- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Polyurethane Coatings Market Size, Industry Report, 2030GVR Report cover

![Polyurethane Coatings Market Size, Share & Trends Report]()

Polyurethane Coatings Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology, By End-use (Automotive, Transportation, Construction, Electrical & Electronics, Wood Furniture), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-517-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyurethane Coatings Market Summary

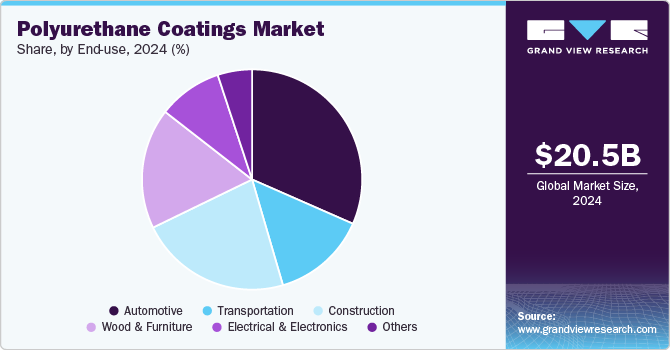

The global polyurethane coatings market size was estimated at USD 20.53 billion in 2024 and is projected to reach USD 28.16 billion by 2030, growing at a CAGR of 5.5% from 2025 to 2030. This growth is attributed to the expansion of the transportation sector, especially in automotive and aerospace, and is fueling market growth.

Key Market Trends & Insights

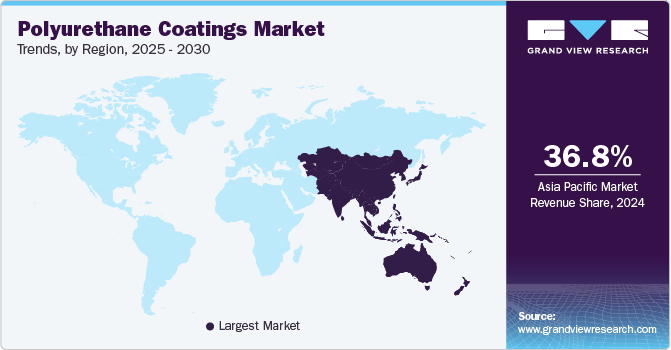

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- In terms of technology, The solvent-borne segment accounted for the largest revenue share of 63.8%, in 2024.

- In terms of end use, The automotive segment dominated the polyurethane coatings industry with a market share of 32.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20.53 Billion

- 2030 Projected Market Size: USD 28.16 Billion

- CAGR (2025 - 2030): 5.5%

- Asia Pacific: Largest market in 2024

The increasing preference for eco-friendly waterborne polyurethane coatings is another reason for the growth of the market. The increasing use of polyurethane coatings in the automotive and transportation sectors drives market growth. These coatings serve as automobile primers, intermediate coats, and finishing paints. Rapid industrialization and urbanization are further contributing to the expansion of the polyurethane coatings industry.

The need for low-VOC alternatives and reduced solvent exposure has driven the development of waterborne polyurethane systems. Modern PUD technology is stable and user-friendly, exhibiting properties approaching those of solvent-based systems without the environmental and health costs. Polyurethane coatings formulated with aliphatic structures exhibit high resistance to ultraviolet (UV) rays, preventing issues like fading, yellowing, or deterioration caused by UV exposure over time. Polyurethane coatings act as excellent waterproofing materials and offer resistance to various chemicals, making them durable in industrial environments and in areas where hygiene is important.

Drivers, Opportunities & Restraints

Polyurethane (PU) coatings are widely used across industries due to their exceptional durability, chemical resistance, and flexibility. They provide strong protection against abrasion, moisture, and UV radiation, making them ideal for applications in automotive, construction, furniture, and industrial equipment. PU coatings also offer excellent adhesion to various substrates, including metal, wood, and concrete, enhancing surface longevity. Their fast-curing properties and availability in both solvent-based and water-based formulations contribute to their growing demand. Additionally, advancements in eco-friendly, low-VOC polyurethane coatings are further driving their adoption in compliance with stringent environmental regulations.

The polyurethane (PU) coatings market faces challenges due to volatile raw material prices, primarily driven by fluctuations in the cost of key ingredients like isocyanates, polyols, and additives. These materials are derived from petrochemicals, making their prices highly sensitive to crude oil price variations, supply chain disruptions, and geopolitical factors. Additionally, increasing regulatory restrictions on certain isocyanates and VOC emissions have impacted production costs. Demand-supply imbalances and inflationary pressures further contribute to cost fluctuations, affecting manufacturers' profit margins. To mitigate these challenges, industry players are investing in bio-based alternatives and improving supply chain efficiency.

The polyurethane (PU) coatings industry faces several challenges, including volatile raw material prices driven by fluctuations in crude oil and petrochemical supply chains. Stringent environmental regulations on VOC emissions and hazardous isocyanates have increased compliance costs and pushed demand for eco-friendly alternatives. Additionally, competition from other advanced coatings, such as acrylic and epoxy-based formulations, poses market constraints. Supply chain disruptions and rising production costs further impact manufacturers, prompting a shift toward sustainable and bio-based PU coatings.

Technology Insights

The solvent-borne segment accounted for the largest revenue share of 63.8%, in 2024 and is expected to continue to dominate the industry over the forecast period. Solvent-borne polyurethane (PU) coatings use organic solvents as carriers, offering excellent durability, chemical resistance, and fast curing properties. These coatings provide superior adhesion and protection against moisture, abrasion, and UV exposure, making them ideal for industrial, automotive, and wood finishing applications.

Water-borne polyurethane (PU) coatings use water as the primary solvent, reducing volatile organic compound (VOC) emissions and making them an environmentally friendly alternative to solvent-borne coatings. They offer excellent durability, flexibility, and chemical resistance, making them ideal for applications in automotive, construction, and furniture industries. With increasing regulatory pressure on VOC limits, the demand for water-borne PU coatings is growing, driving innovation in high-performance, low-emission formulations.

End-use Insights

The automotive segment dominated the polyurethane coatings industry with a market share of 32.1% in 2024, during the forecast period. Polyurethane (PU) coatings are widely used for vehicle exteriors, interiors, and under-the-hood components due to their excellent durability, abrasion resistance, and weather protection. These coatings enhance vehicle aesthetics with superior gloss and color retention while providing protection against corrosion, chemicals, and UV exposure.

Polyurethane (PU) coatings are widely used in the wood and furniture industry for their exceptional durability, scratch resistance, and aesthetic appeal. They enhance the longevity of wooden surfaces by providing protection against moisture, stains, and UV exposure, making them ideal for flooring, cabinetry, and high-end furniture. With increasing demand for eco-friendly solutions, water-based PU coatings are gaining popularity as a low-VOC alternative to traditional solvent-based formulations.

Regional Insights

The North America polyurethane coatings industry is experiencing growth, due to the rise in construction activity, increasing automotive production, and demand for polyurethane coating products.

U.S. Polyurethane Coatings Market Trends

In U.S. market is expected to grow during the forecast period. This growth is attributed to the increasing automobile production, general industry, construction, and oil & gas industries this is expected to positively impact polyurethane coatings market.

Europe Polyurethane Coatings Market Trends

Europe's polyurethane coatings industry is expected to grow over the forecast period. This growth can be attributed to the increasing product demand from various end use industries such as the general industry, power generation, aerospace, and automotive and vehicle refinishing. The regional market is also expected to grow due to the increasing automobile production, construction activity, and the growing aerospace sector.

Asia Pacific Polyurethane Coatings Market Trends

Asia Pacific is dominant in the polyurethane coatings industry. The rapid industrialization in the region is anticipated to increase the demand for polyurethane coatings. Asia Pacific region is expected to be driven by increasing urbanization and growing product consumption from the automotive and vehicle refinish sectors in countries such as India, Japan, and South Korea.

The Chinapolyurethane coatings market is expected to witness growth during the forecast period. This growth is attributed to the increasing construction activity in the region and led to increased demand for product in the region.

Latin America Polyurethane Coatings Market Trends

The Latin America polyurethane coatings industry is expected to witness steady growth over the forecast period. The rising product demand from the general, automotive, aerospace, and marine industries is anticipated to positively influence market growth in the region. The presence of automotive production plants and oil & gas-producing countries in the region, including Brazil, Colombia, and Venezuela, is also projected to fuel the demand for polyurethane coatings in the region.

Middle East & Africa Polyurethane Coatings Market Trends

The polyurethane coatings industry in Middle East and Africa is expected to witness steady growth over the forecast period due to increasing oil production in the region. The region is the global leader in terms of oil production. The presence of major oil-producing countries such as Saudi Arabia, Kuwait, Oman, Bahrain, Libya, Iraq, Angola, and Iran in the Middle East & Africa is expected to create high demand for polyurethane coatings in the region

Key Polyurethane Coatings Company Insights

Some of the key players operating in the polyurethane coatings market include BASF SE and PPG Industries Inc.

-

Kuraray Co., Ltd. produces and sells activated carbon, along with other technologies. Its technologies are categorized under plastics & polymers, fibers & textiles, chemicals/elastomers & rubber, new businesses, engineering, and medical & environment related categories. The company also has a research and development department, which comprises two research and development centers in Kurashiki and Tsukuba. The company has a significant global presence with offices in countries such as the U.S., Germany, Belgium, China, Korea, Hong Kong, and India.

-

Osaka Gas Chemicals Co., Ltd. is a Japan-based company, which operates through two major business segments, namely, advanced material solutions and absorption & separation solutions. The technologies of the company are categorized as fine chemical materials, surface processing, resin additives, wood preservatives, industrial preservatives, and activated carbon and its technologies. Activated carbon technologies of Osaka Gas Chemicals Co., Ltd. are marketed under the brand, Shirasagi. The company has a technology development center and a distribution center in Osaka, Japan. In addition, it also has a technology center in Nara, Japan.

Key Polyurethane Coatings Companies:

The following are the leading companies in the polyurethane coatings market. These companies collectively hold the largest market share and dictate industry trends.

- Akzo Nobel N.V.

- Valspar Corporation

- Axalta Coating Systems

- BASF SE

- Jotun

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Willams Company

- Valspar Corporation

- Donau Carbon GmbH

Recent Developments

-

In October 2023, SKC sold its 100% stake in SK pucore, a polyurethane manufacturer, to Glenwood Private Equity, a private equity firm based in Seoul. The sales of USD 304.1 million are part of SKC's strategy to streamline its portfolio, focusing on semiconductor and electric vehicle (EV) battery materials.

-

In August 2023, Covestro started production of polyurethane elastomer systems at its new plant in Shanghai. The investment amounts to tens of millions of Euros and is part of recent investments in elastomer raw materials, including facilities in Spain and Thailand.

Polyurethane Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.59 billion

Revenue forecast in 2030

USD 28.16 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Akzo Nobel N.V.; Donau Carbon GmbH; Axalta Coating Systems; BASF SE; Jotun; PPG Industries Inc.; RPM International Inc.; The Sherwin-Willams Company; Valspar Corporation; Donau Carbon GmbH; Oriental International (Pvt) Ltd.; CarboTech.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyurethane Coatings Market Report Segmentation

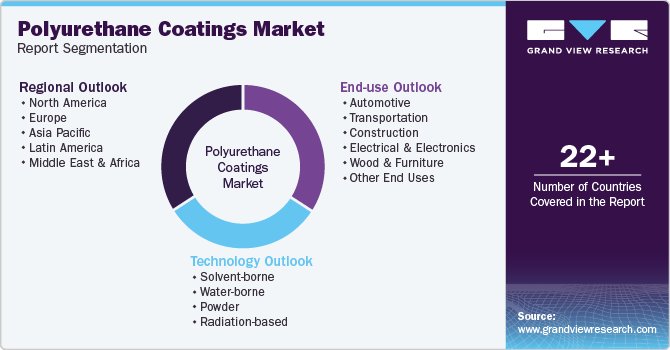

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global polyurethane coatings market report on the basis of technology, end-use, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Solvent-borne

-

Water-borne

-

Powder

-

Radiation-based

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Transportation

-

Construction

-

Electrical & Electronics

-

Wood & Furniture

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polyurethane coatings market size was estimated at USD 20.53 billion in 2024 and is expected to reach USD 21.59 billion in 2025.

b. The global polyurethane coatings market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 28.16 billion in 2030.

b. Asia Pacific dominated the clean label mold inhibitors market in the food & beverages market with a share of 55.3% in 2024. The Asia Pacific region is dominant in the polyurethane coatings market, Rapid industrialization in the region is anticipated to increase the demand for polyurethane coatings market.

b. Some key players operating in the polyurethane market include Akzo Nobel N.V., Donau Carbon GmbH, Axalta Coating Systems, BASF SE, Jotun, PPG Industries Inc., RPM International Inc., The Sherwin-Willams Company, Valspar Corporation, Donau Carbon GmbH, Oriental International (Pvt) Ltd., and CarboTech.

b. This growth is attributed to the expansion of the transportation sector, especially in automotive and aerospace, is fueling market growth. The increasing preference for eco-friendly waterborne polyurethane coatings is another reason for the growth of the market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.