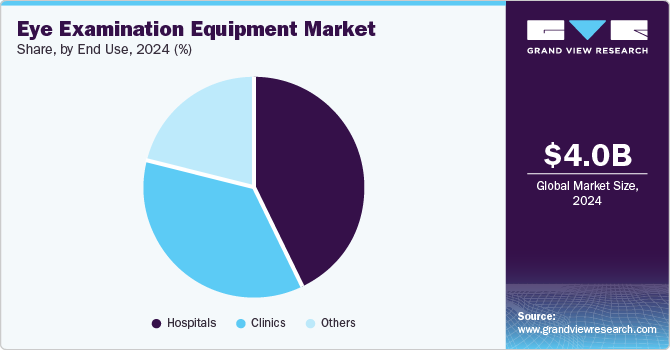

End Use Insights

The hospital segment dominated the market in 2024, owing to the many ophthalmic surgeries performed in these facilities. Hospitals are equipped with advanced surgical and diagnostic equipment, such as optical coherence tomography (OCT) scanners and fundus cameras, which are essential for comprehensive eye examinations and treatments. The increasing prevalence of eye disorders, particularly among the aging population, drives demand for hospital-based services. For instance, the number of corneal transplants and cataract surgeries has steadily risen, necessitating sophisticated equipment to ensure successful outcomes. Hospitals also benefit from established reimbursement frameworks that support acquiring high-cost equipment, further solidifying their market dominance.

The clinics segment is projected to grow at the fastest CAGR of 6.7% over the forecast period. This growth can be attributed to several factors, including the rising number of private clinical practices and the increasing accessibility of specialized optometry services. Clinics often provide more affordable treatment options than hospitals, making them attractive to patients seeking routine eye examinations and minor procedures. The growing awareness of eye health and the need for regular check-ups drive patient traffic to these facilities. Furthermore, advancements in portable diagnostic equipment allow clinics to offer a range of services without the need for extensive infrastructure. For instance, devices like portable tonometers and autorefractors enable quick eye health assessments, making clinics an appealing choice for patients.

Regional Insights

The North American eye examination equipment market held the largest share in 2024 due to the region's advanced healthcare infrastructure and high prevalence of eye diseases. The strong presence of leading market players and continuous technological advancements have also contributed significantly. Investment in research and development by both the government and private sectors has further propelled market growth.

U.S. Eye Examination Equipment Market Trends

The U.S. dominated the North American eye examination equipment market in 2024. The country's focus on preventive healthcare and the increasing adoption of teleophthalmology have played crucial roles in this growth. Technological advancements, such as AI-driven diagnostic tools and remote monitoring systems, have further enhanced the efficiency and accuracy of eye examinations. Additionally, favorable reimbursement policies and government initiatives supporting eye care, like the Vision Health Initiative by the Centers for Disease Control and Prevention (CDC), have contributed to the market's expansion.

Europe Eye Examination Equipment Market Trends

The European eye examination equipment market was identified as a lucrative region in 2024. This growth is fueled by the rising prevalence of eye diseases and the region's commitment to improving healthcare services. Government initiatives to control visual impairment and promote regular eye check-ups have significantly boosted the demand for advanced eye examination equipment. For instance, the UK's National Health Service (NHS) has implemented several programs to increase access to eye care services.

Asia Pacific Eye Examination Equipment Market Trends

The Asia Pacific eye examination equipment market is anticipated to grow at a CAGR of 7.0% during the forecast period. This rapid growth can be attributed to the region's increasing healthcare expenditure and the rising awareness of eye health. Countries like India and China are leading the charge, with significant investments in healthcare infrastructure and the adoption of advanced medical technologies. The expanding middle class and the growing demand for quality healthcare services are also driving this region's growth.

Key Eye Examination Equipment Company Insights

Some of the key companies in the eye examination equipment market include Johnson & Johnson Services, Inc., Carl Zeiss Meditec AG, Alcon, Bausch & Lomb Incorporated, Quantel Medical, TOPCON CORPORATION, Essilor, and others.

-

Johnson & Johnson Services, Inc. offers a comprehensive range of eye examination equipment and solutions through its Vision Care division. Its product portfolio includes advanced diagnostic tools like OCT scanners, slit lamps, and phoropters, which are widely used by ophthalmologists and optometrists.

-

Carl Zeiss Meditec AG’s product offerings include VISUSCOUT 100 portable digital fundus cameras, VISUCORE 500 digital needs analysis systems, and VISUFIT 1000 platform for comprehensive eye examinations. It also offers i.Profilerplus is a 4-in-1 device that combines wavefront aberrometry, autorefractokeratometry, and corneal topography for providing eye measurement.

Key Eye Examination Equipment Companies:

The following are the leading companies in the eye examination equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc.

- Carl Zeiss Meditec AG

- Alcon

- Bausch & Lomb Incorporated

- Quantel Medical

- TOPCON CORPORATION

- Essilor

- NIDEK CO., LTD.

- HAAG-STREIT

- VISIONCARE INC.

Recent Developments

-

In July 2024, EssilorLuxottica completed the acquisition of an 80% stake in Heidelberg Engineering, a German-based company specializing in OCT scanners. This acquisition represents a major step forward in EssilorLuxottica's strategic expansion into the medical technology sector.

-

In January 2023, Visibly and EyecareLive officially announced their merger. This collaboration will facilitate the launch of real-time video visits between optometrists and patients, enhancing the scope of vision consultations.

Eye Examination Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.25 billion

Revenue forecast in 2030

USD 5.75 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, KSA, UAE, South Africa and Kuwait.

Key companies profiled

Johnson & Johnson Services, Inc., Carl Zeiss Meditec AG, Alcon, Bausch & Lomb Incorporated, Quantel Medical, TOPCON CORPORATION, Essilor, NIDEK CO., LTD., HAAG-STREIT, VISIONCARE INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Eye Examination Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global eye examination equipment market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Optical coherent tomography scanners (OCT)

-

Ophthalmic ultrasound imaging systems

-

Corneal topography systems

-

Slit lamps

-

Tonometer

-

Ophthalmoscopes

-

Perimeters/visual field analyzers

-

Fundus cameras

-

Autorefractors and Keratometers (phoropters)

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.