- Home

- »

- Electronic Security

- »

-

Physical Security Market Size, Trends, Industry Report, 2030GVR Report cover

![Physical Security Market Size, Share & Trends Report]()

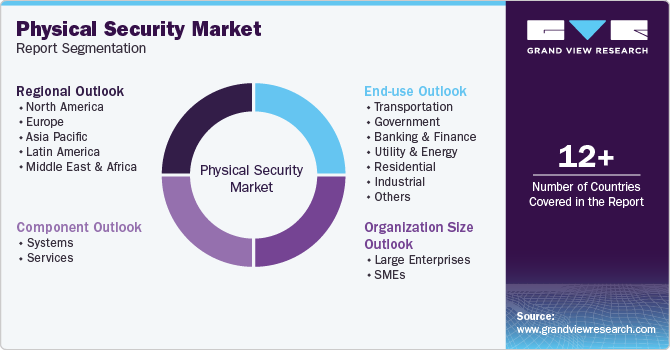

Physical Security Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Systems, Services), By Organization Size (Large Enterprises, SMEs), By End-use (Residential, Commercial, Retail), By Region, And Segment Forecasts

- Report ID: 978-1-68038-293-8

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Physical Security Market Summary

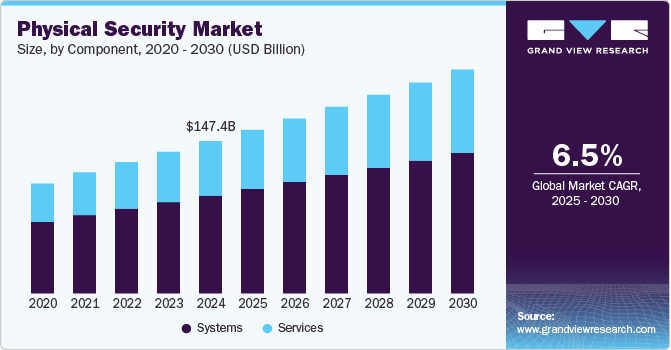

The global physical security market size was estimated at USD 147.36 billion in 2024 and is projected to reach USD 216.43 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030. The need to secure the physical environment from activities such as crime, vandalism, potential burglaries, theft, and fire incidences is one of the crucial factors expected to drive the industry.

Key Market Trends & Insights

- North America physical security market dominated the global industry in 2024, accounting for over 37.0% share of the global revenue.

- The physical security industry in the U.S. is anticipated to exhibit a significant CAGR over the forecast period.

- By component, the system segment led the market in 2024.

- By end-use, the government segment led the market in 2024.

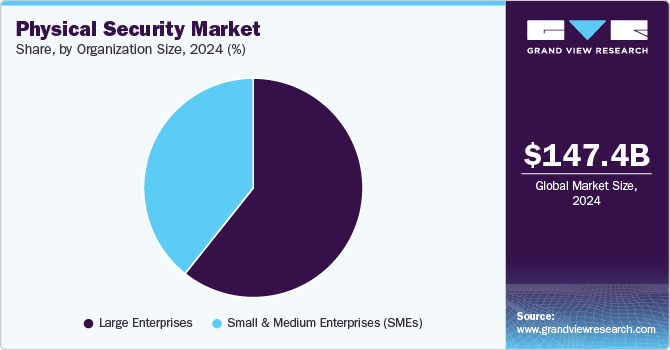

- By organization size, the large enterprise segment led the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 147.36 Billion

- 2030 Projected Market Size: USD 216.43 Billion

- CAGR (2025-2030): 6.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, factors such as increased spending on security to protect the organization’s critical assets, adoption of cloud-based data storage, advanced analytics, as well as technological developments in access control and video surveillance are some of the key trends expected to drive the industry. In addition, the shifting focus from legacy solutions such as badge readers, alarm systems, and door locks to advanced logical security, which encompasses breach detection, threat management, and intrusion prevention, among others, has helped the organization and government agencies to deter crime incidence and breaches at a higher success rate.

Governments across different countries and regions are taking up smart city initiatives to enhance their infrastructure and are hence deploying improved security systems. Additionally, modernizing the existing infrastructure with robust security measures and strengthening the security of government agencies have been some of the top priorities for governments across developed countries. Organizations are increasingly concerned about employee safety and are hence setting up systems to prevent unauthorized access, further driving the demand for physical security solutions.

The physical security environment continues to evolve globally. Over the past few years, numerous sectors and leading industries such as BFSI, residential, government, and transport, among others, have witnessed a swift growth in the number of security breaches. Furthermore, growing concerns to ensure the safety of resources, people, and vital assets, against physical threats and unique vulnerabilities, are anticipated to become major factors driving the need for a robust security environment. Moreover, rising threat incidents have increased the need to strengthen efforts to maintain a highly secured physical infrastructure at residential as well as business premises.

Governments across major regions are continuously involved in strengthening their physical security infrastructure to curb the growing threats. For instance, in December 2021, Axis Communications AB., a Sweden-based company that provides services to private sectors and governments around the world, launched its body-worn camera for the private security of government officials. The body-worn cameras have advantages of multiple benefits for liability protection, personal safety, and operational efficiency.

The advent of technology such as the Internet of Things (IoT) has potentially created vulnerabilities with additional entry points into the data systems through the connectivity of physical objects. However, IoT has also widened the scope of opportunities for the consumer by enabling data protection through the advanced connected networks of the physical security system. Furthermore, innovations and technology advancements in integrated sensors, video, and access systems for IoT-enabled devices are anticipated to spur the market at a high rate.

Component Insights

The system segment led the market in 2024. Further, the sub-segments of systems include physical access control systems (PACS), video surveillance systems, perimeter intrusion detection and prevention, physical security information management (PSIM), physical identity and access management (PIAM), and fire and life safety. The video surveillance system segment dominated the market in 2024. The system included in video surveillance systems is analog cameras, Axis network cameras, video encoders, monitors, and storage solutions. Technological advancements such as UHD, coupled with decreasing cost of equipment, have led to increased adoption of video surveillance systems to enhance remote monitoring and physical security. Increasing physical security and safety concerns and stringent regulatory compliance are some of the potential factors driving the segment growth. Furthermore, the rapid development of commercial and institutional infrastructure across several regions has driven the demand for video surveillance, thereby boosting the segment growth.

The services segment is expected to showcase lucrative growth over the forecast period. Services comprise deployment, maintenance, and updating of equipment as well as software, which further improves performance by providing the user with optimum control of the complete security infrastructure. Rapid infrastructure development in emerging economies and advancements in technology, such as Ultra High Definition (UHD) surveillance, have led to an increased demand for additional physical security services. Further, the sub-segments of services include system integration, remote monitoring, and others. The system integration segment dominates with market. The segment is driven by factors such as new technologies, changing approach of customers toward security operations, demand for cost-effective physical security systems, stringent regulatory compliance, and rapid growth of enterprises. The wide usage of cloud computing solutions in organizations, increasing automation, and an integrated approach in business processes are projected to drive the implementation of integrated solutions.

End-use Insights

The government segment led the market in 2024, driven by increasing investments in national safety and critical infrastructure protection. Amid rising threats such as terrorism, cyber-physical attacks, and civil unrest, governments worldwide are prioritizing the modernization of their physical security systems. However, many agencies face the challenge of balancing these upgrades with limited budgets and aging legacy infrastructure. Thus, governments are increasingly adopting integrated security solutions that combine surveillance, access control, and real-time monitoring. Public-private partnerships and smart city initiatives are also playing a key role in driving innovation in this space.

The residential segment is anticipated to register prominent growth over the forecast period due to the high number of damages caused to assets and resources during thefts and other attacks. Application in residential properties has enhanced the user experience, along with protecting assets from any potential risks. Safety is achieved by the integration of comprehensive video surveillance systems, smart access control, and a rapid intrusion detection system. Globally, the U.S. is currently the largest market for physical security equipment for the residential sector. The growth is attributed to the development of smart homes coupled with the increased use of advanced video surveillance and access control systems.

Organization Size Insights

The large enterprise segment led the market in 2024. The segment is driven by factors such as more significant infrastructure to safeguard, highly critical information to protect, and greater revenue to spend. So, they are the early adopters of physical security. Further, protecting their data from theft, cyberattacks, and unauthorized access lets the segment shift towards physical security solutions. Cyber threats are most likely to target businesses that store essential personal and sensitive information. These threats further result in information security incidents, financial losses, information security, and data breaches.

The SMEs segment is anticipated to experience significant growth over the forecast period. The segment can be attributed to theft, environmental dangers, and intruders, as small businesses also have a lot of resources and people to protect. For instance, in February 2022, the U.S. Small Business Administration (SBA), a U.S. state government agency that helps small businesses and entrepreneurs, provided USD 3 million in funding to help SMEs across the U.S. develop a physical security infrastructure. As there is an increase in the number of threats and fraudsters evolving around small businesses, this funding would help them secure their premises with physical security and protect their resources and people.

Regional Insights

North America physical security market dominated the global industry in 2024, accounting for over 37.0% share of the global revenue. This trend is expected to continue through the forecast period. North America accounts for the highest adoption of advanced physical security systems. The regional market is driven by factors such as strong economic growth, regulatory reforms, and rising investments by SMEs in physical security solutions. Moreover, several public facilities and transportation systems, such as airports, seaports, railways, and bus stations, are focusing on safeguarding their infrastructure through security layers.

U.S. Physical Security Market Trends

The physical security industry in the U.S. is anticipated to exhibit a significant CAGR over the forecast period, driven by growing concerns over public safety and critical infrastructure protection. Rising incidents of mass shootings, cyber-physical threats, and vandalism have prompted increased investments in advanced surveillance and access control systems. Government regulations and mandates are also pushing organizations to upgrade their physical security infrastructure. The adoption of smart technologies such as AI-powered video analytics and IoT-based sensors is further accelerating market growth.

Europe Physical Security Market Trends

The physical security industry in Europe is expected to witness significant growth over the forecast period, fueled by increasing concerns around terrorism, urban safety, and infrastructure protection. Governments across the region are actively investing in advanced surveillance systems and public safety initiatives. The adoption of smart city projects and stricter regulatory frameworks is further contributing to market expansion.

Asia Pacific Physical Security Market Trends

The physical security market in Asia Pacific is expected to register the fastest CAGR over the forecast period. This growth can be attributed to the increasing demand for smart security solutions across India and China. Significant investments by the Chinese government in safe city projects, which primarily focus on city surveillance and traffic monitoring, are anticipated to drive market growth. Since the establishment of the China Smart City Industry Alliance in 2010, the country has developed 500 smart cities throughout the country. In 2012, China started to encourage the implementation of technologies such as artificial intelligence and IoT for national smart city development to enhance urban planning and development.

Key Physical Security Companies Insights

Key players operating in the physical security market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Physical Security Companies:

The following are the leading companies in the physical security market. These companies collectively hold the largest market share and dictate industry trends.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International, Inc.

- Genetec Inc.

- Cisco Systems Inc.

- Axis Communications AB

- Pelco

- Robert Bosch GmbH

- Johnson Controls

- ADT LLC

- Siemens

Recent Developments

-

In April 2025, MCA, Inc. acquired Presidio, Inc.'s Physical Security Integration business (PhySec), strengthening its position as a leading provider of workplace safety and security solutions. The acquisition reflects MCA, Inc.'s commitment to delivering innovative, customizable security offerings while continuing to support clients and invest in new technologies to protect both physical and intellectual assets.

-

In January 2025, Spot AI, Inc. launched its Remote Security Agent, an AI-powered solution designed to enhance security in the retail sector. Building on its earlier Video AI Agents, this new offering combines smart hardware with AI to address challenges posed by rising retail crime and limitations of traditional security methods. The Remote Security Agent aims to replace costly, understaffed on-site guards and outdated remote surveillance systems, providing businesses with a more efficient and scalable approach to protecting their premises.

-

In August 2024, Rhombus Systems, a leading provider of cloud-managed physical security solutions, announced a strategic partnership with Convergint Technologies LLC, a global leader in integrated security services. This collaboration reflects Rhombus Systems’ continued commitment to expanding its global reach and delivering end-to-end, scalable security solutions. By combining Rhombus Systems’ advanced cloud-native technologies with Convergint Technologies LLC, implementation expertise, the partnership aims to empower organizations to enhance safety, improve operational efficiency, and adopt forward-looking security strategies.

Physical Security Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 158.14 billion

Revenue forecast in 2030

USD 216.43 billion

Growth rate

CAGR of 6.5% from 2025 to 2030

Historical data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, organization size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Hangzhou Hikvision Digital Technology Co., Ltd.; Honeywell International, Inc.; Genetec Inc.; Cisco Systems Inc.; Axis Communications AB; Pelco; Robert Bosch GmbH; Johnson Control International Plc; ADT LLC; Siemens.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Physical Security Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global physical security market report based on component, organization size, end-use, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Systems

-

Physical Access Control System (PACS)

-

Video Surveillance System

-

Perimeter Intrusion Detection and Prevention

-

Physical Security Information Management (PSIM)

-

Physical Identity & Access Management (PIAM)

-

Fire and Life Safety

-

-

Services

-

System Integration

-

Remote Monitoring

-

Others

-

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Transportation

-

Government

-

Banking & Finance

-

Utility & Energy

-

Residential

-

Industrial

-

Retail

-

Commercial

-

Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global physical security market size was estimated at USD 147.36 billion in 2024 and is expected to reach USD 158.14 billion in 2025

b. The global physical security market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2030 to reach USD 216.43 billion by 2030.

b. Video surveillance systems dominated the market with a share of more than 50.5% in 2024. This is attributable to technological advancements such as UHD, coupled with the decreasing cost of equipment.

b. Some key players operating in the physical security market include Hangzhou Hikvision Digital Technology Co., Ltd.; Honeywell International, Inc.; Genetec Inc.; Cisc Systems Inc.; Axis Communications AB; Pelco; Robert Bosch GmbH; Johnson Control International Plc; and ADT LLC.

b. Key factors that are driving the physical security market growth include the increasing importance of improving physical security for organizations and identifying potential threats.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.