- Home

- »

- Plastics, Polymers & Resins

- »

-

Pharmaceutical Glass Packaging Market Size Report, 2030GVR Report cover

![Pharmaceutical Glass Packaging Market Size, Share & Trends Report]()

Pharmaceutical Glass Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Type I, Type II, Type III), By Product (Vials, Bottles, Ampoules), By Drug Type (Generic, Branded, Biologic), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-175-7

- Number of Report Pages: 165

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Glass Packaging Market Summary

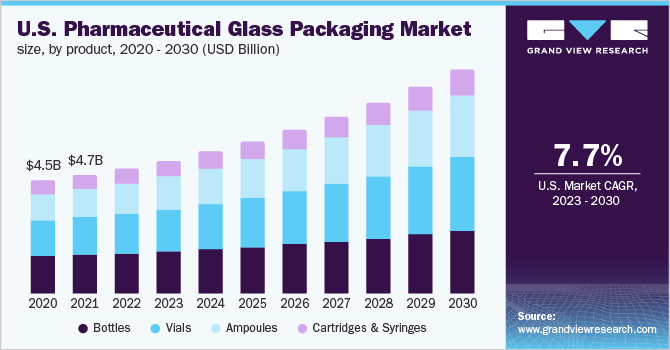

The global pharmaceutical glass packaging market size was estimated at USD 19.75 billion in 2023 and is projected to reach USD 37.62 billion by 2030, growing at a CAGR of 9.8% from 2024 to 2030. Extensive utilization of generic injectable drugs, coupled with high demand from the pharmaceutical industry, is anticipated to drive market growth.

Key Market Trends & Insights

- North America dominated the market and accounted for more than 35.5% share of global revenue in 2023.

- By product, pharmaceutical glass bottles were the largest market segment, accounting for more than 34.2% in 2023.

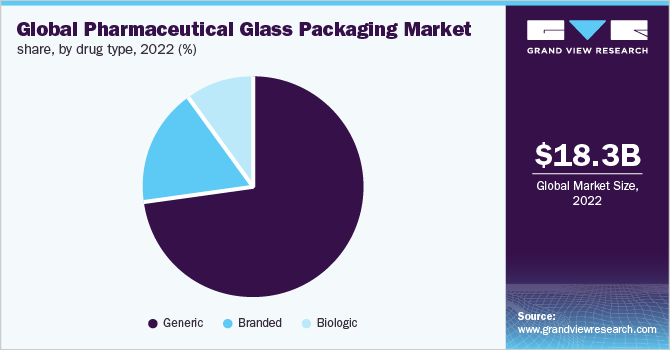

- By drug type, the generic drug type led the market and accounted for more than 72.9% share of the global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 19.75 Billion

- 2030 Projected Market Size: USD 37.62 Billion

- CAGR (2024-2030): 9.88%

- North America: Largest market in 2023

Limestone (CaCO3), soda ash (Na2CO3), cullet, and sand (SiO2) comprise the overall chemical composition of glass. For pharmaceutical packaging applications, the most common cations found in glassware are barium, zinc, ferrous, magnesium, calcium, potassium, sodium, boron, aluminum, and silicon. These materials influence the properties of glass such as chemical resistance, hardness, and durability.

According to the U.S. Centers for Medicare & Medicaid Services, the national health spending of the country is expected to grow at an annual rate of 5.4% and expected to reach USD 6.2 trillion by 2028. The federal government healthcare expenditure supporting programs such as the Veterans Administration, U.S. Department of Defense healthcare programs, Affordable Care Act (ACA), Children’s Health Insurance Program (CHIP), Medicaid, and Medicare are expected to support the healthcare-related aid to the U.S. population can increase the consumption for pharmaceuticals, thereby positively impacting the market in the country.

The growing significance of cost-sensitivity and biotech drugs in the healthcare sector has resulted in the establishment of strict regulations related to the drug delivery products. Multiple manufacturers working in pharmaceutical glass manufacturing market are focused on packaging aimed at increasing shelf life of a product and are therefore investing in vials.

Pharmaceutical glass packaging developers have been enhancing their product capabilities in order to cater to the changing pharmaceutical industry, which can further contribute to the market in the U.S. For instance, in November 2023, Corning Incorporated introduced coated specially engineered Type I borosilicate vials known as Corning Velocity Vials. These vials exhibit effective hardness compared to conventional borosilicate vials, reducing the probability of cracking and breaking.

The additional impact of COVID-19 pandemic has left the pharmaceutical industry with a steadily growing high demand for medicines and other healthcare facilities. The surge in demand for pharmaceutical drugs, as a result of the pandemic, has affected the market positively. The demand is expected to reach a new peak in the case of approval for COVID-19 vaccines developed by different institutions and companies in various countries.

For instance, the U.S. produces millions of surplus doses of vaccines that are packaged in large, multi-dose vials. These vials are either used domestically or distributed to other countries of the world. The U.S. is expected to have approximately 500 million doses of the Johnson & Johnson, Moderna, and Pfizer-BioNTech vaccines by 2022 Despite the demand from state officials in U.S., there have been various challenges for manufacturers in switching from large multi-dose vials to single-dose vials for supplying vaccines.

Presently, most vaccines in the U.S. are distributed in the form of single-dose vials or prefilled syringes, but the COVID-19 vaccines are being distributed through multi-dose vials owing to the requirement of their quick manufacturing in the early months of the inoculation campaign carried out in the country.

Glass poses as a hindrance to atmospheric gases such as carbon dioxide and oxygen from entering the primary pharmaceutical glass container, mitigating the risk of contamination of the drugs. Glass packaging lowers the drug’s susceptibility to degradation, such as hydrolysis and oxidation. Moreover, glass packaging helps in resisting escape of volatile ingredients, thereby increasing the drug stability. All these factors are anticipated to surge the product demand in near future.

The Pharmaceutical Glass Packaging Market is poised for significant growth and innovation. Given its recyclable nature, the industry's increasing focus on sustainability and environmentally friendly packaging solutions positions glass as an attractive choice, which aligns well with pharmaceutical companies' heightened emphasis on sustainable practices. Integrating intelligent packaging technologies, such as RFID tags and tamper-evident features, enhances the appeal and functionality of pharmaceutical glass packaging. In response to tightening regulations on pharmaceutical packaging, manufacturers that offer inventive, compliant, and cost-effective glass packaging solutions are well-positioned to capture substantial market share.

Market Concentration & Characteristics

Pharmaceutical glass packaging market is witnessing growth owing to high product demand in pharmaceutical industry and extensive utilization of glass in generic injectable drugs. The glass used for primary pharmaceutical packaging has a well-established production system and supply chain. A large number of suppliers are mainly concentrated in the developed regions, such as North America and Europe, owing to the presence of a well-established pharmaceutical industry here.

Key players in the market include Gerresheimer AG, Corning Incorporated, Nipro Corporation, Schott AG, SGD Pharma, Shandong Pharmaceutical Glass Co., Ltd., Bormioli Rocco Pharma, Ardagh Group, West Pharmaceutical Services, Inc., Şişecam Group, Stölzle Oberglas GmbH, and Beatson Clark. In terms of revenue, the top ten manufacturers in the market hold a share of over 75.0%, while the other manufacturers account for the rest.

Companies such as Gerresheimer AG, Corning Incorporated, and Schott AG are pioneers of a majority of the research initiatives undertaken in pharmaceutical glass packaging market. These companies are engaged in introducing new technologies and products to better cater to drug manufacturing companies across the globe. An increasing number of innovative biotech drugs, which have to be injected, are being introduced in the market and must be supplied in the necessary concentrations in vials and prefilled syringes.

Manufacturers of glass packaging for pharmaceuticals are constantly striving to offer a wide range of technologies covering as much of the value chain as possible. For instance, On July 13, 2023, Corning Inc. launched the innovation in the pharmaceutical glass packaging portfolio “Viridian Vials”. The new technology can improve filling-line efficiency by up to 50% while reducing vial-manufacturing carbon dioxide equivalent emissions by up to 30%. These new product uses 20% less glass material than conventional glass vials, with no impact on the quality or safety of the vial. This reduction in glass material lowers manufacturing and transportation-related emissions by up to 30% and decreases the total amount of glass entering the waste stream. Viridian’s low-friction external coating minimizes cracks, breaks, and cosmetic rejects while improving filling-line efficiency by up to 50%.

Material Insights

Based on material, market is segmented into the Type I, Type II, and Type III.

Type I Glass (Borosilicate Glass) is accounted for the major share of the market in 2023, and it is anticipated that it will maintain its attractiveness during the forecast period. As the glass has exceptional resistance to chemical interactions. It is commonly used for parenteral drug products, injectables, and other formulations that demand a high level of chemical durability and stability.

Pharmaceutical glass type II is soda-lime glass treated to enhance its chemical resistance. While not as inert as Type I, it still provides a suitable barrier for many pharmaceutical products.

Product Insights

Pharmaceutical glass bottles were the largest market segment, accounting for more than 34.2% in 2023 in terms of global revenue. The pharmaceutical glass packaging market has been segmented on the basis of product as ampoules, bottles, vials, syringes, and cartridges. Vials have high analytical performance and great sustainability, which is expected to drive the segment with second fastest growth rate after ampoules. Therefore, the vials segment is expected to witness a rise in market share over the forecast period from 33.3% in 2023.

Pharmaceutical glass vials are made from Type 1 borosilicate glass which imparts the desired chemical resistance properties to the glass vials. Ampoules is expected to witness the fastest growth, whereas the largest market share is anticipated to be held by bottles. It also accounted for a volume share of over 75.0% in 2023 owing to its better analytical performance and suitability.

Glass bottles used for pharmaceutical packaging are categorized into two types depending on their size, namely, small bottles and large bottles. The large size glass bottles are used for packaging of reagents as well as transfusion and infusion bottles. The small glass bottles is used for packaging of syrup bottles and other oral liquids. The small-sized sized bottles segment is expected to witness growth on account of numerous new opportunities including the rising consumption of oral tablets that are packaged in small bottles.

Ampoules that are largely developed from glass are anticipated to grow with the most attractive CAGR, in terms of revenue, during the forecast period from 2024 to 2030 owing to the ability of glass to filter specific wavelengths, high microbiological control, and high chemical resistance. Large number of ampoules are produced in compliance with the DIN ISO EN 9187-1/2 standard in sealed designs, funnel-type, and straight-stem.

Drug Type Insights

Generic drug type led the market and accounted for more than 72.9% share of the global revenue in 2023. The global market for generic drugs has seen a rise in the past several years due to increasing cases of chronic diseases, aging population, and the rise in the expiration of drug patents.

Furthermore, the efforts from governments and healthcare service providers to reduce healthcare expenditure & drug prices and provision of health insurance coverage are also anticipated to fuel the consumption of generic drugs. The increased consumption of generics is expected to ascend the demand for pharmaceutical glass packaging owing to its regulatory ease and extraordinary barrier property.

The growth of biologic drugs is majorly due to their ability to treat major chronic diseases, especially certain forms of autoimmune diseases and cancer. However, glass delamination and chipping that results from surface degradation is anticipated to lower the growth of primary glass packaging for the biologic drugs.

The generic drug segment in North America is expected to witness a higher growth than branded segment, both in terms of volume and revenue, as it is affordable, whereas the patent expirations are going to further led the branded segment to have a moderate growth rate. The primary glass packaging is expected to show a sluggish growth on account of decreased volume sales of branded drugs.

The pharmaceutical industry is expected to largely benefit from biologics as they cater to therapeutic aspects that are underserved. The biosimilar competition for biologics has remained low resulting in moderate growth of the segment, thereby slowing the growth of the segment in the market.

The U.S. boasts presence of pharmaceutical giants and therefore is expected to stay a core region for various business activities related to pharmaceutical glass packaging. The customer consolidation and increased competitive intensity in the country is expected to result in a significant increase in the volume of generic drug sales causing rapid change in market dynamics. This change coupled with patent expirations of numerous drugs is expected to constrain branded product sales in the U.S.

Regional Insights

North America dominated the market and accounted for more than 35.5% share of global revenue in 2023. The developing markets are expected to witness a surge in spending in the pharmaceutical industry over the upcoming years. The U.S. is expected to remain a key driver and most important market for the growth of the pharmaceutical sector in the region with innovative products leading the growth. This growth is expected to be aided by the rise in generics in the region that are anticipated to witness consistently high demand in terms of volume and sales.

Emerging markets are expected to show higher growth rates compared to developed markets due to the rapid increase in consumer base and spending. Increased cases of chronic ailments, increased healthcare awareness, and rising income levels are expected to further aid the growth of emerging markets in the Asia Pacific. The governments in the Asia Pacific region are expanding their private and public healthcare coverage as a result of increased awareness. The efforts of the government in developing regions to promote low-cost generic drugs and reduce healthcare costs is expected to result in an increased volume of pharmaceutical products further fueling the growth of the market in the region.

Europe region accounted for more than 19.0% of the volume share in 2023. The research-based pharmaceutical industry is a key asset of the European economy. The pharmaceutical glass packaging industry is on the rise owing to the growth in medical progress by means of research, development, and introduction of new medicines aimed at improving the health and quality of life of patients in the region.

The national regulation that holds down prices & profits and results in market fragmentation is anticipated to be a major factor that differentiates the strengths of the European research-based industry and its American counterparts in the pharmaceutical sector.

The current Russia and Ukraine conflict has negatively impacted the energy supplies consisting of natural gas and electricity, thereby progressing its impact on the glass production in the Europe. Since glass manufacturing involves melting of limestone, soda ash, and sand, the temperatures required for melting the mixture depend on the energy generated from the natural gas supplied by Russia. The natural gas shortage has led to the halting of operations by European bottle manufacturers, automobile manufacturers, and skyscraper builders.

Asia Pacific is anticipated to be the fastest-growing region in terms of revenue. This growth in demand can be ascertained by the presence of numerous small and medium scaled production units in the region. The region also enjoys lenient regulatory regimes which work out to support the manufacturers, along with attracting foreign investment. Usually, companies like Corning Incorporated and Schott AG partners up with small scaled production units in the region which provides them a platform to expand their regional presence along with gaining higher market share.

Saudi Arabia Pharmaceutical Glass Packaging Market

International pharmaceutical players' rising interest in setting up their offices to capture the attractive markets in the Middle East & North Africa is further expected to impact the market growth positively. The Saudi Arabian pharmaceutical market reach to USD 10.74 billion in 2023, according to the Ministry of Health and Prevention (MoHaP). In an event, the Ministry of Health and Prevention (MoHaP) laid out the kingdom's planning of rapid reforms in the field of healthcare at both service provision and regulatory levels, which is in line with the National Transformation Program and Saudi Arabia's Vision 2030.

Key Companies & Market Share Insights

Numerous pharmaceutical glass manufacturing companies are primarily concentrated in the developed regions such as Europe and North America resulting in well-established supply chain and production system in the regions. However, manufacturers are shifting their base to countries such as Brazil, India, and China due to low labor costs and growth of opportunities offered by these countries. The generic sector is expected to drive the demand for pharmaceutical glass packaging in these countries over the forecast period.

-

In June 2023, Müller + Müller, the manufacturer of primary packaging materials made of tubular glass for the pharmaceutical industry, has invested 15 million EUR at its vial manufacturing site in Holzminden. The investment includes up to 14 new production lines as well as a corresponding clean room.

-

In June 2023, Corning and SGD Pharma with joint venture open a new glass tubing facility and expand access to Corning Velocity Vial technology in in Telangana, India. Manufacturing of Velocity Vials at SGD Pharma’s facility in Vemula, India, is expected to begin in 2024. Pharmaceutical tubing production is expected to begin in 2025.

Key Pharmaceutical Glass Packaging Companies:

- Corning Incorporated

- Nipro Corporation

- SGD S.A.

- Stoelzle Oberglas GmbH

- Bormioli Pharma S.p.A.

- West Pharmaceutical Services, Inc.

- Schott AG

- Gerresheimer AG

- Shandong Medicinal Glass Co., Ltd.

- Beatson Clark

- Ardagh Group S.A

- Arab Pharmaceutical Glass Co.

- Piramal Enterprises Ltd.

- Şişecam Group

- Owens-Illinois, Inc.

- DWK Life sciences

Recent Developments

-

In June 2023, SDG SA announced its partnership with Corning Incorporated to establish a glass tubing facility in Telangana, India. The partnership combined SDG’s expertise with Corning’s glass coating technology to enhance fine-line productivity, thus initiating expansion in pharmaceutical manufacturing.

-

In May 2023, Bormioli Pharma S.p.A renewed its partnership with Desall.com to develop new innovation and ideas about pharmaceutical packaging by focusing on augment reality solutions for drug delivery, and biometric recognition solutions to transform child-resistant closure systems.

-

In March 2023, Schott AG launched the production of FIOLAX®amber pharma glass in India with the aim to meet its increasing demand in Asia. This production will improve the reliability, planning, availability, and cost-efficiency of pharmaceutical converters.

-

In October 2022, Gerresheimer AG in collaboration with Merck developed a digitalized twin solution to ensure trust and traceability in the pharmaceutical supply chain. This solution aimed to create a digital representation of packaging for syringes and vials.

-

In January 2022, West Pharmaceutical Services Inc. partnered with Corning to make advancements in drug delivery and drug containment by developing pharmaceutical packaging solutions.

-

In May 2021, Nipro Corporation acquired all shares of Piramida d.o.o to make expansion in the European market, and strengthen its position in the pharmaceutical glass packaging sector.

Pharmaceutical Glass Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 21.46 billion

Revenue forecast in 2030

USD 37.62 billion

Growth rate

CAGR of 9.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million units; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, drug type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Switzerland; Denmark; Belgium; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; and South Africa

Key companies profiled

Amcor plc; Becton, Dickinson, and Company; AptarGroup, Inc.; Drug Plastics Group; Gerresheimer AG; Schott AG; Owens Illinois, Inc.; West Pharmaceutical Services, Inc.; Berry Global, Inc.; WestRock Company; SGD Pharma; International Paper; Comar, LLC; CCL Industries, Inc.; Vetter Pharma International

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Glass Packaging Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the pharmaceutical glass packaging market report on the basis of material, product, drug type, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Type I

-

Type II

-

Type III

-

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Vials

-

Small vials

-

Large vials

-

-

Bottles

-

Small bottles

-

Large bottles

-

-

Cartridges & Syringes

-

Ampoules

-

-

Drug Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Generic

-

Branded

-

Biologic

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Switzerland

-

Belgium

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical glass packaging market was estimated at USD 18.27 billion in the year 2022 and is expected to reach USD 19.7 billion in 2023.

b. The global pharmaceutical glass packaging market is expected to grow at a compound annual growth rate of 9.6% from 2023 to 2030 to reach USD 37.6 billion by 2030.

b. North America emerged as a dominating region with a volume share of over 36.0% in the year 2022 owing to the presence of a strong pharmaceutical industry and the introduction of new & innovative pharmaceutical products requiring glass packaging.

b. The key market player in the global pharmaceutical glass packaging market includes Corning Incorporated, Nipro Corporation, SGD S.A., Stölzle-Oberglas GmbH, Bormioli Pharma S.p.A., West Pharmaceutical Services, Inc., Schott AG, Gerresheimer AG, Shandong Medicinal Glass Co., Ltd., Beatson Clark, Ardagh Group S.A, Arab Pharmaceutical Glass Co., Piramal Enterprises Ltd., and Şişecam Group.

b. Increasing demand for generic drugs in developing as well as emerging markets owing to higher consumer healthcare awareness and low-cost initiatives carried out by governments is expected to drive the pharmaceutical glass packaging market growth

b. The bottles segment dominated the global pharmaceutical glass packaging market accounting for the largest share of over 34.0% in terms of revenue in 2022.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.