- Home

- »

- Biotechnology

- »

-

Plasmid Purification Market Size, Industry Report, 2033GVR Report cover

![Plasmid Purification Market Size, Share & Trends Report]()

Plasmid Purification Market (2025 - 2033) Size, Share & Trends Analysis Report By Product & Service, By Grade (Molecular Grade, Transfection Grade), By Application (Cloning & Protein Expression, Transfection & Gene Editing), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-413-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plasmid Purification Market Summary

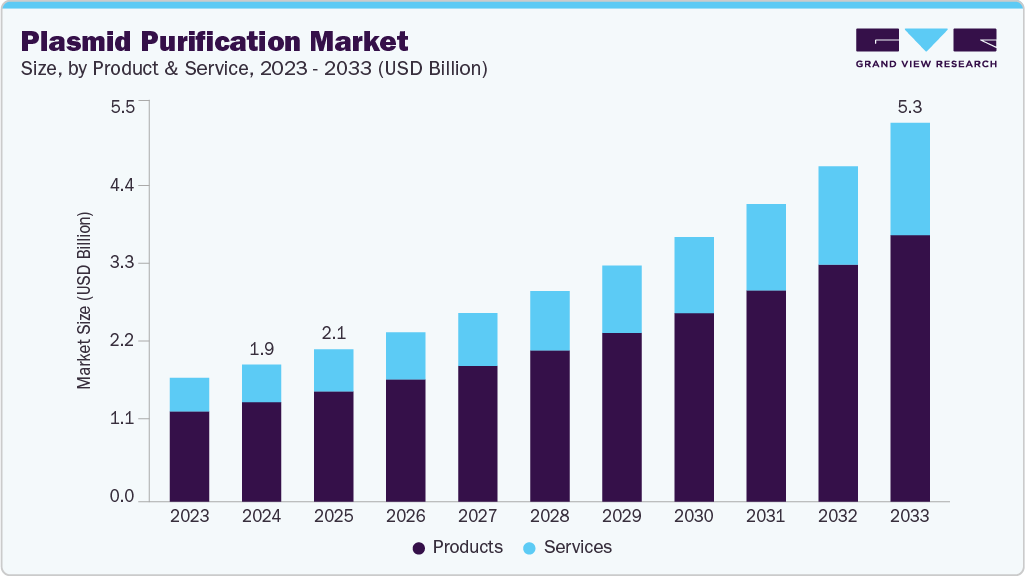

The global plasmid purification market size was estimated at USD 1.91 billion in 2024 and is projected to reach USD 5.28 billion by 2033, growing at a CAGR of 12.09% from 2025 to 2033. The growing demand for recombinant DNA technology products and technological advancements in plasmid purification are some of the factors driving market growth.

Key Market Trends & Insights

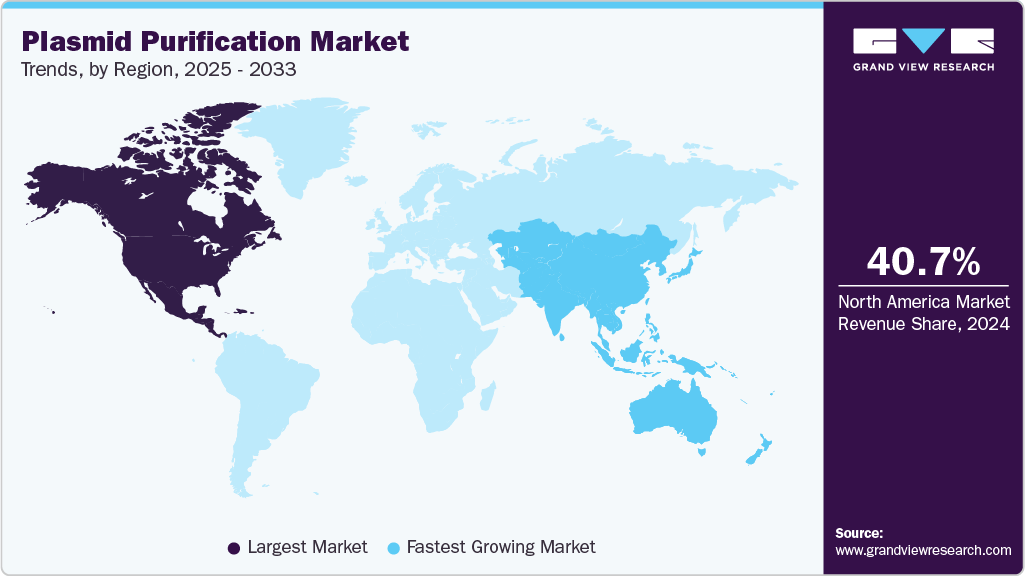

- The North America plasmid purification market held the largest share of 40.69% of the global market in 2024.

- The plasmid purification industry in the U.S. is expected to grow significantly over the forecast period.

- By product & service, the products segment held the largest market share in 2024.

- Based on application, the cloning & protein expression segment held the largest market share of 48.90% in 2024.

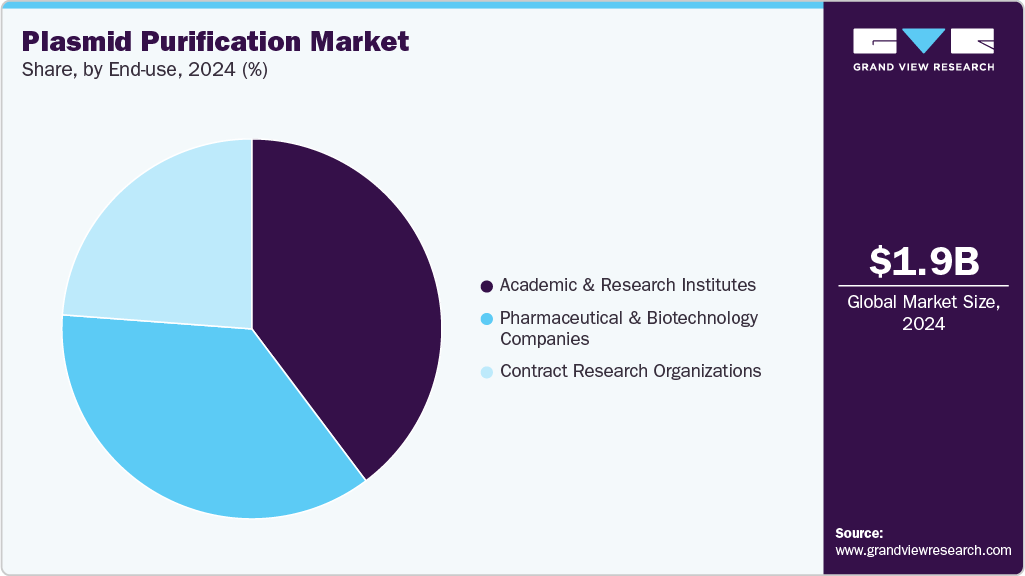

- By end use, the academic & research institutes segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.91 Billion

- 2033 Projected Market Size: USD 5.28 Billion

- CAGR (2025-2033): 12.09%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the rising acceptance of cell and gene therapy to treat chronic diseases further propels market growth.

Growth of Gene Therapy and Cell Therapy

The rising prominence of gene and cell therapies is a major driver of growth in the plasmid purification industry. These advanced therapies rely heavily on high-purity plasmid DNA as a critical component for delivering genetic material into target cells. Plasmids serve as non-viral vectors in gene editing, gene replacement, and CAR-T cell therapies, making them essential for successfully developing and commercializing these treatments. With a rapidly expanding pipeline of gene therapy candidates, many of which are advancing through clinical trials, there is a growing demand for GMP-grade plasmid DNA that meets stringent regulatory and quality standards.

As gene therapies gain regulatory approval and expand into new therapeutic areas such as oncology, rare genetic disorders, and neurodegenerative diseases, the need for large-scale, scalable, and compliant plasmid purification technologies is intensifying. Biopharmaceutical companies, CDMOs, and research institutions invest in sophisticated purification platforms to meet this demand and support consistent production. This shift toward personalized and precision medicine is expanding the applications of plasmid DNA and reinforcing the plasmid purification industry as a foundational element of the broader gene therapy ecosystem.

Advances in Synthetic Biology

The growing field of synthetic biology is pivotal in driving demand for plasmid purification. Synthetic biology involves designing and constructing new biological systems or reprogramming existing organisms to perform specific tasks, such as producing pharmaceuticals, biofuels, enzymes, and other high-value chemicals. At the core of this innovation are engineered microbes, bacteria, yeast, or other organisms that are genetically modified using plasmids to introduce and express synthetic gene circuits. As synthetic biology becomes more sophisticated, the need for high-quality, custom plasmids increases significantly, fueling demand for advanced purification technologies that deliver DNA with high purity, stability, and reproducibility.

These custom plasmids must meet strict performance requirements to ensure consistent expression and stability within engineered systems, especially in industrial-scale production environments. Poor-quality or impure plasmids can lead to variability in gene expression, reduced yields, or failed fermentation processes, making efficient and scalable purification a critical step in synthetic biology workflows. Moreover, synthetic biology is expanding far beyond academia and research with growing investment from biotech firms and industries such as agriculture, energy, and materials science. This broadening application base intensifies the need for robust plasmid purification solutions, positioning it as a key enabler of innovation and scalability in the synthetic biology market.

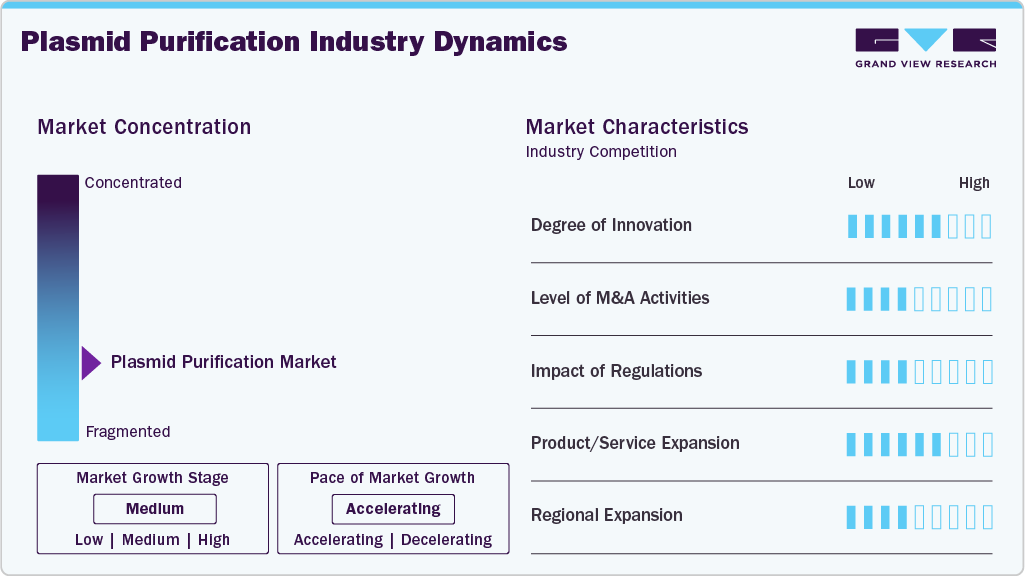

Market Concentration & Characteristics

The plasmid purification industry is experiencing significant innovation driven by advancements in genetic engineering and cloning technologies and the increasing demand for personalized medicine and gene therapies. The market is witnessing a surge in the adoption of novel and advanced DNA & gene cloning technologies, propelling growth and creating new opportunities for companies offering gene synthesis, custom cloning, sub-cloning, and other related services.

The industry is experiencing moderate merger and acquisition activities undertaken by several key players. This is due to several factors, including the desire to gain a competitive advantage in industry and the need to consolidate in a rapidly growing market. However, market players are engaged in collaboration and partnerships to expand their product and service portfolios owing to the rapid advancements in molecular and recombinant DNA technologies.

Increasing regulatory scrutiny from agencies like the FDA and EMA drives demand for GMP-compliant plasmid purification in clinical and commercial biomanufacturing. As gene therapies, mRNA vaccines, and other genetic medicines advance, companies must meet strict standards for plasmid DNA purity, safety, and traceability. This has accelerated investment in validated, scalable purification technologies, making regulatory compliance a key driver of innovation and growth in the plasmid purification industry.

Key players are adopting the strategy of increasing production capacity and expanding their market reach to improve the availability of their products and services in diverse geographic areas. Moreover, companies are launching new platforms to strengthen their product and service portfolios. For instance, in August 2023, CD Bioparticles launched a new line of DNA extraction and purification kits. The kits are designed for reliable and rapid isolation and purification of DNA, including plasmid DNA, genomic DNA, cell-free DNA (cfDNA), mitochondrial DNA, tissue DNA, and PCR products.

The plasmid purification industry is experiencing significant growth due to regional expansion across emerging and established biotech hubs. Strong R&D infrastructure, regulatory support, and investment in advanced therapies continue to drive demand in regions like North America and Europe. Meanwhile, Asia-Pacific, especially China, India, and South Korea, is rapidly scaling up biopharmaceutical manufacturing, fueled by government initiatives, increasing clinical trial activity, and local demand for gene and cell therapies. This global expansion is prompting companies to establish localized manufacturing facilities and partnerships, enhancing supply chain resilience and making plasmid purification capabilities more accessible across diverse markets.

Product & Service Insights

The products segment dominated the market with the largest revenue share in 2024. This growth is attributed to the advancements in instruments and kits for efficient and reliable purification processes. Instruments such as automated purification systems have gained popularity due to their ability to streamline workflows, reduce manual errors, and increase throughput. In addition to instruments, the kits and reagents segment plays a crucial role in market growth. Companies like Takara Bio and MP Biomedicals offer a range of kits that cater to different scales of purification, from mini preps to large-scale preparations.

The services segment is expected to grow at the fastest CAGR from 2025 to 2033. The demand for high-quality plasmid DNA is increasing in academic and industrial laboratories for applications such as gene therapy, vaccine development, and synthetic biology. Companies specializing in plasmid purification offer tailored services that cater to specific research needs, ensuring the delivery of high-purity plasmids essential for downstream applications. This demand is fueled by the growing emphasis on personalized medicine, where plasmid DNA is crucial in developing targeted therapies tailored to individual genetic profiles.

Grade Insights

Based on grade, the molecular-grade segment led the market with the largest revenue share in 2024, driven by the demand for high-quality plasmid DNA in various applications. Molecular-grade plasmid DNA is essential for gene therapy, vaccine development, and synthetic biology applications. In addition, the rise of personalized medicine has significantly impacted the demand for molecular-grade plasmid purity. Moreover, advancements in molecular-grade plasmid purification technologies are propelled by the increasing complexity of therapeutic modalities, such as CAR-T cell therapies and mRNA vaccines.

The transfection grade segment is expected to grow at the fastest CAGR over the forecast period. Transfection-grade plasmids are characterized by their high purity and yield, which is essential for successful transfection into mammalian cells. The demand for high-quality plasmid DNA has surged due to the increasing prevalence of genetic engineering techniques and the growing interest in personalized medicine. As the market evolves, the ever-increasing focus on high-quality purification technologies will likely drive innovation and investment. For instance, in June 2023, GenScript in the United States launched the AmMag Quatro system, enhancing high-volume plasmid purification by reducing workforce and time needed to obtain transfection-grade plasmids through automation.

Application Insights

The cloning and protein expression segment led the market in 2024, accounting for the largest revenue share of 48.90%. The growing demand for recombinant proteins across therapeutic, diagnostic, pharmaceutical, agricultural, and research sectors has driven significant advancements in plasmid purification technologies. These technologies are crucial for achieving high yields and purity of plasmids carrying genes of interest (GOIs) used in various expression systems. In cloning, plasmids function as versatile vectors that enable the insertion of GOIs into host cells, facilitating the production of recombinant proteins. For example, the food and beverage industry leverages enzymes engineered through recombinant DNA technology to improve product quality and processing efficiency.

The transfection & gene editing segment is expected to grow at the fastest CAGR of 13.30% over the forecast period, driven by the increasing demand for effective gene delivery systems and innovative editing technologies. Plasmids serve as essential vectors in transfection processes, facilitating the introduction of genetic material into target cells. In gene editing, techniques like CRISPR-Cas9, which rely on plasmid vectors to deliver guide RNAs and Cas9 proteins, have shown remarkable efficiency in editing specific genomic locations. As gene editing applications expand into clinical settings, robust, scalable, and safe plasmid systems become increasingly critical, further driving the demand for advanced purification methods.

End-use Insights

Based on end use, the academic and research institutes segment led the market with the largest revenue share in 2024, driven by their reliance on high-quality plasmid DNA for applications such as transfection and gene editing. Plasmids serve as vital vectors for gene delivery, supporting studies on gene function and the development of gene therapies. The rise of CRISPR and other gene editing technologies has further increased the demand for reliable plasmid purification. Moreover, as these institutes focus more on synthetic biology and personalized medicine, adopting automated, high-throughput purification systems is expected to streamline workflows and improve efficiency in plasmid production.

The contract research organizations (CROs) segment is projected to grow at the fastest CAGR during the forecast period, driven by their critical role in facilitating preclinical and clinical studies that demand highly purified, contaminant-free plasmid DNA. ROs increasingly adopt automated purification systems that streamline workflows, reduce turnaround times, and ensure stringent quality control. Moreover, CROs are expected to expand their capabilities by integrating next-generation plasmid purification technologies designed to overcome challenges associated with increased production demands.

Regional Insights

North America plasmid purification industry dominated globally with the largest revenue share of 40.69% in 2024, owing to the advancements in research related to molecular cloning, innovative technologies, and the increasing commercial demand for molecular cloned products. Moreover, the region benefits from substantial research and development investments in cell & gene therapy, government funding for biotechnology and healthcare research, and highly advanced healthcare infrastructure.

U.S Plasmid Purification Market Trends

The plasmid purification industry in the U.S. is expected to grow at the fastest CAGR over the forecast period due to the robust research and development landscape in biotechnology and life sciences, harnessing innovation and technological advancements in molecular cloning techniques, and the presence of key players in the country.

Europe Plasmid Purification Market Trends

The plasmid purification industry in Europe is expected to grow significantly over the forecast period. Europe was identified as a lucrative region in this industry. Strong research and development in biology, pharmaceuticals, and therapeutics, along with the presence of key market players in the region, are factors driving market growth.

The UK plasmid purification industry is expected to grow significantly over the forecast period. The rise in demand for personalized medicine, increased prevalence of chronic and hereditary diseases, and the surge in gene therapies have propelled the use of gene cloning techniques in the country. Furthermore, government laws regarding genetically modified crops will likely boost market growth. For instance, in March 2023, the Government of England legalized the commercial production of gene-edited food. Thus, using rDNA technology, scientists can enhance agricultural outcomes & food production.

The plasmid purification industry in Germany is expected to grow at a substantial CAGR over the forecast period, driven by increased demand for molecularly cloned products, advancements in cloning technologies, and rising research and development investments in biotechnology sectors.

Asia Pacific Plasmid Purification Market Trends

The plasmid purification industry in Asia Pacific is anticipated to witness the fastest CAGR of 14.74% throughout the forecast period, due to the rising prevalence of chronic diseases, increasing research activities, advancements in genetic engineering, rising adoption of gene therapies, and a strong presence of biotechnology and biopharmaceutical companies in the region. For instance, in February 2025, a cardiologist at the University of Pennsylvania led a groundbreaking CRISPR gene-editing treatment for a nine-month-old with a rare CPS1 deficiency, showcasing the power of precision medicine. This breakthrough highlights the critical role of advanced genetic tools like plasmid purification in enabling personalized therapies. As gene editing and precision medicine evolve, the demand for high-quality plasmid purification solutions continues to drive growth in the market.

The plasmid purification industry in China is expected to grow at a significant CAGR over the forecast period, owing to increasing investments in healthcare innovation and research. The country's focus on advancing biotechnology and cell and gene therapy, coupled with the rising awareness of personalized medicine, is driving the market's expansion in China.

The Japan plasmid purification industry is anticipated to grow significantly over the forecast period. The increasing demand for recombinant DNA technique products, advancement in molecular engineering, and the rising demand for therapeutic products are expected to propel market growth.

Middle East & Africa Plasmid Purification Market Trends

The plasmid purification industry in the Middle East and Africa is projected to grow significantly during the forecast period due to increasing investments in biotechnology and pharmaceutical research, expanding healthcare infrastructure, and rising awareness of advanced gene therapies and personalized medicine. Moreover, government initiatives to support life sciences innovation and growing collaborations with global biotech firms drive the region's demand for high-quality plasmid purification technologies.

The plasmid purification industry in Kuwait is poised for growth due to increasing investments in biotechnology and life sciences research, coupled with the country’s expanding healthcare infrastructure. Growing interest in advanced therapies, including gene therapy and personalized medicine, drives demand for high-quality plasmid DNA. Such factors collectively contribute to a positive outlook for the market in Kuwait over the forecast period.

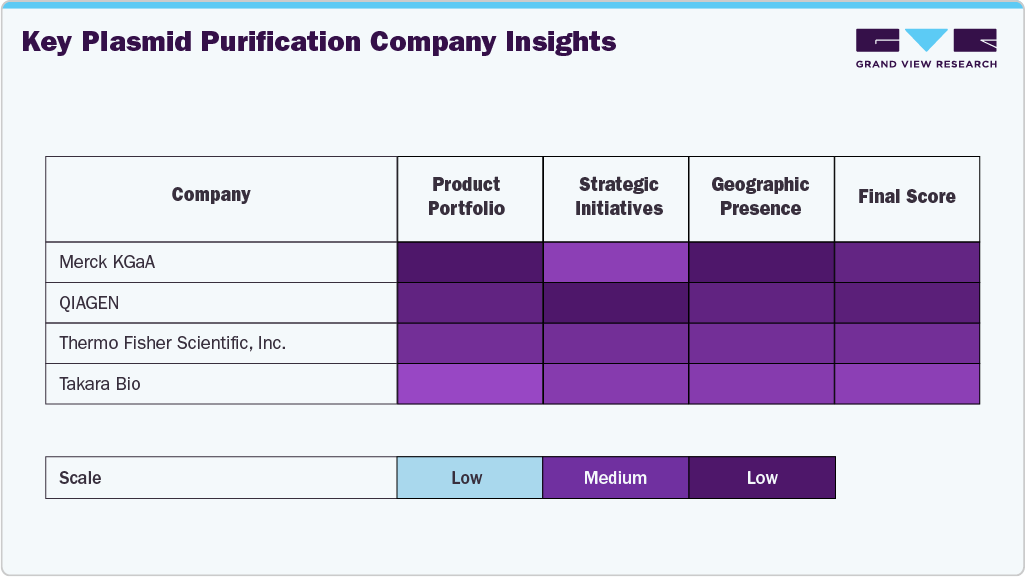

Key Plasmid Purification Company Insights

The plasmid purification industry is dominated by several established players who maintain leadership through extensive product portfolios, strategic collaborations, and continuous investments in research and development. Key companies such as Merck KGaA, QIAGEN, Thermo Fisher Scientific, Inc., Takara Bio, and Promega Corporation hold significant market share by offering advanced purification technologies, broad application capabilities, and strong global distribution networks.

Companies such as Zymo Research, MP BIOMEDICALS, New England Biolabs, MCLAB, and Applied Biological Materials Inc. are expanding their footprint by delivering innovative purification solutions and customizable services tailored to the evolving needs of academic research, biopharmaceutical development, and synthetic biology industries.

Market leaders sustain dominance by integrating cutting-edge purification technologies with comprehensive service offerings and strategic growth initiatives. These firms have established their position by addressing the increasing demand for high-purity plasmid DNA essential in gene editing, gene therapy, vaccine development, and synthetic biology applications.

The market is witnessing a dynamic interplay between established expertise and emerging innovators. Mergers and acquisitions, strategic partnerships, and purification efficiency and yield advancements are intensifying competition. Companies that effectively combine scientific innovation with customer-focused solutions are well-positioned to create sustained value in this rapidly evolving landscape, aligning market growth with broader healthcare innovation and quality standards.

Key Plasmid Purification Companies:

The following are the leading companies in the plasmid purification market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Takara Bio

- Promega Corporation

- Zymo Research

- MP BIOMEDICALS

- New England Biolabs

- MCLAB

- Applied Biological Materials Inc.

Recent Developments

-

In May 2025, Thermo Fisher Scientific introduced the Applied Biosystems MagMAX Pro HT NoSpin Plasmid MiniPrep Kit in the U.S., enabling rapid, automated plasmid DNA isolation for small-scale experiments.

-

In June 2024, Thermo Fisher Scientific launched the only fully automated plasmid purification system in the US, accelerating therapy discovery and development for biopharma companies.

-

In June 2024, Asahi Kasei's U.S. subsidiary, Bionova Scientific, announced plans to establish a new facility in Texas dedicated to plasmid DNA production. This move aims to support the growing demand for gene therapies and aligns with Asahi Kasei's strategic focus on expanding biopharmaceutical capabilities.

Plasmid Purification Market Report Scope

Report Attribute

Details

Market size in 2025

USD 2.12 billion

Revenue forecast in 2033

USD 5.28 billion

Growth rate

CAGR of 12.09% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, grade, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Merck KGaA; QIAGEN; Thermo Fisher Scientific, Inc.; Takara Bio; Promega Corporation; Zymo Research; MP BIOMEDICALS; New England Biolabs; MCLAB; Applied Biological Materials Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plasmid Purification Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global plasmid purification market report based on product & service, grade, application, end-use, and region.

-

Product & Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Products

-

Instruments

-

Kits & Reagents

-

-

Services

-

-

Grade Outlook (Revenue, USD Million, 2021 - 2033)

-

Molecular Grade

-

Transfection Grade

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloning & Protein Expression

-

Transfection & Gene Editing

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Contract Research Organizations

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global plasmid purification market size was estimated at USD 1.91 billion in 2024 and is expected to reach USD 2.12 billion in 2025.

b. The global plasmid purification market is expected to grow at a compound annual growth rate of 12.09% from 2025 to 2033 to reach USD 5.28 billion by 2033.

b. North America dominated the market and accounted for 40.69% revenue share in 2024 owing to the advancements in research related to molecular cloning, the introduction of innovative technologies, and the increasing commercial demand for molecular cloned products.

b. Some key players operating in the plasmid purification market include Merck KGaA; QIAGEN; Thermo Fisher Scientific, Inc.; Takara Bio; Promega Corporation; Zymo Research; MP BIOMEDICALS; New England Biolabs; MCLAB; Applied Biological Materials Inc.

b. Key factors that are driving the market growth include the growing demand for recombinant DNA technology products and technological advancements in plasmid purification.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.