- Home

- »

- Plastics, Polymers & Resins

- »

-

Post-consumer Recycled Plastics In Consumer Electronics Market Report 2033GVR Report cover

![Post-consumer Recycled Plastics In Consumer Electronics Market Size, Share & Trends Report]()

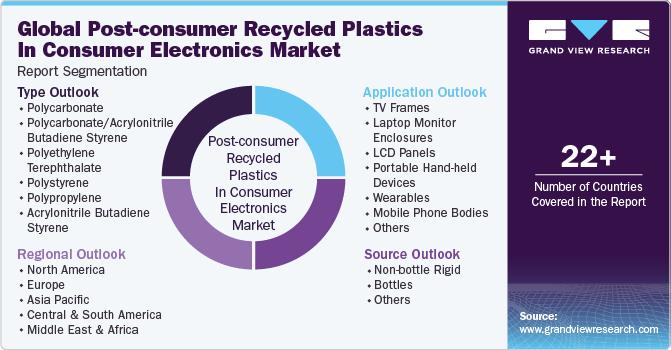

Post-consumer Recycled Plastics In Consumer Electronics Market (2024 - 2033) Size, Share & Trends Analysis Report By Type (PC, PC/ABS, PET, PS, PP, ABS), By Source, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-604-2

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Post-consumer Recycled Plastics In Consumer Electronics Market Summary

The global post-consumer recycled plastics in consumer electronics market size was estimated at USD 13.90 million in 2023 and is projected to reach USD 37.79 million by 2033, growing at a compound annual growth rate (CAGR) of 10.5% from 2024 to 2033. The market is poised for growth due to increasing adoption of post-consumer recycled plastic resins in the production of consumer electronics.

Key Market Trends & Insights

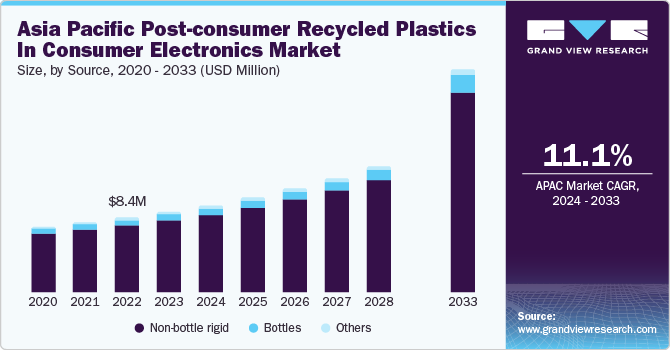

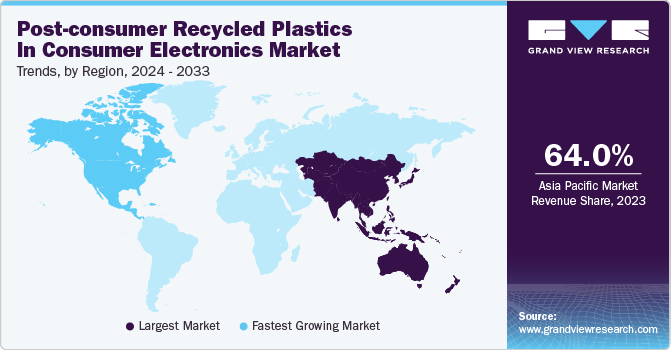

- Asia Pacific dominated the market with a share of more than 64% in 2023.

- North America is anticipated to witness significant growth in the post-consumer recycled plastics in consumer electronics industry.

- Based on source, the non-bottle rigid segment dominated the market with a share of more than 88% in 2023.

- Based on type, the polycarbonate (PC) type segment held the largest market revenue share of more than 57% in 2023.

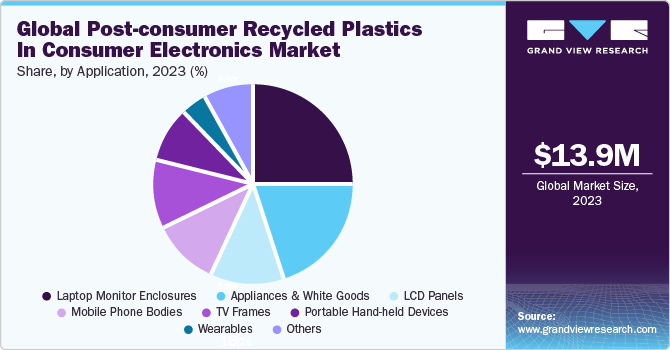

- Based on application, the laptop monitor enclosures segment dominated the market in 2023 with a market share of more than 25%.

Market Size & Forecast

- 2023 Market Size: USD 13.90 Million

- 2033 Projected Market Size: USD 37.79 Million

- CAGR (2024-2033): 10.5%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

Rapidly increasing amount of e-waste is a major global concern and is being addressed by various countries. In addition, a rising number of environmental conservation awareness programs are being carried out, keeping both consumers and electronic device manufacturers well-informed regarding the rapid growth of e-waste.

Post-consumer recycled plastics industry in consumer electronics in Asia Pacific is primarily driven by ascending product demand from applications such as TV frames, laptop monitor enclosures, LCD panels, portable hand-held devices, wearables, mobile phone bodies, appliances & white goods, and others. In addition, a well-established manufacturing base for consumer electronics in Taiwan, Japan, China, and South Korea among other countries is anticipated to provide further impetus to market growth.

Moreover, availability of cheap labor, as well as close proximity to raw material suppliers, is further attracting investors to the region. Appliance & white goods industry has witnessed growth in the recent years on account of rising disposable income and increasing demand for household appliances in emerging economies such as India and China. In addition, the presence of major household appliance manufacturers, such as LG Electronics, Haier Group, SAMSUNG, Siemens, Panasonic Corporation, and others, is expected to create opportunities for post-consumer recycled plastics in the region.

Furthermore, recycled plastics are used to produce a wide range of products such as composite lumber, roofing tiles, insulation, bottles used for the packaging of food & household products, and cosmetics packaging products. Several benefits of post-consumer recycled plastics include lightweightness, durability, and low carbon footprint, are attracting manufacturers of consumer electronics toward the adoption of post-consumer recycled plastics.

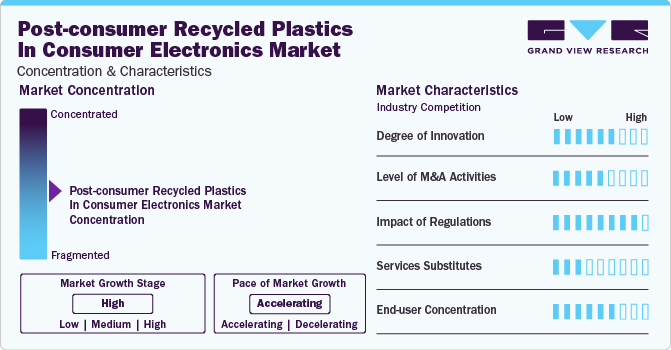

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in the production of recycled plastics, availability of raw materials, and increasing plastics consumptions in consumer electronics. Subsequently, innovative recycled plastics applications are constantly emerging, disrupting existing industries and creating new ones.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new recycling technologies and talent, need to consolidate in a rapidly growing market, and increasing strategic importance of post-consumer recycled plastics in consumer electronics.

The market is also subject to increasing regulatory scrutiny. This is due to concerns about the potential negative impacts of plastics waste generated during production and recycling. As a result, governments around the globe are developing regulations to govern the production and recycling of plastics. These regulations could have a significant impact on the market, affecting the development and usage of recycled plastics in consumer electronics.

There are a limited number of direct product substitutes for recycled plastics in consumer electronics. However, some high-performance electronic components may require specific material properties, which might hamper the demand for post-consumer recycled plastics in consumer electronics.

End-user concentration is a significant factor in the market. Since there are a number of end-use applications that are driving demand for post-consumer recycled plastics. The concentration of demand in a small number of end-user applications creates opportunities for companies that focus on developing post-consumer recycled plastics solutions for the consumer electronic industry. However, it also creates challenges for companies that are trying to compete in a crowded market.

Source Insights

Non-bottle rigid sector dominated the market with a share of more than 88% in 2023. The non-bottle rigid plastic recycling has witnessed significant growth in recent years with an increase in the purchase of difficult-to-recycle commodities such as mixed resin rigid bales by exporters, along with the growth in recovery and manufacturing of these commodities across the globe.

During the recycling process of plastic bottles, majorly driven resins include polyethylene terephthalate (PET) and high-density polyethylene (HDPE). HDPE is used for the manufacturing of mobile phones and laptop cases, owing to its light weight and high durability properties. Furthermore, rising demand for electronics, including mobile phones and laptops, has positively fueled the demand for plastic bottles as a raw material for post-consumer recycled plastics.

Type Insights

Polycarbonate (PC) type segment held the largest market revenue share of more than 57% in 2023 Post-consumer recycled polycarbonate (PC) resins have properties such as higher toughness & impact strength, light transmittance, protection from ultraviolet (UV) radiations, and chemical & heat resistance, making them suitable for use in electrical & electronic device components such as television frames, mobile cases, and electrical housing.

Recycled PC/ABS application segment is expected to grow at the fastest CAGR during the forecast period. This blend offers high heat resistance, impact strength, flexibility, improved processing, and biocompatibility, making it suitable for producing electronic housings for devices. This has propelled the demand for post-consumer recycled PC/ABS across the electrical & electronics industry and the market is expected to grow over the forecast period. Moreover, post-consumer recycled PET resin offers mechanical, thermal, and chemical resistance and dimensional stability, similar to PET resin. In addition, it is ideal for manufacturing TV frames and laptop enclosures owing to its properties such as stiffness, high impact capability, shatter resistance, hot filling capability, as well as its role as an excellent barrier to moisture, water, and gas.

Application Insights

The laptop monitor enclosures segment dominated the market in 2023 with a market share of more than 25 %. Growing emphasis on sustainability and progressive efforts to reduce carbon footprint by various consumer electronics manufacturers have augmented the demand for post-consumer recycled plastic resins in recent years. Laptop manufacturers such as Lenovo manufactures notebooks, desktops, workstation, monitors, and other accessories using post-consumer recycled plastic resins. This increasing adoption of post-consumer recycled plastic resins is expected to continue over the forecast period. Innovations in recycling technologies are continuously raising the caliber and practicality of PCR plastics for electrical applications. These developments make it easier to include recycled materials in laptop monitor casings as they offer strength or quality to the product.

The mobile phone bodies’ segment is projected to grow at a significant CAGR over the forecast period. Increasing concerns related to plastic waste, such as environmental depletion, climatic changes, and biodiversity loss, are a major challenge among mobile phone manufacturers across the globe. In addition, the rising competitive environment due to the high purchasing power of consumers across major economies and rising disposable incomes of the middle-income groups are the major drivers for the mobile phone market.

TV Frames application segment is also anticipated to witness substantial upsurge in adoption of post-consumer recycled plastics.Factors such as technological advancements and rising disposable income have fueled the growth of global television sales. In addition, increasing demand for durable and long-lasting television devices has propelled the demand for post-consumer recycled plastic resins from the television manufacturers. PCR-based PC/ABS blends have gained popularity in the manufacturing of TV enclosures and other computer peripherals due to their higher impact and thermal resistance.

Regional Insights

Asia Pacific dominated the market with a share of more than 64% in 2023. The construction industry in Asia Pacific is expected to witness considerable growth in the coming years owing to increasing demand for non-residential construction projects, such as hospitals, schools, and colleges, over the forecast period. This, in turn, will drive the demand for personal protective equipment products, such as safety vests, helmets, safety belts, and various other products, thus propelling industry growth.

North America is anticipated to witness significant growth in the post-consumer recycled plastics in consumer electronics industry. This market is driven by the growth of the major end-use industries, such as electrical and electronics, construction, and packaging. Rising demand for packed and processed food and the rising construction industry in the U.S., Mexico, and Canada are anticipated to augment market growth in the near future. Factors such as increasing concerns over landfill, reduced carbon footprint, regulatory-framework, and inclination of consumers toward sustainable products are anticipated to fuel the demand for post-consumer recycled plastics in consumer electronics applications over the forecast period. The National Waste & Recycling Association, Waste360, Association of Plastic Recyclers (APR), NAPCOR, and Solid Waste Association of North America are working to create awareness regarding plastic waste recycling in the region.

Key Companies & Market Share Insights

Some of the key players operating in the market include BASF SE and Solvay..

-

BASF SE is engaged in the production of a broad range of plastic products such as performance polymers, plastic additives, and polyamides & intermediates, which find use in automation, transportation, construction, electrical & electronics, and consumer goods industries. It offers post-consumer recycled resins through its plastics & rubber segments

-

Solvay is engaged in manufacturing chemicals. It operates its business through four segments including advanced formulations, advanced materials, performance chemicals, and functional polymers. The polymers segment offers plastic products such as acrylonitrile butadiene styrene (ABS), polybutylene terephthalate (PBT), polycarbonate (PC), polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP), polystyrene (PS), and polyvinyl chloride (PVC). It offers its post-consumer recycled (PCR) resins through its specialties business segment.

PolyVisions and MBA Polymers Inc. are the emerging market participants in the market.

-

PolyVisions offers thermoplastic compounding solutions with recycled content, formulated expertise, and polymer science. Its product portfolio includes polyethylene terephthalate (PET), and post-consumer recycled (PCR) resins. Moreover, PCR resins are obtained using DuraPET PCR category.

-

MBA Polymers Inc. recycles plastics from goods such as computers, electronics, appliances, and autos. It has administration, production and tech-units in countries including the UK, China, Austria, the U.S., and Germany.

Key Post-consumer Recycled Plastics In Consumer Electronics Market Companies:

- BASF SE

- SABIC

- Covestro AG

- Trinseo

- MBA Polymers, Inc.

- INEOS Styrolution Group GmbH

- LAVERGNE, Inc.

- PolyVisions

Recent Developments:

-

In April 2023, Indorama Ventures and Evertis announced their partnership to create PET film for food packaging trays using PET flake from recycled PET trays. The collaboration helps Evertis reach its goal of 50% post-consumer recycled content in its products by 2025.

-

In February 2023, Loop Industries, SUEZ, and SK geocentric announced the installation of manufacturing site for virgin-quality PET plastic created from 100% recycled content in the Grand Est area of France. The three partners hope to begin construction in early 2025, with plant commissioning in 2027.

-

In January 2022, Gamma Communications plc announced the adoption of Thales' Eco-SIM cards as part of its efforts to become more environment friendly. Gamma intends to expand its cooperation with Thales by deploying Eco-SIM across its network of channel partners and business mobile clients.

Post-consumer Recycled Plastics In Consumer Electronics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.98 million

Revenue forecast in 2033

USD 37.79 million

Growth rate

CAGR of 10.5% from 2024 to 2033

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2033

Quantitative units

Volume in tons, revenue in USD thousand/million and CAGR from 2024 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; The Netherlands; Spain; Turkey; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); South Africa

Key companies profiled

BASF SE; SABIC; Covestro AG; Trinseo; MBA Polymers, Inc.; INEOS Styrolution Group GmbH; LAVERGNE, Inc.; PolyVisions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Post-consumer Recycled Plastics In Consumer Electronics Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global post-consumer recycled plastics in consumer electronics market report based on source, type, application, and region:

-

Source Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2033)

-

Non-bottle rigid

-

Bottles

-

Others

-

-

Type Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2033)

-

Polycarbonate (PC)

-

Polycarbonate/Acrylonitrile Butadiene Styrene (PC/ABS)

-

Polyethylene Terephthalate (PET)

-

Polystyrene (PS)

-

Polypropylene (PP)

-

Acrylonitrile Butadiene Styrene (ABS)

-

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2033)

-

TV Frames

-

Laptop Monitor Enclosures

-

LCD Panels

-

Portable Hand-held Devices

-

Wearables

-

Mobile Phone Bodies

-

Appliances & White Goods

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

The Netherlands

-

Spain

-

Turkey

-

-

Asia Pacific

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global post-consumer recycled plastics in consumer electronics market size was estimated at USD 13.90 million in 2023 and is expected to reach USD 14.98 million in 2024.

b. The global post-consumer recycled plastics in consumer electronics market is expected to grow at a compound annual growth rate of 10.8% from 2024 to 2033 to reach USD 37.79 million by 2033.

b. Asia Pacific dominated the post-consumer recycled plastics in consumer electronics market with a share of 64.80% in 2023. This is primarily driven by ascending product demand from applications such as TV frames, laptop monitor enclosures, LCD panels, portable hand-held devices, wearables, mobile phone bodies, appliances & white goods, and others.

b. Some key players operating in the post-consumer recycled plastics in consumer electronics market include BASF SE, SABIC, Trinseo S.A., INEOS Styrolution Group GmbH, and Covestro AG.

b. Key factors that are driving the post-consumer recycled plastics in consumer electronics market growth include a life expectancy of plastics in consumer electronics is high, which has resulted in rising e-waste across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.