- Home

- »

- Plastics, Polymers & Resins

- »

-

Pharmaceutical Contract Packaging Market Size Report 2033GVR Report cover

![Pharmaceutical Contract Packaging Market Size, Share & Report]()

Pharmaceutical Contract Packaging Market (2025 - 2033) Size, Share & Analysis Report By Packaging Type (Primary, Secondary, Tertiary), By Material (Plastics, Paper & Paperboard, Glass, Aluminum Foil), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-949-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Contract Packaging Market Summary

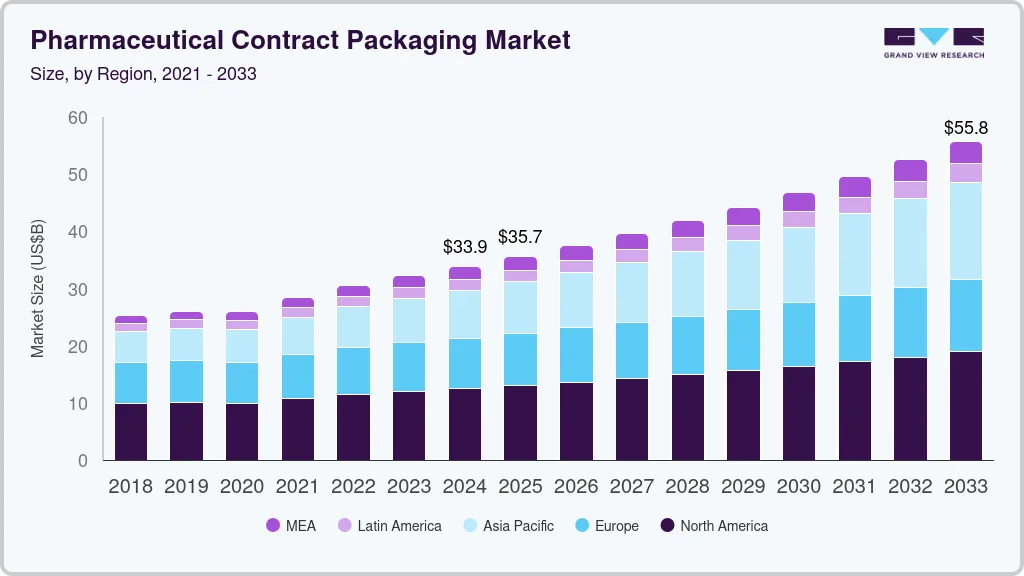

The global pharmaceutical contract packaging market size was estimated at USD 33.87 billion in 2024 and is anticipated to reach USD 55.78 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. Growth outlook is driven by the increasing trend of outsourcing packaging operations to specialized contract packaging companies.

Key Market Trends & Insights

- North America dominated the pharmaceutical contract packaging market with the largest revenue share of over 36.8% in 2024.

- The pharmaceutical contract packaging industry in the Asia Pacific is expected to grow at a substantial CAGR of 8.2% from 2025 to 2033.

- By material, the glass segment is expected to grow at a considerable CAGR of 6.4% from 2025 to 2033 in terms of revenue.

- By packaging type, the primary packaging segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

- By primary packaging type, the vials sub-segment is expected to grow at a considerable CAGR of 6.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 33.87 Billion

- 2033 Projected Market Size: USD 55.78 Billion

- CAGR (2025-2033): 5.8%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Facing pressure to cut costs and increase operational efficiency, pharmaceutical companies find outsourcing an effective solution. By partnering with packaging suppliers, they can focus on their core activities, such as drug discovery and development, leaving behind complex packaging, including compliance with regulatory requirements and managing new packaging for outside experts.Another key factor driving the market's growth is the demand for customized, complex packaging products such as biologics, biosimilars, and personalized medicines that require specialized packaging. For instance, biologics and injectables often require temperature-controlled, sterile, non-deformable packaging to ensure packaging stability and safety. Contract packaging suppliers have increasingly deployed the technical capabilities and resources to handle these complex packaging requirements, ensuring that pharmaceutical companies deliver quality to consumers while meeting stringent regulatory standards.

Moreover, pharmaceutical products are subject to safety regulations, such as serialization requirements for traceability and compliance with Good Manufacturing Practices (GMP), ensuring that packaging adheres to the specific guidelines of regulatory bodies such as the FDA, EMA, and other regional agencies. Since packaging is critical to drug safety and counterfeit assurance, pharmaceutical companies have increasingly relied on experienced contract packagers to meet these evolving regulatory requirements and drive overall market expansion.

The growth of biopharmaceuticals and personalized medicine is another factor linking pharmaceutical industry expansion to packaging demand. Biologics and advanced therapies such as cell and gene therapies often require highly specialized packaging environments, including cold chain logistics and sterile containment. Contract packagers with expertise in temperature-controlled packaging, lyophilized product packaging, and prefilled syringes are increasingly sought after. For example, companies such as PCI Pharma Services and Catalent have expanded their facilities to support biologics packaging, reflecting the growing need for customized solutions aligned with pharmaceutical innovation trends.

Moreover, the globalization of pharmaceutical production and distribution magnifies the importance of contract packaging. With cross-border supply chains and rising exports of medicines from countries like India (the world’s largest supplier of generics) and China (a major API and formulation producer), packaging must meet diverse international regulatory standards such as FDA, EMA, and MHRA guidelines. Contract packagers act as strategic partners by offering multi-market compliant packaging and serialization services, enabling pharmaceutical companies to enter new geographies efficiently. This global expansion of the pharmaceutical industry, therefore, directly translates into sustained growth opportunities for contract packaging providers.

Market Concentration & Characteristics

The industry is relatively mature, particularly in regions such as Europe and North America. The industry is sensitive to macroeconomic conditions, such as GDP growth, healthcare spending, and currency fluctuations. In growing economies, increasing healthcare expenditure and rising pharmaceutical production stimulate demand for contract packaging services. Conversely, economic downturns in some parts of the world pressure pharmaceutical manufacturers to cut costs, potentially delaying new packaging investments. Inflation in raw materials, energy, and labor costs also directly impacts the pricing and profitability of packaging contracts.

Rivalry among existing players is intense, driven by a mix of established global leaders and specialized regional players. Competition is based on capabilities, regulatory compliance, technological innovation, speed, and cost efficiency. The industry is fragmented with differentiated services (primary, secondary, tertiary packaging; serialization; cold-chain packaging), which reduces price wars but increases competition for high-value clients. Consolidation trends, M&A activity, and investment in advanced technologies such as AI-based inspection and serialization platforms further intensify rivalry as players seek to secure long-term contracts and global footprints.

The pharmaceutical contract packaging industry has moderate entry barriers. While initial capital investment for packaging lines and regulatory compliance can be substantial, technological advancements and modular packaging solutions have lowered some barriers. New entrants must navigate stringent FDA, EMA, and local regulatory frameworks, acquire GMP-certified facilities, and build credibility in a highly quality-sensitive industry. However, niche opportunities such as biologics, personalized medicines, and small-batch contract packaging allow smaller specialized players to enter without needing large-scale operations.

Material Insights

The plastics segment contributed the largest revenue share of 38.5% by 2024, mainly due to their versatility, cost-effectiveness, durability, ease of manufacturing, and ability to be molded into various shapes and sizes. These materials are ideal for special packaging such as bottles, blister packs, vials, and ampoules, commonly used in the pharmaceutical industry. In addition, plastics and polymers can be easily tailored to specific regulatory requirements for sterility, tamper-proof, and child-resistance, making them popular materials for chemical packaging.

The plastic material segment holds a significant share due to its versatility, durability, and cost-effectiveness compared to alternatives such as glass or metal. Plastics such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polyvinyl chloride (PVC) are widely used for blister packs, bottles, vials, caps, and closures. These materials provide excellent barrier properties against moisture, oxygen, and light, ensuring drug stability and extended shelf life. For instance, high-density polyethylene (HDPE) bottles are extensively used for solid oral dosage forms such as tablets and capsules, while PET is preferred for liquid formulations due to its clarity and strength.

The glass segment is forecast to grow at the fastest CAGR over the forecast period. The glass segment in pharmaceutical contract packaging holds a critical role owing to its unmatched barrier properties, chemical inertness, and regulatory compliance advantages. Glass containers such as vials, ampoules, syringes, and bottles are widely used for packaging biologics, injectables, and sensitive formulations where protection from moisture, oxygen, and chemical interaction is paramount. The rise of biologics and biosimilars has particularly boosted the demand for glass-based packaging, as these drugs require high stability and sterility. For example, the growing market for monoclonal antibodies (mAbs) and vaccines has fueled the adoption of sterile glass vials and prefilled syringes among pharmaceutical companies outsourcing packaging operations to contract packagers.

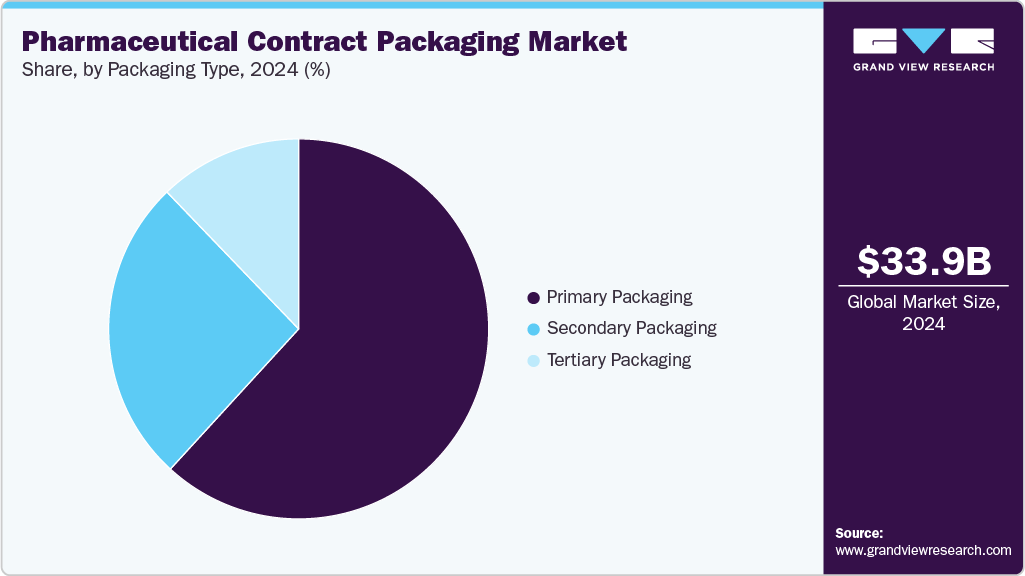

Packaging Type Insights

The primary packaging segment recorded the largest market revenue share of over 61.8% in 2024 and is expected to grow at the fastest CAGR of 6.2% during the forecast period. Primary packaging includes blister packs, bottles, vials, ampoules, syringes, and pouches that come into direct contact with medicines. Its dominance is attributed to strict regulatory compliance requiring tamper-evident, contamination-free, and secure packaging that maintains drug stability throughout its shelf life.

Demand for innovative and sustainable solutions in primary pharmaceutical packaging is also increasing as companies focus on patient-centric designs and eco-friendly materials. Contract packagers are adopting advanced technologies such as cold-form foil blister packs, prefilled syringes, and single-dose vials to cater to the rising demand for biologics, injectables, and specialty drugs. For instance, West Pharmaceutical Services has expanded its contract packaging solutions for injectable therapies, reflecting the segment’s evolution beyond conventional packaging to highly specialized formats that support precision medicine and self-administration trends.

The vials sub-segment is forecasted to grow at a significant CAGR over the coming years. Vials are a crucial component of the primary packaging segment, particularly for injectable drugs, vaccines, biologics, and high-value specialty medicines. They are designed to maintain sterility, ensure precise dosing, and protect sensitive formulations from contamination, moisture, and light. Vials are typically made from glass or specialty plastics, and their sizes can range from 1 mL to 50 mL or more depending on the dosage requirements. For example, small-volume glass vials are standard for vaccines, while larger vials are often used for injectable biologics. Their critical role in injectable drug delivery makes vials an indispensable part of pharmaceutical contract packaging operations.

Regional Insights

The North America pharmaceutical contract packaging market represents one of the most mature and technologically advanced markets. The region benefits from a highly developed pharmaceutical sector, stringent regulatory frameworks, and strong demand for outsourced packaging solutions from both innovator and generic drug manufacturers. For instance, according to the European Federation of Pharmaceutical Industries Associations (EFPIA), North America accounted for 53.3% of global pharmaceutical sales as of 2023, far outpacing Europe, which held 22.7%. Generic drugs accounted for 84% of total U.S. pharmaceutical sales, supporting the country’s strong position in supplying cost-effective medications globally.

U.S. Pharmaceutical Contract Packaging Market Trends

The pharmaceutical contract packaging industry in the U.S.dominated the North America market with a revenue share of 84.59% in 2024. Its dominance is primarily driven by the country’s status as a global pharmaceutical hub, hosting a significant concentration of both innovator and generic drug manufacturers. The U.S. pharmaceutical sector emphasizes stringent regulatory compliance, including FDA guidelines, the Drug Supply Chain Security Act (DSCSA), and Good Manufacturing Practices (GMP), which encourages manufacturers to outsource complex packaging operations to specialized contract packaging providers. This regulatory environment ensures high demand for services such as serialization, tamper-evident packaging, labeling, and combination packaging for complex formulations.

Europe Pharmaceutical Contract Packaging Market Trends

The Europe pharmaceutical contract packaging industry recorded a market share of over 26.1% in 2024. Europe is a mature and highly regulated market for pharmaceutical contract packaging, characterized by strong compliance requirements and advanced manufacturing standards. The region has a well-established pharmaceutical industry, with countries such as Germany, Switzerland, France, and the UK hosting a large number of pharmaceutical manufacturers and biotech companies. This concentration of pharmaceutical production drives demand for contract packaging services, including primary, secondary, and tertiary packaging solutions.

The presence of major pharmaceutical giants such as Bayer, Boehringer Ingelheim, and Merck KGaA further fuels the need for advanced and compliant packaging solutions. Contract packaging organizations (CPOs) in Germany are tasked with meeting stringent EU-wide requirements, including serialization, tamper-evident seals, and child-resistant formats under the EU Falsified Medicines Directive (FMD). This strict regulatory environment encourages CPOs to implement state-of-the-art technologies like track-and-trace systems and smart packaging formats, cementing Germany’s role as a hub for compliance-driven packaging innovation.

Asia Pacific Pharmaceutical Contract Packaging Market Trends

The Asia Pacific pharmaceutical contract packaging industry growth is due to its rapidly growing pharmaceutical and biotechnology industries. Countries such as China, India, and Japan have become major hubs for pharmaceutical manufacturing and clinical research, creating a substantial demand for outsourced packaging solutions. For instance, India’s increasing role as a global supplier of generic drugs requires sophisticated packaging for compliance with both domestic and international regulatory standards. Similarly, Japan’s aging population and high demand for specialty pharmaceuticals further fuel the need for efficient contract packaging services that ensure safety, traceability, and compliance with strict regulations.

The pharmaceutical contract packaging industry in China is home to numerous contract manufacturing organizations (CMOs) and pharmaceutical companies that are increasingly outsourcing packaging solutions to specialized providers to meet both domestic and international demand. High-volume production of generic drugs, active pharmaceutical ingredients (APIs), and over-the-counter medications has created significant opportunities for contract packaging players to offer efficient, scalable, and cost-effective solutions. Furthermore, China’s position as the world’s second-largest pharmaceutical market, behind only the U.S., provides a solid foundation for the growth of the pharmaceutical contract packaging segment. The presence of major domestic pharmaceutical companies such as Sinopharm, Jiangsu Hengrui Medicine, CSPC Pharmaceutical, and WuXi AppTec enhances local production capabilities and drives innovation in packaging technologies.

Key Pharmaceutical Contract Packaging Company Insights

Some key players in the pharmaceutical contract packaging market are Amcor plc, BALL CORPORATION, Nipro Corporation, Daito Pharmaceutical Co., Ltd., Pfizer, and others.

Emerging technologies, such as serialization, RFID tagging, track-and-trace solutions, and smart packaging with IoT integration, present significant opportunities for contract packagers to differentiate themselves. Regulatory requirements in markets such as the U.S., EU, and Brazil mandate serialization and traceability to prevent counterfeit drugs. Providers that can integrate these technologies into packaging lines efficiently, while reducing costs and cycle times, gain a competitive edge. For instance, integrating 2D barcodes and tamper-evident seals allows pharmaceutical firms to comply with regulations and maintain supply chain transparency.

-

In August 2025, Amcor plc expanded its healthcare packaging network by opening a new warehouse and distribution facility in San José, Costa Rica. This strategically located center aims to serve medical customers across the Americas, improving supply chain efficiency for products like trays, die-cut lids, forming films, bags, pouches, and labels.

-

In August 2025, SCHOTT Pharma launched the SCHOTT TOPPAC polymer cartridge, the industry's first ready-to-use (RTU) polymer cartridge that complies with ISO dimensions. It offers glass-like functional performance with added break resistance, is compatible with all major fill-and-finish lines and injection devices such as pen systems, and currently comes in 1.5 ml, 3 ml, and 5 ml formats, with a 10 ml version in development.

Key Pharmaceutical Contract Packaging Companies:

The following are the leading companies in the pharmaceutical contract packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- NIPRO

- Daito Pharmaceutical Co., Ltd.

- West Pharmaceutical Services, Inc.

- CCL Industries Inc.

- Aphena Pharma Solutions

- PCI Pharma Services

- Reed-Lane

- Wasdell Packaging Group

- Tjoapack

Pharmaceutical Contract Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 35.65 billion

Revenue forecast in 2033

USD 55.78 billion

Growth rate

CAGR of 5.8% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, packaging type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Amcor plc; NIPRO; Daito Pharmaceutical Co., Ltd.; West Pharmaceutical Services, Inc.; CCL Industries Inc.; Aphena Pharma Solutions; PCI Pharma Services; Reed-Lane; Wasdell Packaging Group; Tjoapack

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Contract Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pharmaceutical contract packaging market report based on material, packaging type, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastic

-

Paper & Paperboard

-

Glass

-

Aluminum Foil

-

Others

-

-

Packaging Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Primary Packaging

-

Bottles

-

Vials

-

Ampoules

-

Blister Packs

-

Others

-

-

Secondary Packaging

-

Tertiary Packaging

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.