- Home

- »

- Healthcare IT

- »

-

Patient Data Hub Solutions Market, Industry Report, 2033GVR Report cover

![Patient Data Hub Solutions Market Size, Share & Trends Report]()

Patient Data Hub Solutions Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution Type (Health Data Apps & AI Solutions, Data Integration Solutions, Patient 360 View Platforms), By Deployment Mode (Cloud-based,), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-612-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Patient Data Hub Solutions Market Summary

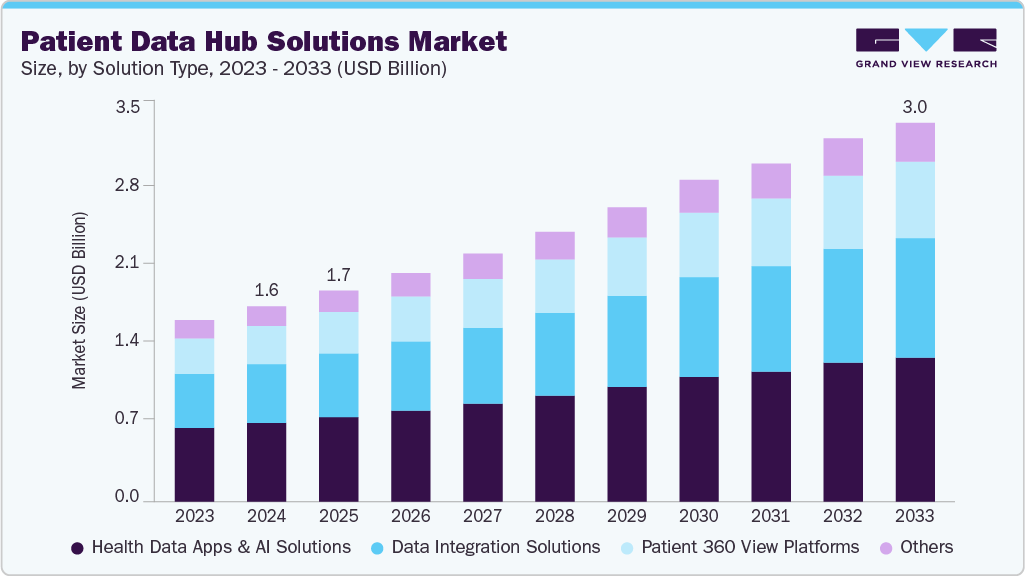

The global patient data hub solutions market size was estimated at USD 1.55 billion in 2024 and is projected to reach USD 3.01 billion by 2033, growing at a CAGR of 7.59% from 2025 to 2033. The market demand is attributed to a rising need for centralized patient data to improve patient care, a need for interoperability, and advancements in health IT infrastructure.

Key Market Trends & Insights

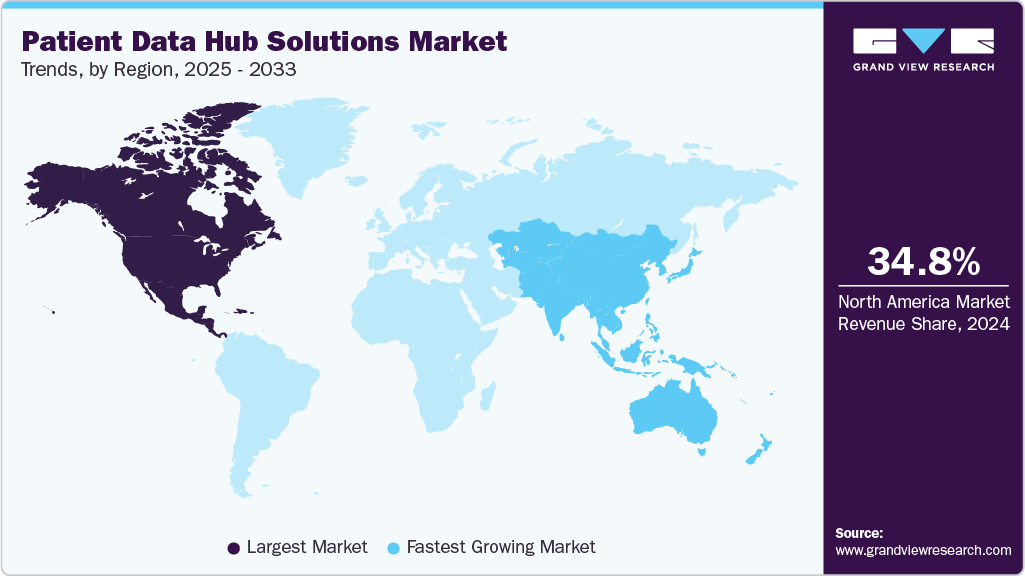

- North America dominated the market and accounted for a 34.75% share in 2024.

- The patient data hub solutions market in the U.S. has seen significant growth over the forecast period owing to the adoption of integrated solutions.

- By solution type, the health data apps & AI solutions segment dominated the market with a share of 40.34% in 2024.

- By deployment mode, the cloud-based segment dominated the patient data hub solutions industry with a share in 2024.

- By end-use, the healthcare companies’ segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.55 Billion

- 2033 Projected Market Size: USD 3.01 Billion

- CAGR (2025-2033): 7.59%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In October 2023, Microsoft launched advanced data and AI solutions aimed at empowering healthcare organizations to derive deeper insights and enhance both patient care and clinician experiences. According to the World Economic Forum, hospitals generate around 50 petabytes of siloed data annually-the equivalent of nearly 10 billion music files. Yet, an astonishing 97% of this data remains untapped, meaning countless insights with the potential to improve patient care and streamline operations are left unexplored. Effectively harnessing this data is essential to achieving meaningful clinical and operational advancements.

The growing demand for centralized patient data drives the patient data hub solutions market. As healthcare providers face challenges in delivering better, more personalized care, having a unified view of a patient's medical history has become essential. Centralized data helps reduce redundancies, supports accurate diagnosis, and improves treatment plans. The article published by the National Library of Medicine in January 2024 discusses the implementation of a Centralized Healthcare Database (CHD) to enhance patient care, streamline healthcare systems, and support research. It emphasizes the importance of addressing challenges related to data management, security, and standardization to maximize the benefits of CHD.

Hospitals and clinics often use diverse systems that don’t communicate well with each other. Patient data hub solutions address this by integrating various platforms into a single, connected ecosystem. This improves communication among healthcare providers and reduces the risk of errors. Because of this, many companies are coming up with various services and solutions. For instance, in February 2025, Cotiviti agreed to acquire Edifecs to enhance healthcare interoperability. The combined platform aims to improve connectivity between payers and providers, streamline operations, and accelerate the deployment of value-based care solutions in healthcare systems.

Technological advancements in healthcare IT infrastructure significantly contribute to the growth of the patient data hub solutions market. Tools like cloud computing and AI enable smarter, faster, and more secure handling of patient information.

Emerging Pricing Models Analysis

The pricing structures in the Patient Data Hub Solutions market are designed to align with healthcare providers’ evolving needs for data integration, scalability, and compliance. Vendors typically offer flexible and tiered pricing strategies to accommodate various organizational sizes, data volumes, and integration complexities.

- Subscription-Based Pricing (Annual or Monthly)

This is the most common pricing model adopted by patient data hub providers. Clients are charged a fixed monthly or annual fee based on selected modules, user access levels, and data storage capacity. This model offers predictable budgeting for providers and supports long-term service contracts. Example: A health system subscribing to a patient data aggregation and analytics suite for multi-hospital deployment.

- Usage-Based or Pay-Per-Interaction

This model charges clients based on the actual volume of data processed, patient interactions managed, or API calls made. It is especially favored by smaller practices or those with fluctuating data loads. It aligns costs with utilization, offering a cost-effective entry point for early adopters. This is often used in value-based care programs or for payer-provider integration platforms.

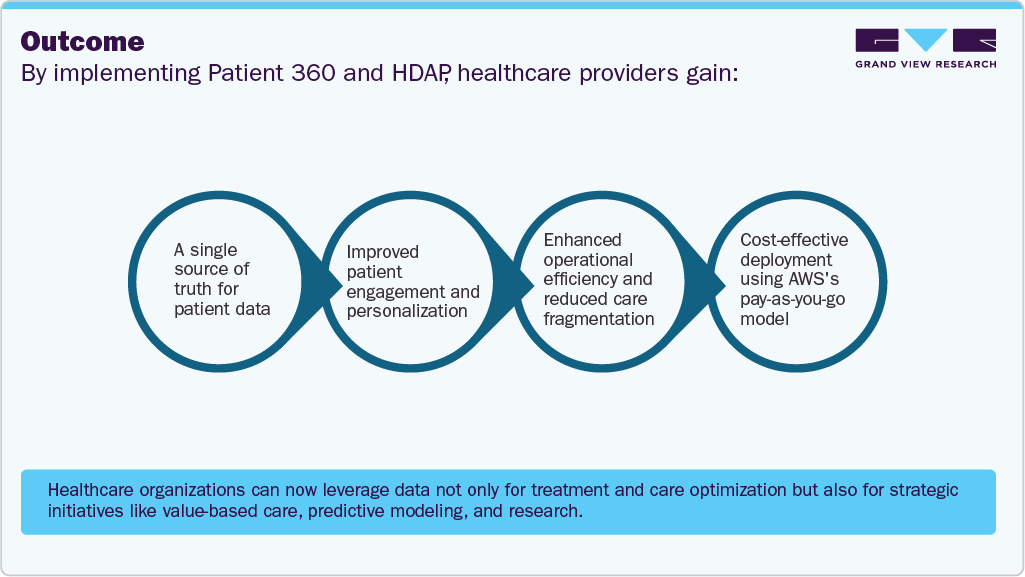

Case Study: Transforming Healthcare with Apexon's Patient 360 and HDAP Platform

Background

Healthcare organizations are under growing pressure to deliver personalized, seamless, and outcomes-driven care experiences. In response to updated Centers for Medicare & Medicaid Services (CMS) guidelines, which by 2023 allocated 57% of Medicare Advantage (MA) star ratings to patient experience, providers are actively seeking technology solutions that unify patient data and drive care transformation.

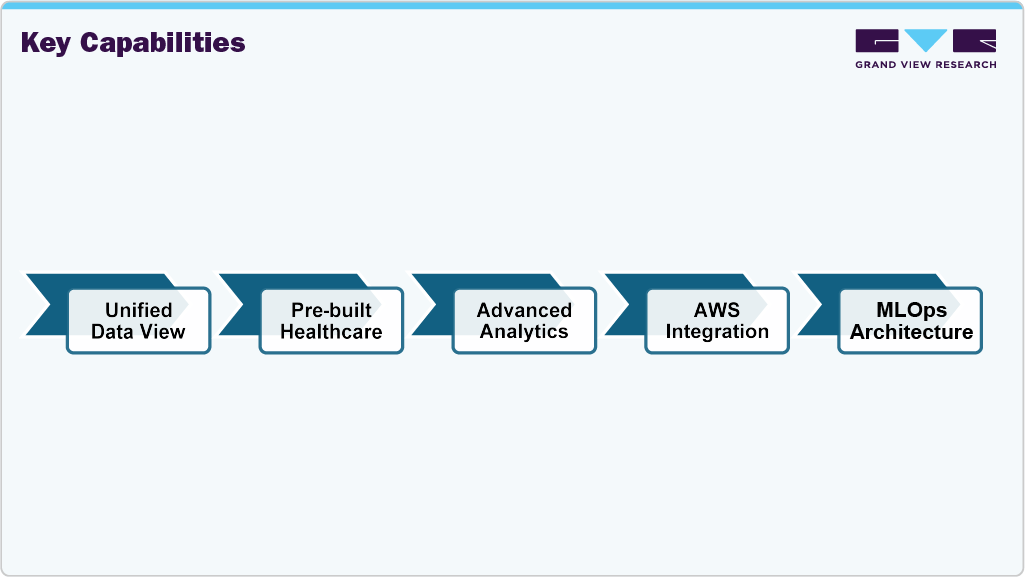

To address this need, Apexon, an AWS Advanced Tier Services Partner, developed the Patient 360 solution powered by its proprietary Health Data Analytics Platform (HDAP) and hosted on AWS.

The Challenge

Healthcare data is inherently complex, fragmented, and sensitive. Providers struggle to integrate data from clinical visits, diagnostics, medications, wearables, and social determinants of health to create a unified view of each patient. This disjointed information landscape hinders proactive engagement, care coordination, and patient outcomes.

Solution Overview: Apexon's Patient 360 and HDAP

Patient 360 is a healthcare analytics framework that provides a real-time, 360-degree view of patient health, supported by Apexon's HDAP-a scalable, secure platform built on AWS.

Conclusion

Apexon's Patient 360, powered by HDAP and AWS, is a next-generation healthcare solution that bridges data silos, enhances patient engagement, and improves clinical and operational outcomes. It positions providers to meet the rising expectations of value-based care and consumer-centric delivery.

Market Concentration & Characteristics

The degree of innovation in the patient data hub solutions industry is high, driven by rapid advancements in digital health technologies, growing investments in healthcare IT, and the increasing adoption of AI and machine learning. These innovations enable real-time analytics, predictive insights, and more personalized care delivery.

The level of mergers and acquisitions in industry is significantly growing as companies seek to expand their technological capabilities, strengthen their market presence, and address the rising demand for integrated healthcare solutions. Larger health IT firms are acquiring innovative startups to gain access to advanced data integration, analytics, and interoperability tools. These strategic partnerships allow firms to offer more comprehensive solutions that cater to complex healthcare data management needs.

The impact of regulations in the industry is high, as healthcare providers must comply with strict data privacy, security, and interoperability standards. Laws such as HIPAA in the United States, GDPR in Europe, and other regional regulations mandate secure storage, access, and sharing of patient information. In addition, governing bodies promoting electronic health records (EHRs) and value-based care models further intensify the need for regulated, interoperable data infrastructure.

For instance, in July 2023, the World Health Organization (WHO) and Health Level Seven International (HL7) signed a Project Collaboration Agreement to promote the global adoption of open interoperability standards in digital health. This partnership aims to support the implementation of the WHO Global Strategy on Digital Health 2020-2025 by enhancing countries' capacities to adopt and effectively use interoperability standards. A key focus is integrating HL7's Fast Healthcare Interoperability Resources (FHIR) standard, facilitating seamless data exchange across diverse health systems.

The industry is experiencing moderate to high regional expansion as healthcare systems worldwide increasingly recognize the importance of centralized, interoperable data platforms. While North America and Europe lead due to advanced healthcare infrastructure and supportive regulatory frameworks, emerging markets in Asia-Pacific, Latin America, and the Middle East are rapidly adopting digital health technologies.

Solution Type Insights

The Health Data Apps & AI Solutions segment dominated the market with a share of 40.34% in 2024. The demand is rising as healthcare organizations rely on intelligent technologies to improve diagnosis and treatment and manage, analyze, and interpret large volumes of patient data. Integrating these solutions with remote monitoring tools and apps enhances their utility in chronic disease management and telehealth. Furthermore, the need for faster decision-making, reduced administrative burden, and improved workflow efficiency is pushing healthcare organizations to adopt AI-driven data hub technologies at a growing rate.

Data Integration Solutions is expected to grow at the fastest CAGR over the forecast period. This is due to the increasing need for seamless connectivity among disparate healthcare systems and the consolidation of clinical, financial, and operational data into unified platforms. As healthcare organizations continue to adopt various electronic health record (EHR) systems, laboratory information systems, and third-party applications, data silos have become a major challenge. Data integration solutions address this by enabling interoperability, real-time data sharing, and streamlined data workflows.

Deployment Mode Insights

The cloud-based segment dominated the patient data hub solutions industry with a share in 2024. This is due to the increasing preference for scalable, cost-effective, and easily accessible data management solutions across healthcare organizations. Cloud-based platforms enable real-time access to patient information from multiple locations, essential for remote care, telemedicine, and multi-site healthcare systems. They also reduce the need for heavy on-premise infrastructure, cutting IT maintenance costs and facilitating faster deployment. Moreover, cloud solutions offer huge data backup, disaster recovery, and enhanced security features that help healthcare providers comply with strict regulatory standards. As interoperability and data sharing across healthcare networks become more critical, cloud-based deployment models are gaining traction for flexibility, easy integration with other systems, and support for advanced analytics and AI capabilities.

The on-premise segment is expected to grow significantly over the forecast period. This can be attributed to the increasing concerns around data privacy, security, and regulatory compliance. Healthcare organizations, especially large hospitals and government institutions, prefer on-premise deployments to maintain direct control over sensitive patient information and to meet strict regional data protection regulations such as HIPAA and GDPR. The segment also benefits from growing investments in internal IT capabilities, particularly in markets with limited cloud adoption due to connectivity or policy constraints.

End-use Insights

Healthcare companies accounted for the largest revenue share in 2024. This is attributed to their extensive investment in digital transformation, growing emphasis on drug development efficiency, and the need for real-time data analytics. Pharmaceutical and biotechnology companies increasingly rely on patient data hub solutions to streamline clinical trials, accelerate R&D, and support pharmacovigilance.

These hubs enable comprehensive data integration from multiple sources, enhancing decision-making and compliance with regulatory standards. As these companies handle vast volumes of sensitive health data, strong and secure platforms are essential, driving their dominance in the market. For instance, in January 2024, XO Health partnered with Innovaccer to enhance member experiences for self-insured employers. The collaboration uses Innovaccer's data platform, CRM, and population health tools to unify data-driven healthcare journeys, benefits, care delivery, and advocacy, enabling personalized and improved outcomes.

Healthcare providers are expected to grow at the fastest CAGR during the forecast period. This is due to the rising demand for efficient patient care, improved clinical decision-making, and enhanced interoperability. Hospitals, clinics, and diagnostic centers are adopting patient data hubs to unify fragmented data from EHRs, imaging systems, and lab results. This integration supports better diagnosis, treatment planning, and patient engagement while ensuring compliance with healthcare regulations. The push toward value-based care and remote monitoring further fuels the need for centralized, accessible patient data.

Regional Insights

North America patient data hub solutions market held the largest revenue share of 34.75% in 2024 due to its advanced healthcare infrastructure, early adoption of digital technologies, and strong regulatory frameworks like HIPAA. The demand is driven by the need for real-time patient data access, value-based care models, and integration of AI and analytics in patient care. Investments in health IT and support from government initiatives like the HITECH Act further boost market growth in this region. The strong presence of market players further propels the market. For instance, in September 2021, ZS, a U.S.-based company, launched ZAIDYN, an intelligent, cloud-based platform designed to transform life sciences operations digitally. It integrates AI-driven analytics, modular applications, and business-ready connectors to enhance customer engagement, field performance, and clinical development.

U.S. Patient Data Hub Solutions Market Trends

The patient data hub solutions market in the U.S. dominated the North American market, accounting for the majority share in 2024. The shift toward value-based care models emphasizes the importance of integrated data solutions that can provide comprehensive patient insights, thereby improving treatment efficacy and reducing healthcare costs. Advancements in healthcare technology, including the integration of artificial intelligence and machine learning, have further propelled the adoption of patient data hubs by enabling predictive analytics and personalized care strategies.

Europe Patient Data Hub Solutions Market Trends

The patient data hub solutions market in Europe is growing as the region has a strong demand due to the increasing digitization of healthcare and emphasis on cross-border health data sharing under initiatives like the European Health Data Space. The region is also witnessing a rise in chronic illness, elderly population, and AI integration, which fuels demand for centralized patient data hub solutions for better patient management and research efficiency.

The UK patient data hub solutions market is anticipated to grow as the country is actively investing in NHS digital transformation programs, including unified health records and interoperability standards. Demand is high due to national-level strategies focusing on integrated care systems (ICS), improved patient outcomes, and reduced healthcare costs through better data management. The shift toward personalized medicine and population health management also accelerates market growth.

The patient data hub solutions industry in Germany is projected to grow due to reforms like the Hospital Future Act (Krankenhauszukunftsgesetz), which promotes hospital digitalization. The country’s move towards electronic patient records (ePA), better healthcare data management, and GDPR-compliant cloud and hybrid solutions further fuel the demand. Investments from both the public and private sectors are further encouraging adoption.

Asia Pacific Patient Data Hub Solutions Market

The patient data hub solutions market in Asia-Pacific is growing at the fastest CAGR, driven by rapid adoption of cloud based technologies, increasing healthcare expenditure, and government focus on health tech modernization. The demand arises from the growing patient population, urbanization, and the need for remote health services. There’s also a shift toward centralized health data platforms for population health and outbreak tracking.

China patient data hub solutions market is seeing significant demand due to government-led initiatives like "Healthy China 2030" and investments in digital health infrastructure. The push for smart hospitals and AI-driven health systems requires integrated data platforms, making patient data hubs essential for hospital management, chronic disease tracking, and AI training models. For instance, IQVIA's China Regional Electronic Health Records (rEHR) dataset integrates patient-level data from 333 hospitals and 256 health centers across Chongqing, Tianjin, and Yinzhou. It encompasses inpatient and outpatient records, including demographics, diagnoses, procedures, lab results, and treatment costs. This standardized, longitudinal dataset supports real-world research, AI/ML applications, and healthcare optimization.

The patient data hub solutions market in India is significantly growing due to initiatives such as the government’s National Digital Health Mission (NDHM), which aims to provide digital health IDs and unified health records for citizens. The rise in chronic illnesses, telemedicine, and private hospital chains further drives demand for interoperable and scalable health data hubs.

Latin America Patient Data Hub Solutions Market

The patient data hub solutions market in Latin America is driven by increasing investment in health IT infrastructure and efforts to improve healthcare quality and access. Countries like Brazil and Mexico focus on digital health strategies, and the rising demand for integrated EHR systems pushes the market forward.

Middle East & Africa Patient Data Hub Solutions Market

The patient data hub solution market in the Middle East and Africa region is projected to grow, led by Gulf countries like the UAE and Saudi Arabia, which invest in smart healthcare as part of Vision 2030 strategies. The need to modernize outdated systems, manage population health data, and improve care coordination in urban hospitals is driving adoption. In Africa, digital transformation projects supported by NGOs and international agencies create a foundation for future growth.

Key Patient Data Hub Solutions Companies Insights

Key players operating in the patient data hub solutions market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Patient Data Hub Solutions Companies:

The following are the leading companies in the patient data hub solutions market. These companies collectively hold the largest market share and dictate industry trends.

- IQVIA, Inc.

- WellSky

- Veeva Systems

- Capgemini (LiquidHub)

- Optum (UnitedHealth Group)

- ZS

- Equipo Health Inc.

- NXGN Management, LLC. (NextGen Healthcare, Inc.)

- Beghou Consulting

- IntegriChain Incorporated

- Informatica

Recent Developments

-

In February 2025, WellSky launched New Patient Panel, offering a 360° view of patient populations to strengthen care continuity and improve outcomes across the continuum

-

In May 2024, Informatica launched the Cloud Integration Hub for Healthcare, using a publish/subscribe model to simplify data exchange. It supports standards like HL7 and FHIR, offers prebuilt templates, and enables efficient, governed access to data for improved care and operations.

-

In April 2024, Innovaccer launched the AI-powered Healthcare Experience Platform (HXP) by acquiring Cured. HXP unifies healthcare data, omnichannel communications, and analytics to deliver personalized, digital patient experiences. Key features include a Consumer Data Platform and an AI-powered Contact Center to enhance care access and operational efficiency.

-

In November 2022, Salesforce introduced Patient 360 for Health innovations to improve care and efficiency. The platform features cost-saving automation, personalized intelligence, and real-time data tools. Its key additions include Behavioral Health, Advanced Therapy Management, and Salesforce Genie, enabling comprehensive patient profiles and supporting equitable, patient-centered healthcare amid rising challenges.

Patient Data Hub Solutions Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.67 billion

Revenue forecast in 2033

USD 3.01 billion

Growth rate

CAGR of 7.59% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution type, deployment mode, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; and Kuwait

Key companies profiled

IQVIA, Inc.; WellSky; Veeva Systems; Capgemini (LiquidHub); Optum (UnitedHealth Group); ZS; Equipo Health Inc.; NXGN Management, LLC. (NextGen Healthcare, Inc.); Beghou Consulting; IntegriChain Incorporated; Informatica

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patient Data Hub Solutions Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global patient data hub solutions market report based on solution type, deployment mode, end use, and regions.

-

Solution Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Health Data Apps & AI Solutions

-

Data Integration Solutions

-

Patient 360 View Platforms

-

Others

-

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud-based

-

On-premise

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare Companies

-

Healthcare Providers

-

Healthcare Payers

-

Others (Include CRO, CDMO, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global patient data hub solutions market size was estimated at USD 1.55 billion in 2024 and is expected to reach USD1.67 billion in 2025.

b. The global patient data hub solutions market is expected to grow at a compound annual growth rate of 7.59% from 2025 to 2033 to reach USD 3.01 billion by 2033.

b. North America dominated the patient data hub solutions market with a share of 34.75% in 2024. This is attributable to advanced healthcare infrastructure, early adoption of digital technologies, strong regulatory frameworks like HIPAA, and strong presence of market players.

b. Some key players operating in the Patient Data Hub Solutions market include IQVIA, Inc., WellSky, Veeva Systems, Capgemini (LiquidHub), Optum (UnitedHealth Group), ZS, Equipo Health Inc., NXGN Management, LLC. (NextGen Healthcare, Inc.), Beghou Consulting, IntegriChain Incorporated, Informatica

b. Key factors that are driving the market growth driven by the increasing need for centralized, interoperable healthcare data systems that enable seamless data exchange across stakeholders. Rising adoption of electronic health records (EHRs), the push for real-time clinical decision-making, and growing demand for integrated patient views are accelerating solution deployment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.