- Home

- »

- Biotechnology

- »

-

Pharmaceutical Rapid Microbiology Testing Market Report 2030GVR Report cover

![Pharmaceutical Rapid Microbiology Testing Market Size, Share & Trends Report]()

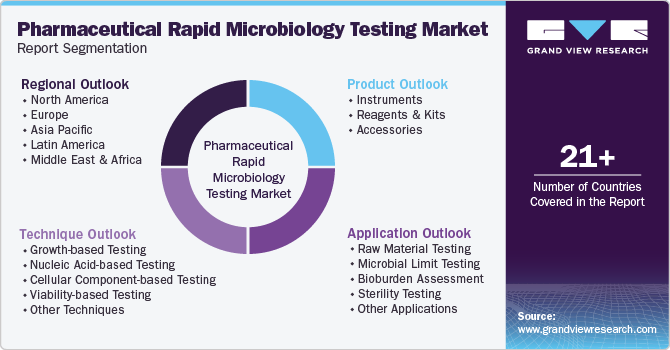

Pharmaceutical Rapid Microbiology Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Reagents & Kits), By Technique (Growth-based Testing, Nucleic Acid-based Testing), By Application (Raw Material Testing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-506-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Rapid Microbiology Testing Market Summary

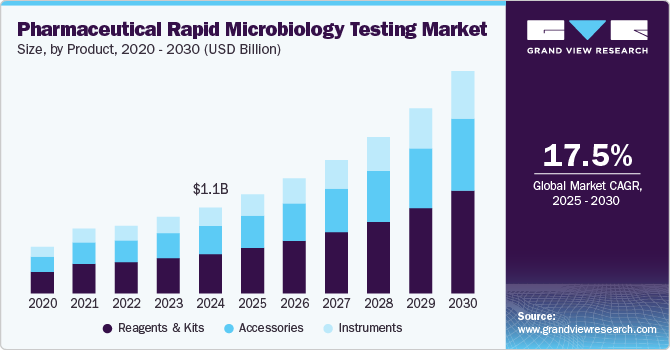

The global pharmaceutical rapid microbiology testing market size was estimated at USD 1,080.2 million in 2024 and is projected to reach USD 2,797.7 million by 2030, growing at a CAGR of 17.5% from 2025 to 2030. The market is experiencing significant growth, driven by a combination of technological advancements, regulatory pressures, and an increasing emphasis on patient safety and product quality.

Key Market Trends & Insights

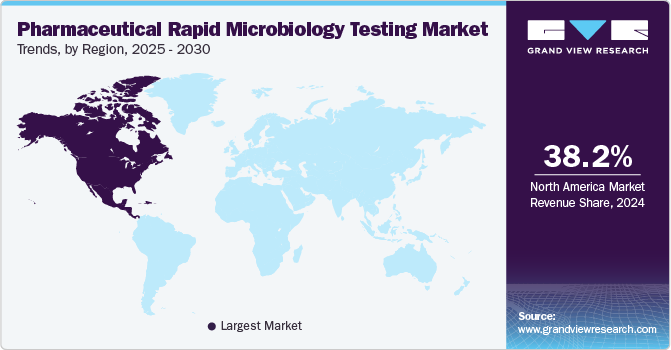

- North America dominated the pharmaceutical rapid microbiology testing market in 2024 and accounted for a market share of 38.16%.

- Based on product, the reagents & kits segment dominated the market and accounted for the largest share of 45.85% in 2024.

- Based on technique, the growth-based testing segment held the largest market share of 42.25% in 2024.

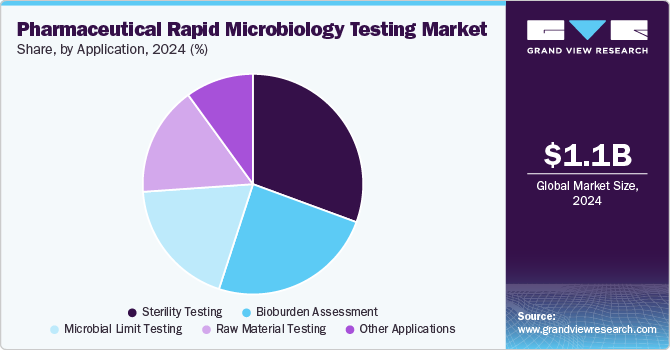

- Based on application, the sterility testing segment held the largest market share of 30.64% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,080.2 Million

- 2030 Projected Market Size: USD 2,797.7 Million

- CAGR (2025-2030): 17.5%

- North America: Largest market in 2024

Traditional microbiological testing methods, which often rely on culture-based techniques, can take several days to produce results. This time lag can hinder the timely release of pharmaceutical products, potentially delaying treatments for patients. In contrast, rapid microbiology testing technologies, such as Polymerase Chain Reaction (PCR), ATP bioluminescence, and next-generation sequencing, offer the ability to obtain results in a much shorter time frame, often within hours. These advancements allow pharmaceutical companies to make quicker decisions, reducing time-to-market for new drugs and improving overall efficiency in the production process. The rapid identification of microbial contamination is particularly crucial in ensuring the safety and efficacy of pharmaceutical products, especially biologics and vaccines, which require stringent testing for contamination.

Another key driver of the rapid microbiology testing market is the increasing pressure from regulatory bodies to ensure the highest standards of quality control. Agencies such as the FDA and the European Medicines Agency (EMA) have established stringent guidelines for the testing of pharmaceutical products. As regulations continue to evolve, there is a growing need for faster, more accurate testing methods to comply with these requirements. Traditional methods, such as microbial culturing, often fall short in meeting the faster timelines mandated by regulatory authorities, thus driving the adoption of rapid microbiology techniques. By ensuring that products meet safety standards more quickly, rapid testing methods help pharmaceutical companies avoid costly recalls, penalties, and delays, all while adhering to global regulatory expectations.

In addition, the increasing complexity of pharmaceutical products, particularly biologics, cell therapies, and gene therapies, has led to the demand for more sophisticated and efficient testing solutions. These products are often more sensitive to contamination than traditional drugs, making rapid and accurate microbiological testing essential. Moreover, the rise in production volumes, combined with the globalization of supply chains, has further highlighted the need for reliable and swift microbiology testing to ensure product quality at every stage of production.

Furthermore, there is a growing awareness among pharmaceutical companies regarding the cost-effectiveness of rapid microbiology testing. Although the initial investment in advanced rapid testing technologies may be higher than traditional methods, the long-term benefits of quicker testing and fewer product failures or recalls result in significant cost savings. The ability to perform real-time microbial testing during production can reduce the need for extensive batch testing, streamline operations, and ultimately lead to more efficient manufacturing processes.

The increasing focus on personalized medicine, coupled with the growing demand for faster drug development and production, also contributes to the growth of the rapid microbiology testing market. As pharmaceutical companies aim to bring innovative, individualized treatments to market more quickly, rapid microbiology testing serves as an essential tool in ensuring the quality, safety, and sterility of these products.

Market Concentration & Characteristics

The degree of innovation in the pharmaceutical rapid microbiology testing industry is high, driven by advanced technologies such as PCR, ATP bioluminescence, and next-generation sequencing. These innovations provide faster, more accurate results compared to conventional methods, enabling quicker decisions, improving product safety, and ensuring compliance with stringent regulatory requirements.

The level of collaboration and partnership activities in the pharmaceutical rapid microbiology testing industry is substantial. Pharmaceutical companies are increasingly partnering with technology providers, contract research organizations (CROs), and regulatory bodies to develop innovative testing solutions. These collaborations foster advancements in testing technologies, streamline product development, and ensure compliance with evolving regulations, ultimately driving market growth.

Regulations have a significant impact on the pharmaceutical rapid microbiology testing industry. Stringent guidelines set by regulatory bodies such as the FDA and EMA demand faster, more reliable testing methods to ensure product safety and quality. These regulations drive the adoption of rapid microbiology technologies, as traditional methods often fail to meet the required timelines for testing and release. Compliance with evolving standards for microbiological testing not only ensures safety but also reduces risks of costly recalls and penalties, further accelerating the demand for advanced testing solutions in the pharmaceutical industry.

The pharmaceutical rapid microbiology testing industry is driven by the increasing demand for more efficient, faster, and reliable testing methods. As pharmaceutical companies face evolving challenges in drug development and production, there is a growing need for innovative testing solutions that cater to various product types, such as biologics, vaccines, and personalized medicines. This demand fosters the development of new rapid microbiology testing products, ranging from automated systems to advanced molecular diagnostic tools, enabling companies to expand their offerings and enhance product portfolios to meet diverse market needs.

Regional expansion in the pharmaceutical rapid microbiology testing industry is being driven by the increasing adoption of advanced testing technologies across various geographical areas. Emerging markets in Asia Pacific, Latin America, and the Middle East are experiencing significant growth as pharmaceutical companies in these regions adopt rapid microbiology testing solutions to meet rising demand for quality products and regulatory compliance.

Product Insights

The reagents & kits segment dominated the market and accounted for the largest share of 45.85% in 2024. These products play an indispensable role in microbial detection, quality control, and regulatory compliance. These consumables are essential for various rapid testing methods, including PCR, ATP bioluminescence, and immunoassays, ensuring consistent and accurate results. The recurring demand for reagents in routine testing, coupled with advancements in assay technologies and automation, further strengthened their market position. In addition, their ease of use and compatibility with high-throughput systems contributed to widespread adoption across pharmaceutical industries.

The instruments segment is expected to grow significantly over the forecast period due to the increasing demand for automation, efficiency, and precision in microbial testing. Advanced instruments, such as automated PCR machines, bioluminescence readers, and rapid microbiology detection systems, offer faster results and reduce human error. The rise of biologics and the need for stringent regulatory compliance further fuel demand for sophisticated instruments capable of providing real-time, accurate data. In addition, innovations in instrument design, compatibility with various testing methods, and ease of integration into production lines contribute to the segment's growth.

Technique Insights

Growth-based testing held the largest market share of 42.25% in 2024 due to its established reliability, regulatory acceptance, and widespread use in sterility, bioburden, and environmental monitoring. Despite advancements in molecular methods, growth-based techniques, including membrane filtration and direct inoculation, remained the industry standard due to their ability to detect a wide range of microorganisms.

Nucleic acid-based testing is projected to witness the highest CAGR of 19.64% from 2025 to 2030. This growth is due to its high sensitivity, accuracy, and speed in detecting microbial contamination. Techniques such as PCR and next-generation sequencing enable faster identification of pathogens compared to traditional methods. The increasing adoption of biologics, personalized medicine, and cell and gene therapies, which require stringent microbial control, is driving demand. Regulatory agencies are also supporting advanced molecular diagnostics for compliance. Automation and advancements in assay technologies further contribute to market expansion.

Application Insights

Sterility testing held the largest market share of 30.64% in 2024 due to its critical role in ensuring the safety of pharmaceutical products, especially biologics, injectables, and sterile drugs. Regulatory agencies such as the FDA and EMA mandate stringent sterility testing to prevent contamination risks. The increasing production of biologics, cell and gene therapies, and parenteral drugs further drove demand. In addition, advancements in rapid sterility testing methods, including membrane filtration and ATP bioluminescence, enhanced efficiency, accuracy, and compliance, solidifying its market dominance.

Bioburden assessment segment is expected to grow at the highest CAGR of 19.59% from 2025 to 2030. The rising demand for contamination control in sterile and non-sterile pharmaceutical products is driving the segment. Stringent regulatory guidelines from agencies such as the FDA and EMA require rigorous microbial monitoring throughout manufacturing. The increasing production of biologics, vaccines, and cell and gene therapies, which are highly sensitive to microbial contamination, further drives demand. In addition, advancements in rapid bioburden testing methods, including ATP bioluminescence and automated systems, enhance efficiency and accuracy, accelerating market growth.

Regional Insights

North America dominated the pharmaceutical rapid microbiology testing market in 2024 and accounted for a market share of 38.16%. North America is expected to experience significant growth due to its well-established pharmaceutical industry, robust regulatory frameworks, and high demand for advanced testing technologies. The presence of key players, along with ongoing innovation in testing methods, drives market expansion. Regulatory agencies such as the FDA set stringent standards, ensuring continuous adoption of rapid microbiology testing for compliance. In addition, the increasing focus on biologics, personalized medicine, and patient safety in the region further supports the demand for efficient and reliable microbial testing solutions.

U.S. Pharmaceutical Rapid Microbiology Testing Market Trends

The U.S. pharmaceutical rapid microbiology testing market dominated the global market in 2024. The U.S. is expected to see significant growth in the coming years due to its dominant pharmaceutical industry and the increasing need for advanced microbial testing in biologics, vaccines, and personalized medicine. The nation’s focus on innovation, coupled with ongoing investments in research and development, drives the adoption of cutting-edge technologies.

Europe Pharmaceutical Rapid Microbiology Testing Market Trends

Europe pharmaceutical rapid microbiology testing market registered significant growth in 2024. Stringent standards set by the European Medicines Agency (EMA) drive the adoption of advanced testing technologies in biologics and sterile products. Moreover, Europe’s emphasis on patient safety, innovation, and rapid drug development contributes to the growing need for faster, more accurate microbiological testing solutions.

The pharmaceutical rapid microbiology testing market in the UK held a significant share in 2024 due to a strong biopharmaceutical sector and advanced research infrastructure. The focus on improving drug manufacturing processes, enhancing product quality, and ensuring faster time-to-market for new treatments contributes to the need for rapid and accurate microbiological testing. In addition, the UK’s growing focus on biotechnology advancements and personalized medicine will further drive market demand.

France pharmaceutical rapid microbiology testing market is experiencing significant growth. France is expected to experience notable growth due to its strong pharmaceutical and biotechnology sectors, along with its emphasis on innovation and research. The country's regulatory landscape, including strict standards from agencies such as ANSM (French National Agency for Medicines and Health Products Safety), promotes the adoption of advanced testing technologies.

The pharmaceutical rapid microbiology testing market in Germany is growing due to a combination of factors. As a leader in biotechnology and medical research, Germany's focus on innovation and efficiency drives demand for rapid microbiological testing solutions. The increasing emphasis on biologics, vaccines, and personalized medicine in Germany will further accelerate the adoption of advanced microbiology testing technologies.

Asia Pacific Pharmaceutical Rapid Microbiology Testing Market Trends

Asia Pacific pharmaceutical rapid microbiology testing market is anticipated to witness significant growth in the near future. Countries such as China, India, and Japan are investing heavily in manufacturing and research, driving demand for efficient microbial testing solutions. In addition, increasing regulatory pressure to ensure product quality, along with growing production of biologics and vaccines, is expected to boost the adoption of advanced microbiology testing technologies across the region.

China pharmaceutical rapid microbiology testing market is rapidly expanding, driven by the growing biopharmaceutical industry. With significant investments in research, drug manufacturing, and the growing demand for biologics and vaccines, there is an increased need for efficient microbial testing solutions. In addition, China's evolving regulatory framework and emphasis on improving product quality and safety are expected to drive the adoption of advanced microbiology testing technologies, further fueling market expansion.

Japan's pharmaceutical rapid microbiology testing market is expected to steadily advance in the coming years. The country’s aging population drives the need for innovative treatments and rapid microbiological testing. In addition, Japan’s commitment to adhering to global regulatory standards, combined with its focus on efficient and reliable testing methods, further fuels the demand for rapid microbiology solutions in drug development and manufacturing.

MEA Pharmaceutical Rapid Microbiology Testing Market Trends

The MEA pharmaceutical rapid microbiology testing market has experienced considerable growth in recent years. The region is driven by increased investments in healthcare infrastructure and pharmaceutical production. The rising demand for high-quality medicines, biologics, and vaccines, coupled with improving regulatory standards in countries such as the UAE and Saudi Arabia, is fostering the adoption of advanced microbial testing technologies. In addition, the expanding biotechnology sector and the focus on improving healthcare access and safety in the region further propel the growth of the market.

Saudi Arabia pharmaceutical rapid microbiology testing market is expected to grow in the near future. Saudi Arabia is expected to experience notable growth as the country seeks to diversify its economy and boost the biotechnology and pharmaceutical sectors, there is growing demand for advanced microbial testing solutions.

Kuwait's pharmaceutical rapid microbiology testing market is expected grow in the coming years. The country’s focus on enhancing healthcare quality, coupled with increasing demand for biologics, vaccines, and advanced medical treatments, drives the need for efficient and accurate microbial testing solutions. In addition, Kuwait's efforts to strengthen regulatory frameworks and meet global pharmaceutical standards will further accelerate the adoption of rapid microbiology testing technologies.

Key Pharmaceutical Rapid Microbiology Testing Market Company Insights

Key companies are growing their market revenue by adopting product launches to increase the reach of their products in the market, improve their availability in diverse geographical areas, and expand to enhance production/research activities. These strategies enables companies to increase their capabilities, expand their product portfolios, and improve their competencies..

Key Pharmaceutical Rapid Microbiology Testing Market Companies:

The following are the leading companies in the pharmaceutical rapid microbiology testing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- BD

- bioMérieux

- Danaher

- Sartorius AG

- Abbott

- QuidelOrtho Corporation

- Charles River Laboratories

- Rapid Micro Biosystems, Inc.

Recent Developments

-

In January 2024, Rapid Micro Biosystems announced the expected mid-2024 launch of its Growth Direct Rapid Sterility application. This innovation delivers organism detection in 12 hours and final results in 1-3 days, significantly improving upon traditional 14-day methods and offering an advantage over current rapid sterility solutions.

-

In May 2023, Charles River Laboratories International, Inc. introduced Accugenix Next Generation Sequencing (NGS) for bacterial and fungal identification. This technology analyzed millions of DNA fragments from a sample, offering pharmaceutical and personal care manufacturers enhanced microbial control insights.

-

In July 2022, Merck, a leading science and technology company, announced the launch of its first Microbiology Application and Training (MAT) Lab in Jigani, Bengaluru. The lab aimed to provide facilities and technical expertise to support the development of microbial quality control capabilities within India's life sciences community.

Pharmaceutical Rapid Microbiology Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.25 billion

Revenue forecast in 2030

USD 2.80 billion

Growth rate

CAGR of 17.53% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technique, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Merck KGaA; BD; bioMérieux; Danaher; Sartorius AG; Abbott; QuidelOrtho Corporation; Charles River Laboratories; Rapid Micro Biosystems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Rapid Microbiology Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the pharmaceutical rapid microbiology testing market report based on product, technique, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents & Kits

-

Accessories

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Growth-based Testing

-

Nucleic Acid-based Testing

-

Cellular Component-based Testing

-

Viability-based Testing

-

Other Techniques

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Raw Material Testing

-

Microbial Limit Testing

-

Bioburden Assessment

-

Sterility Testing

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

APAC

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical rapid microbiology testing market is valued at USD 1.08 billion in 2024 and is expected to reach USD 1.25 billion by 2025.

b. The global pharmaceutical rapid microbiology testing market is anticipated to reach USD 2.80 billion by 2030 and grow at a CAGR of 17.53% from 2025 to 2030

b. Based on technology, the growth-based testing segment dominated the market in 2024. These methods are widely used due to their reliability and acceptance by regulatory agencies.

b. Key market players operating in the global pharmaceutical rapid microbiology testing market include Thermo Fisher Scientific Inc., Merck KGaA, BD, bioMérieux, Danaher, Sartorius AG, Abbott, QuidelOrtho Corporation, Charles River Laboratories, and Rapid Micro Biosystems, Inc.

b. The factors driving the pharmaceutical rapid microbiology testing market include the increasing demand for biologics and advanced therapies, growing regulatory pressure, and technological advancements such as nucleic acid-based testing, and growing public concern about the safety of pharmaceuticals has pushed manufacturers to adopt advanced quality control measures, including rapid microbiology testing

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.