- Home

- »

- Plastics, Polymers & Resins

- »

-

Packaging Nets Market Size & Share, Industry Report, 2030GVR Report cover

![Packaging Nets Market Size, Share & Trends Report]()

Packaging Nets Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Synthetic, Natural), By Type (Extruded Net, Knitted Net), By Application (Food Industry, Non-food Industries), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-535-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Packaging Nets Market Size & Trends

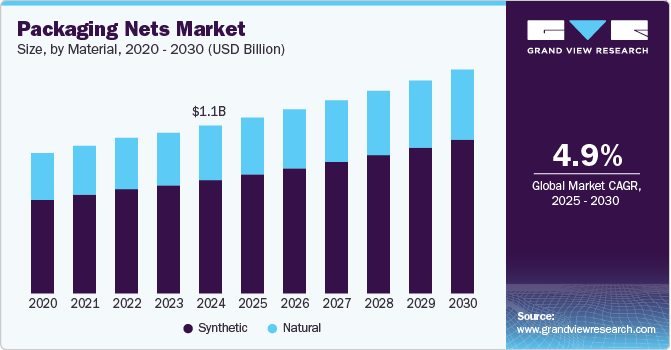

The global packaging nets market size was estimated at USD 1.06 billion in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2030. The packaging nets industry’s growth is primarily driven by the rising demand for sustainable and cost-effective packaging solutions across multiple industries, including fresh produce, seafood, and industrial goods.

Packaging nets are increasingly favored due to its lightweight, breathability, and recyclability, which align with global sustainability trends. With the growing focus on reducing plastic waste, manufacturers are shifting toward biodegradable and compostable Packaging nets materials made from plant-based polymers. For example, companies such as Packnatur GmbH, CompoPac, and Naturpac are innovating with compostable nets for fruits and vegetables, catering to the rising consumer preference for eco-friendly alternatives.

Additionally, the booming fresh produce industry is also contributing to an increasing demand for packaging nets, particularly in regions with high fruit and vegetable consumption. Packaging nets is widely used for onions, citrus fruits, and potatoes due to its ability to enhance product visibility while maintaining airflow, preventing spoilage. The increasing demand for convenience and bulk packaging in retail and supermarkets further boosts the market. Countries such as the U.S., Germany, and China are witnessing high adoption rates of net bags in grocery chains, as they offer easy handling and an extended shelf life for fresh products.

Technological advancements in packaging materials and manufacturing processes are also propelling growth of the packaging nets industry. Innovations such as high-strength polyethylene (PE) and polypropylene (PP) nets enhance durability and reusability, making them suitable for heavier applications such as shellfish and firewood packaging. Additionally, automation in packaging nets machines has improved efficiency and reduced labor costs, encouraging wider adoption across food processing and distribution channels. Companies such as Grup Giró and Volm Companies are investing in advanced netting solutions with features such as laser perforations and resealable closures to enhance functionality and consumer appeal.

Government regulations and policies promoting sustainable packaging also play a significant role in driving the packaging nets market. Countries in the European Union and North America are implementing stricter regulations on single-use plastics, pushing retailers and food suppliers to adopt recyclable and biodegradable packaging nets solutions. This regulatory landscape encourages investments in research and development for alternative materials, such as bioplastics and fiber-based netting. As sustainability becomes a key factor in packaging choices, the market is poised for continued growth, driven by both environmental concerns and shifting consumer preferences.

Material Insights

The synthetic material segment recorded the largest revenue share of over 67.0% in 2024 and is expected to grow at the fastest CAGR of 5.3% during the forecast period. Synthetic packaging nets is primarily made from materials such as polyethylene (PE), polypropylene (PP), and nylon. These materials offer superior durability, moisture resistance, and strength, making them ideal for applications in food packaging, agriculture, and industrial use. Synthetic netting is widely used for packaging fresh produce, shellfish, firewood, and construction materials due to its lightweight nature and cost-effectiveness. Advances in polymer technology, such as biodegradable and recycled plastics, are also enhancing the appeal of synthetic packaging nets.

Natural packaging nets is made from biodegradable and renewable materials such as jute, cotton, and coir. These materials are gaining popularity due to their eco-friendly nature, as they decompose without leaving harmful residues. Natural packaging nets is commonly used for organic produce, artisanal goods, and premium packaging where sustainability is a key selling point. Therefore, the increasing emphasis on sustainability and environmental regulations is a major driver for natural packaging nets.

Type Insights

The extruded net segment recorded the largest revenue share of over 54.0% in 2024. Extruded packaging nets is made by forcing molten plastic through a die to create a continuous, uniform mesh structure. This type of netting is widely used for packaging fruits, vegetables, shellfish, and industrial products due to its durability, flexibility, and breathability. It ensures efficient airflow, which helps extend the shelf life of fresh produce while providing visibility and convenience for both consumers and retailers.

The knitted net segment is expected to grow at the fastest CAGR of 5.4% during the forecast period. It is produced using interlocking loops of material, providing greater elasticity and flexibility compared to extruded netting. It is commonly used in packaging applications where stretchability is needed, such as wrapping firewood, meat products, and agricultural produce. The demand for knitted packaging nets is driven by its superior adaptability to various product shapes and sizes, making it ideal for irregularly shaped goods.

Application Insights

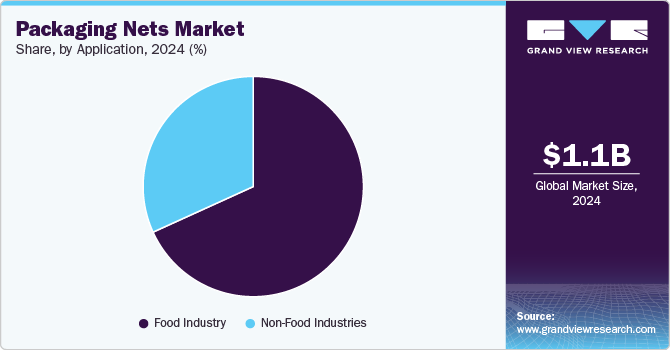

The food industry segment recorded the largest market share of over 68.0% in 2024 and is projected to grow at the fastest CAGR of 5.4% during the forecast period. The food industry is a major application segment in the global packaging nets market, primarily used for packaging fresh produce such as fruits, vegetables, shellfish, and other perishable items. The increasing demand for fresh and minimally processed food products is a key driver for packaging nets in the food industry. Additionally, the expansion of e-commerce and online grocery shopping has increased the need for protective yet breathable packaging solutions, further driving segment growth.

Packaging nets are also widely used in non-food industries for applications such as packaging firewood, toys, sports equipment, industrial parts, and horticultural products. Its durability and flexibility make it suitable for securing and transporting bulky or irregularly shaped items. The growing industrial and retail sectors are key drivers for packaging nets in non-food applications. The rising demand for sustainable and reusable packaging solutions, particularly in the gardening and home improvement sectors, is further fueling market growth.

Regional Insights

Asia Pacific dominated the packaging nets industry and accounted for the largest revenue share in 2024. It is projected to grow at the fastest CAGR of 5.4% during the forecast period. The region’s dominance is due to its rapid industrialization, expanding consumer base, and evolving retail landscape. Countries such as China, India, Japan, and Thailand have seen significant increases in demand for packaging nets solutions across food and beverage, agriculture, and consumer goods sectors. Moreover, the region's agricultural prominence plays a crucial role in adopting packaging nets. Countries such as Thailand, Vietnam, and Indonesia have substantial fruit and vegetable exports requiring protective yet breathable packaging solutions during transit.

China Packaging Nets Market Trends

China's packaging nets market is primarily driven by its due to its massive manufacturing capacity, technological advancements, and strategic economic policies. As the world's largest exporter, China has developed extensive packaging infrastructure to support its supply chains across industries ranging from electronics to fresh produce. The government's focus on sustainability has also encouraged innovation in biodegradable packaging nets solutions, helping Chinese manufacturers stay ahead of global environmental regulations.

North America Packaging Nets Market Trends

The region's strong food and beverage industry has fueled the demand for packaging nets for fresh produce, seafood, and specialty items, driven by its sustainability benefits and visual appeal. Major retailers like Whole Foods and Walmart have notably increased their use of net bags for organic produce, allowing shoppers to easily identify premium products while reducing plastic waste. Additionally, the farm-to-table movement has further accelerated this trend, as consumers favor the transparent and natural look of packaging nets, which enables easy product inspection.

The packaging nets industry in the U.S. is primarily driven by its expanding agricultural sector, which is adopting the packaging nets solutions, particularly for premium fruits and specialty produce. Companies such as Driscoll's berries and Washington apple exporters utilize breathable protective nets that extend shelf life while showcasing product quality.

Europe Packaging Nets Market Trends

The EU's stringent policies on single-use plastics and packaging waste, including the European Green Deal and Circular Economy Action Plan, have pushed manufacturers to adopt more sustainable alternatives such as packaging nets. These regulations mandate specific recycling targets and waste reduction measures, creating a regulatory environment that favors packaging nets recyclable and biodegradable properties.

Packaging nets market in Germany is primarily driven by its strong focus on organic and premium products has created significant demand for specialized packaging nets. German retailers such as Aldi and Lidl have pioneered the use of lightweight, recyclable packaging nets for fruits and vegetables, allowing for proper air circulation while reducing plastic usage. These innovations have spread to their international operations, influencing global retail packaging practices. The wine and specialty beverage industries also utilize custom net protective sleeves for glass bottles, providing impact resistance while maintaining the premium aesthetic that German exports command.

Key Packaging Nets Company Insights

The global packaging nets market is highly competitive, driven by increasing demand from the food, agriculture, and industrial sectors. Prominent players leverage advanced manufacturing techniques and sustainable materials to gain a competitive edge. Market share is influenced by factors such as product innovation, regional expansion, and eco-friendly packaging solutions, with companies focusing on biodegradable and recyclable netting to meet consumer and regulatory demands. The industry is fragmented, with a mix of global and regional players competing based on cost-effectiveness, durability, and customization.

-

In May 2024, Mesh Pack, a German producer of various packaging nets, launched a new biodegradable net made from corn starch as a sustainable alternative to traditional plastic nets.

-

In June 2023, Giro Pack, a renowned company in the packaging industry, was on the verge of launching a groundbreaking new product, a cellulose mesh bag. This innovative packaging solution is entirely plastic-free and made from paper-based materials, aligning with the growing demand for sustainable packaging options.

Key Packaging Nets Companies:

The following are the leading companies in the packaging nets market. These companies collectively hold the largest market share and dictate industry trends.

- GSH Group

- Chemco Group

- LC Packaging International BV

- Packnatur GmbH

- CL Industries India

- SKAPS Industries

- Satya Group

- Norplex Inc

- Lenzing

- Intermas Nets, S.A.U.

- Grup Giró

- EXPO-NET

- Paardekooper B.V.

- Indonet Plastic Industries

Packaging Nets Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.11 billion

Revenue forecast in 2030

USD 1.41 billion

Growth rate

CAGR of 4.9% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, type, application, region

States scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Key companies profiled

GSH Group; Chemco Group; LC Packaging International BV; Packnatur GmbH; CL Industries India; SKAPS Industries; Satya Group; Norplex Inc; Lenzing; Intermas Nets, S.A.U.; Grup Giró; EXPO-NET; Paardekooper B.V.; Indonet Plastic Industries

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Packaging Nets Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global packaging nets market report based on material, type, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Natural

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Extruded Net

-

Knitted Net

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Industry

-

Non-Food Industries

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global packaging nets market was estimated at around USD 1.06 billion in the year 2024 and is expected to reach around USD 1.11 billion in 2025.

b. The global packaging nets market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 to reach around USD 1.41 billion by 2030.

b. Food industry emerged as the dominating application in the packaging nets market due to increasing demand for breathable, lightweight, and cost-effective packaging solutions for fresh produce, meat, and seafood.

b. The key players in the packaging nets market include GSH Group, Chemco Group, LC Packaging International BV, Packnatur GmbH, CL Industries India, SKAPS Industries, Satya Group, Norplex Inc, Lenzing, Intermas Nets S.A.U., Grup Giró, EXPO-NET, Paardekooper B.V., and Indonet Plastic Industries.

b. The packaging nets market is driven by increasing demand for protective and breathable packaging solutions in the food, agriculture, and consumer goods industries. Additionally, sustainability trends and the rising preference for lightweight, recyclable materials further fuel market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.