- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Contract Manufacturing Market Size Report, 2030GVR Report cover

![Plastic Contract Manufacturing Market Size, Share, & Trends Report]()

Plastic Contract Manufacturing Market (2023 - 2030) Size, Share, & Trends Analysis Report By Product (Polypropylene, ABS, Polyethylene, Polystyrene, Others), By Application (Medical, Aerospace & Defense, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-968-5

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Contract Manufacturing Market Summary

The global plastic contract manufacturing market size was valued at USD 30.37 billion in 2022 and is projected to reach USD 45.11 billion by 2030, growing at a CAGR of 5.1% from 2023 to 2030. Increasing usage of plastics, such as polystyrene, polyethylene, polypropylene, and polyurethane, in household appliances is expected to fuel market growth.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of 44.7% in 2022.

- The market in Central & South America is expected to grow at a CAGR of 5.0%.

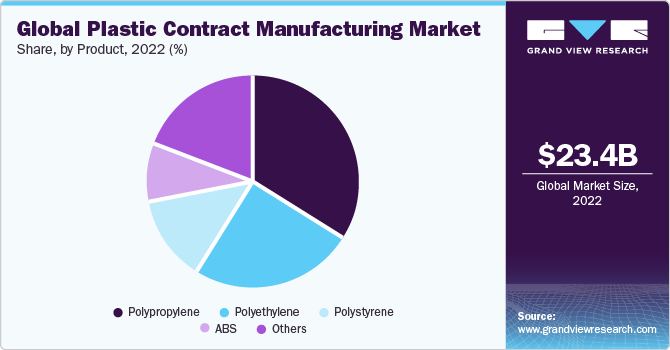

- By product, the polypropylene segment accounted for the largest revenue share of 34.5% in 2022.

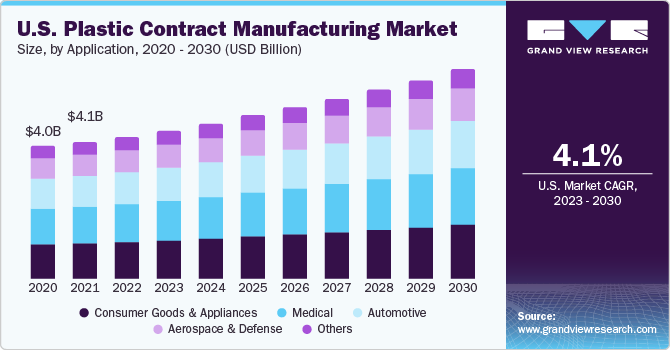

- By application, the consumer goods and appliances segment held the largest revenue share of 26.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 30.37 Billion

- 2030 Projected Market Size: USD 45.11 Billion

- CAGR (2023-2030): 5.1%

- Asia Pacific: Largest market in 2022

Demand for home appliances and electronics products is rising rapidly owing to the work-from-home culture. This, in turn, is expected to benefit the market growth over the forecast period. The high demand for healthcare services along with medical devices is anticipated to boost market growth in the U.S. over the forecast period. Innovations in the electronics industry to produce lightweight, user-friendly, and better-quality products are anticipated to have a positive impact on market growth.As the household appliances market is highly competitive, manufacturers are continuously making efforts to develop innovative low-cost product designs that offer improved performance to tap consumer attention. Technical know-how and adequate availability of raw materials are expected to reduce barriers for new players in the global market.

However, high initial capital investments and increased requirements of establishing good relations with raw material suppliers are expected to restrict the entry of new players into the market. Thus, the threat of new entrants is expected to be moderate. In-house manufacturing is one of the alternatives used by companies. However, the requirement of large capital to set up plastic molding facilities and the rapidly changing manufacturing technologies are expected to have a positive effect on market growth.

Plastic contract manufacturing enables three major benefits for any business that include knowledge base, work offloading, and cost savings. Plastic contract manufacturers work with customers to determine materials to be used for manufacturing components based on their time requirements, design specifications, and certification requirements. Manufacturers develop customized products based on specific size, design, and quantity requirements. Outsourcing a certain part of this production process also leads to reduced manufacturing and operational costs for end users.

Increasing penetration of plastics for manufacturing consumer electronics is expected to be one of the key factors for the growth of the market over the forecast period. Plastics are widely used for manufacturing structures and bodies of TV, smartphones, cameras, laptops, and recorders, among others. Plastics offer benefits, over metals in terms of chemical resistance, low costs, lightweight, and excellent durability.

The market for plastic contract machinery is anticipated to see an increase owing to the growing sales of smartphones. In emerging economies such as India, China, and South Korea, the use of smartphones is rising rapidly owing to the growing consumer disposable income, changing consumer lifestyles, rising popularity of electronic gadgets, and ongoing technological innovations in products. Furthermore, various initiatives by manufacturers in the form of technological advancements in their household appliances by incorporating intelligent electronic controls, sensors, and machine programming are expected to be the key drivers for growth in mature and developing markets.

The growth of the market for plastic contract manufacturing is expected to be restrained by fluctuations in the prices of raw materials due to volatility in oil production globally and its costs. Components used in various industries are manufactured from chemical compounds such as polyether, polyester, polyethylene, polyurethane, polyolefin, PVC, SBR, PEEK, and ABS. The aforementioned raw materials are developed from byproducts of refineries. These include naphtha, kerosene, diesel fuel, asphalt, tar, etc.

Application Insights

The consumer goods and appliances segment held the largest revenue share of 26.6% in 2022. Rising dependency on household appliances, owing to the increasing working population, coupled with increasing disposable income levels, is expected to drive the demand for these appliances, propelling the segment growth. The automotive industry utilizes plastics in power trains, electrical components, interior & exterior furnishes, and chassis. Some of the commonly used plastics in the automotive industry are PP, PU, ABS, PE, PVC, PA, and PMMA. The contract manufacturers provide services for manufacturing various automotive parts including exterior plastic automotive components, interior molded systems, interior wrapping, interior, and under-the-hood plastic components.

The medical segment is expected to grow at the fastest CAGR of 6.8% over the forecast period. Increasing utilization of catheters in the medical sector in several applications, such as angiography, cardiac electrophysiology testing, angioplasty, and administration of intravenous fluids, is expected to drive product demand. In the aerospace industry, plastics are used for various applications including aerostructure, components, equipment, system & support, cabin interiors, propulsion systems, satellites, and insulation components. The aerospace and defense components require the utilization of advanced engineering plastics including POM, PA, PTFE, PPS, PEEK, PAI, & PI, and also require specialized technology for the production of the component. These factors are expected to drive the aerospace & defense application segment.

Product Insights

The polypropylene segment accounted for the largest revenue share of 34.5% in 2022. Polypropylene is majorly used for manufacturing components in medical and automotive applications. The properties of polypropylene, including sterilization and impact resistance, are expected to augment its utilization in the medical industry. Its low weight and excellent chemical & electrical resistance properties allow it to be used in automotive applications.

The ABS segment is projected to grow at the fastest CAGR of 6.1% over the forecast period. ABS is a polymer, which provides chemical & impact resistance, strength, and chemical inertness. The segment is mainly driven by increasing demand for applications for insulation in the electronics and construction industries and growing integration in the automotive industry.

Polyethylene (PE) is used in various applications including toys, milk bottles, shampoo bottles, pipes, houseware, reusable bags, trays, containers, and packaging films. Polyethylene is also used in bags designed for the packaging of medical devices and equipment components. The demand for the product is expected to witness growth on account of the rising adoption of plastic in pouches & rolls.

Polystyrene is generally available in three forms including Expanded Polystyrene (EPS), High Impact Polystyrene (HIPS), and General-Purpose Polystyrene (GPPS). Increasing adoption of HIPS and GPPS in food & non-food packaging, yogurt pots, meat trays, disposable cups & cutlery, and consumer electronics, including TV, fridge liners, and display sheets, is expected to positively affect the growth of the segment over the forecast period.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 44.7% in 2022. The region is the largest manufacturer as well as consumer of plastics. In addition, it is the largest producer of household appliances in the world. Increasing disposable incomes and population growth in the region are projected to result in a quick expansion of the appliances industry, which is positive for market growth. A rapidly growing economy, coupled with government efforts to promote manufacturing in various sectors, is expected to be the major factor contributing to the growth of the market in India. India is one of the fastest-growing markets for aerospace, medical devices, automotive, as well as consumer goods, which is likely to attract numerous market players in the economy

The market in Central & South America is expected to grow at a CAGR of 5.0% owing to significant growth in the appliances and consumer goods industry over the past few years as a result of the high investments in the manufacturing sector of the country. This is likely to have a positive impact on regional market growth. The growing aircraft manufacturing in Germany and the U.K. is expected to have a positive impact on the Europe regional market growth. The aerospace sector requires a workforce with experience in the design and construction of complicated airplane structures, which is anticipated to stimulate market expansion.

North America is one of the important markets for plastic contract manufacturing worldwide. The U.S. dominates the market in the region owing to the early industrialization of the country and the adoption of new trends related to technology and innovation. The presence of numerous manufacturers of consumer electronics and appliances in the U.S. is expected to be a key factor for the growth of the plastic contract manufacturing market over the assessment period.

Key Companies & Market Share Insights

The market is characterized by the presence of various contract manufacturers across the world. The market players cater to the product demand stemming from applications in the medical, automotive, aerospace & defense, consumer goods & appliances, telecommunication, industrial, and agriculture industries. The competitive environment in the market is driven by innovation in technology used in manufacturing processes. Companies operating in the market are investing heavily in R&D as well as developing equipment to optimize production methods, improve process efficiency, and manufacture complex components.

Key Plastic Contract Manufacturing Companies:

- McClarin Plastics, LLC

- EVCO Plastics

- C&J Industries

- Plastikon Industries, Inc.

- RSP, Inc.

- Mack Molding

- Tessy Plastics

- Inzign Pte Ltd.

- Genesis Plastics Welding

- Baytech Plastics

- Gregstrom Corp.

- Nolato AB

- Natech Plastics, Inc.

- PTI Engineered Plastics, Inc.

- Rosti Group AB, Inc.

Recent Developments

-

In March 2023, Vonco Products, a prominent manufacturer specializing in plastic products and packaging, disclosed its acquisition of Genesis Plastics Welding, a well-established contract manufacturer of thermoplastics. This strategic move by Vonco aims to enhance its portfolio diversification and expand its range of offerings. With expertise in the production of custom flexible components and packaging solutions, Vonco is recognized for its ability to manufacture liquid-tight bags of various shapes and accommodate desired fitments using both supported and unsupported films

-

In October 2022, Eakin Surgical, a UK-based manufacturer of single-use surgical instruments located in Cardiff, South Wales, unveiled plans to expand its contract manufacturing services. The company aims to assist medical device original equipment manufacturers (OEMs) in cost reduction, meeting the increasing demand for sterile packaging, and mitigating supply shortages. Eakin Surgical's comprehensive service encompasses various aspects of medical device manufacturing, including plastics injection molding, assembly, packaging within an ISO Class 8 cleanroom, and ethylene oxide (EtO) sterilization

-

In October 2022, Seaway Plastics Engineering, a prominent provider of injection-molded components and value-added services to various industries including medical devices, healthcare, and aerospace, acquired MME Group. MME Group, located in Minnesota, U.S., specializes in contract manufacturing services such as injection molding, engineering, tooling, and assembly for FDA-regulated medical products and other highly engineered items subject to regulations. This strategic acquisition aligns with Seaway's growth strategy by enhancing its geographic presence and product offerings, enabling the company to better meet the needs of its valued customers

Plastic Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 31.81 billion

Revenue forecast in 2030

USD 45.11 billion

Growth rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Russia; China; Japan; India; Australia; South Korea; Thailand; Indonesia; Malaysia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

McClarin Plastics, LLC; EVCO Plastics; C&J Industries, Plastikon Industries, Inc.; RSP, Inc.; Mack Molding; Tessy Plastics; Inzign Pte Ltd.; Genesis Plastics Welding; Baytech Plastics; Gregstrom Corp.; Nolato AB; Natech Plastics, Inc.; PTI Engineered Plastics, Inc.; Rosti Group AB, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic contract manufacturing market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Polypropylene

-

ABS

-

Polyethylene

-

Polystyrene

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Aerospace & Defense

-

Automotive

-

Consumer Goods & Appliances

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plastic contract manufacturing market size was estimated at USD 30.37 billion in 2022 and is expected to reach USD 31.81 billion in 2023.

b. The global plastic contract manufacturing market is expected to grow at a compound annual growth rate of 5.1% from 2023 to 2030 and reach USD 45.11 billion by 2030.

b. Asia Pacific dominated the plastic contract manufacturing market with a share of 44.7% in 2022, owing to easy availability of raw materials, land, cheap labor cost, and high domestic demand are the important factors influencing the growth of the manufacturing sector in the region.

b. Some of the key players operating in the plastic contract manufacturing market include McClarin Plastics, LLC, EVCO Plastics, C&J Industries, Plastikon Industries, Inc., RSP Inc., Mack Molding, Tessy Plastics, Inzign Pte Ltd., Genesis Plastics Welding, Baytech Plastics, Gregstrom Corporation, Nolato AB, Natech Plastics, Inc., PTI Engineered Plastics, Inc., Rosti Group AB, Inc.

b. The key factors that are driving the plastic contract manufacturing market include increasing penetration of plastics for manufacturing consumer electronics, automotive, and medical products coupled with the flourishing global consumer electronics industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.