- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyaryletherketone Market Size And Share Report, 2030GVR Report cover

![Polyaryletherketone Market Size, Share & Trends Report]()

Polyaryletherketone Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (PEEK, PEK, PEKK), By Application (Automotive, Aerospace, Electrical & Electronics, Medical,), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-2-68038-067-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyaryletherketone Market Size & Trends

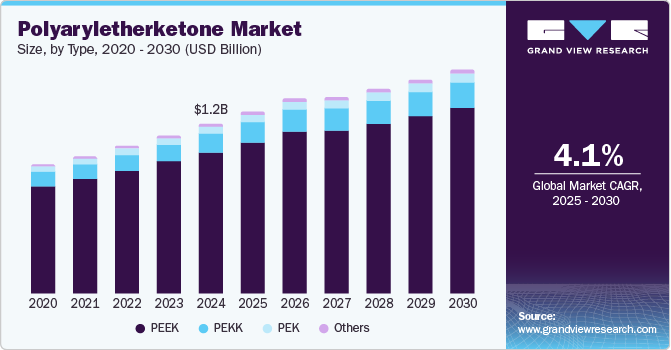

The global polyaryletherketone market size was valued at USD 1.23 billion in 2024 and is expected to grow at a CAGR of 4.1% from 2025 to 2030. Growing demand for solar photovoltaic (PV) modules and increasing utilization in aerospace industry and biomedical applications are some of the key growth driving factors for this market.

Polyaryletherketone (PAEK) is primarily preferred for its strength, wear resistance, temperature tolerance, and chemical resistance. Some of the PEAK variants are also biocompatible, which makes them suitable for applications in medical implants, dental treatments, surgical instruments, and others. Due to its wear resistance, PAEK is also used in bone implants and drug delivery devices.

Polyaryletherketone (PAEK) is used in the aerospace industry to make critical components such as seals, bearings, and other aircraft structural parts. The light weight of materials and capacity to withstand the high temperatures of the material provide unmatched benefits in these applications. The aerospace industry also uses Polyaryletherketone to make thermal acoustic blankets, which are used to control temperature fluctuations and extreme noise levels. It is also used in pipes to protect high voltage cables.

Components continuously exposed to friction and stress are also made with Polyaryletherketone (PAEK) owing to its wear-resistance properties. In the automotive industry, manufacturers utilize Polyaryletherketone (PAEK) to produce engine components as it offers enhanced dimensional stability and resistance to heat. The growth experienced by application industries such as medical implants, automotive, aerospace, and others is expected to generate a surge in demand for Polyaryletherketone (PAEK) during the forecast period.

The growing adoption of Polyetheretherketone (PEEK) by multiple manufacturers associated with mobility manufacturing also adds to the estimated growth of this market. For instance, in July 2024, Hitachi Rail Limited, one of the participants in the railway systems industry, collaborated with Roboze, an organization operating in additive manufacturing related to high-performance materials. The collaboration aims to implement Hitachi’s new 3D printing technology with materials such as Carbon Polyetheretherketone (PEEK) to produce spare parts used in trains.

Type Insights

The PEEK segment dominated the global Polyaryletherketone (PAEK) industry with a revenue share of 83.5% in 2024. This is attributed to the increasing material utilization in medical implants, drug delivery, dental medicine, chemical processing, aerospace, automotive, food processing, etc. Polyaryletherketone (PEAK) possesses properties to survive high temperatures such as 300 to 400 C. Its high strength, wear resistance capacity, and superior thermal stability have resulted in the growing use of the material in multiple industries. The oil and gas industry uses PEEK for pump components, pipeline fittings, valve seals, etc.

The PEKK (Polyetherketoneketone) segment is projected to experience the highest CAGR during the forecast period. This is attributed to increasing industrial and medical applications and compatibility with 3D printing technology. Due to its high-performance properties, components or industrial parts that must withstand extreme temperatures, high pressure, or exposure to corrosive chemicals are often made with PEKK (Polyetherketoneketone).

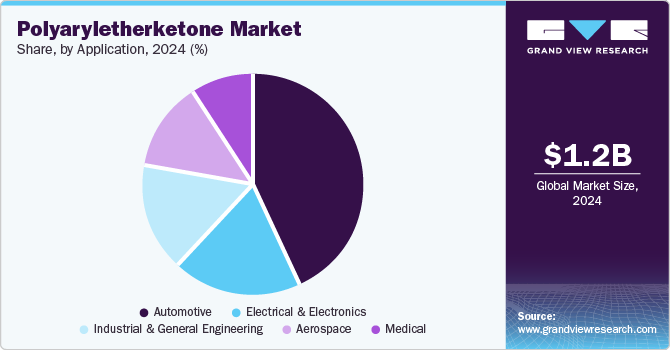

Application Insights

The automotive industry held the largest revenue share of the global Polyaryletherketone (PAEK) industry in 2024. Certain engine components of vehicles continuously experience multiple harsh environments such as heat, pressure, friction, stress, and more during performance. To ensure that engine components withstand such exposures and prevent engine failures, manufacturers utilize materials that offer properties such as chemical resistance, toughness, wear resistance, and others. Polyaryletherketone (PAEK) provides these properties while adding strength to the components. Polyaryletherketone (PAEK) is widely used to make transmission components such as bushings, bearings, gears, seals, etc. It is also utilized in manufacturing braking systems, under-hood components, and suspension components in the automotive industry.

The industrial and general engineering segment is anticipated to experience significant growth during the forecast period. Polyaryletherketone (PAEK) is increasingly used in making seals, compressor rings, valve parts, gears, wire coatings, and other parts in oil drilling systems. It is also included in making chemical pumps. Growing utilization of automotive and industrial manufacturing, rise in transportation applications, and increasing use in the aerospace industry add to the growth experienced by this segment.

Regional Insights

Europe dominated the global Polyaryletherketone (PAEK) industry with a revenue share of 41.8% in 2024. This is attributed to multiple manufacturers operating in medical implants, surgical implants, automotive, aerospace, chemical processing, etc. PAEK is preferred to ensure reduced weight and enhanced performance while replacing metal components. The growth experienced by the electric vehicles industry in the region and the presence of various PAEK manufacturers have been contributing to the development of this market.

Germany Polyaryletherketone (PAEK) Market Trends

Germany held the largest revenue share of the regional industry in 2024. The large number of industrial manufacturing facilities primarily drives this market. Numerous automotive industry participants have manufacturing units in Germany that heavily rely on PAEK to produce engine components, transmission components, and more. The increasing inclusion of the material for various industrial applications is expected to generate a surge in growth during the forecast period.

North America Polyaryletherketone Market Trends

North America held a significant revenue share of the global Polyaryletherketone (PAEK) industry in 2024. This market is primarily driven by aspects such as the growing focus of various automotive manufacturers on incorporating lightweight materials for manufacturing machine components and aerospace industry manufacturers operating in the region. The presence of medical implant makers and surgical instrument manufacturers also contributes to the growth experienced by this market.

The U.S. polyaryletherketone market dominated the regional market in 2024. The strong presence of vehicle manufacturers in the country, multiple manufacturing facilities operating in industries such as medical implants, significant growth experienced by the oil & gas industry, and the presence of aerospace manufacturers in the country add lucrative growth to the market. In recent years, multiple manufacturers have used Polyaryletherketone (PAEK) over other materials due to its beneficial properties.

Asia Pacific Polyaryletherketone Market Trends

The Asia Pacific Polyaryletherketone (PAEK) market is anticipated to experience the highest CAGR from 2025 to 2030. The robust chemical industry primarily drives this market in countries such as China, and the entry of multiple manufacturing organizations in the region for cost-effective material availability and reduced transportation expenses. Favorable regulation scenarios have attracted various regional manufacturers during the last few years. For instance, in March 2024, Autoneum, one of the thermal insulation and vehicle acoustic industry participants and supplier to multiple automotive companies, announced the expansion of its production capacities. The move was initiated by setting up two new plants in India and China. The company supplies lightweight vehicle components, heat protection components, and more.

China polyaryletherketone market held the largest revenue share of the Asia Pacific Polyaryletherketone (PAEK) industry in 2024. This is attributed to the strong chemical and chemical processing industry in the country. China is also home to multiple electric vehicle manufacturers and industrial engineering and manufacturing industry participants. This has increased the demand for Polyaryletherketone (PAEK) in the country.

Key Polyaryletherketone Company Insights

Some of the key companies operating in global Polyaryletherketone (PAEK) industry include Victrex plc, Solvay, Evonik, Arkema, Ensinger, SABIC and others. Increasing demand driven by the automotive and aerospace industry has stimulated significant changes in the industry competition. Multiple companies operating in the business have embraced strategies such as enhanced portfolios, capacity enhancements, geographical expansions, etc.

-

Victrex plc specializes in PEEK-polyetheretherketone-and other high-performance polymer solutions. The company offers a range of solutions designed for industries such as aerospace, automotive, energy, medical, and others. It provides integrated solutions related to parts and polymers.

-

Evonik is a specialty chemicals company that provides various solutions associated with additive manufacturing, adhesives and sealants, aerospace, agriculture, animal nutrition, automotive, batteries, catalysts, and more. While implementing its strategies regarding its specialty chemical portfolio, the company also focuses on delivering sustainability and next-generation solutions.

Key Polyaryletherketone Companies:

The following are the leading companies in the polyaryletherketone market. These companies collectively hold the largest market share and dictate industry trends.

- Victrex plc

- Solvay

- Evonik

- Arkema

- Ensinger

- SABIC

- Mitsubishi Chemical Corporation

- Panjin Zhongrun High Performance Polymers Co., Ltd.

- Jilin Zhongyan High Performance Plastic Co., Ltd.

- Caledonian Industries Ltd.

- Darter Plastics Inc.

- RTP Company

- AKRO-PLASTIC GmbH

- Sinochem International Corporation

- PlastiComp, Inc.(Avient Corporation)

Recent Developments

-

In November 2024, AvientCorporation, one of the market participants in the global sustainable materials services and solutions industry, launched Colorant Chromatics Transcend. Newly developed biocompatible PEEK compounds and colorants were launched at the B2B medical technology trade fair, MEDICA 2024.

-

In April 2024, 3D Systems, Inc., an additive manufacturing solutions supplier, announced receiving Food and Drug Administration (FDA) 510(k) clearance for the VSP PEEK Cranial Implant. This newly designed offering comprises a patient-specific cranial implant that features Evonik VESTAKEEP i4 3DF Polyetheretherketone (PEEK). This is expected to strengthen both companies' positions in the PEEK industry for medical implants.

Polyaryletherketone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.32 billion

Revenue forecast in 2030

USD 1.62 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, China, India, Japan, Australia, South Korea Brazil, UAE, Saudi Arabia

Key companies profiled

Victrex plc; Solvay; Evonik; Arkema; Ensinger; SABIC; Mitsubishi Chemical Corporation; Panjin Zhongrun High Performance Polymers Co., Ltd.; Jilin Zhongyan High Performance Plastic Co., Ltd.; Caledonian Industries Ltd.; Darter Plastics Inc.; RTP Company; AKRO-PLASTIC GmbH; Sinochem International Corporation; PlastiComp, Inc.(Avient Corporation)

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyaryletherketone Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global polyaryletherketone market report based on type, application, and region.

-

Type Outlook ((Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

PEEK

-

PEK

-

PEKK

-

Others

-

-

Application Outlook ((Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Industrial and General Engineering

-

Aerospace

-

Electrical & Electronics

-

Medical

-

-

Regional Outlook ((Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.