- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyaniline Market Size And Share, Industry Report, 2033GVR Report cover

![Polyaniline Market Size, Share & Trends Report]()

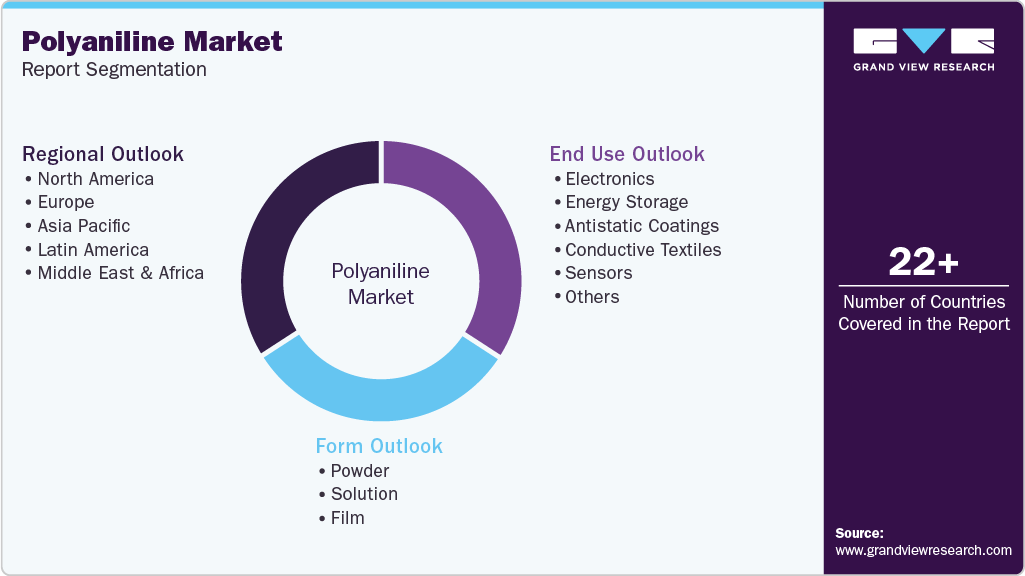

Polyaniline Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Powder, Solution, Film), By End Use (Electronics, Energy Storage, Antistatic Coatings, Conductive Textiles, Sensors), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-797-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyaniline Market Summary

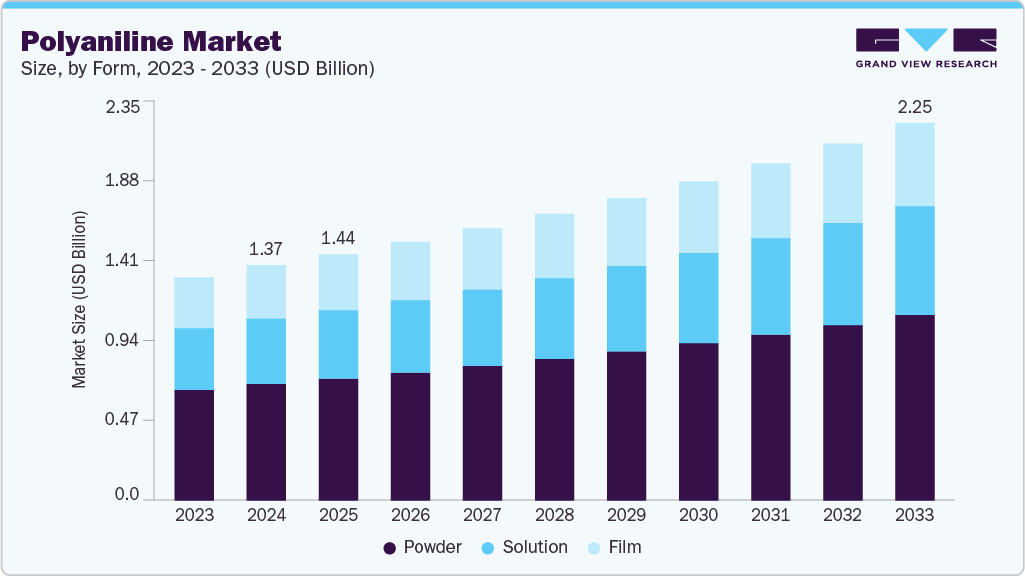

The global polyaniline market size was estimated at USD 1.37 billion in 2024 and is projected to reach USD 2.25 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. Growing use of Polyaniline (PANI) in energy storage devices such as supercapacitors and batteries is driving market growth, as the material offers high conductivity and stable performance for efficient charge storage.

Key Market Trends & Insights

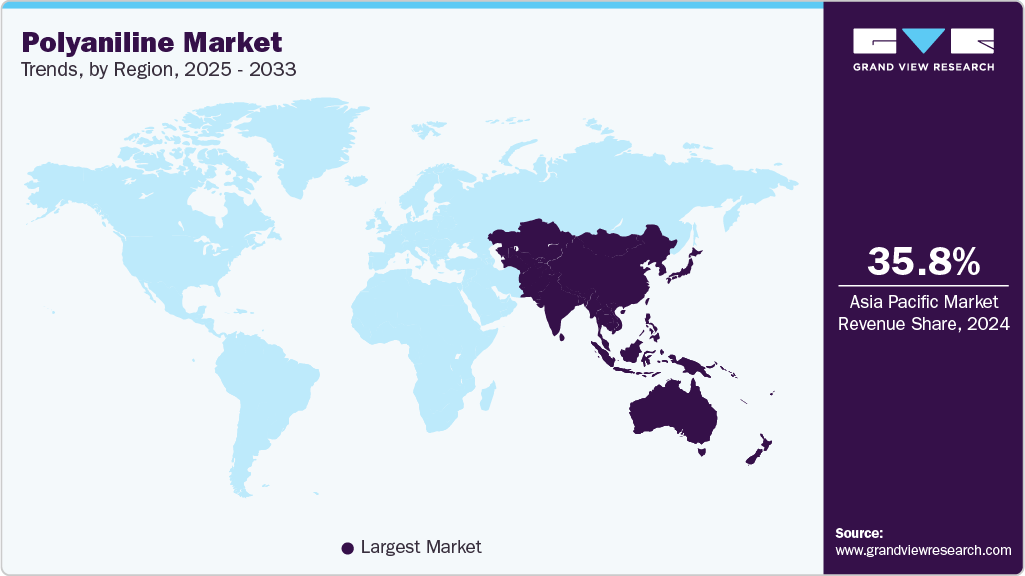

- Asia Pacific dominated the Polyaniline (PANI) market with the largest revenue share of 35.76% in 2024.

- The Polyaniline (PANI) market in China is expected to grow at a substantial CAGR of 6.7% from 2025 to 2033.

- By form, the solution segment is expected to grow at a considerable CAGR of 6.1% from 2025 to 2033 in terms of revenue.

- By end use, the energy storage segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1.37 Billion

- 2033 Projected Market Size: USD 2.25 Billion

- CAGR (2025-2033): 5.7%

- Asia Pacific: largest market in 2024

Increasing investments in renewable energy and electric mobility are further boosting demand for advanced conductive polymers such as polyaniline.

Commercialization of engineered PANI composites and functional inks is redefining how polyaniline is adopted across sectors. Over the last 24 months R&D has shifted from neat PANI powders toward hybrid formulations (PANI combined with carbon, MXene, or nanofibers) and printable ink chemistries that enable flexible EMI shielding, printed sensors and patternable energy-storage electrodes. This productization trajectory is enabling thinner, lighter and mechanically robust conductive layers that meet electronics manufacturing tolerances and scale more readily into end-use assemblies.

Drivers, Opportunities & Restraints

Durable, multi-functional coatings and EMI/ESD protection needs are driving near-term demand for PANI. Industries with dense electronics and corrosion exposure-automotive electronics, industrial controls and telecom infrastructure-are adopting PANI-based antistatic and anticorrosion coatings because they deliver conductivity plus chemical stability in a single material system, reducing the need for multi-layer solutions and lowering life-cycle maintenance costs. This application pull, reinforced by rising electronics content per vehicle and stricter asset-protection requirements, underpins steady market uptake.

The clearest commercial upside lies in differentiated, value-added integrations: inkjet-printable PANI for wearable and flexible sensors, PANI-MXene/carbon hybrids for high-efficiency EMI shielding, and engineered electrodes for fast-charge supercapacitors. These adjacencies allow suppliers to move from commodity resin sales into formulation services, co-development agreements with OEMs, and licensing of application-specific chemistries-higher-margin routes that expand addressable markets in consumer electronics, grid storage balancing and industrial IoT. Regional R&D clusters in APAC and North America make strategic partnerships and pilot scale-ups realistic near-term plays.

Commercial scaling is constrained by feedstock and process variability, long-term stability issues in electrochemical cycling, and tightening regulatory scrutiny of solvent and dopant chemistries. PANI’s electrical performance and shelf life are sensitive to synthesis route, doping level and morphology, which raises quality control costs for manufacturers and complicates qualification for safety-critical applications. Competing materials (PEDOT derivatives, graphene and metal-based films) also pressure pricing and adoption where lifecycle reliability or simpler processing outweighs PANI’s material advantages.

Market Concentration & Characteristics

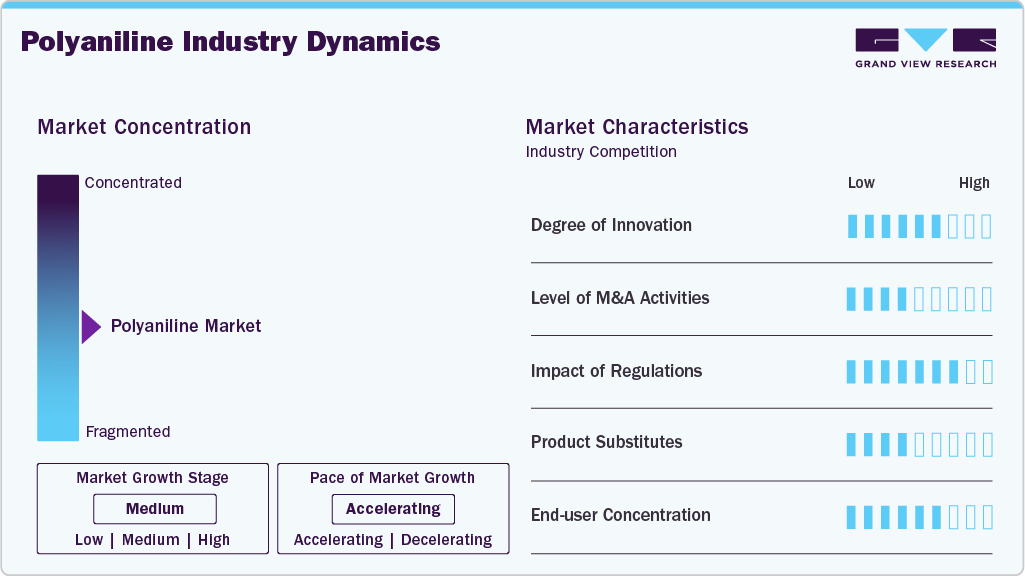

The market growth stage of the Polyaniline (PANI) Market is medium, and the pace is accelerating. The market exhibits slight fragmentation, with key players dominating the industry landscape. Major companies like Thermo Fisher Scientific, Sigma-Aldrich, Shanghai Daken Advanced Materials, Idemitsu, Ormecon, Wuhan Fortuna Chemical, Nath Titanates, Jigs Chemical, Jiangsu King Road New Materials, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

The current innovation trajectory of polyaniline (PANI) is shifting from fundamental material chemistry toward integrated, application-driven engineering. Developers are embedding PANI into functional platforms such as inkjet-printable dispersions, MXene- and graphene-reinforced nanocomposites, and 3D-printable structures designed for industrial scalability and device compatibility. This system-level approach enhances processability, durability, and electrochemical stability, bridging the gap between laboratory research and OEM-grade deployment. PANI is transitioning from a specialty conductive polymer into a commercially viable solution for next-generation sensors, EMI shielding, and printed energy systems, supported by an expanding body of research on hybrid and printable PANI architecture that enable real-world manufacturing integration.

In commercial settings where performance, reliability, and manufacturability determine material selection, polyaniline (PANI) competes under growing substitution pressure from PEDOT: PSS, graphene-based composites, and metal or metal-oxide coatings. Each alternative offers a distinct value proposition: PEDOT: PSS delivers higher intrinsic conductivity and device-grade transconductance in thin-film circuits; graphene and related carbon nanomaterials provide mechanical robustness and cycling stability for electrodes; and metal films retain dominance in applications demanding maximum conductivity and proven qualification.

As a result, PANI suppliers differentiate through cost efficiency, tunable pseudocapacitive behavior, and adaptability to printable, flexible, and hybrid processing routes, positioning the polymer for niche growth in scalable energy, sensing, and EMI applications rather than direct conductivity-based competition.

Form Insights

Powder dominated the Polyaniline (PANI) Market across the form segmentation in terms of revenue, accounting for a market share of 49.50% in 2024. Manufacturers of high-performance composites and engineering plastics are increasingly demanding dry, high-purity polyaniline powders that can be metered into melt compounding and masterbatch lines. Powder PANI enables tighter control of morphology and doping during downstream processing, which is critical when formulators target consistent electrical percolation in thick-section parts or when PANI is compounded with thermoplastics for structural EMI shielding and anticorrosion layers.

The solution segment is anticipated to grow at the fastest CAGR of 6.1% through the forecast period. The surge in demand for printable conductive dispersions is shifting customer preference toward polyaniline supplied as stable solutions and waterborne dispersions that are ready for inkjet, slot die and spray processes. Solution PANI reduces formulation development time for electronics and smart textile manufacturers because it arrives pre-dispersed at controlled particle size and conductivity, which directly lowers pilot run risk and speeds scale up to roll-to-roll production.

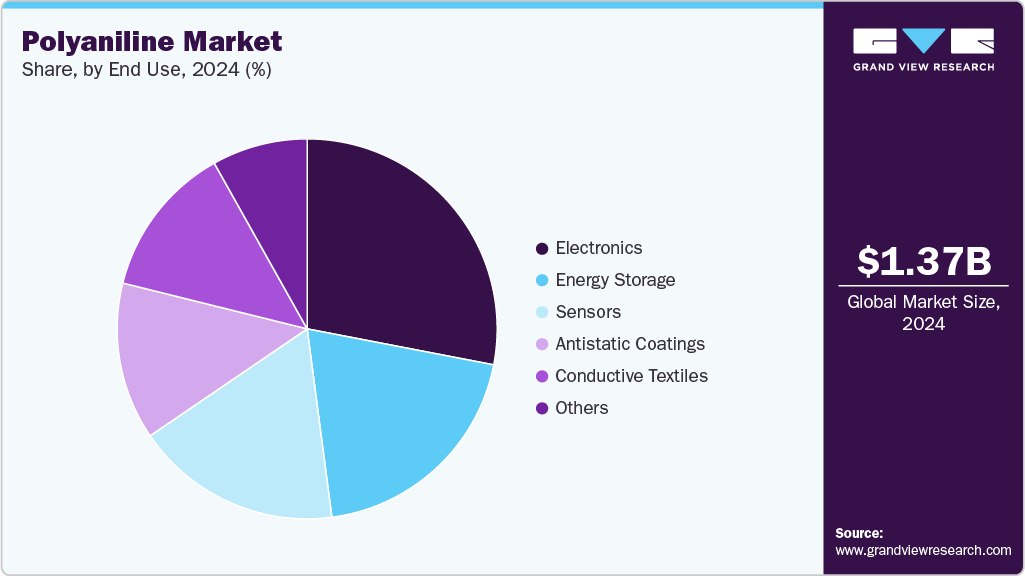

End Use Insights

Electronics dominated the Polyaniline (PANI) Market across the end use segmentation in terms of revenue, accounting for a market share of 28.03% in 2024. End users in electronics are prioritizing materials that deliver reliable electromagnetic interference attenuation while meeting light weighting and flexibility targets; polyaniline composites and coatings answer that brief by enabling thin, conformal conductive layers on polymer substrates. Demand is driven by higher electronics content per device, proliferation of 5G infrastructure and the growth of wearable form factors that require nonmetallic shielding solutions. As a result, OEM qualification efforts are favoring PANI systems that demonstrate consistent sheet resistance and environmental stability in accelerated aging tests.

The energy storage segment is expected to expand at a substantial CAGR of 6.2% through the forecast period. The energy storage segment is adopting polyaniline because its pseudocapacitive charge storage can be combined with carbonaceous scaffolds to substantially raise power and cycle efficiency in supercapacitors and hybrid capacitors. Recent advances in PANI-MXene and PANI-graphene composites show improved rate capability and structural stability, which makes PANI attractive for applications that need fast charge acceptance such as regenerative braking and grid balancing. Developers and system integrators view these composite electrodes as a practical route to higher energy density without abandoning the manufacturing advantages of carbon-based architectures.

Regional Insights

Asia Pacific held the largest share of 35.76% in terms of revenue of the Polyaniline (PANI) Market in 2024 and is expected to grow at the fastest CAGR of 6.4% over the forecast period. Asia Pacific demand is being driven by fast-growing consumer electronics manufacturing, large-scale 5G deployments and a dense network of speciality chemical producers able to commercialize novel PANI blends. Manufacturers in the region prefer ready-to-use dispersions and masterbatches that accelerate roll-to-roll and injection-moulded production, enabling rapid design wins across wearables, thin-film sensors and domestic EV supply chains. Strong private investment in materials research and accessible pilot-scale capacity make APAC the primary scale-up corridor for higher-volume PANI offerings.

China’s market dynamics reflect a dual push from domestic electronics OEMs demanding low-cost printable conductors and from rapid deployment of energy storage and grid balancing projects that require high-power capacitive electrodes. Local chemical manufacturers are vertically integrating synthesis and dispersion capabilities, lowering unit costs and shortening qualification cycles for OEMs. Policy support for electrification and large production clusters for batteries and telecom gear create high-volume demand pockets where cost-competitive PANI composites can win specification alongside carbon and metal-based alternatives.

North America Polyaniline Market Trends

Commercial demand in North America is being pulled by a convergence of advanced electronics manufacturing and strong R&D investment into application-ready conductive polymers. Tier one automotive suppliers and defence contractors are qualifying polymeric EMI shielding and anticorrosion coatings that reduce weight and simplify assembly, creating design-in opportunities for PANI formulations that meet military and automotive specification regimes. Venture and government funding for flexible electronics and printed sensors is accelerating pilot production and supplier scale-up across the region.

U.S. Polyaniline Market Trends

In the U.S. the polyaniline market benefits from structural policy tailwinds and sector programs that favor domestic advanced materials for electrification and telecom. Incentives and manufacturing emphasis under recent industrial policy are increasing local sourcing for EV components, power electronics and 5G infrastructure where lightweight conductive solutions are required, boosting adoption of PANI-based conductive dispersions and coatings. Large OEM qualification projects and fast-moving pilot lines are shortening time to revenue for suppliers with compliant, production-ready chemistries.

Europe Polyaniline Market Trends

Regulatory stringency and sustainability requirements in Europe are reshaping demand toward low-VOC, waterborne and recyclable conductive materials, positioning PANI as an attractive option when chemistry and processing can meet REACH compliance. Automotive electrification and robust electronics standards mean buyers prize materials that demonstrate long-term environmental and thermal stability in accelerated aging tests, creating premium opportunity for certified PANI systems. At the same time, compliance costs are prompting suppliers to offer value-added formulation and testing services to speed OEM approvals.

Key Polyaniline Market Company Insights

The Polyaniline (PANI) Market is highly competitive, with several key players dominating the landscape. Major companies include Thermo Fisher Scientific, Sigma-Aldrich, Shanghai Daken Advanced Materials, Idemitsu, Ormecon, Wuhan Fortuna Chemical, Nath Titanates, Jigs Chemical, and Jiangsu King Road New Materials. The Polyaniline (PANI) Market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Polyaniline Market Companies:

The following are the leading companies in the polyaniline (PANI) market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- Sigma-Aldrich

- Shanghai Daken Advanced Materials

- Idemitsu

- Ormecon

- Wuhan Fortuna Chemical

- Nath Titanates

- Jigs Chemical

- Jiangsu King Road New Materials

Recent Developments

-

In November 2024, researchers demonstrated a roll-to-roll scalable, all-polymer aqueous sodium-ion battery using polyaniline as symmetric electrodes, showing high energy density and long cycle life. This Nature Communications paper signals a near-term commercialization vector for PANI in flexible energy devices and provides a practical, scaleable processing route that OEMs and battery material suppliers can evaluate for pilot production.

-

In September 2023, a comprehensive review consolidated multiple industry and academic formulations of polyaniline-based inks for inkjet printing of supercapacitors, sensors and electrochromic devices. That review captures the maturation of PANI ink chemistries and documents application-ready formulations, evidence that printed-electronics suppliers and ink manufacturers are productizing PANI dispersions for commercial device prototyping.

Polyaniline Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.44 billion

Revenue forecast in 2033

USD 2.25 billion

Growth rate

CAGR of 5.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Report segmentation

Form, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Thermo Fisher Scientific; Sigma-Aldrich; Shanghai Daken Advanced Materials; Idemitsu; Ormecon; Wuhan Fortuna Chemical; Nath Titanates; Jigs Chemical; Jiangsu King Road New Materials

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyaniline Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global polyaniline (PANI) Market report on the basis of form, end use, and region:

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Powder

-

Solution

-

Film

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Electronics

-

Energy Storage

-

Antistatic Coatings

-

Conductive Textiles

-

Sensors

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polyaniline market size was estimated at USD 1.37 billion in 2024 and is expected to reach USD 1.44 billion in 2025.

b. The global polyaniline market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 2.25 billion by 2033.

b. Powder dominated the polyaniline polyaniline market across the form segmentation in terms of revenue, accounting for a market share of 49.50% in 2024 and is forecasted to grow at 5.6% CAGR from 2025 to 2033.

b. Some key players operating in the polyaniline PANI market include Thermo Fisher Scientific, Sigma-Aldrich, Shanghai Daken Advanced Materials, Idemitsu, Ormecon, Wuhan Fortuna Chemical, Nath Titanates, Jigs Chemical, and Jiangsu King Road New Materials.

b. Growing use of PANI in energy storage devices such as supercapacitors and batteries is driving market growth, as the material offers high conductivity and stable performance for efficient charge storage. Increasing investments in renewable energy and electric mobility are further boosting demand for advanced conductive polymers like polyaniline.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.