- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Polymer Foam Market Size, Share & Trends Report, 2030GVR Report cover

![Polymer Foam Market Size, Share & Trends Report]()

Polymer Foam Market Size, Share & Trends Analysis Report By Type (PC, PC/ABS, PET, PS, PP, ABS), By Application (Packaging, Building & Construction, Furniture & Bedding, Automotive, Rail), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-932-6

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Polymer Foam Market Size & Trends

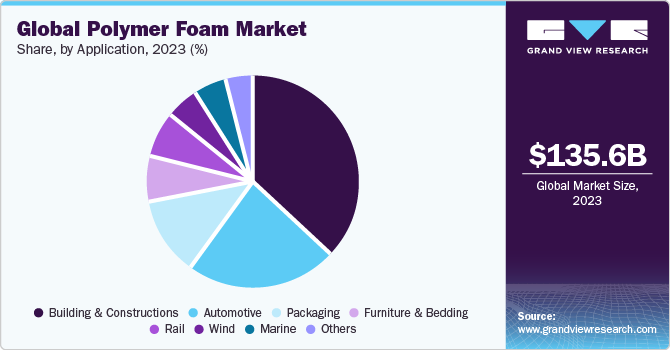

The global polymer foam market size was valued at USD 135.56 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 23.9% from 2024 to 2030. Growing uses in numerous industries, such as packaging, furniture and bedding, and automotive, are likely to fuel polymer foam demand. Polymer foams are exceedingly lightweight and adaptable, as well as being extremely durable, mildew resistant, and dermatologically friendly. These characteristics make them suitable for a wide range of consumer applications. Building and construction, automotive, and marine industries all employ polyurethane-based foams.

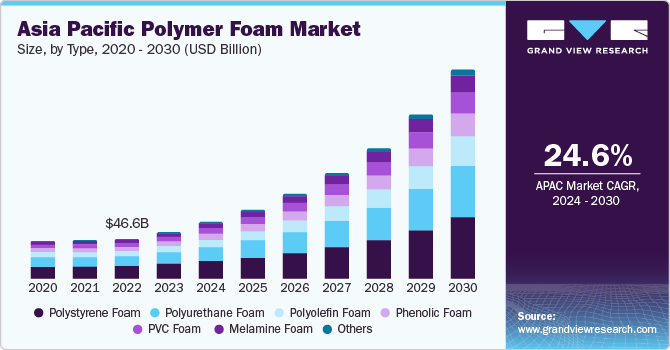

Asia Pacific polymer foam market is characterized by various manufacturing industry, as a result of the increased emphasis on research and development, combined with favorable government initiatives to attract investments, is likely to result in regional market expansion. Growing industrialization, production of vehicle interiors or parts, and packaging sectors in emerging economies like as India and China are expected to drive demand throughout the forecast period. Rising foreign direct investment is predicted to add to investments in these areas.

Moreover, the increase in investments in building & construction, automotive, rail, and wind energy projects is expected to propel the market growth over the forecast period. Growing industrialization, increasing production of automobile interiors or parts, and booming packaging industry in emerging economies such as India and China are some of the factors expected to augment the demand for polymer foam in the region. Increase in foreign direct investment is expected to contribute toward rising investments in these sectors and will eventually be a major growth determining factor for the market.

Furthermore, growing demand for polymer foam is expected to result in growth in building & construction, automobile, and packaging industries. Asia Pacific has also witnessed a significant rise in the number of patents filed for producing polymer foam-based products over the past couple of years, which is likely to be a positive outlook for the market over the next few years.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The polymer foam market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in the production of polymer foams, the availability of raw materials, and increasing plastics consumptions across several applications including packaging, building & construction, automotive, among others. Subsequently, innovative recycled plastics applications are constantly emerging, disrupting existing industries and creating new ones.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new production technologies and talent, need to consolidate in a rapidly growing market, and increasing strategic initiatives of polymer foam.

The polymer foam industry is also subjected to increasing regulatory scrutiny. The global market of polymer foam is subject to numerous regulations, guidelines, and restrictions regarding polymer production and its applications owing to the toxic nature of raw materials such as isocyanates, coupled with certain health hazards of improperly disposed products and over-exposure to chemicals contained in these foams.

There are a limited number of direct product substitutes for polymer foams. However, there are a number of technologies that can be used to achieve sustainable outcomes to polymer foam, such as Natural and Bio-based Foams, Fiberglass. These substitutes can be used certain applications, but they typically do not offer the same level of performance or flexibility as polymer foam

End-user concentration is a significant factor in the market. Since there are a number of end-user industries that are driving demand for post-consumer recycled plastics. The concentration of demand in a small number of end-user industries creates opportunities for companies that focus on developing polymer foamsolutions for the consumer electronic industry. However, it also creates challenges for companies that are trying to compete in a crowded market.

Type Insights

Polystyrene (PS) sector dominated the market and accounted for a share of 88.20%in 2023. The material is utilized in a variety of applications such as furniture, cushions, and carpets. Owing to its unique characteristics, such as lightweight, low heat and sound transfer, high energy dissipation, and insulation, it has a large client base. Increasing demand for residential and commercial space in Southeast Asian countries such as Singapore, Korea, and Indonesia is expected to drive type demand in construction applications even further.

Expanded polystyrene foam is one of the lightest materials, and due to its excellent strength-to-weight ratio, it is utilized in packing applications to save fuel and money on transportation. It can also be used in rail applications such as train station platform extensions and rail embankment buildings. Over the projected period, rail infrastructure construction projects in Asia Pacific, the Middle East, and Africa are expected to stimulate demand for polystyrene foam.

Application Insights

The building & construction segment dominated the market in 2023Owing to the increasing use of polymer foam for insulation, flooring, piping, molding, and wire & cables. These foams enhance the architecture and aesthetics of both residential and commercial structures. In domestic applications, sprayed polyurethane foams act as waterproofing sealants, filling gaps and seams. Growing applications such as carpet padding, fibers, chair cushions, mattress padding, and furniture are likely to drive expansion in the furniture and bedding market.

The automotive application is projected to grow at a significant CAGR over the forecast period on account of the rising product use in various vehicle components, such as seats, dashboards, power trains, and suspension bushings. The revival of the automobile industry in the United States, together with rising automotive demand in the emerging countries of India and China, is predicted to boost global market growth.

Packaging application segment is also anticipated to witness substantial upsurge in adoption of polymer foam.Foams are commonly utilized in packaging applications such as food containers, trash dishes, egg cartons, fast food, and others. Increasing transportation operations, combined with rising packaged food demand, are predicted to drive demand for these foams in packaging applications.

Regional Insights

Asia Pacific dominated the market and accounted for a 40.24% share in 2023. This is due to causes such as fast urbanization, increased construction activity, and rising consumer goods and packaging demand in nations such as China, India, and Japan. The growing middle-class population has increased consumer goods consumption as well as the need for effective packaging solutions, boosting demand for polymer foams. Furthermore, certain nations in the region have created favorable government regulations and incentives to boost enterprises that use lightweight and environmentally friendly materials such as polymer foams. The region also has a strong polymer foam manufacturing base, which promotes its growth in a variety of end-use sectors.

North America is anticipated to witness significant growth in the market. The region has a significant automobile manufacturing sector. Furthermore, the growth of e-commerce and the retail sector stimulate need for effective packaging solutions. Because of their cushioning and shock-absorbing qualities, polymer foams are widely utilized in protective packaging to meet the needs of shipping and logistics.

Key Companies & Market Share Insights

Some of the key players operating in the market include BASF SE and Arkema Group

-

BASF SE is engaged in the production of a broad range of plastic products such as performance polymers, plastic additives, and polyamides & intermediates, which find use in automotive & transportation, construction, electrical & electronics, and consumer goods industries. It offers post-consumer recycled resins through its plastics & rubber segment.

-

Arkema Group is engaged in the manufacturing of specialty chemicals and advanced materials. It operates through three business segments, namely Coating Solutions, Industrial Specialties, and High-Performance Materials. The company’s product portfolio includes specialty adhesives, specialty polyamides, fluoropolymers, fluorochemicals, polymethyl methacrylate (PMMA), hydrogen peroxides, acrylics, coating resins, and plastic additives.

Fritz Nauer AG and Zotefoams plc are some of the emerging market participants in the polymer foam market.

-

Fritz Nauer AG is a business unit of chemical specialties segment of Conzzeta and is headquartered in Wolfhausen, Switzerland. It is a manufacturer of foam materials and offers a diverse product portfolio of over 200 types of foam based on polyurethane foam technology.

-

Zotefoams plc is engaged in the manufacturing of cellular materials and lightweight, cross-linked polyolefin block foams that are used in various applications in marine, automotive, aerospace, construction, industrial machinery, and medical industries.

Key Polymer Foam Companies:

- Arkema Group

- Armacell International S.A.

- BASF SE

- Borealis AG

- Fritz Nauer AG

- Koepp Schaum GmbH

- JSP Corporation

- Polymer Technologies, Inc.

- Recticel NV

- Rogers Corporation

- SEKISUI ALVEO AG

- Synthos S.A.

- DowDuPont, Inc.

- Trelleborg AB

- Zotefoams plc

- Woodbridge Foam Corporation

- Sealed Air Corporation

Recent Developments:

-

In December 2023, BASF introduced Irgastab® PUR 71, a cutting-edge antioxidant that improves regulatory compliance and performance in polyols and polyurethane foams. This premium solution has been designed without aromatic amine, successfully addressing the limits of traditional anti-scorch additives. With its excellent environmental, health, and safety profile, this solution fulfills the industry's increasing regulatory requirements on substance classification and sustainability.

-

In September 2023, Covestro and the Selena Group of Poland collaborated to develop a more sustainable variety of polyurethane (PU) foams for improving building thermal insulation. The material is ISSC Plus certified to contain plant-based feedstocks via the mass balancing approach, resulting in a 60% carbon footprint reduction when compared to fossil-derived competitors.

-

In November 2022, Huntsman released Acoustiflex VEF BIO, a visco-elastic foam generated from vegetable oils with up to 20% bio-based content for moulded acoustic applications in the automobile industry. When compared to existing Huntsman systems, this innovative technology can lower the carbon footprint of automobile carpet back-foaming by up to 25%.

Polymer Foam Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 162.90 billion

Revenue forecast in 2030

USD 588.99 billion

Growth rate

CAGR of 23.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; China; India; Japan; South Korea; Singapore, Indonesia; Brazil

Key companies profiled

Arkema Group; Armacell International S.A; BASF SE; Borealis AG; Fritz Nauer AG; Koepp Schaum GmbH; JSP Corporation; Polymer Technologies; Inc.; Recticel NV; Rogers Corporation; SEKISUI ALVEO AG; Synthos S.A.; DowDuPont; Inc; Trelleborg AB; Zotefoams plc; Woodbridge Foam Corporation; Sealed Air Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polymer Foam Market Report Segmentation

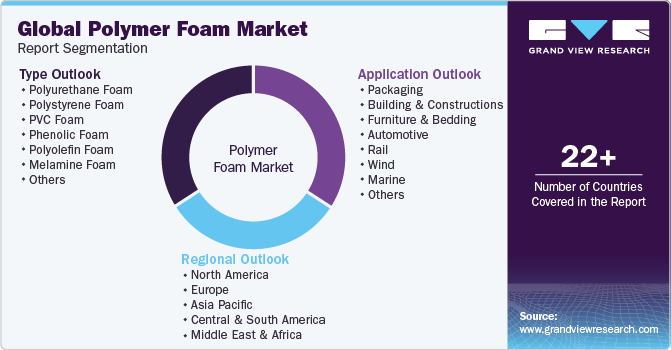

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global polymer foam market report based on type, application, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2033)

-

Polyurethane Foam

-

Polystyrene Foam

-

PVC Foam

-

Phenolic Foam

-

Polyolefin Foam

-

Melamine Foam

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2033)

-

Packaging

-

Building & Constructions

-

Furniture & Bedding

-

Automotive

-

Rail

-

Wind

-

Marine

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Indonesia

-

-

Central & South America (MEA)

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global polymer foam market size was estimated at USD 135.56 billion in 2023 and is expected to reach USD 162.90 billion in 2024.

b. The global polymer foam market is expected to grow at a compound annual growth rate of 23.9% from 2024 to 2030 to reach USD 588.99 billion by 2030.

b. The Asia Pacific dominated the polymer foam market with a share of over 40% in 2023. Growing industrialization, increasing production of automobile interiors or parts, and booming packaging industry in emerging economies such as India and China are some of the factors expected to augment the demand for polymer foam in the region.

b. Some of the key players operating in the polymer foam market include Arkema Group, Armacell International S.A, BASF SE, Borealis AG, Fritz Nauer AG, Koepp Schaum GmbH, JSP Corporation, Polymer Technologies, Inc., Recticel NV, Rogers Corporation, SEKISUI ALVEO AG, Synthos S.A., DowDuPont, Inc, Trelleborg AB, Zotefoams plc, Woodbridge Foam Corporation, Sealed Air Corporation.

b. Key factors driving the polymer foam market growth include increasing demand from the automotive industry, an increase in building & construction activities, an increase in rail infrastructure, and an increase in wind turbine installations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."