- Home

- »

- Advanced Interior Materials

- »

-

Plastic Processing Auxiliary Equipment Market Report, 2030GVR Report cover

![Plastic Processing Auxiliary Equipment Market Size, Share & Trends Report]()

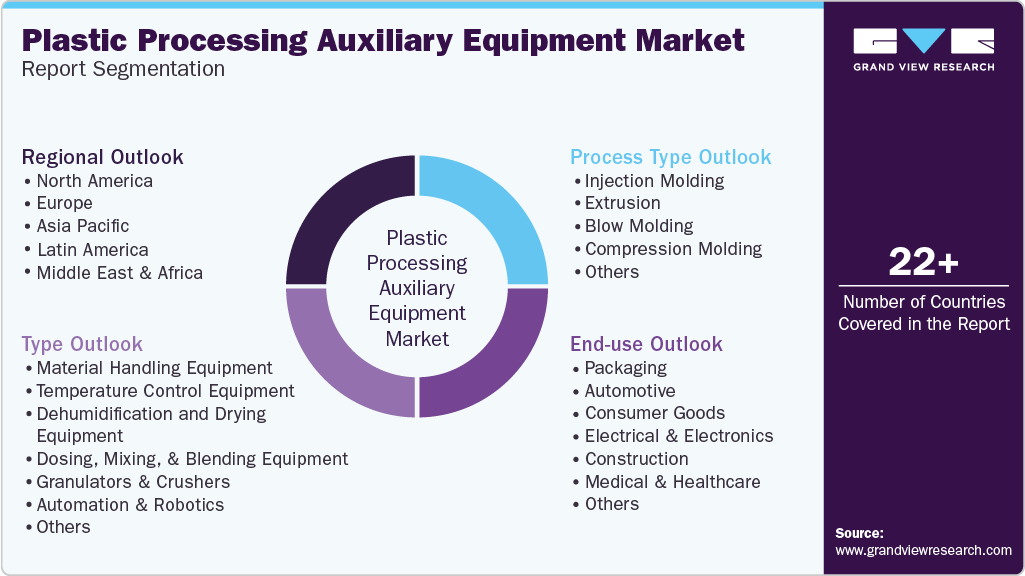

Plastic Processing Auxiliary Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Material Handling Equipment, Temperature Control Equipment), By Process Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-588-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

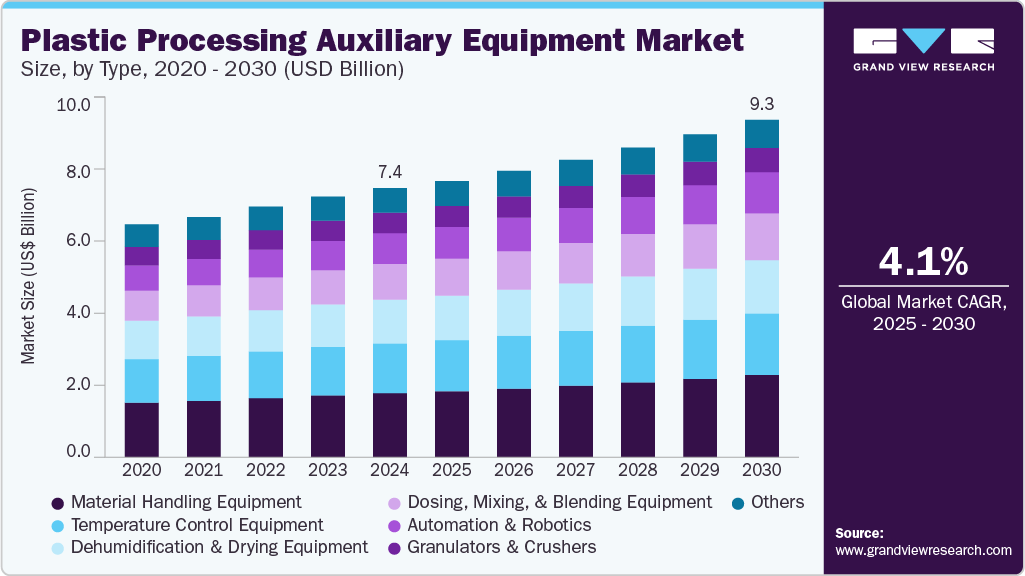

The global plastic processing auxiliary equipment market size was estimated at USD 7,405.6 million in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2030. The plastic processing auxiliary equipment industry is increasingly focused on energy efficiency and sustainability, driven by both regulatory pressures and the rising demand for eco-friendly manufacturing solutions.

Key Highlights:

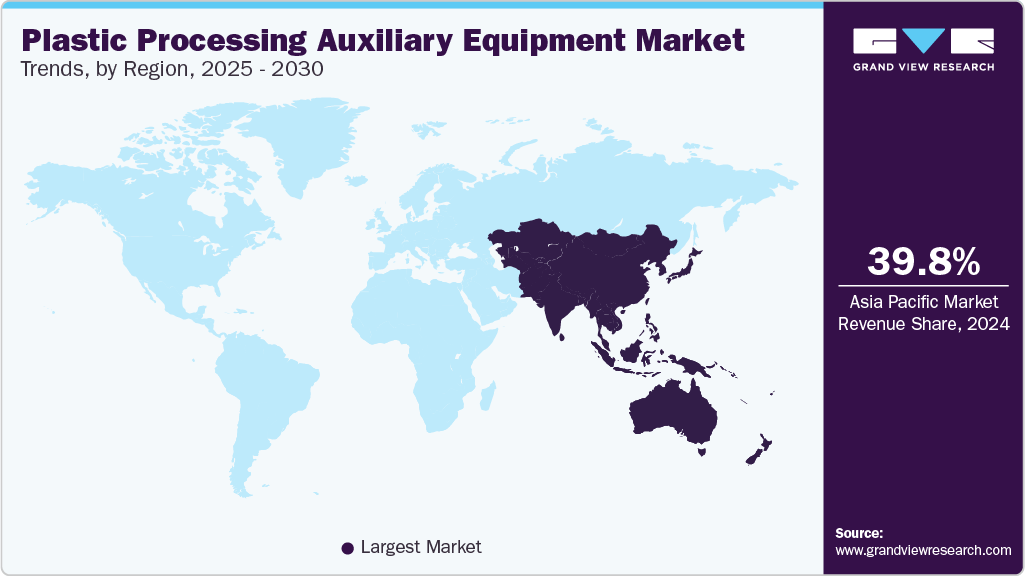

- The Asia Pacific plastic processing auxiliary equipment market accounted for 39.8% of the global market share in 2024.

- China is the largest market for plastic processing auxiliary equipment in Asia Pacific.

- By type, the material handling equipment segment held a significant share of 23.8% in 2024.

- By process type, the injection molding segment held a significant market share of 39.8% in 2024.

As environmental concerns grow, manufacturers are developing equipment that reduces energy consumption, optimizes processing cycles, and minimizes waste. This shift is especially evident in the design of energy-efficient drying systems, temperature control units, and material handling solutions, which help manufacturers meet stringent environmental standards while reducing operating costs.

Automation and digitalization are also reshaping the landscape of the market. The rise of Industry 4.0 technologies, including IoT-enabled systems, robotics, and advanced control software, is driving significant advancements in manufacturing efficiency. These innovations allow for real-time monitoring, predictive maintenance, and enhanced precision in processing, helping reduce downtime and improve product consistency. As production environments become more automated, demand for advanced auxiliary systems that seamlessly integrate with other manufacturing technologies is rising. This trend toward smarter, more interconnected systems is revolutionizing the market, providing companies with the tools to optimize their operations and increase overall productivity.

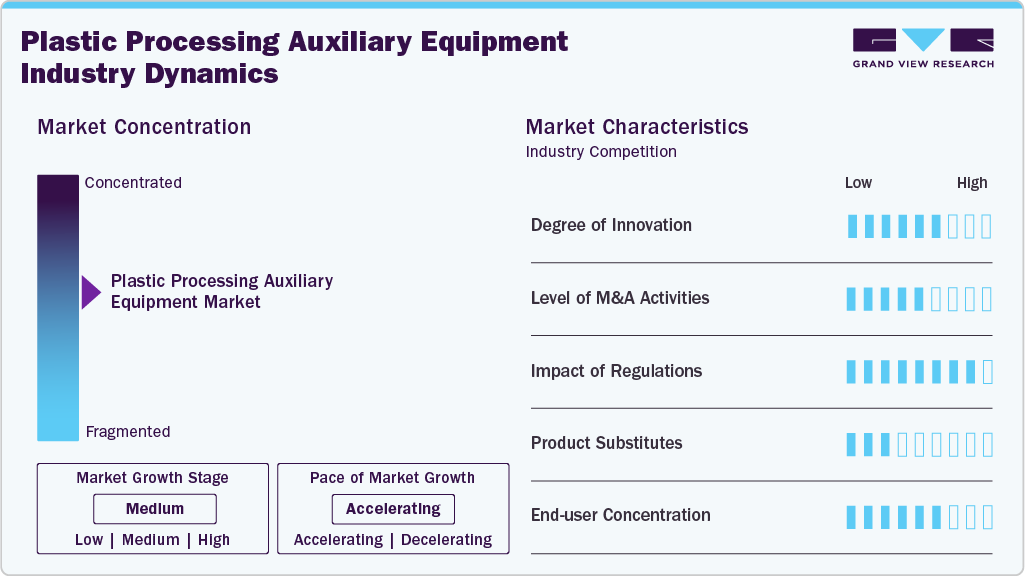

Market Concentration & Characteristics

The market is moderately fragmented, featuring a combination of established global players and increasing regional and specialized distributors. Leading companies such as Piovan, Conair, Motan Colortronic, and AEC maintain strong market positions through comprehensive product portfolios, cutting-edge technologies, and extensive distribution networks. Moreover, regional and independent distributors are vital in serving local markets, offering tailored solutions that meet specific industry needs, material handling requirements, and customer preferences in different regions.

Environmental regulations and sustainability standards play a critical role in shaping the dynamics of the plastic market. Regulatory agencies enforce stricter guidelines on energy efficiency and waste reduction, prompting manufacturers to develop eco-friendly solutions. As a result, manufacturers increasingly focus on offering auxiliary equipment that complies with these evolving standards, leading to greater demand for energy-efficient systems, such as low-energy dryers, optimized material handling equipment, and sustainable cooling solutions. This regulatory pressure not only drives market growth but also encourages manufacturers and distributors to invest in innovative, environmentally friendly technologies.

Technological innovations are reshaping the plastic processing auxiliary equipment industry, with the integration of advanced automation and smart technologies. IoT-enabled systems, predictive maintenance tools, and enhanced process control are transforming the way plastic manufacturers handle materials, monitor equipment performance, and manage production processes. These technologies are becoming standard in the market, prompting distributors to offer products that provide real-time data, increase energy efficiency, and streamline operations. Additionally, the growing adoption of advanced filtration systems and automated blending solutions is enhancing operational efficiency and product quality, pushing the market toward more sophisticated and digitally connected equipment.

Asia Pacific holds a dominant share of the market, supported by robust industrial activity, regulatory incentives for energy-efficient solutions, and a well-established aftermarket service network. The region's focus on sustainable manufacturing practices and technological advancements further solidifies its position as a leader in the market. These trends reflect the shift toward high-performance, energy-efficient, and environmentally friendly plastic processing solutions, distributed through an increasingly diverse and technologically advanced network of distributors and suppliers.

Drivers, Opportunities & Restraints

The growing demand for energy-efficient and environmentally friendly solutions is a key driver for the plastic processing auxiliary equipment industry. Stricter environmental regulations and sustainability standards are pushing manufacturers to adopt more energy-efficient technologies, such as low-energy dryers, advanced material handling systems, and optimized cooling equipment. These innovations not only help companies meet regulatory requirements but also reduce operational costs, making them increasingly popular in industries such as automotive, packaging, and consumer goods.

High initial investment costs for advanced plastic processing auxiliary equipment pose a significant restraint on the market. While these systems offer long-term operational savings, the upfront cost of acquiring sophisticated machinery like automated material handling systems, smart temperature control units, and IoT-enabled solutions can be prohibitive for smaller manufacturers. This can limit the adoption of such technologies in emerging markets or for companies with lower capital expenditures, slowing overall market growth.

The rising adoption of recycled plastics presents a significant opportunity for the market. As the demand for sustainable production practices grows, manufacturers are increasingly incorporating recycled materials into their processes. This requires specialized equipment capable of handling the unique challenges of recycled plastics, such as varying moisture content and inconsistent material properties. Companies that can develop and offer advanced solutions tailored for recycling processes are well-positioned to capitalize on this growing trend in the market.

Type Insights

The material handling equipment type segment held a significant share of the market and accounted for a share of 23.8% in 2024 due to its crucial role in improving efficiency and reducing labor costs in plastic manufacturing processes. Systems such as vacuum loaders, conveyors, and automated storage and retrieval systems streamline the flow of raw materials, additives, and finished products. These solutions help reduce material wastage, enhance production speeds, and ensure consistent material quality throughout the manufacturing process.

Robotic systems, including robotic arms for part removal, automated material handling, and smart blending systems, are revolutionizing the way plastic products are processed and assembled. These technologies not only reduce labor costs but also minimize human error, improve product consistency, and increase production throughput. The increasing integration of IoT-enabled systems and AI-driven robots is further boosting the demand for automation solutions, making it a dominant segment in the market as industries strive for higher operational efficiency and faster time-to-market.

Process Type Insights

The injection molding process type segment held a significant market share, accounting for 39.8% in 2024. Injection molding is a widely used plastic processing method that involves injecting molten plastic into a mold to form parts with intricate shapes and high precision. This process relies heavily on equipment such as material handling systems, dryers, mold temperature controllers, and robotic part removal systems. Material handling systems, such as vacuum loaders, ensure a smooth and continuous resin supply to the injection molding machine.

Extrusion is a continuous process where plastic is melted and forced through a die to create long shapes such as pipes, sheets, and profiles. In the market, extrusion systems are supported by various auxiliary equipment, including material handling solutions, granulators, and cooling systems. Material handling systems, such as conveyors and loaders, ensure the smooth delivery of raw materials to the extruder. Granulators are often used to recycle plastic scrap, reducing waste and cost. Cooling systems, such as water baths and air cooling units, are crucial for solidifying the extruded plastic and ensuring it retains the desired properties.

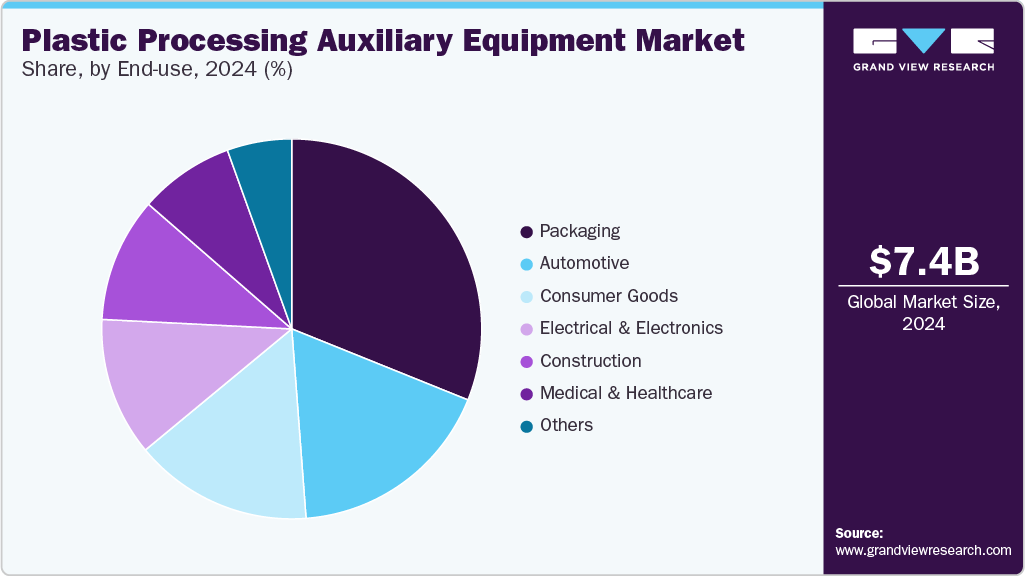

End-use Insights

The packaging end use segment held a significant share of the market and accounted for a share of 31.1% in 2024. In the packaging industry, plastic processing auxiliary equipment plays a crucial role in ensuring high-quality, efficient production of plastic packaging materials such as bottles, films, and containers. Equipment like material handling systems, dryers, and blending units is essential for managing the flow of raw materials, ensuring that plastics are processed with minimal defects. Auxiliary equipment such as automated labeling systems, temperature control units, and cutting devices further streamlines the production of plastic packaging, meeting the high-speed demands of the industry.

The medical & healthcare industries require highly specialized plastic products that must meet strict quality, safety, and compliance standards. In this sector, plastic processing auxiliary equipment such as temperature controllers, material dryers, and mold temperature controllers is essential for producing components like syringes, IV bags, surgical instruments, and diagnostic devices. These pieces of equipment ensure that the materials used in medical applications are processed consistently and without contamination, maintaining the integrity of the products.

Regional Insights

The North American plastic processing auxiliary equipment market is seeing substantial growth driven by the strong industrial base in the region, with key sectors such as automotive, packaging, and healthcare fueling demand. The increasing adoption of energy-efficient and automated solutions, in line with stricter environmental regulations, is one of the major trends in this market. Manufacturers are investing in advanced equipment such as IoT-enabled systems, material handling units, and smart temperature control devices.

U.S. Plastic Processing Auxiliary Equipment Market Trends

The plastic processing auxiliary equipment market in the U.S. is expected to grow at a CAGR of 3.2% from 2025 to 2030, driven by a robust manufacturing sector that includes industries such as automotive, consumer goods, and packaging. The demand for automation and smart manufacturing solutions is increasing, with companies focusing on improving production efficiency and reducing operational costs. The growing emphasis on sustainable practices is also leading to the adoption of energy-efficient systems like low-energy dryers, predictive maintenance tools, and recyclable material handling solutions.

The plastic processing auxiliary equipment market in Canada is expected to grow at a CAGR of 3.8% from 2025 to 2030. Canada’s plastic processing auxiliary equipment market is benefiting from steady growth in the manufacturing and construction sectors, with a particular focus on energy efficiency and sustainability. The demand for eco-friendly solutions, such as low-GWP refrigerants, advanced cooling systems, and optimized drying units, is rising as Canadian manufacturers seek to meet regulatory requirements and reduce their environmental impact.

Asia Pacific Plastic Processing Auxiliary Equipment Market Trends

The Asia Pacific region dominated the market and accounted for 39.8% of the global market share in 2024. The market is experiencing rapid growth, driven by rapid industrialization, urbanization, and rising demand for plastic products in sectors such as automotive, construction, and packaging. Countries like China and India are witnessing a surge in manufacturing activities, which is driving the need for advanced, efficient plastic processing equipment. The market is also witnessing an increase in the adoption of automation and digital technologies, such as IoT-enabled systems and robotics, to improve productivity and reduce operational costs.

China plastic processing auxiliary equipment market held a significant share in the Asia Pacific market. China is the largest market for plastic processing auxiliary equipment in Asia Pacific, fueled by its massive manufacturing sector and demand for a wide variety of plastic products. The country’s focus on upgrading its manufacturing infrastructure through Industry 4.0 technologies is driving demand for advanced auxiliary equipment, particularly in injection molding and extrusion processes.

The plastic processing auxiliary equipment market in India is expected to grow at a CAGR of 5.7% from 2025 to 2030. India’s plastic processing auxiliary equipment market is expanding rapidly, supported by the country's thriving manufacturing sector and increased demand for plastic products in the packaging, automotive, and consumer goods industries. The rise in industrial automation and the need for more energy-efficient solutions are key trends driving the market.

Europe Plastic Processing Auxiliary Equipment Market Trends

Europe is one of the key regions driving innovation in the plastic processing auxiliary equipment market, with a strong focus on sustainability, energy efficiency, and compliance with strict environmental regulations. The European Union’s commitment to reducing carbon emissions and promoting circular economies is pushing the demand for advanced auxiliary equipment, such as material handling systems that support the recycling of plastics and low-energy processing technologies.

The Germany plastic processing auxiliary equipment market is a European region owing to its strong manufacturing and industrial base, particularly in the automotive and packaging sectors. The country’s commitment to Industry 4.0 technologies, such as automation and digitalization, is transforming the market.

The UK plastic processing auxiliary equipment market is driven by the expanding demand for packaging solutions, particularly in the food and beverage industries. Sustainability and regulatory compliance are top priorities, with a rising demand for energy-efficient equipment such as dryers, blending systems, and cooling units that meet environmental standards.

Middle East & Africa Plastic Processing Auxiliary Equipment Market Trends

The plastic processing auxiliary equipment market in the Middle East & Africa is experiencing steady growth, with increasing demand from industries like construction, packaging, and automotive. The region’s focus on infrastructure development and industrialization is driving the demand for plastic products, leading to higher adoption of plastic processing technologies.

The Saudi Arabia plastic processing auxiliary equipment market is growing rapidly, driven by the country’s focus on industrial diversification and infrastructure development. The demand for plastic products in construction, packaging, and consumer goods is on the rise, leading to a greater need for advanced processing equipment. Saudi Arabia is also increasingly focused on sustainability, with growing interest in energy-efficient and environmentally friendly auxiliary equipment that helps reduce the carbon footprint of plastic manufacturing processes.

Latin America Plastic Processing Auxiliary Equipment Market Trends

The Latin American plastic processing auxiliary equipment market is experiencing moderate growth, primarily driven by the automotive and packaging industries. With a growing emphasis on sustainability, Latin American countries are increasingly adopting energy-efficient solutions to meet environmental regulations and reduce costs. As manufacturing activities ramp up in countries like Brazil and Mexico, there is a rising need for automation and smart technologies to improve production efficiency.

The Brazil market for plastic processing auxiliary equipment is the largest in Latin America, with significant demand from the automotive, packaging, and consumer goods sectors. The country’s growing focus on sustainability and the adoption of energy-efficient technologies are driving the demand for advanced auxiliary equipment, such as low-energy drying systems and optimized material handling solutions.

Key Plastic Processing Auxiliary Equipment Company Insights

Some of the key players operating in the market include Wittmann and Shibaura Machine Co., Ltd.

-

Wittmann is a leading global supplier of automation and auxiliary equipment for the plastics processing industry, known for its high-quality products that enhance the efficiency, sustainability, and performance of manufacturing processes. Founded in 1976 and headquartered in Vienna, Austria, the company offers a wide range of solutions, including robotics, dryers, granulators, temperature control units, and material handling systems. Wittmann focuses on providing integrated systems that enable seamless automation, improve production quality, and optimize energy usage.

-

Shibaura Machine Co., Ltd., a prominent Japanese manufacturer, specializes in injection molding machines and automation solutions for the plastics processing industry. Founded in 1949, the company is renowned for its advanced technology, producing high-precision and energy-efficient machines that meet diverse industrial needs. Shibaura Machine's product offerings include injection molding machines, robotic systems, and other auxiliary equipment designed to improve manufacturing efficiency and product quality.

Key Plastic Processing Auxiliary Equipment Companies:

The following are the leading companies in the plastic processing auxiliary equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Fel Plast India

- Wittmann

- Piovan

- Shibaura Machine Co., Ltd.

- Colortronic GmbH

- Conair

- Yushin

- Motan Colortronic

- Sidel

- Buss AG

- Coperion

- Novatec

- XIECHENG

- AIC Acquisition Company LLC

- Bry-Air (Asia) Pvt. Ltd.

Recent Developments

- In August 2022, LS Mtron launched a new AI-powered smart injection system for its injection molding machines. This innovative technology includes two key features: the AI Molding Assistant and Smart Weight Control. The AI Molding Assistant is a condition-based system that significantly reduces the time required to stabilize the initial molding setup by learning and replicating the actions of expert molding specialists through artificial intelligence.

Plastic Processing Auxiliary Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7,599.7 million

Revenue forecast in 2030

USD 9,285.7 million

Growth rate

CAGR of 4.1% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, process type, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Fel Plast India; Wittmann; Piovan; Shibaura Machine Co., Ltd.; Colortronic GmbH; Conair; Yushin; Motan Colortronic; Sidel; Buss AG; Coperion; Novatec; XIECHENG; AIC Acquisition Company LLC; Bry-Air (Asia) Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Processing Auxiliary Equipment Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic processing auxiliary equipment market report based on type, process type, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Material Handling Equipment

-

Temperature Control Equipment

-

Dehumidification and Drying Equipment

-

Dosing, Mixing, & Blending Equipment

-

Granulators & Crushers

-

Automation & Robotics

-

Others

-

-

Process Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Extrusion

-

Blow Molding

-

Compression Molding

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Automotive

-

Consumer Goods

-

Electrical & Electronics

-

Construction

-

Medical & Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Spain

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plastic processing auxiliary equipment market size was estimated at USD 7,405.6 million in 2024 and is expected to be USD 7,599.7 million in 2025.

b. The global plastic processing auxiliary equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030 to reach USD 9,285.7 million by 2030.

b. Packaging end use segment held a significant share of the market and accounted for a share of 31.1% in 2024. In the packaging industry, plastic processing auxiliary equipment plays a crucial role in ensuring high-quality, efficient production of plastic packaging materials such as bottles, films, and containers.

b. Some of the key players operating in the plastic processing auxiliary equipment market include Fel Plast India, Wittmann, Piovan, Shibaura Machine Co., Ltd., Colortronic GmbH, Conair, Yushin, Motan Colortronic, Sidel, Buss AG, Coperion, Novatec, XIECHENG , AIC Acquisition Company LLC, Bry-Air (Asia) Pvt. Ltd.

b. Key factors driving the plastic processing auxiliary equipment market are growth in plastic production and processing volumes, demand for enhanced operational efficiency and automation, and technological advancements and industry 4.0 integration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.