- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Organic Pigments Market Size, Share, Industry Report, 2033GVR Report cover

![Organic Pigments Market Size, Share & Trends Report]()

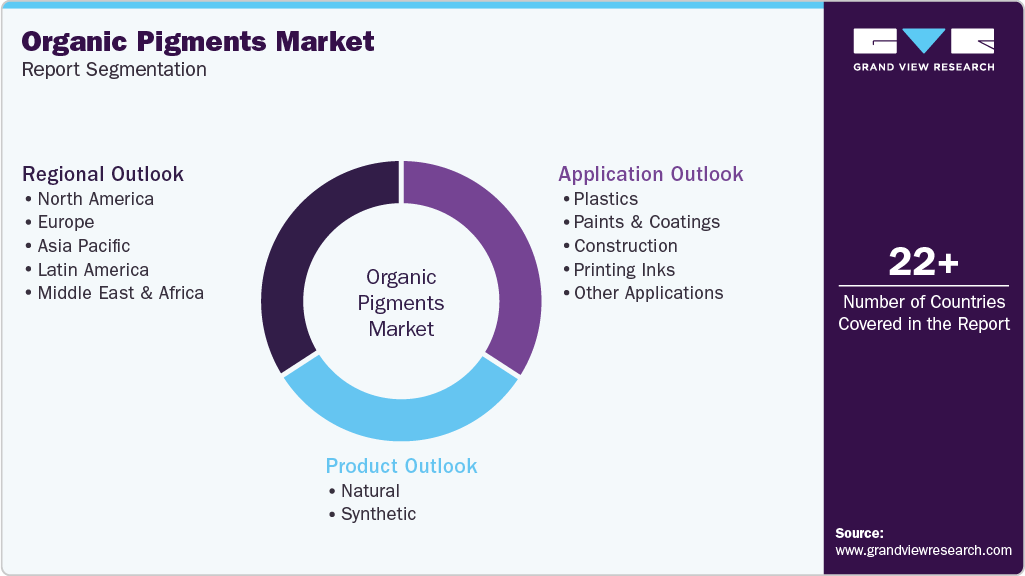

Organic Pigments Market (2025 - 2033) Size, Share & Trends Analysis Report Product (Natural, Synthetic), By Application (Plastics, Paints & Coatings, Printing Inks, Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-829-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Pigments Market Summary

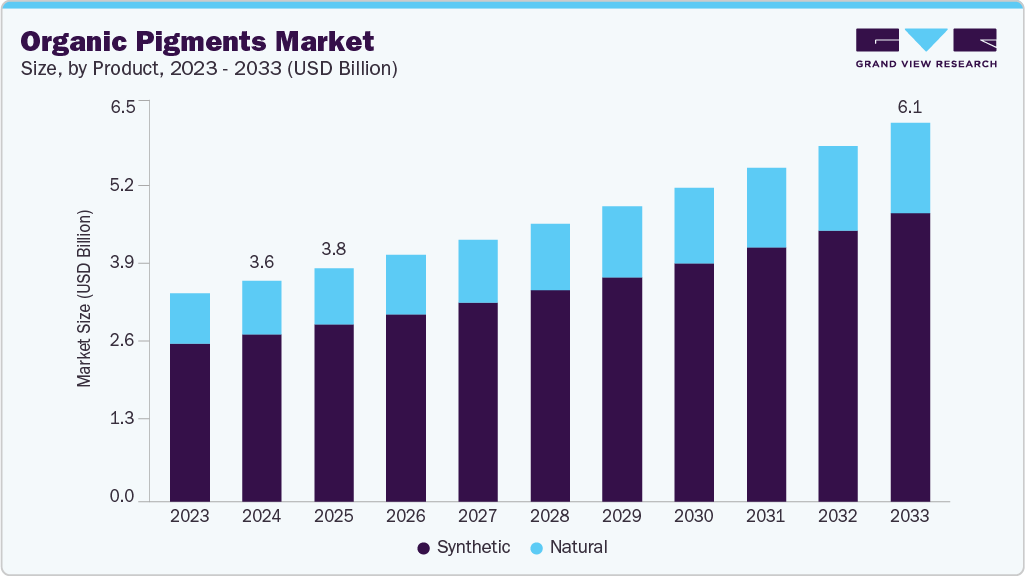

The global organic pigments market size was estimated at USD 3,557.4 million in 2024 and is projected to reach USD 6,112.5 million by 2033, growing at a CAGR of 6.22% from 2025 to 2033. The market growth is primarily driven by rising demand from plastics and paints & coatings industries, supported by growth in construction activity, packaging consumption, automotive production, and consumer goods manufacturing.

Key Market Trends & Insights

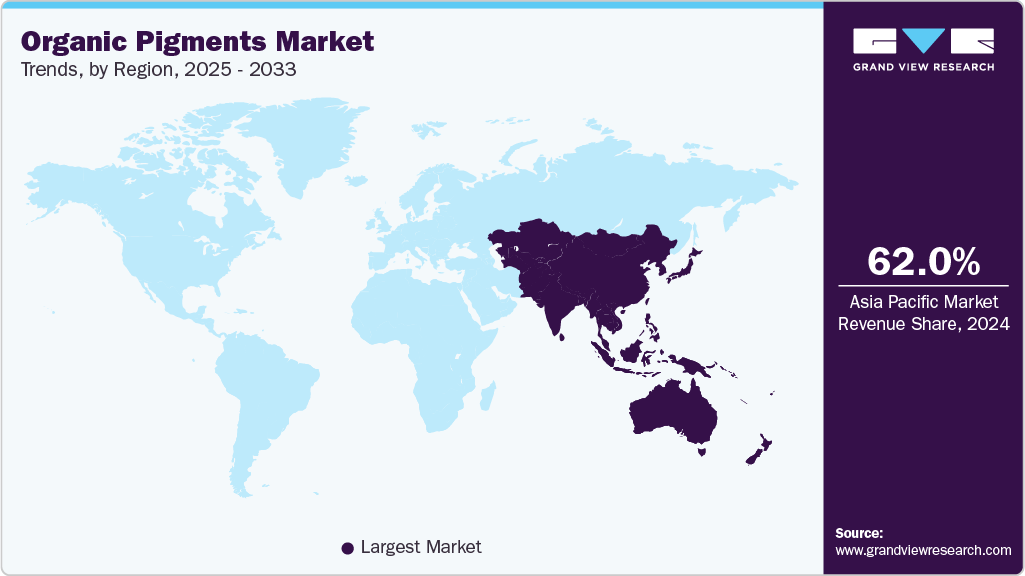

- Asia Pacific dominated the organic pigments market with the largest revenue share of 62.0% in 2024.

- The organic pigments industry in China is expected to grow at the fastest CAGR of 6.5% from 2025 to 2033.

- By product, the synthetic segment held the largest revenue share of 76.0% in 2024 in terms of revenue.

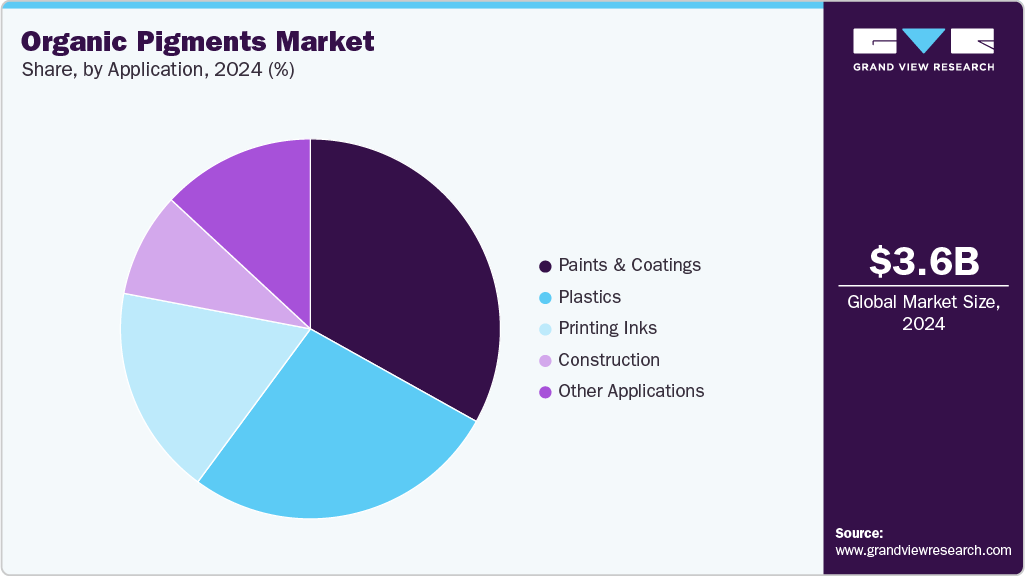

- By application, the paints & coatings segment held the largest revenue share of 33.1% in 2024 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 3,557.4 Million

- 2033 Projected Market Size: USD 6,112.5 Million

- CAGR (2025-2033): 6.2%

- Asia Pacific: Largest Market in 2024

Increasing preference for high-performance, vibrant, and durable color solutions in plastic packaging, automotive components, and architectural coatings is accelerating the adoption of organic pigments over inorganic alternatives. The tightening of environmental regulations is encouraging a shift toward low-toxicity, heavy-metal-free pigments, particularly in Europe and North America. At the same time, rapid urbanization and industrial expansion in the Asia Pacific continue to create sustained demand for synthetic pigments across various applications.

Significant opportunities are emerging from the growing demand for sustainable and bio-based pigments, driven by regulatory pressure and evolving brand commitments toward eco-friendly materials. Advancements in pigment technologies, such as high-performance organic pigments (HPPs) offering superior heat stability and weather resistance, are expanding application scope in automotive coatings, premium plastics, and digital printing. Furthermore, increasing investments in emerging economies, rising disposable incomes, and the expansion of packaging and construction sectors in Southeast Asia, India, and Latin America present attractive growth avenues. At the same time, innovations in natural pigment formulations offer differentiation potential for manufacturers targeting health-conscious and environmentally sensitive markets.

The organic pigments industry faces challenges from volatile raw material prices, stringent compliance requirements, and rising production costs associated with environmentally compliant manufacturing processes. Organic pigments also face competitive pressure from inorganic pigments and alternative coloring solutions, which may offer cost advantages in certain applications. The technical limitations related to lightfastness, weather resistance, and thermal stability in certain pigment classes restrict usage in demanding environments. At the same time, high R&D expenditure and complex manufacturing processes create entry barriers for new players and margin pressure for existing manufacturers.

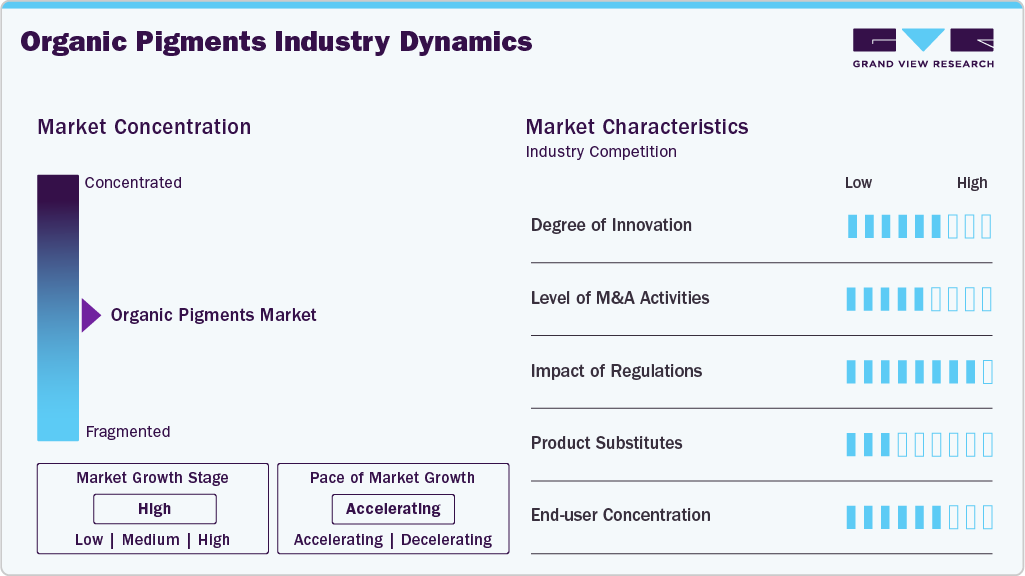

Market Concentration & Characteristics

The competitive landscape of the global organic pigments market is moderately consolidated, characterized by the presence of multinational chemical corporations alongside strong regional manufacturers competing on product performance, innovation capability, cost efficiency, and geographic reach. Leading players, including BASF SE, Clariant AG, DIC Corporation, Lanxess AG, Huntsman Corporation, Vibrantz, and Kronos Worldwide, focus on expanding their high-performance organic pigment portfolios, particularly for plastics, paints & coatings, and printing ink applications. These companies leverage advanced R&D capabilities, vertically integrated production structures, and long-term supply agreements with end-use industries to strengthen market positioning, while also investing in sustainable pigment technologies and regulatory-compliant formulations to meet evolving environmental standards.

In parallel, emerging and mid-sized players, such as Sudarshan Chemical Industries, Atul Ltd., and Kiri Industries, are increasingly expanding their global footprint through capacity expansions, strategic acquisitions, and export-oriented manufacturing models, particularly in Asia and the Middle East. Competitive dynamics are further shaped by pricing pressure from low-cost producers, frequent product differentiation through performance enhancements (such as improved lightfastness and thermal stability), and a growing emphasis on bio-based and eco-friendly pigment solutions. As sustainability becomes a key purchase criterion, companies are competing not only on cost and color range but also on lifecycle impact, supply chain transparency, and compliance with international environmental regulations.

Product Insights

The synthetic segment dominated the global organic pigments industry in 2024, accounting for 76.0% of the revenue, driven by its superior performance, wide color range, cost-effectiveness, and large-scale production capabilities. Synthetic pigments, including azo, phthalocyanine, and high-performance organics, are extensively used across plastics, paints & coatings, and printing inks due to their excellent lightfastness, thermal stability, and chemical resistance. Consistent quality and versatility across industrial and premium applications further reinforce their dominant market position.

The natural pigments segment, while smaller, is gaining traction in cosmetics, food packaging, and specialty coatings due to rising demand for eco-friendly and non-toxic solutions. Despite challenges such as lower color intensity, limited lightfastness, and higher costs, regulatory support and advancements in extraction and stabilization technologies are expected to drive steady growth, positioning natural pigments as a strategic niche within the broader market.

Application Insights

The paints & coatings segment dominated the global organic pigments market in 2024, capturing the largest revenue share of 33.1%, driven by strong demand from architectural, industrial, and automotive coatings. The segment benefits from the extensive use of high-performance pigments, which offer superior lightfastness, weather resistance, and vibrant color options, critical for both aesthetic and protective purposes. Rapid urbanization, growing construction activity, and the expansion of automotive and industrial coatings sectors in emerging economies have further reinforced its market leadership, making paints & coatings the primary revenue contributor for pigment manufacturers.

The plastics segment follows closely, supported by increasing demand for colored consumer goods, packaging materials, and engineering plastics that require durable and consistent pigments. Printing inks continue to grow steadily, driven by packaging and specialty printing applications, while construction pigments are used in colored mortars, tiles, and cement-based products. The others category, encompassing textiles, cosmetics, automotive interiors, and specialty applications, represents a strategic growth opportunity for manufacturers seeking to diversify portfolios. Overall, the market is characterized by rising adoption of high-performance and sustainable pigments across applications, with demand trends closely aligned with industrial production, consumer preferences, and regulatory frameworks.

Regional Insights

Asia Pacific dominated the global organic pigments market in 2024 with a commanding 62.0% revenue share, driven by robust industrialization, large-scale plastics and packaging production, and strong growth in construction and automotive sectors. The region benefits from cost-efficient manufacturing ecosystems, abundant raw material availability, and the presence of key pigment producers, particularly in China and India. Rapid expansion in consumer goods, infrastructure development, and export-oriented manufacturing continues to position Asia Pacific as the primary demand and production hub for organic pigments.

Chinaorganic pigments market accounted for a 67.1% share of Asia Pacific in 2024, supported by its dominant role in global plastics, coatings, and printing ink manufacturing. The country’s extensive chemical production infrastructure, competitive pricing, and strong domestic demand from the packaging, automotive, and construction industries underpin its leadership. The expanding investments in high-performance and environmentally compliant pigments are enabling Chinese manufacturers to strengthen their position in both domestic and international markets.

Europe Organic Pigments Market Trends

Europe held an 18.2% share of the global organic pigments industry in 2024, driven by strong demand for sustainable, high-performance pigments across automotive coatings, packaging, and industrial applications. The region emphasizes regulatory compliance, innovation, and eco-friendly formulations, which support the steady adoption of advanced organic pigments. Technological advancements and the rising use of pigments in specialty coatings and premium consumer products further support growth.

Germany'sorganic pigments market remains a key contributor to Europe, due to its strong automotive, industrial coatings, and high-end chemical manufacturing sectors. The country’s focus on precision engineering, sustainability, and advanced material science has driven demand for premium, weather-resistant, and low-toxicity pigments. Germany also serves as a strategic innovation hub, with continuous R&D investments aimed at developing high-performance and environmentally compliant pigment solutions.

North America Organic Pigments Market Trends

North America accounted for 10.8% of the global market in 2024, supported by consistent demand from the packaging, construction, automotive refinishing, and printing industries. The region benefits from strong technological capabilities, high product quality standards, and increasing adoption of sustainable pigment formulations. Infrastructure renovation activities and the expanding use of organic pigments in specialty and high-value applications further reinforce growth.

U.S. Organic Pigments Market Trends

The U.S. dominated the North American organic pigments industry, holding a 72.6% regional share in 2024, driven by strong demand in the packaging, industrial coatings, and consumer goods sectors. The presence of established pigment manufacturers, advanced R&D facilities, and high demand for performance-driven and compliant products continues to fuel market expansion. Increasing focus on eco-friendly and low-VOC solutions is also accelerating innovation and product upgrades.

Middle East & Africa Organic Pigments Market Trends

The Middle East & Africa organic pigments industry is witnessing gradual growth, supported by expanding construction activities, rising infrastructure investments, and increasing demand for colored coatings and plastics. Urban development projects and industrial diversification initiatives in countries such as Saudi Arabia, the UAE, and South Africa have a particularly significant influence on growth. However, the market remains constrained by limited domestic production and reliance on imports for advanced pigment formulations.

Latin America Organic Pigments Market Trends

Latin America represents an emerging market for organic pigments, driven by rising demand from construction, packaging, and automotive industries in Brazil and Mexico. Increasing urbanization, growth in consumer goods manufacturing, and expanding applications of printing ink are supporting market development. While economic volatility poses challenges, growing industrial activity and foreign investments are expected to create long-term opportunities for pigment manufacturers.

Key Organic Pigments Company Insights

Key players, including Clariant AG, BASF SE, DIC Corporation, Sudarshan Chemical Industries Ltd., Atul Ltd., and Huntsman Corporation, are dominating the market.

- Clariant AG is one of the key players in the organic pigments market, recognized for its strong portfolio of high-performance, sustainable pigment solutions serving paints & coatings, plastics, printing inks, and specialty applications. The company emphasizes innovation and regulatory-compliant formulations, with a strategic focus on eco-efficient pigments that offer enhanced color strength, durability, and a low environmental impact. Through its advanced R&D capabilities, global manufacturing footprint, and customer-centric approach, Clariant continues to strengthen its competitive positioning by addressing evolving industry requirements such as sustainability, digital printing compatibility, and premium aesthetic performance across diverse end-use sectors.

Key Organic Pigments Companies:

The following are the leading companies in the organic pigments market. These companies collectively hold the largest market share and dictate industry trends.

- Clariant AG

- BASF SE

- DIC Corporation

- Sudarshan Chemical Industries Ltd.

- Atul Ltd.

- Huntsman Corporation

- Kronos Worldwide Inc.

- Lanxess AG

- Kiri Industries Ltd.

- Vibrantz

Recent Developments

-

In March 2025, Sudarshan Chemical completed its acquisition of Heubach Group, forming a combined global pigment entity with 19 production sites worldwide. This consolidation significantly enhances Sudarshan’s specialty pigment portfolio across coatings, plastics, and inks, broadens its geographic footprint (Europe, Americas, APAC), and strengthens its R&D and supply-chain capabilities, positioning it among the leading global players in organic/high-performance pigments.

-

In February 2025, Lanxess expanded its pigment offering with new pigment types, including micronized iron-oxide yellow pigments, designed to minimize carbon footprint (reportedly reducing carbon footprint by ~35% compared to conventional alternatives). This initiative reflects a strategic push toward more sustainable, regulation-compliant pigments for coatings, plastics, and other applications, aligning with growing global demand for eco-friendly colorants and regulatory pressure on emissions and chemical safety.

Organic Pigments Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,763.5 million

Revenue forecast in 2033

USD 6,112.5 million

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Clariant AG; BASF SE; DIC Corporation; Sudarshan Chemical Industries Ltd.; Atul Ltd.; Huntsman Corporation; Kronos Worldwide Inc.; Lanxess AG; Kiri Industries Ltd.; Vibrantz

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Pigments Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global organic pigments market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Natural

-

Synthetic

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Plastics

-

Paints & Coatings

-

Construction

-

Printing Inks

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global organic pigments market size was estimated at USD 3,557.4 million in 2024 and is expected to reach USD 3,763.5 million in 2025.

b. The organic pigments market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 6,112.5 million by 2033.

b. The synthetic segment dominated the organic pigments market in 2024 due to its superior color consistency, high performance characteristics (lightfastness, thermal stability, and chemical resistance), and cost-efficient mass production capabilities. Its wide applicability across high-volume industries such as plastics, paints & coatings, and printing inks further reinforced its revenue leadership.

b. Some of the key players operating in the organic pigments market include Clariant AG, BASF SE, DIC Corporation, Sudarshan Chemical Industries Ltd., Atul Ltd., Huntsman Corporation, Kronos Worldwide Inc., Lanxess AG, Kiri Industries Ltd., and Vibrantz

b. The organic pigments market is primarily driven by rising demand from plastics, paints & coatings, and printing inks, supported by rapid urbanization, infrastructure development, and growth in packaging applications. Increasing adoption of high-performance and eco-friendly pigments due to stringent environmental regulations and evolving consumer preferences further accelerates market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.