- Home

- »

- Medical Devices

- »

-

Orthopedic Biomaterials Market Size & Share Report, 2030GVR Report cover

![Orthopedic Biomaterials Market Size, Share & Trends Report]()

Orthopedic Biomaterials Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Metal, Polymers, Ceramics & Bioactive Glass Biomaterials), By Application (Orthobiologics, Orthopedic Implants), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-152-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Orthopedic Biomaterials Market Trends

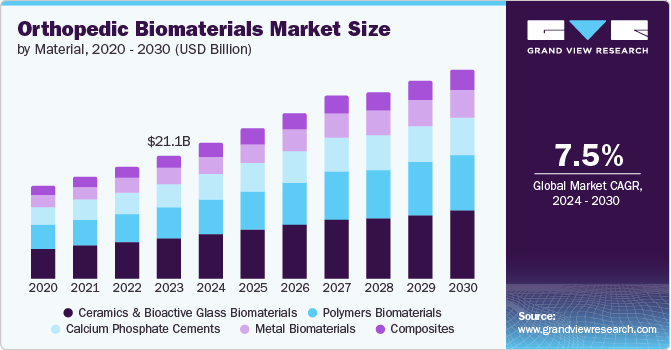

The global orthopedic biomaterials market size was estimated at USD 21.16 billion in 2023 and is projected to grow at a CAGR of 7.5% from 2024 to 2030. The increased prevalence of musculoskeletal disorders and chronic skeletal conditions fuel the growth. According to the 2023 HSE Report , approximately 473,000 workers in Great Britain experienced work-related musculoskeletal disorders (MSDs), resulting in the loss of around 6.6 million working days. These disorders accounted for 27% of all work-related ill health cases.

The growing proportion of the geriatric population particularly vulnerable to these chronic illnesses is expected to fuel the growth further. According to an article by the World Health Organization (WHO), by 2030, one out of every six individuals globally will be 60 or older. At that point, the population aged 60 and above will grow from 1 billion in 2020 to 1.4 billion. By 2050, the global population of 60 years and older will reach 2.1 billion.

An article published in the Times of India in September 2022 indicates that knee injuries among football and cricket players have surged by 500%, while anterior cruciate ligament injuries have increased by 400%. The rise in these athletic injuries is expected to drive the market growth. According to American Academy of Orthopaedic Surgeons Annual Meeting held in March 2023 for the study of “Epidemiology of Sports Injuries Among High School Athletes in the U.S.,” revealed a concerning trend:

1) The study found that an estimated 5,228,791 sports injuries occurred nationally.

2) The overall injury rate was 2.29 per 1,000 athletic exposures (AEs). This rate was calculated by dividing the total number of injuries (15,531) by the total number of exposures (6,778,209), then multiplying the result by 1,000.

The lead author of the study said, “We are seeing an increase in head and neck injuries, especially concussions, as well as more severe injuries and those requiring surgery. Many organizations have adopted safety equipment and injury prevention guidelines; it is questionable if they are being applied correctly.”

The development of innovative cartilage repair techniques, such as microfracture, autologous chondrocyte implantation (ACI), and matrix-induced autologous chondrocyte implantation (MACI), has opened new avenues for treating cartilage damage. As per Washington University Orthopedics, the success rate of ACI in enabling patients to resume pain-free activities is approximately 85%. These procedures often involve using biomaterials to support cartilage regeneration and promote healing.

The increasing prevalence of orthopedic diseases and musculoskeletal problems drives the demand for orthopedic surgeons. For instance, according to self-reported data from the 2022 National Health Survey (NHS) by the Australian Bureau of Statistics (ABS), approximately 7.3 million Australians, or 29% of the population, were estimated to be living with chronic musculoskeletal conditions. The prevalence of these chronic musculoskeletal conditions are:

-

4.0 million individuals were estimated to be living with back problems

-

3.7 million individuals were estimated to be living with arthritis

-

854,000 individuals were estimated to be living with osteopenia or osteoporosis

The need for next-generation orthopedic biomaterials, which are specifically designed to fulfill the requirements of a particular orthopedics operation, is on the rise globally. Advancements in medical technology have significantly propelled the market through the development of innovative biomaterials and minimally invasive procedures. Ongoing research and development efforts have resulted in new and improved biomaterials that exhibit greater compatibility with the human body, thereby enhancing the success rates of orthopedic surgeries. Advances in surgical techniques, particularly minimally invasive procedures, necessitate specialized biomaterials that facilitate quicker healing and reduce postoperative discomfort, making these materials indispensable in modern orthopedic treatments.

Moreover, research into spinal cord injury treatments is progressing, focusing on biomaterials that can facilitate nerve regeneration and improve functional recovery. Biomaterials are being explored in spinal cord implants, nerve conduits, and other applications to restore neurological function. For instance, a clinical trial conducted in November 2023 at the University of Houston has shown promising results for using Riluzole to improve functionality in people with acute spinal cord injuries (SCI) if the drug is administered within 12 hours post-injury. The trial consisted of a pharmacokinetic sub-study focused on the drug’s absorption, distribution, metabolism, and excretion in the body.

Market Concentration & Characteristics

The orthopedic biomaterials industry is characterized by a relatively moderate concentration level, with a few key players dominating the market. This concentration is driven by several factors, including the significant investment required in research and development, stringent regulatory requirements, and the need for specialized technology and expertise. In addition, their ability to navigate complex regulatory landscapes and secure necessary approvals allows them to maintain a competitive edge.This concentration can lead to high barriers to entry for new companies, thus perpetuating the dominance of established firms and shaping the competitive market dynamics.

The orthopedic biomaterials industry is characterized by a high degree of innovation. Nanomaterials have emerged as a promising strategy for treating various orthopedic diseases, such as developing nanoparticle-based drug delivery systems. These systems can improve the efficacy and safety of drug therapy by enhancing drug solubility, protecting drugs from degradation, and enabling targeted drug delivery to specific sites within the body. Moreover, nanostructured scaffolds for tissue engineering have been developed. These scaffolds can provide a structural framework for the growth and differentiation of cells, promoting the regeneration of damaged or diseased tissues.

Regulations significantly impact the orthopedic biomaterials industry by ensuring patient safety, product quality, and efficacy. The International Standards Organization (ISO) has established a comprehensive standard, ISO 10993, to guide biocompatibility testing. This standard outlines a series of tests designed to evaluate the potential biological effects of materials used in medical devices. The tests cover a wide range of aspects, including:

-

Cytotoxicity: Assessing the material’s ability to damage or kill cells.

-

Sensitization: Determining if the material can trigger an allergic reaction.

-

Irritation: Evaluating the material’s potential to cause skin or tissue irritation.

-

Genotoxicity: Assessing the material’s ability to damage DNA.

-

Implantation: Evaluating the material’s long-term effects on tissues after implantation.

Mergers and acquisitions in the orthopedic biomaterials industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in January 2023, Zimmer Biomet Holdings, Inc. announced the acquisition of Embody, Inc., a private medical device organization aimed at soft tissue healing. The agreement is focused on achieving future commercial and regulatory milestones over a period of three years. Furthermore, the acquisition is expected to increase the company’s total revenue and contribute to the company’s sales, leading to a larger overall revenue figure.

Companies adopt various strategies, which include collaboration, product expansion, and partnerships, to strengthen their market position. For instance, in January 2023, Victrex, a UK-based company, plans to expand its medical business by adding medical device R&D and manufacturing capabilities. This expansion is likely to allow Invibio to collaborate with a wider range of OEMs to create and launch new implantable medical devices made from PEEK polymer. Moreover, this center is anticipated to help Invibio and its partners develop innovative PEEK polymer implants that meet the needs of the growing medical device market.

The orthopedic biomaterials industry is experiencing robust global expansion due to increasing healthcare expenditure, technological advancements, and growing awareness about arthroplasty, trauma, and spinal applications. As the population ages, the prevalence of musculoskeletal disorders such as osteoarthritis, osteoporosis, and rheumatoid arthritis also increases, leading to a higher demand for orthopedic biomaterials used in joint replacements, spinal implants, and other surgical procedures.

Material Insights

The ceramics & bioactive glass segment accounted for the largest market share of 32.25% in 2023. The growth is attributed to the increased adoption of ceramics in repairing hard tissues in various procedures. Bioactive glasses are one of the most preferred hard materials used to treat soft tissue damage. These substances were originally designed to facilitate the treatment of damaged bones; however, they also help repair and regenerate various wounds and delicate structures of the body, driving their demand.

The polymer biomaterials segment is expected to grow at the fastest CAGR during the forecast period owing to the widespread use of polymers as bone cement and load-bearing surfaces in total joint arthroplasties; the demand for polymers has significantly increased. Moreover, the availability of advanced polymers and biopolymers for various applications, including orthobiologics and bio-resorbable tissue fixation, has further driven global demand for these materials.

Application Insights

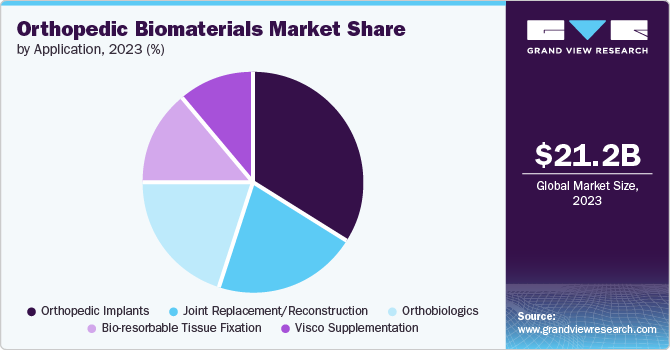

The orthopedic implants segment held the largest revenue share of 33.99% in 2022, owing to the rising incidences of disc degenerative conditions and bone fractures coupled with increasing trauma cases. For instance, according to a study published in January 2024 by The Leagrave Therapy Clinic, approximately 20% of teenagers may show mild degeneration, increasing to 60% of 70-year-olds.

The orthobiologics segment is expected to grow at the fastest CAGR over the forecast period owing to the increasing number of bone repair and reconstruction surgeries worldwide because of the rise in obesity and trauma cases. For instance, the Global Status Report on Road Safety 2023, published by the World Health Organization (WHO), indicates a slight decrease in annual road traffic deaths, reaching 1.19 million. This represents a decline from previous years, but it's crucial to understand the context and implications of this data.

Regional Insights

North America orthopedic biomaterials market dominated the overall global market and accounted for the 36.23% revenue share in 2023. This is due to its large market size and significant growth in the healthcare sector. Moreover, the rise in patients requiring knee replacement and other joint-related orthopedic procedures and the quick adoption of advanced products for bone void filling and implant load-bearing purposes is anticipated to drive the regional market further. According to the American College of Rheumatology (ACR), approximately 1.3 million total joint replacements are performed annually in the U.S., with high safety and reliability.

The U.S. Orthopedic Biomaterials Market Trends

The orthopedic biomaterials market in the U.S. held the largest share in 2023 the North American region, owing to the aging population of older individuals. The market is growing rapidly, driven by several factors, including an aging population, advancements in medical technology, and a rise in sports-related injuries. As the elderly population increases, so does the demand for orthopedic biomaterials to manage age-related conditions such as arthritis and osteoporosis. Innovations in biomaterials, such as more compatible and durable options and advancements in minimally invasive surgical techniques, are enhancing the effectiveness of orthopedic procedures. The surge in sports-related injuries also contributes to market growth, as these injuries often require specialized biomaterials for effective treatment.

Asia Pacific Orthopedic Biomaterials Market Trends

The orthopedic biomaterials market in the Asia Pacific is expected to grow at the fastest CAGR from 2024 to 2030. Factors such as the rising prevalence of bone degenerative diseases and bone disorders in low- and middle-income countries. Moreover, continuously increasing healthcare expenditure coupled with improving healthcare infrastructure is expected to serve as a high-impact rendering driver to the market in this region. The presence of the Asia Pacific Consortium on Osteoporosis (APCO) is also boosting the market growth by continuously contributing to addressing the significant challenge of osteoporosis and fracture prevention in the Asia Pacific region. The organization states that this region, characterized by its immense population and rapid growth, faces a unique set of challenges related to bone health.

Japan orthopedic biomaterials market is expected to grow at the fastest rate in the region due to the ongoing advanced medical technologies and strategic initiatives by the key players in Japan. The prevalence of musculoskeletal disorders and chronic skeletal conditions in Japan is a significant market driver. Approximately 10-20% of the Japanese population experiences chronic pain. This trend is expected to continue, driving the demand for orthopedic biomaterials used in various treatments and implants.

The orthopedic biomaterials market in India holds a significant share of the Asia Pacific regional market revenue. The increasing prevalence of chronic diseases creates a lucrative opportunity for the market. The need for next-generation orthopedic biomaterials, which are specifically designed to fulfill the requirements of a particular orthopedics operation, is on the rise globally. These materials offer improved clinical outcomes, enhanced patient safety, and effective cost management. As a result, there is a growing demand for these advanced biomaterials in various orthopedic applications. This trend is expected to drive market growth during the forecast period.

Europe Orthopedic Biomaterials Market Trends

The orthopedic biomaterials market in Europe is expected to witness lucrative growth over the forecast period. The increasing emphasis on healthcare drives the growth. Furthermore, government initiatives to improve healthcare infrastructure and accessibility are also boosting the market for orthopedic biomaterials in Europe.

The UK orthopedic biomaterials market is one of the major markets in the region. The extensive use of polymers in joint replacements and bone cement, along with the availability of advanced polymers and biopolymers for various applications, is driving demand. Increased healthcare expenditure and improved access to medical care further support market expansion. The market is expected to grow, driven by technological advancements and demographic trends.

The orthopedic biomaterials market in Germany is projected to expand in the forecast period owing to a rapidly aging population, a growing prevalence of trauma and spinal disorders, a sophisticated healthcare system, a highly qualified workforce, and high healthcare spending. Moreover, the supportive reimbursement policies and strategic collaborations within the healthcare industry further boost the country's market growth.

Latin America Orthopedic Biomaterials Trends

The orthopedic biomaterials market in Latin America is experiencing significant growth. The increasing prevalence of orthopedic diseases, such as osteoarthritis, rheumatoid arthritis, and bone fractures, is a significant driver for the Latin American market. According to the World Health Organization (WHO), musculoskeletal conditions are the second leading cause of disability worldwide, with a higher prevalence in low- and middle-income countries such as those in Latin America. As a result, the demand for orthopedic biomaterials is increasing to address these health issues.

Brazil orthopedic biomaterials market is experiencing significant growth due to the aging population, which is more susceptible to orthopedic diseases. In addition, the increasing prevalence of obesity and sedentary lifestyles has led to an increase in the number of orthopedic procedures, including joint replacements and spinal surgeries.

MEA Orthopedic Biomaterials Market Trends

The orthopedic biomaterials market in MEA is experiencing significant growth. This is driven by factors such as governments and private investors in the Middle East and Africa's increasing investment in healthcare infrastructure, including hospitals, clinics, and research centers. These investments create market growth opportunities as they drive the demand for advanced medical devices and technologies.

Saudi Arabia orthopedic biomaterials market is anticipated to expand in the forecast period. By the end of 2050, it is predicted that 25% of Saudi Arabia’s total population of 40 million will be aged 60 or older. Moreover, the number of individuals aged 80 and above is expected to reach 1.6 million, accounting for 4% of the total population. As the elderly population is more prone to orthopedic diseases, the demand for orthopedic biomaterials is expected to increase, driving market growth.

The orthopedic biomaterials market in Kuwait is expected to grow over the forecast period due to the next-generation orthopedic biomaterials tailored for specific orthopedic surgeries. Moreover, the rising prevalence of chronic diseases and musculoskeletal disorders, particularly among the elderly population, and growing technological advancements in biomaterials leading to improved product offerings and patient outcomes are boosting the market growth.

Key Orthopedic Biomaterials Company Insights

The market is highly competitive, with major companies undertaking various organic and inorganic strategies, such as new product development, collaborations, acquisitions, mergers, and regional expansion, to serve their customers' unmet needs

Key Orthopedic Biomaterials Companies:

The following are the leading companies in the orthopedic biomaterials market. These companies collectively hold the largest market share and dictate industry trends.

- DSM Biomedical

- Evonik industries AG

- Stryker Corp

- Depuy Synthes Inc.

- Zimmer Biomet

- Invibo Ltd.

- Globus Medical

- Exactech, Inc.

- Matexcel

- AdvanSource

- Biomaterials Corp.

- CAM Bioceramics B.V.

- Heraeus Holding

Recent Developments

-

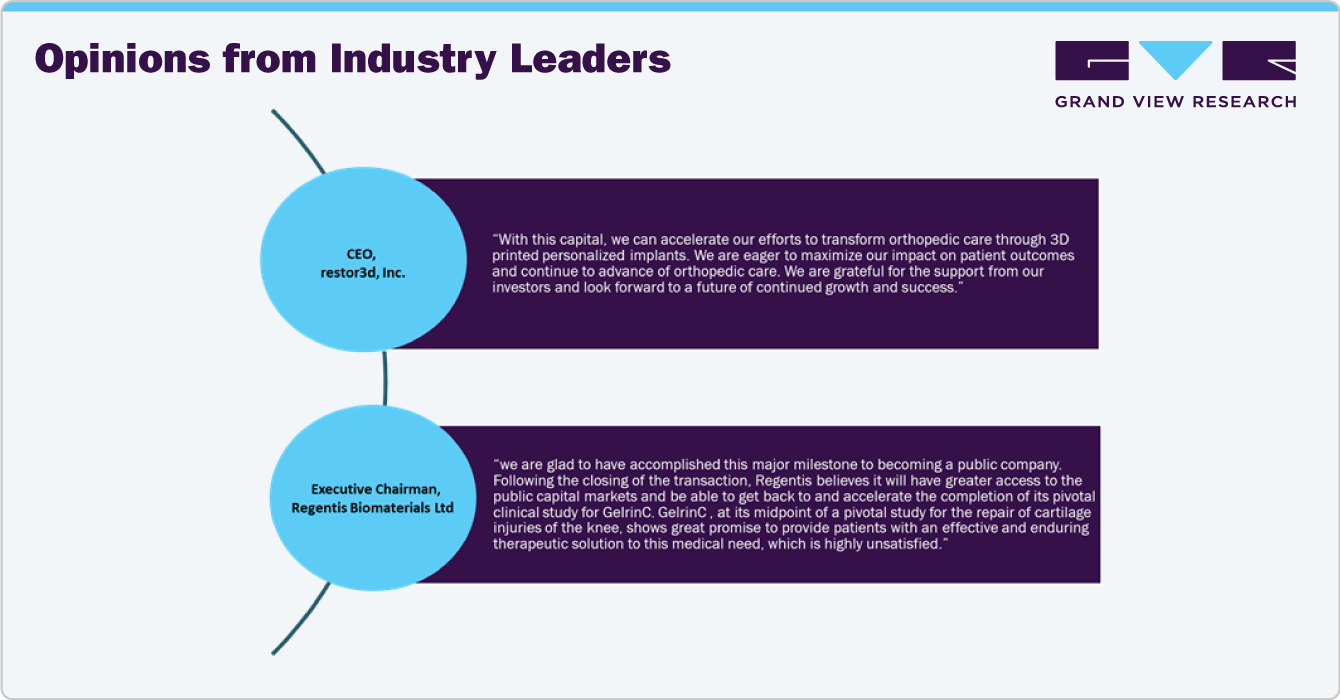

In June 2024, Restor3d, which focuses on 3D-printed orthopedic implants, raised USD 70 million in funding. This includes a USD 55 million Series A round led by Summers Value Partners and debt capital from Trinity Capital of USD 15 million.

-

In September 2023, Restor3d finalized its acquisition of Conformis. This merger brings together two innovative organizations with a shared focus on delivering cutting-edge, patient-specific solutions to improve patient outcomes.

-

In May 2023,OceanTech Acquisitions I Corp. announced a definitive agreement and merger plan with Regentis Biomaterials Ltd.Regentis developed the Gelrin platform, which utilizes resorbable hydrogel implants to regenerate damaged or diseased tissue in orthopedic treatments. The key components of the Gelrin platform are polyethylene glycol diacrylate (PEGDA) and denatured fibrinogen

Orthopedic Biomaterials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.30 billion

Revenue forecast in 2030

USD 35.90 billion

Growth rate

CAGR of 7.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

DSM Biomedical; Evonik Industries AG; Stryker Corp.; DePuy Synthes Inc.; Zimmer Biomet; Invibio Ltd.; Globus Medical; Exactech, Inc.; Matexcel; AdvanSource Biomaterials Corp.; CAM Bioceramics B.V.; Heraeus Holding

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

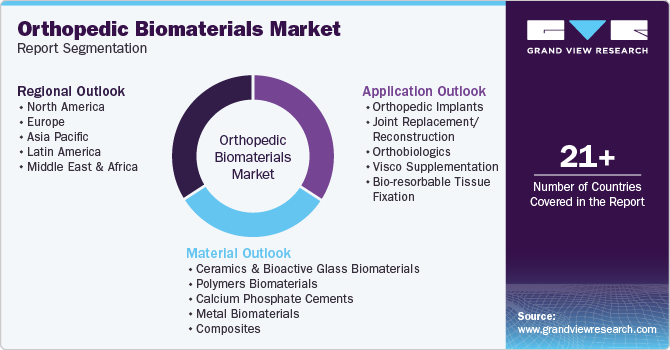

Global Orthopedic Biomaterials Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global orthopedic biomaterials market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceramics & Bioactive Glass Biomaterials

-

Polymers Biomaterials

-

Calcium Phosphate Cements

-

Metal Biomaterials

-

Composites

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Implants

-

Joint replacement/reconstruction

-

Orthobiologics

-

Visco supplementation

-

Bio-resorbable tissue fixation

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic biomaterials market size was estimated at USD 21.16 billion in 2023 and is expected to reach USD 23.30 billion in 2024.

b. The global orthopedic biomaterials market is expected to grow at a compound annual growth rate of 7.5% from 2024 to 2030 to reach USD 35.90 billion by 2030.

b. Ceramics & bioactive glass biomaterials dominated the orthopedic biomaterials market with a share of 32.3% in 2023. This is attributable to the increased adoption of ceramics in the repair of hard tissues in various procedures.

b. Some key players operating in the orthopedic biomaterials market include DSM Biomedical; Evonik Industries AG; Stryker Corp.; DePuy Synthes Inc.; Zimmer Biomet; Invibio Ltd.; Globus Medical; Exactech, Inc.; Matexcel; AdvanSource Biomaterials Corp.; CAM Bioceramics B.V.; and Heraeus Holding.

b. Key factors that are driving the orthopedic biomaterials market growth include increasing the incidence of musculoskeletal ailments and chronic skeletal conditions are boosting the product demand, thereby augmenting the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.